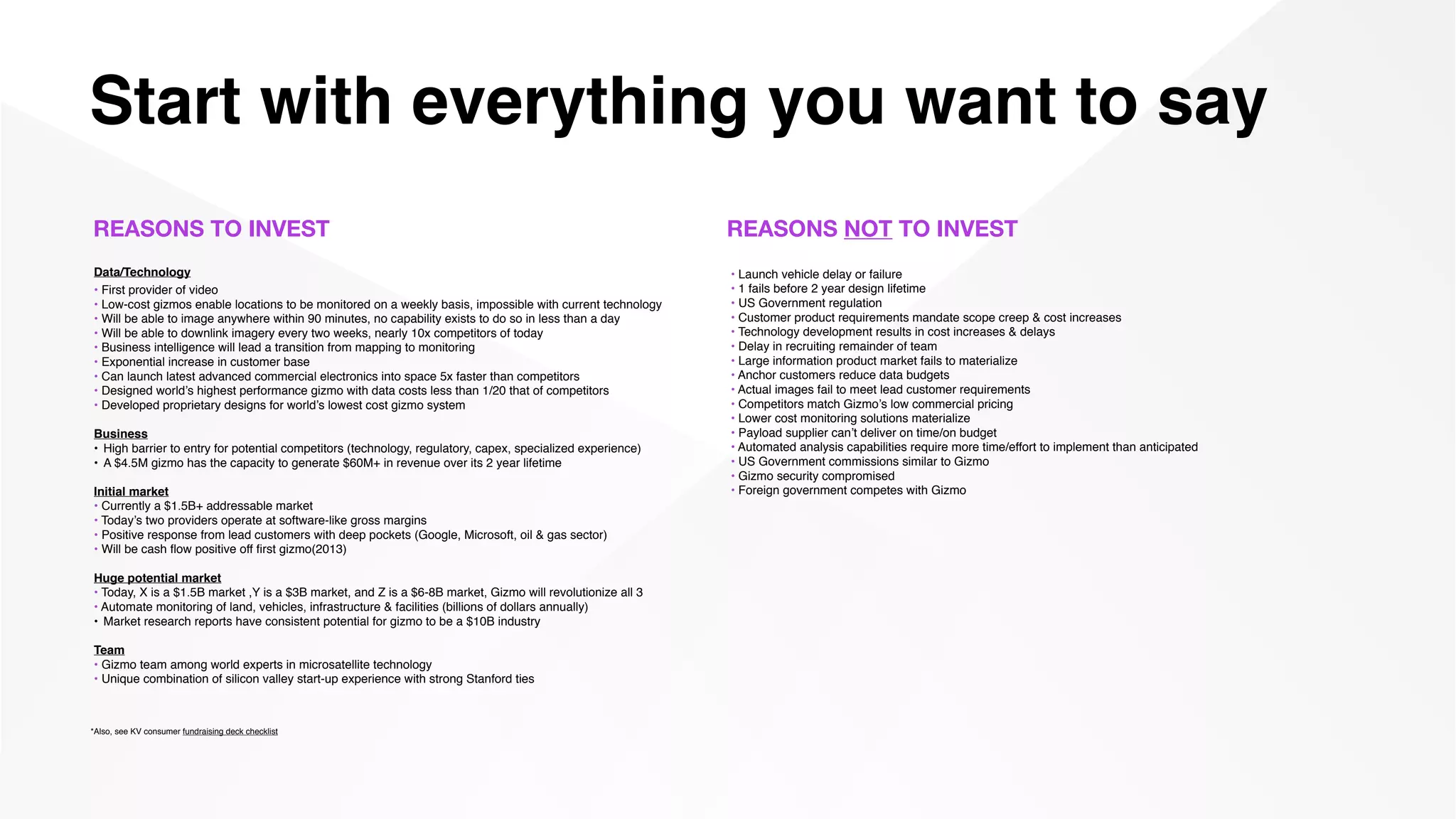

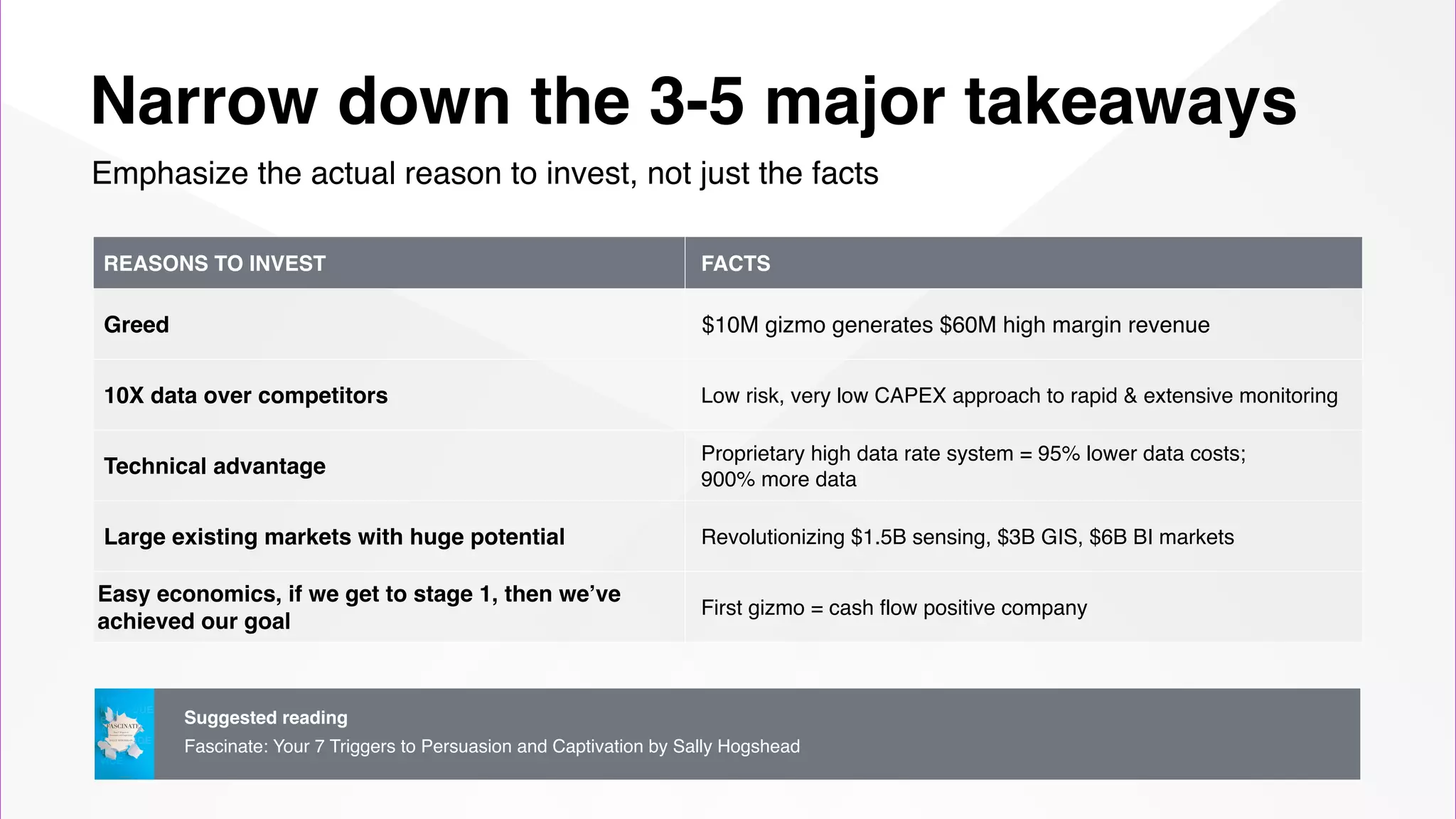

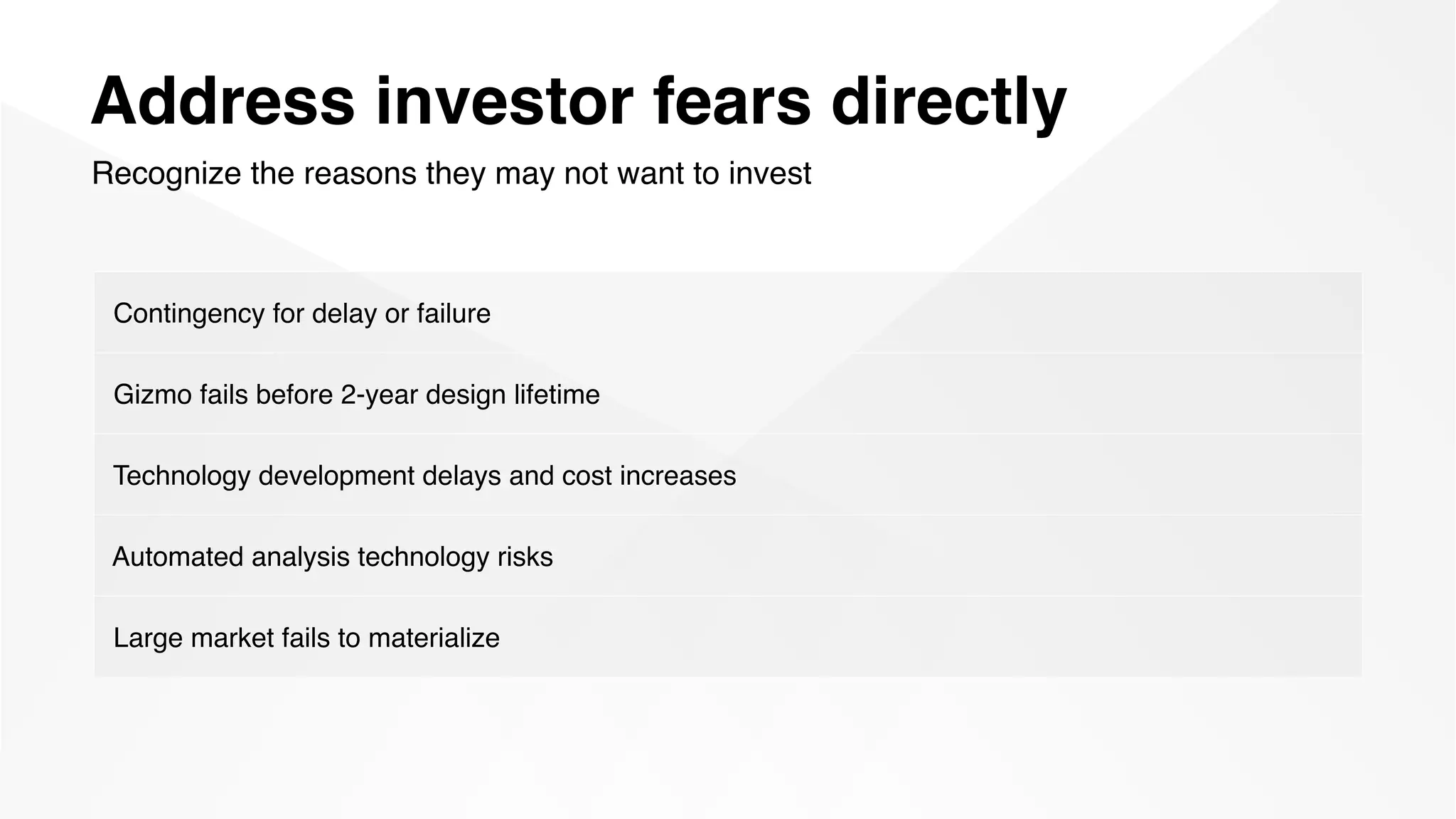

