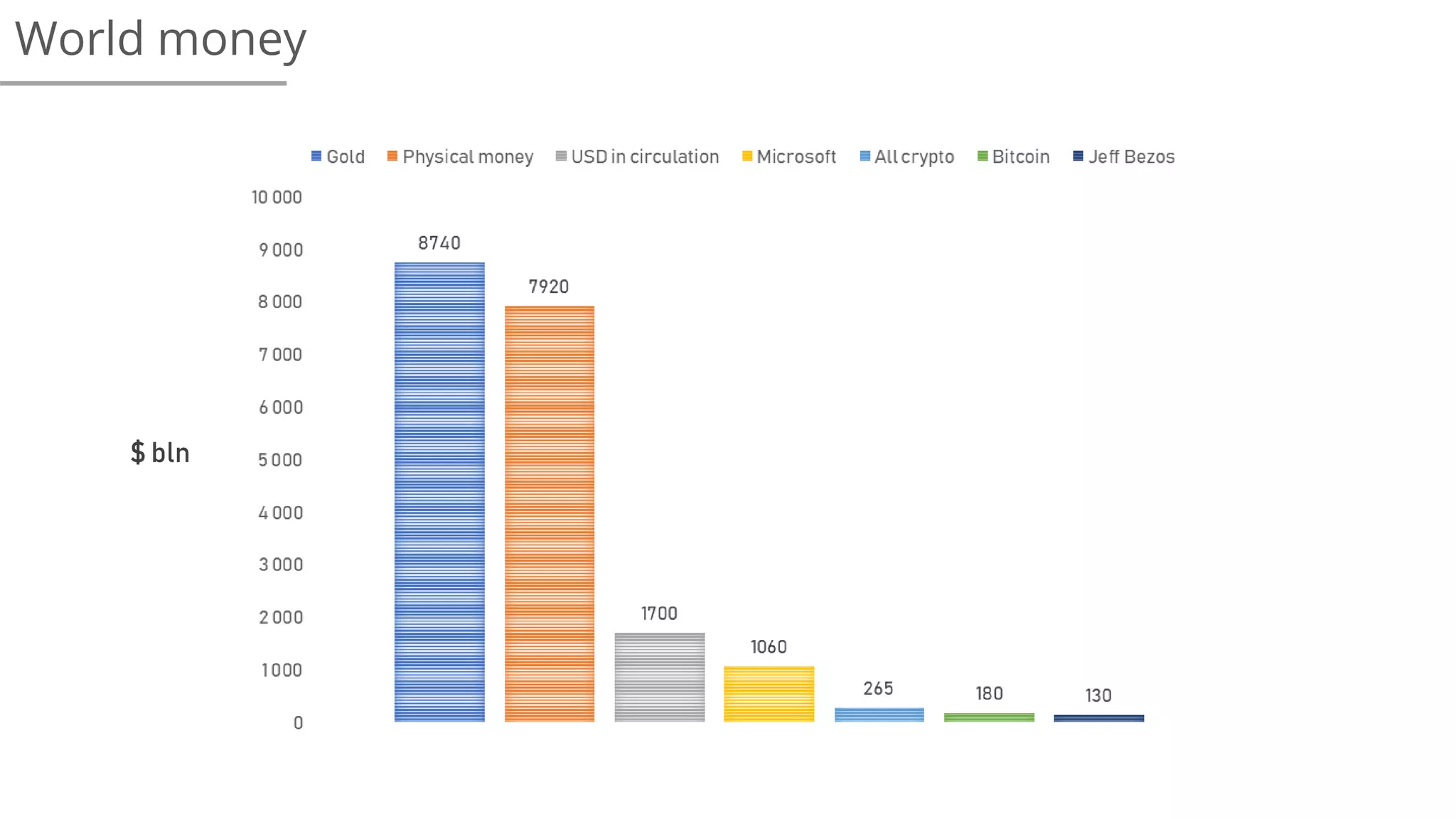

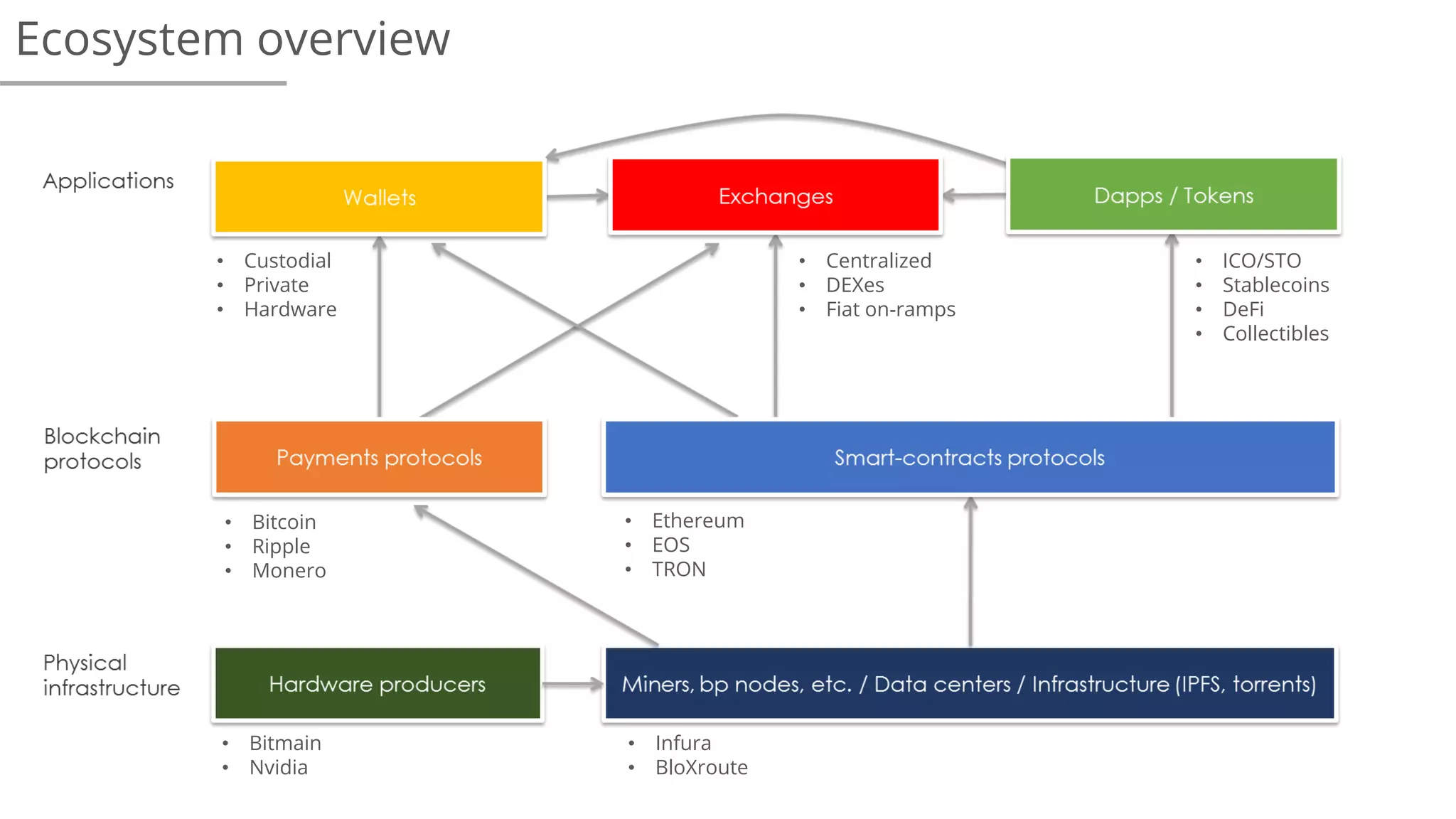

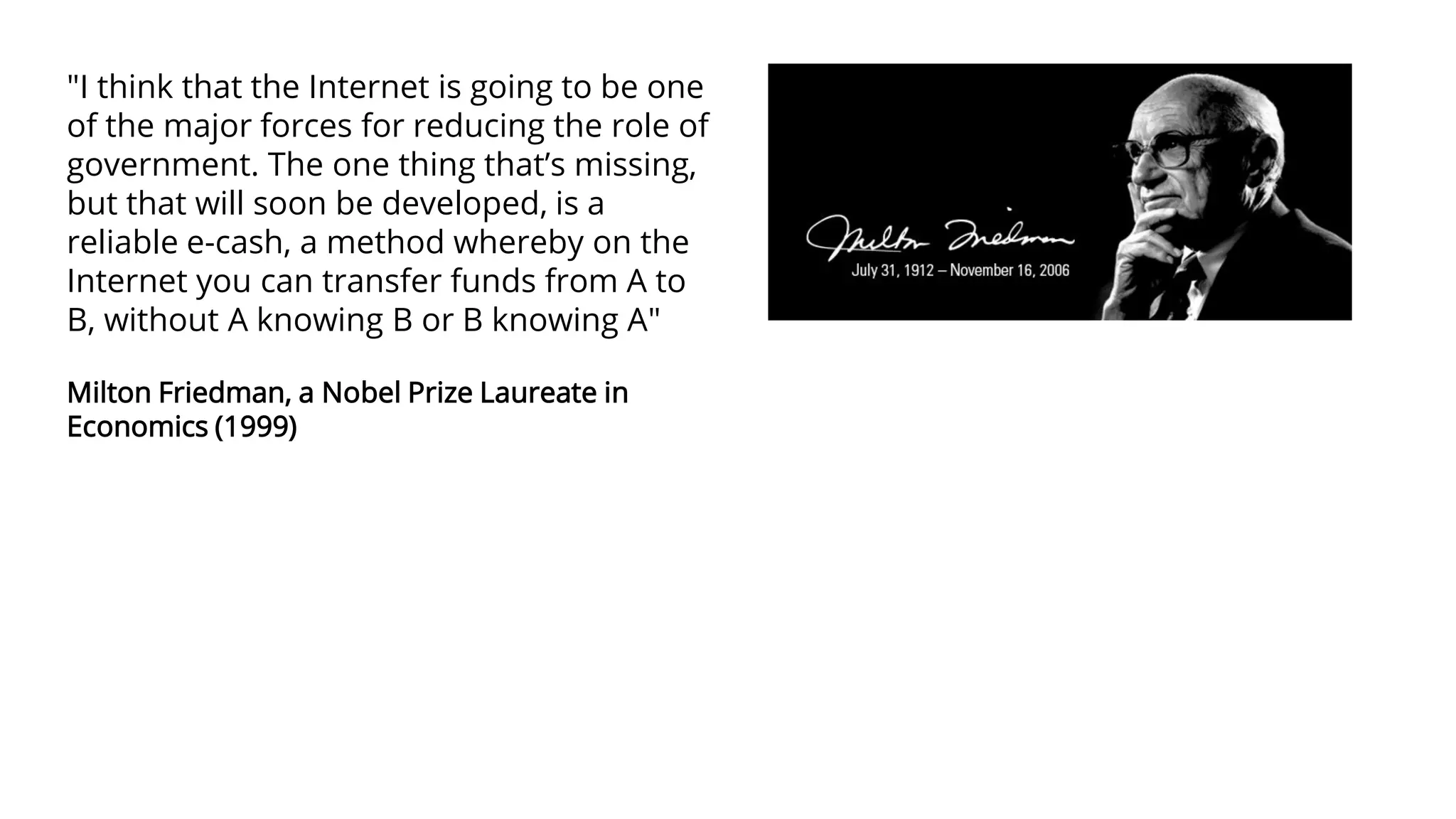

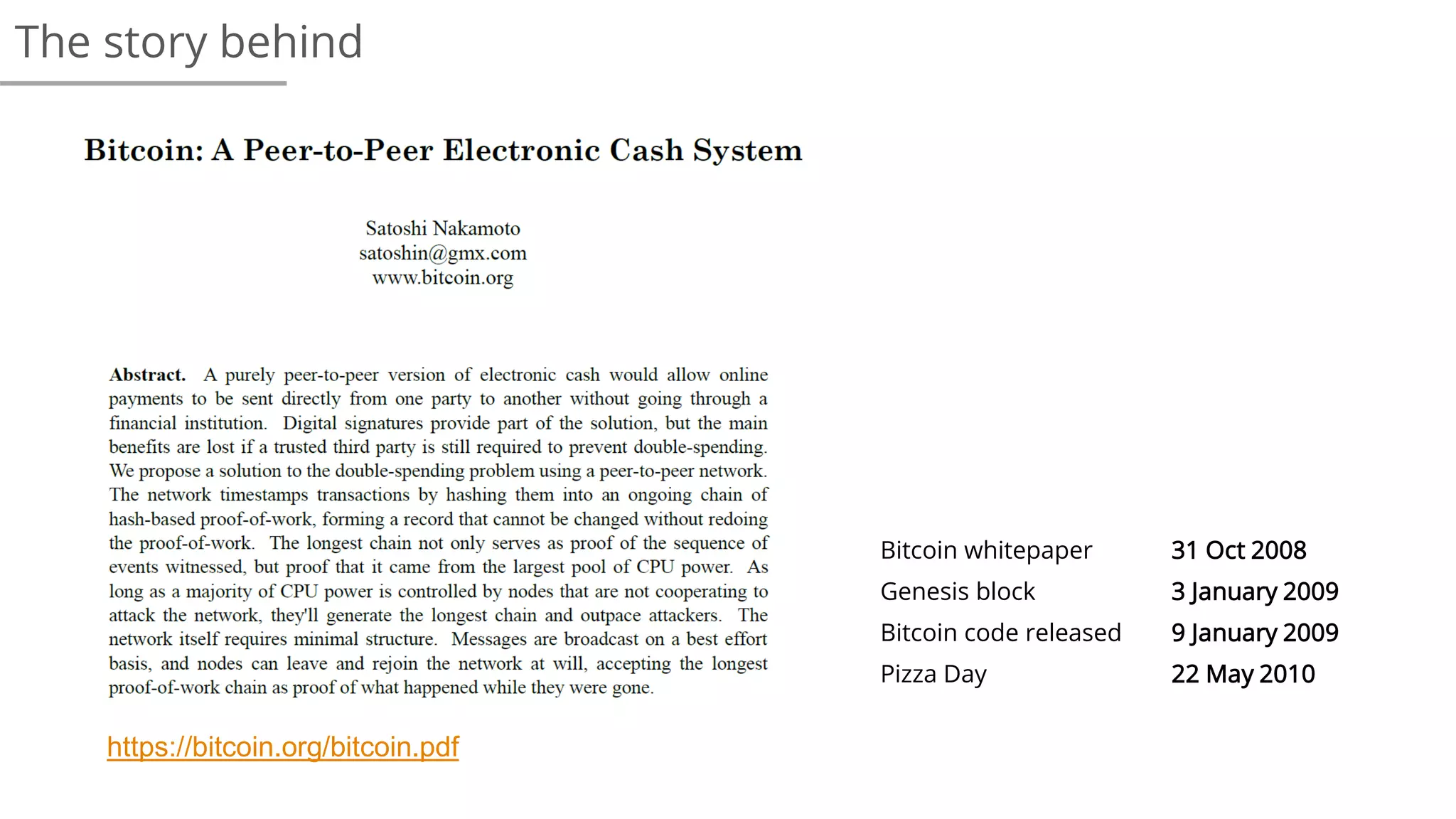

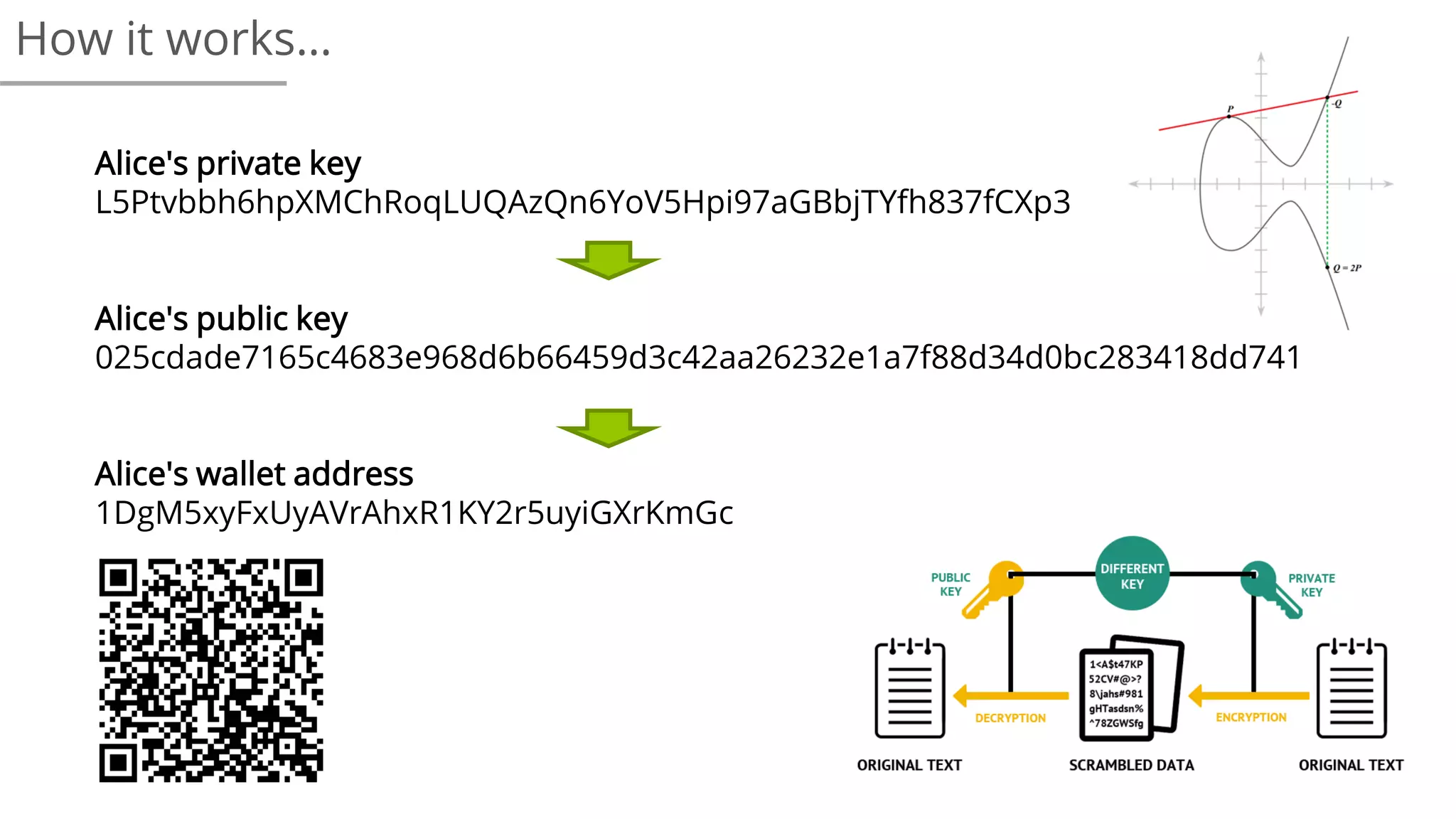

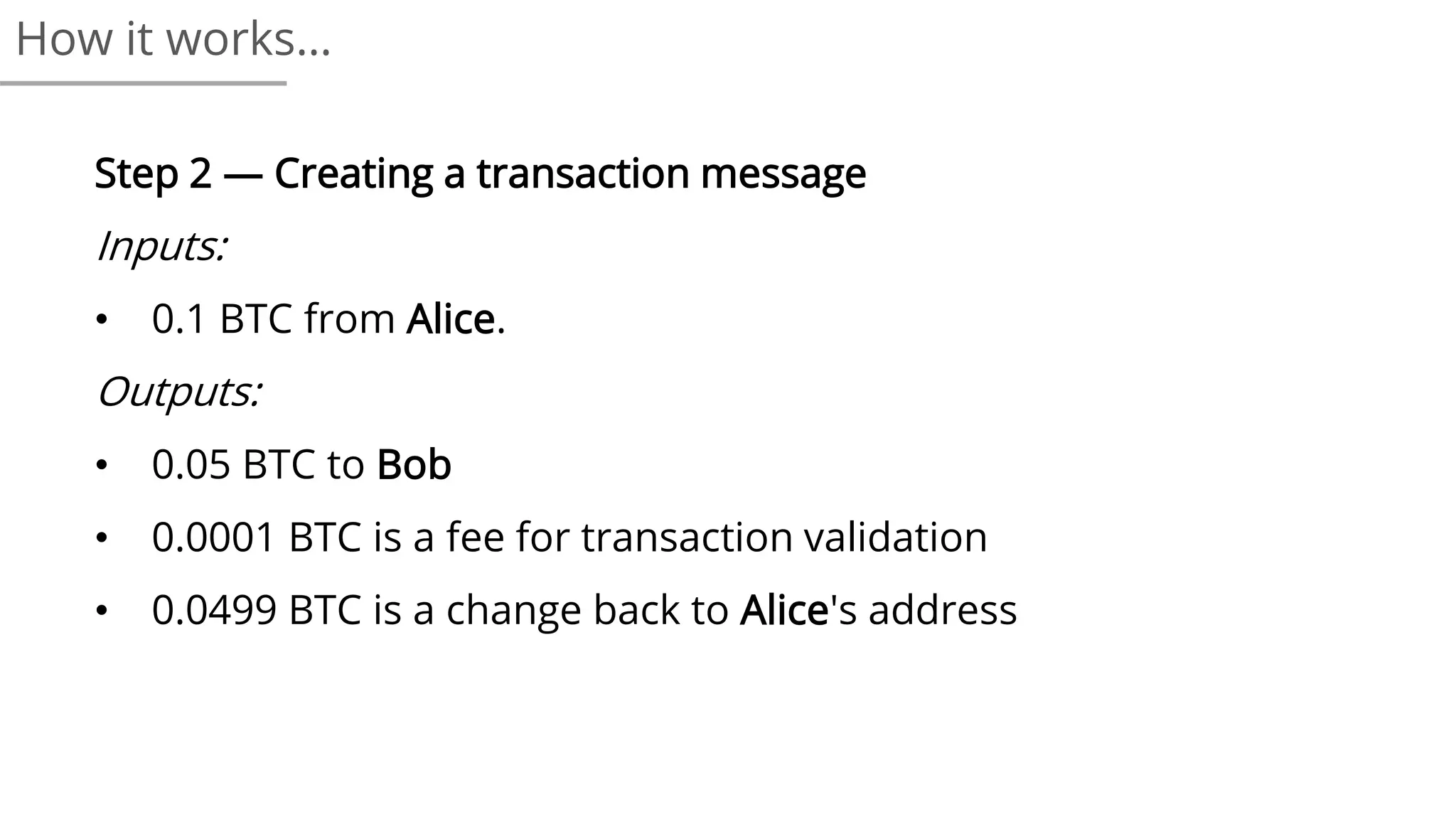

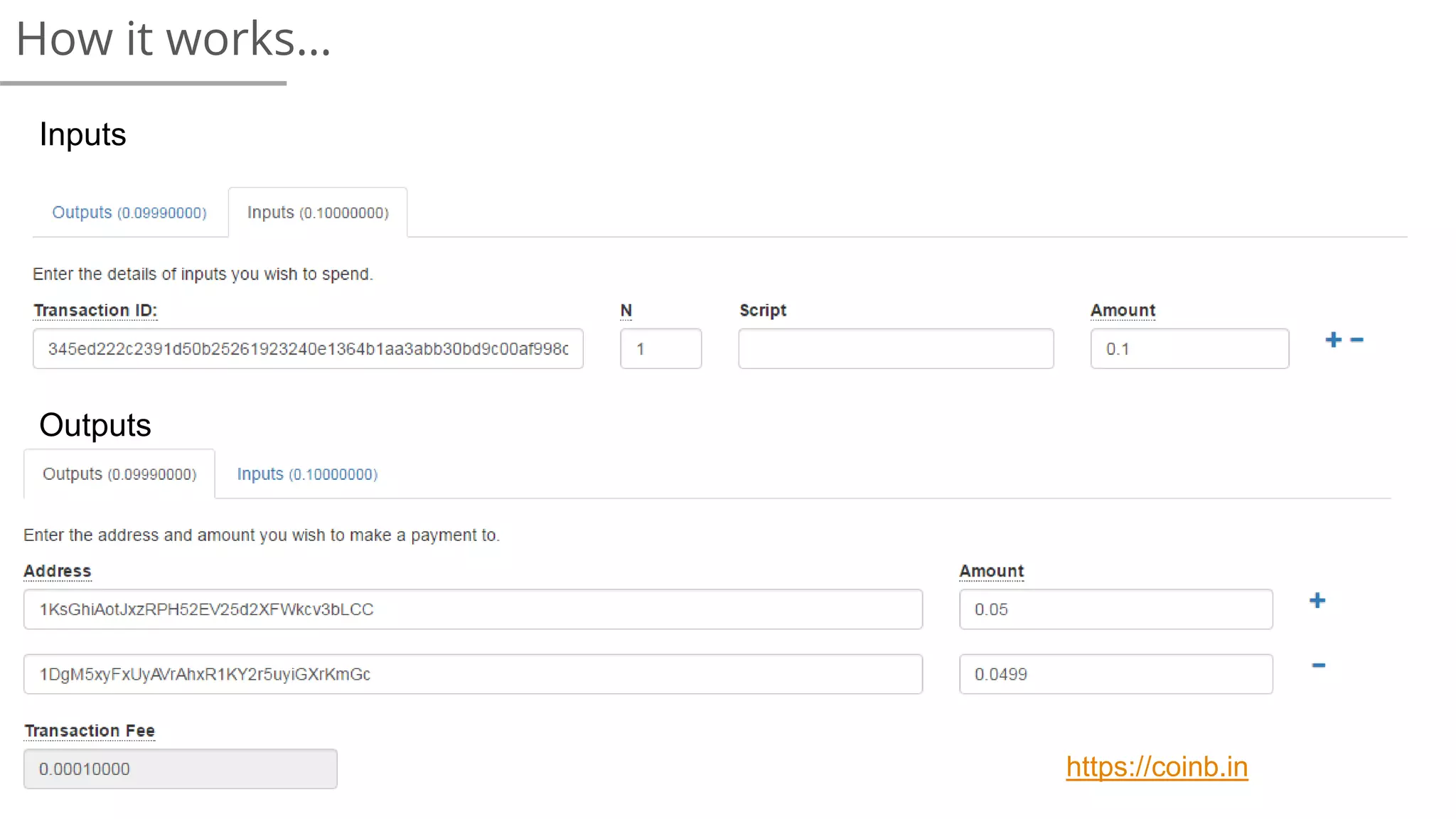

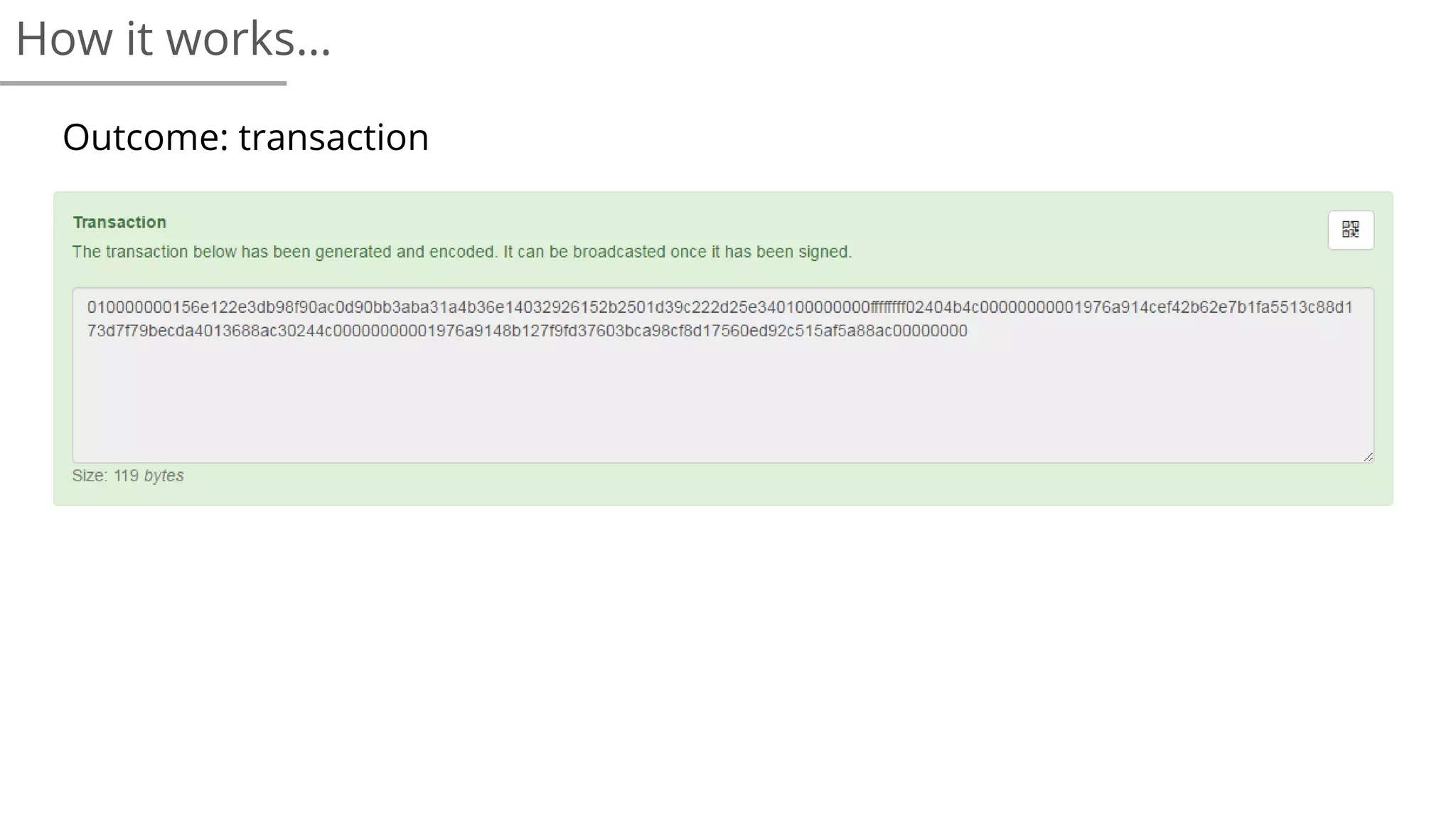

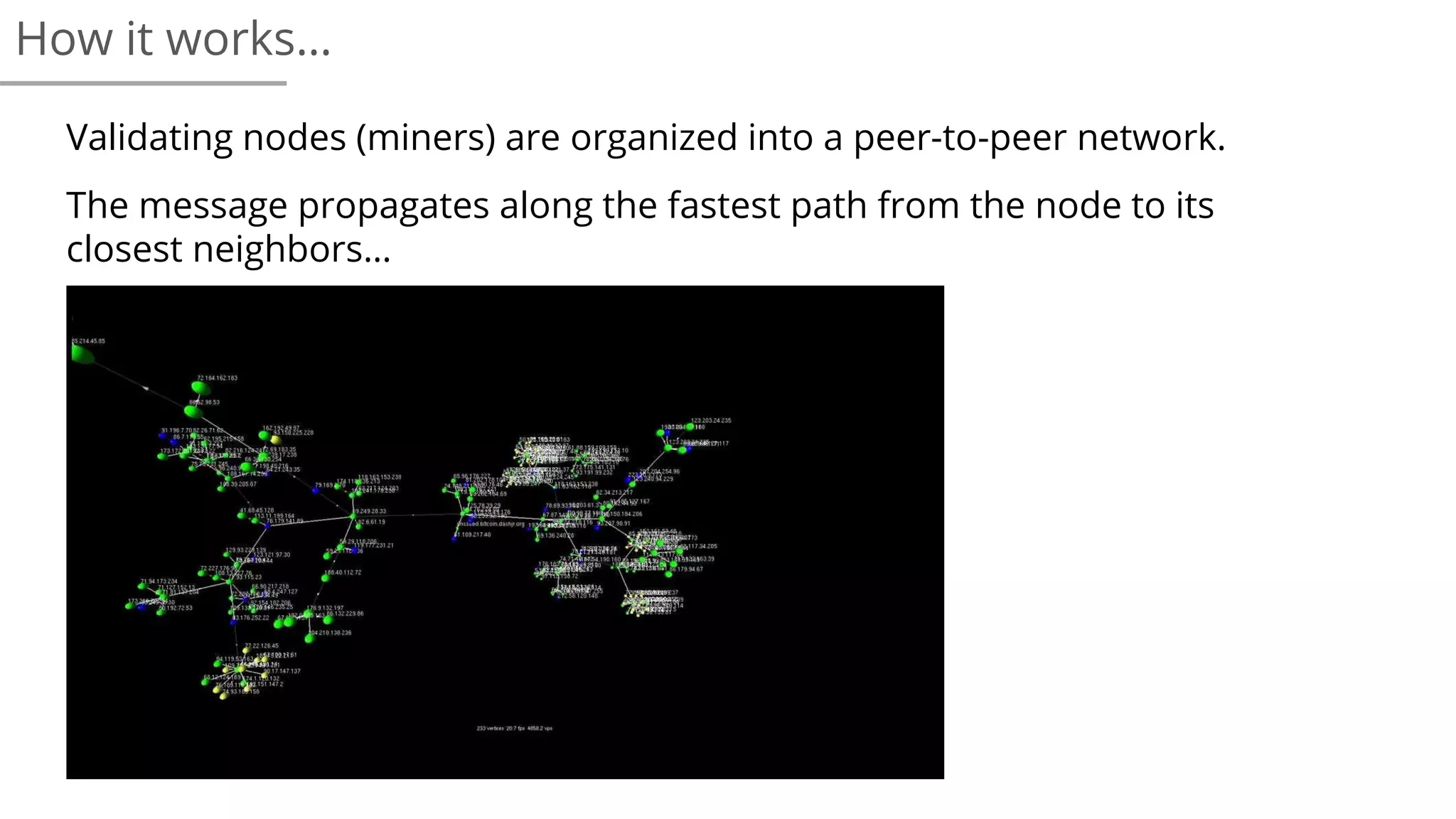

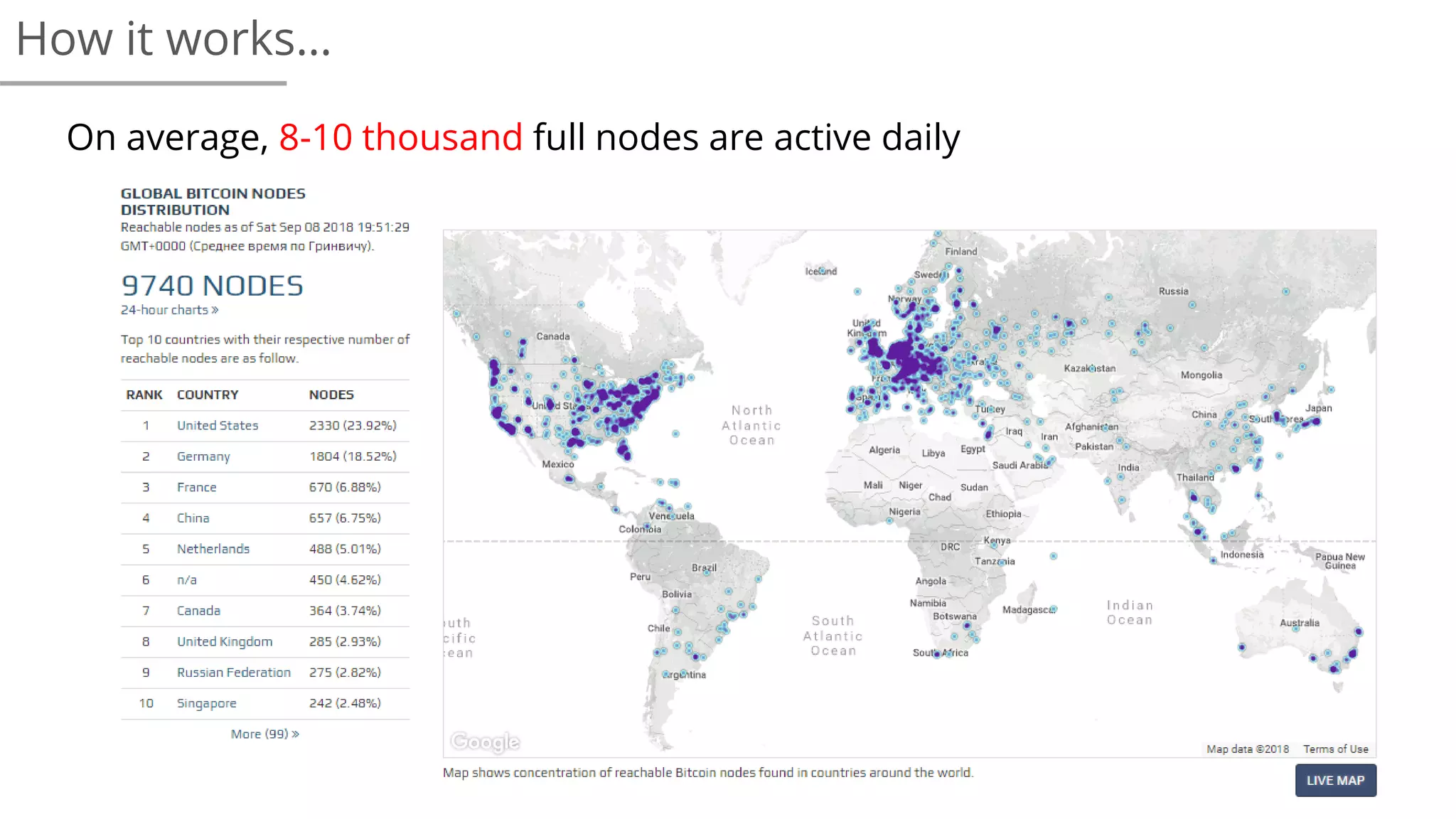

