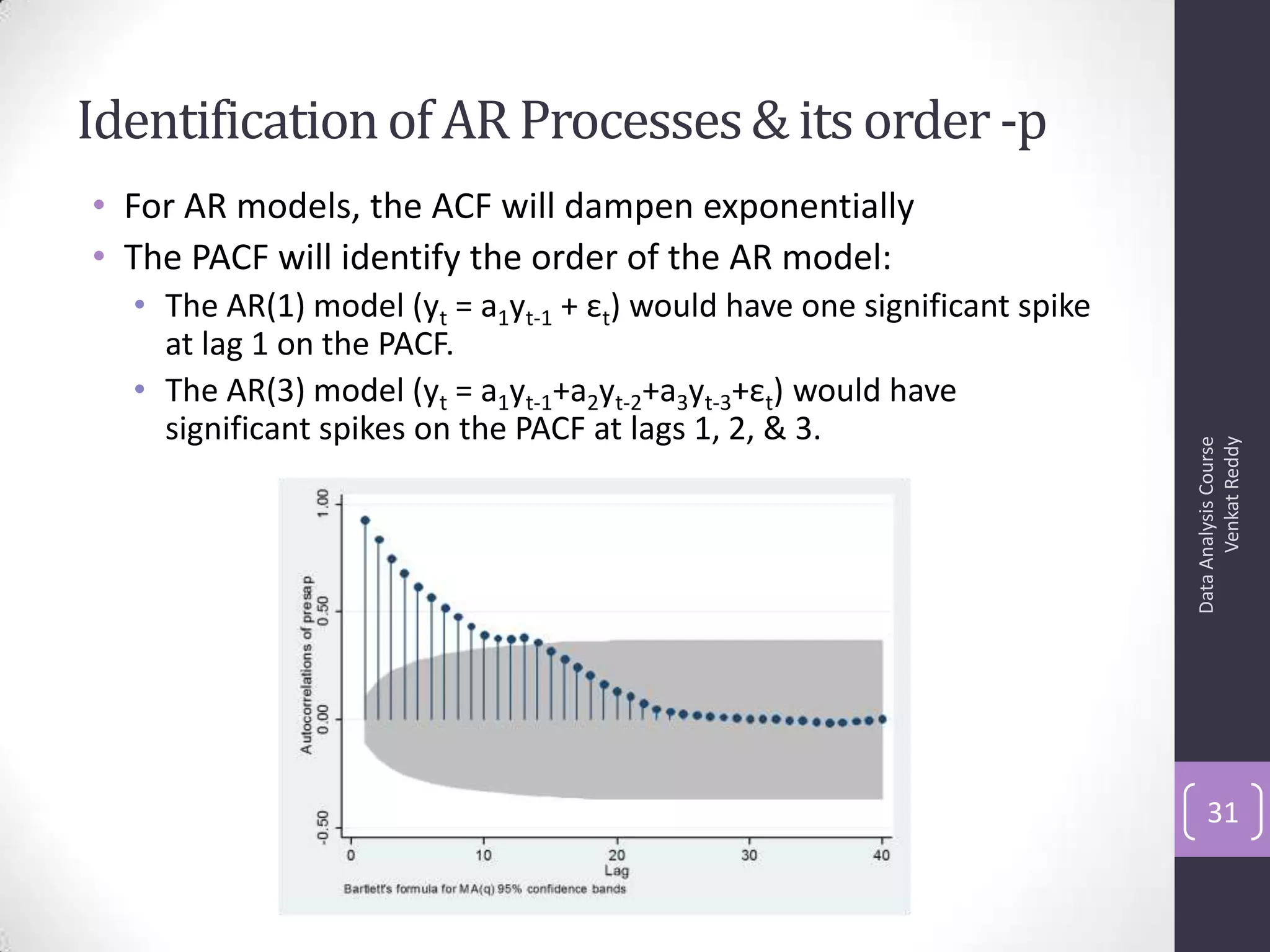

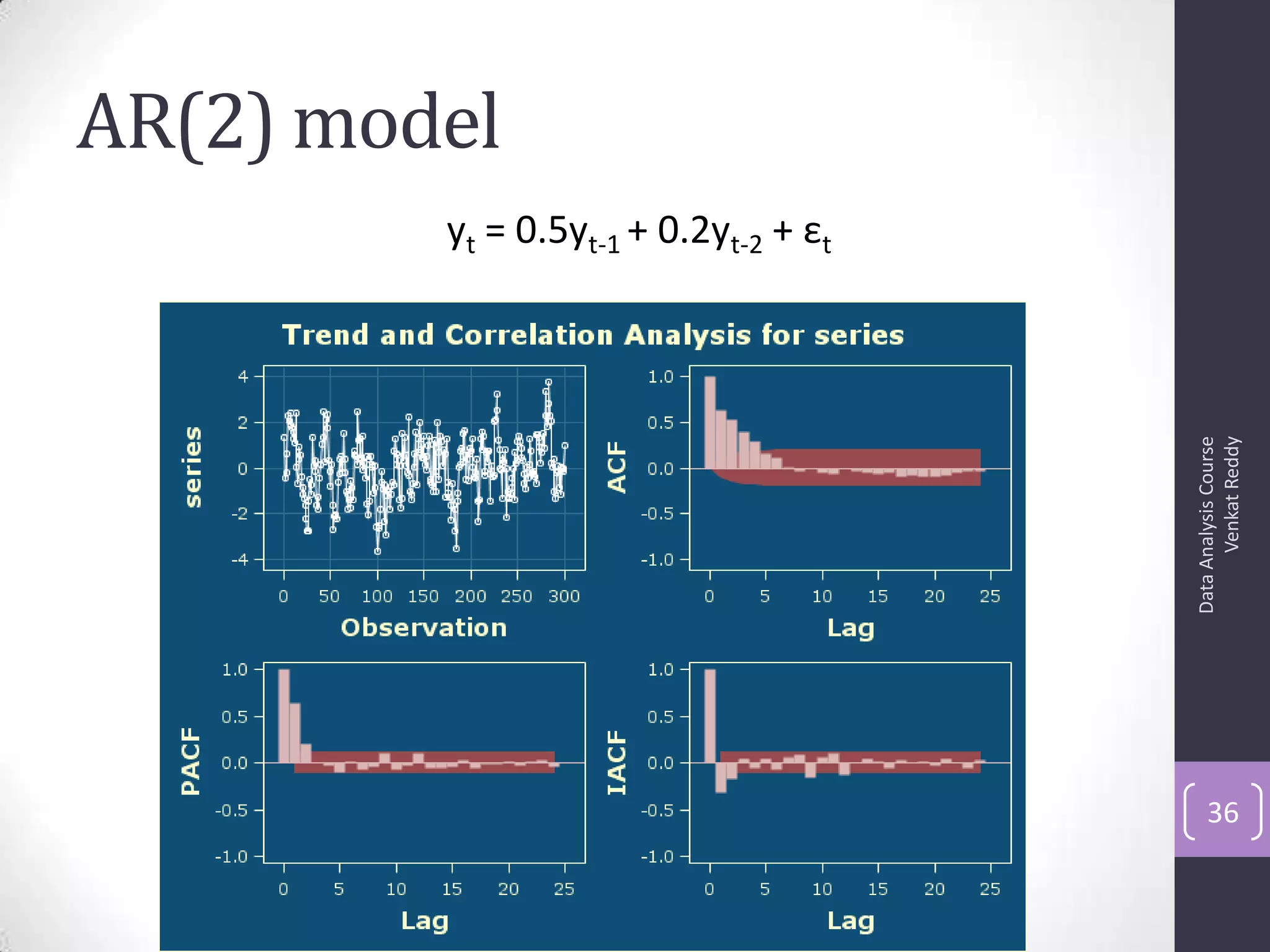

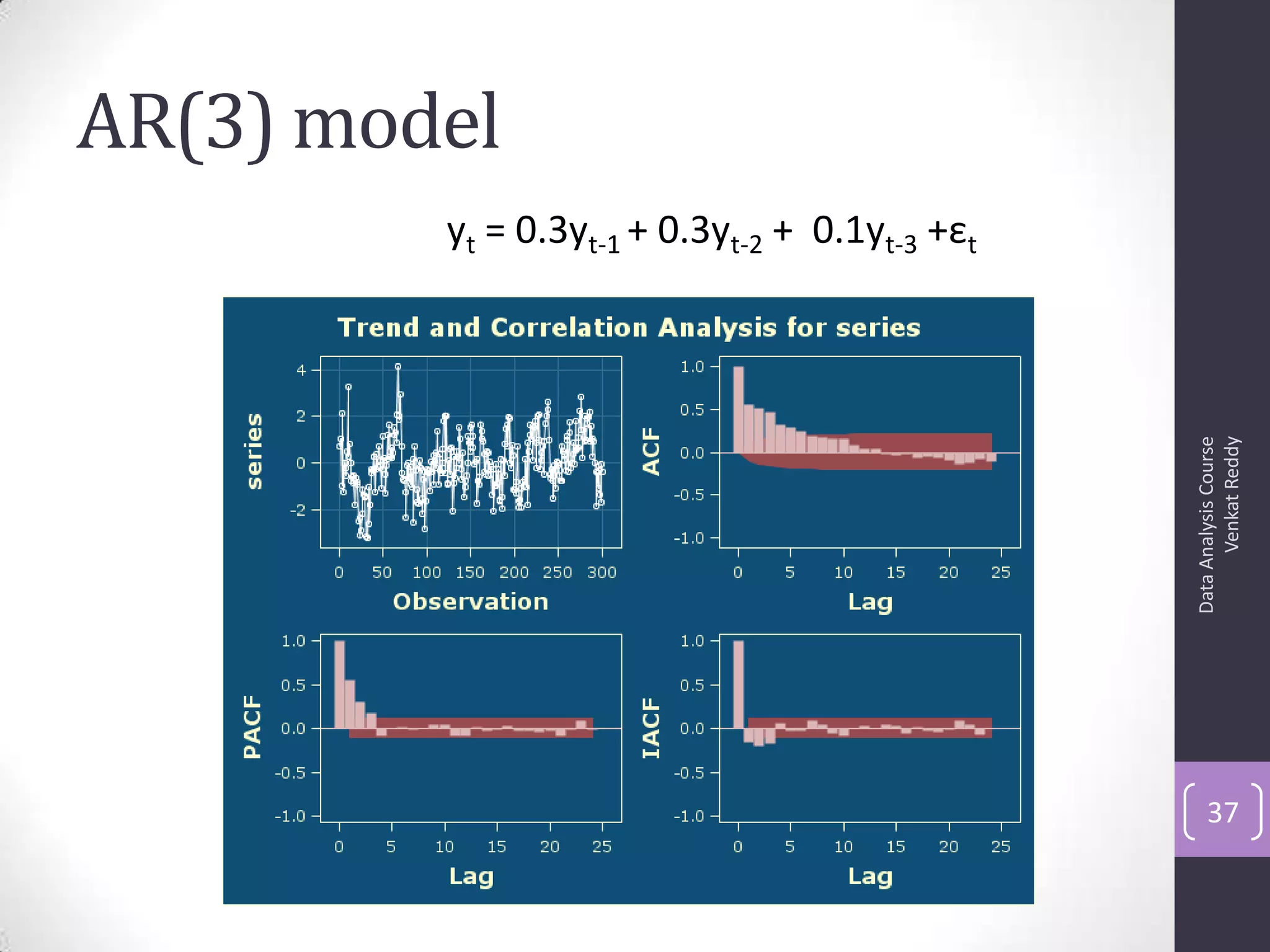

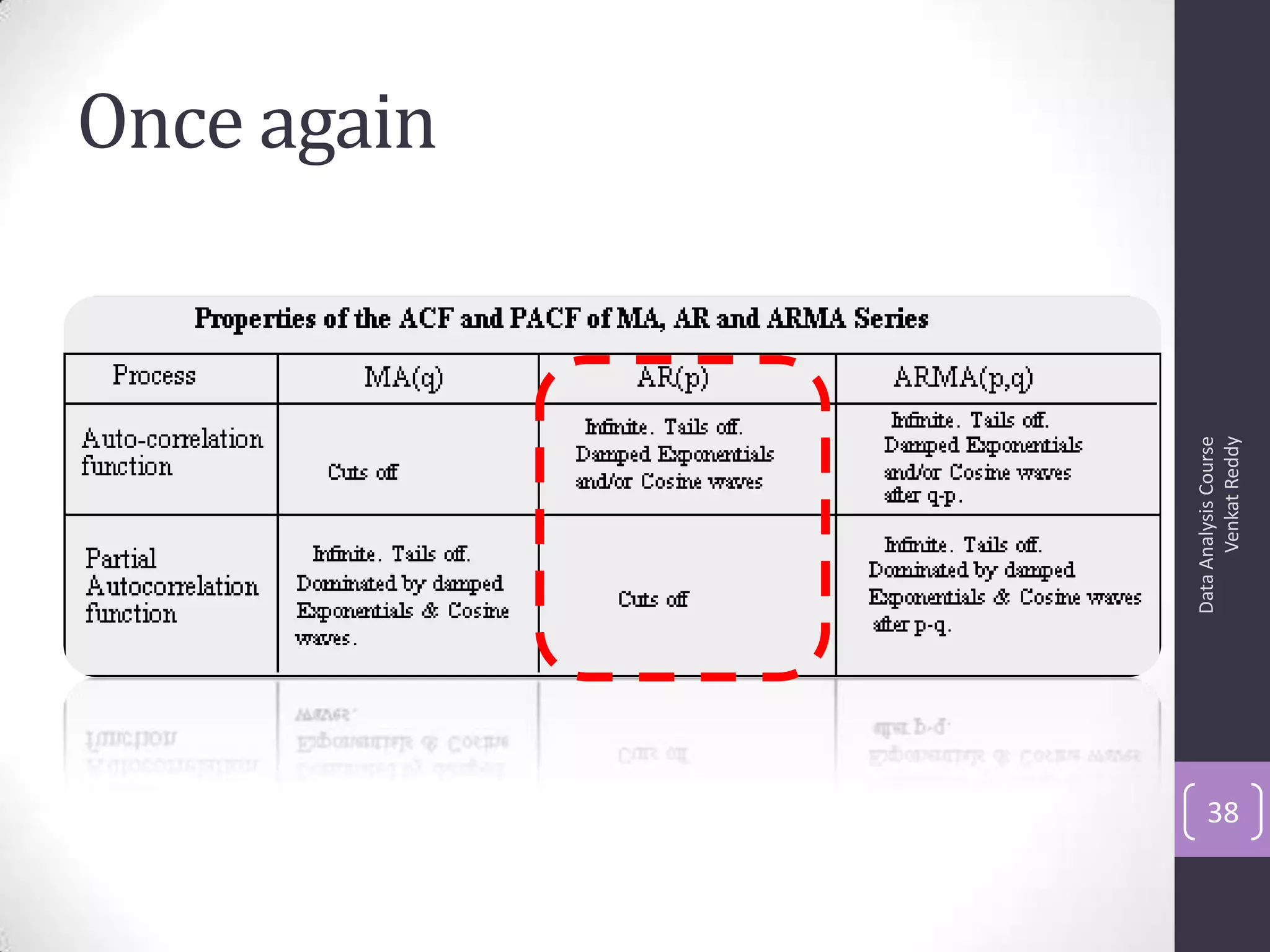

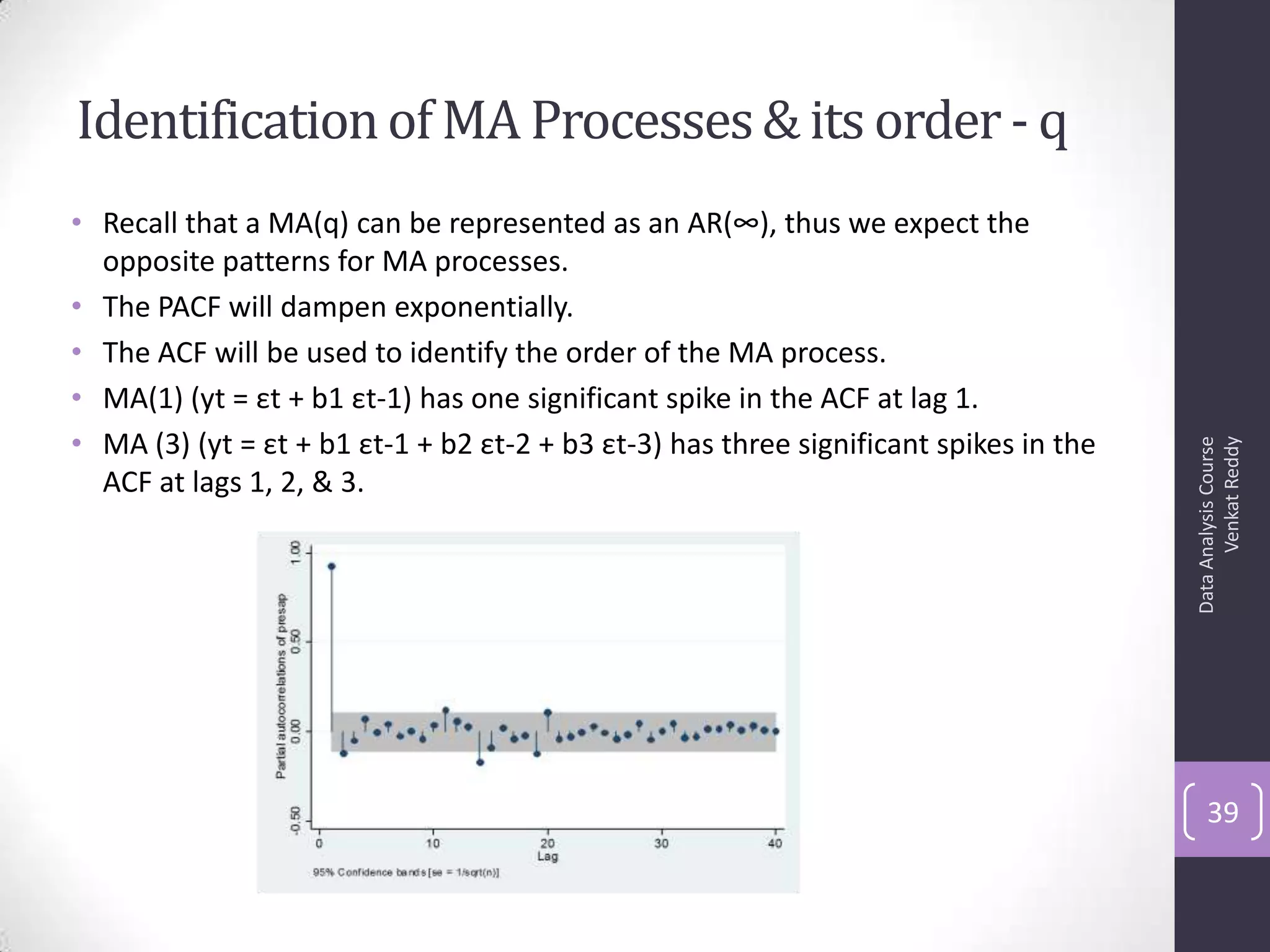

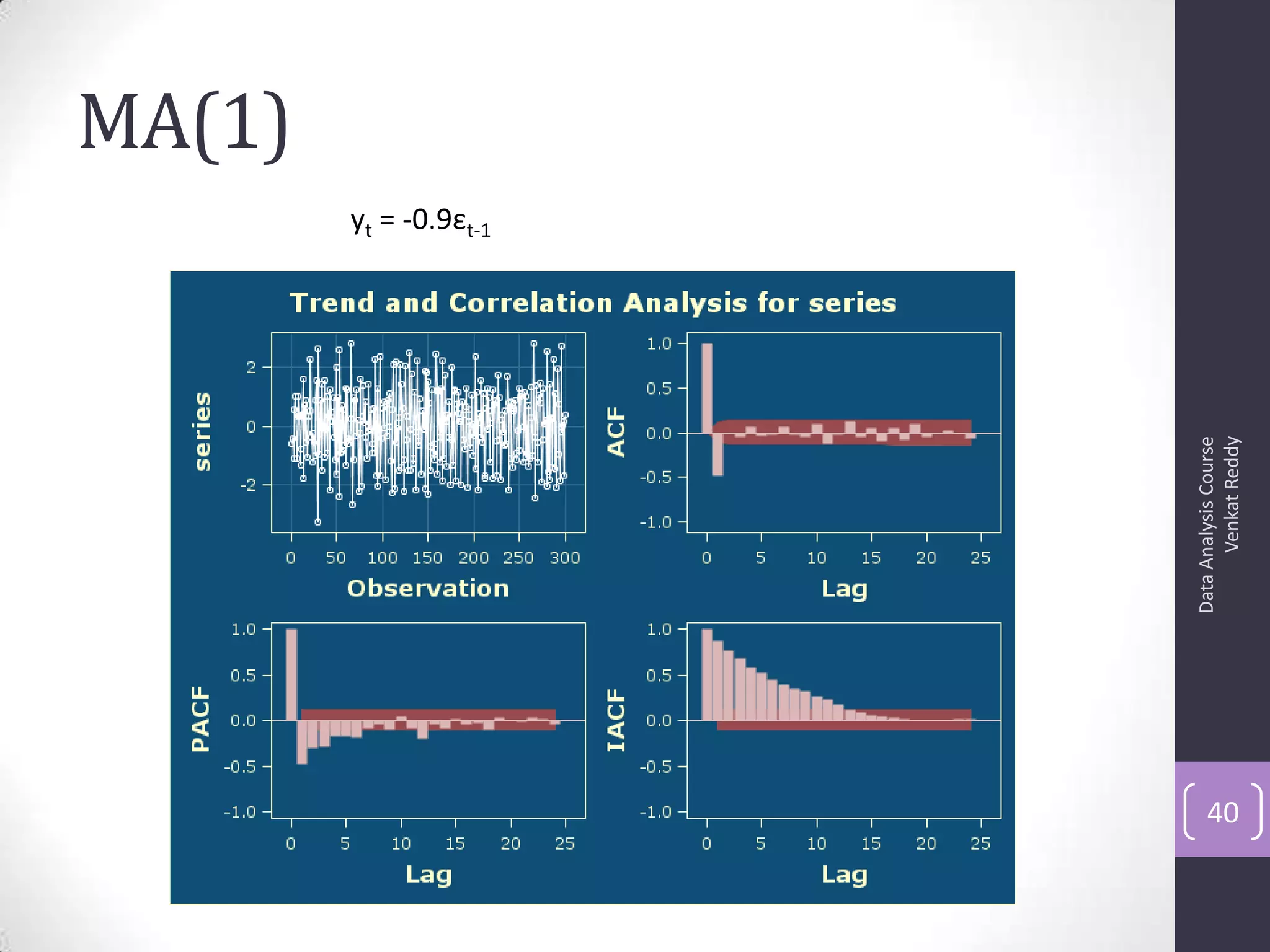

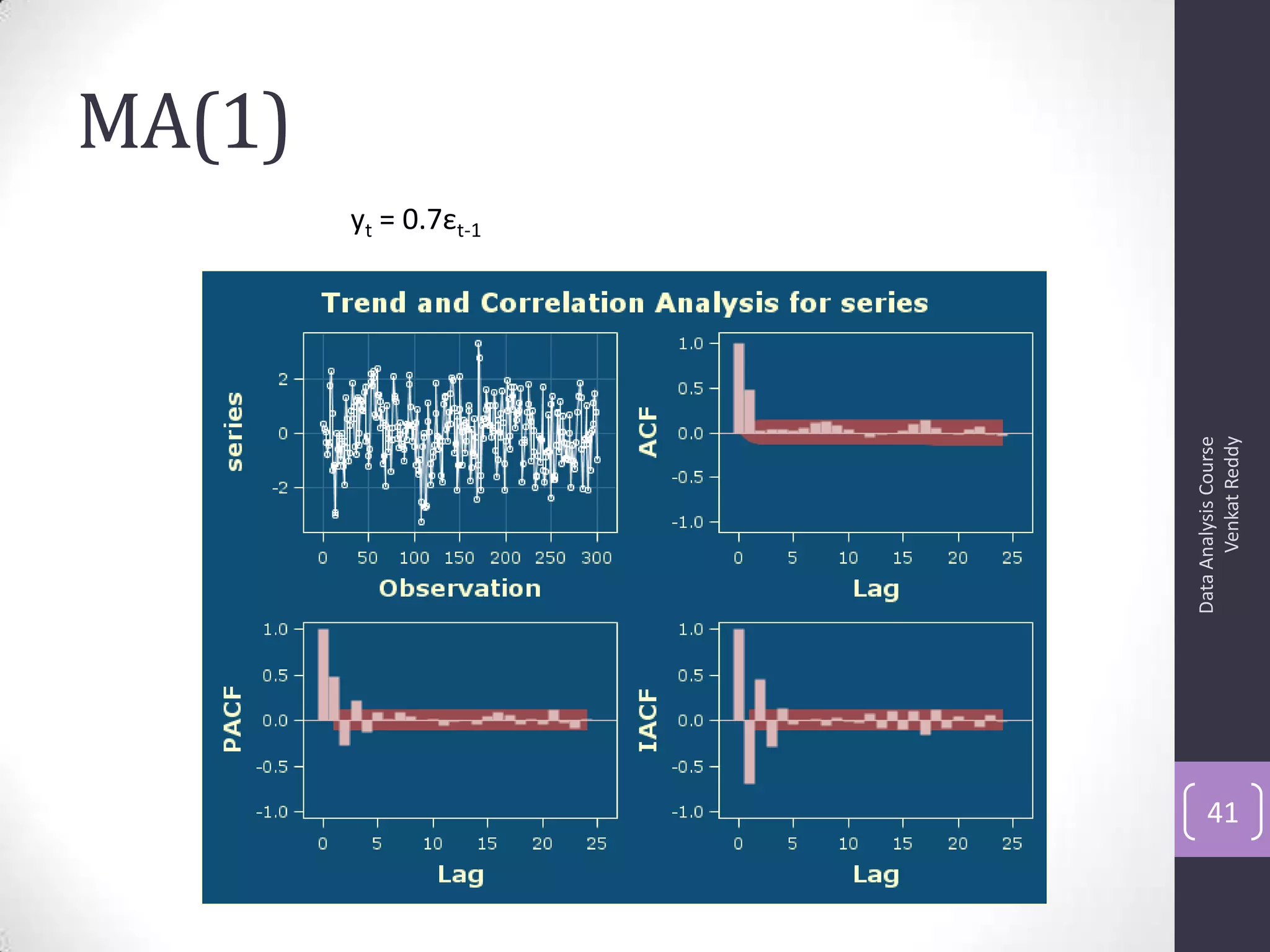

