100% found this document useful (3 votes)

8K views13 pagesAccounts of Non Trading Organisation

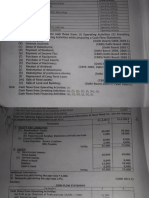

This document discusses the accounting treatment for non-trading organizations. It explains that non-trading organizations provide services rather than goods. Their key financial statements are the receipts and payments account, income and expenditure account, and balance sheet. The receipts and payments account summarizes all cash receipts and payments, while the income and expenditure account only includes revenue items. Special items for non-trading organizations and adjustments for preparing the accounts are also outlined.

Uploaded by

Mahesh KumarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (3 votes)

8K views13 pagesAccounts of Non Trading Organisation

This document discusses the accounting treatment for non-trading organizations. It explains that non-trading organizations provide services rather than goods. Their key financial statements are the receipts and payments account, income and expenditure account, and balance sheet. The receipts and payments account summarizes all cash receipts and payments, while the income and expenditure account only includes revenue items. Special items for non-trading organizations and adjustments for preparing the accounts are also outlined.

Uploaded by

Mahesh KumarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

/ 13