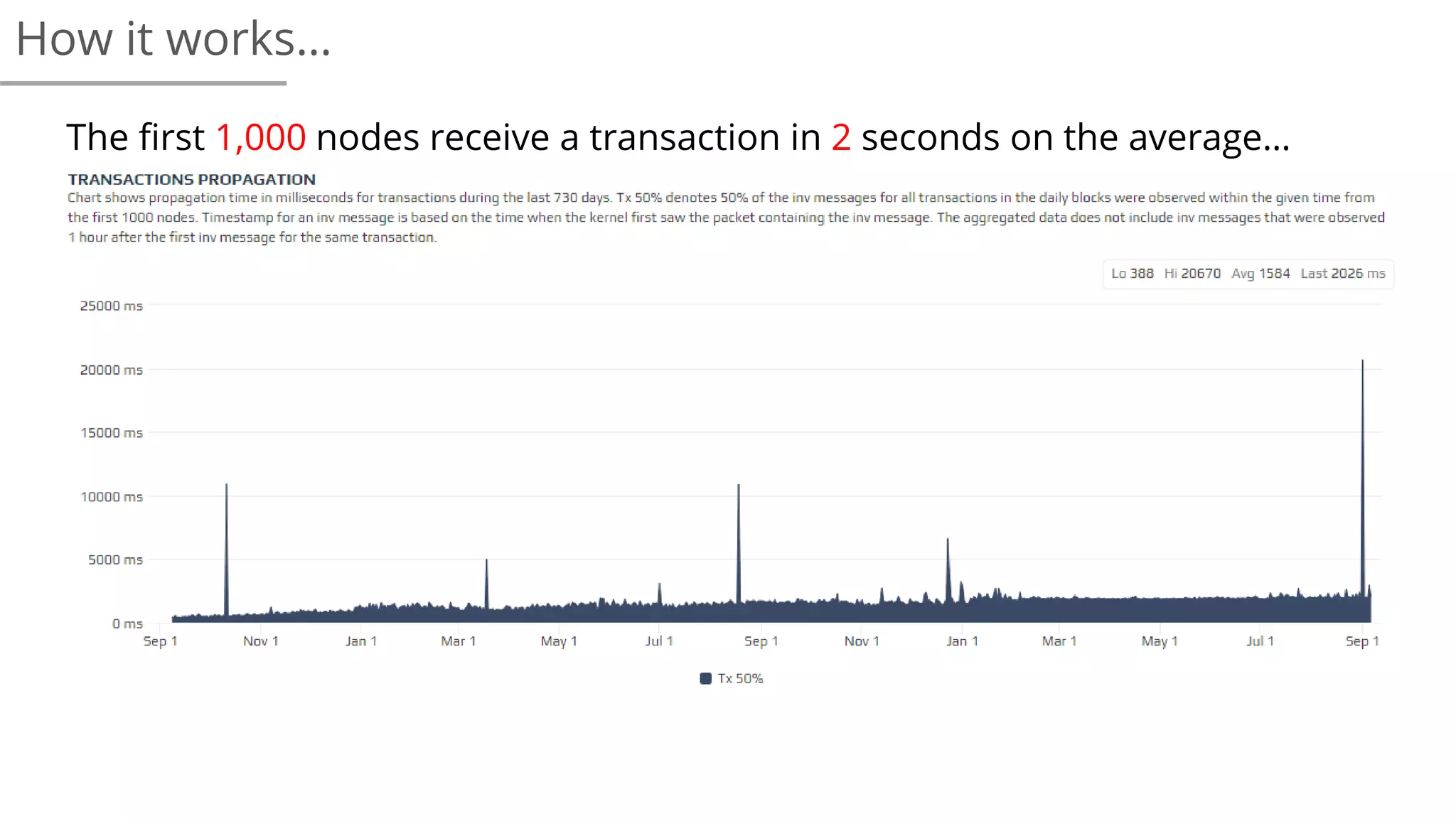

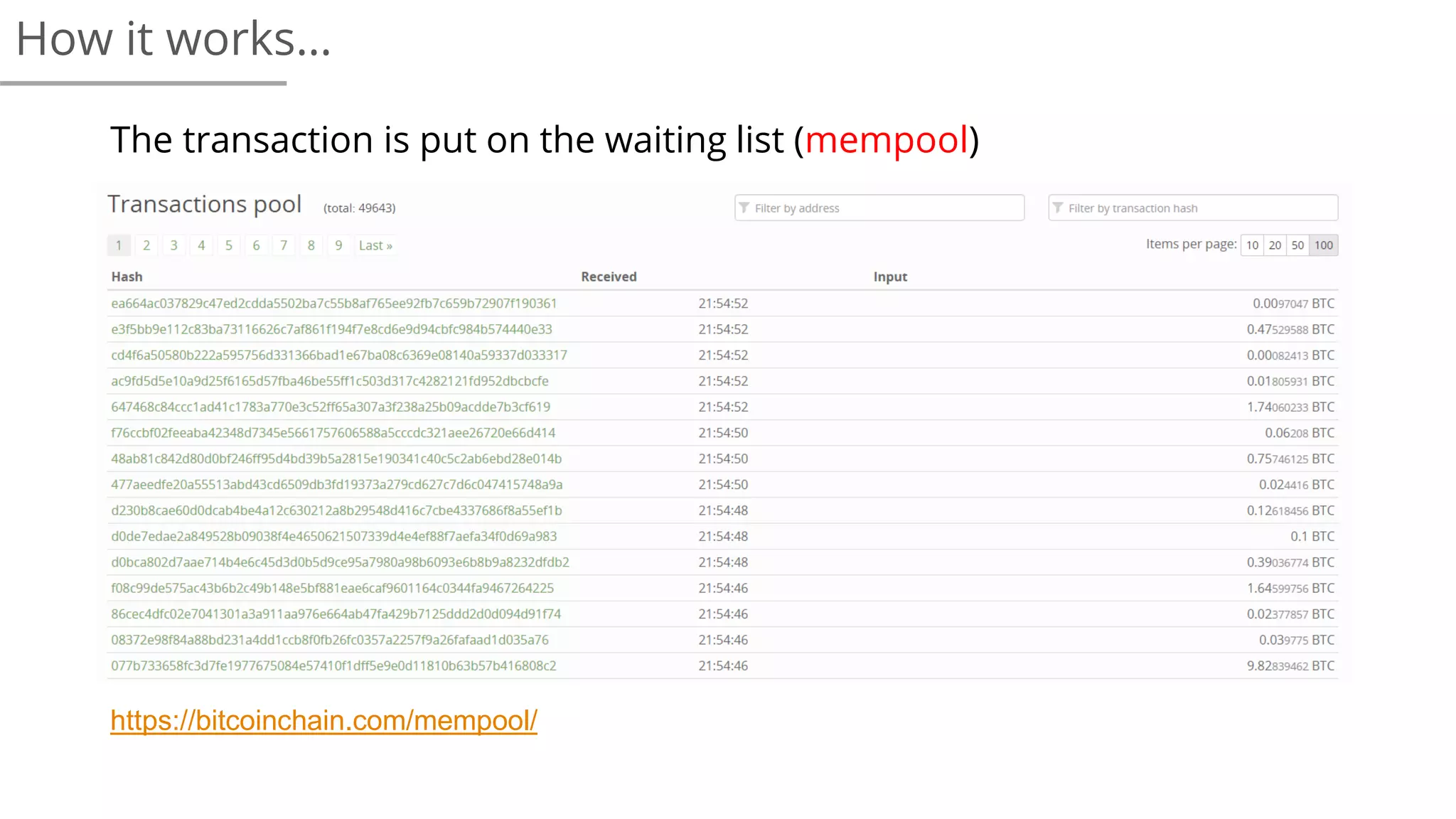

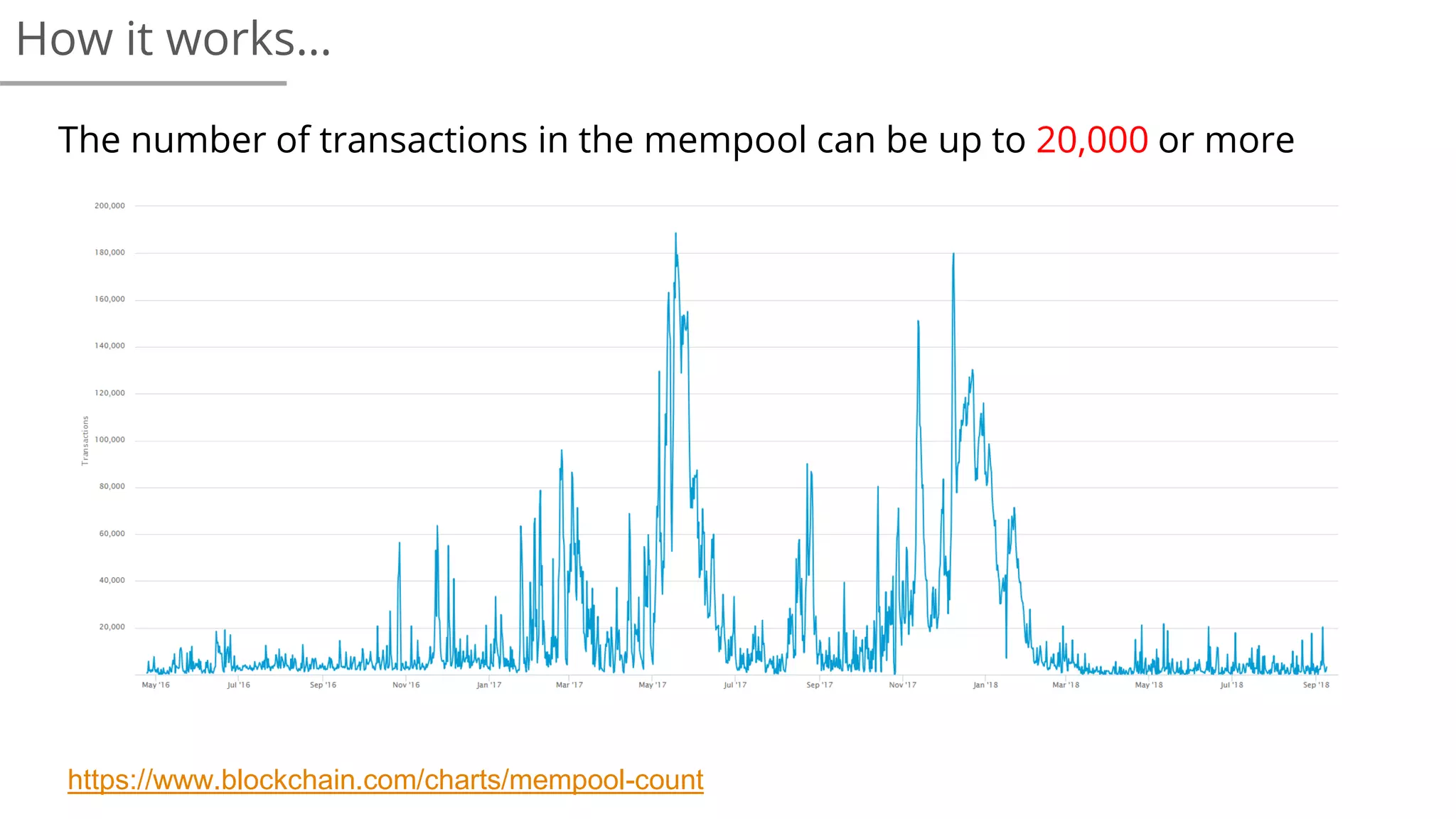

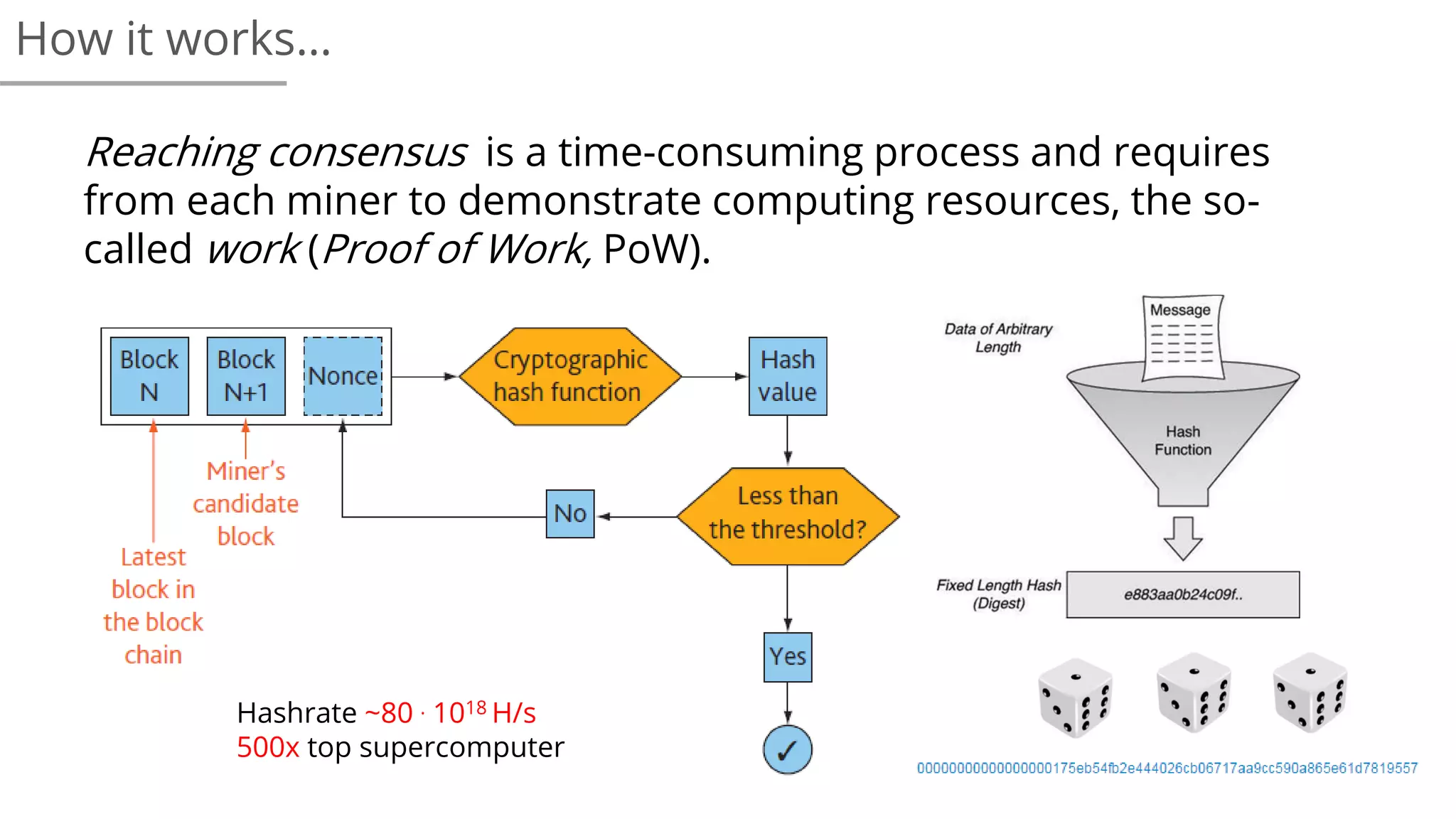

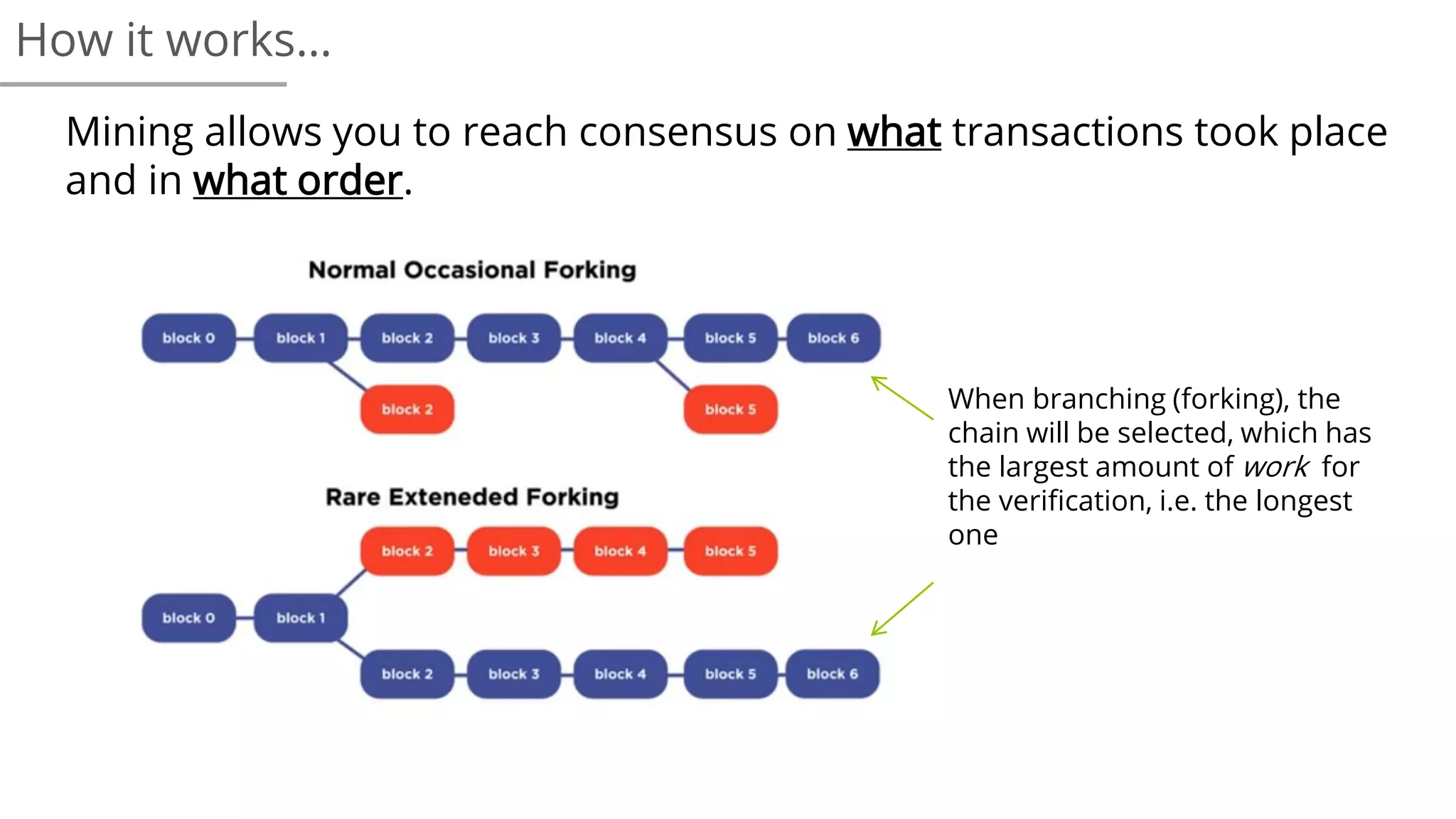

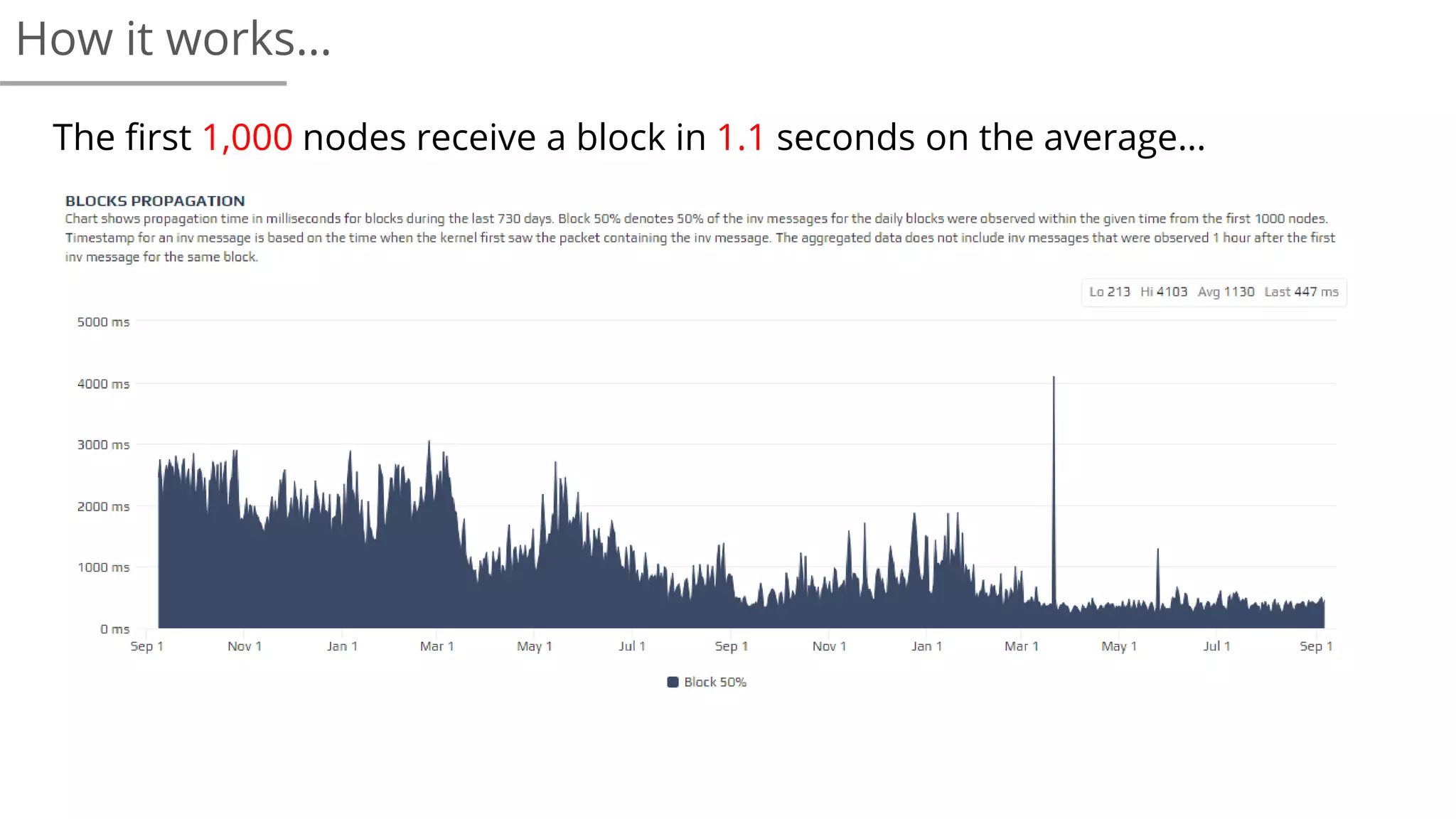

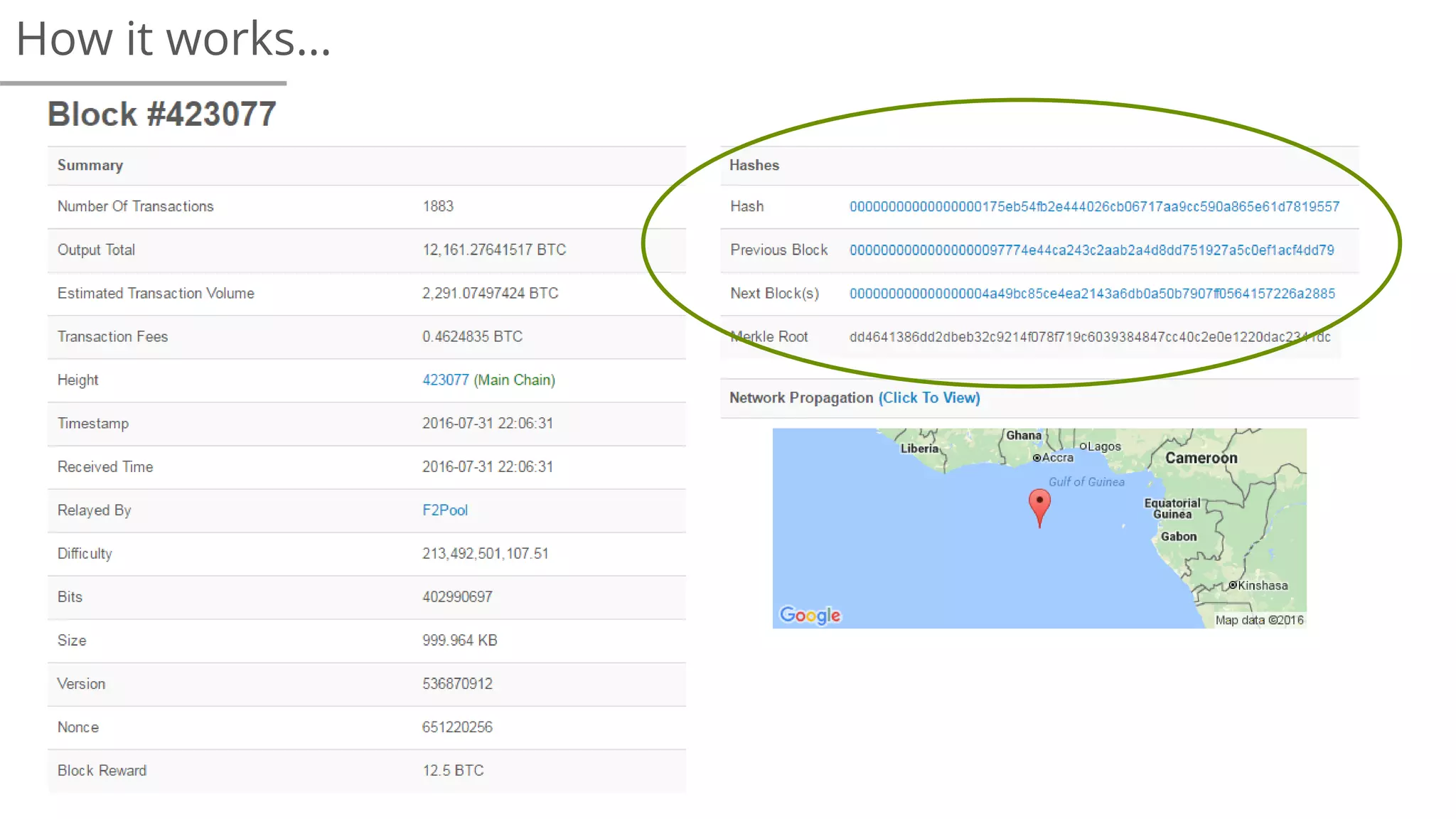

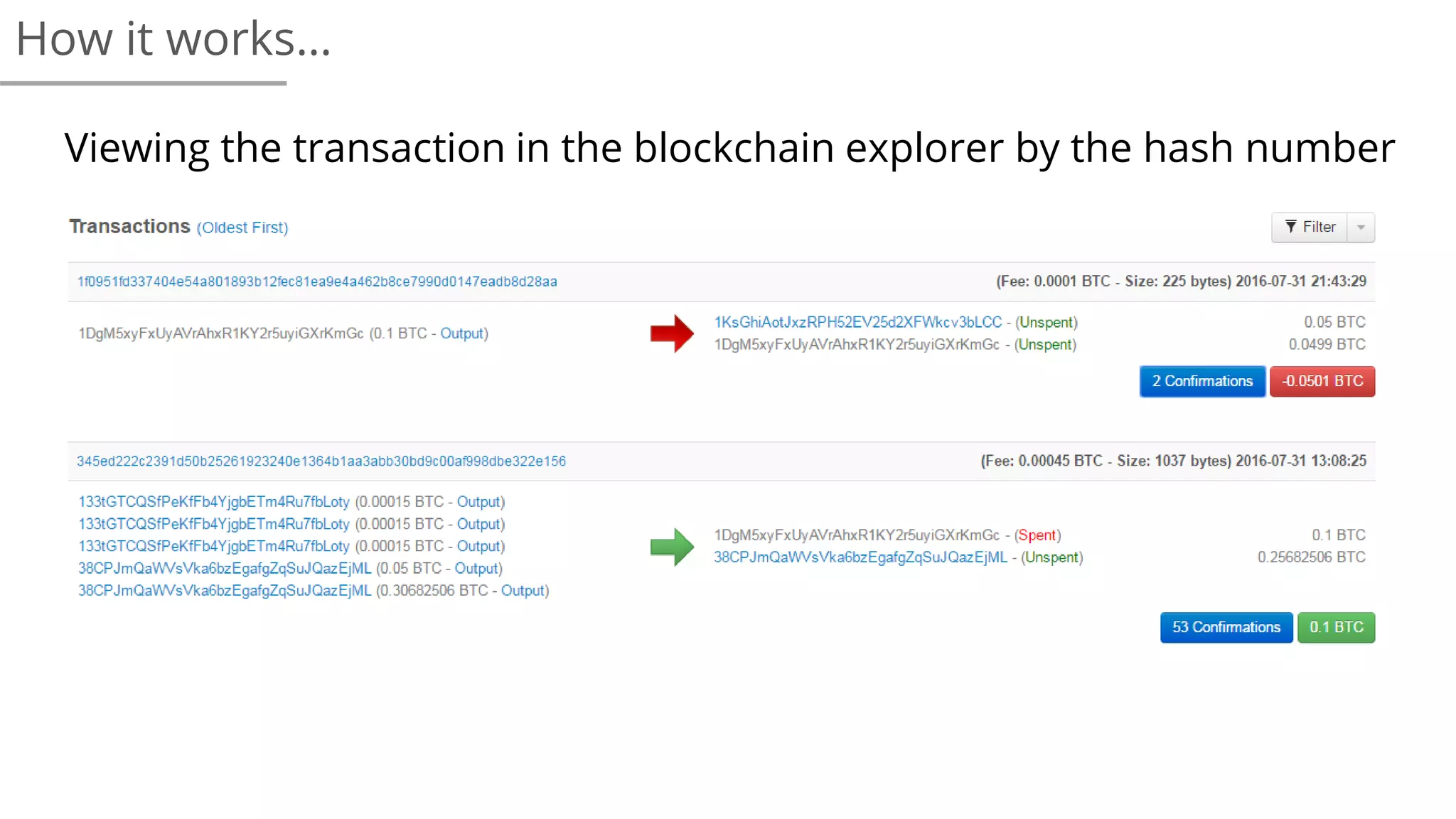

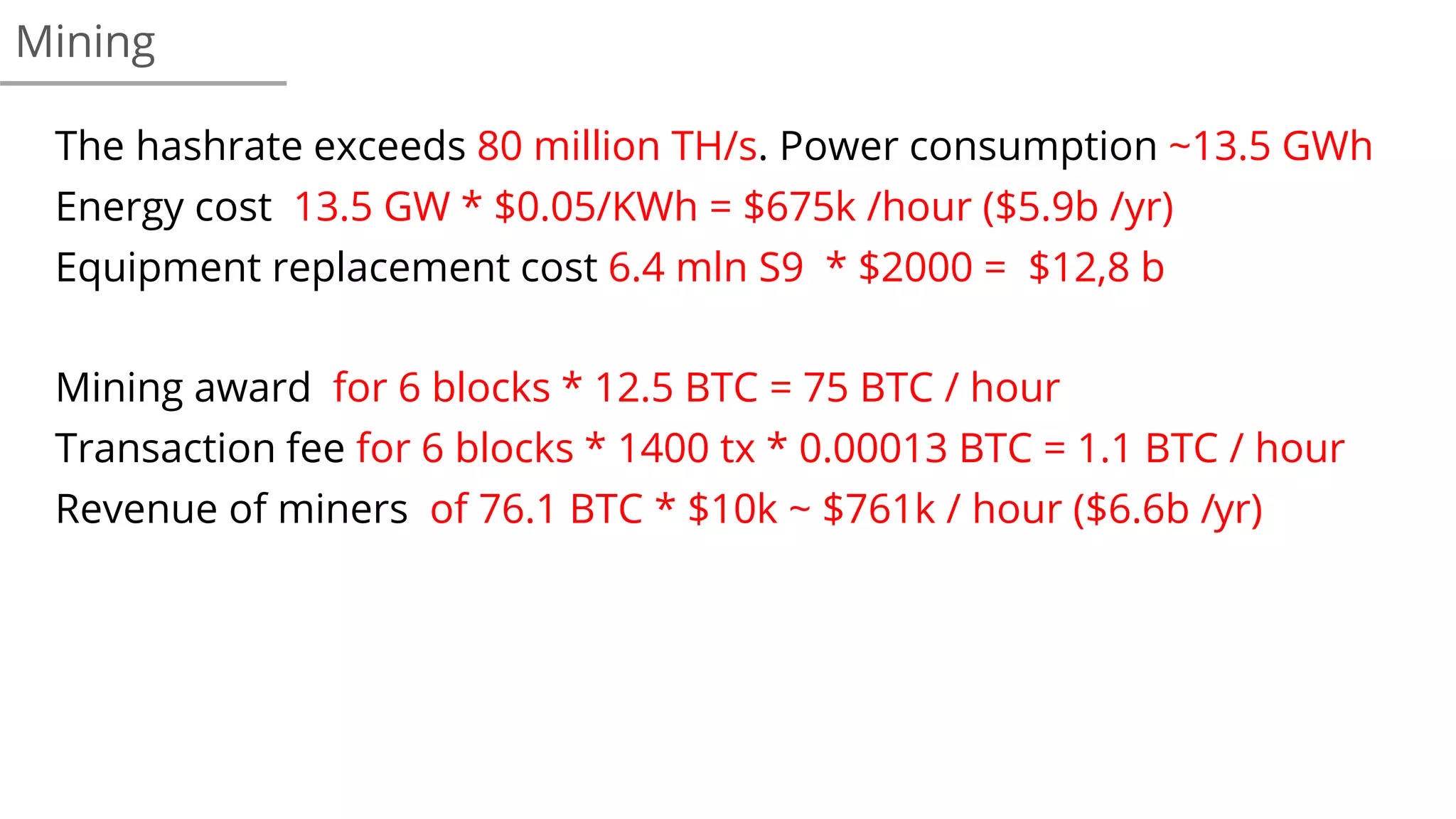