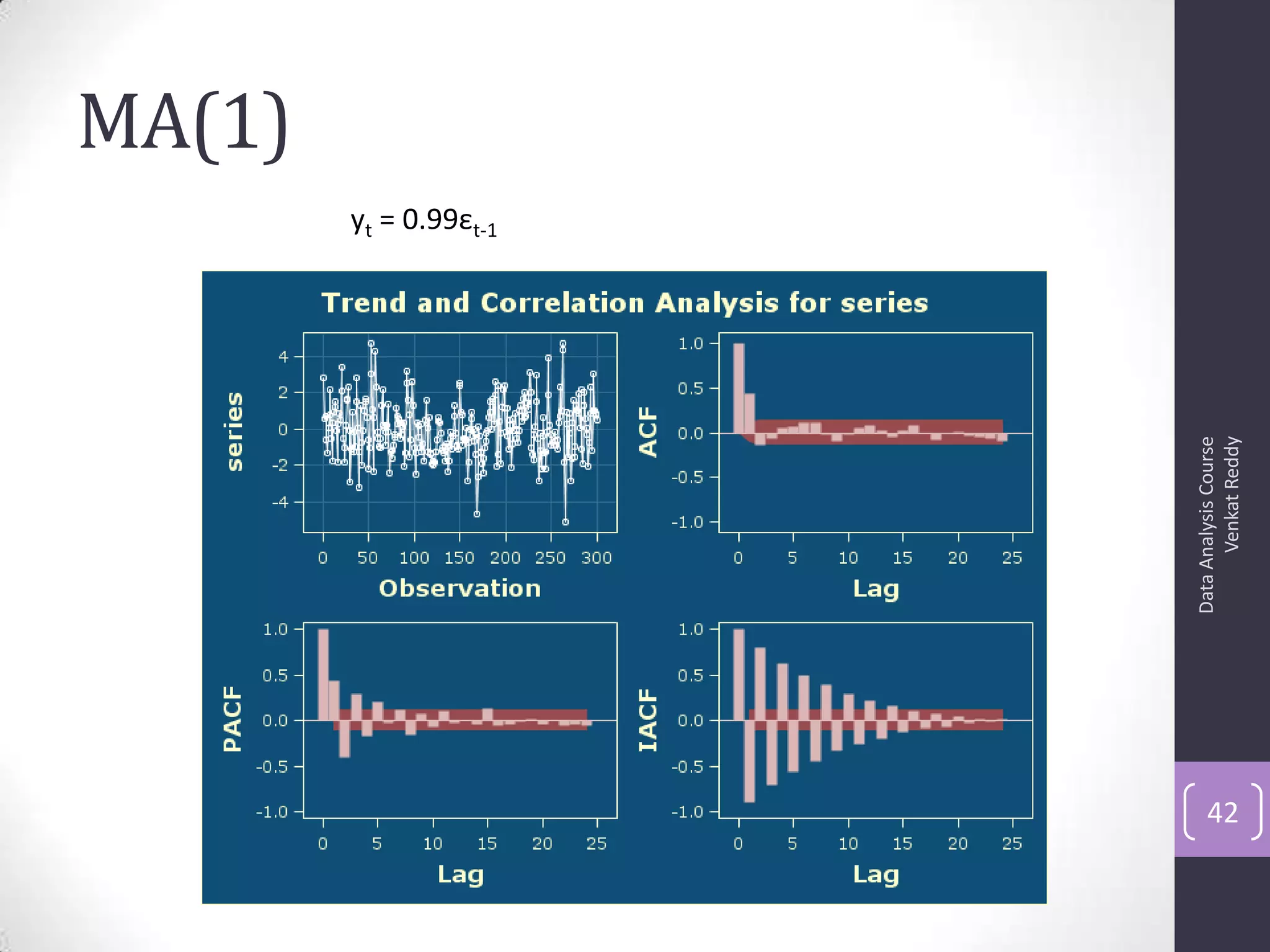

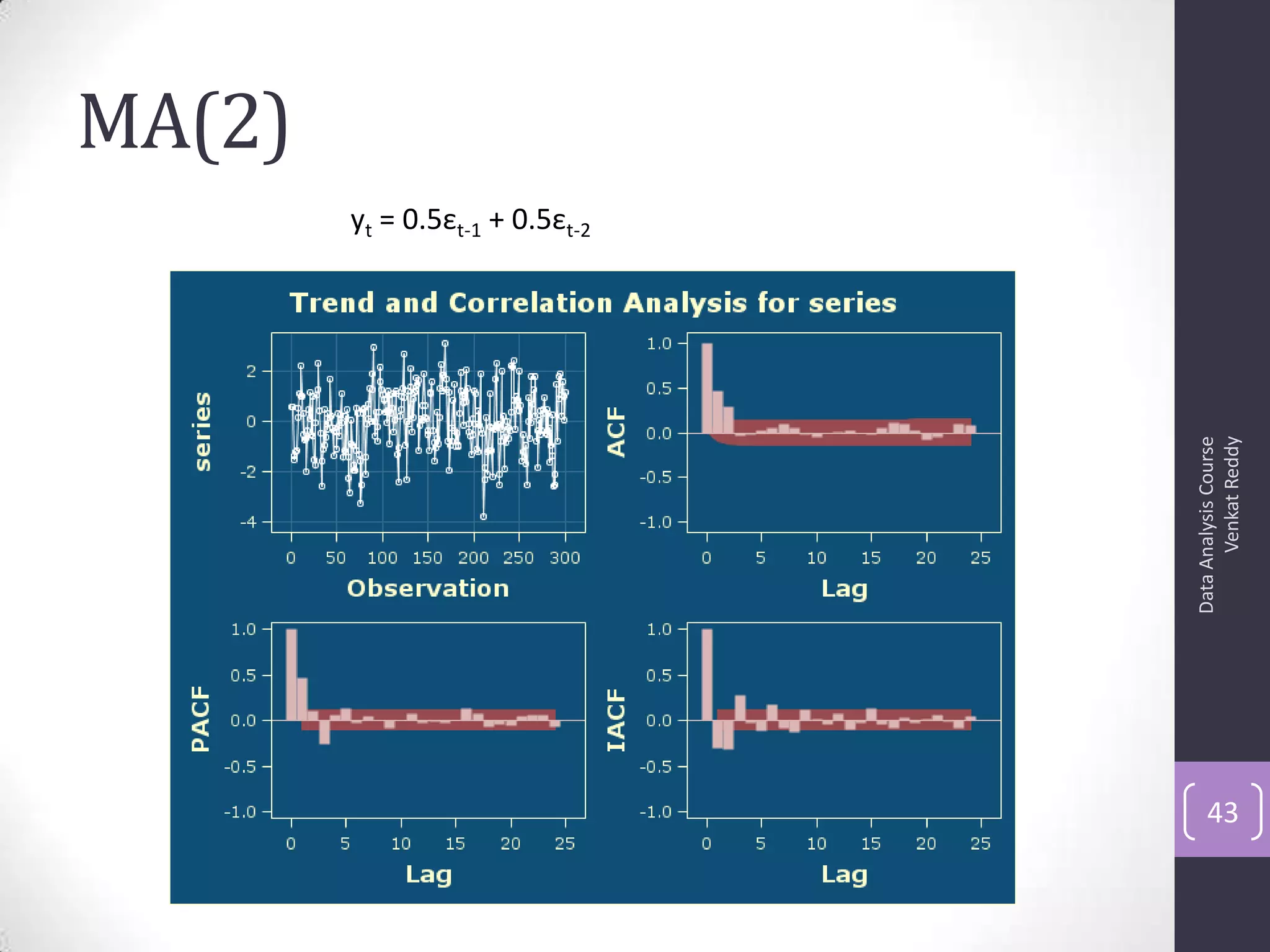

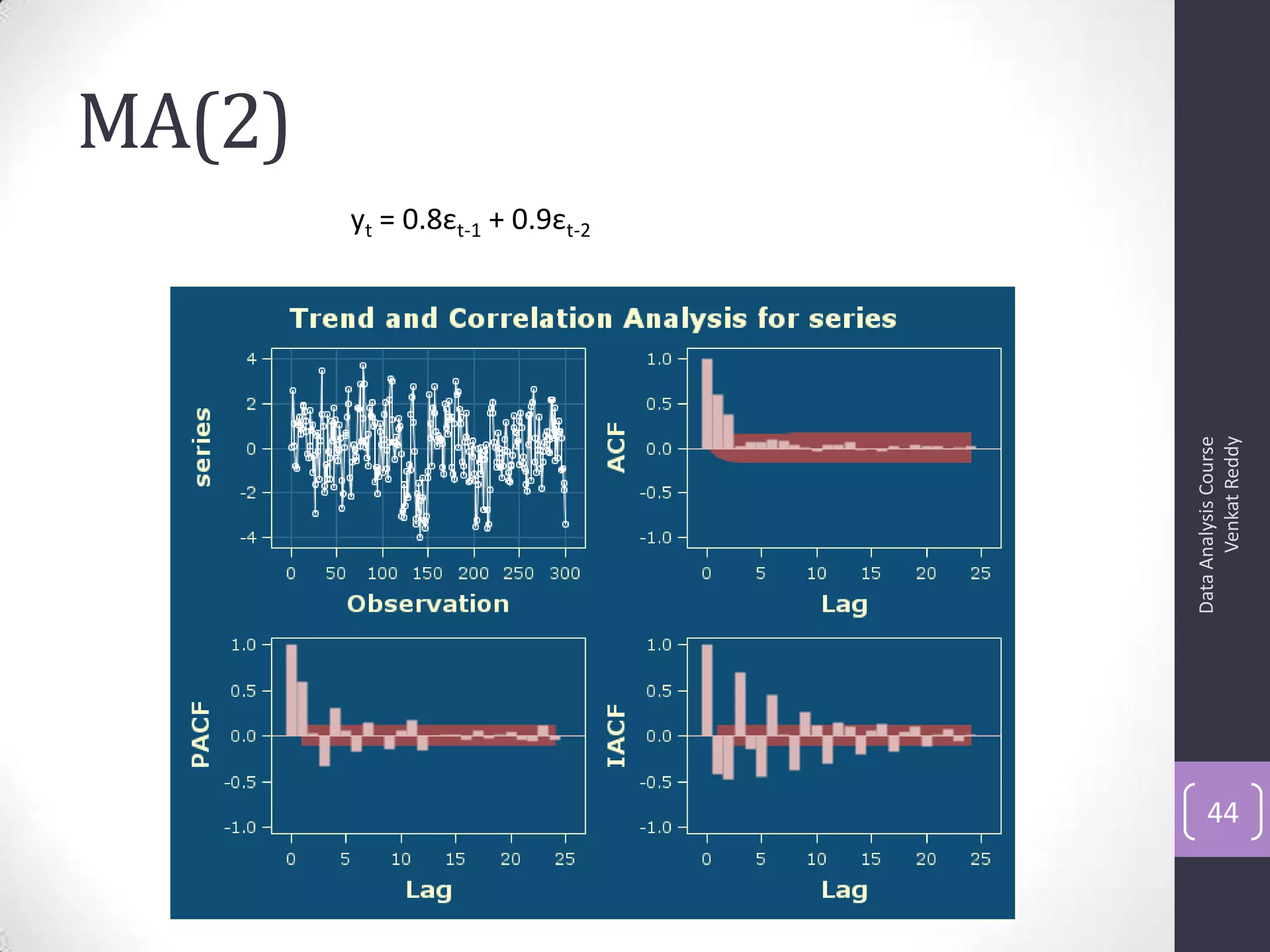

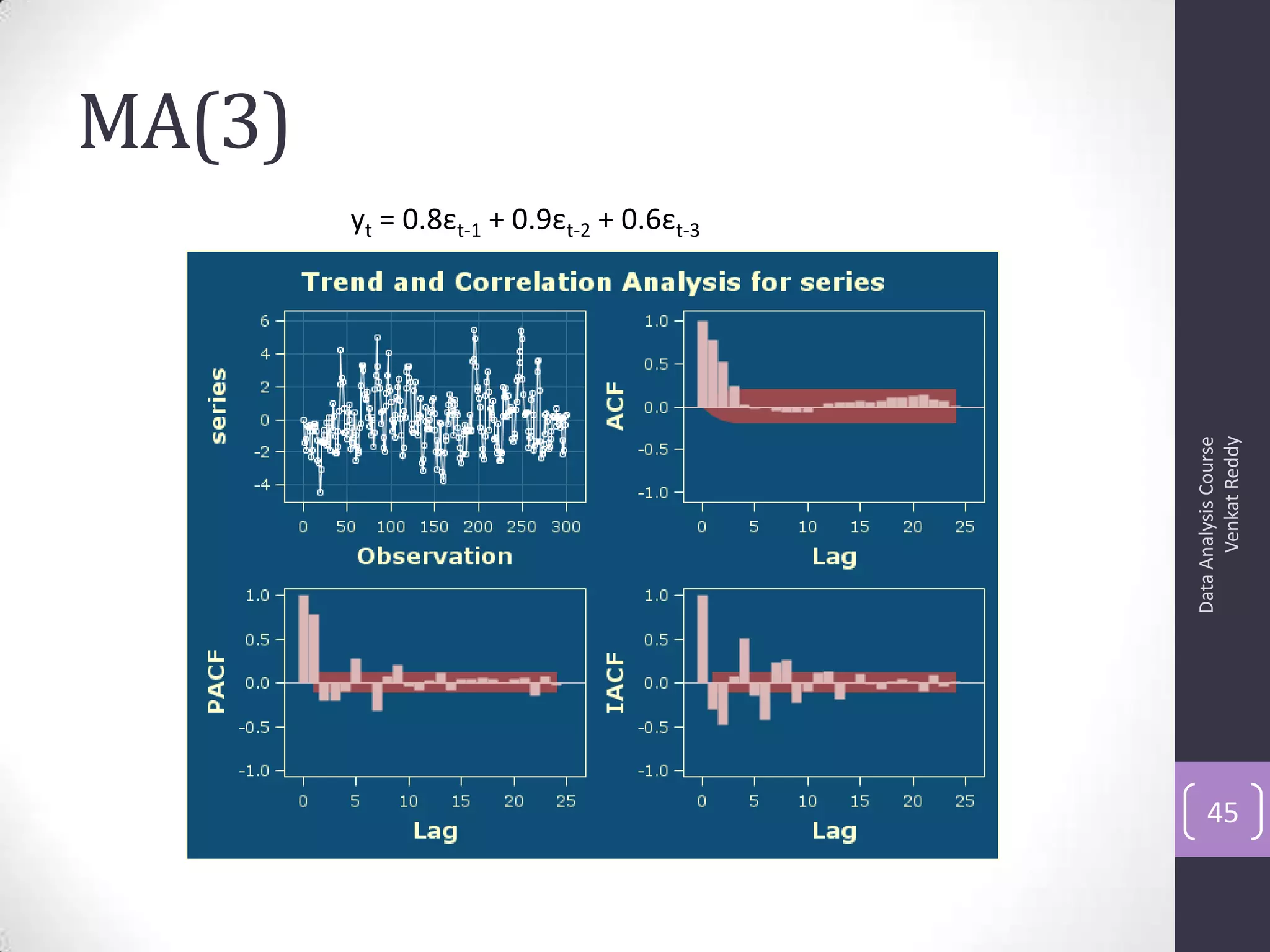

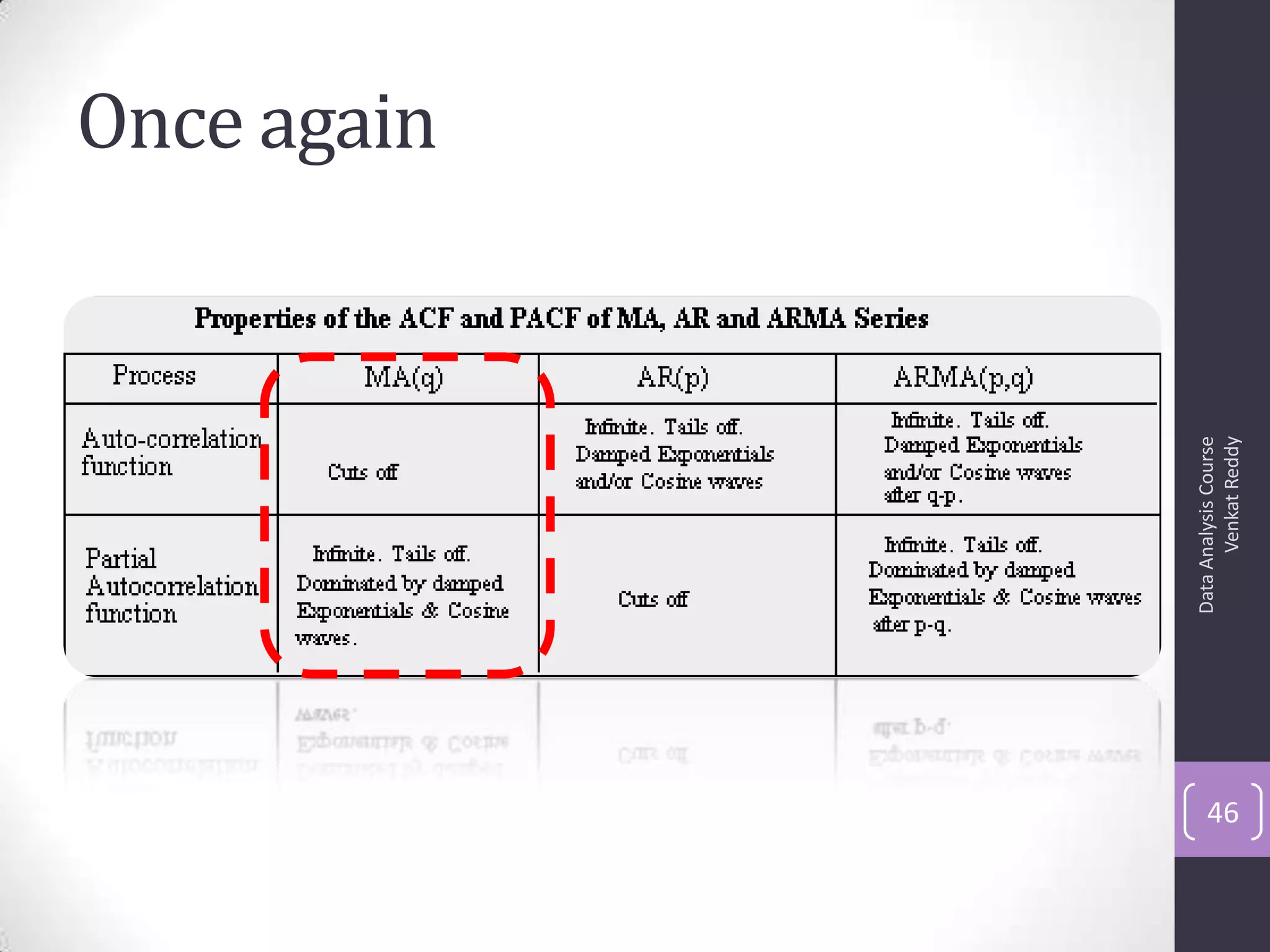

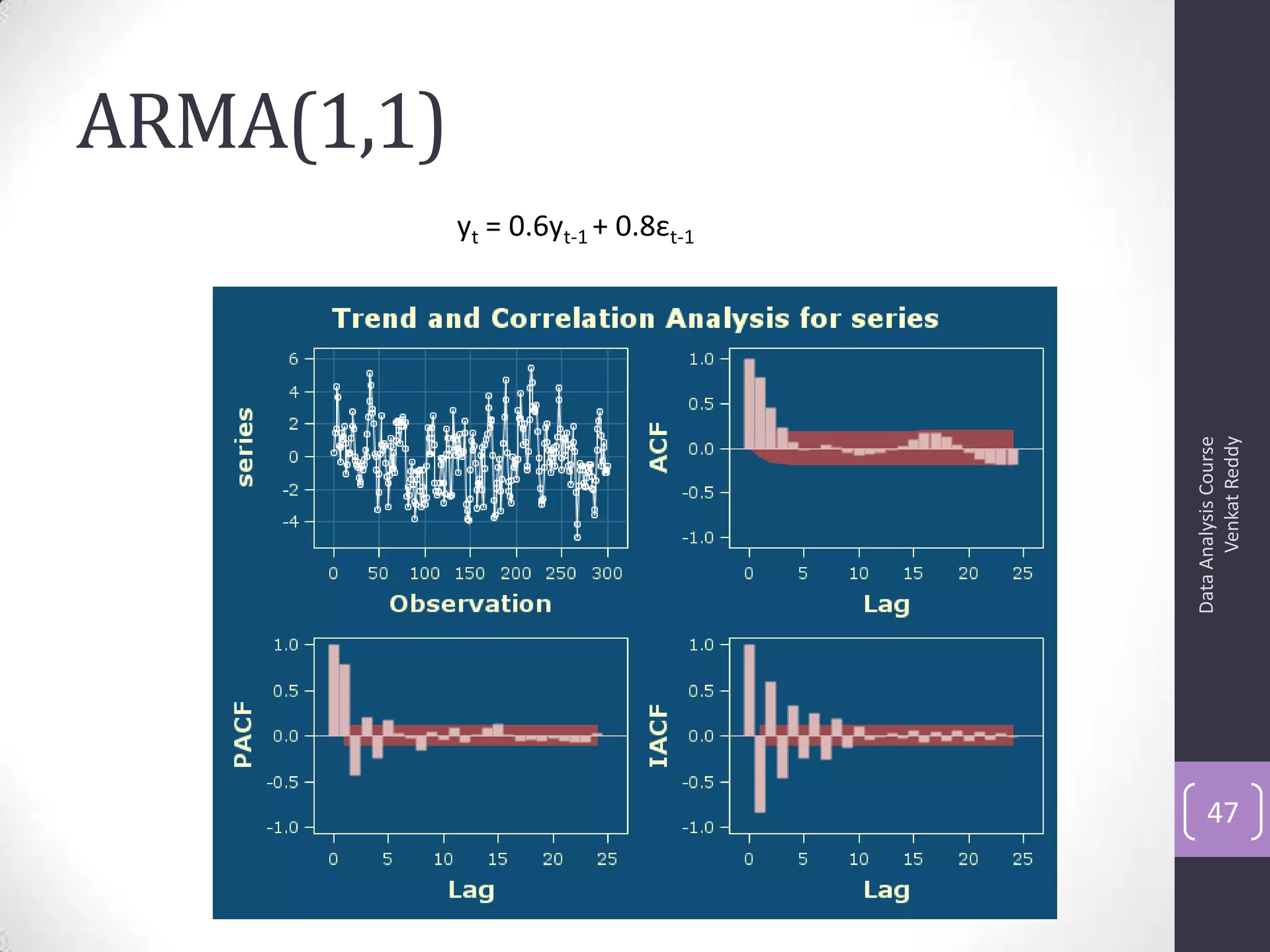

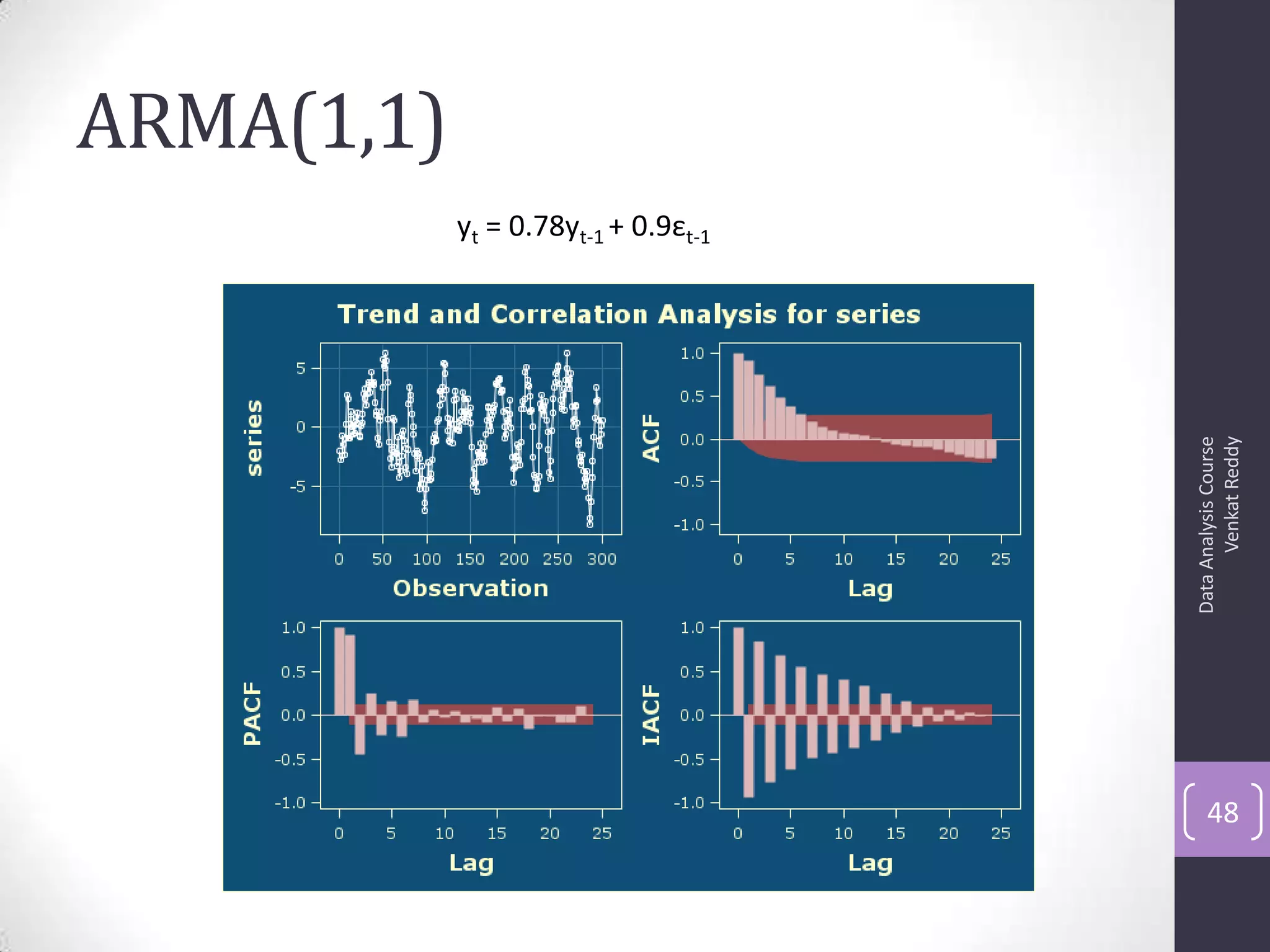

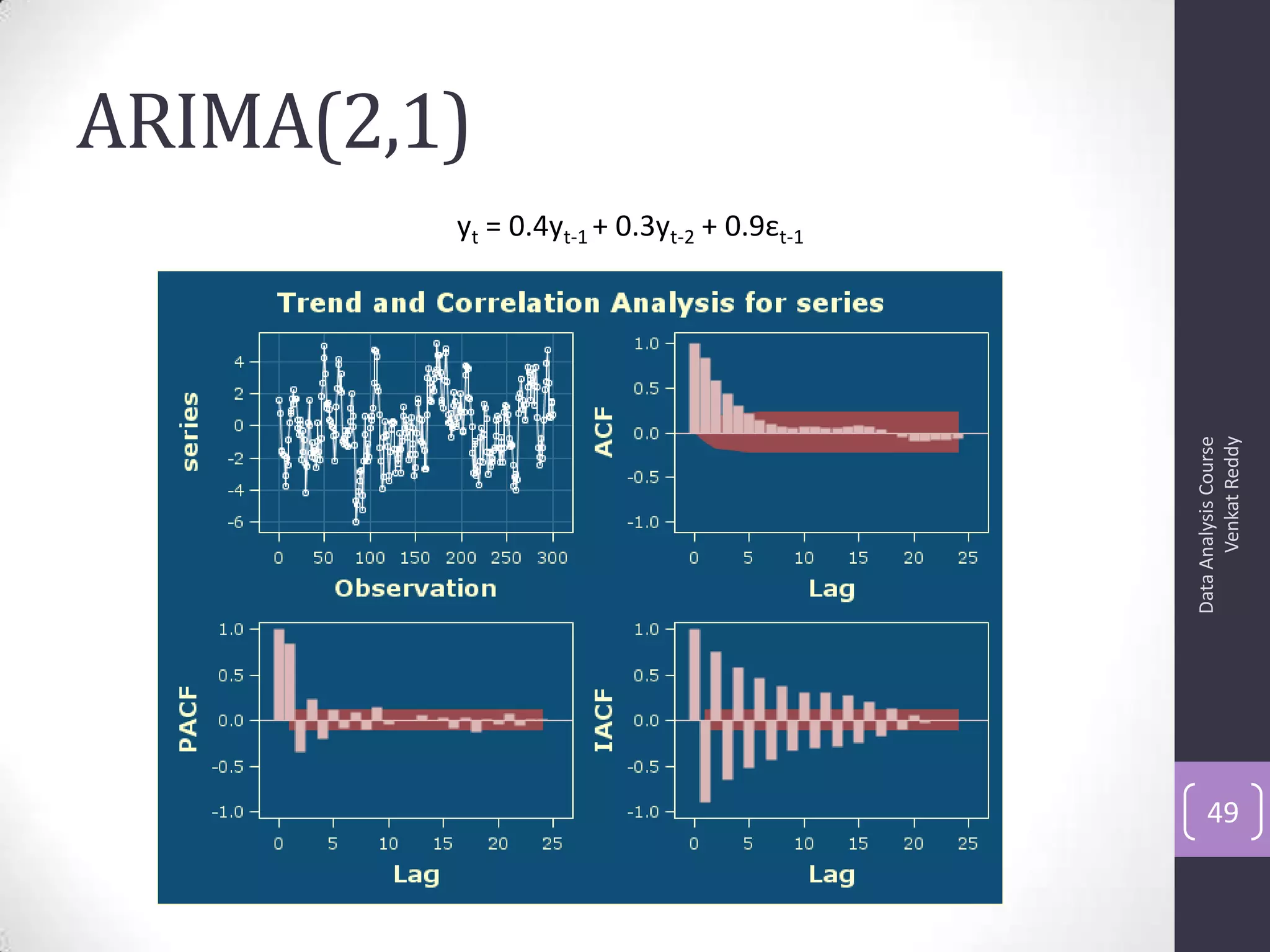