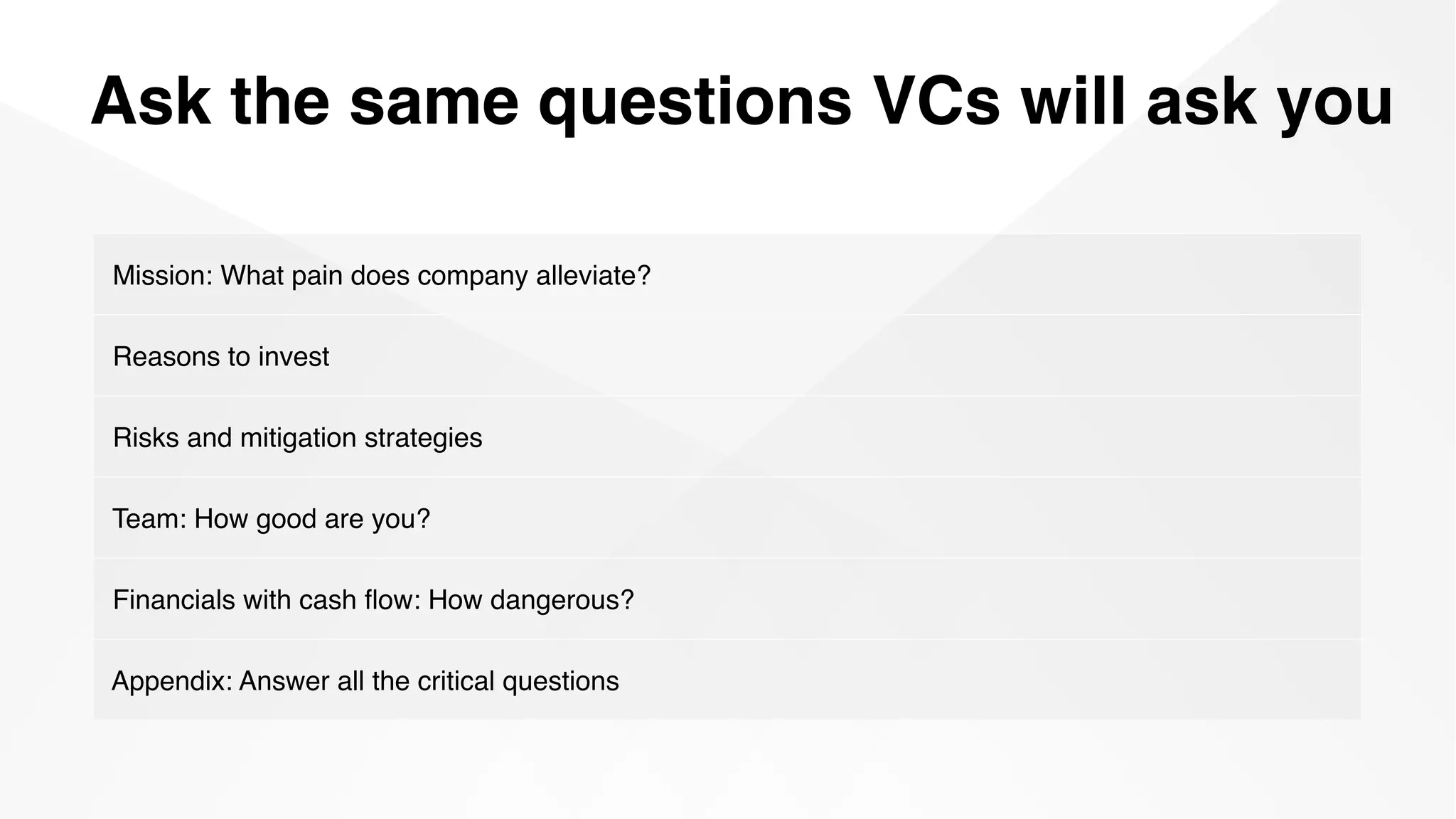

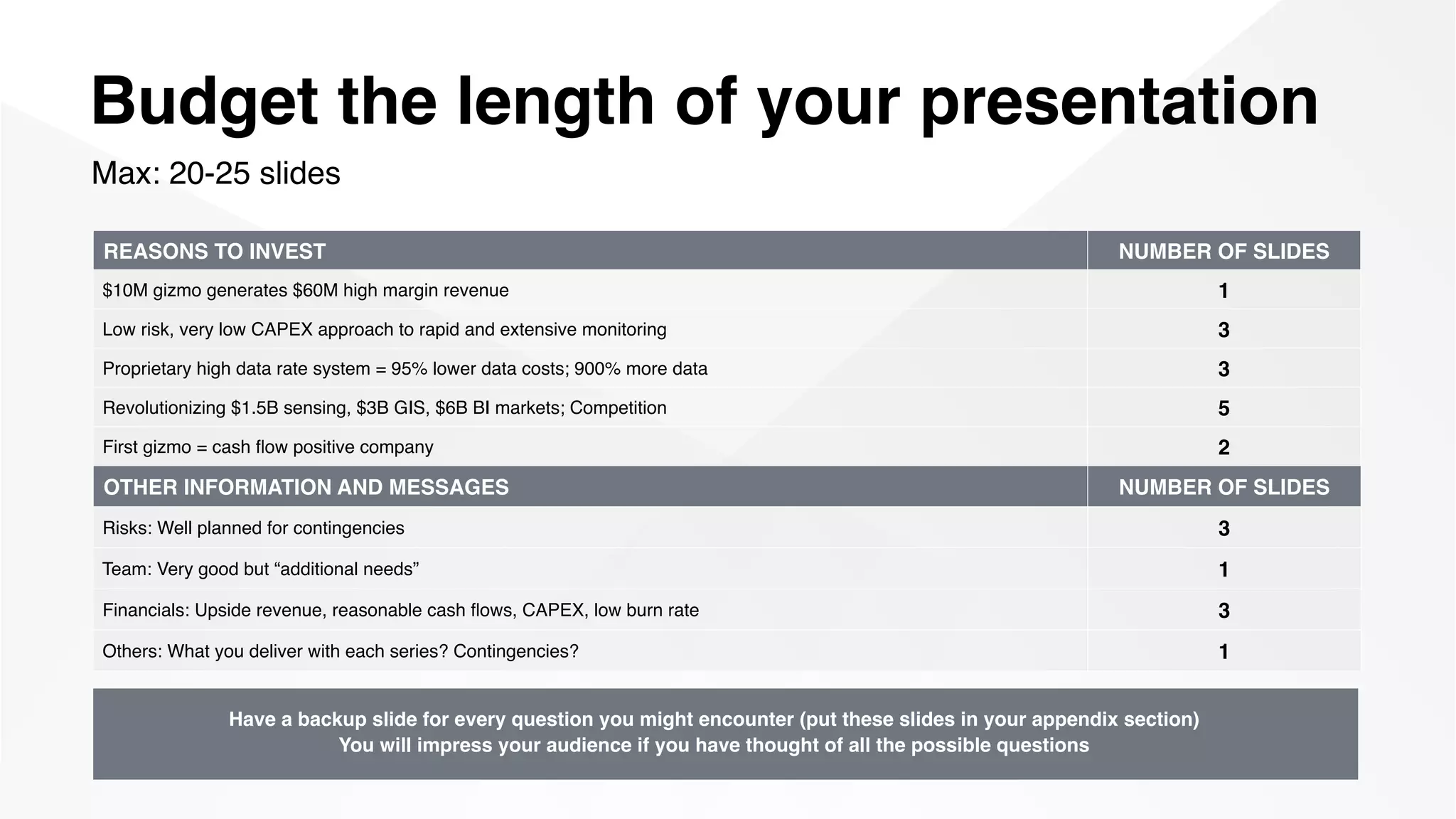

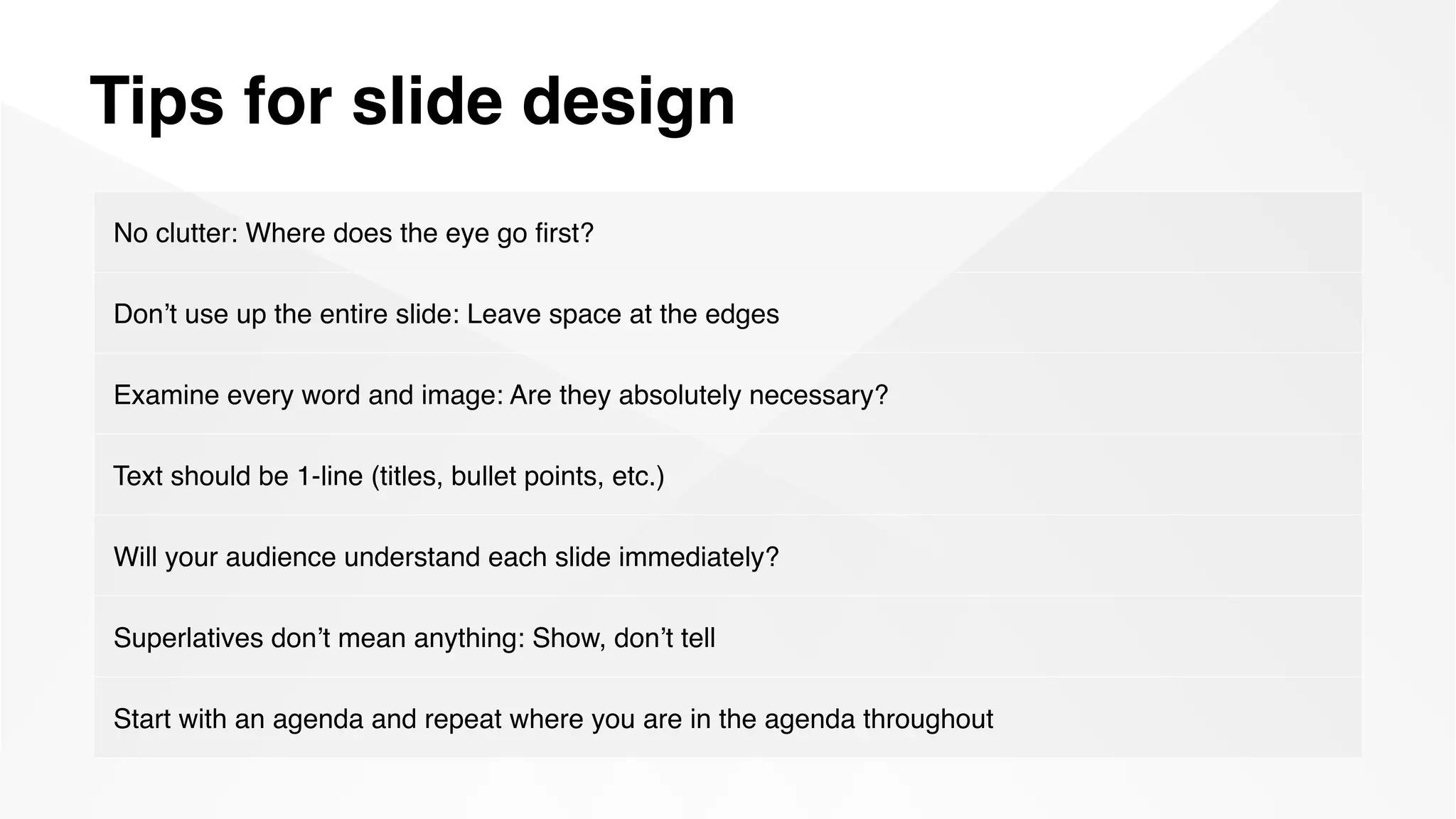