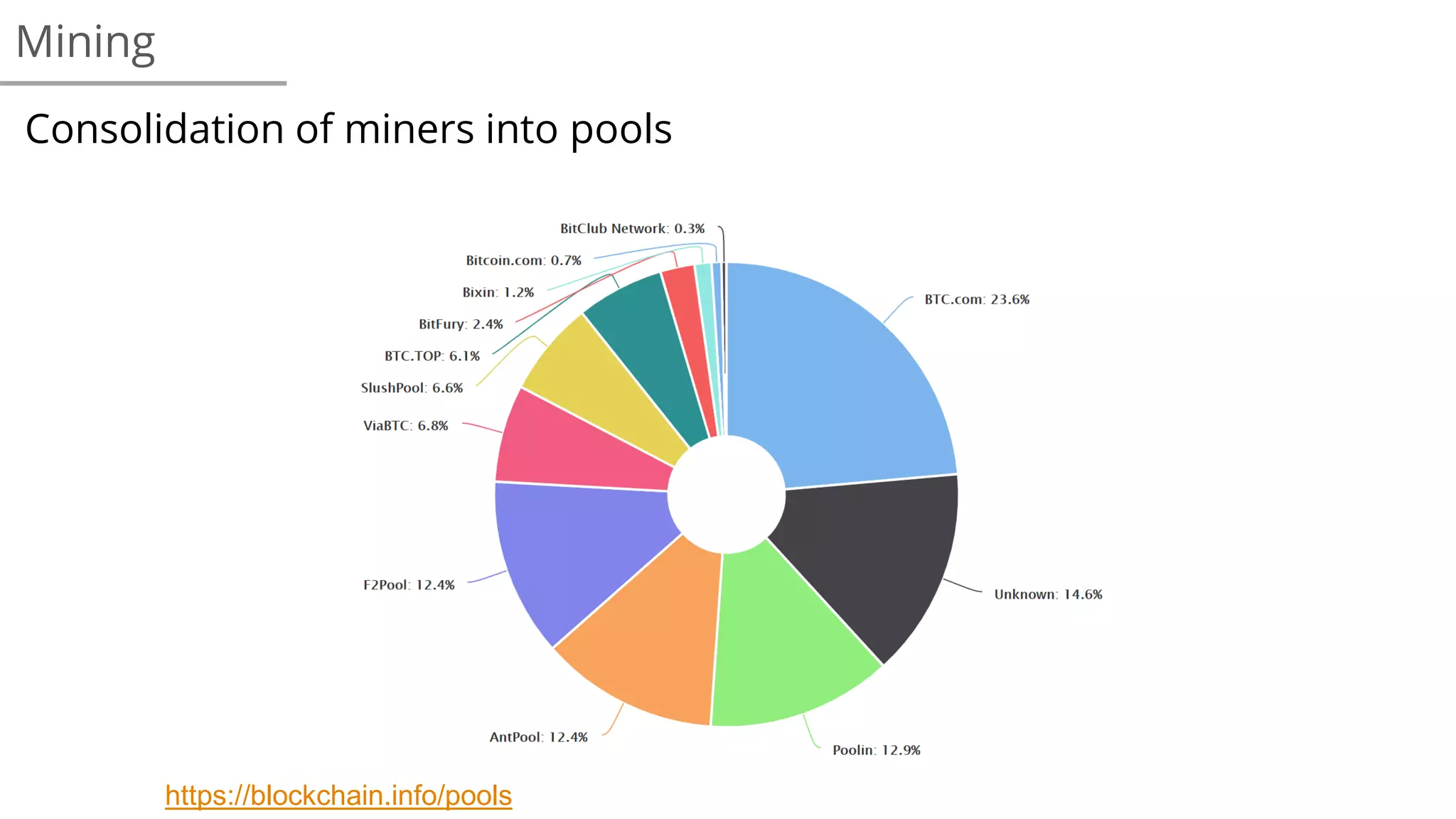

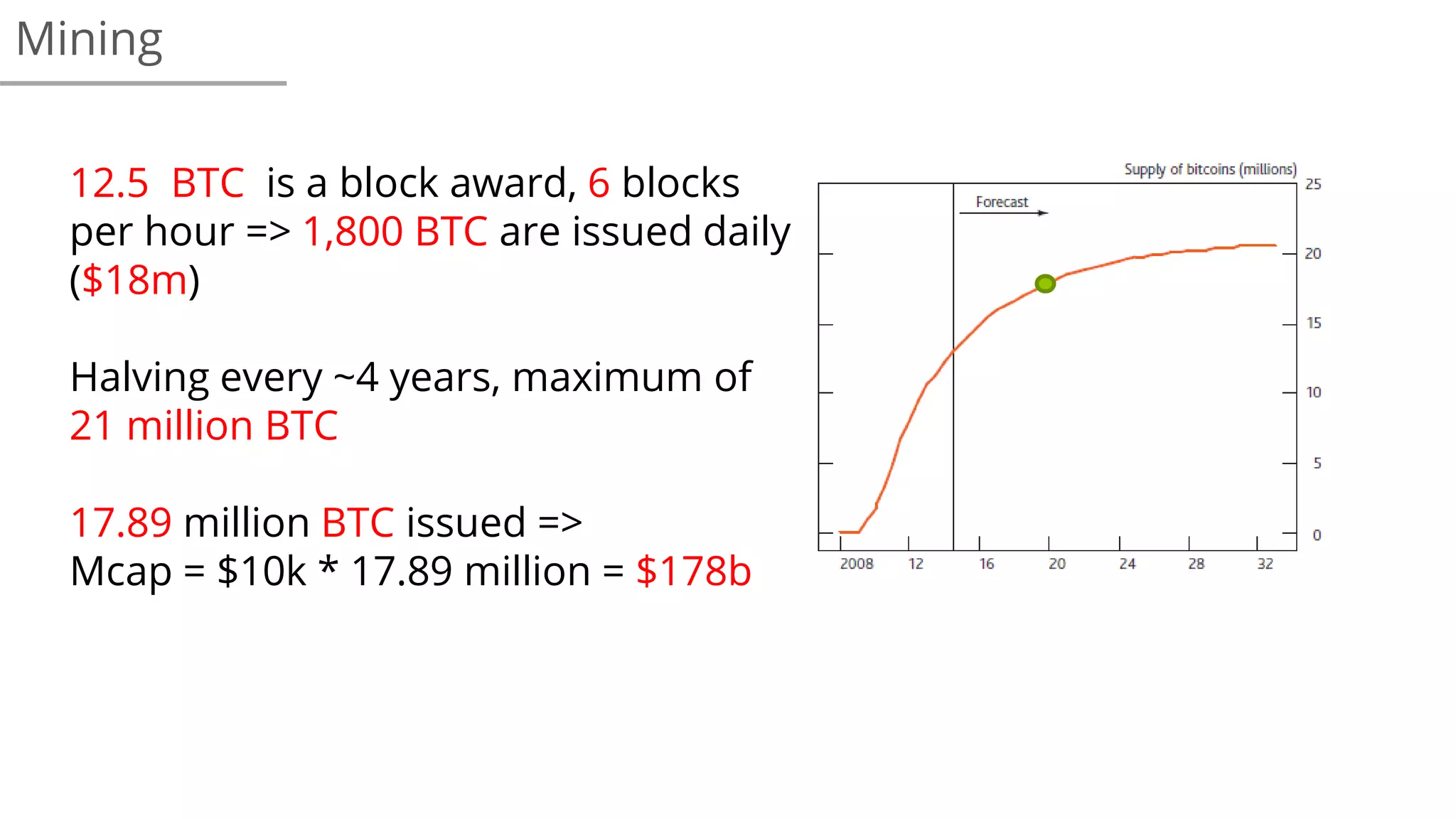

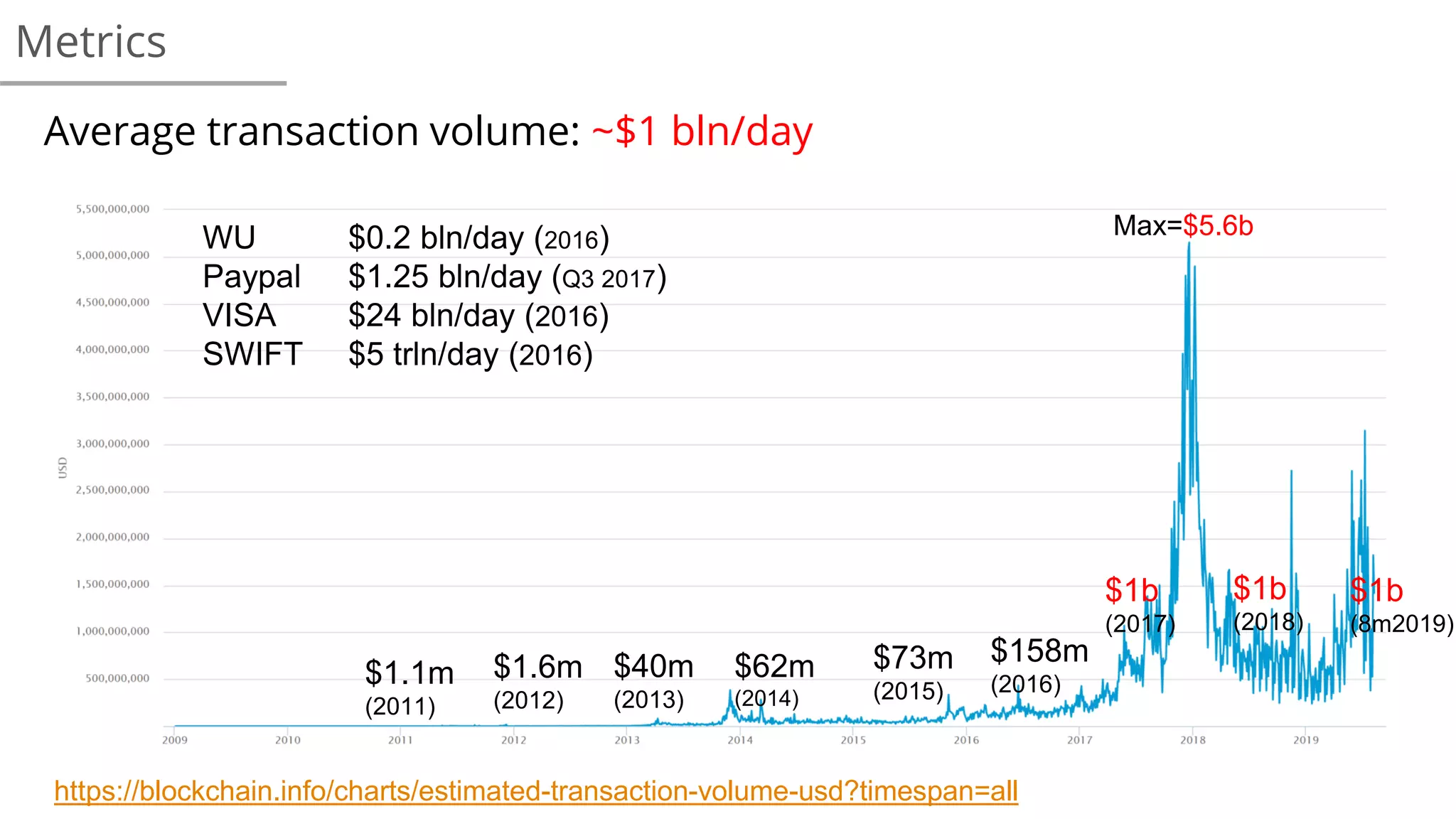

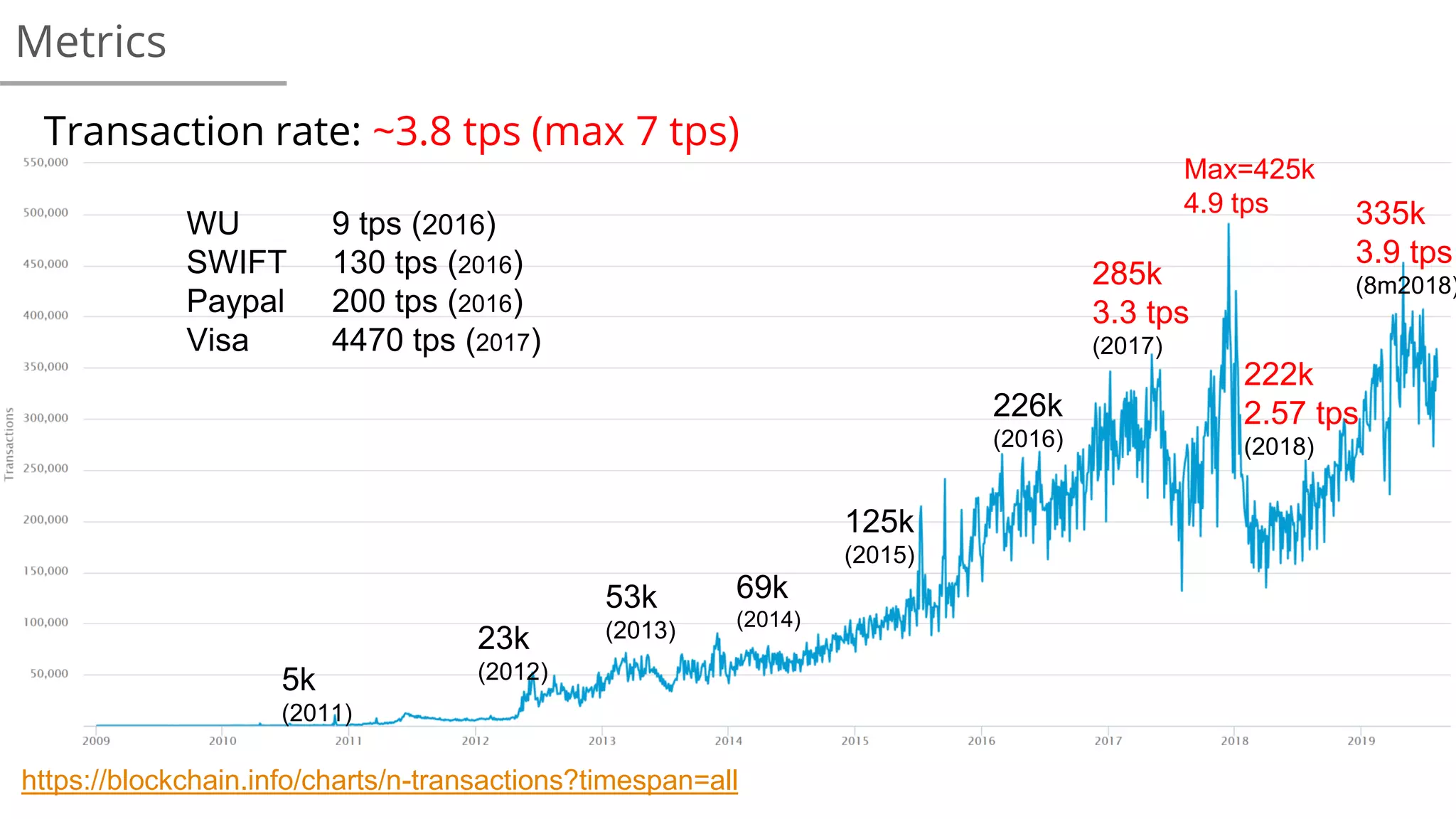

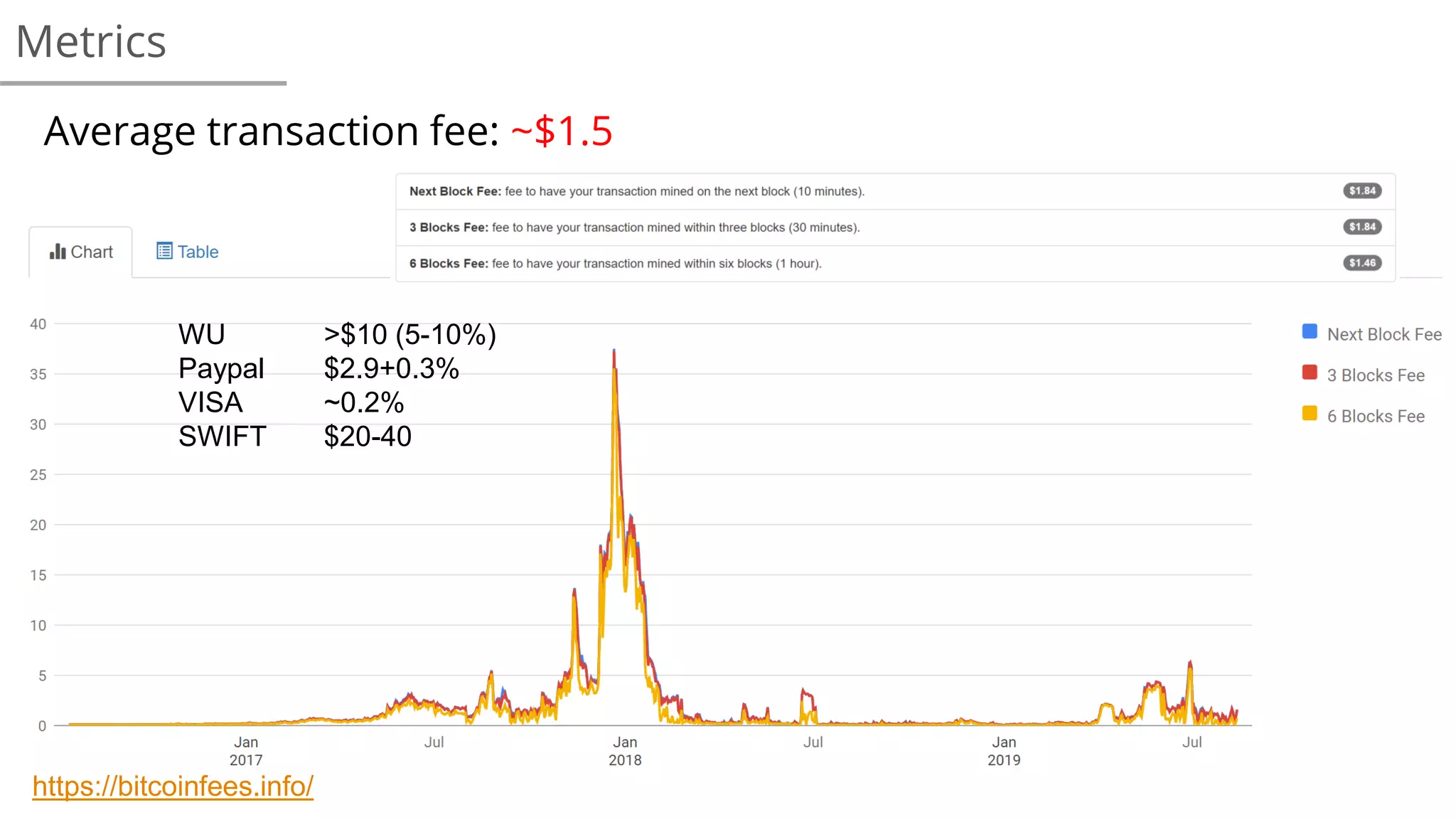

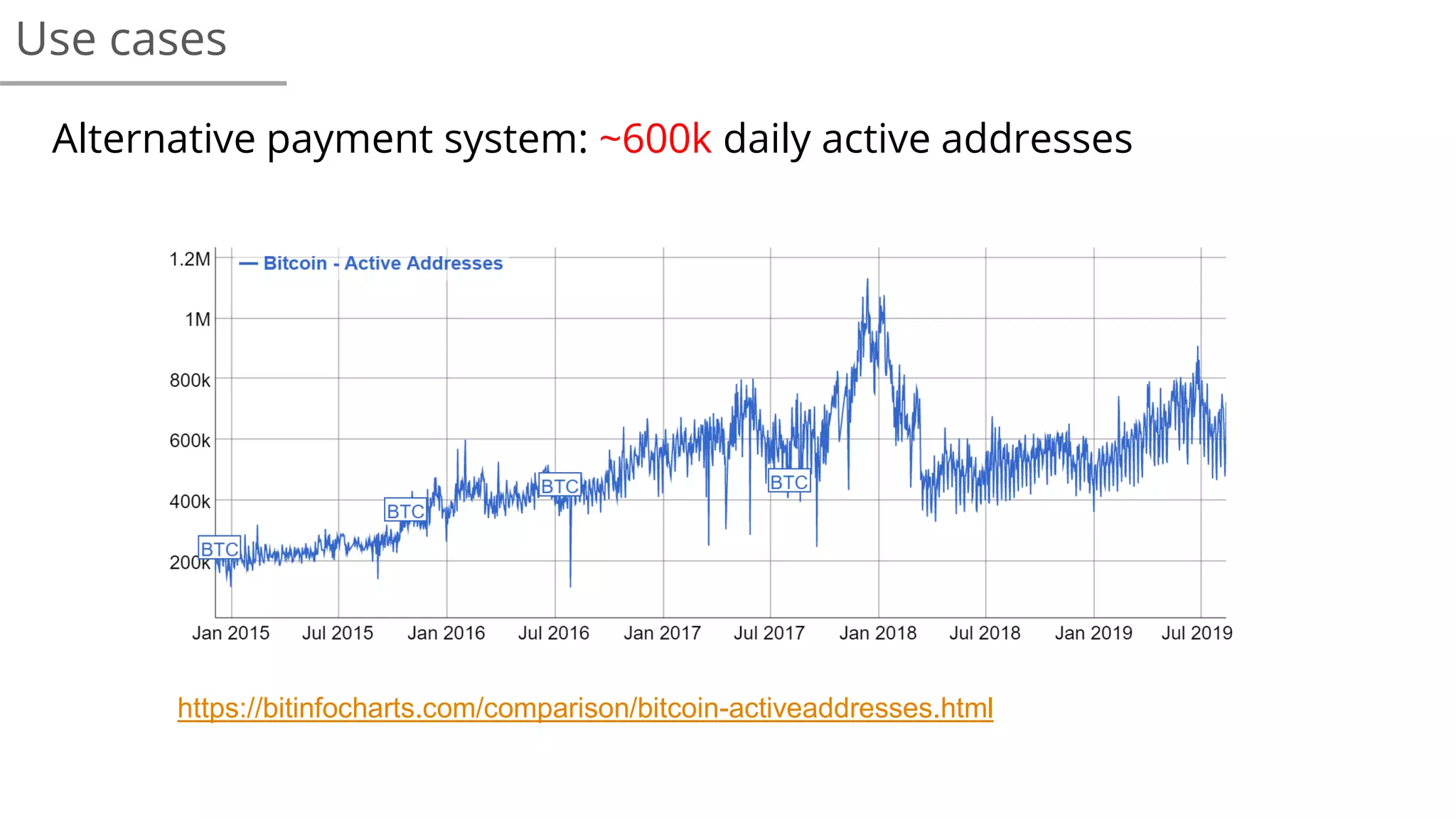

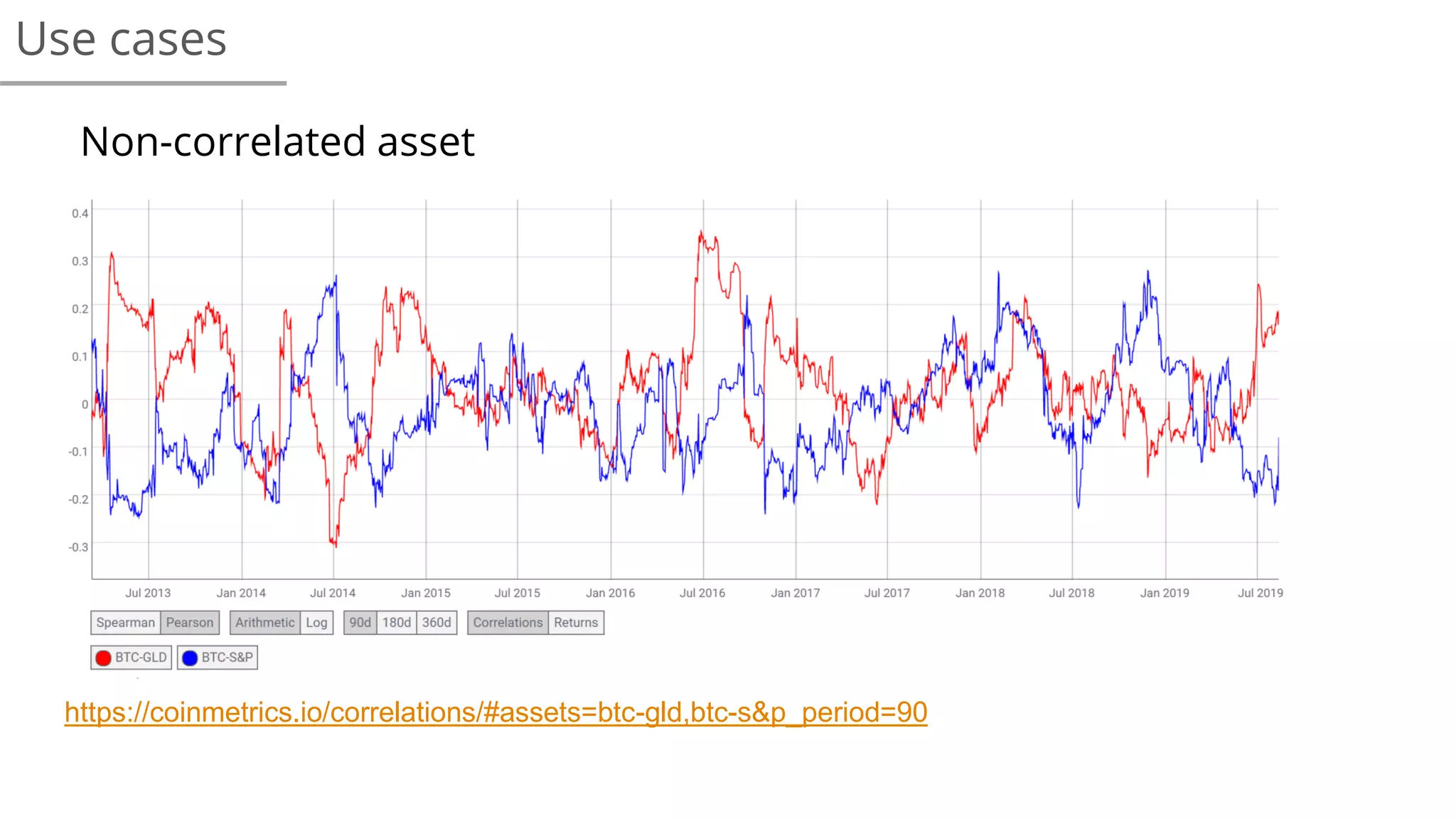

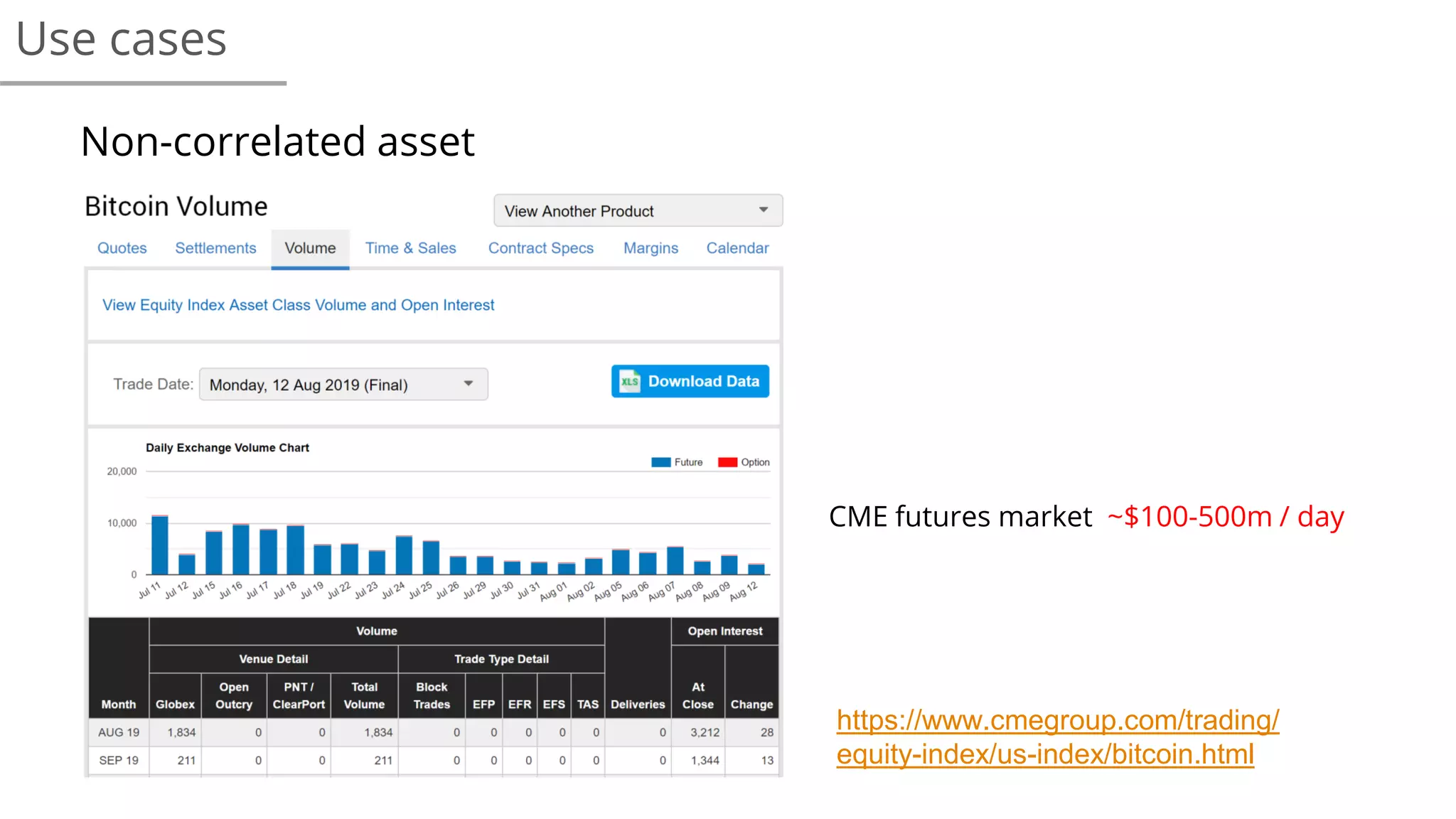

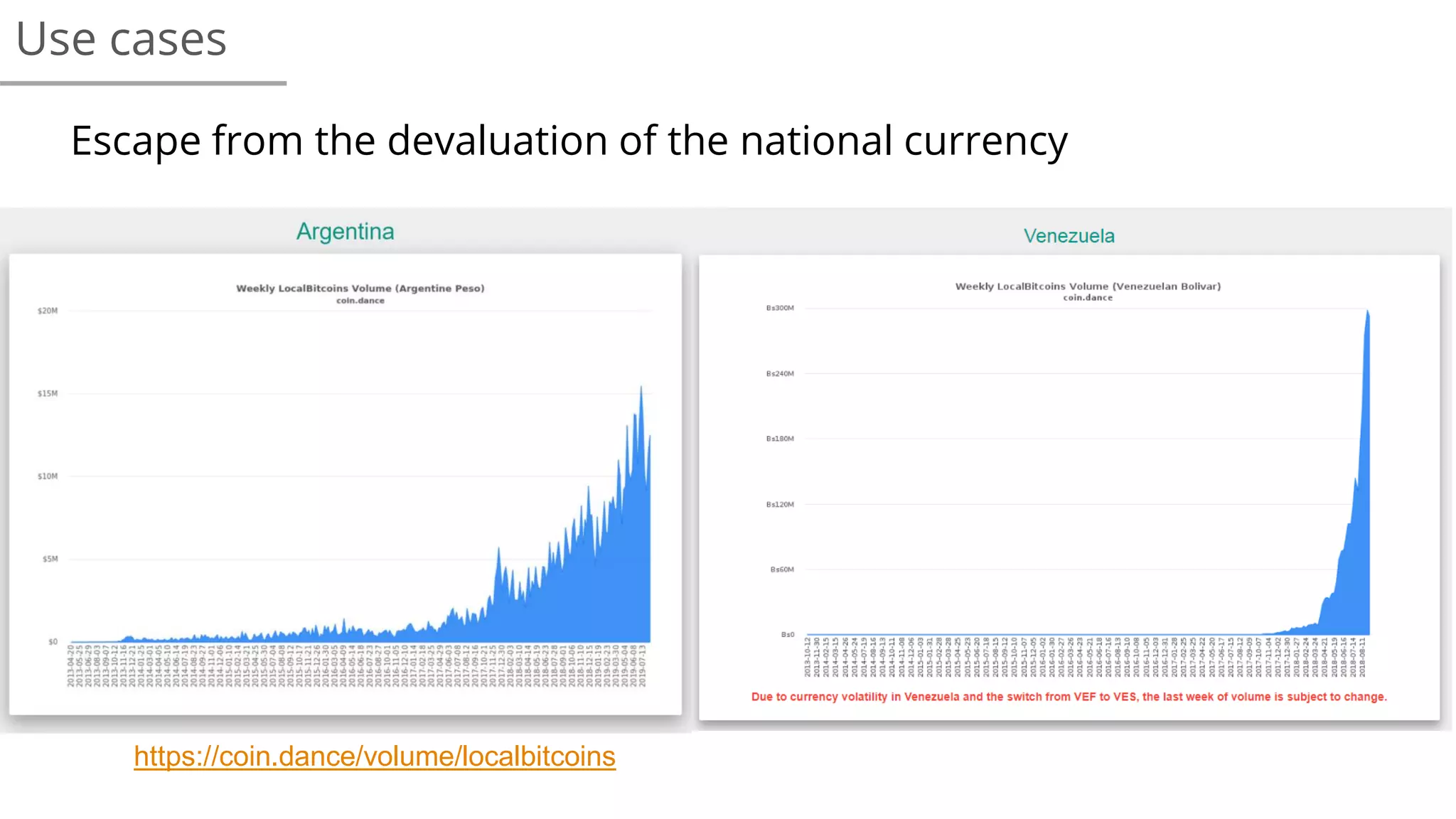

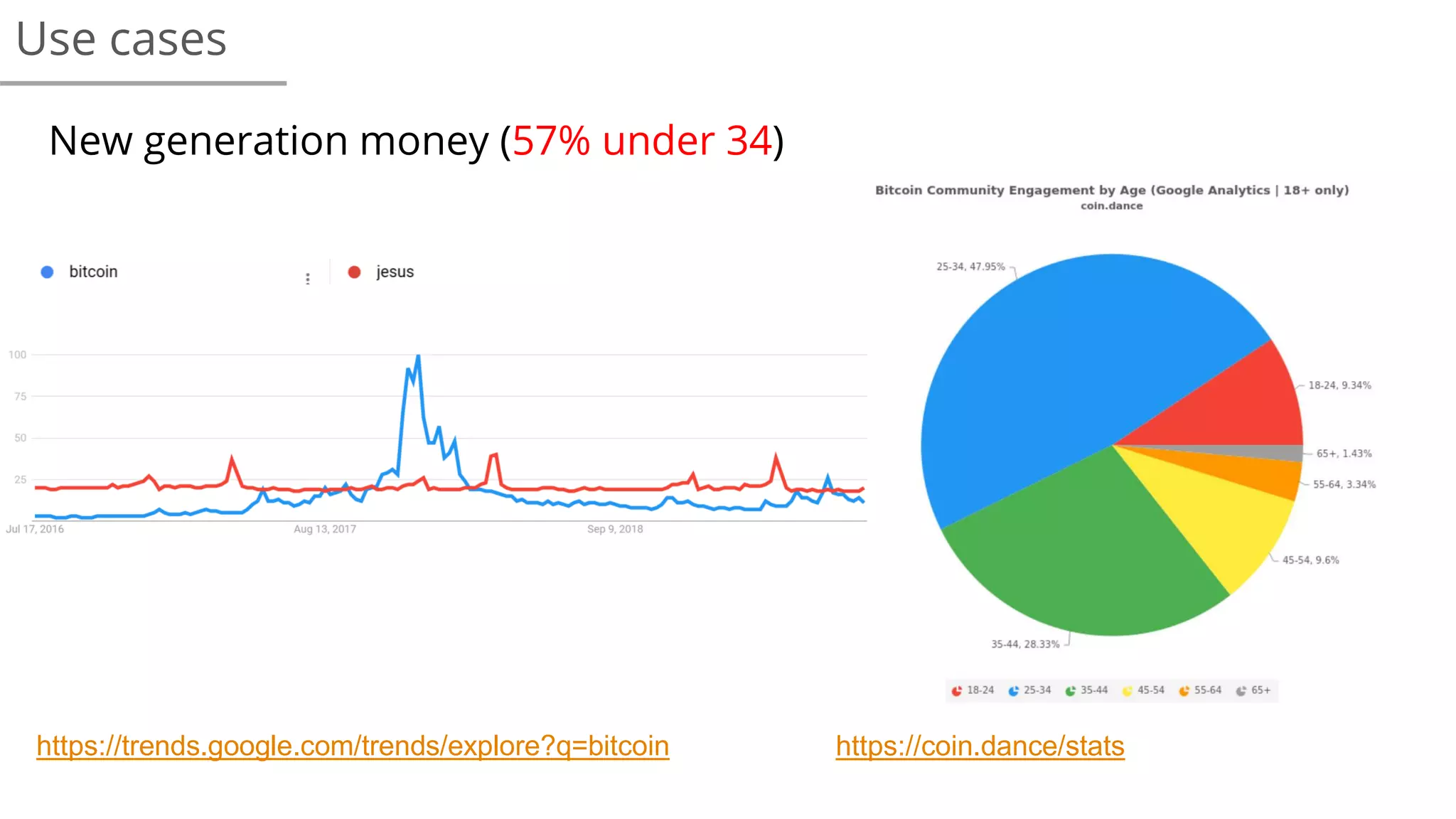