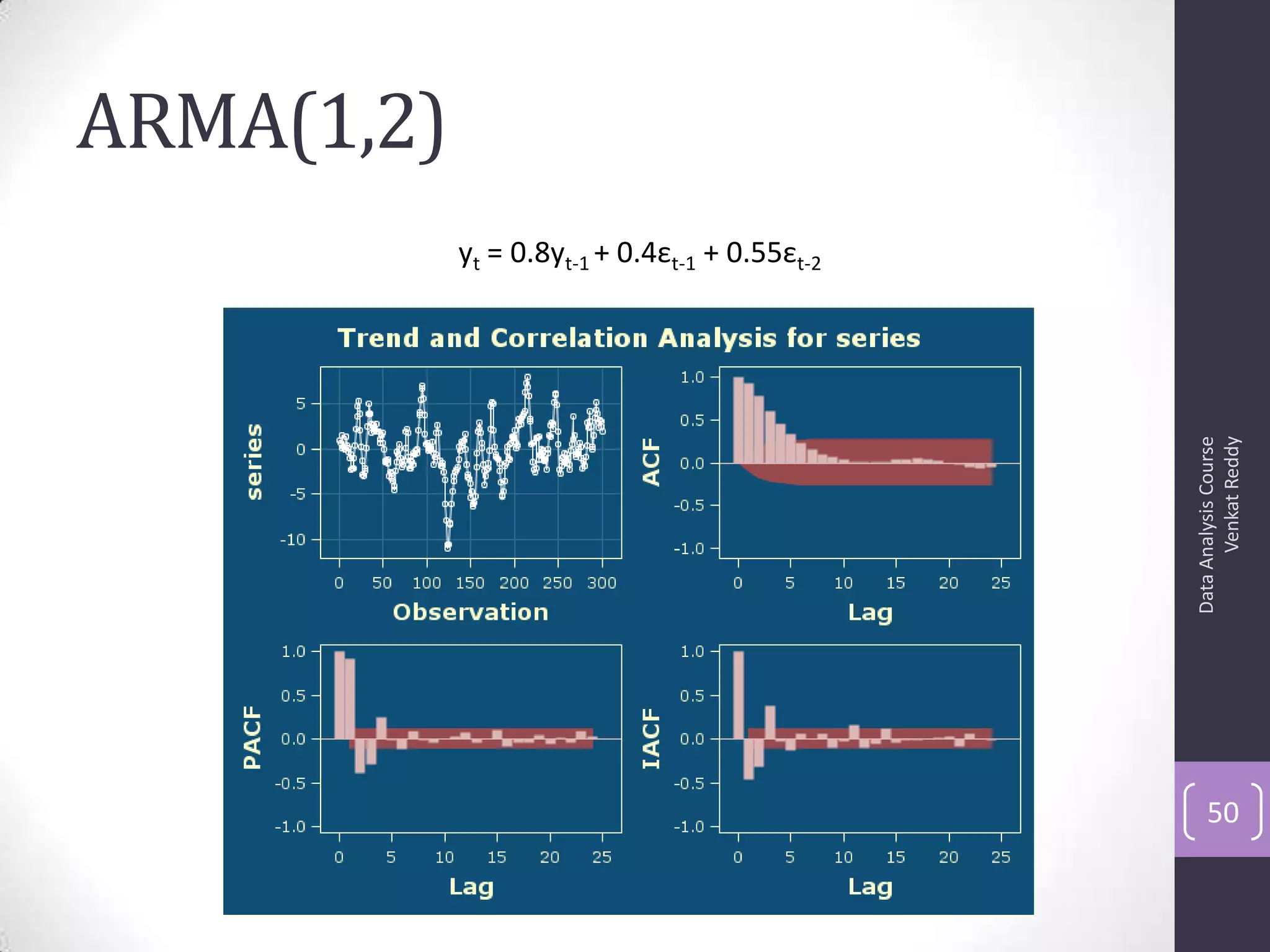

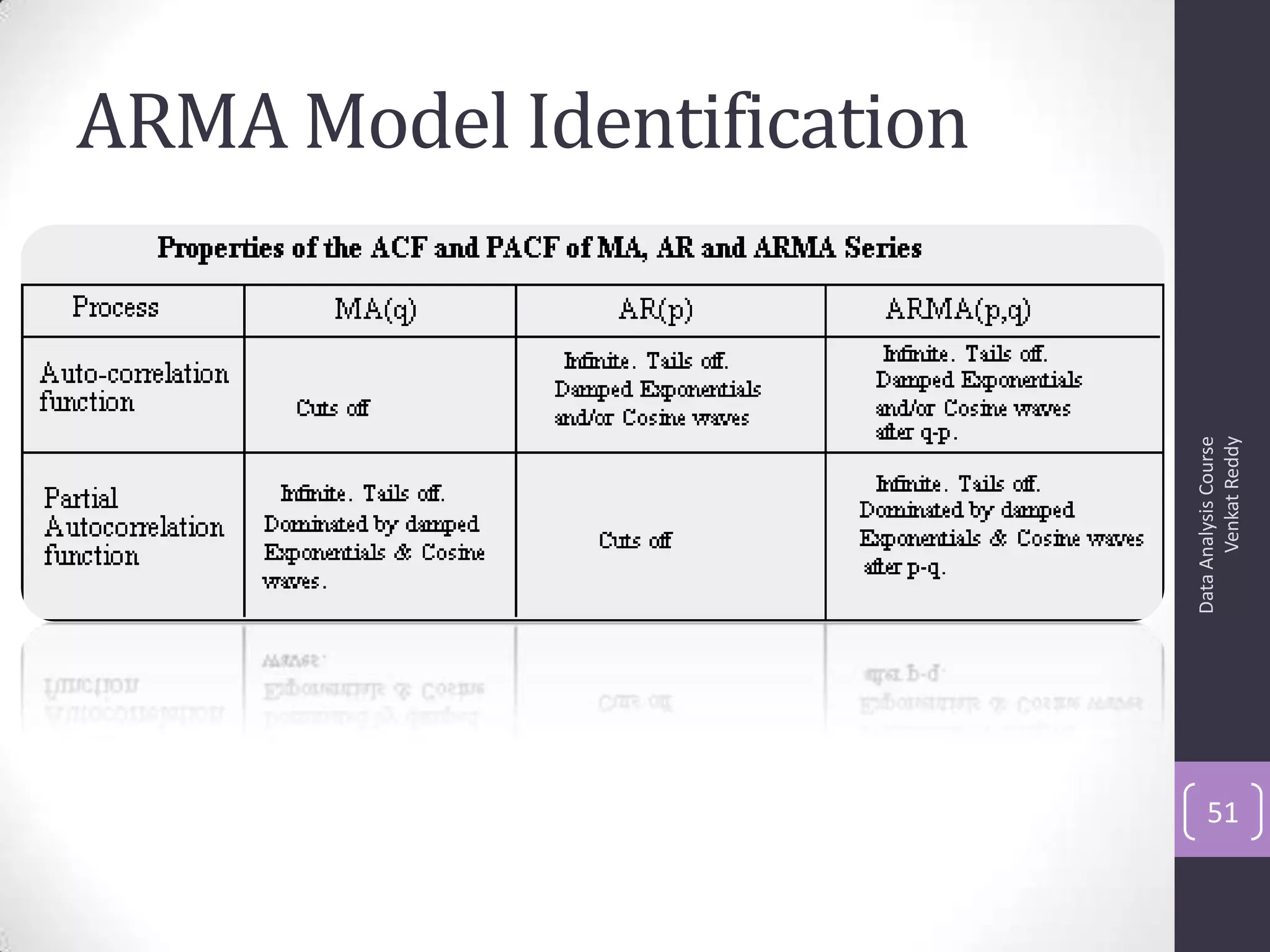

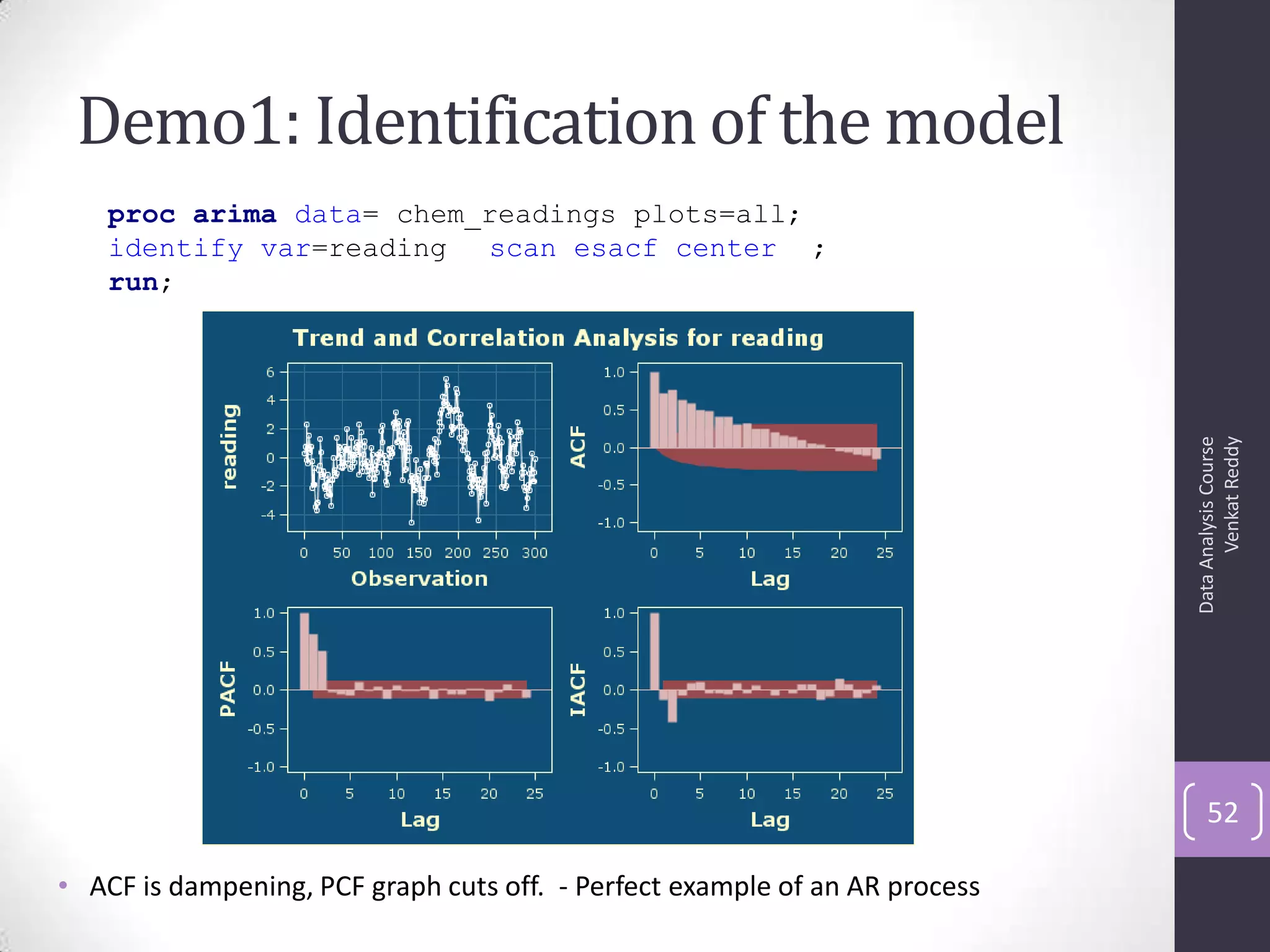

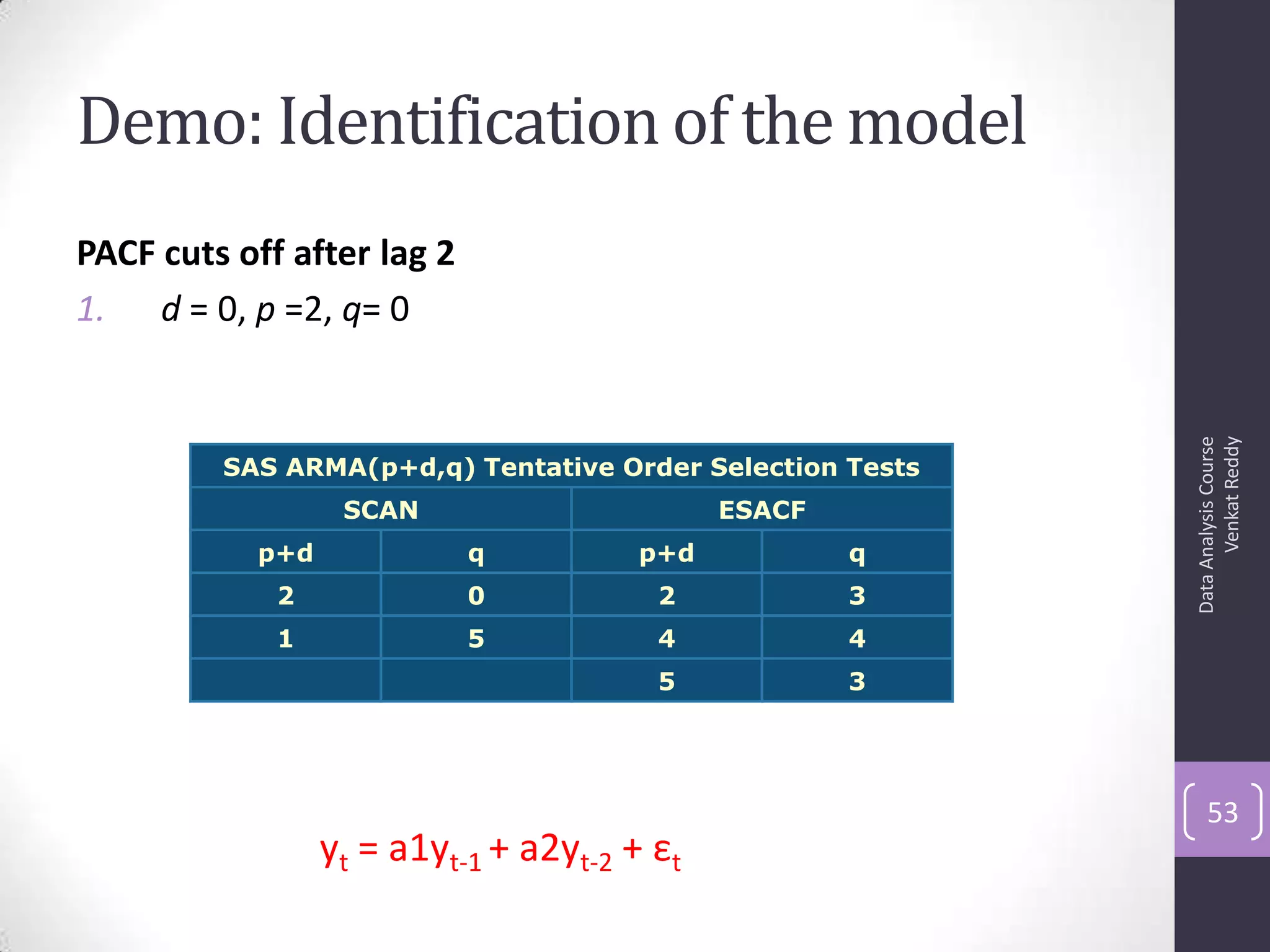

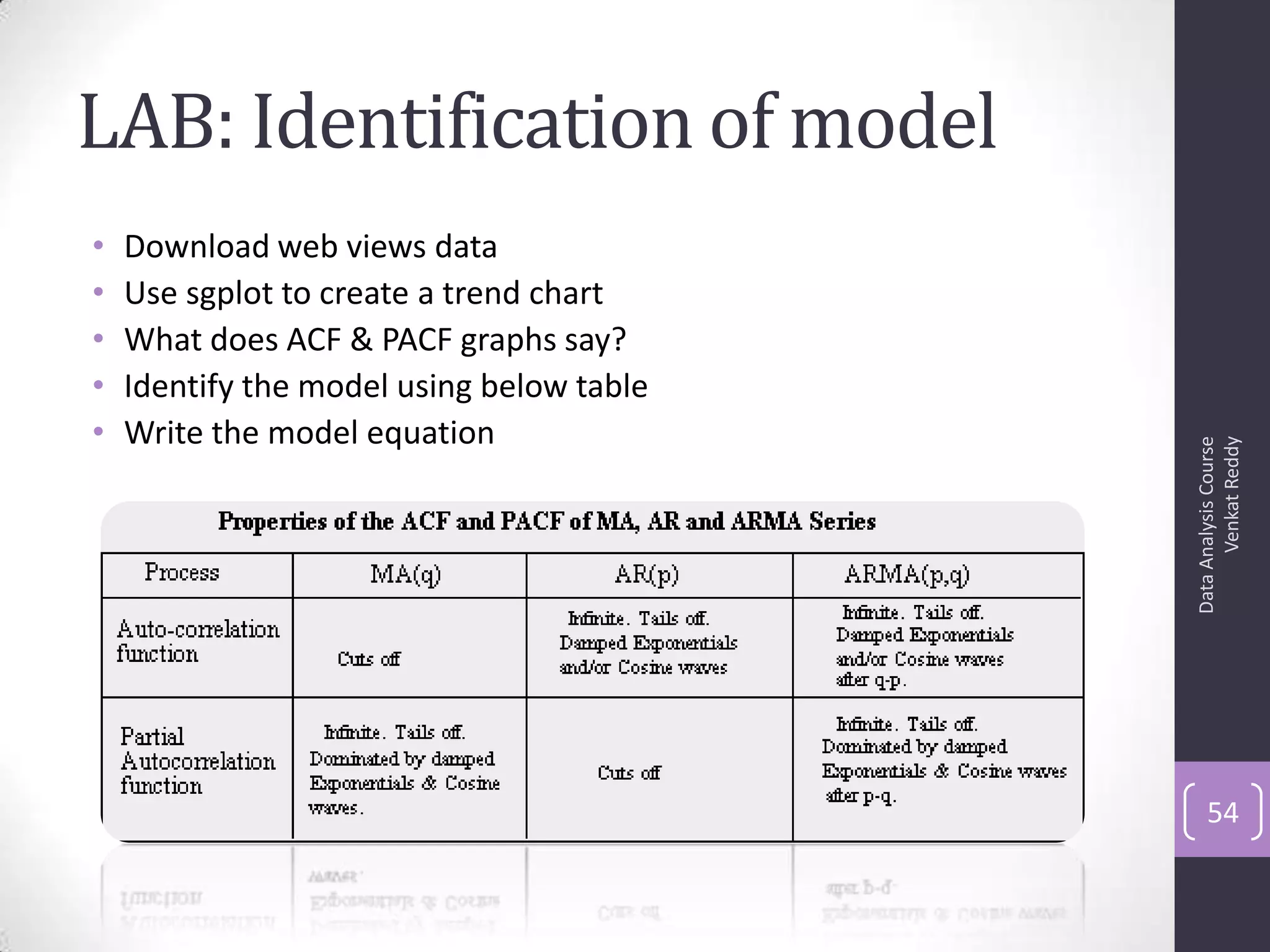

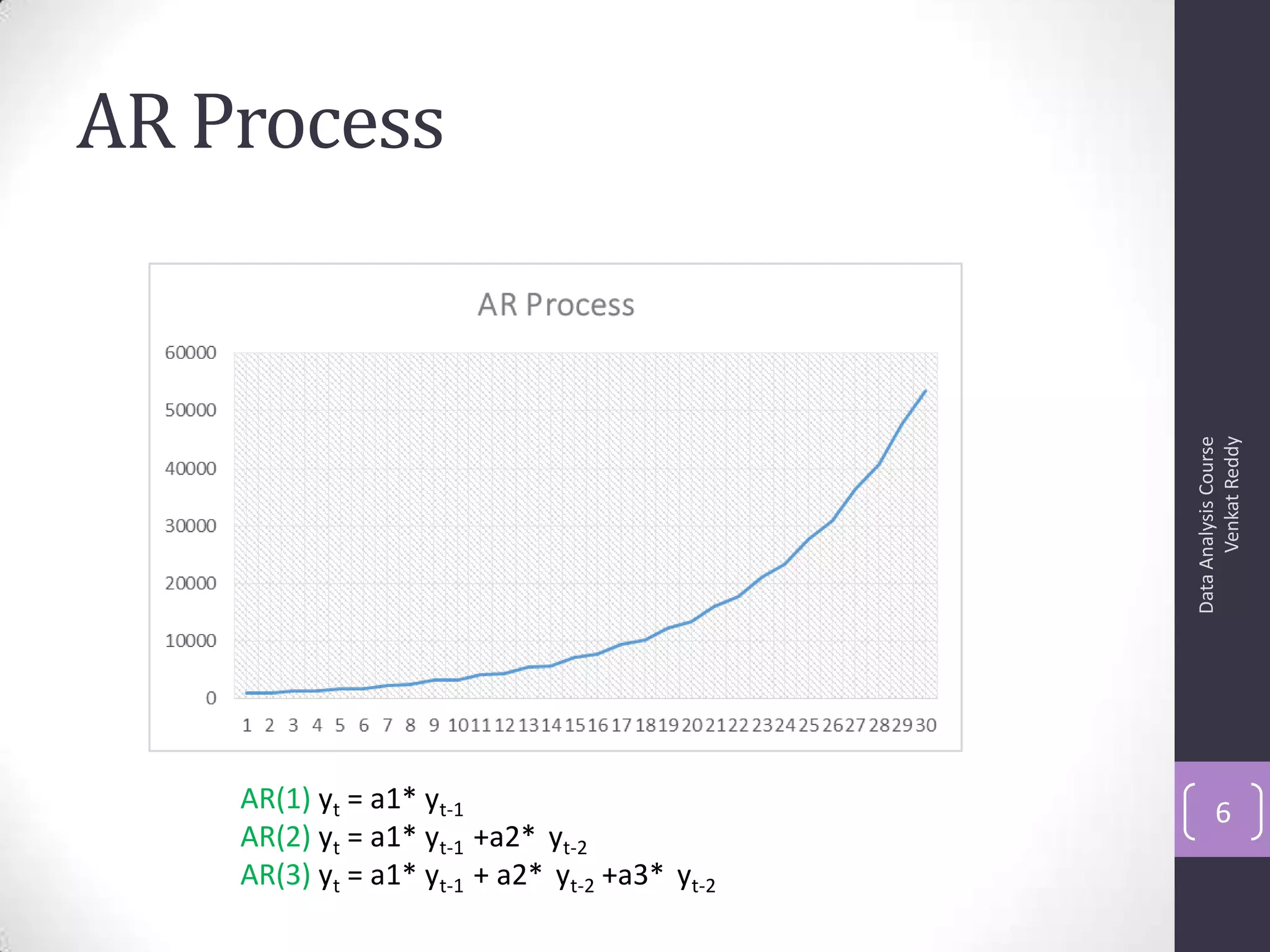

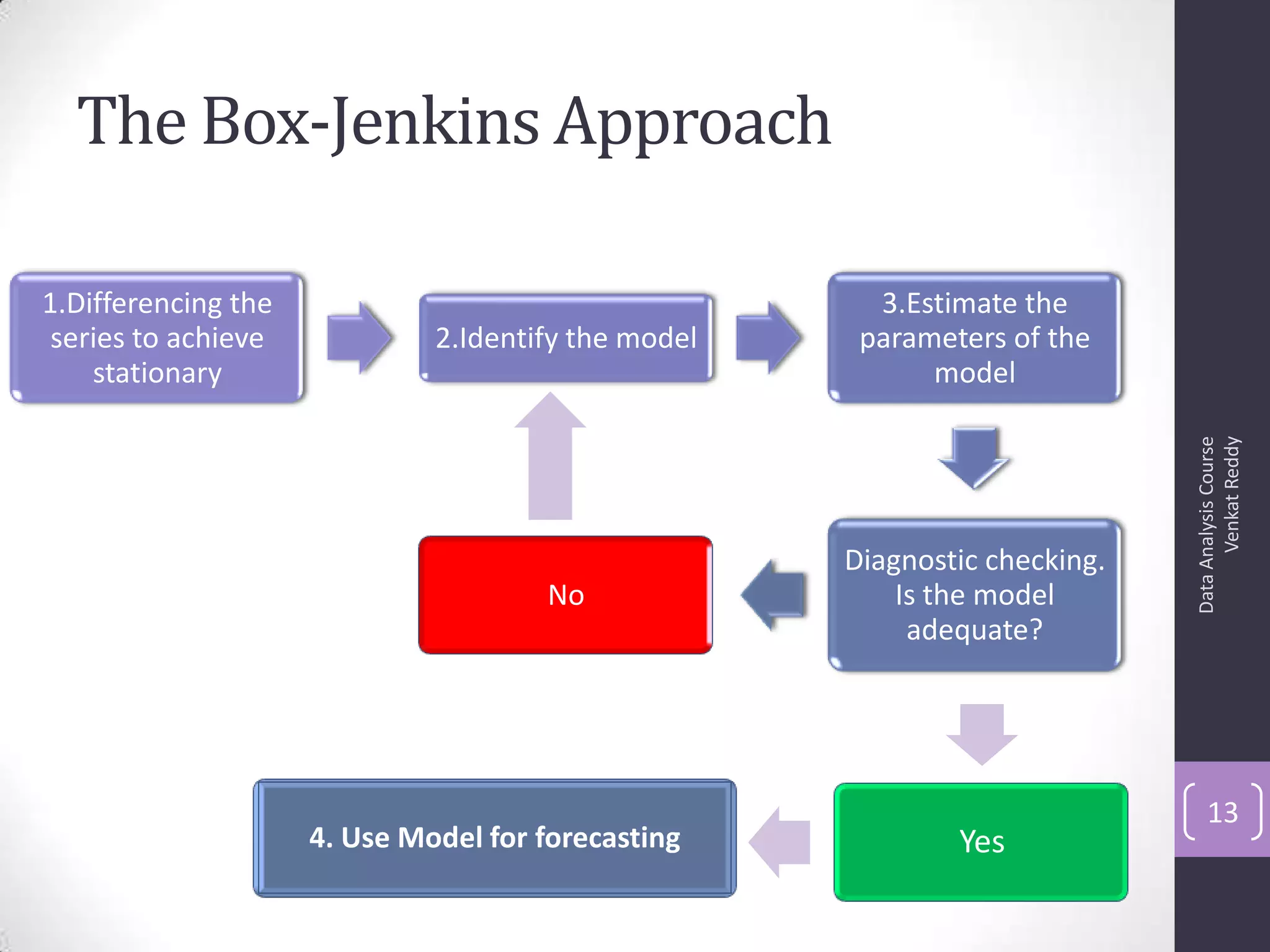

