0% found this document useful (0 votes)

16 views10 pagesCandlestick Patterns TextOnly

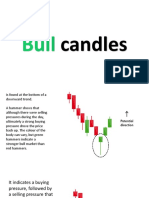

The document outlines various candlestick patterns used in technical analysis to indicate potential market reversals or continuations. Key patterns include the Hammer, Inverted Hammer, Bullish and Bearish Engulfing, Morning and Evening Stars, Doji, Shooting Star, Spinning Top, and Marubozu. Each pattern provides insights into market sentiment and possible future price movements.

Uploaded by

merijoni42Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

16 views10 pagesCandlestick Patterns TextOnly

The document outlines various candlestick patterns used in technical analysis to indicate potential market reversals or continuations. Key patterns include the Hammer, Inverted Hammer, Bullish and Bearish Engulfing, Morning and Evening Stars, Doji, Shooting Star, Spinning Top, and Marubozu. Each pattern provides insights into market sentiment and possible future price movements.

Uploaded by

merijoni42Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 10