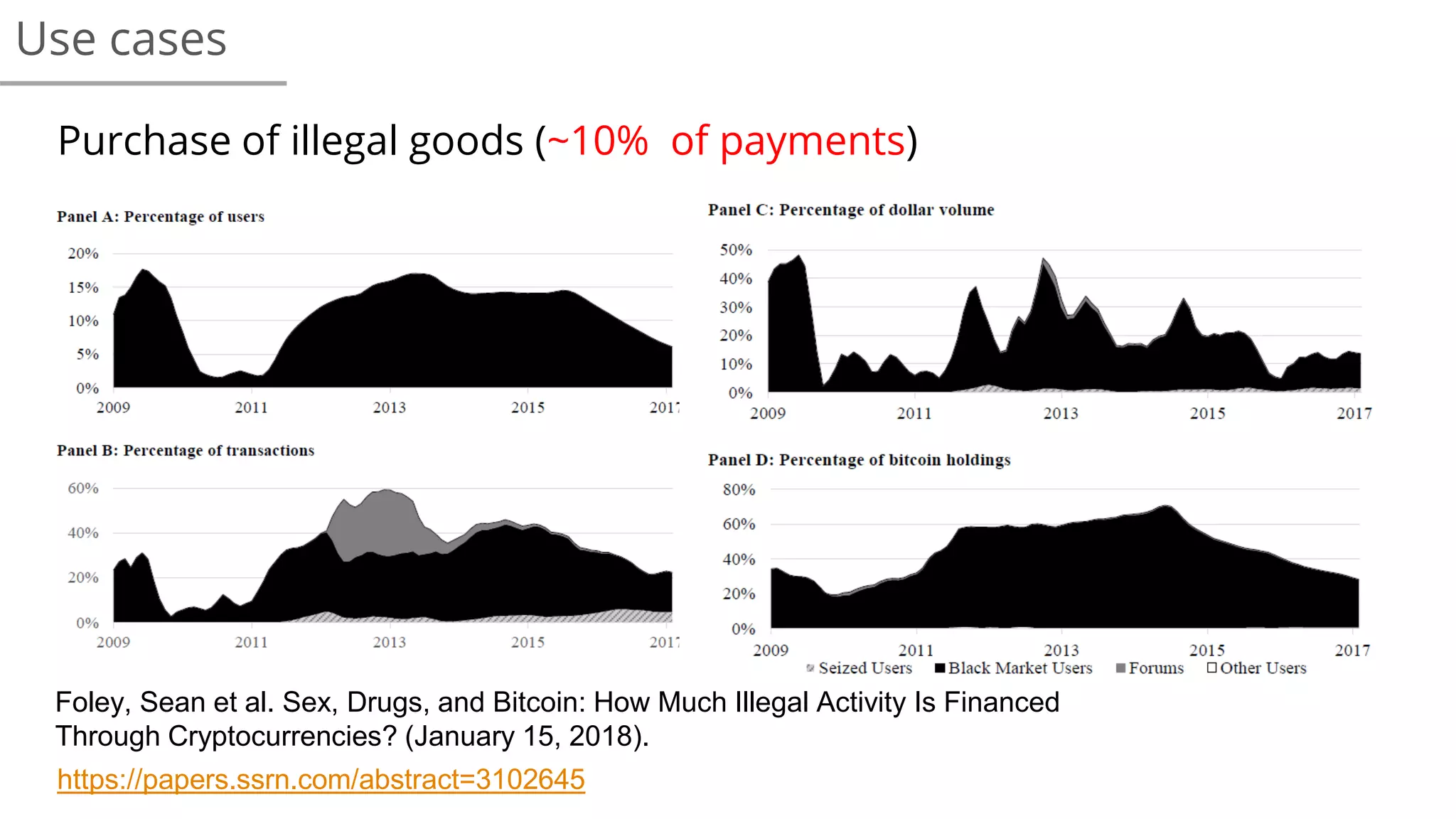

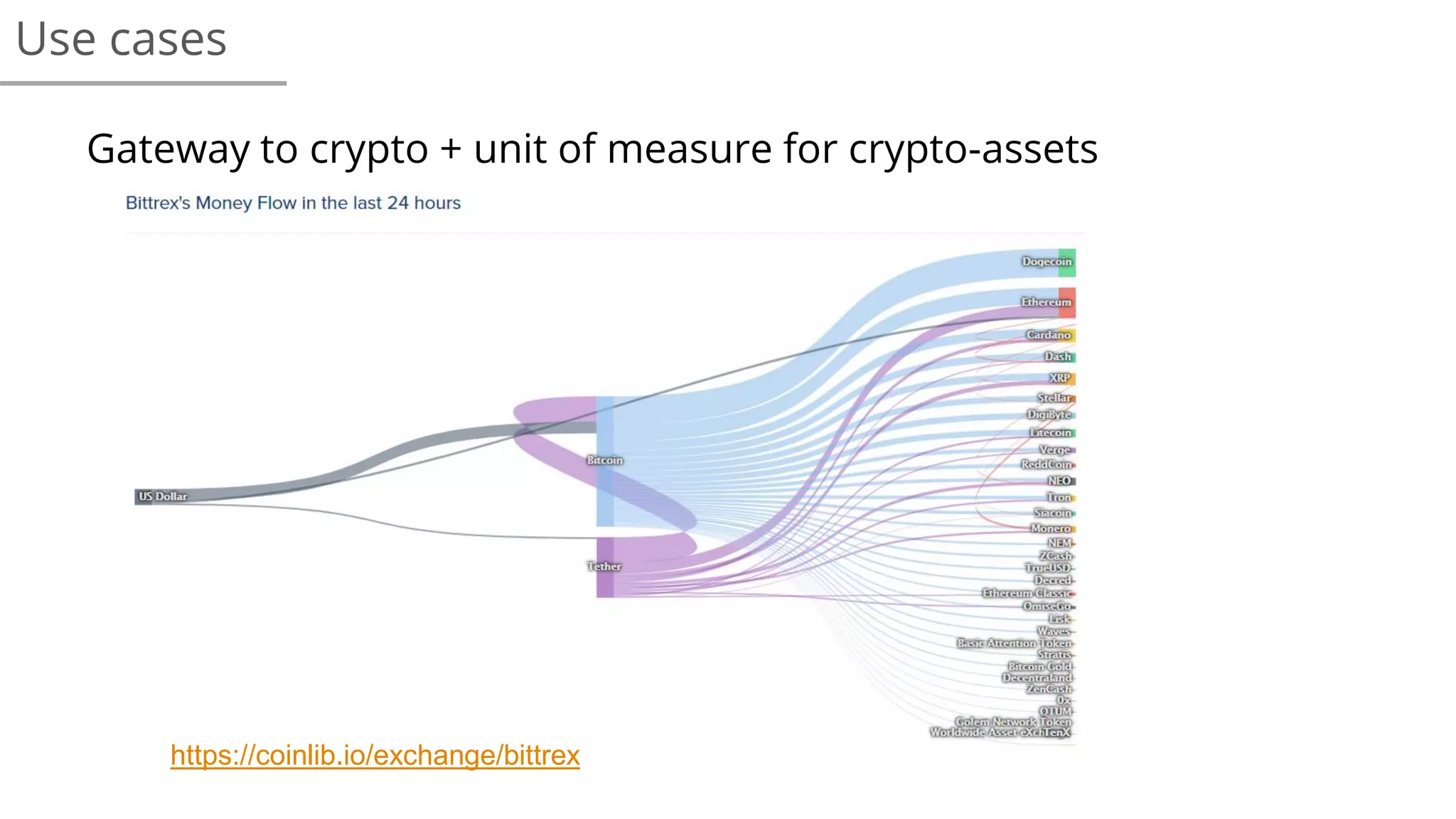

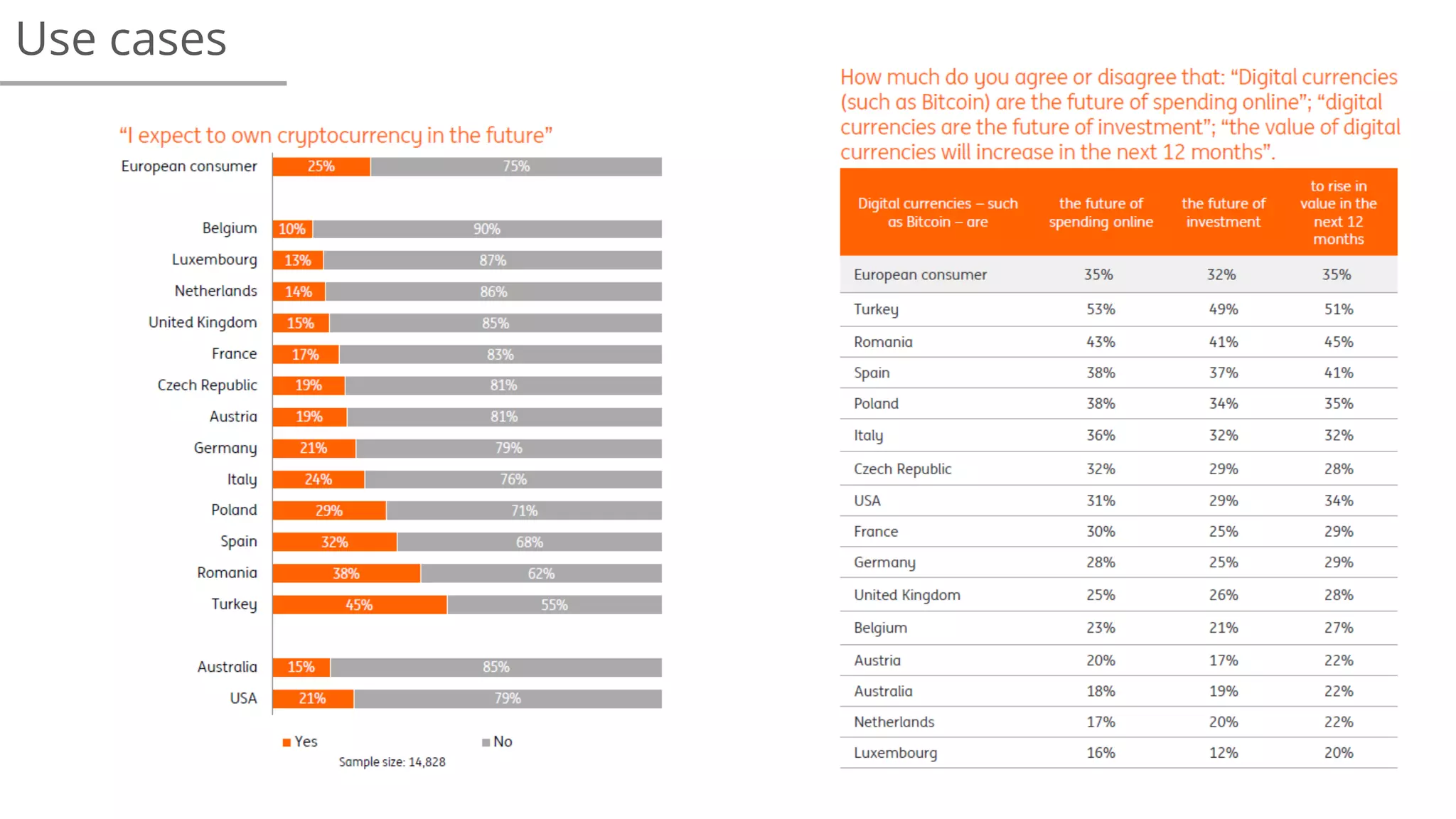

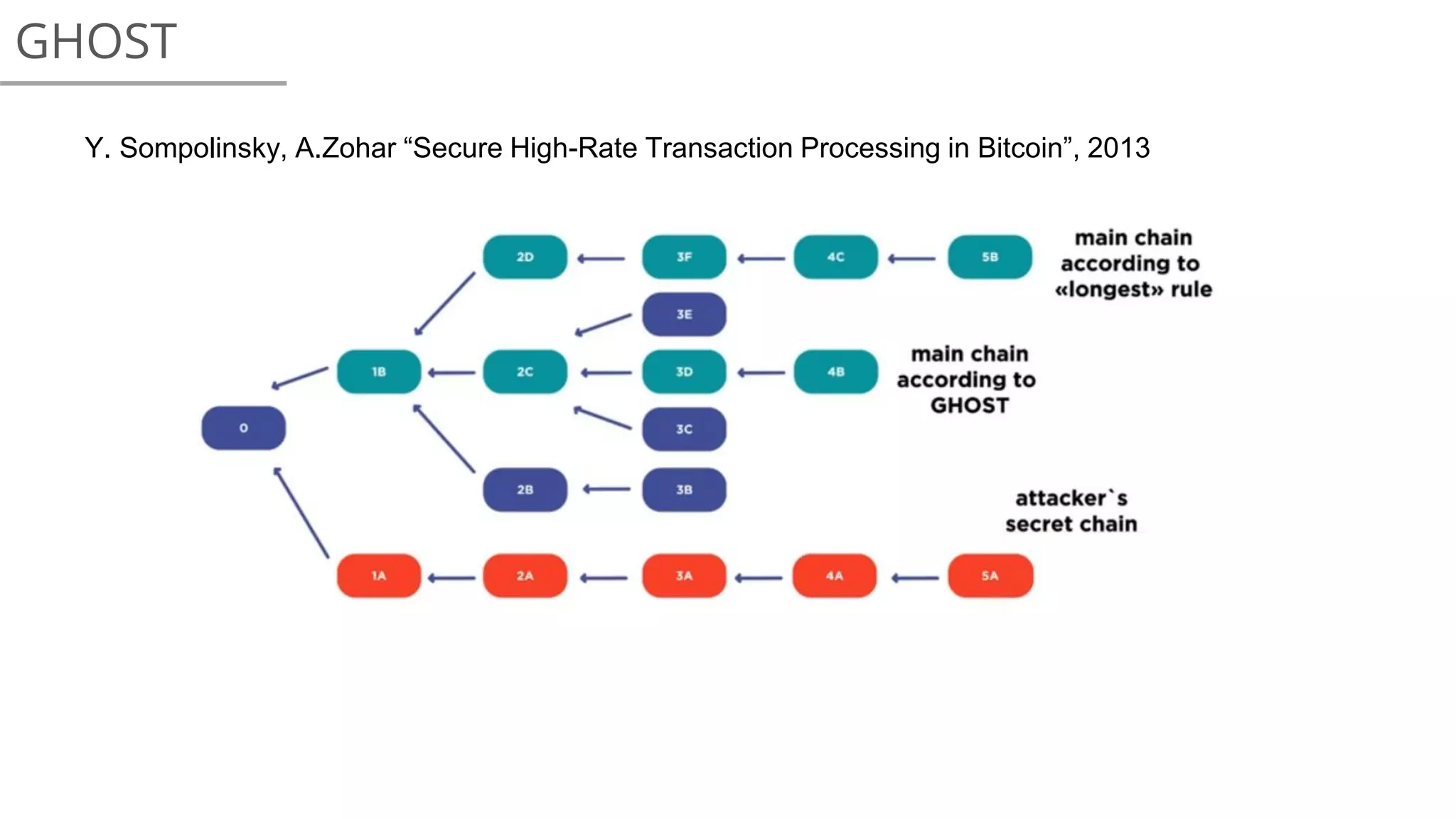

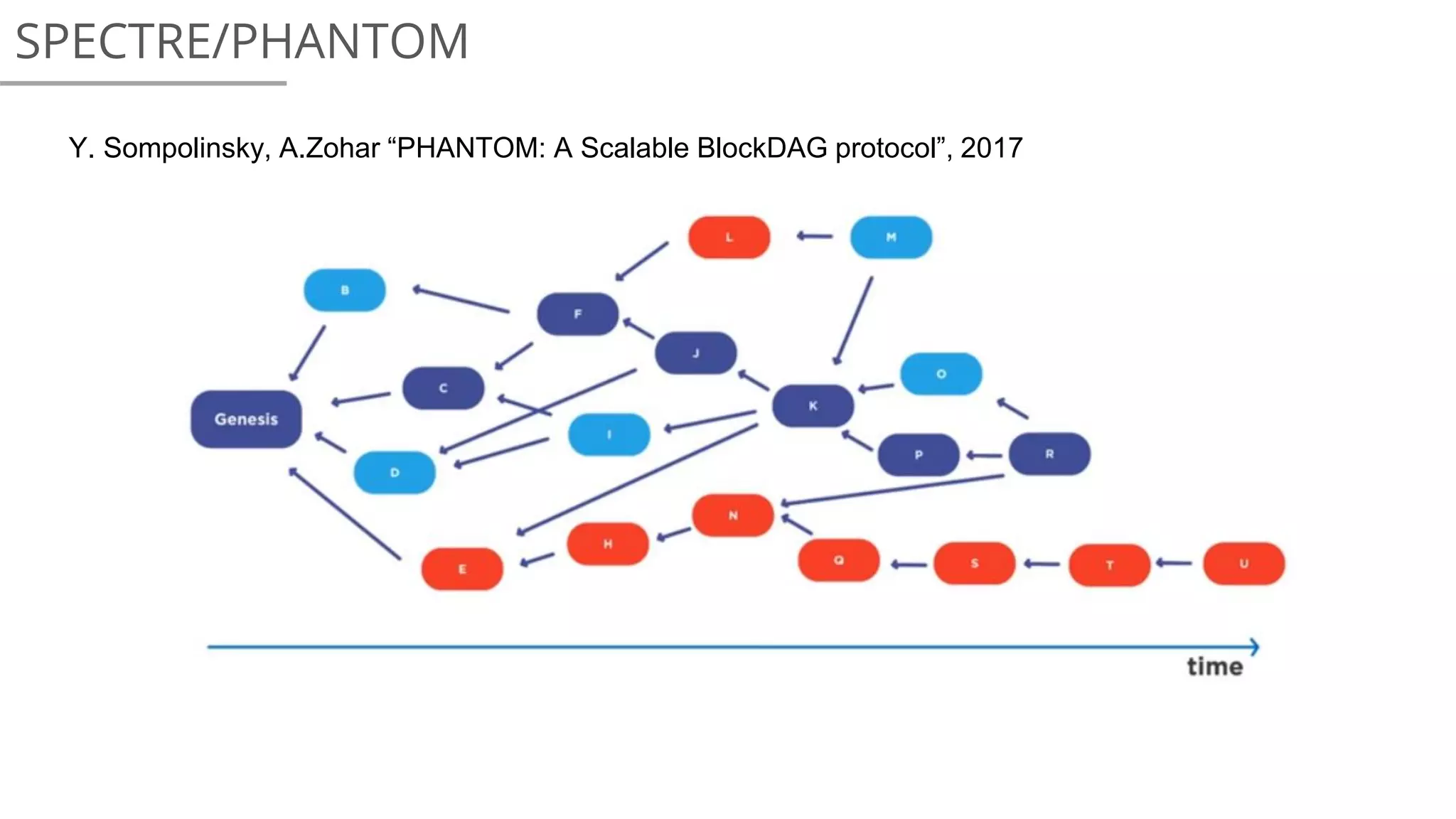

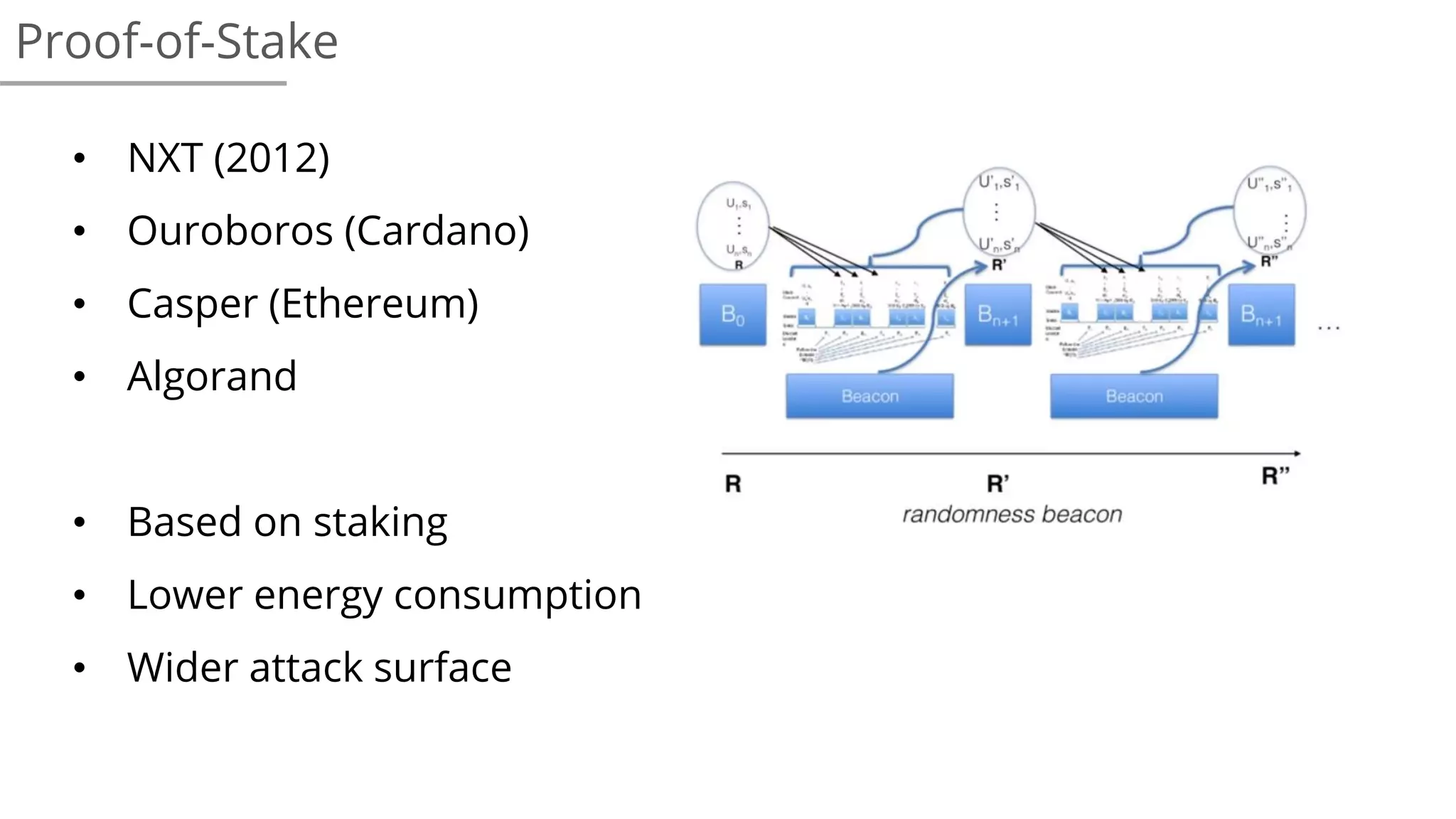

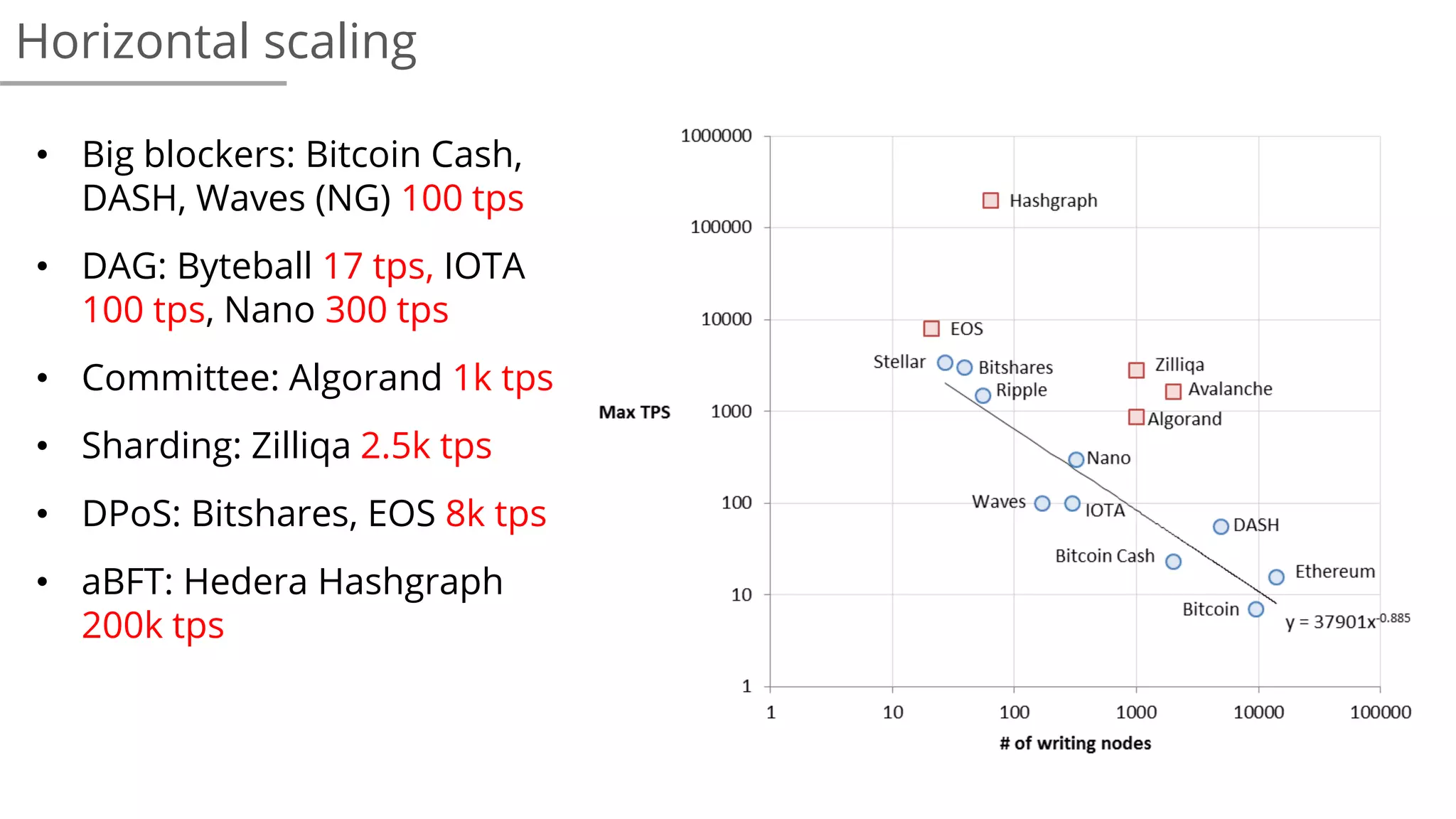

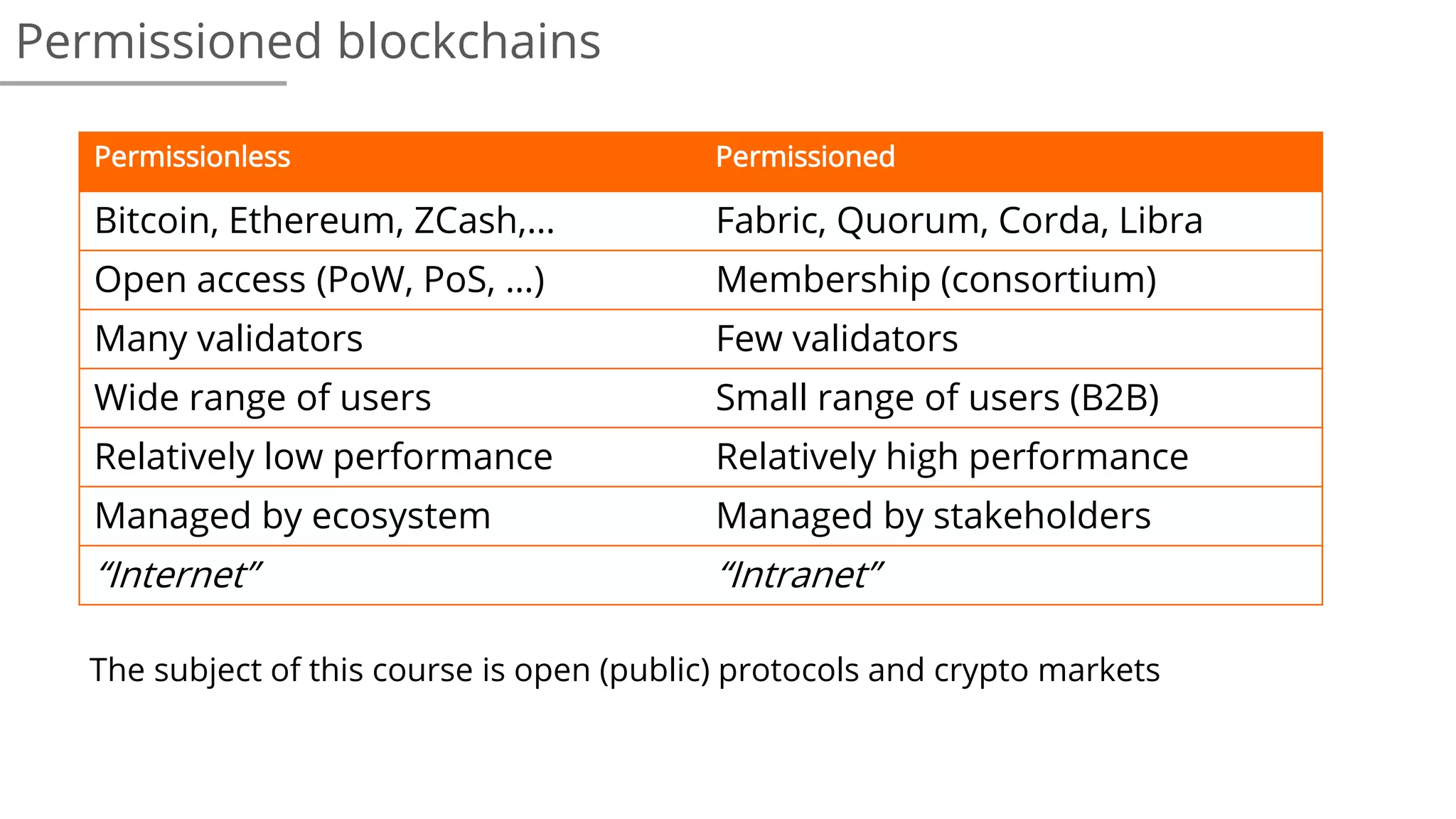

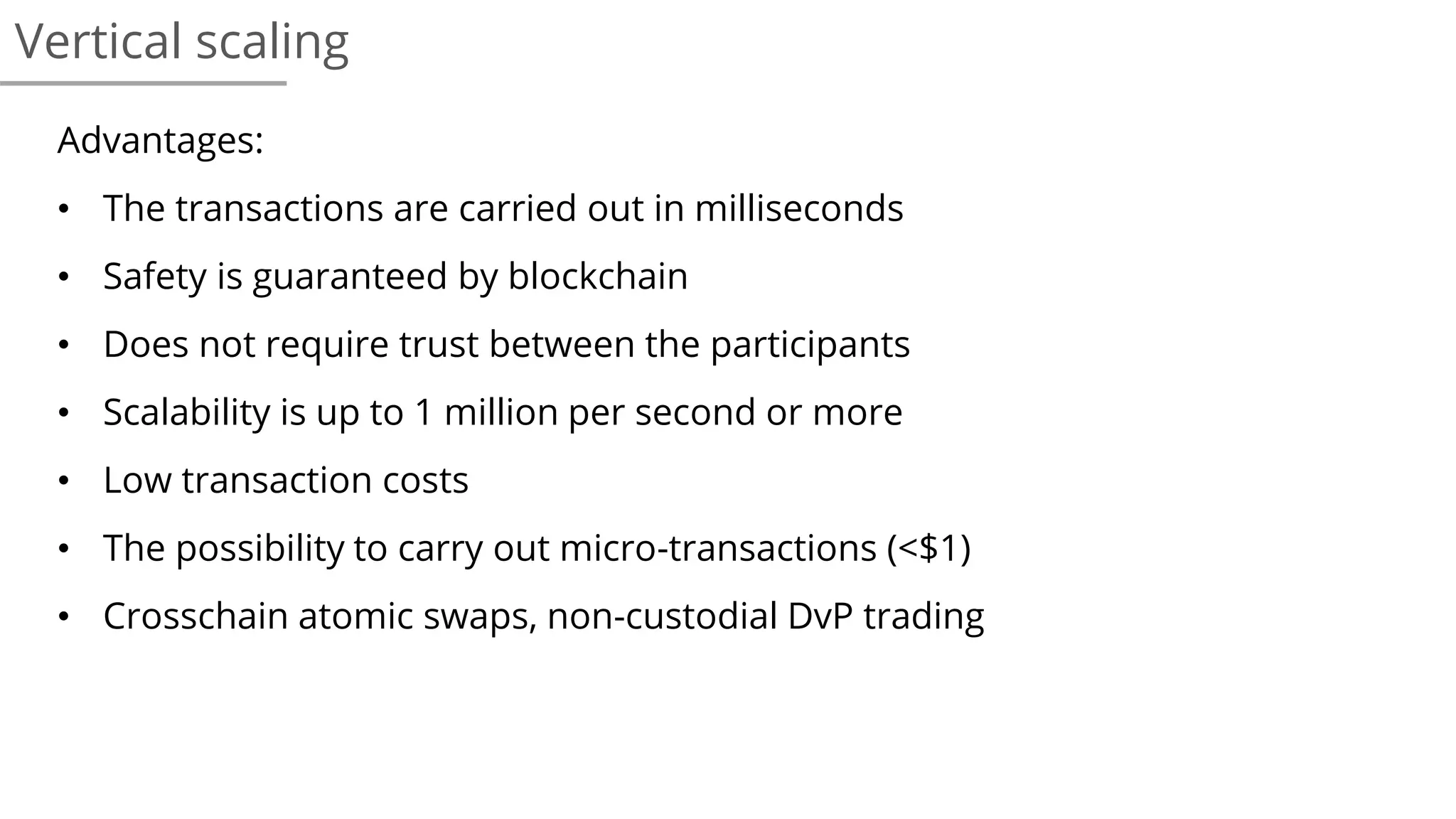