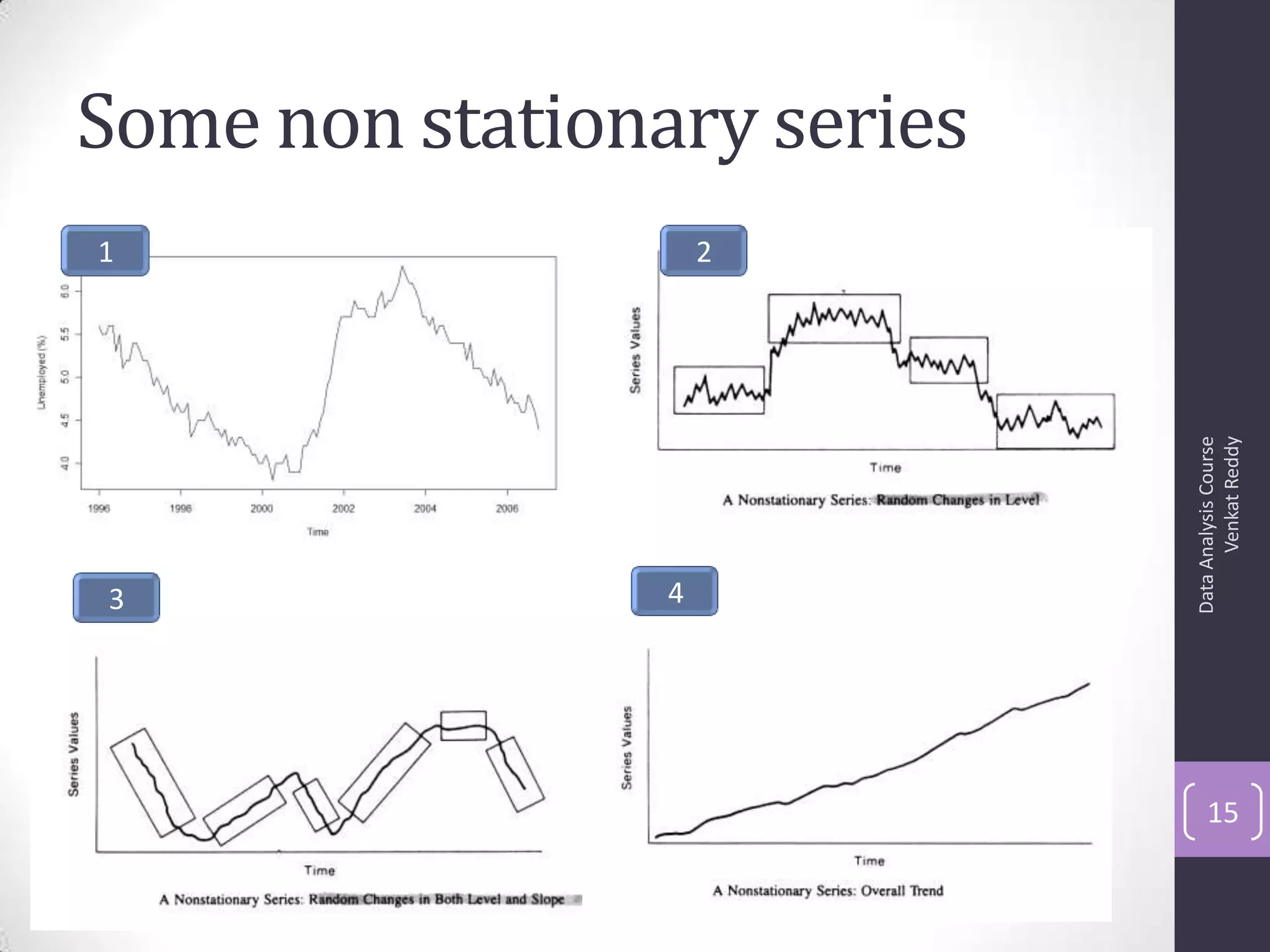

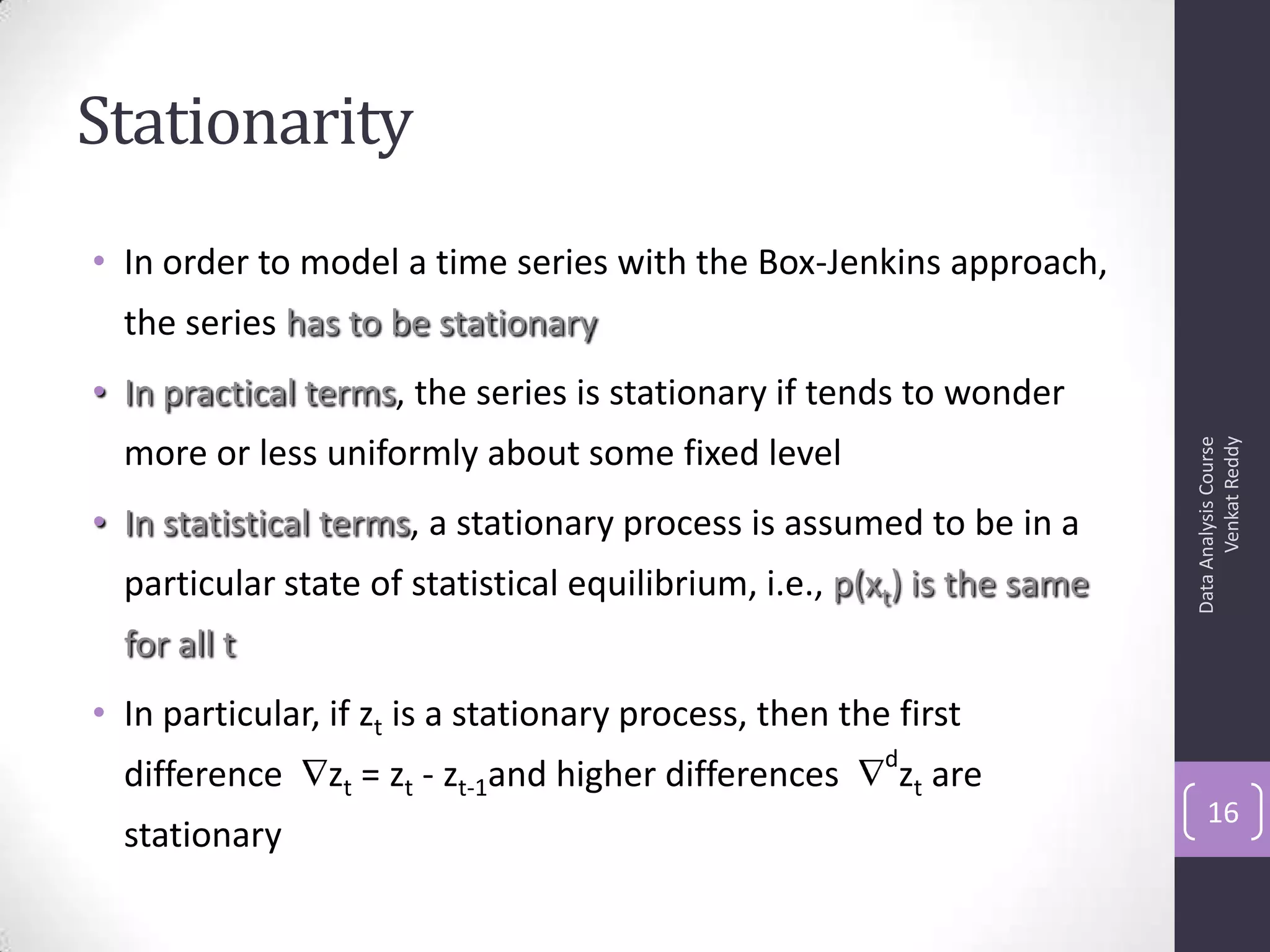

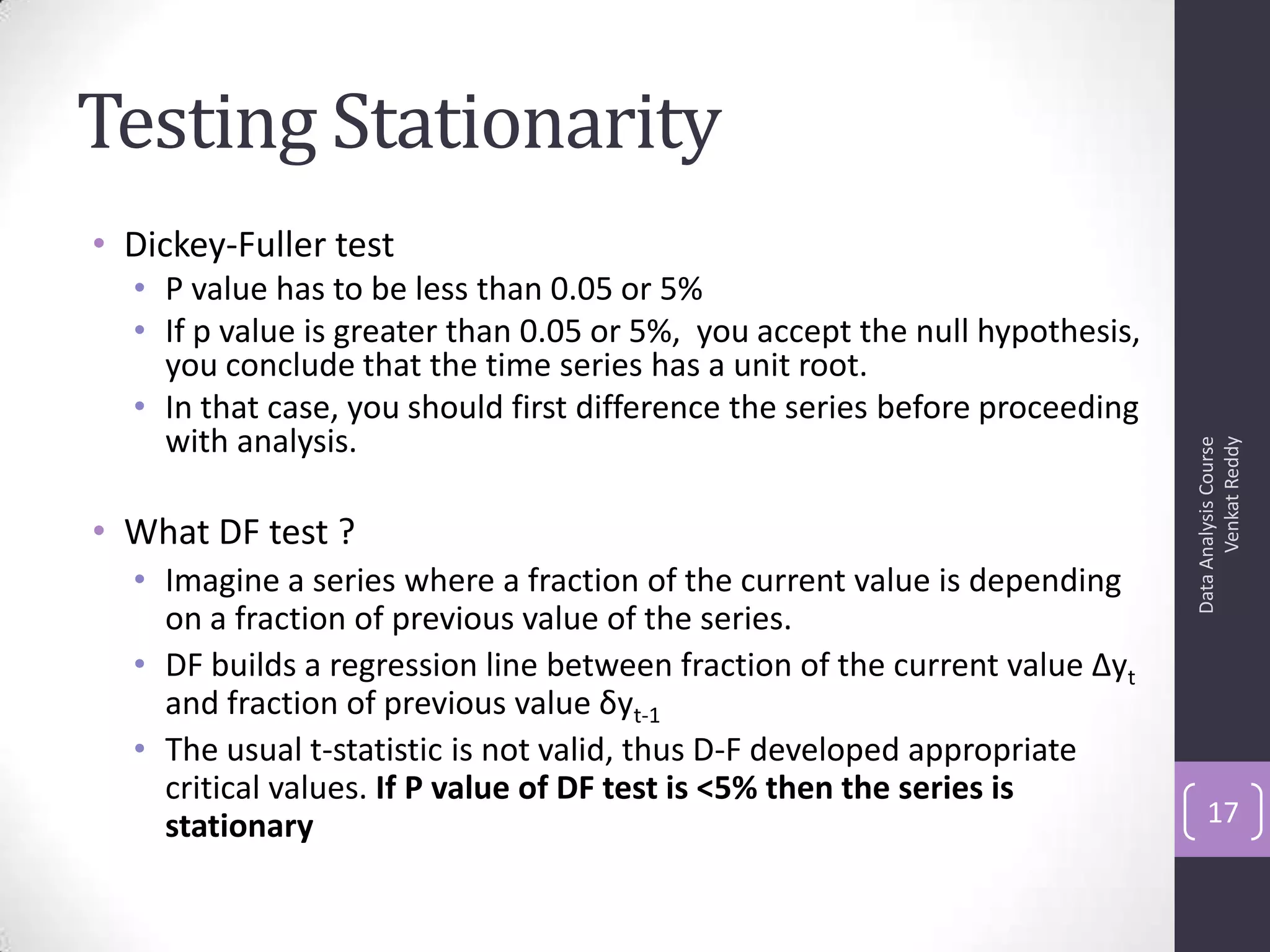

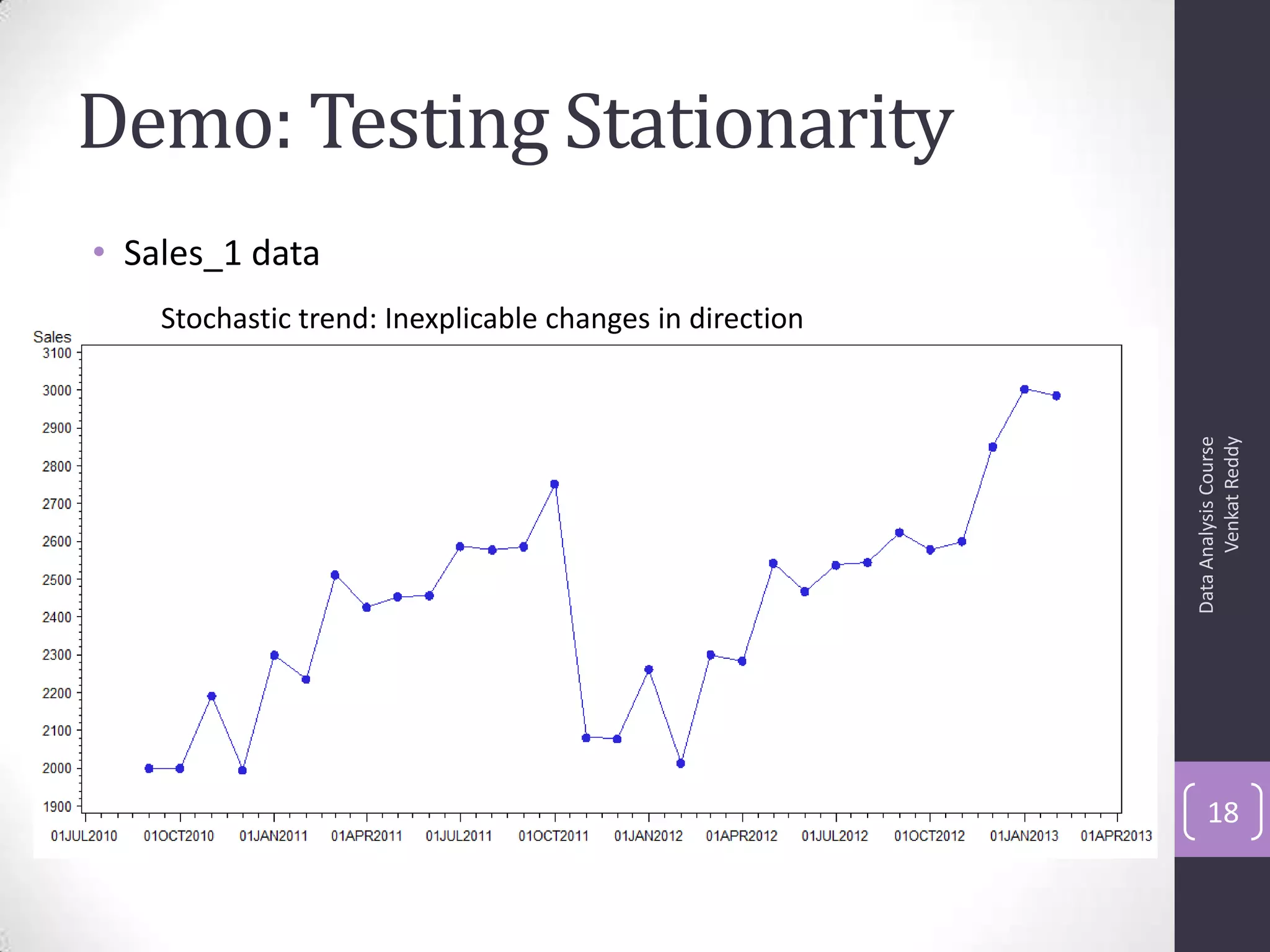

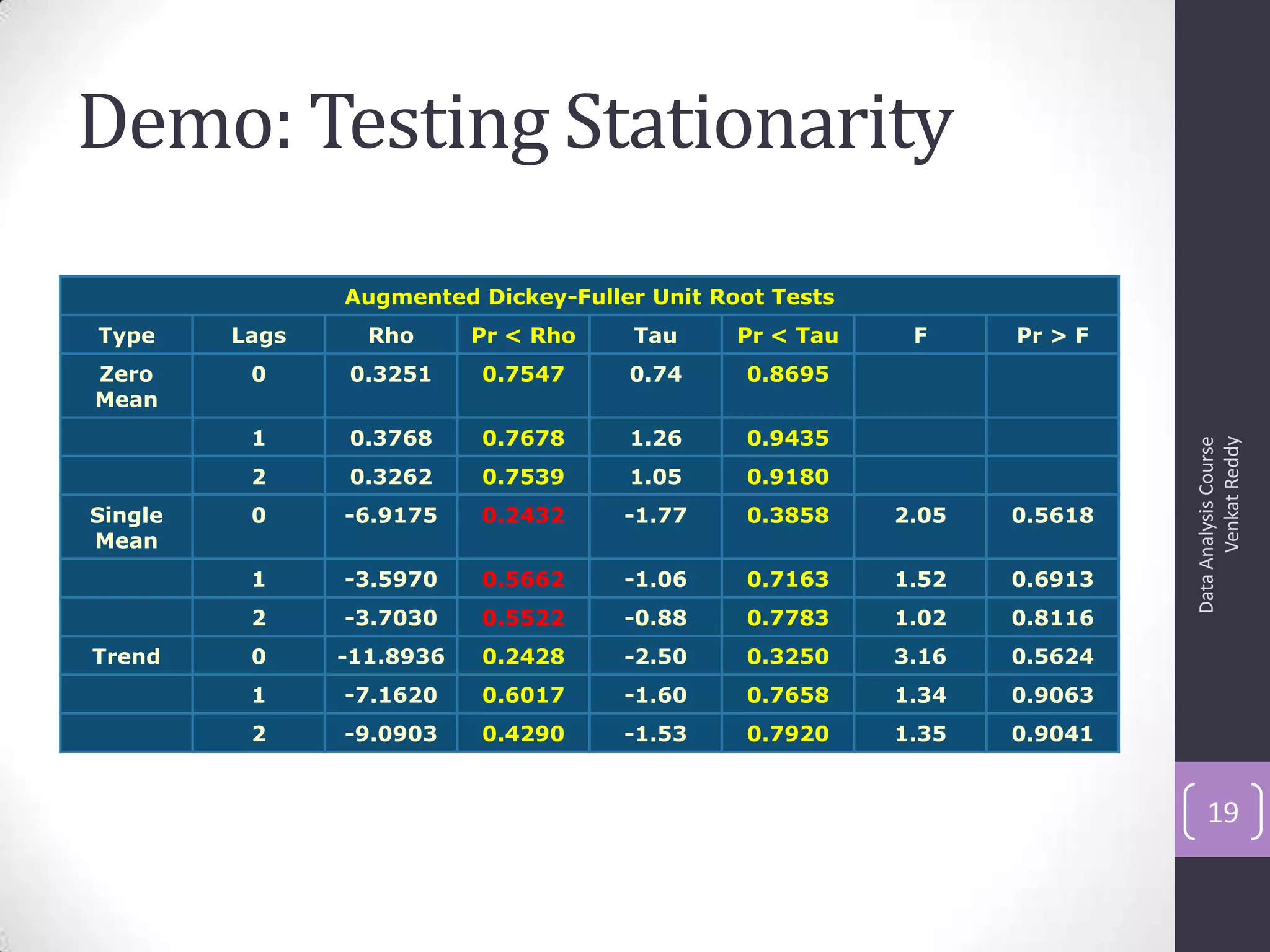

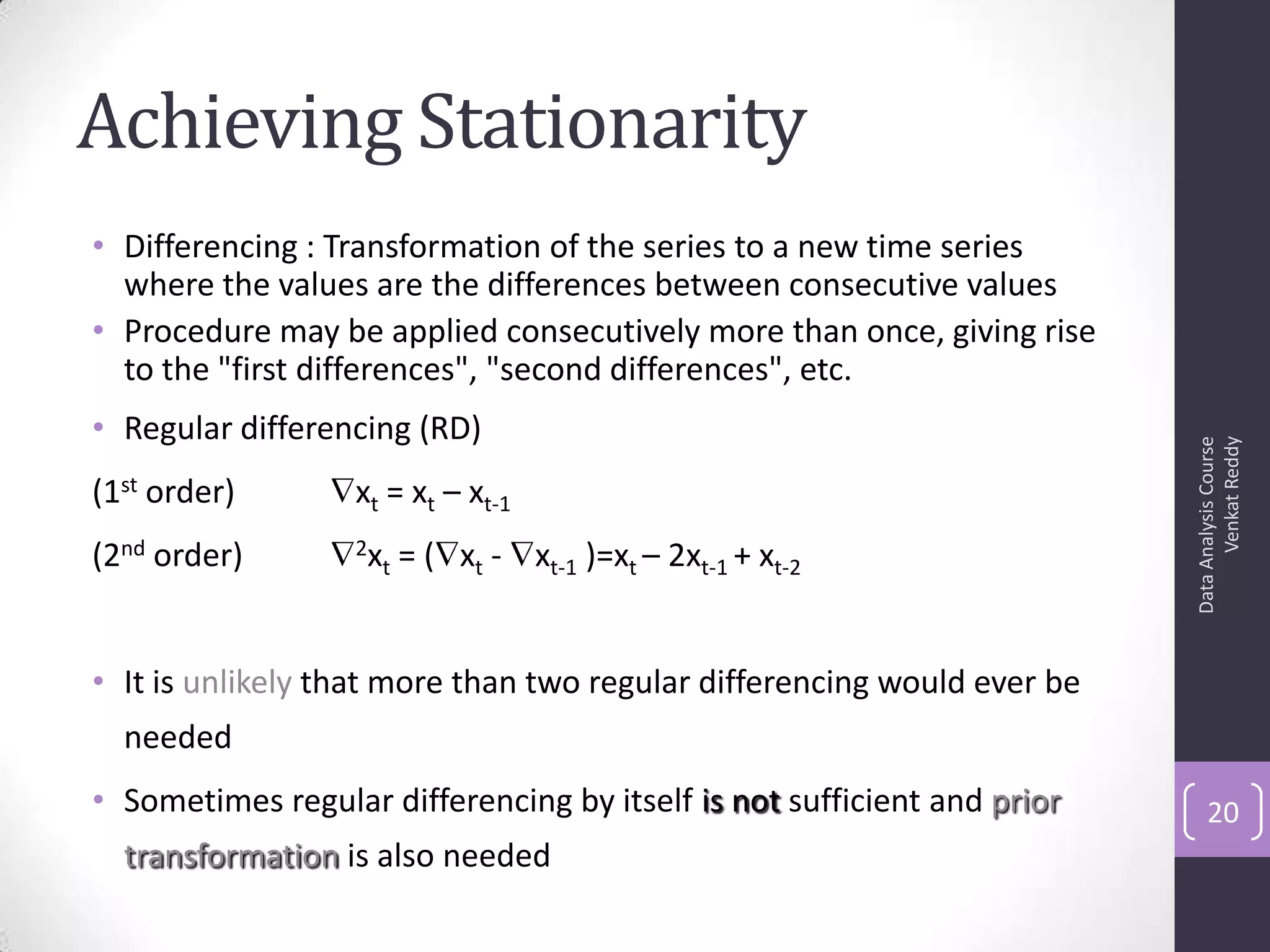

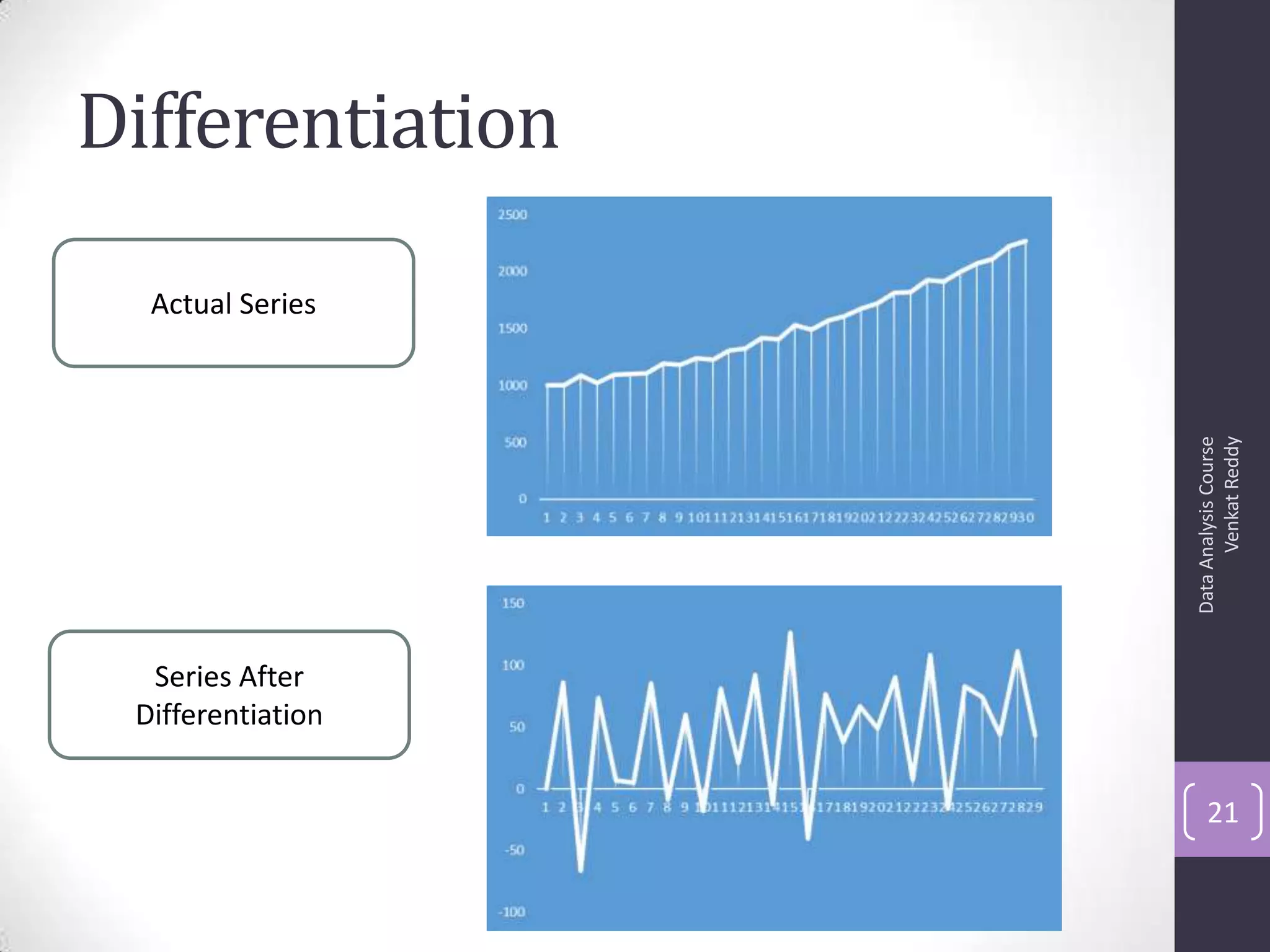

