0% found this document useful (0 votes)

22 views7 pagesProblems

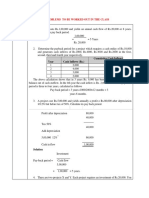

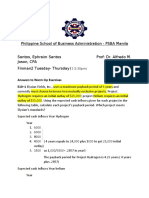

The document evaluates two mutually exclusive projects, A and B, requiring an initial investment of ₹60,000 each, detailing their cash inflows over five years. It calculates the payback period, net profit, ROI, and NPV for both projects, concluding that Project A has a payback period of 4 years and a negative NPV, while Project B has a payback period of 3.33 years and a positive NPV. Additionally, it analyzes an uneven cash flow project with an initial investment of ₹50,000, resulting in a breakeven ROI and a negative NPV.

Uploaded by

sangeethak.rvitmCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

22 views7 pagesProblems

The document evaluates two mutually exclusive projects, A and B, requiring an initial investment of ₹60,000 each, detailing their cash inflows over five years. It calculates the payback period, net profit, ROI, and NPV for both projects, concluding that Project A has a payback period of 4 years and a negative NPV, while Project B has a payback period of 3.33 years and a positive NPV. Additionally, it analyzes an uneven cash flow project with an initial investment of ₹50,000, resulting in a breakeven ROI and a negative NPV.

Uploaded by

sangeethak.rvitmCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 7