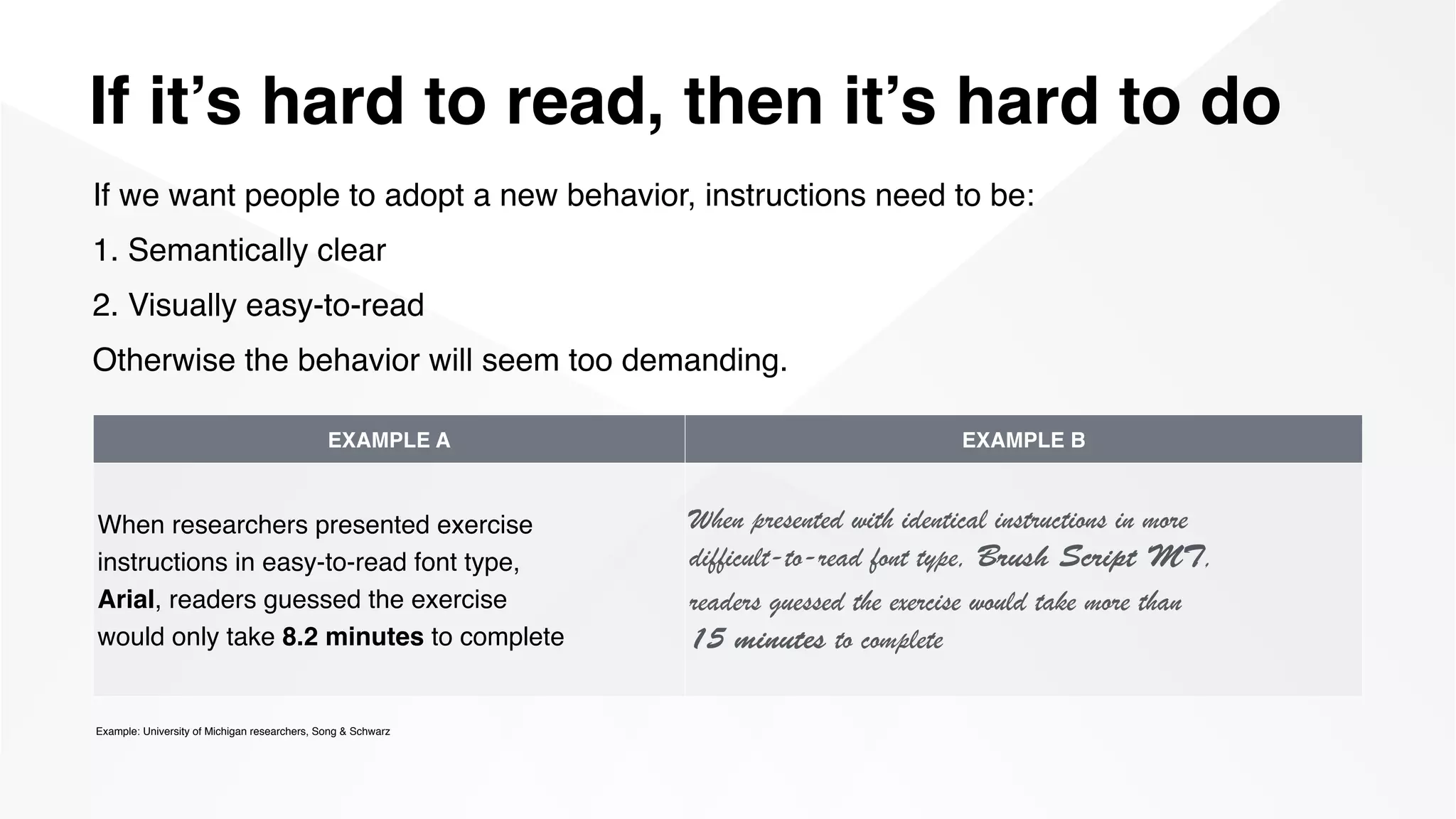

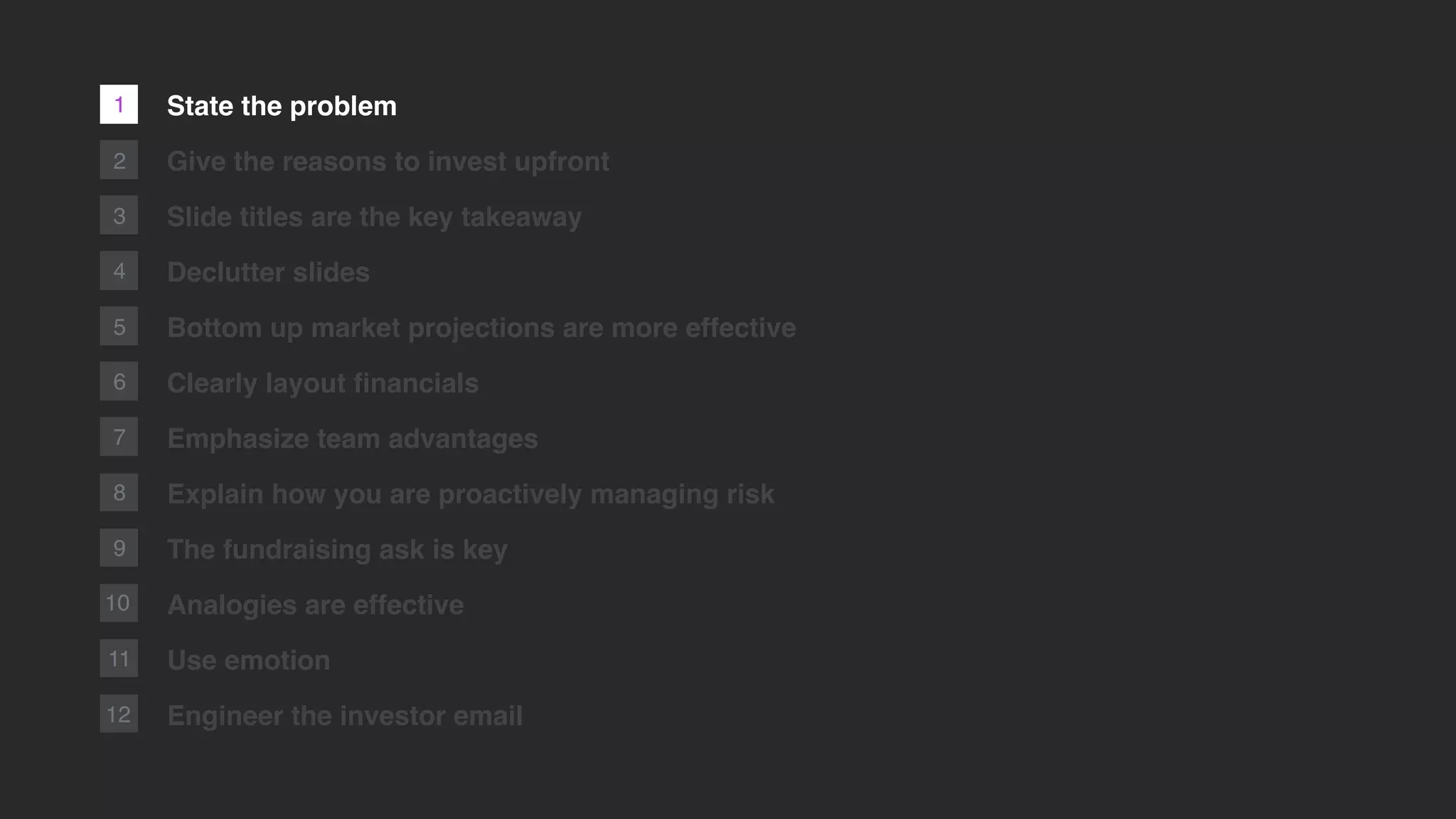

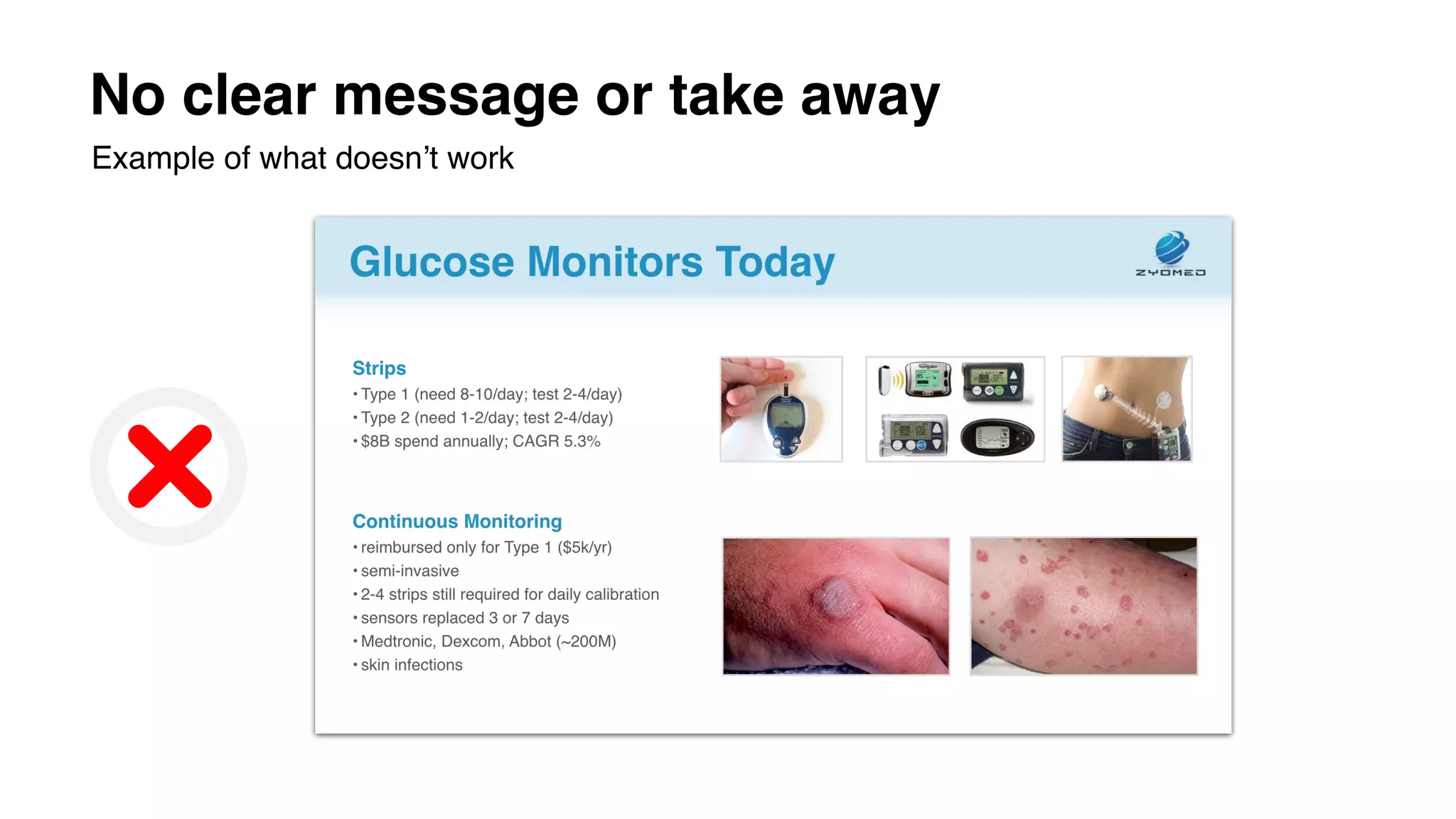