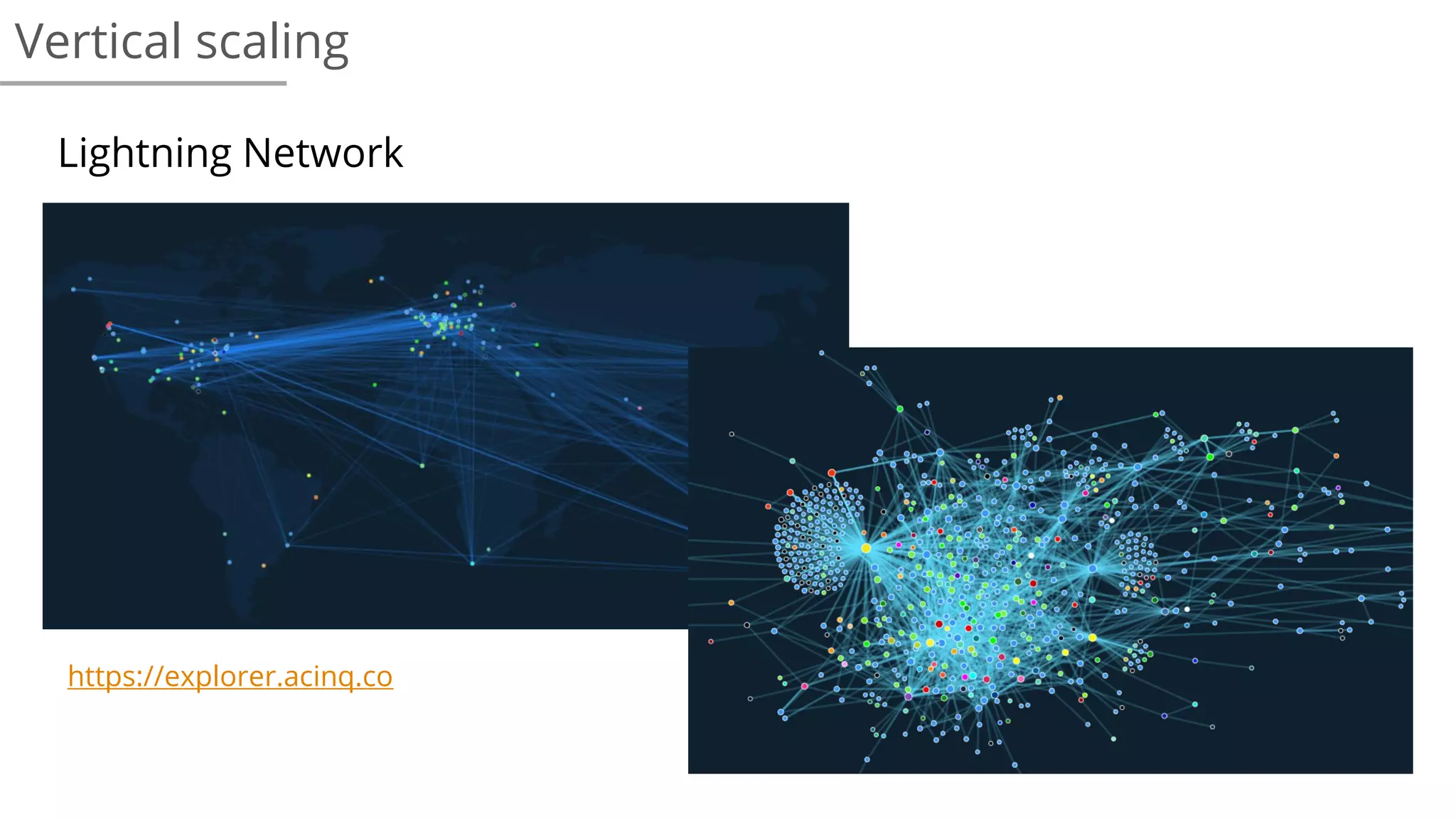

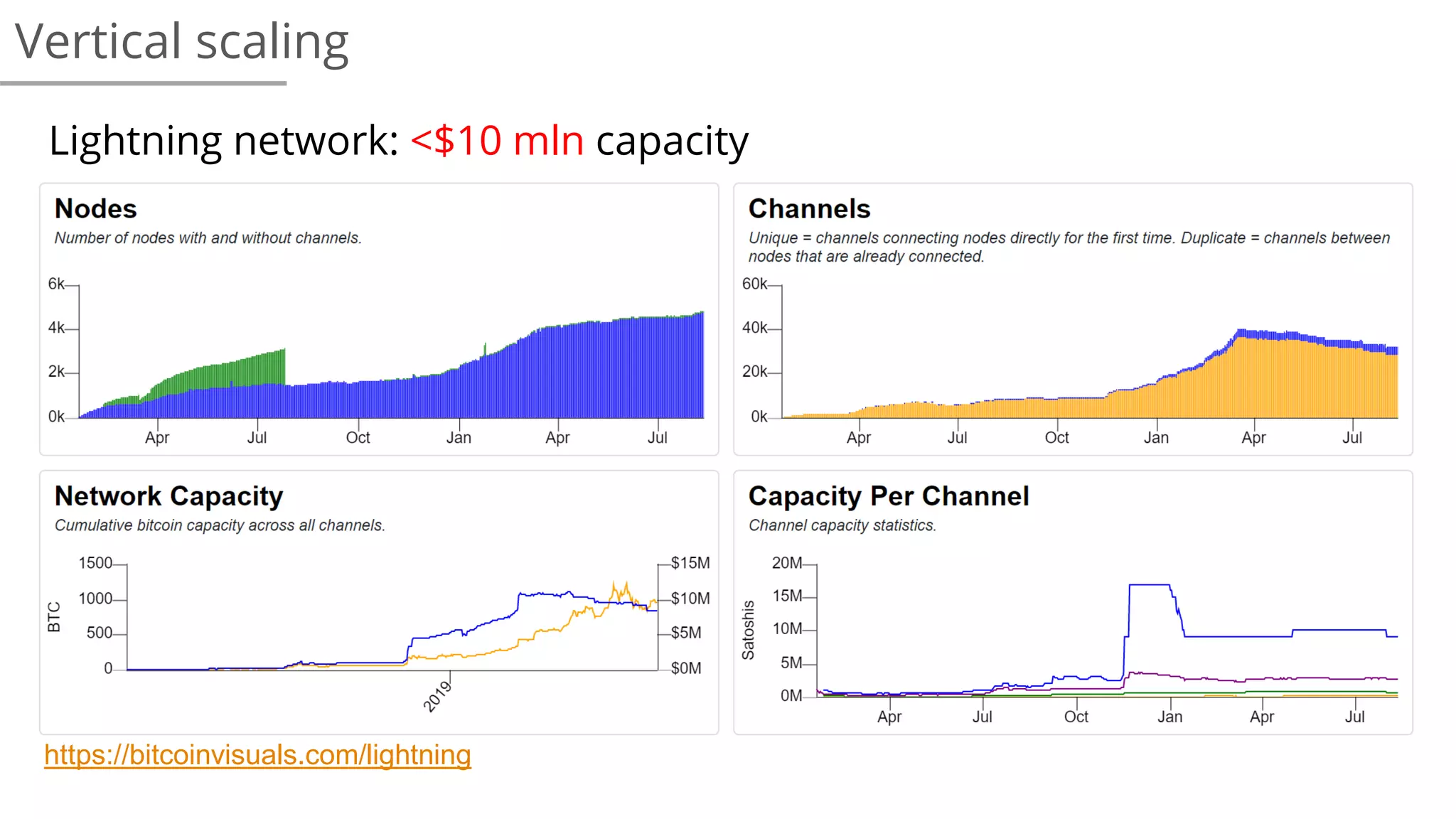

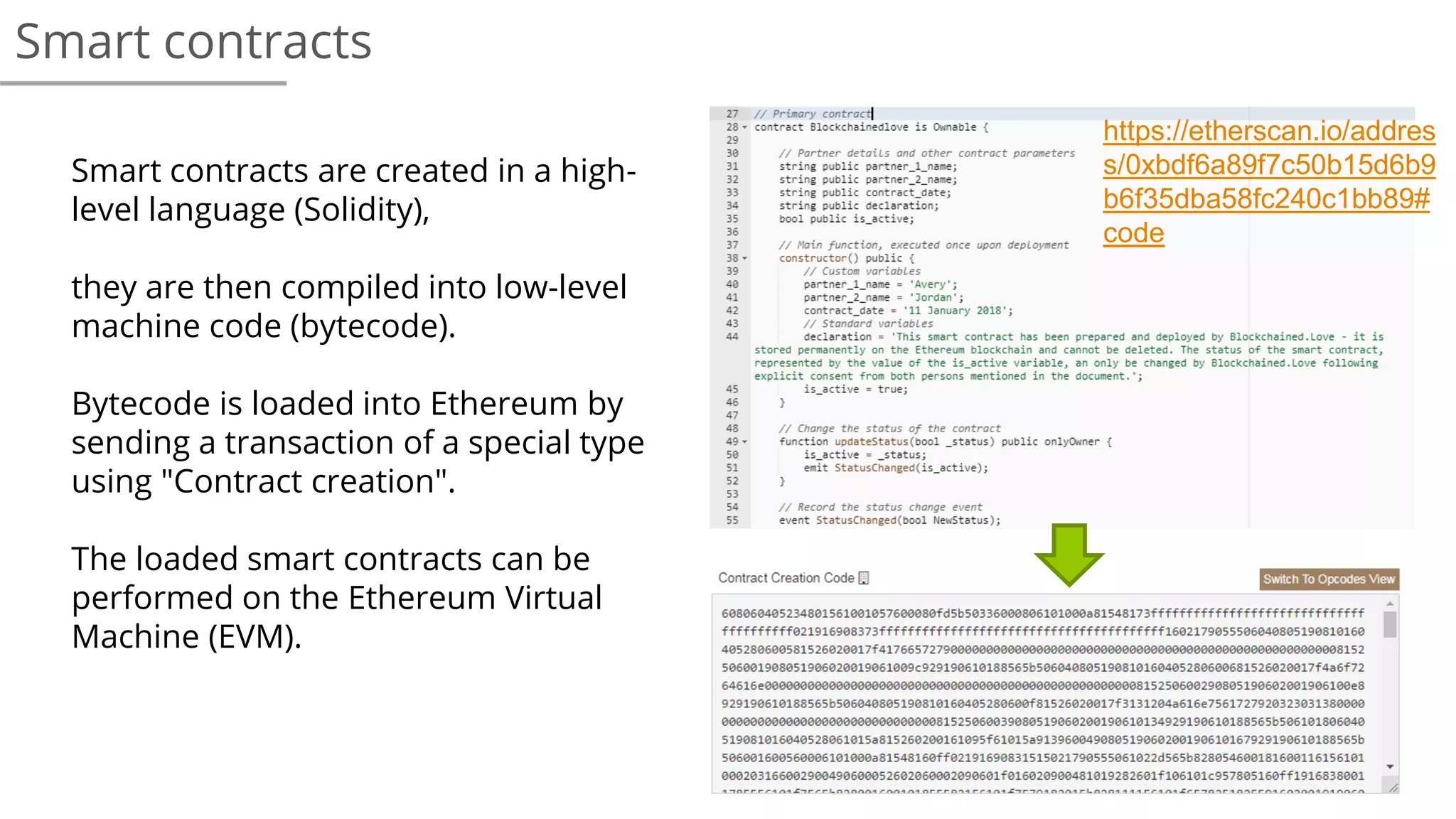

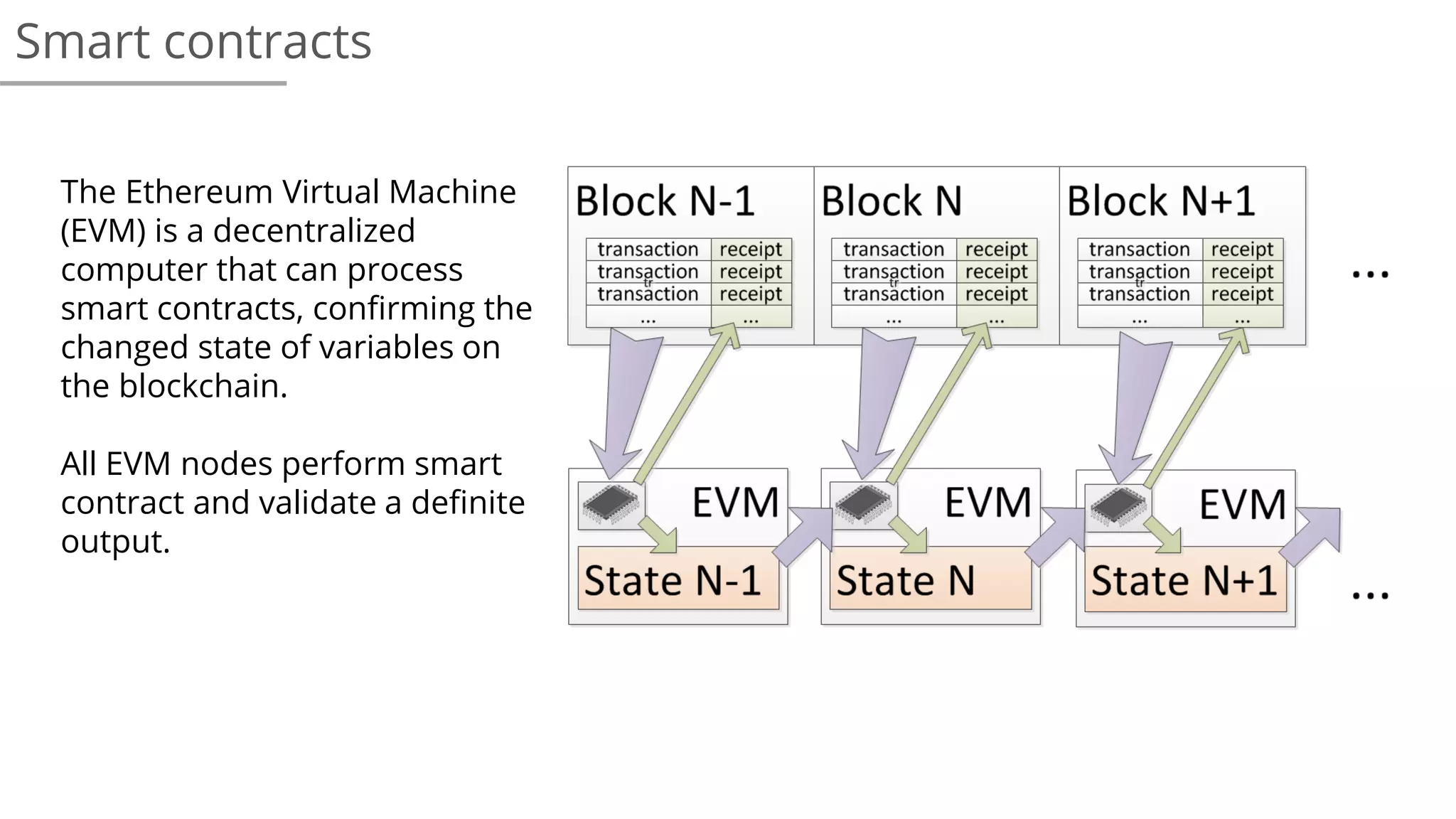

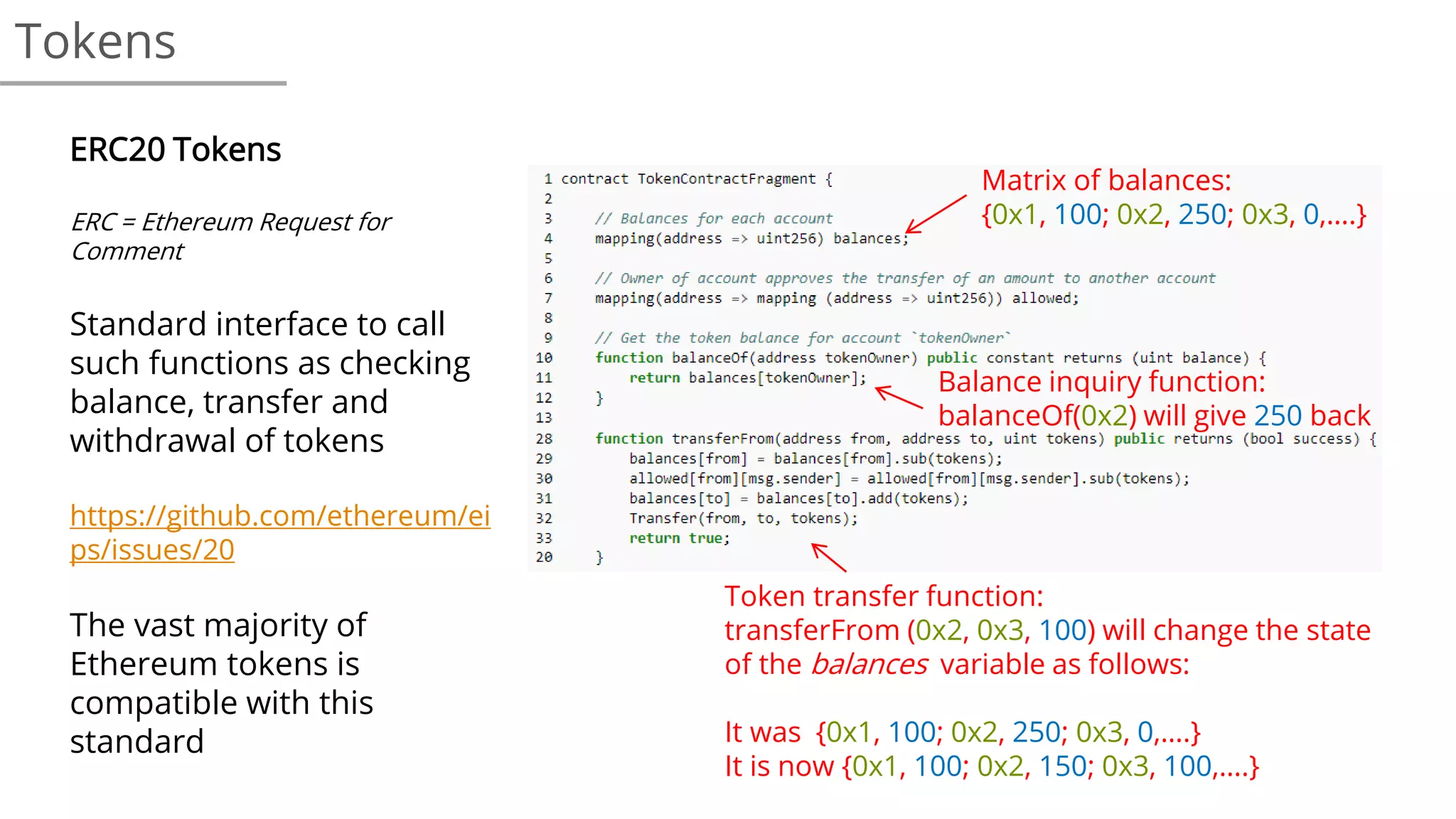

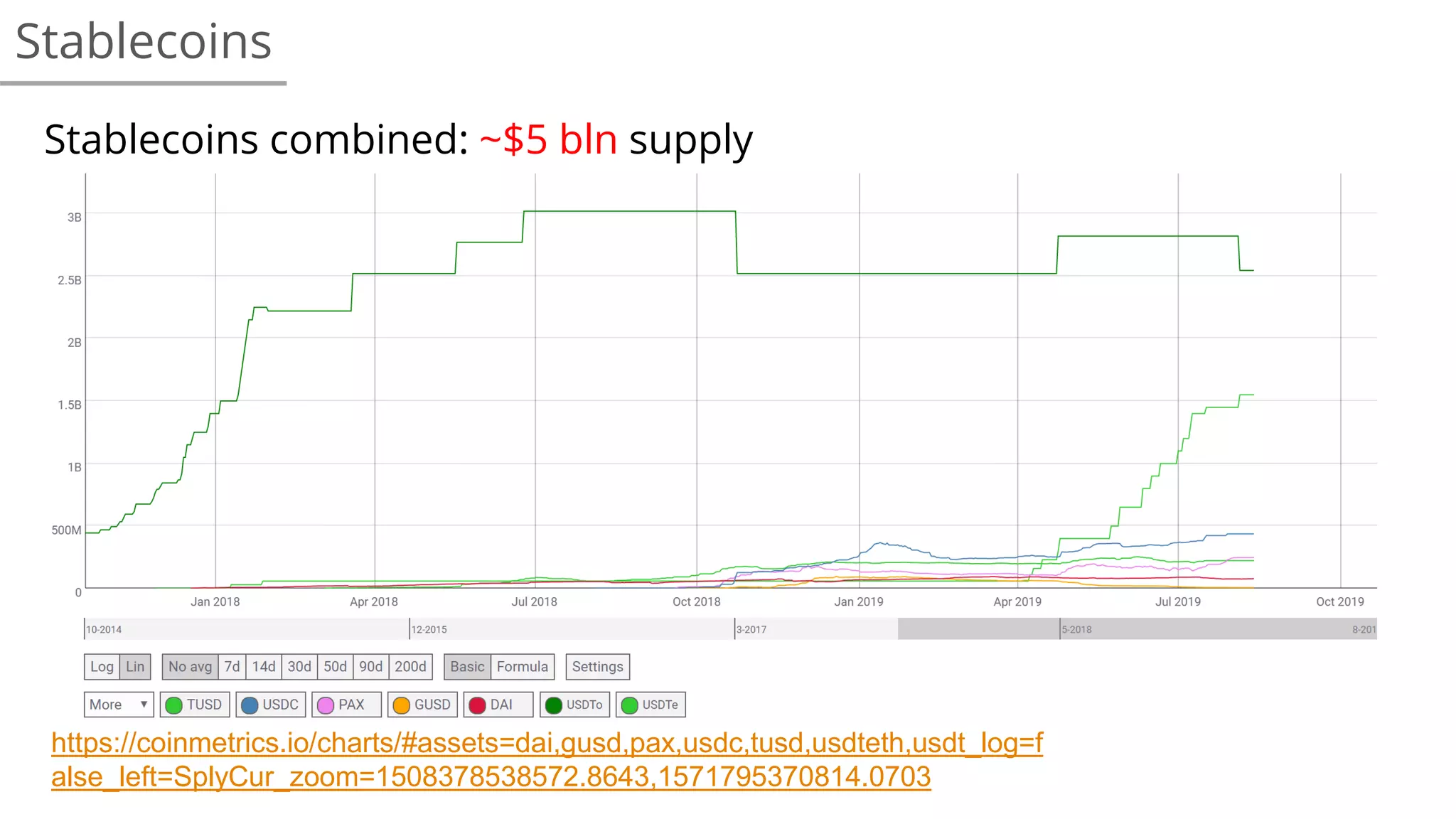

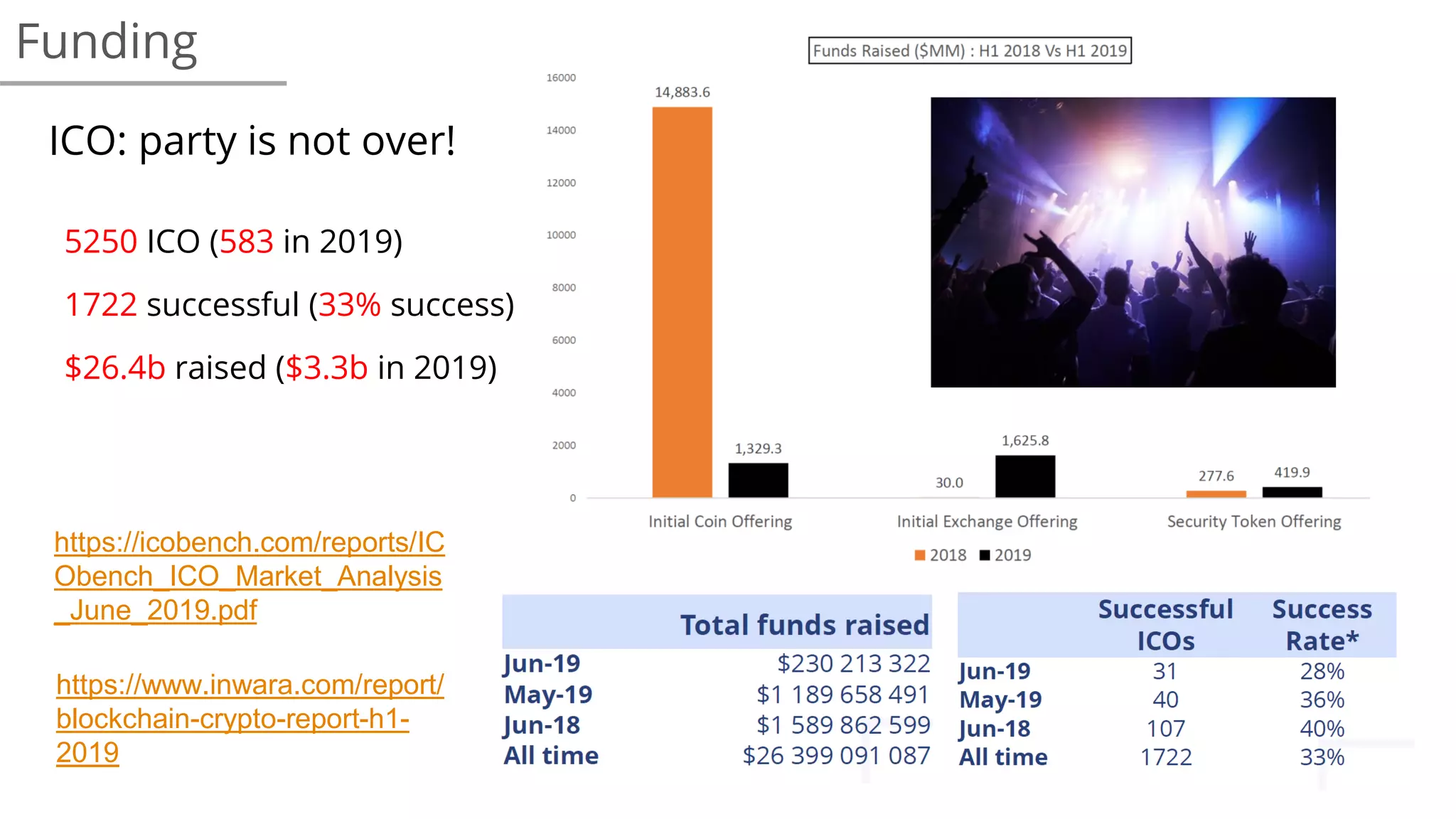

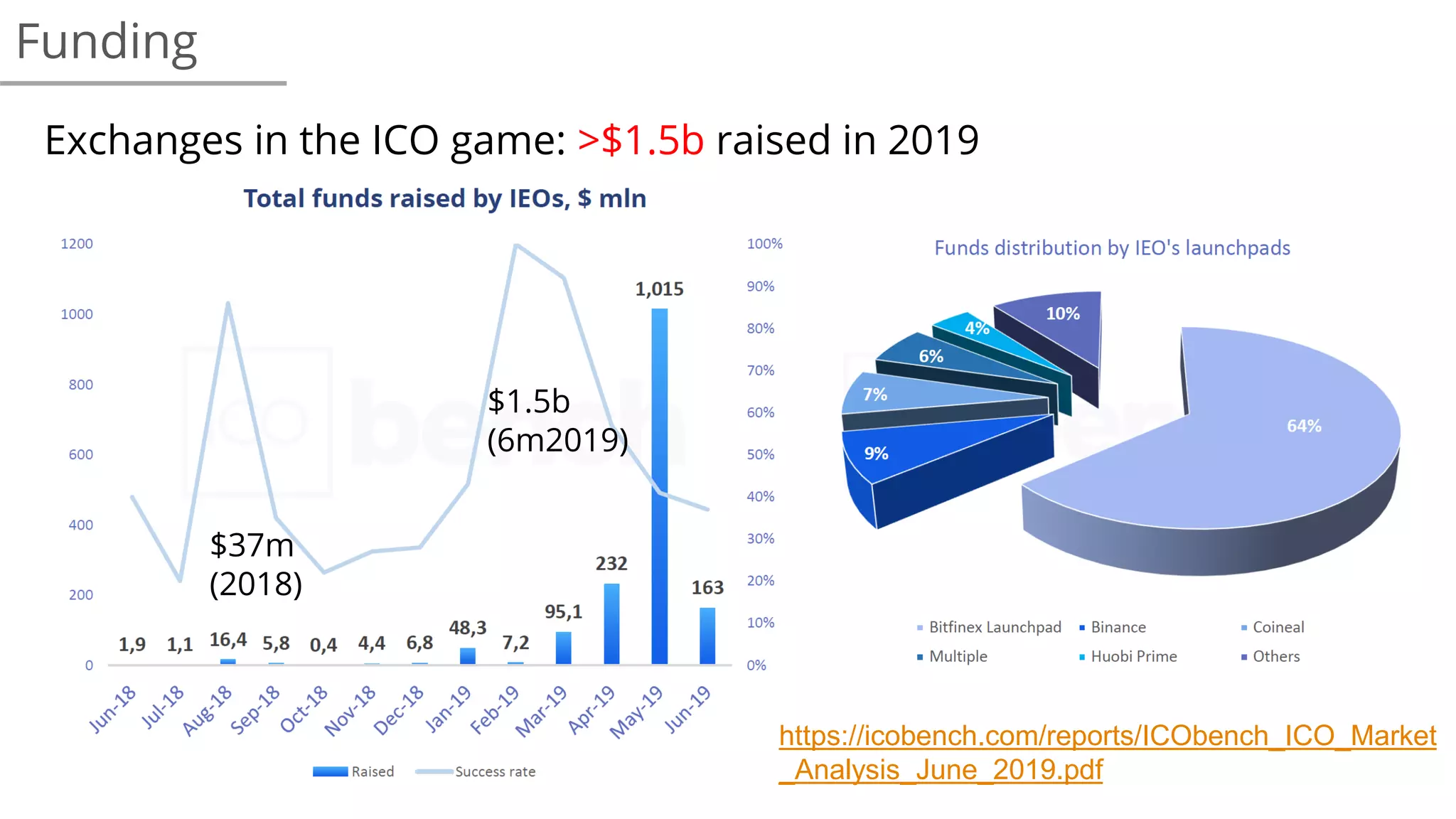

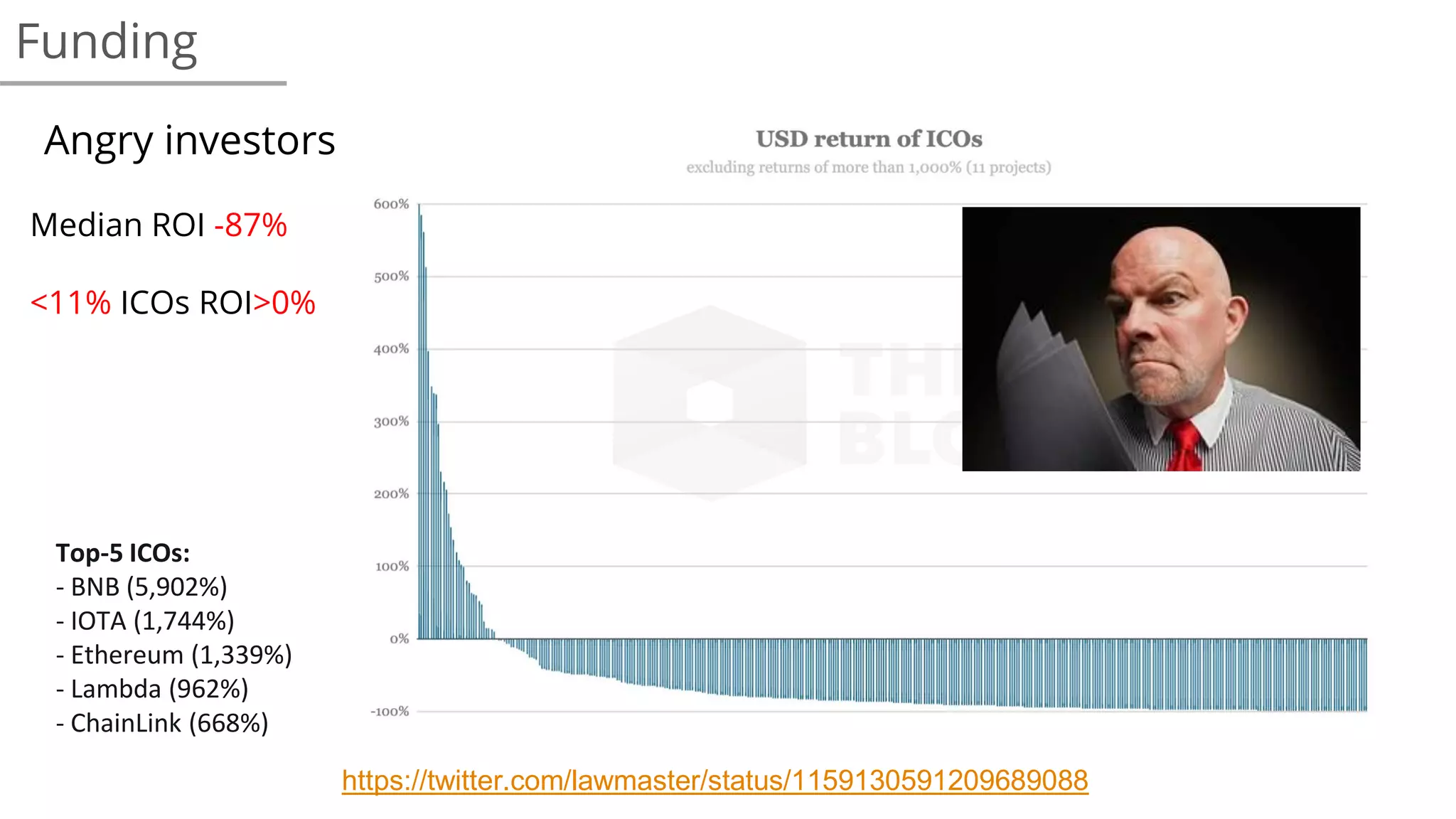

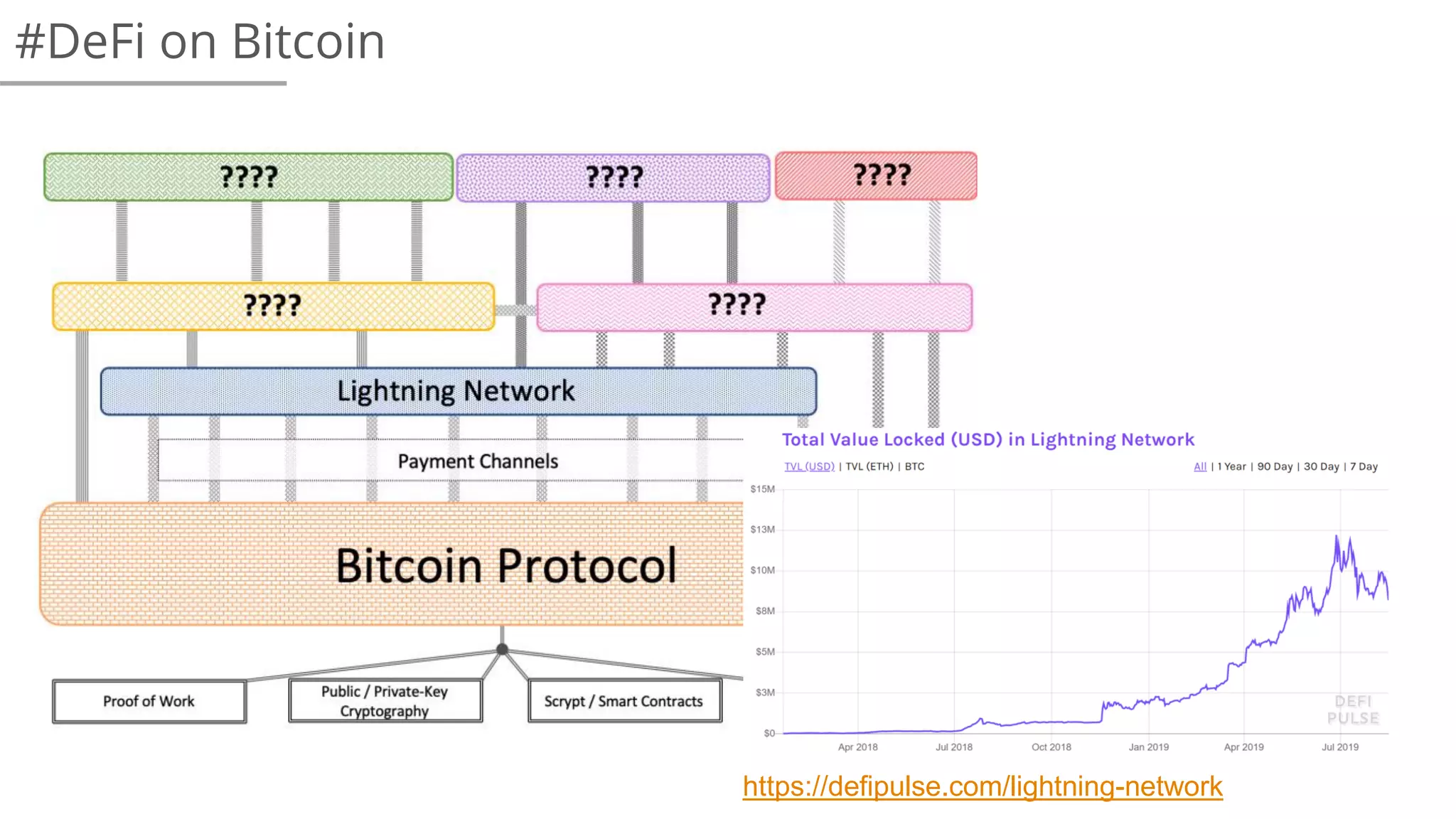

