0% found this document useful (0 votes)

49 views2 pagesJob Order Problem

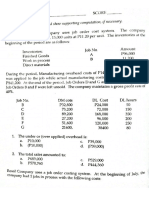

The document outlines job order cost details for Otto Company, requiring journal entries for various transactions related to direct materials, payroll, and factory overhead. It also presents inventory details for Noah as of March 1, 2025, and includes operations information for March 2025, necessitating journalization of transactions and preparation of an inventory schedule. Key tasks involve calculating costs for job orders, applying factory overhead, and tracking inventory movements.

Uploaded by

mykellandreihabladoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

49 views2 pagesJob Order Problem

The document outlines job order cost details for Otto Company, requiring journal entries for various transactions related to direct materials, payroll, and factory overhead. It also presents inventory details for Noah as of March 1, 2025, and includes operations information for March 2025, necessitating journalization of transactions and preparation of an inventory schedule. Key tasks involve calculating costs for job orders, applying factory overhead, and tracking inventory movements.

Uploaded by

mykellandreihabladoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2