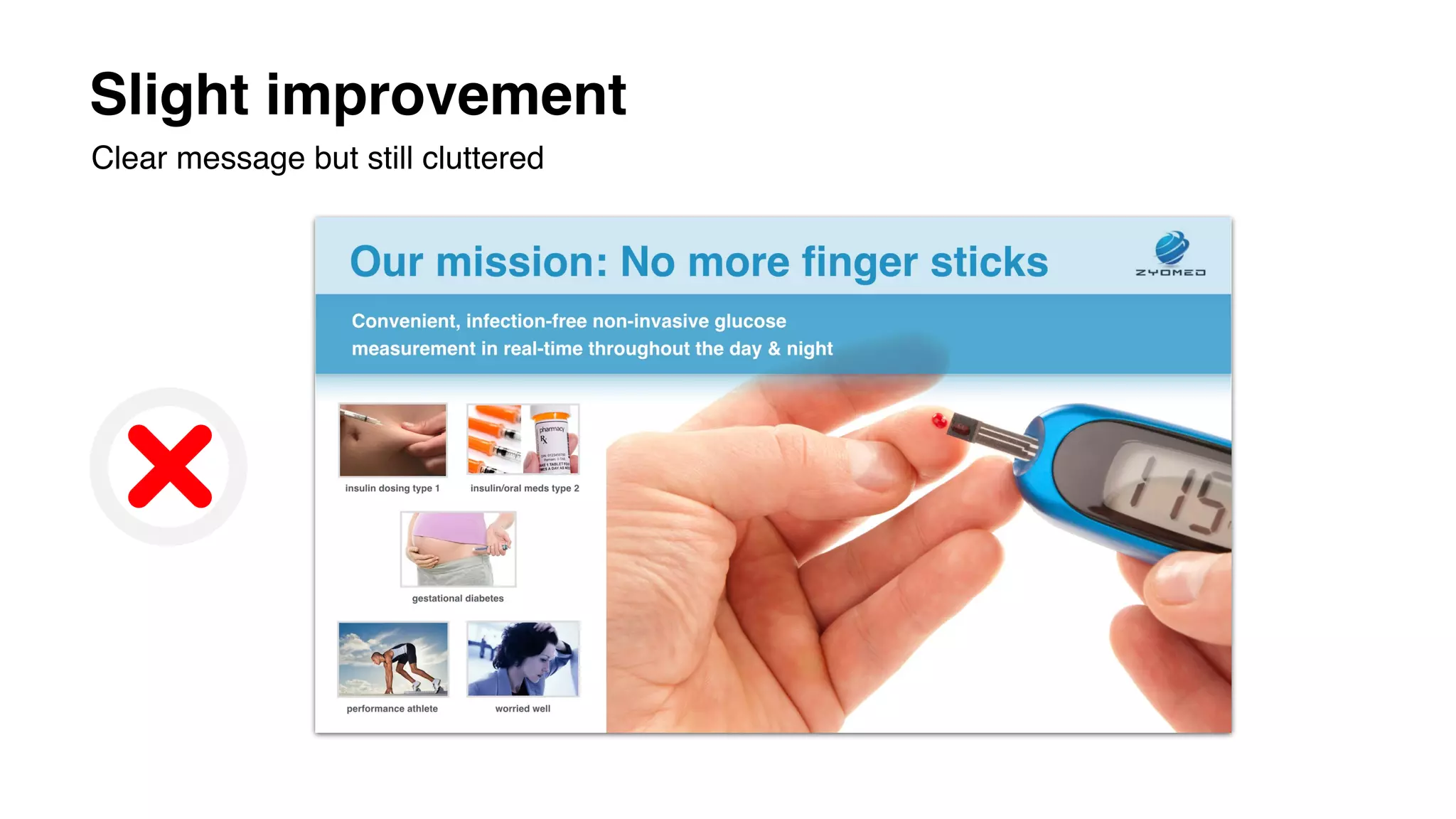

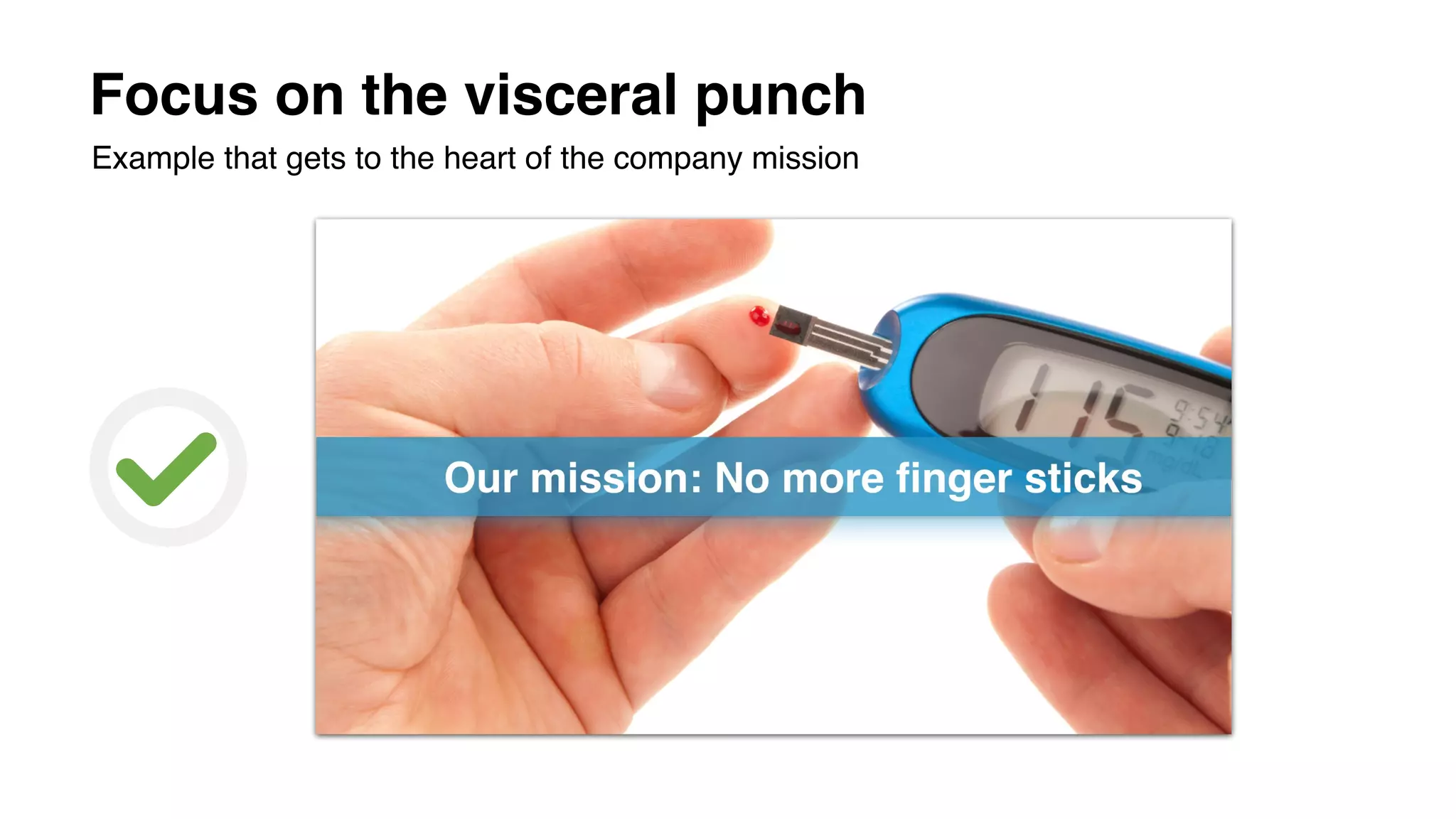

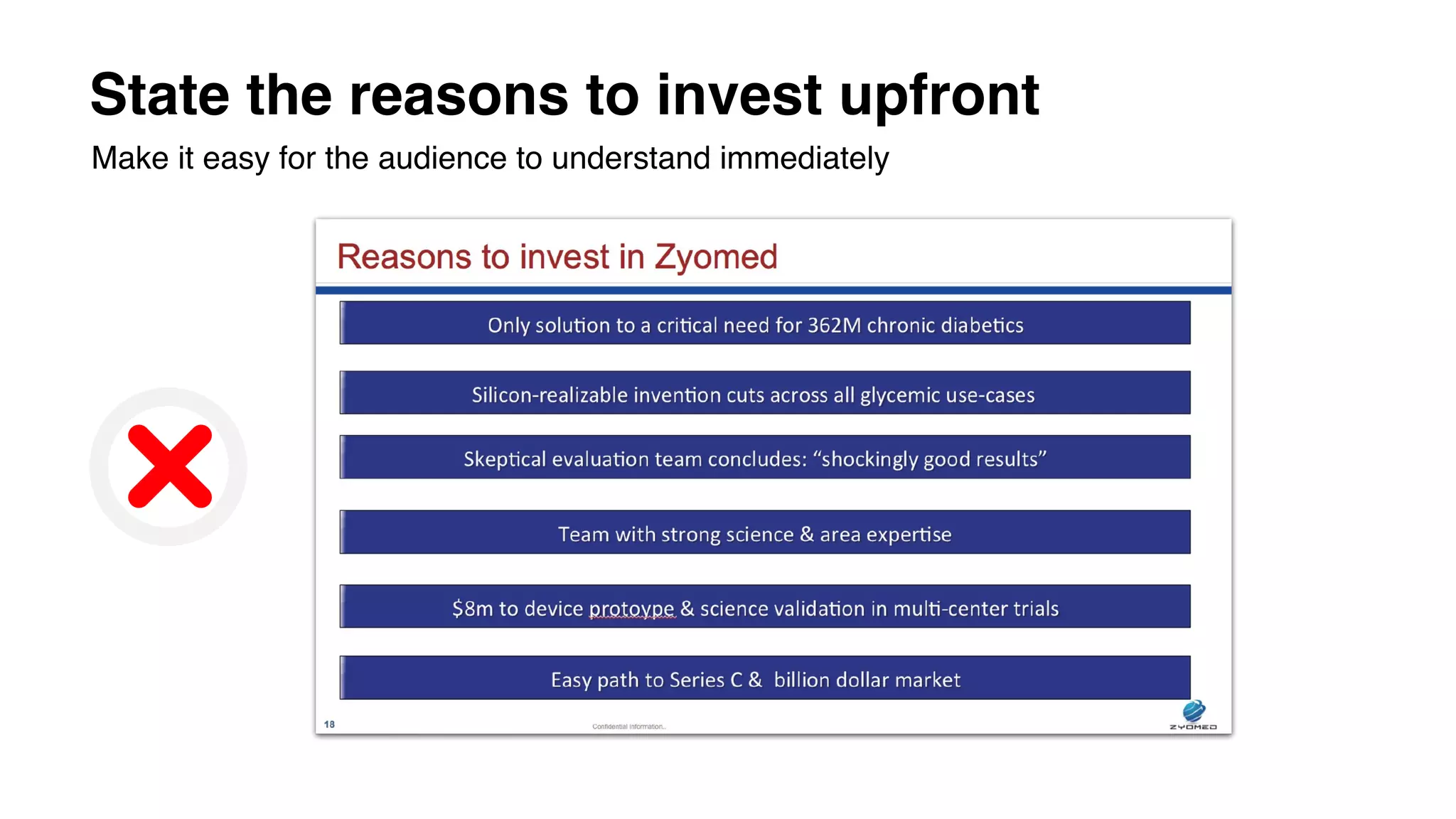