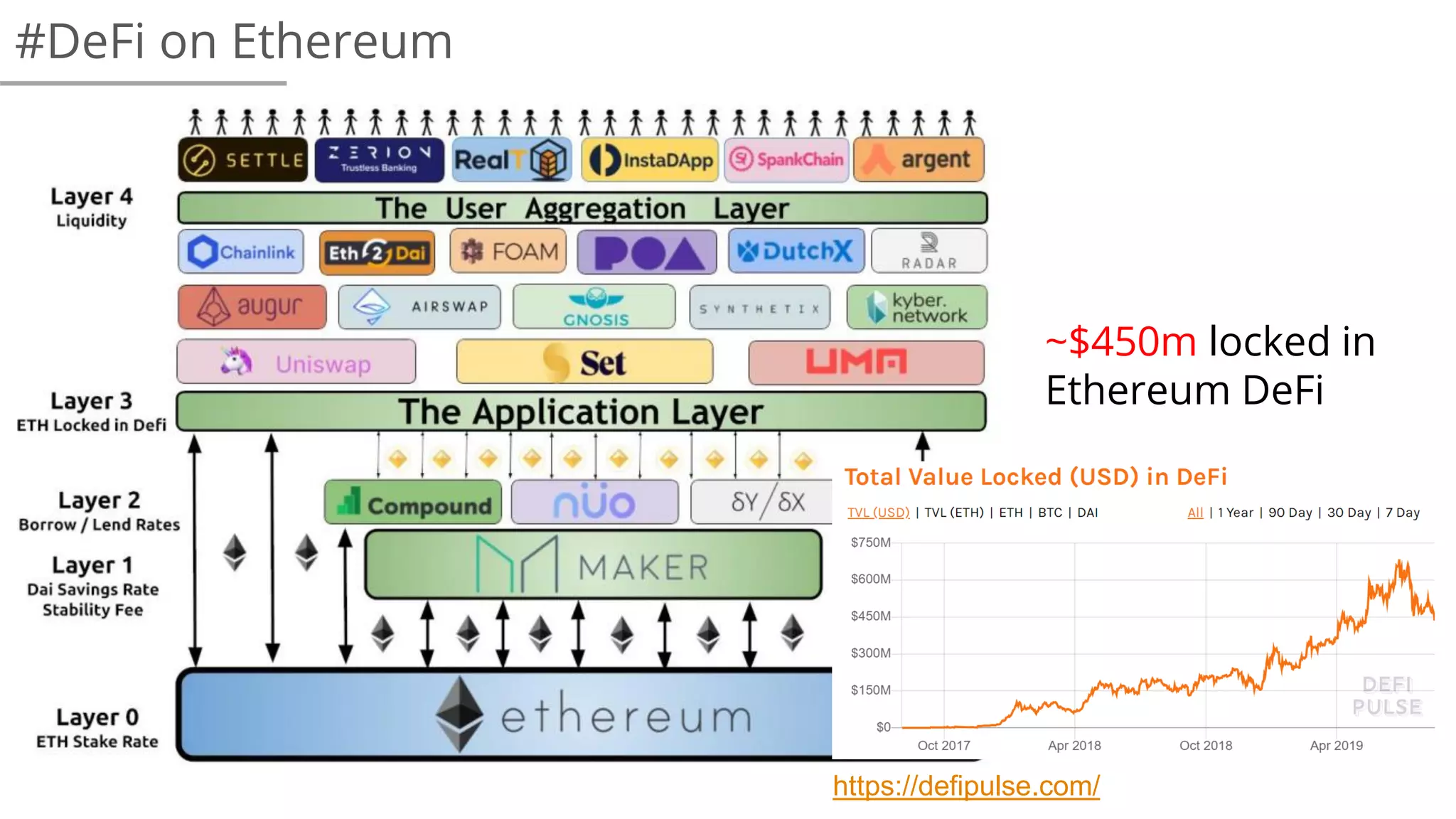

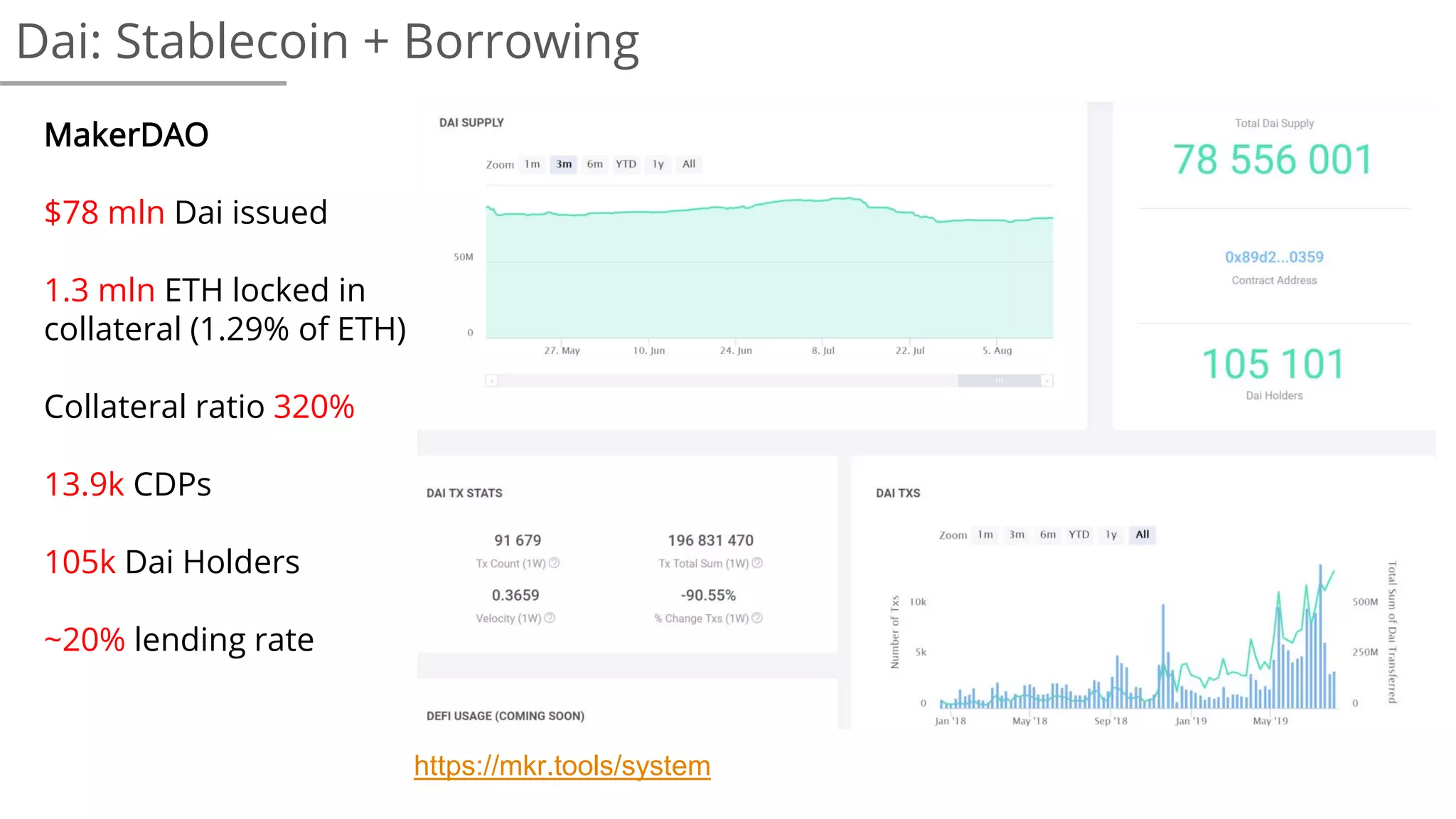

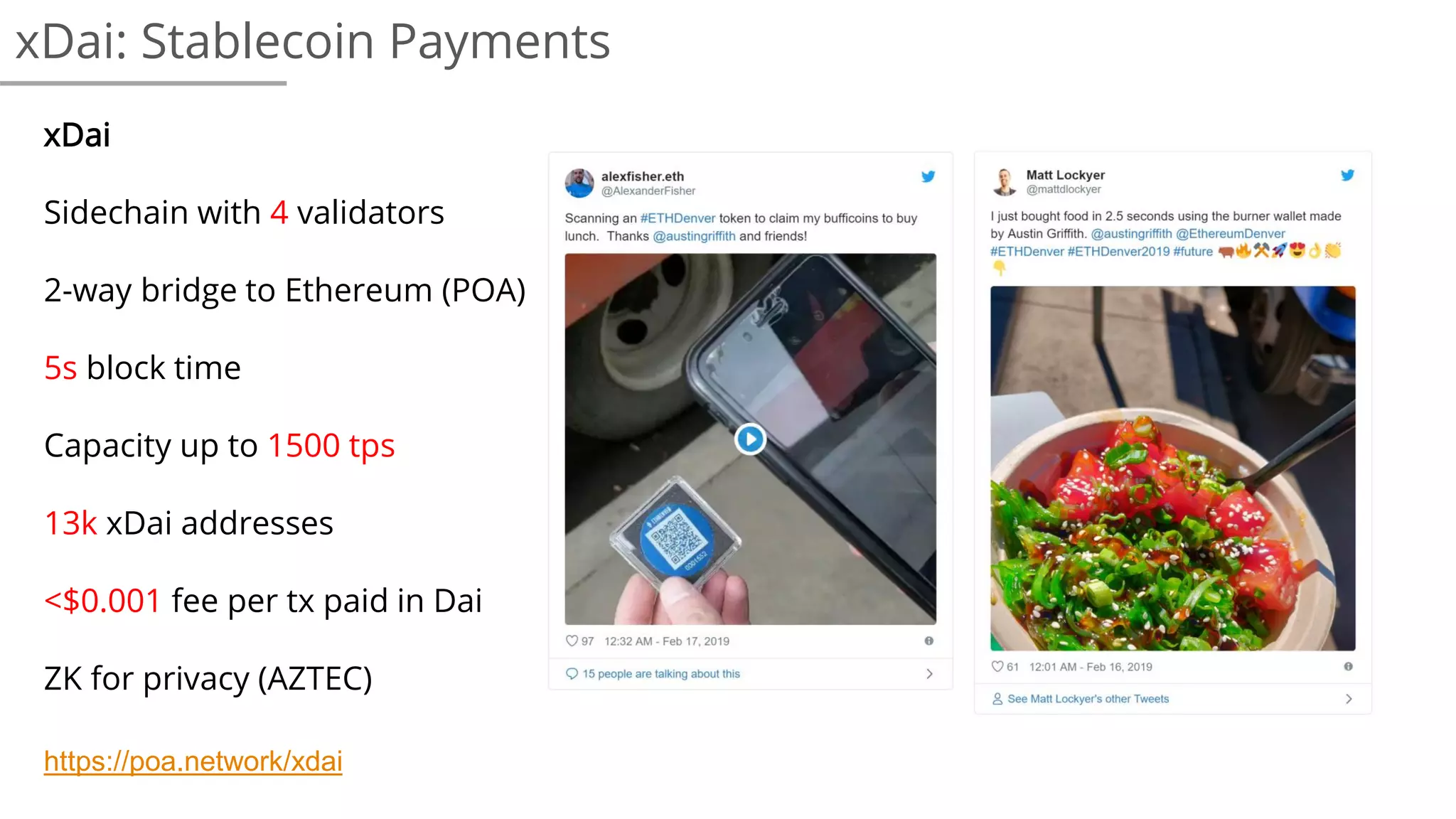

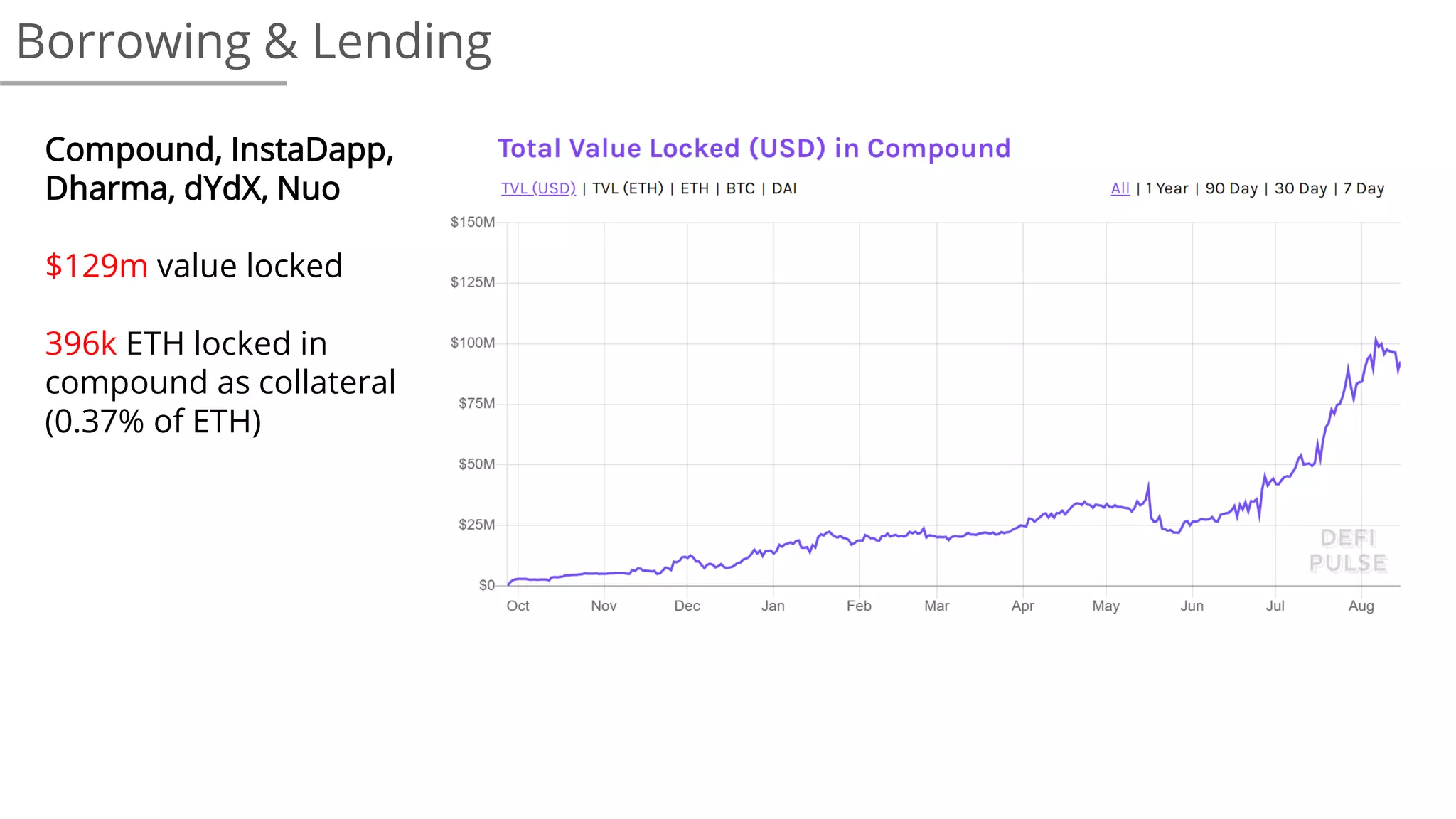

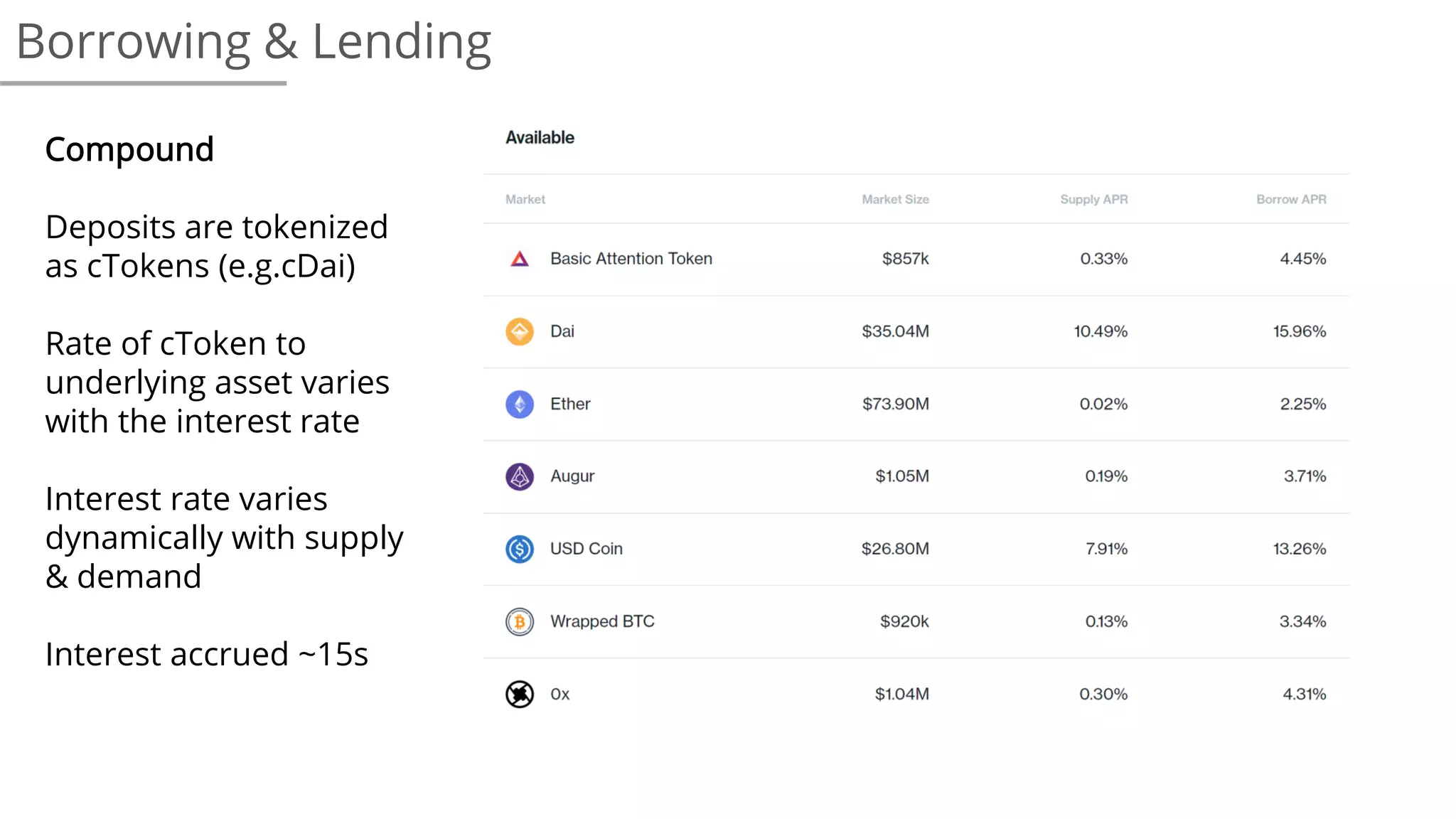

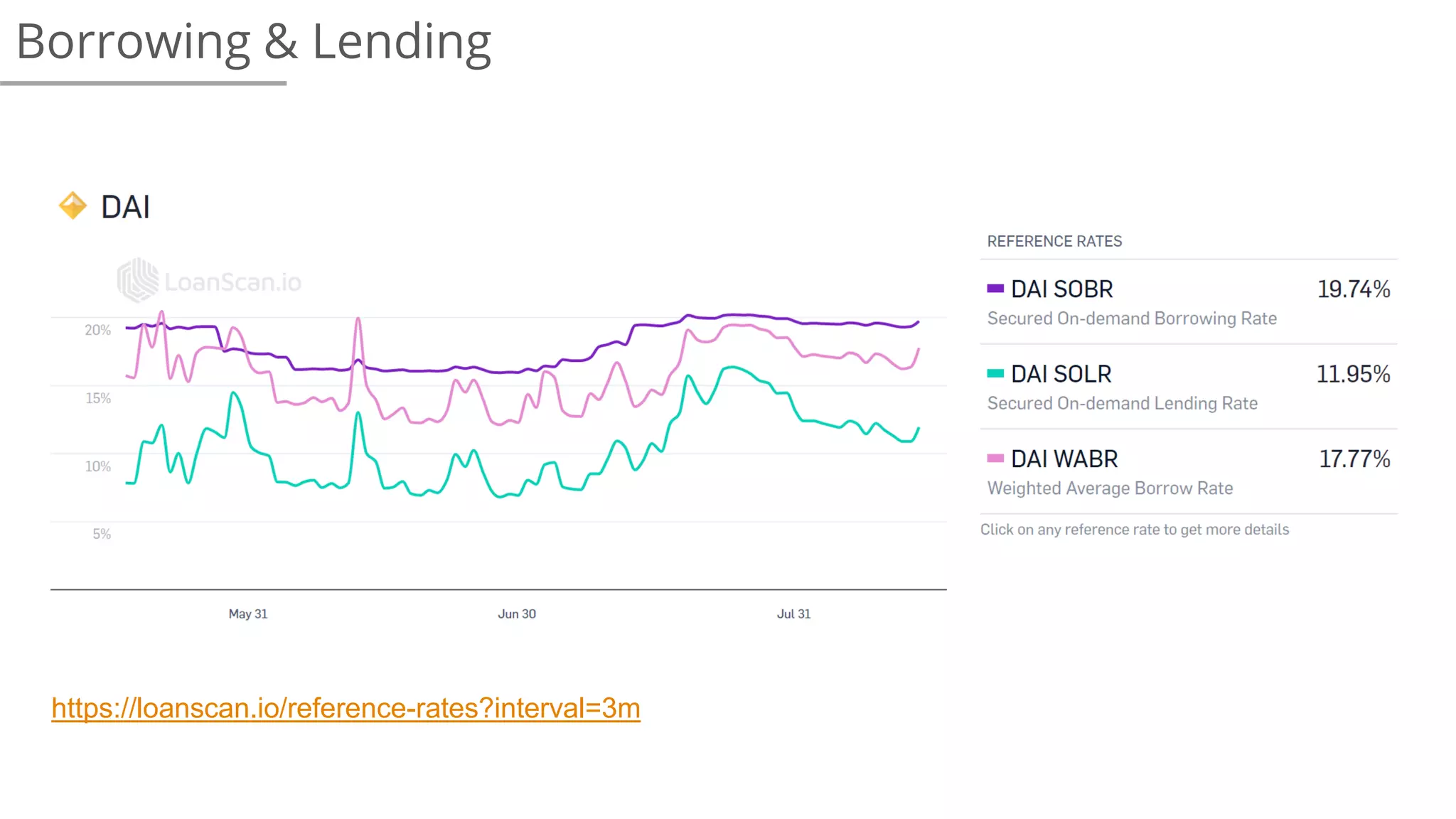

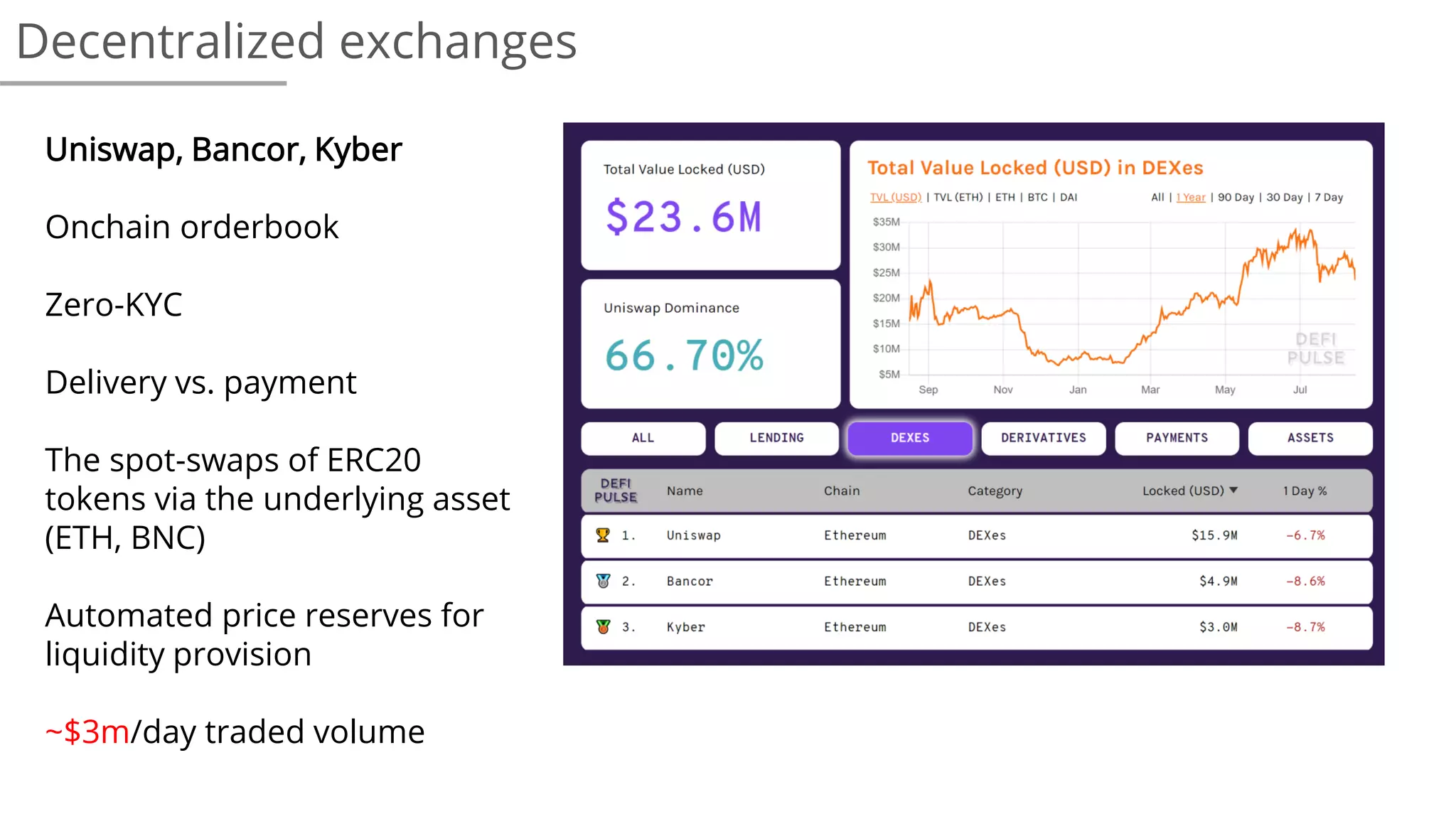

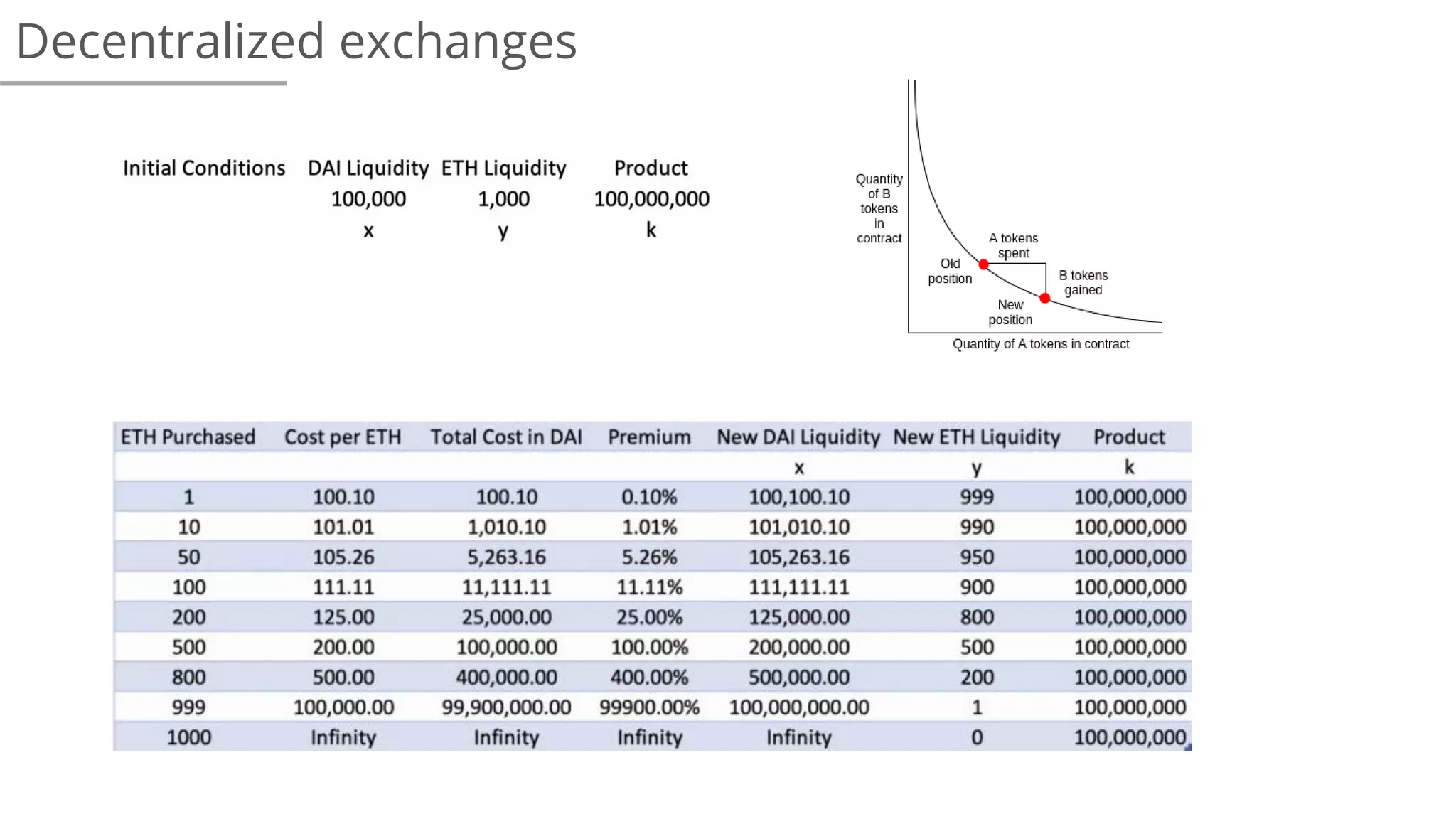

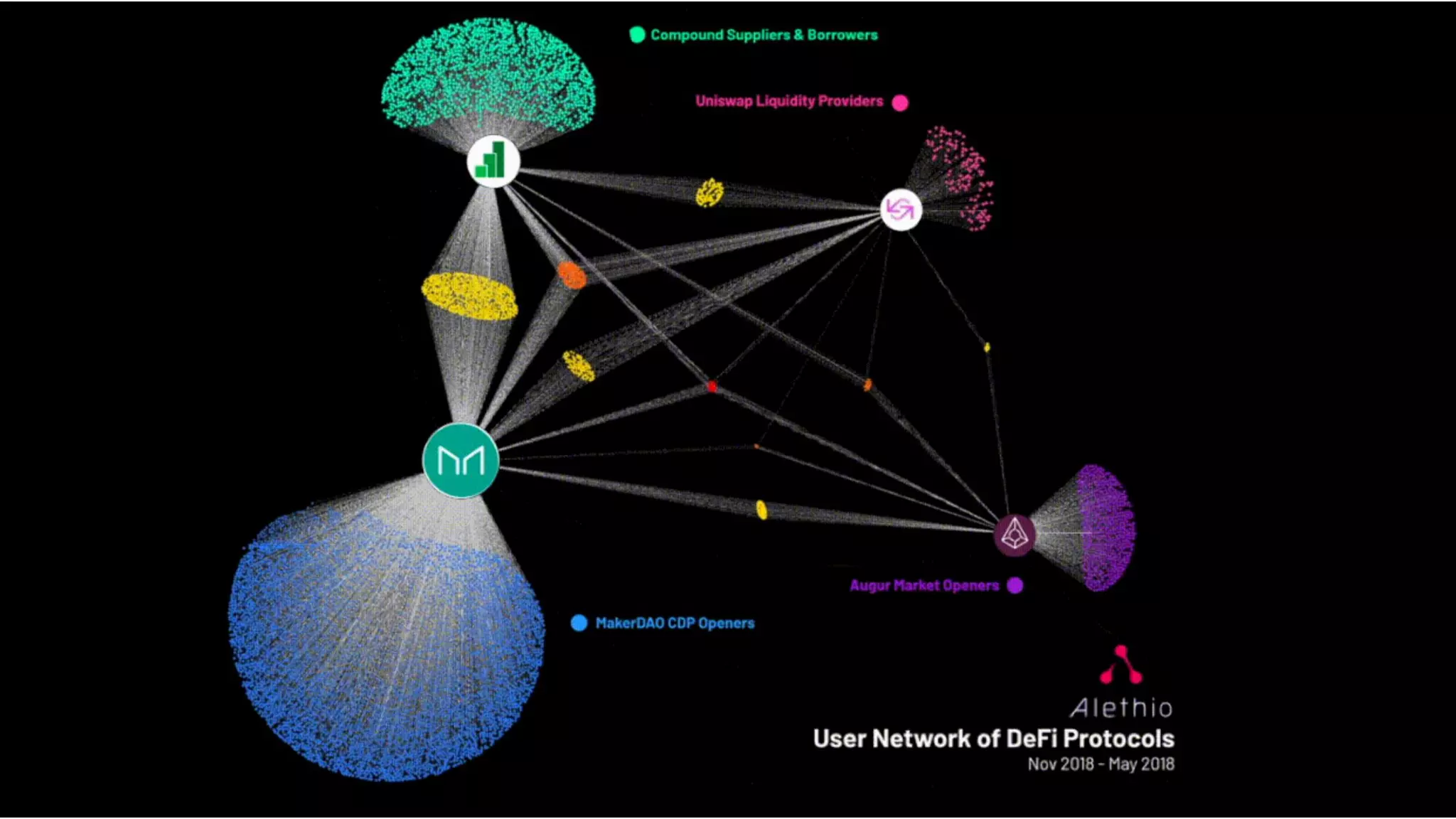

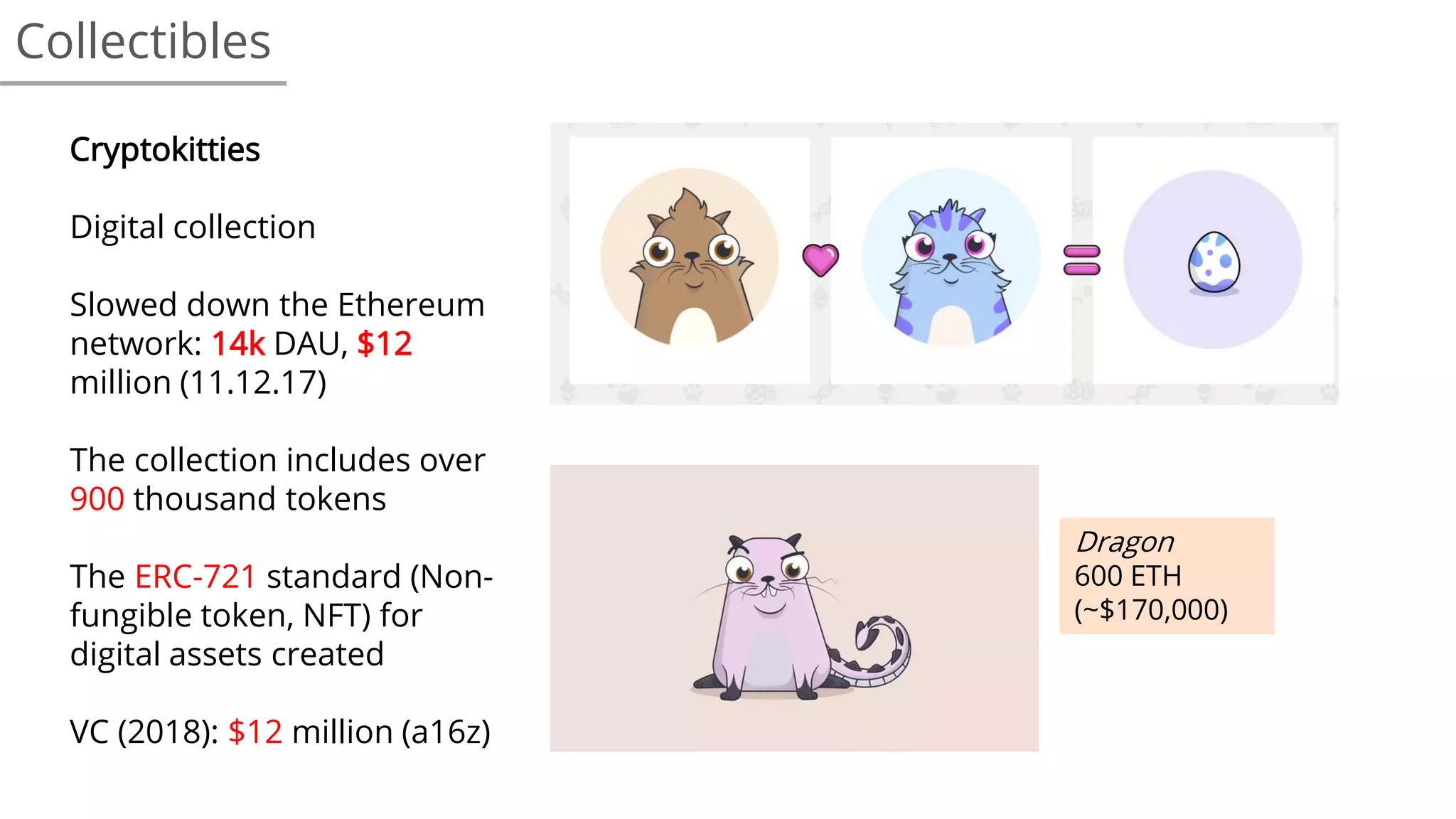