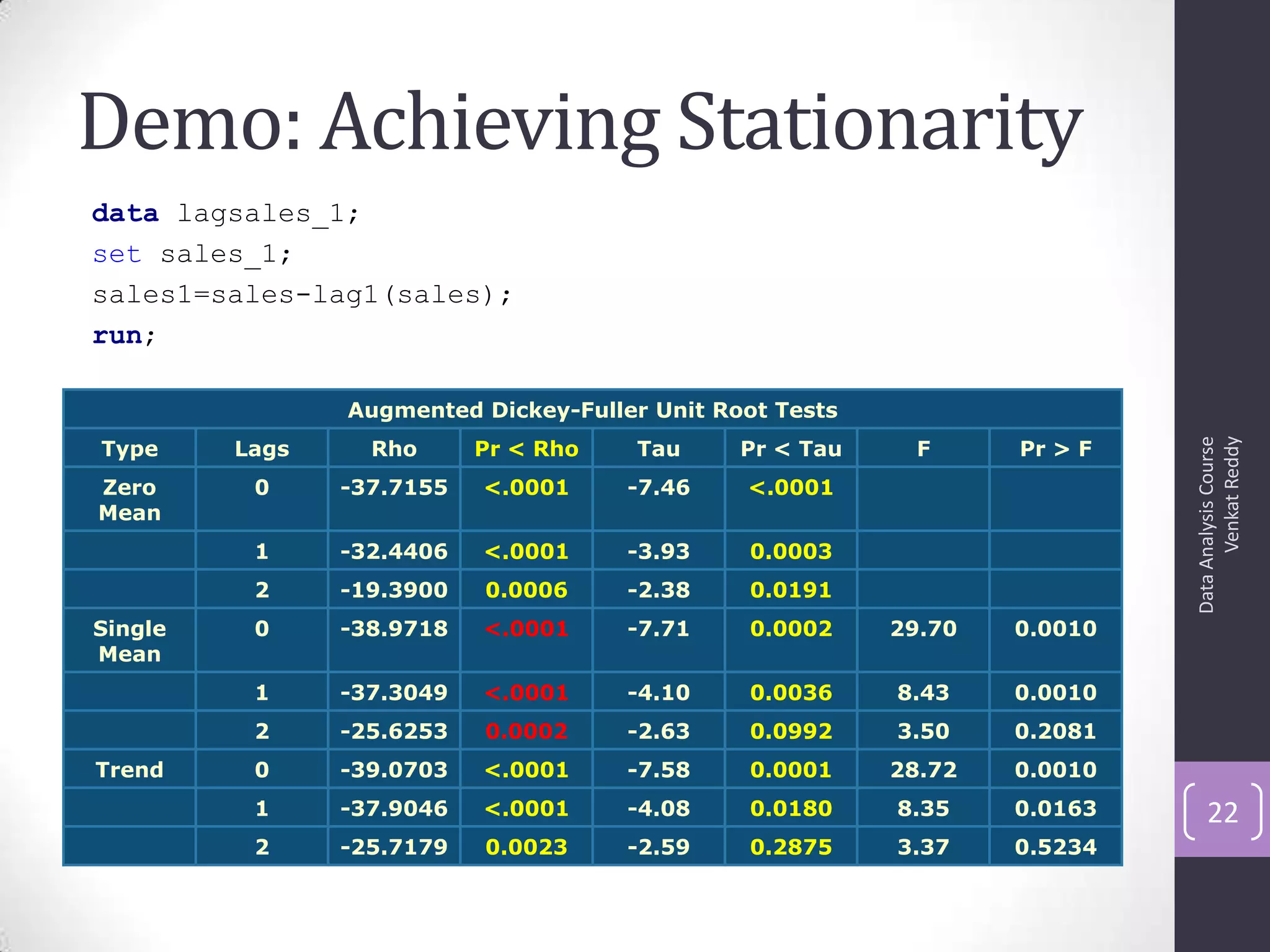

The document discusses time series analysis and forecasting using ARIMA models, focusing on the methodologies for model identification, estimation, and forecasting. It emphasizes the importance of stationarity in time series data and the steps involved in the Box-Jenkins approach, including differencing, model identification through ACF and PACF analysis, and diagnostic checking for model adequacy. Key components such as autoregressive and moving average processes are explained, along with practical guidelines for implementing ARIMA modeling.

![Autocorrelation Function (ACF)

