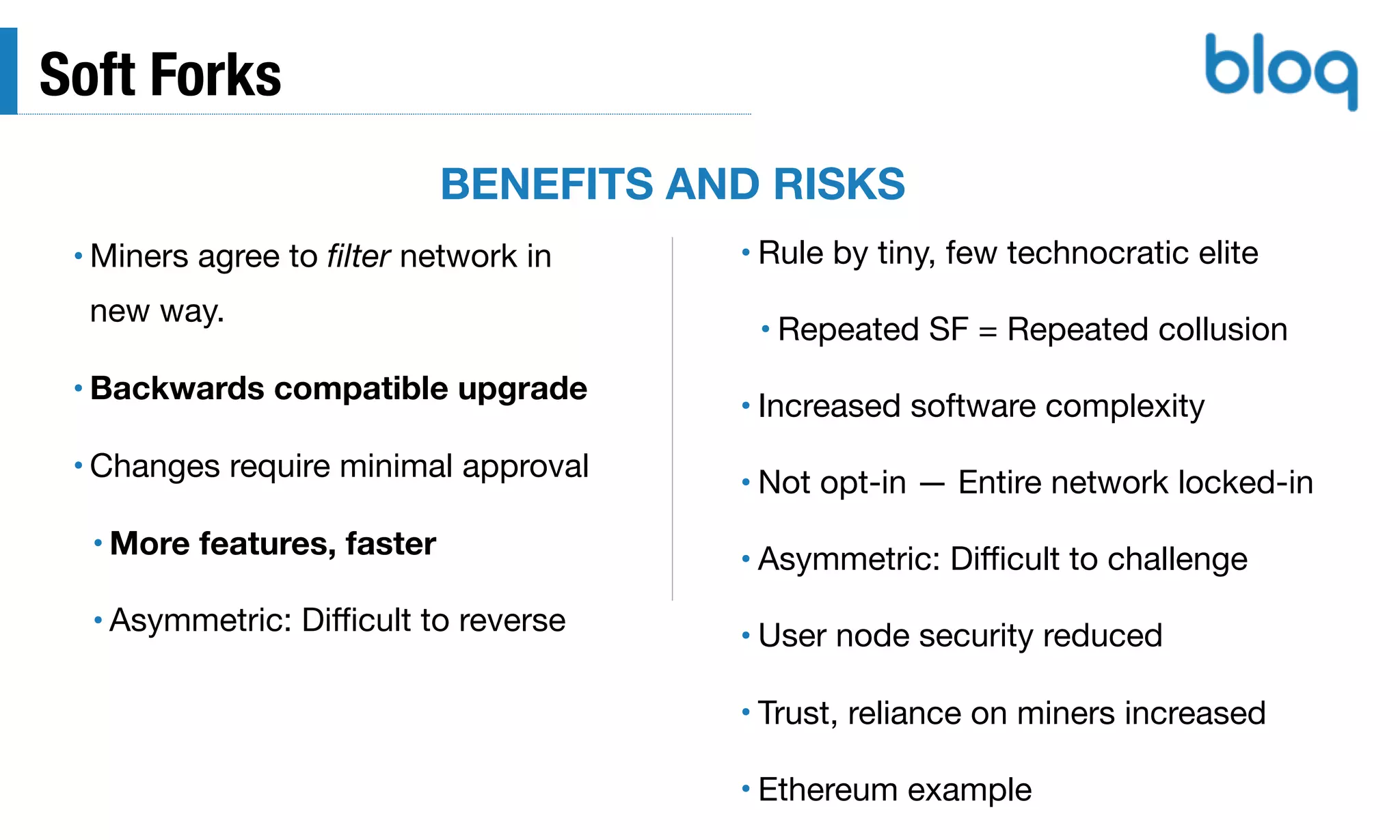

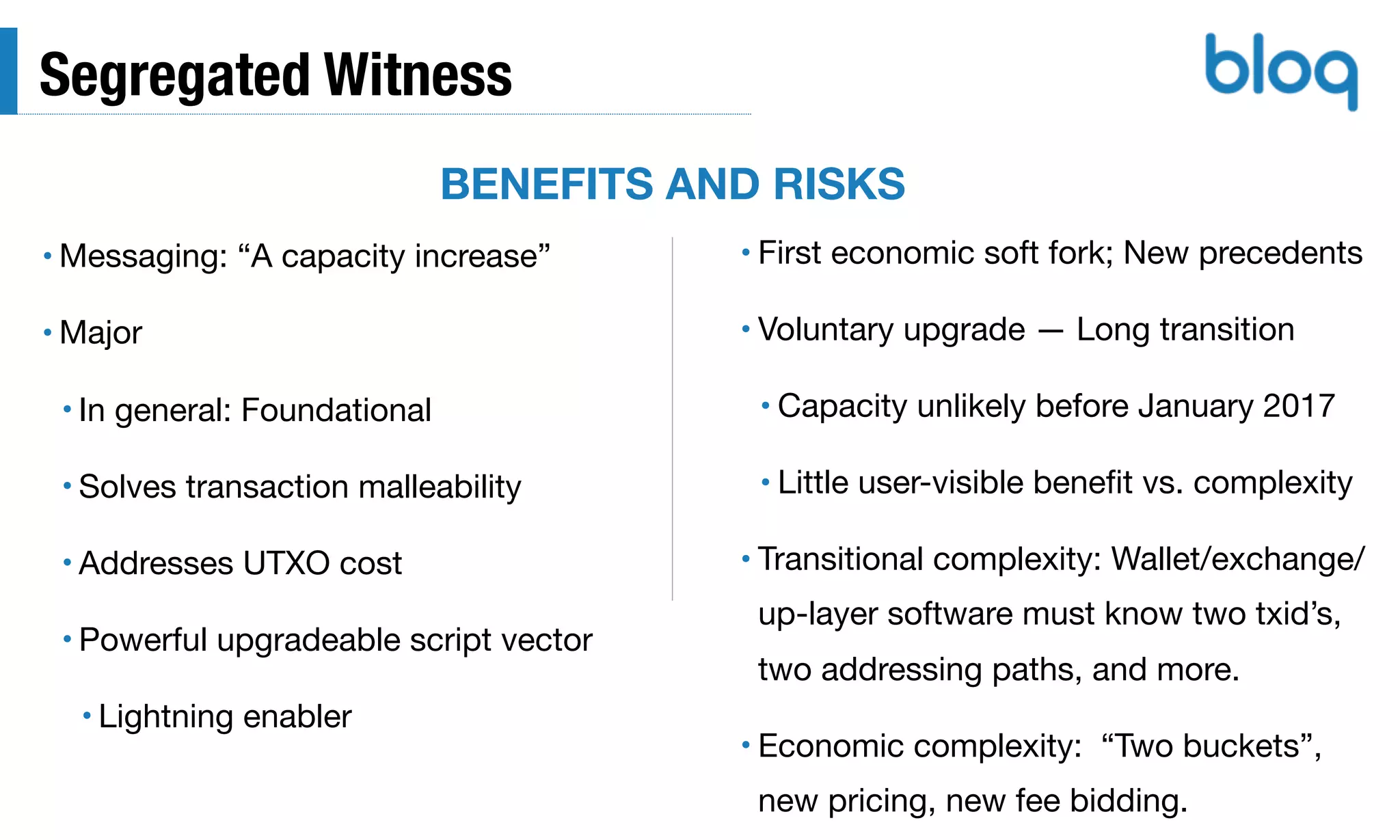

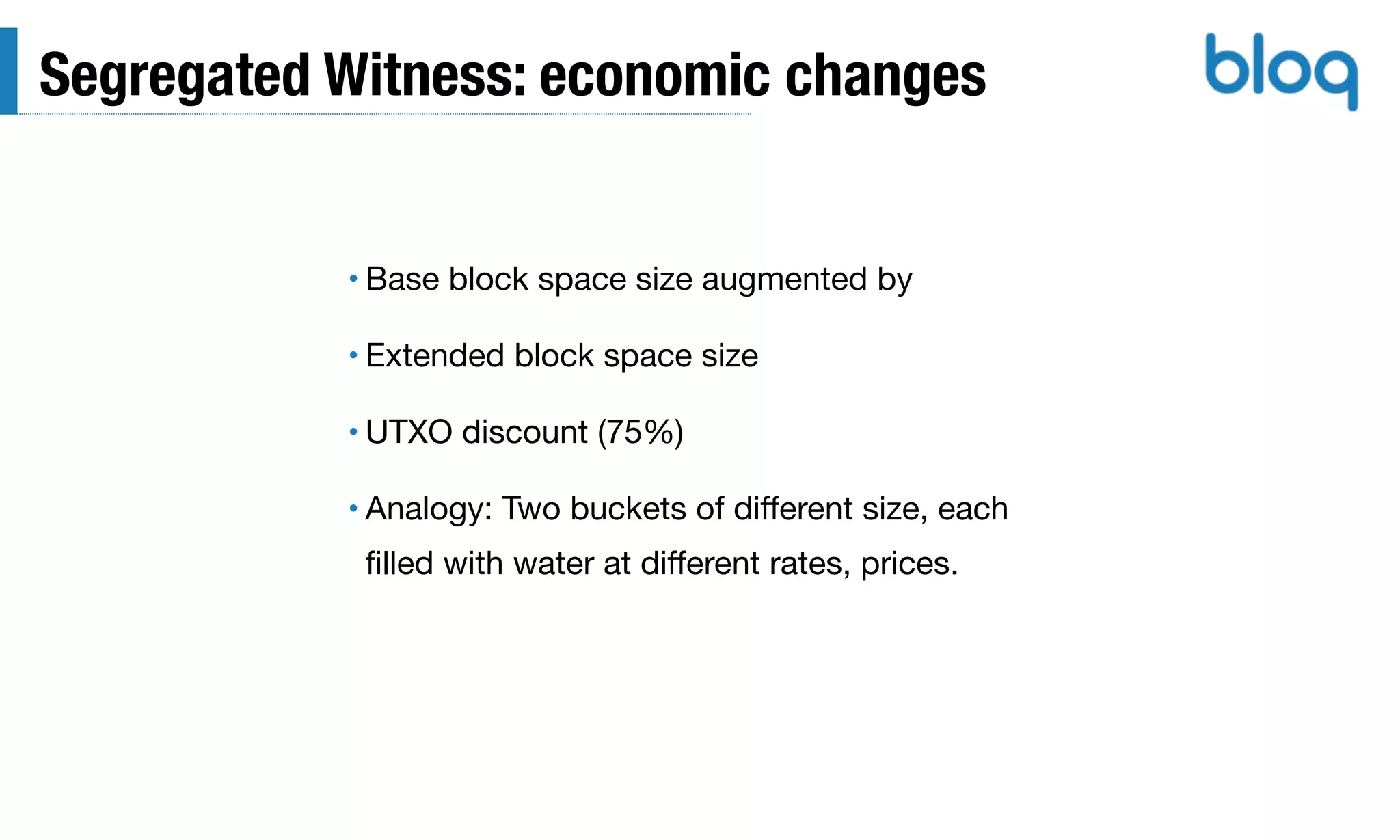

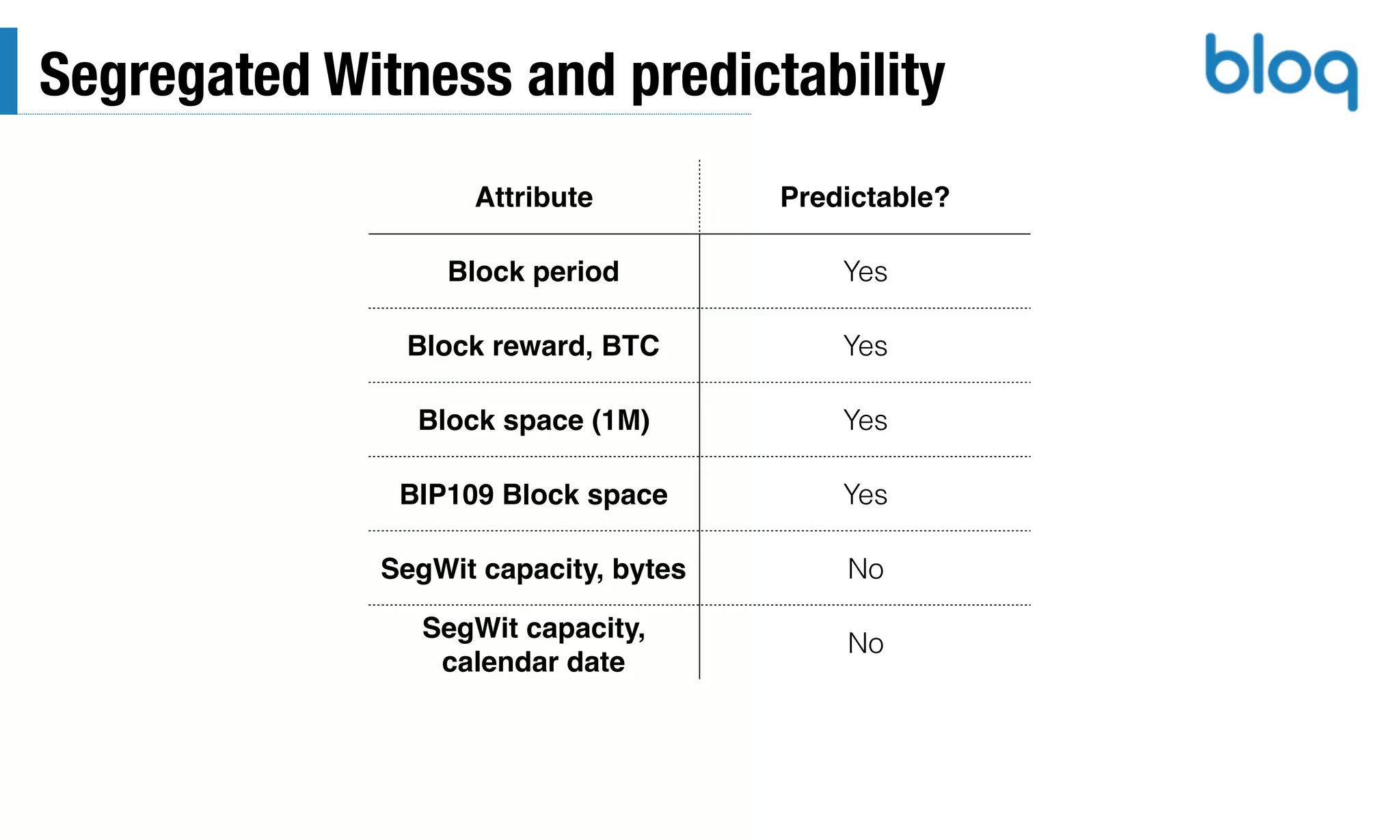

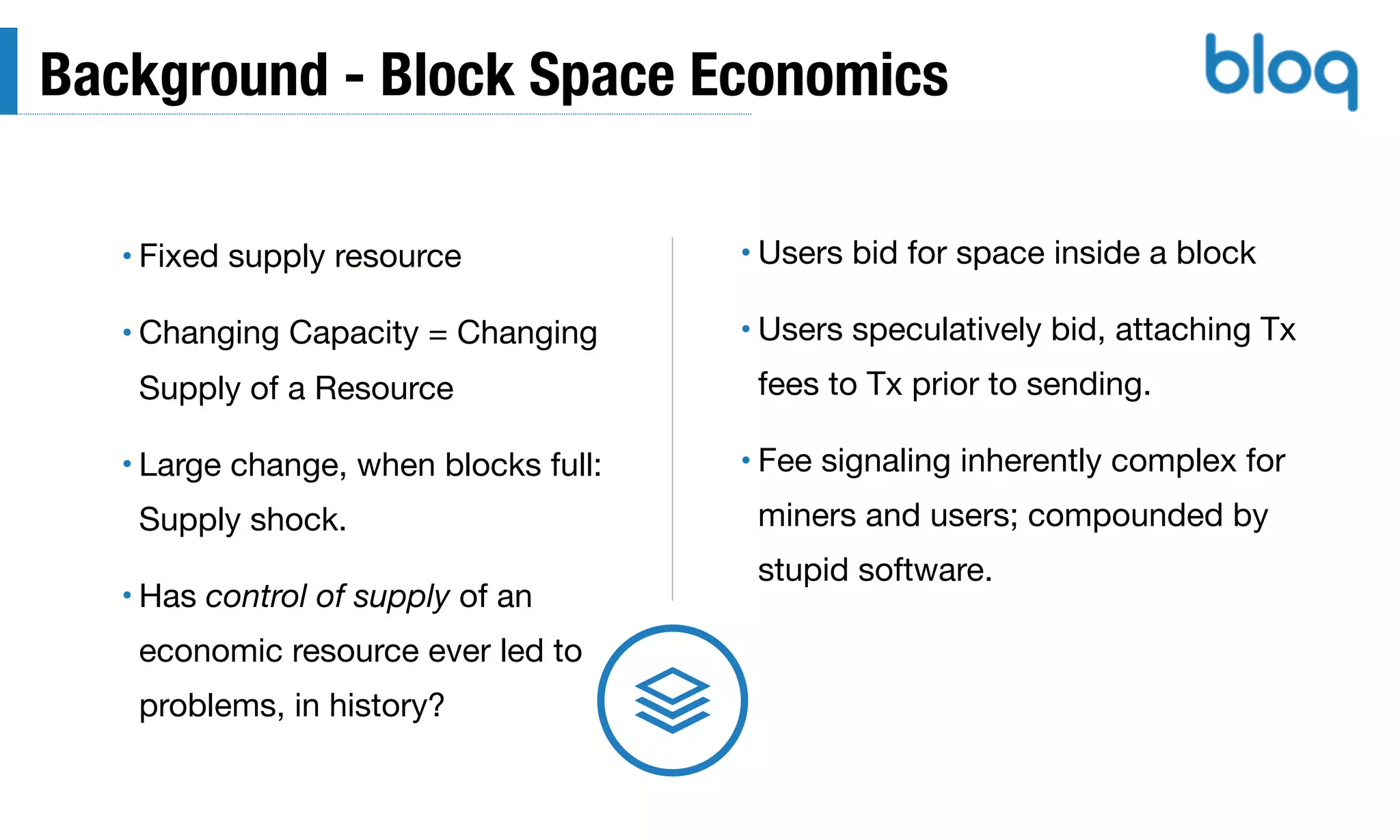