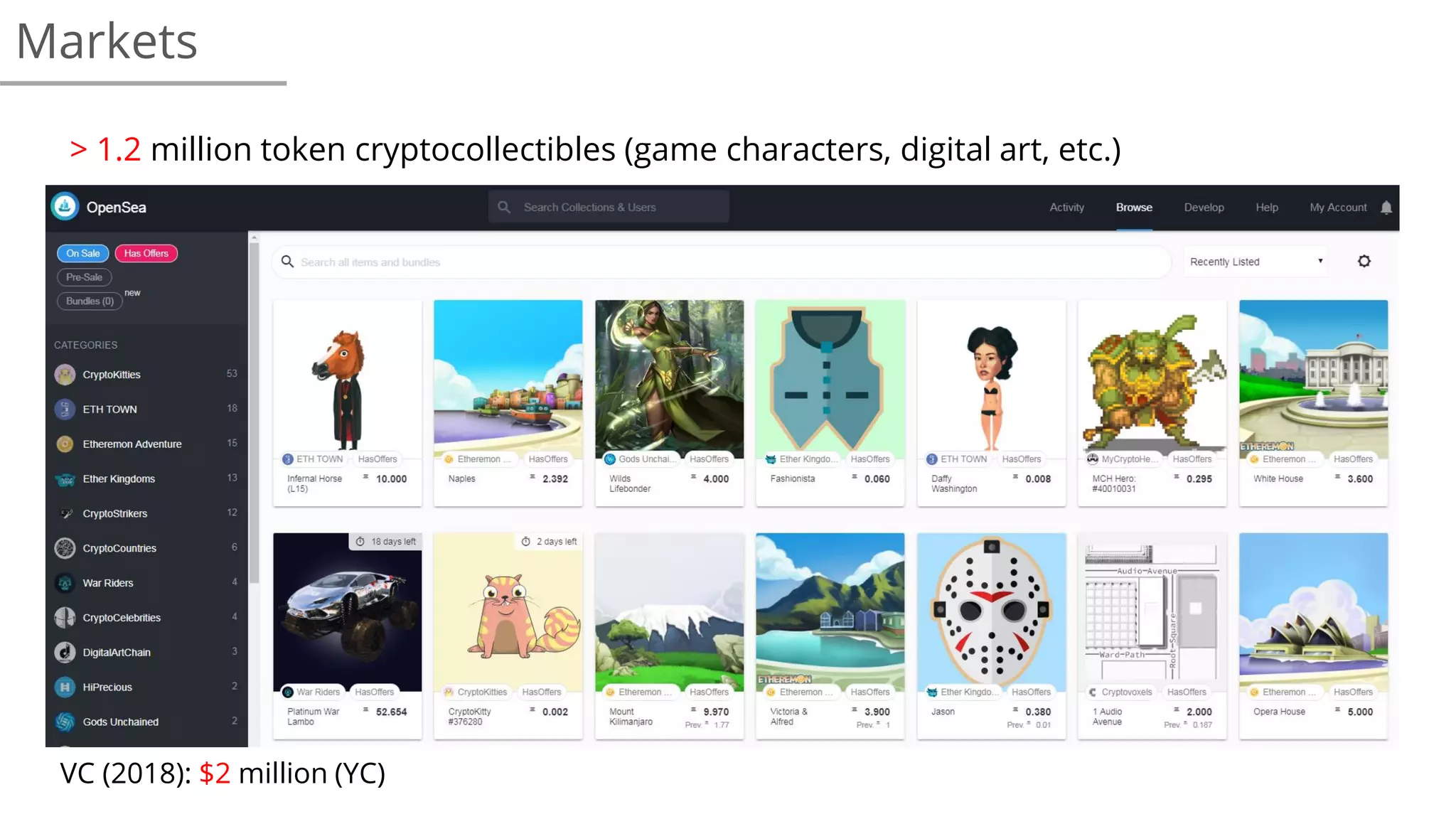

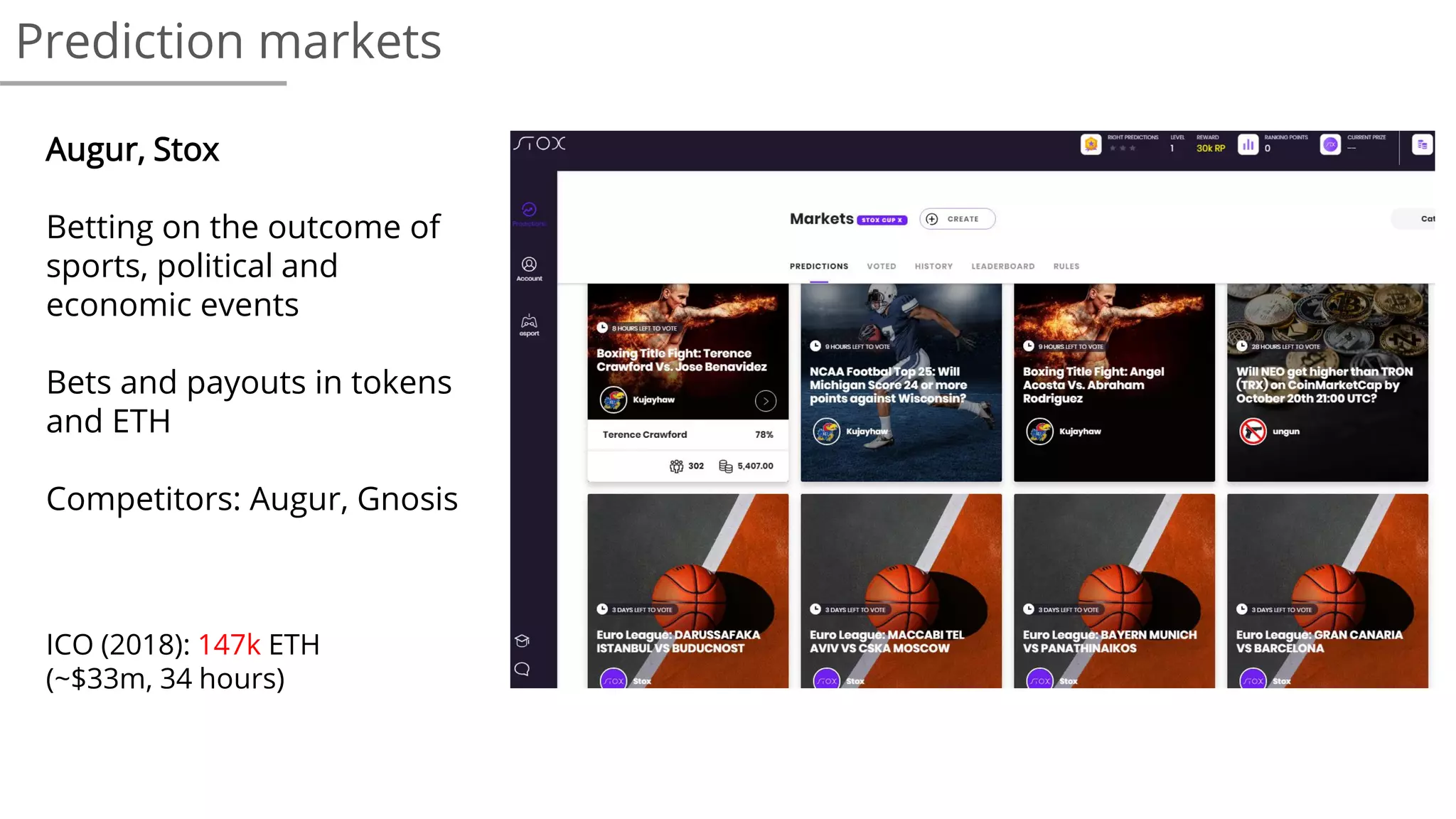

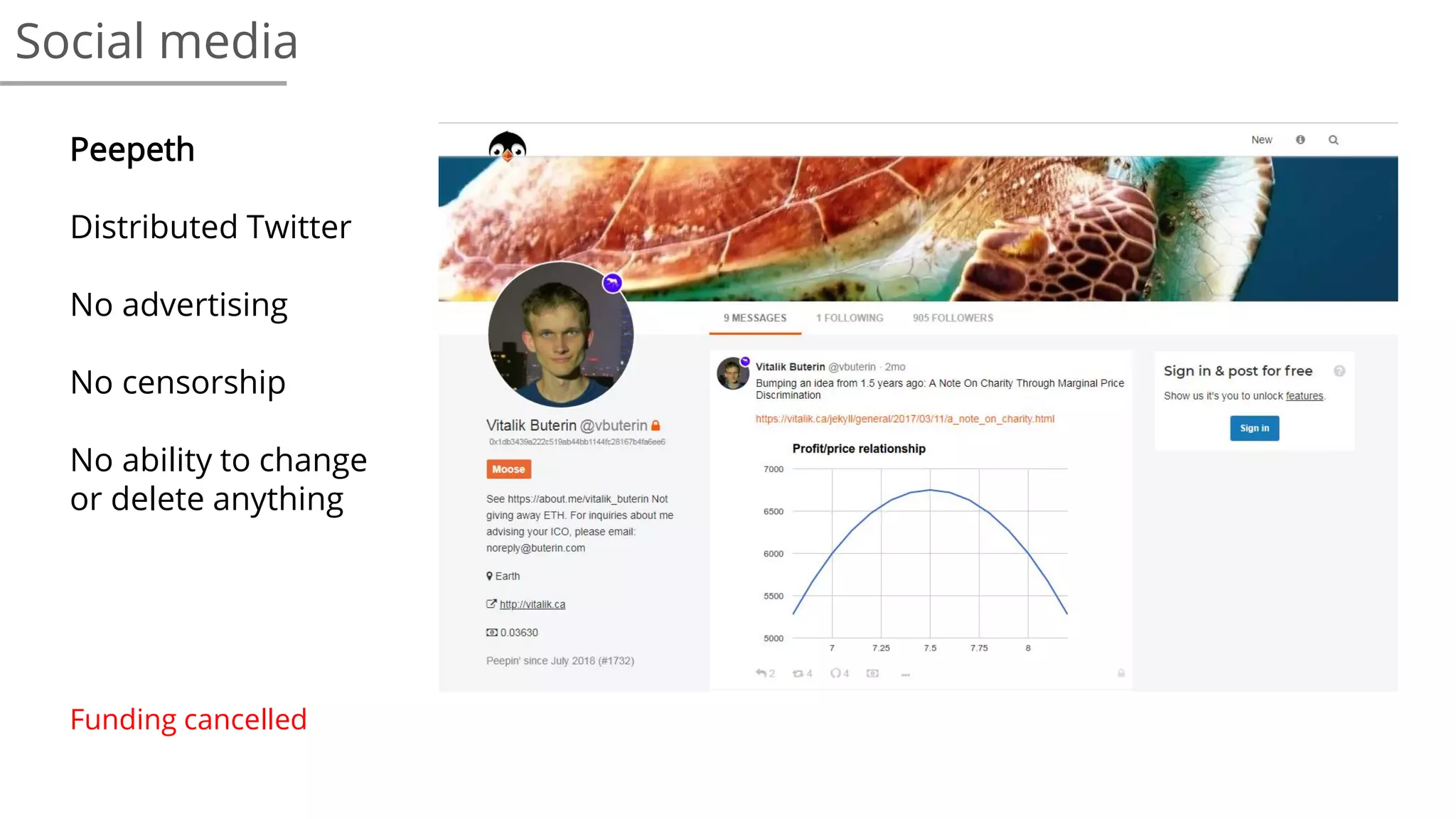

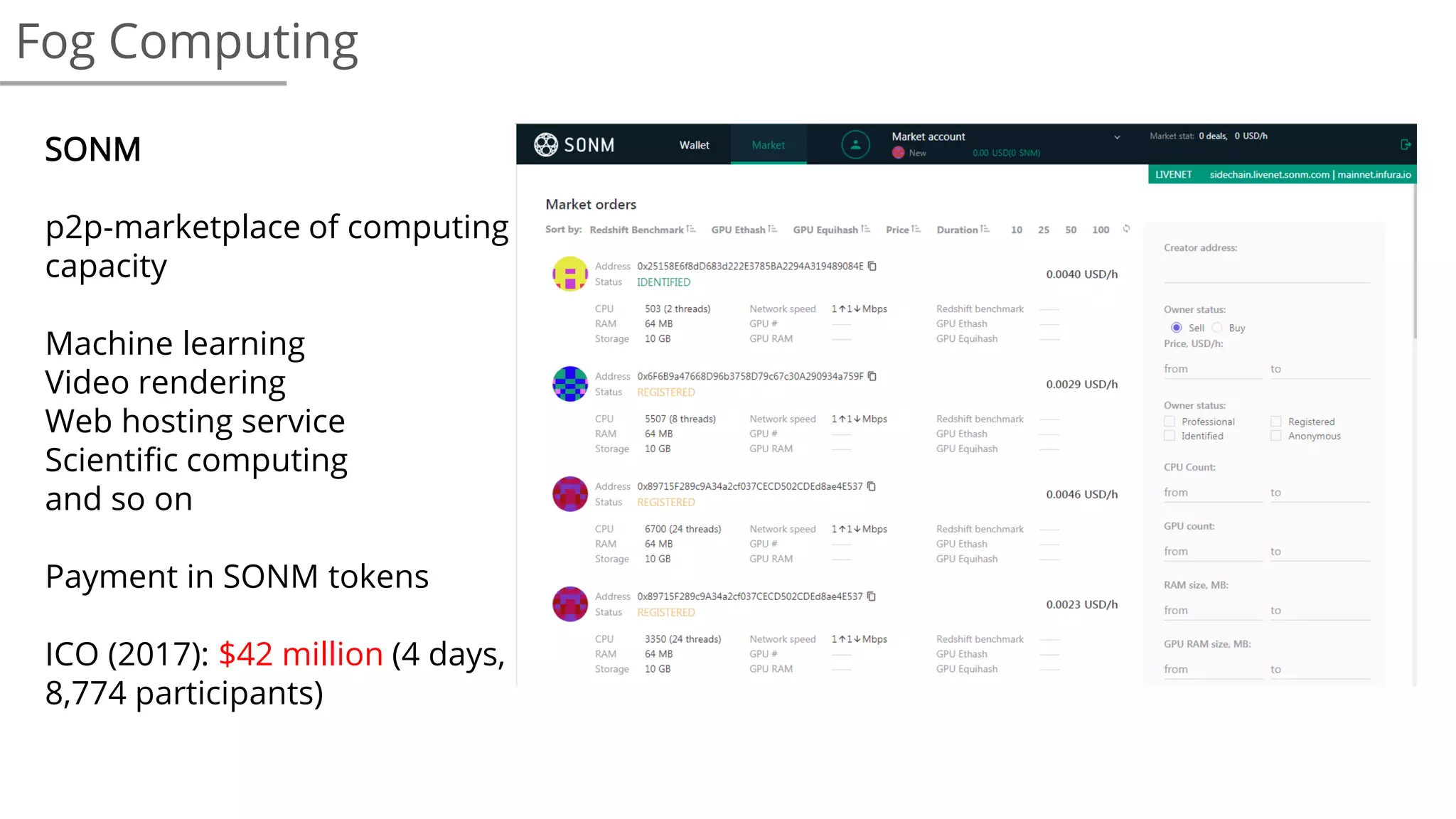

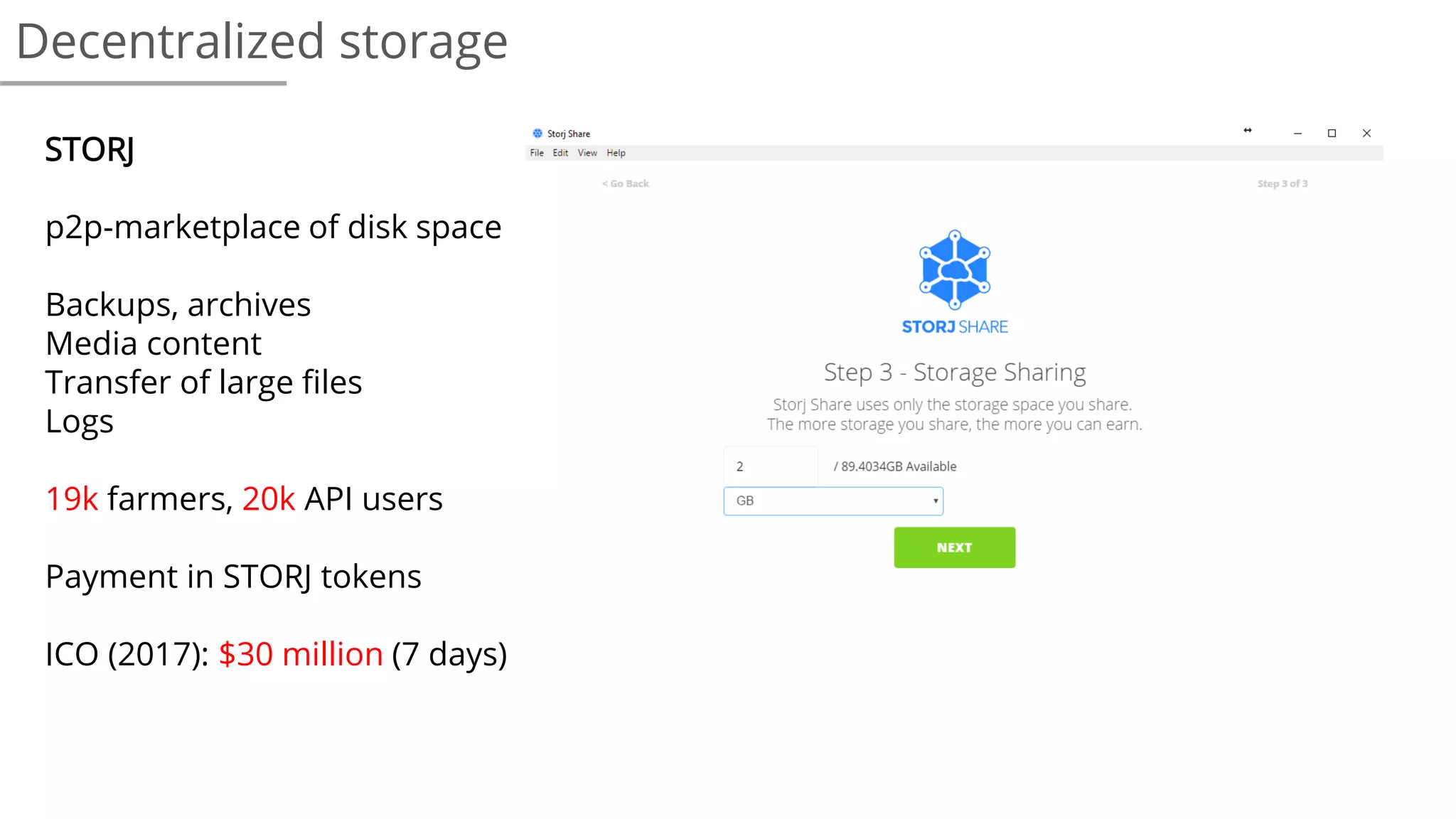

The document provides a comprehensive overview of blockchains and cryptocurrencies, detailing the digital assets ecosystem, key concepts such as Bitcoin, smart contracts, and DeFi, and the mechanisms of transaction processes. It discusses challenges like double spending and the evolution of blockchain technology, including the introduction of various consensus mechanisms and scaling solutions like the Lightning Network. Additionally, the document analyzes the use cases, market metrics, and the significance of decentralized financial systems in bypassing traditional intermediaries.