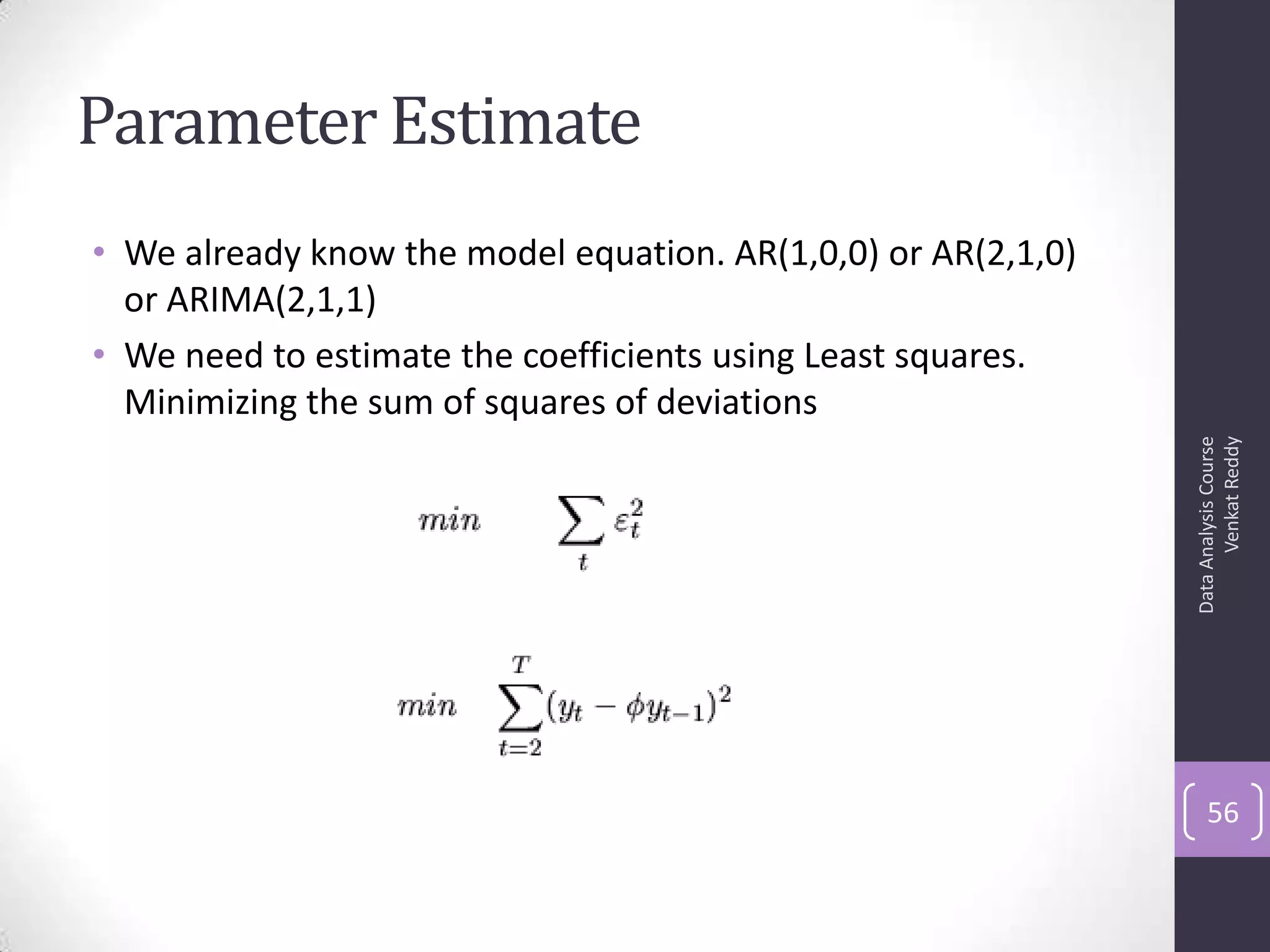

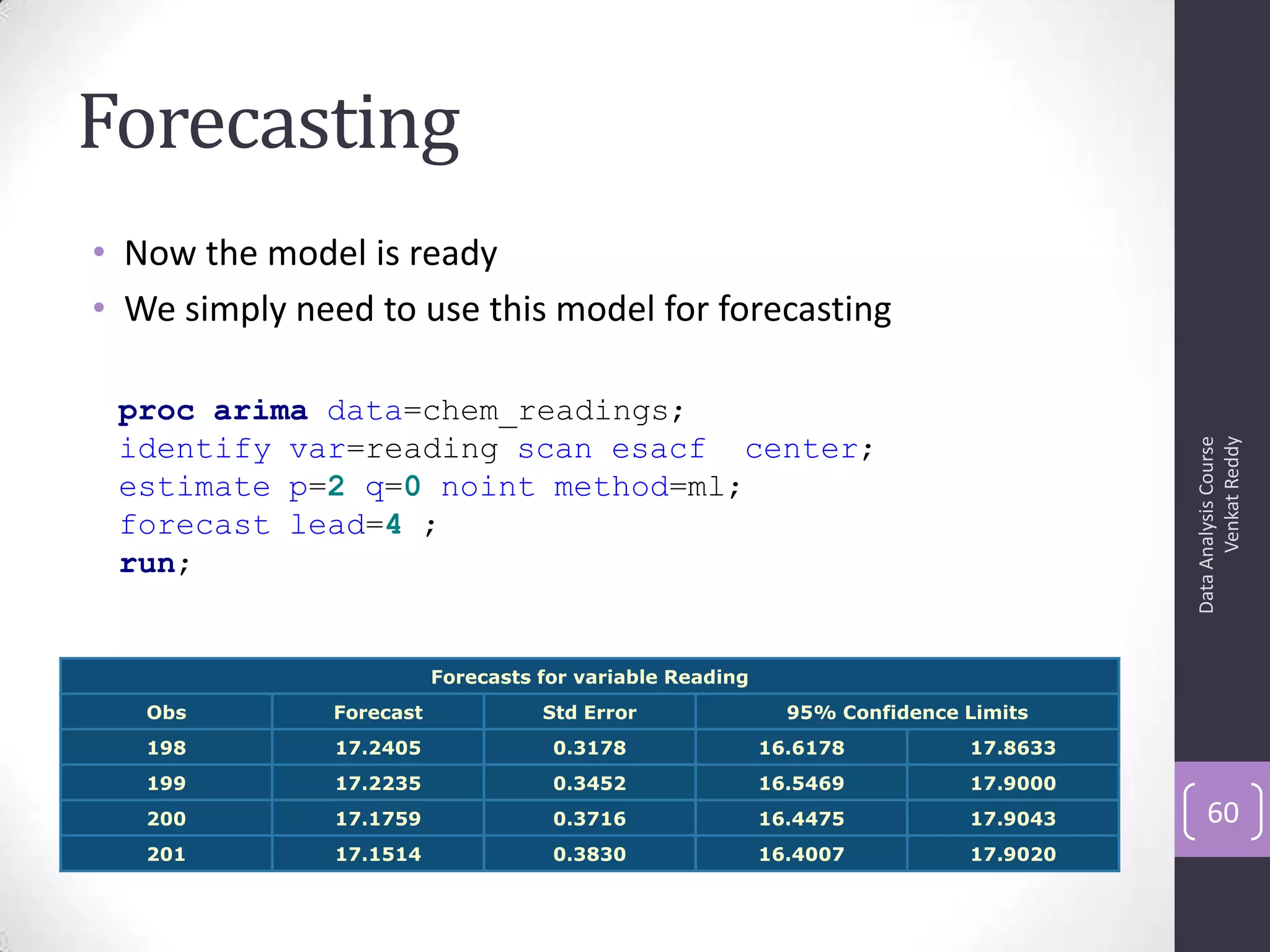

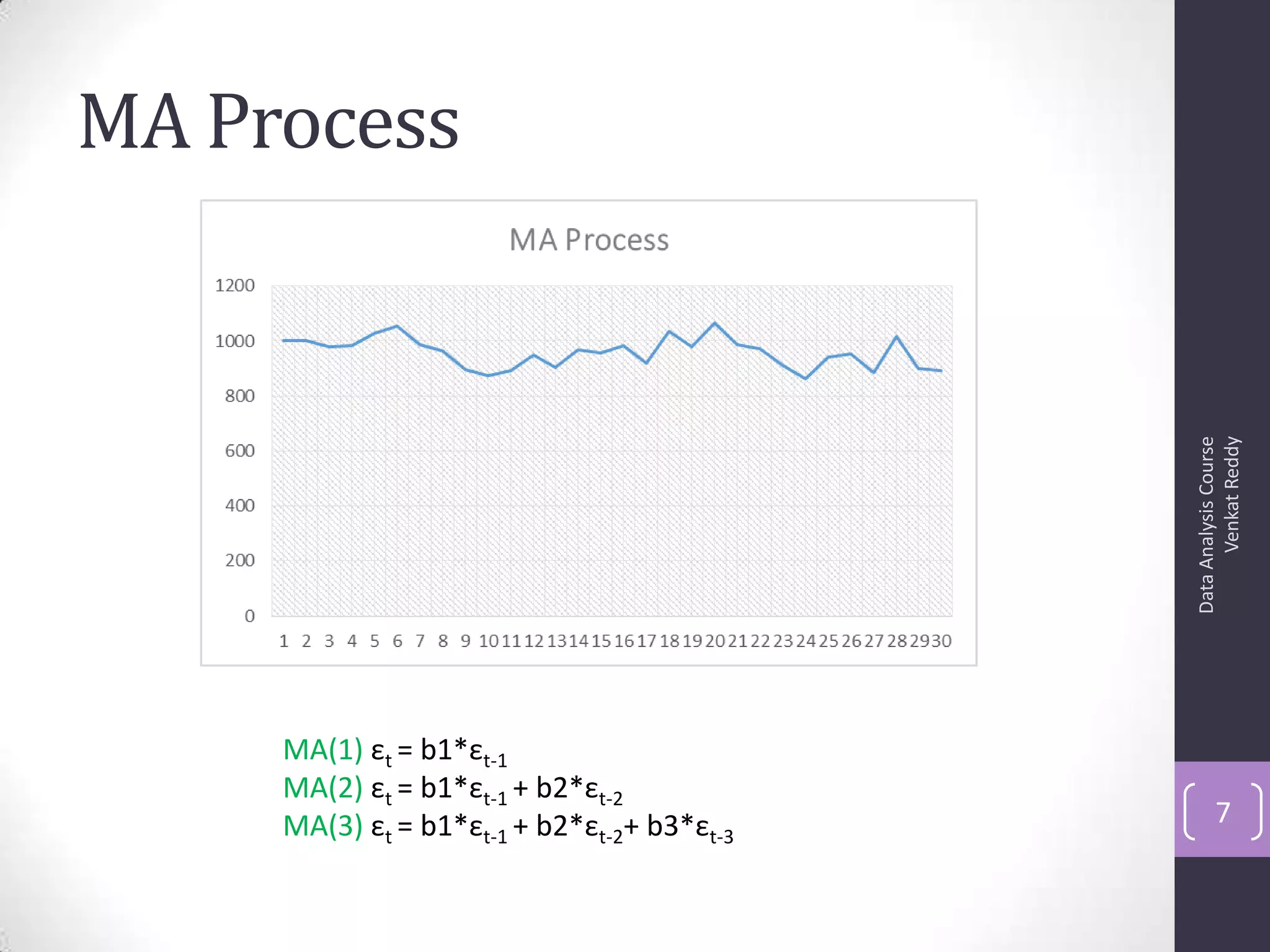

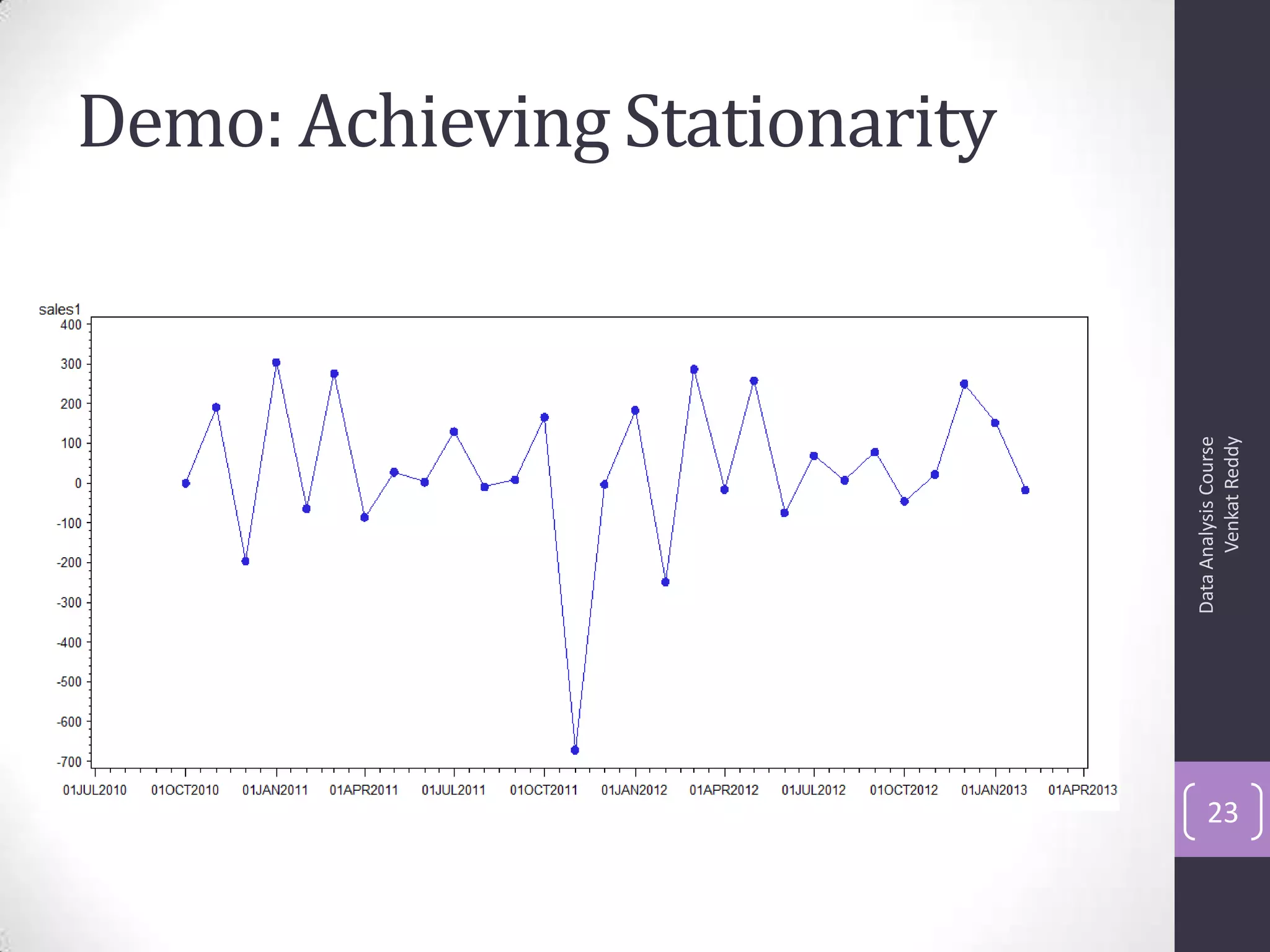

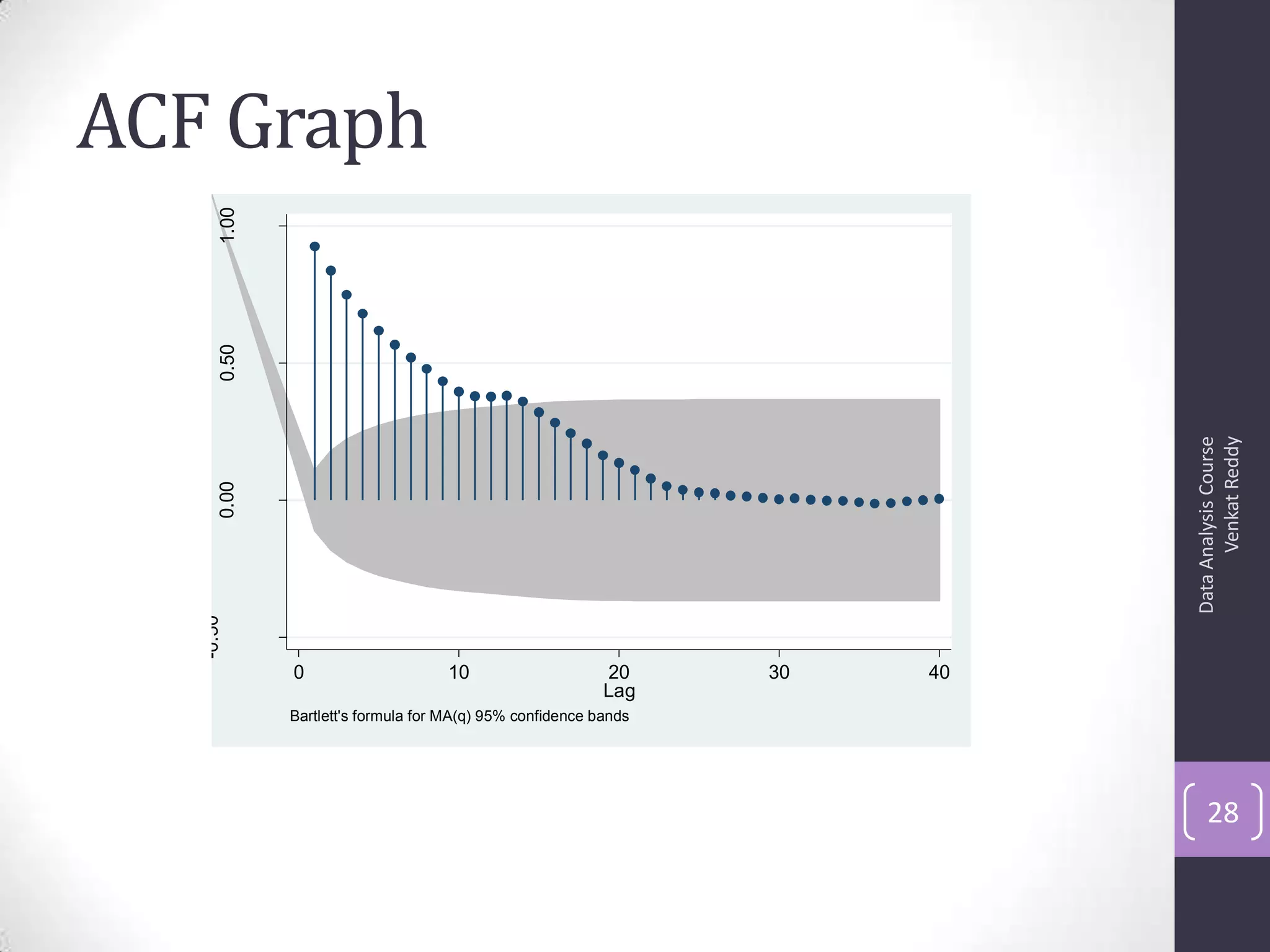

• Autocorrelation is a correlation coefficient. However, instead

of correlation between two different variables, the correlation

is between two values of the same variable at times Xi and

Xi+k.

• Correlation with lag-1, lag2, lag3 etc.,

• The ACF represents the degree of persistence over respective

lags of a variable.

