0% found this document useful (0 votes)

12 views32 pagesLecture 1 - Introduction (Updated)

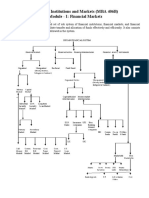

The document outlines the importance of studying financial markets, defining financial assets, markets, and institutions. It explains the roles and properties of financial assets, types of financial markets, and the functions of financial institutions. Key points include the provision of liquidity, price discovery, and the categorization of markets by various criteria.

Uploaded by

Chow CaihongCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

12 views32 pagesLecture 1 - Introduction (Updated)

The document outlines the importance of studying financial markets, defining financial assets, markets, and institutions. It explains the roles and properties of financial assets, types of financial markets, and the functions of financial institutions. Key points include the provision of liquidity, price discovery, and the categorization of markets by various criteria.

Uploaded by

Chow CaihongCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 32