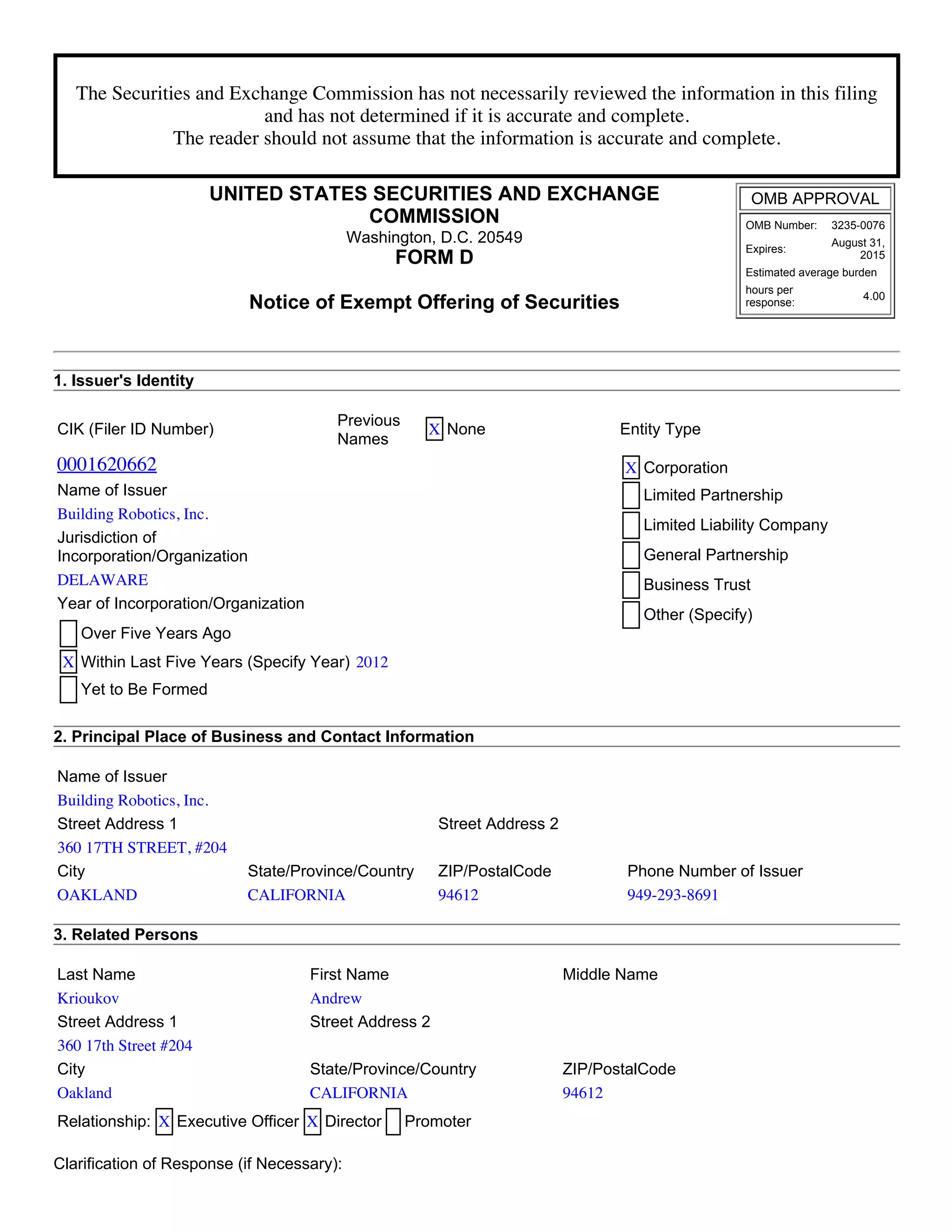

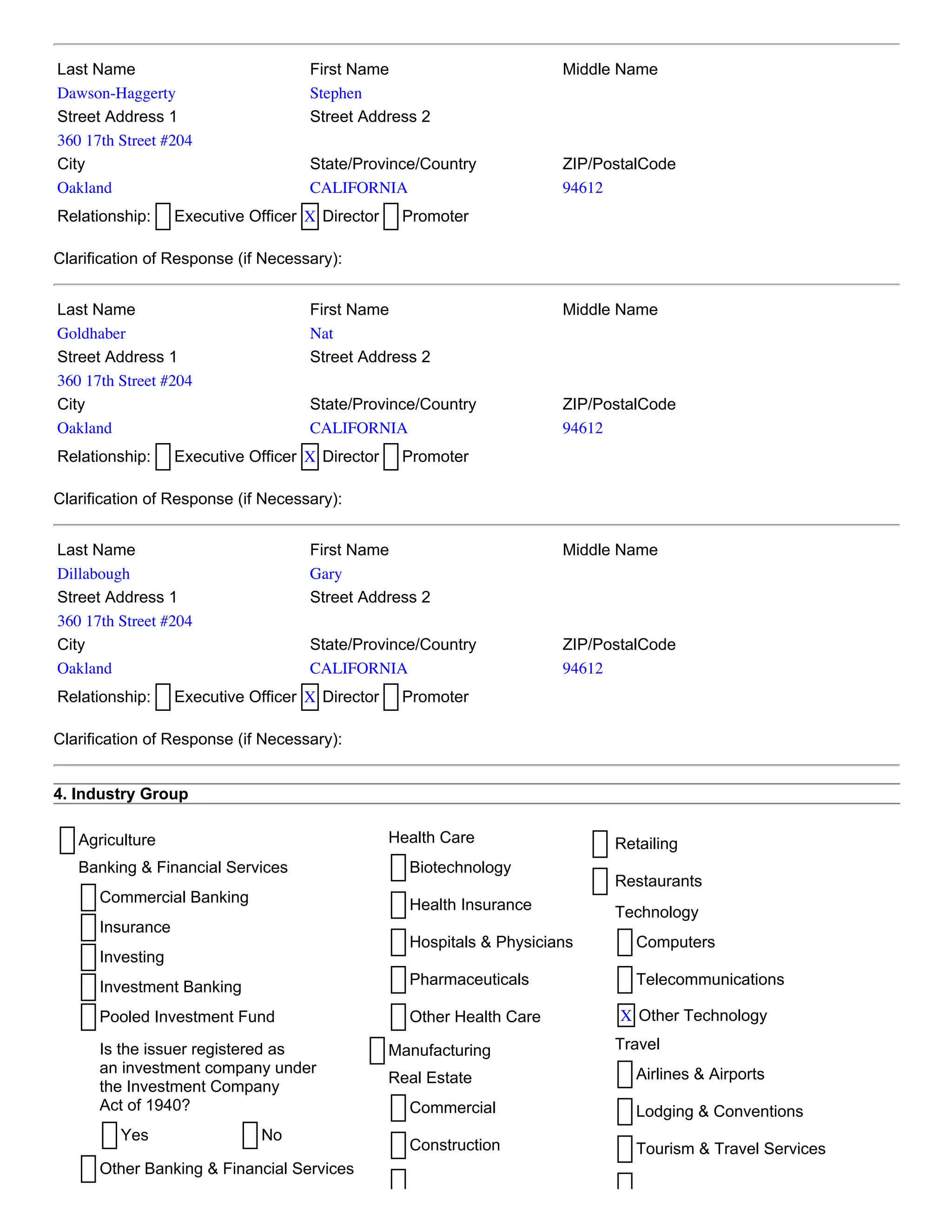

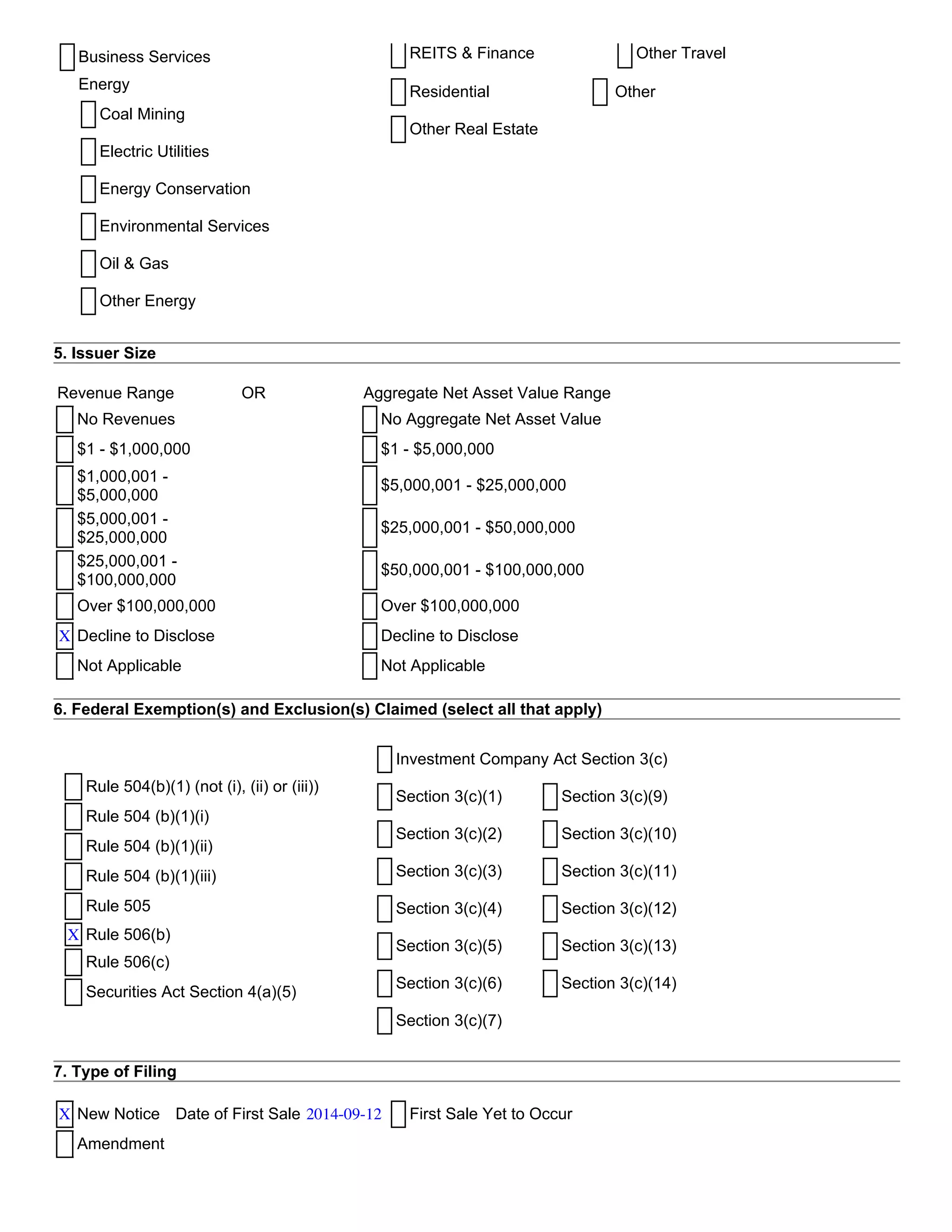

The SEC filing is for a Form D notice of exempt offering of securities filed by Building Robotics, Inc. The filing discloses that Building Robotics, Inc. is offering $7,206,815 in securities under Rule 506(b) of Regulation D. As of the filing date, $6,706,816 has been sold to 13 investors. The proceeds will be used for general corporate purposes. The filing provides contact information and identifies the executive officers, directors, and promoters of Building Robotics, Inc.

![Persons who respond to the collection of information contained in this form are not required to

respond unless the form displays a currently valid OMB number.