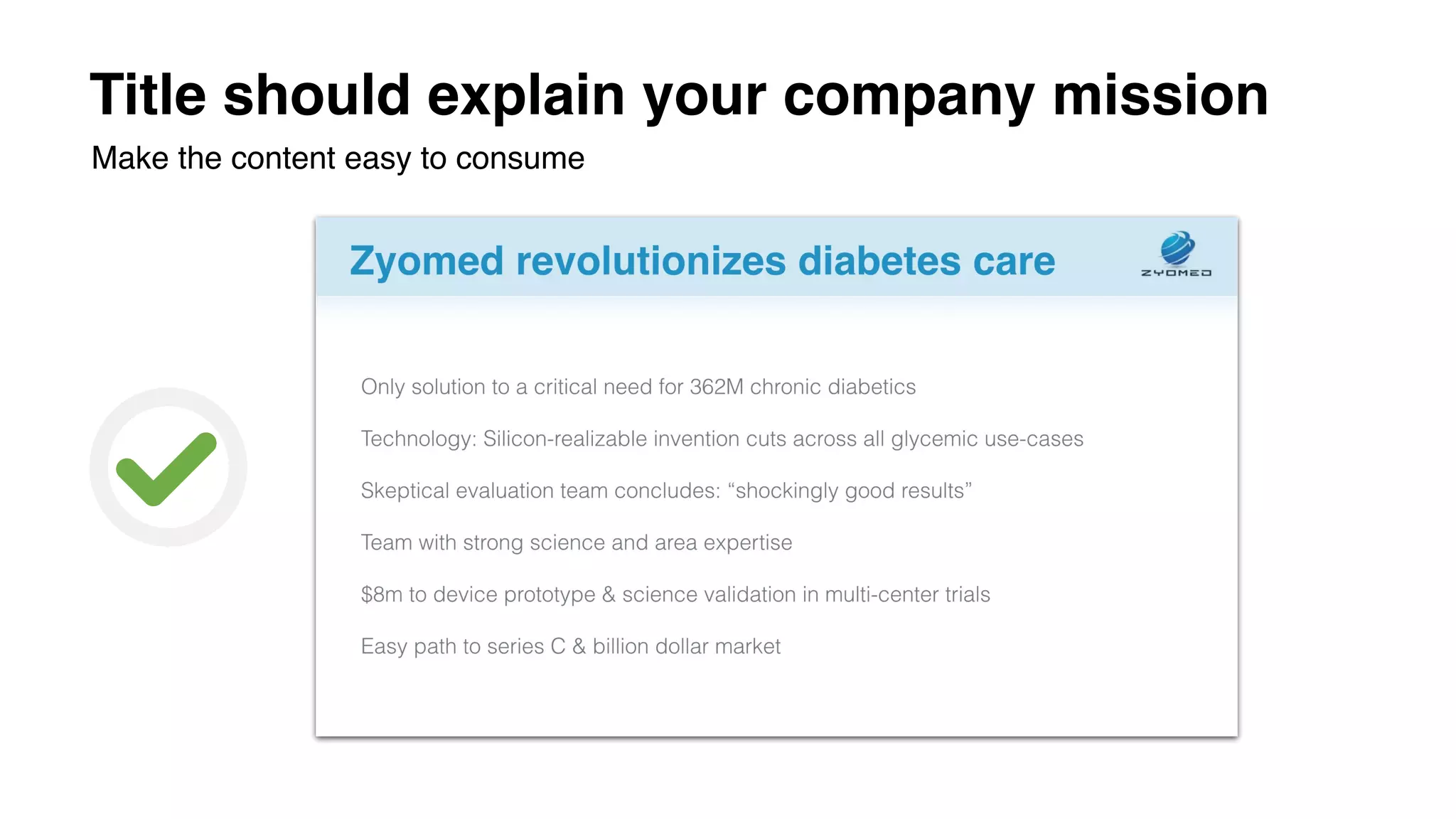

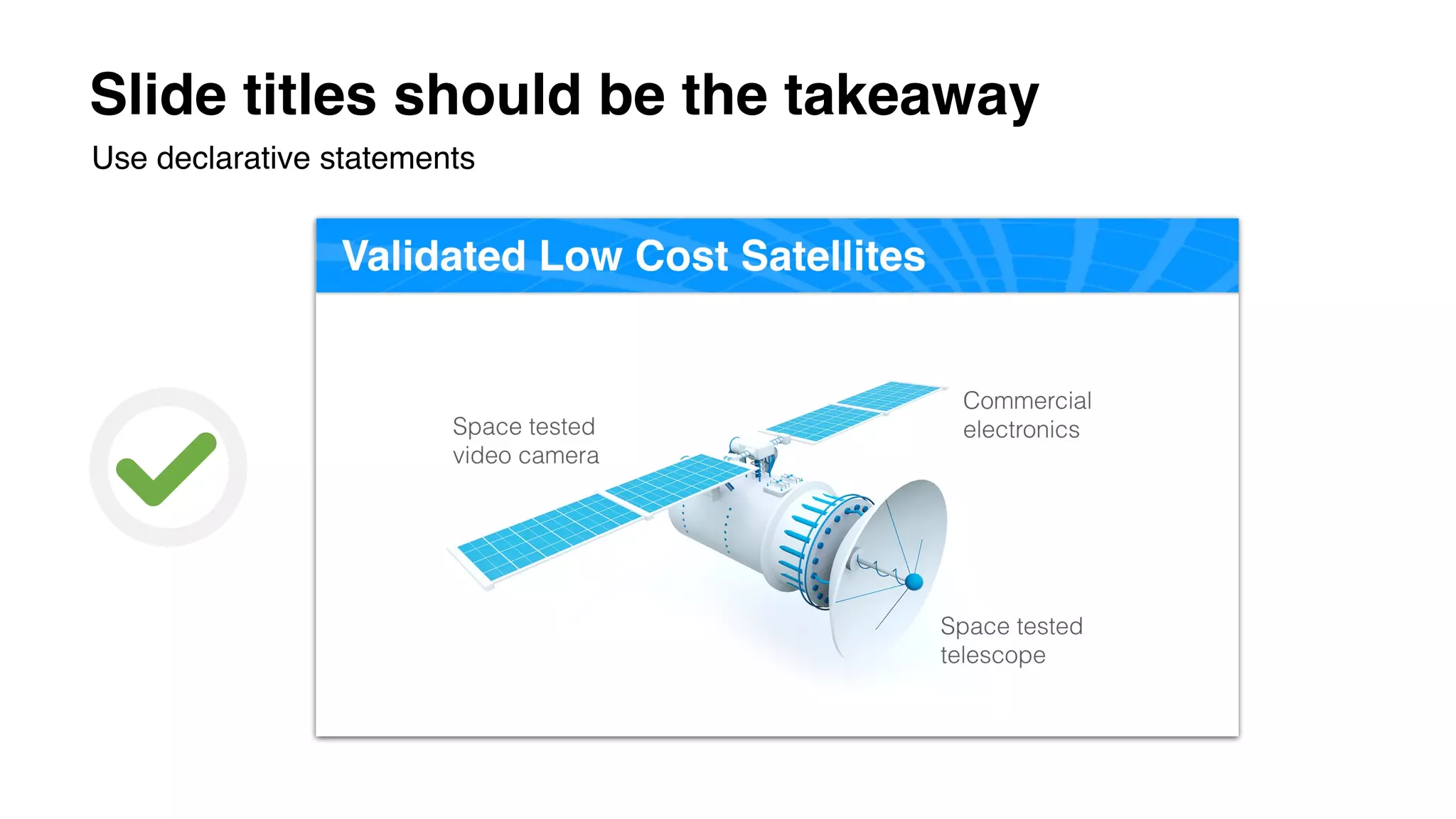