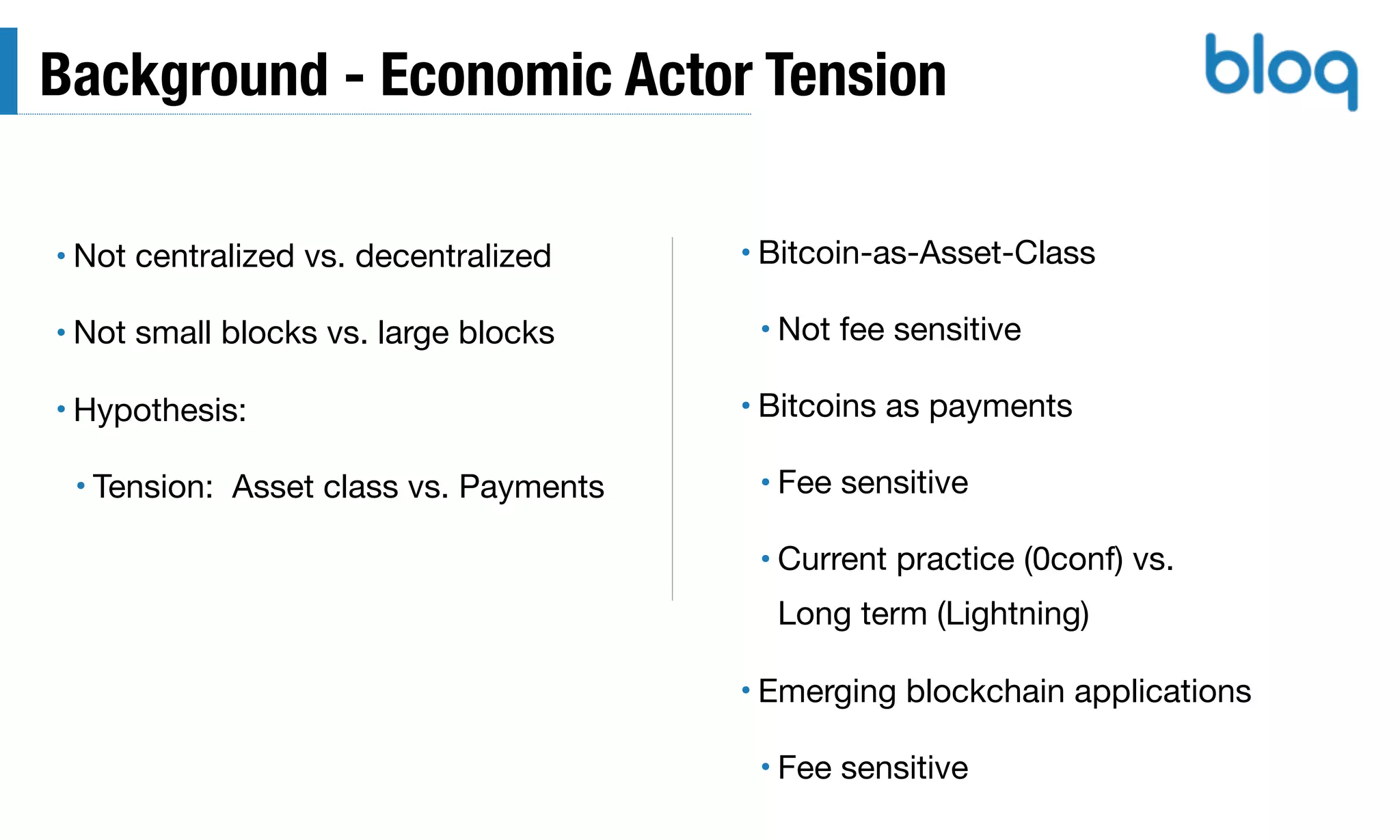

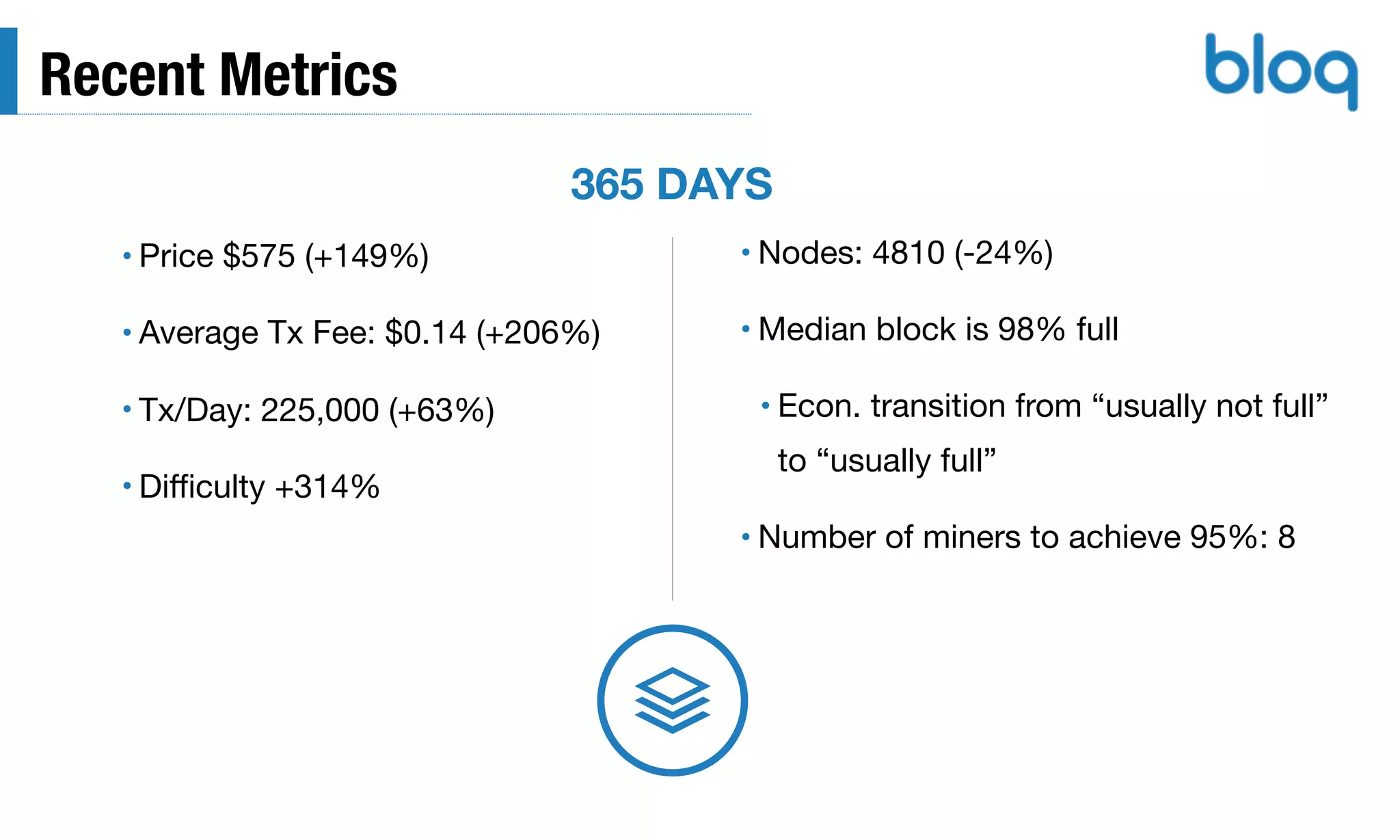

The document summarizes a presentation on the current state of Bitcoin and proposals to scale the blockchain network. It discusses recent metrics like rising transaction fees and block space utilization. It analyzes the tradeoffs of hard forks and soft forks to increase network capacity. Specifically, it notes that Segregated Witness is a useful but complex upgrade that introduces long-term transitional challenges and reduces predictability, arguing it would be better implemented as a hard fork. The presentation concludes by emphasizing the need to replace humans with algorithms in determining block space and to consider the costs of failing to increase capacity for existing users.

![Hard Forks

• High user consent

• Clear upgrade path, rules.

• Reduced software complexity

• Fewer software changes req’d;

Fewer potential bugs.

• Clear user choice + market path.

• Requires long lead time (est. 3-6mo)

• Disruptive: Not backward compatible;

upgrade [probably] required.

• On-going network partition

• Users confused

• Ethereum/ETC example - rushed fork

BENEFITS AND RISKS](https://image.slidesharecdn.com/onchainscalingaug2016-160830150525/75/Bitcoin-Status-Report-On-Chain-Scaling-Aug-2016-11-2048.jpg)