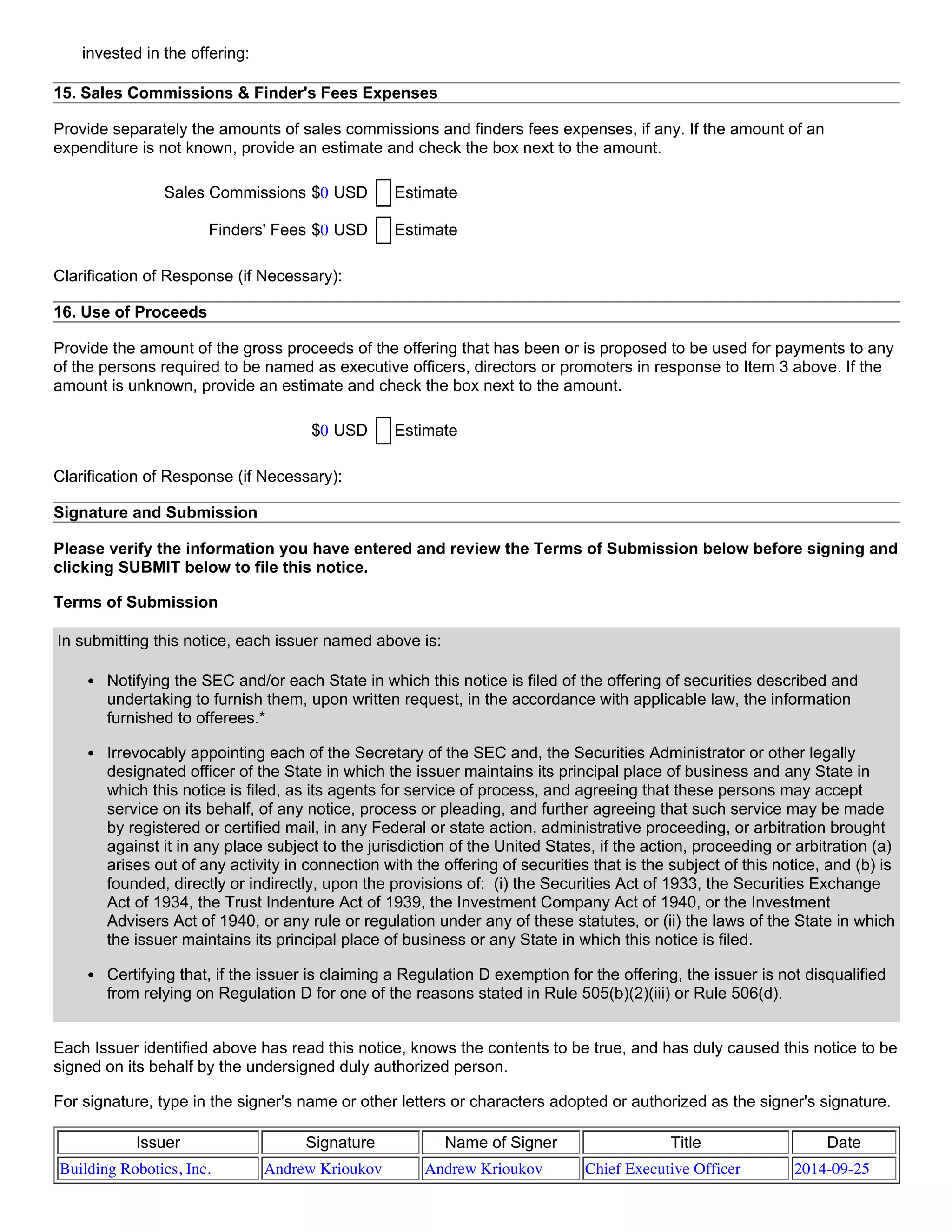

* This undertaking does not affect any limits Section 102(a) of the National Securities Markets Improvement Act of 1996 ("NSMIA") [Pub. L. No. 104290, 110 Stat. 3416

(Oct. 11, 1996)] imposes on the ability of States to require information. As a result, if the securities that are the subject of this Form D are "covered securities" for purposes

of NSMIA, whether in all instances or due to the nature of the offering that is the subject of this Form D, States cannot routinely require offering materials under this

undertaking or otherwise and can require offering materials only to the extent NSMIA permits them to do so under NSMIA's preservation of their antifraud authority.](https://image.slidesharecdn.com/buildingroboticssecformd-140926094318-phpapp01/75/Building-robotics-sec-form-d-6-2048.jpg)