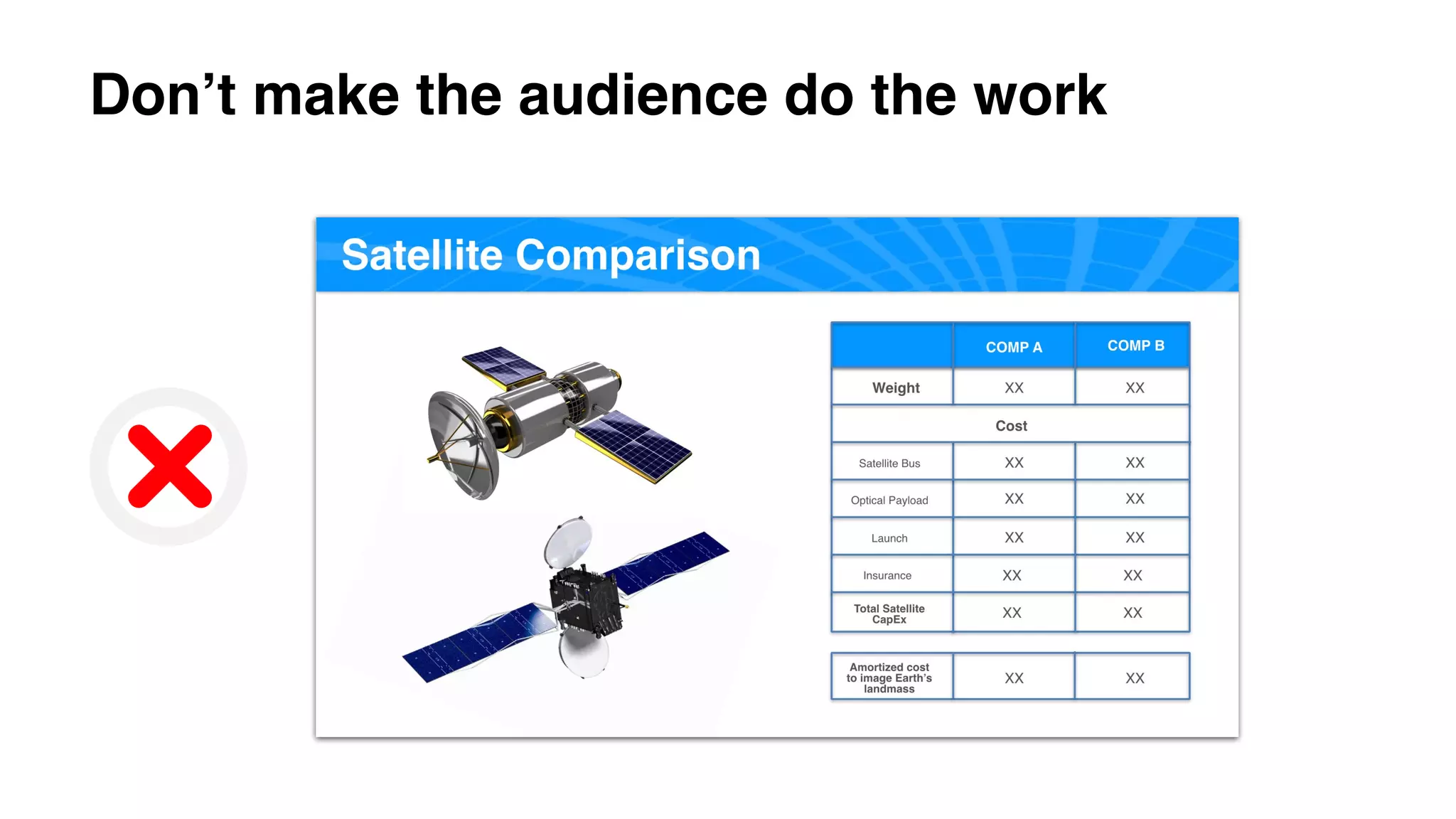

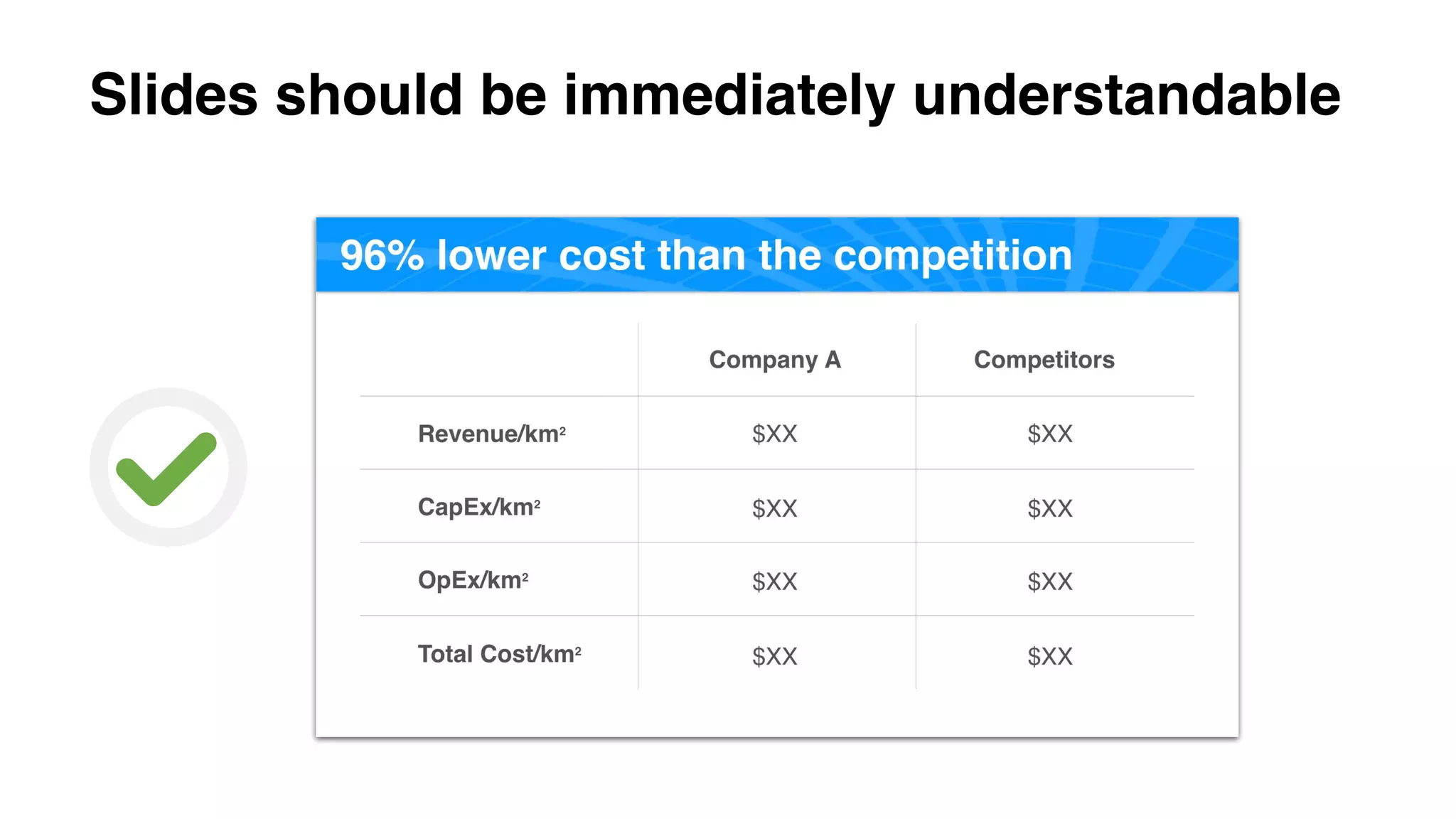

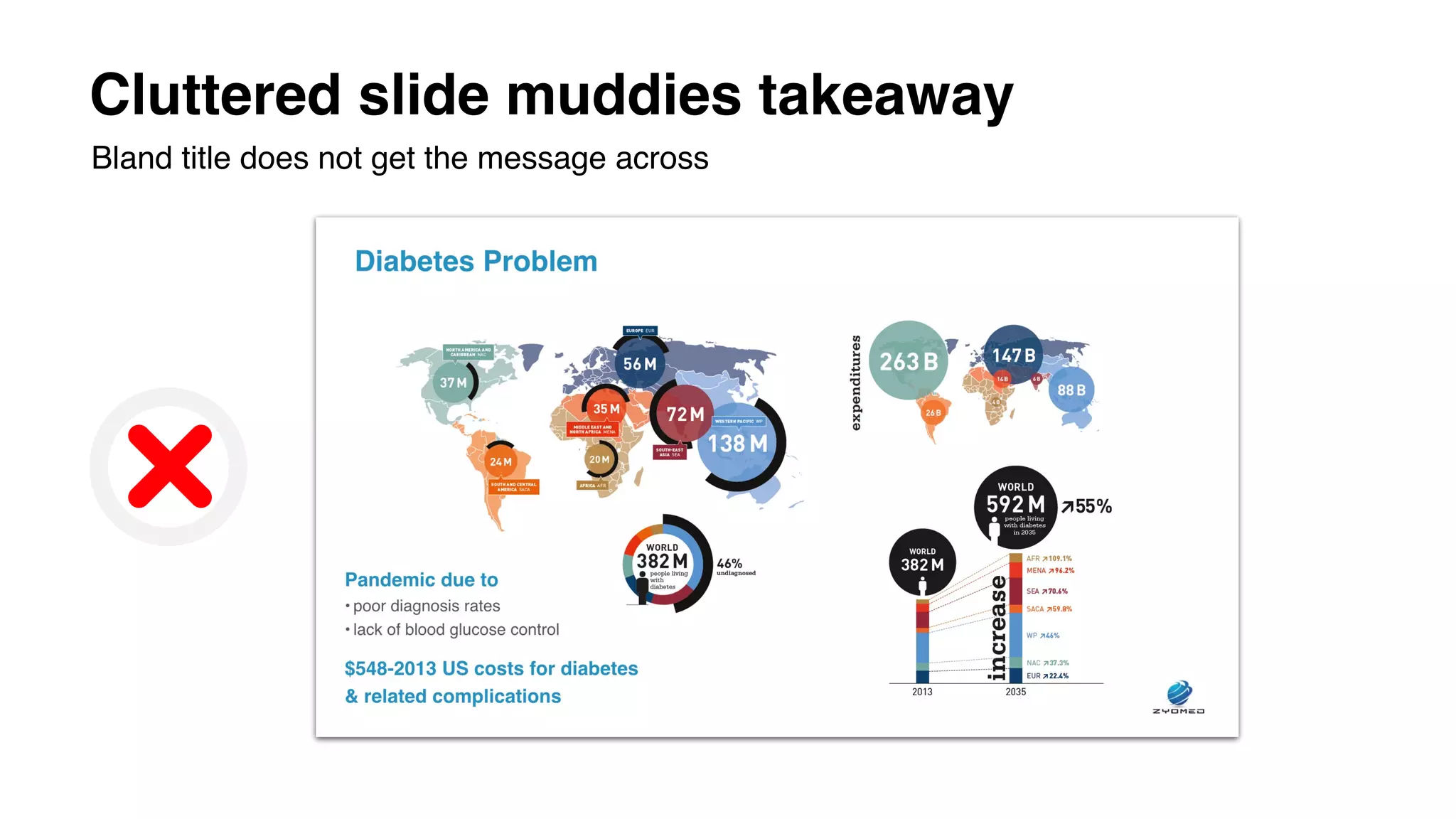

