0% found this document useful (0 votes)

17 views10 pagesLesson 7 Practice Exercises

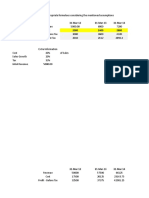

The document outlines payroll computation for employees at Elite Enterprises, detailing their monthly rates, days worked, overtime hours, and tax codes, along with calculations for gross pay, withholding tax, and net pay. It also includes product inventory information with unit prices and stock levels, as well as sales data showing invoices, salespersons, regions, products sold, and total sales amounts. The total sales across different regions sum up to 73,151.25.

Uploaded by

ReynalynCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

17 views10 pagesLesson 7 Practice Exercises

The document outlines payroll computation for employees at Elite Enterprises, detailing their monthly rates, days worked, overtime hours, and tax codes, along with calculations for gross pay, withholding tax, and net pay. It also includes product inventory information with unit prices and stock levels, as well as sales data showing invoices, salespersons, regions, products sold, and total sales amounts. The total sales across different regions sum up to 73,151.25.

Uploaded by

ReynalynCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 10