ρk = γk / γ0 = covariance at lag k/ variance

ρk = E[(yt – μ)(yt-k – μ)]2

E[(yt – μ)2]

ACF (0) = 1, ACF (k) = ACF (-k)

DataAnalysisCourse

VenkatReddy

27](https://image.slidesharecdn.com/6-130914140240-phpapp01/75/ARIMA-27-2048.jpg)

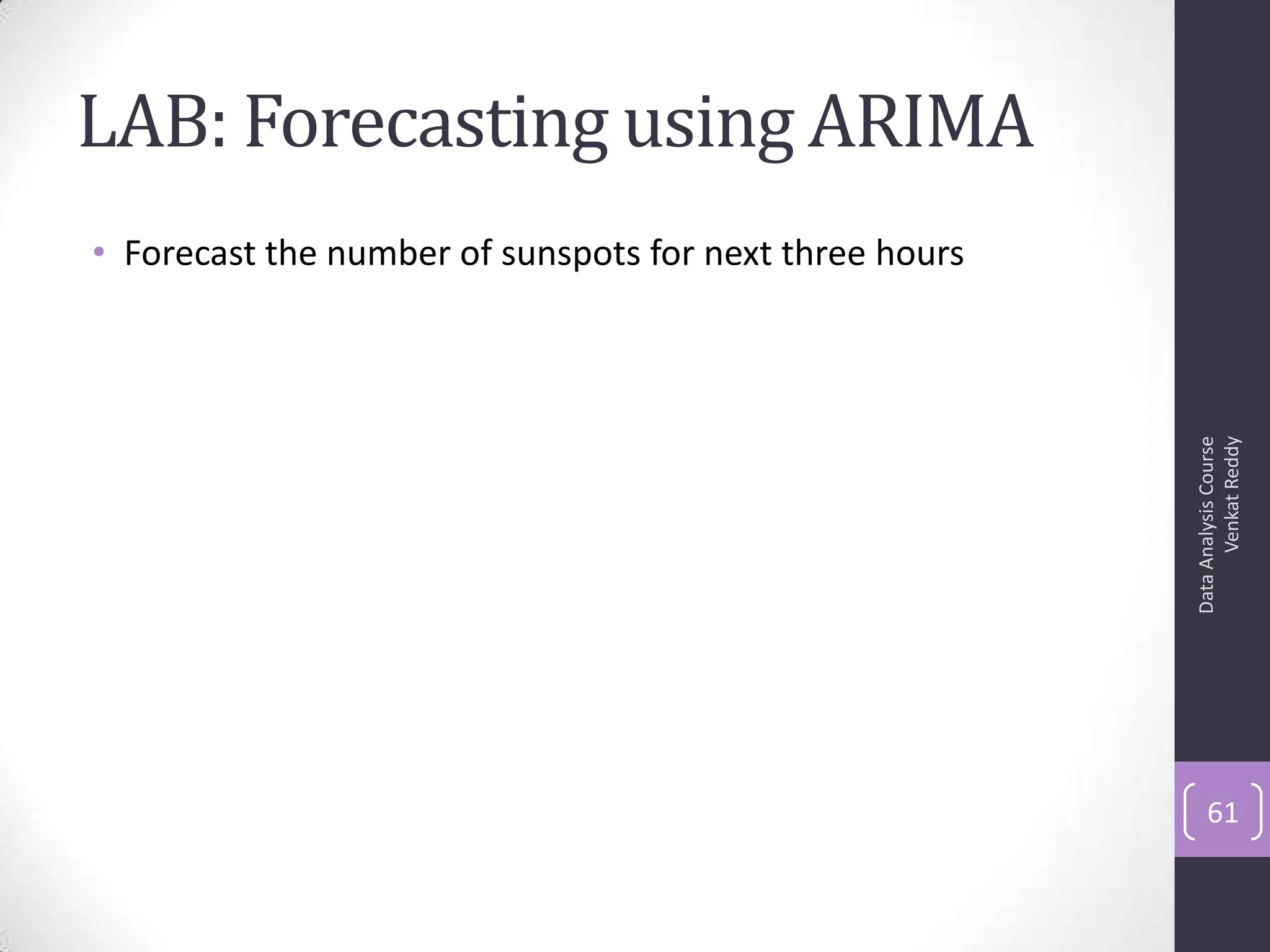

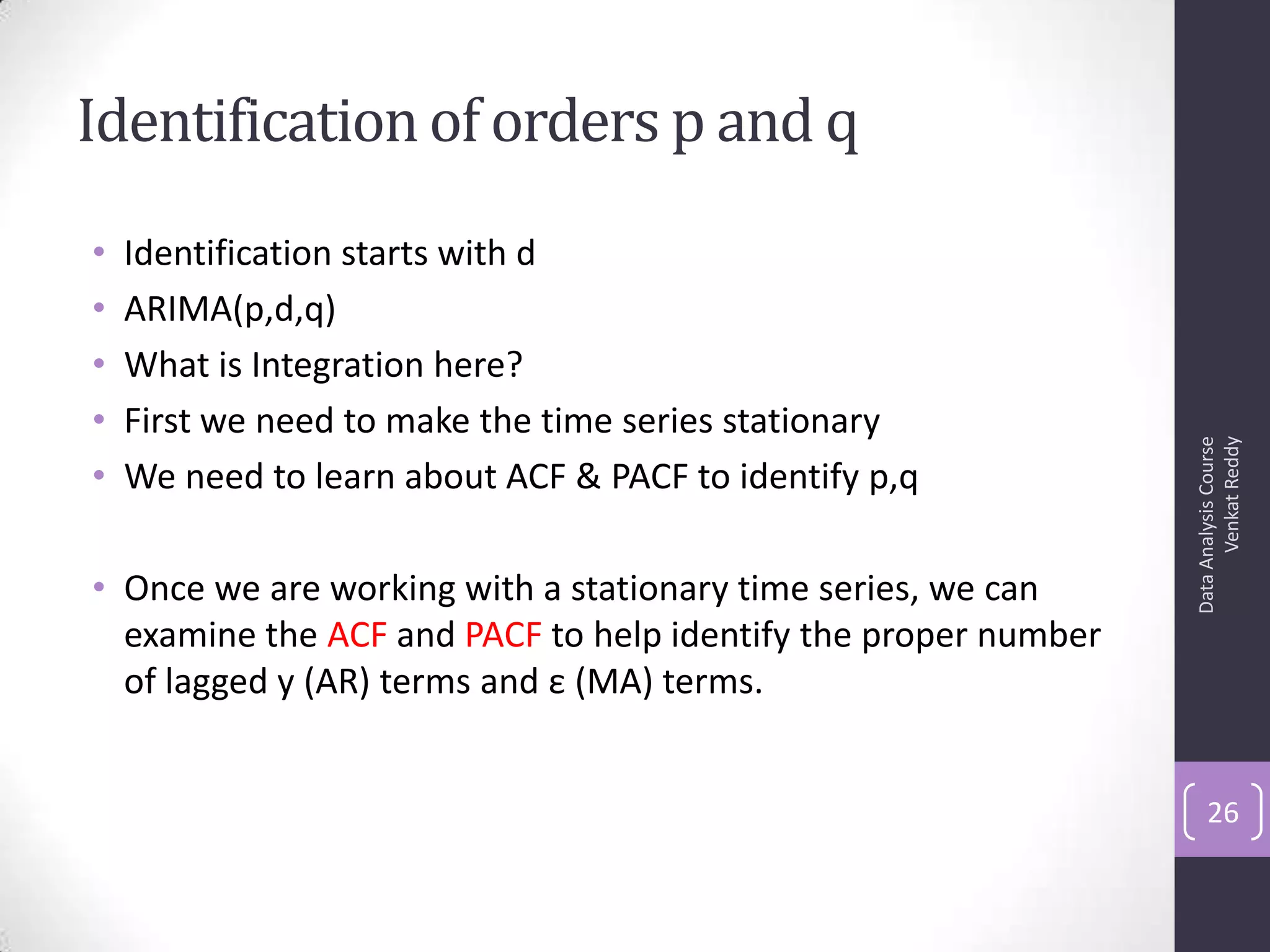

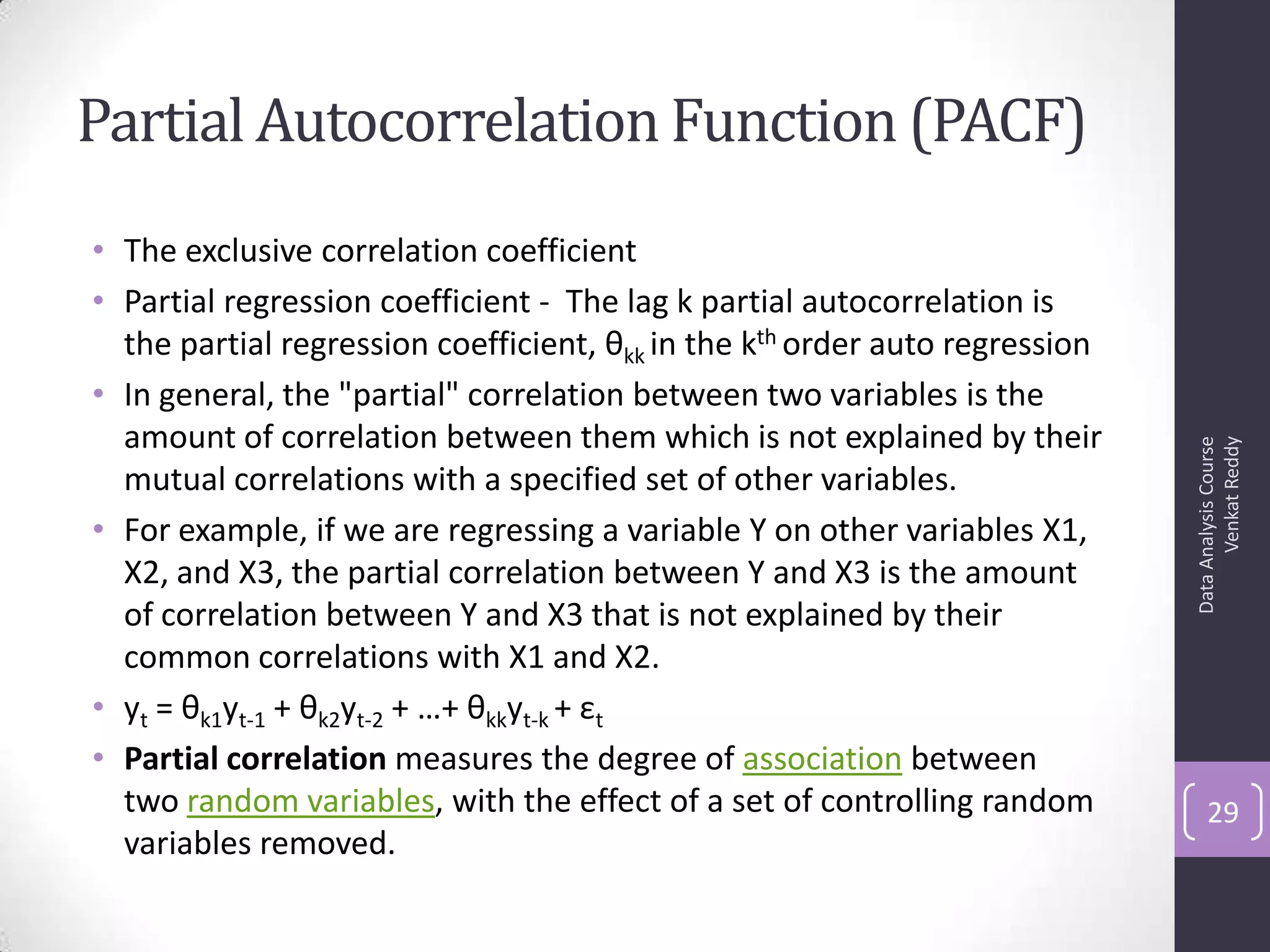

![PACF Graph

DataAnalysisCourse

VenkatReddy

30

-0.50

0.000.501.00

0 10 20 30 40

Lag

95% Confidence bands [se = 1/sqrt(n)]](https://image.slidesharecdn.com/6-130914140240-phpapp01/75/ARIMA-30-2048.jpg)