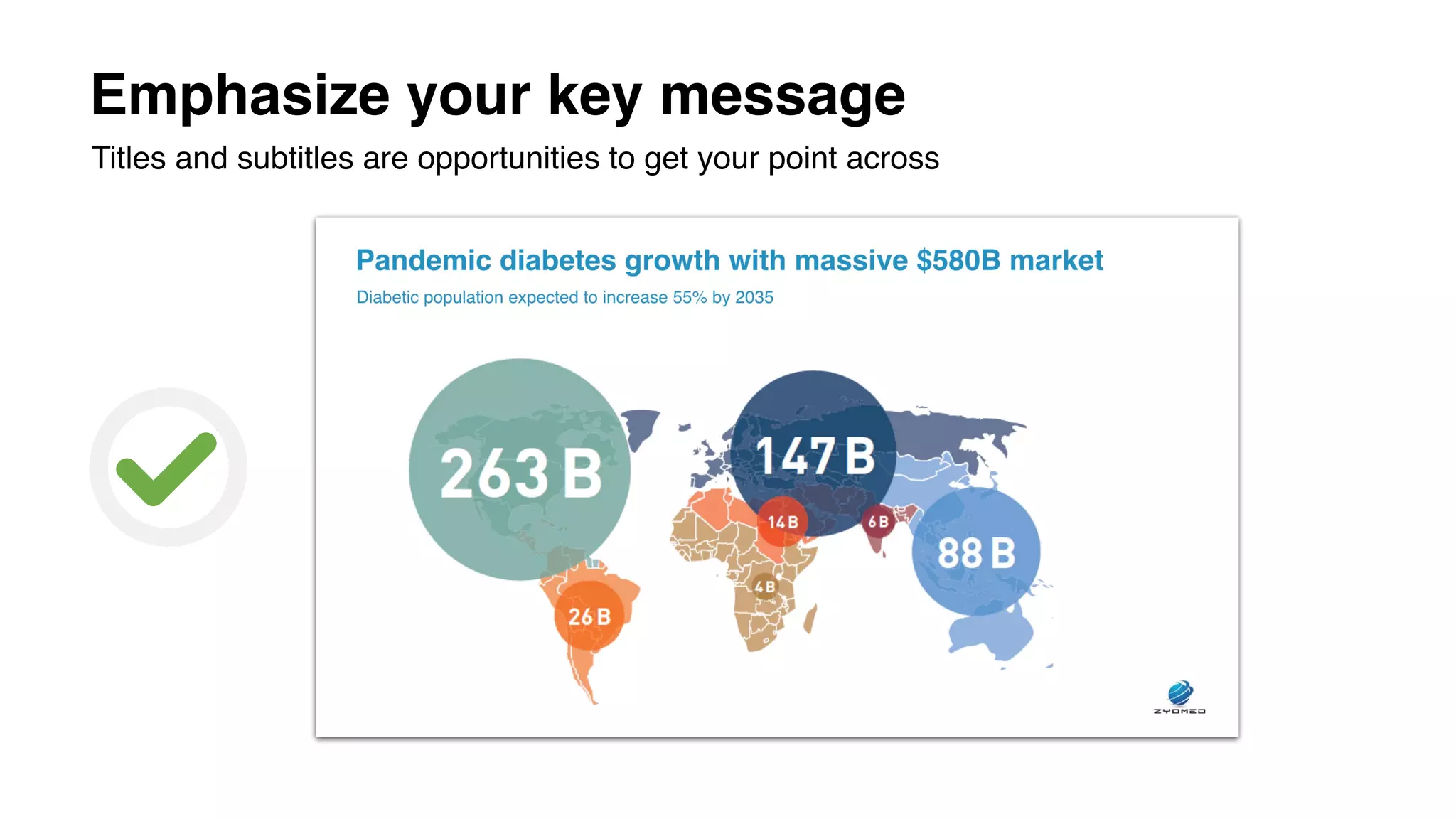

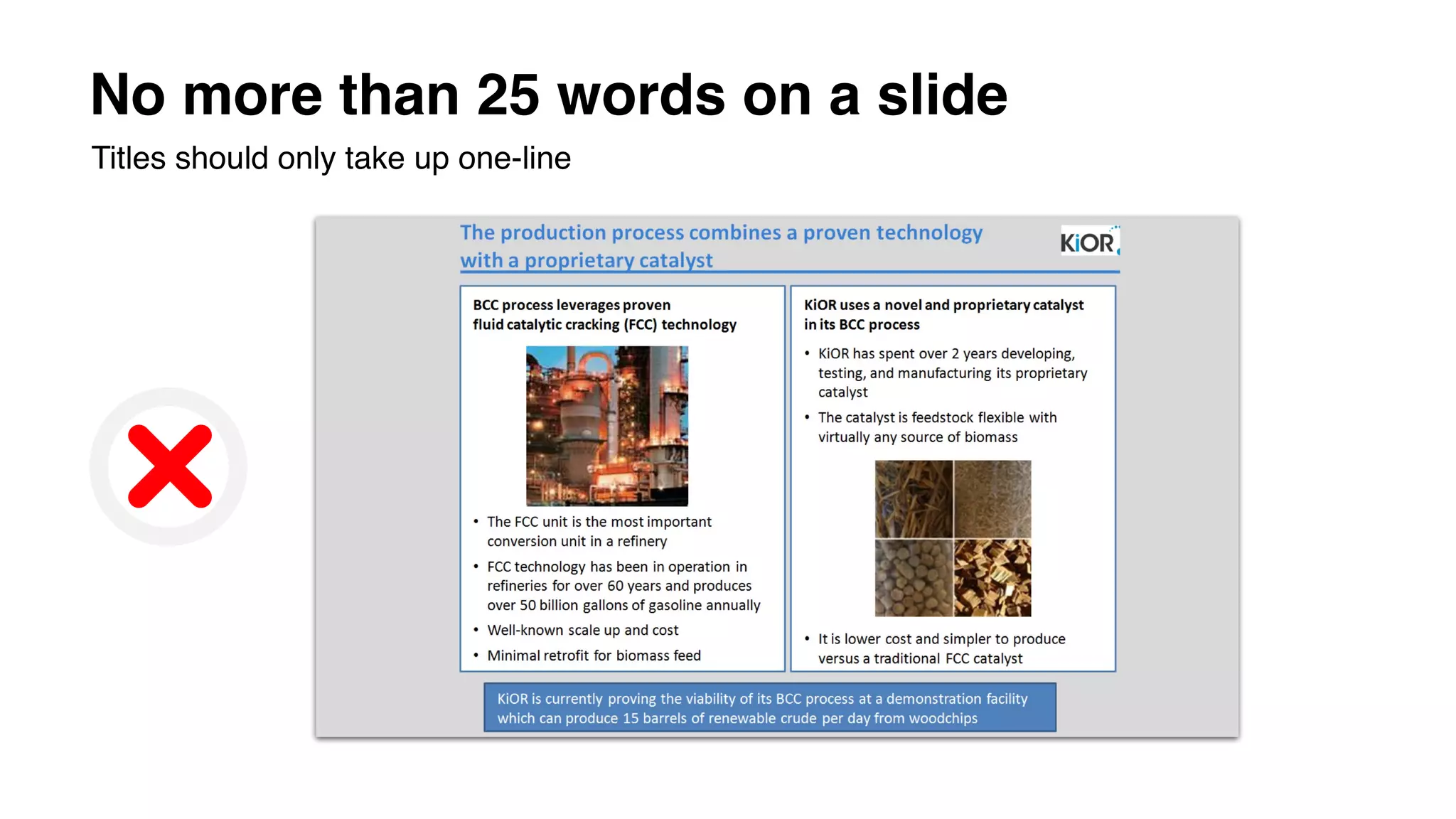

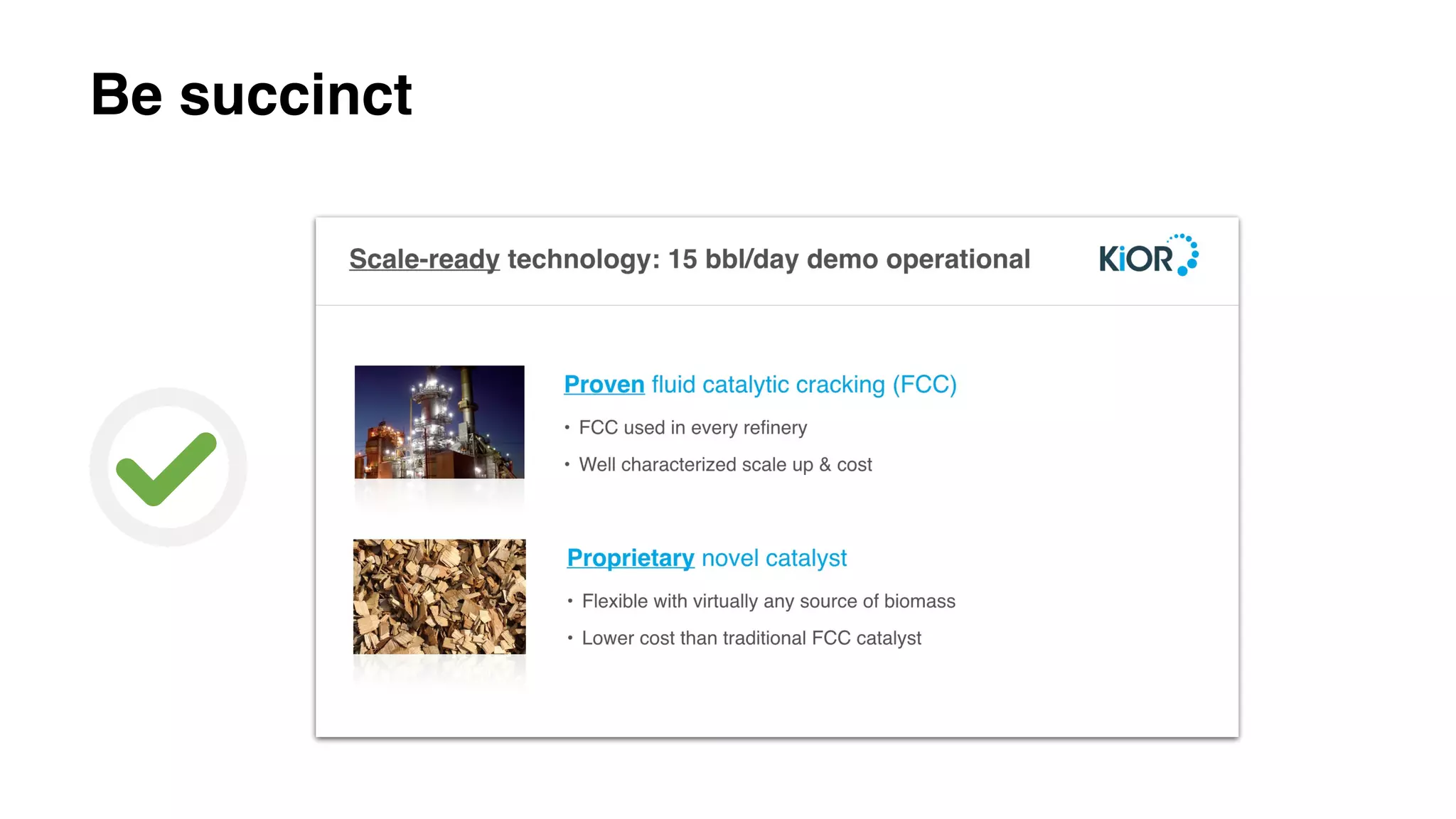

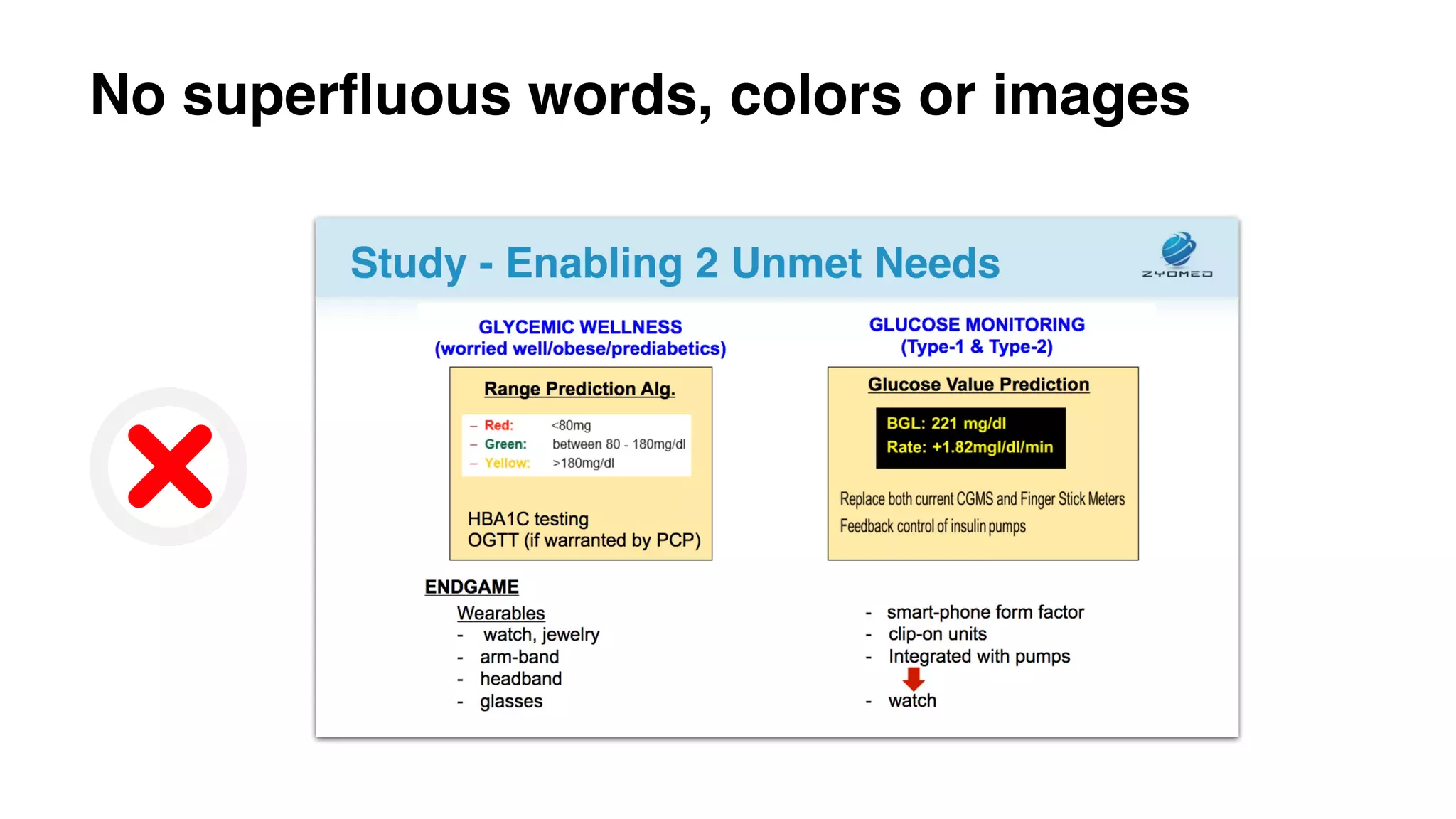

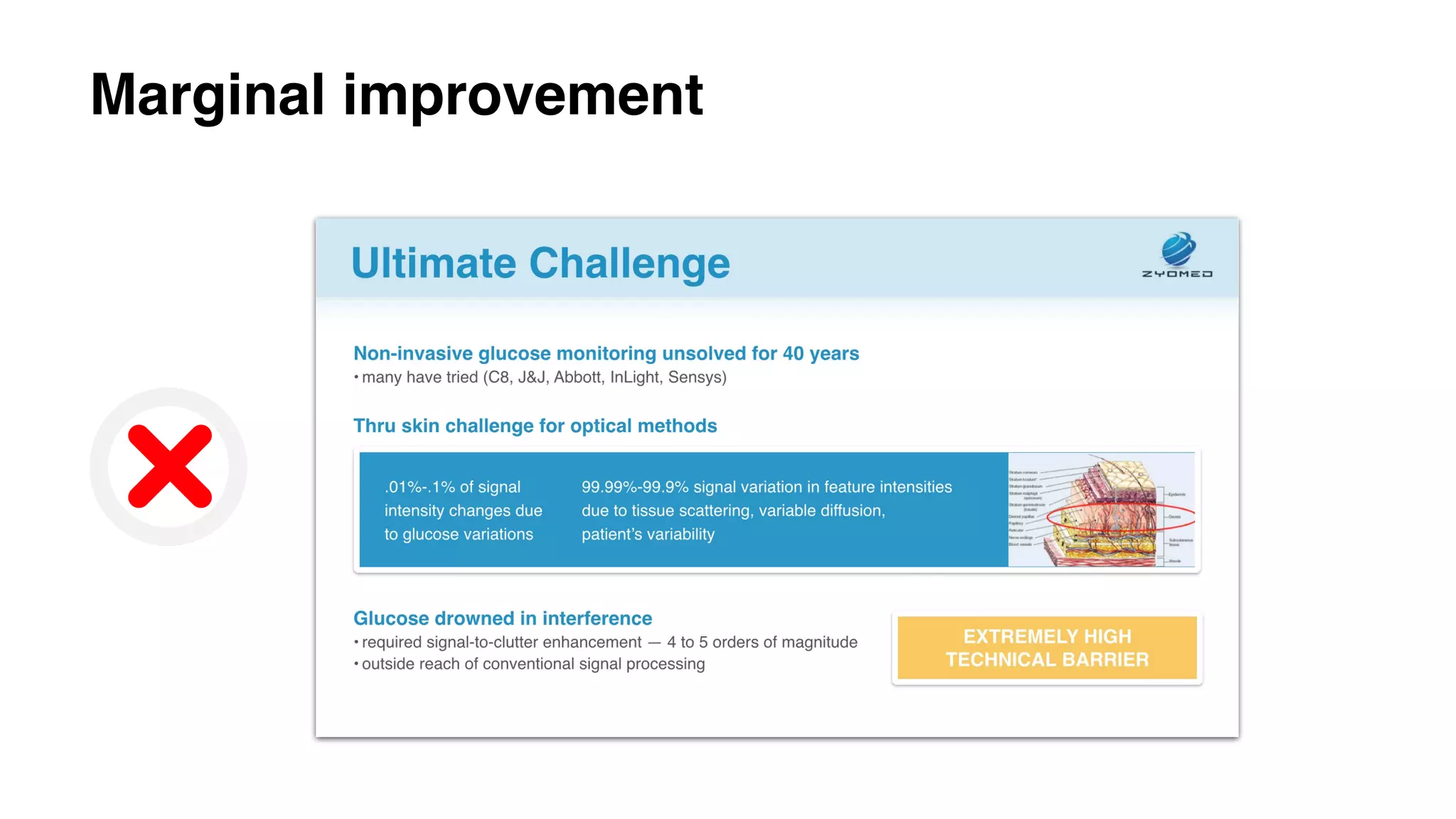

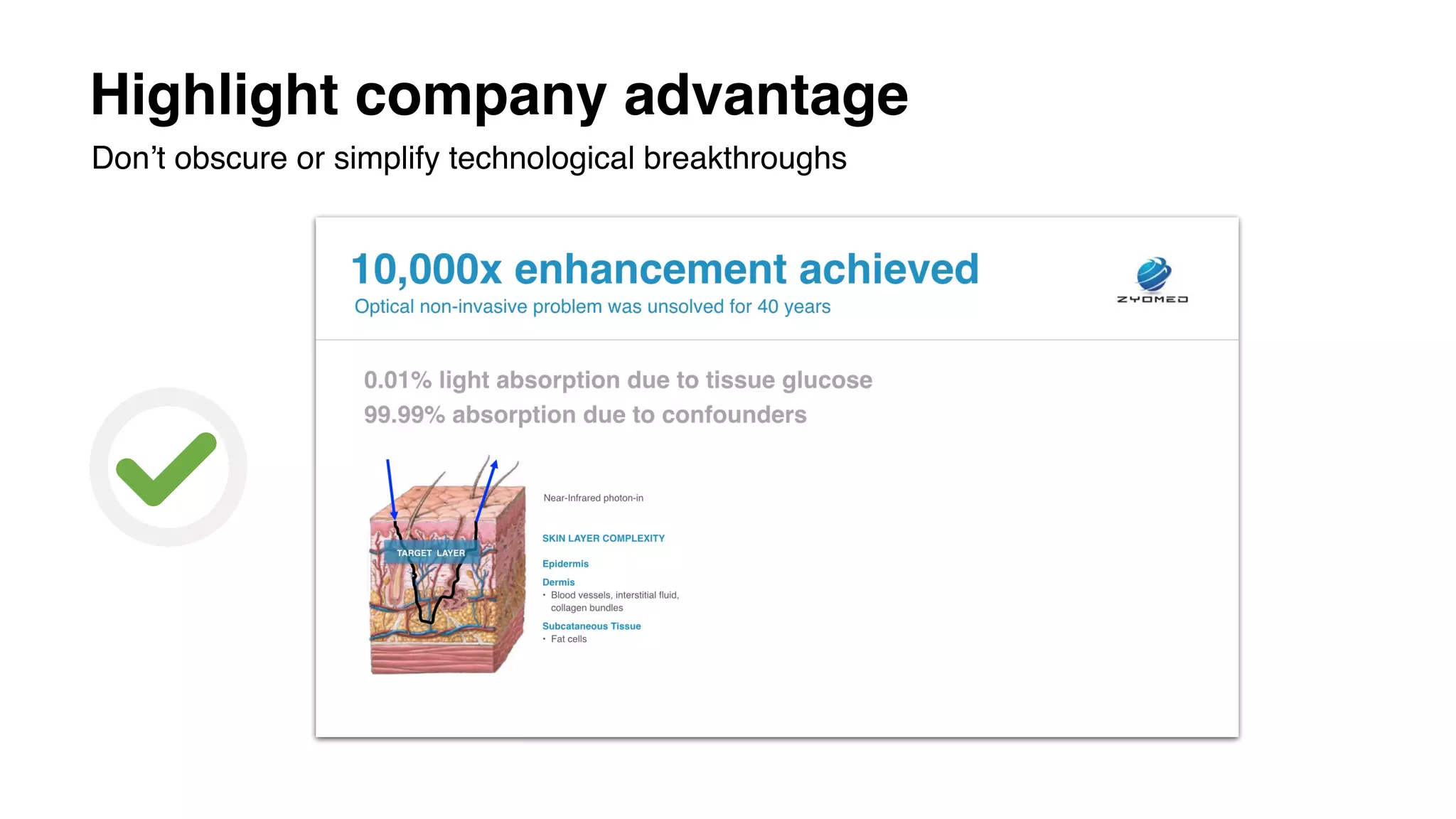

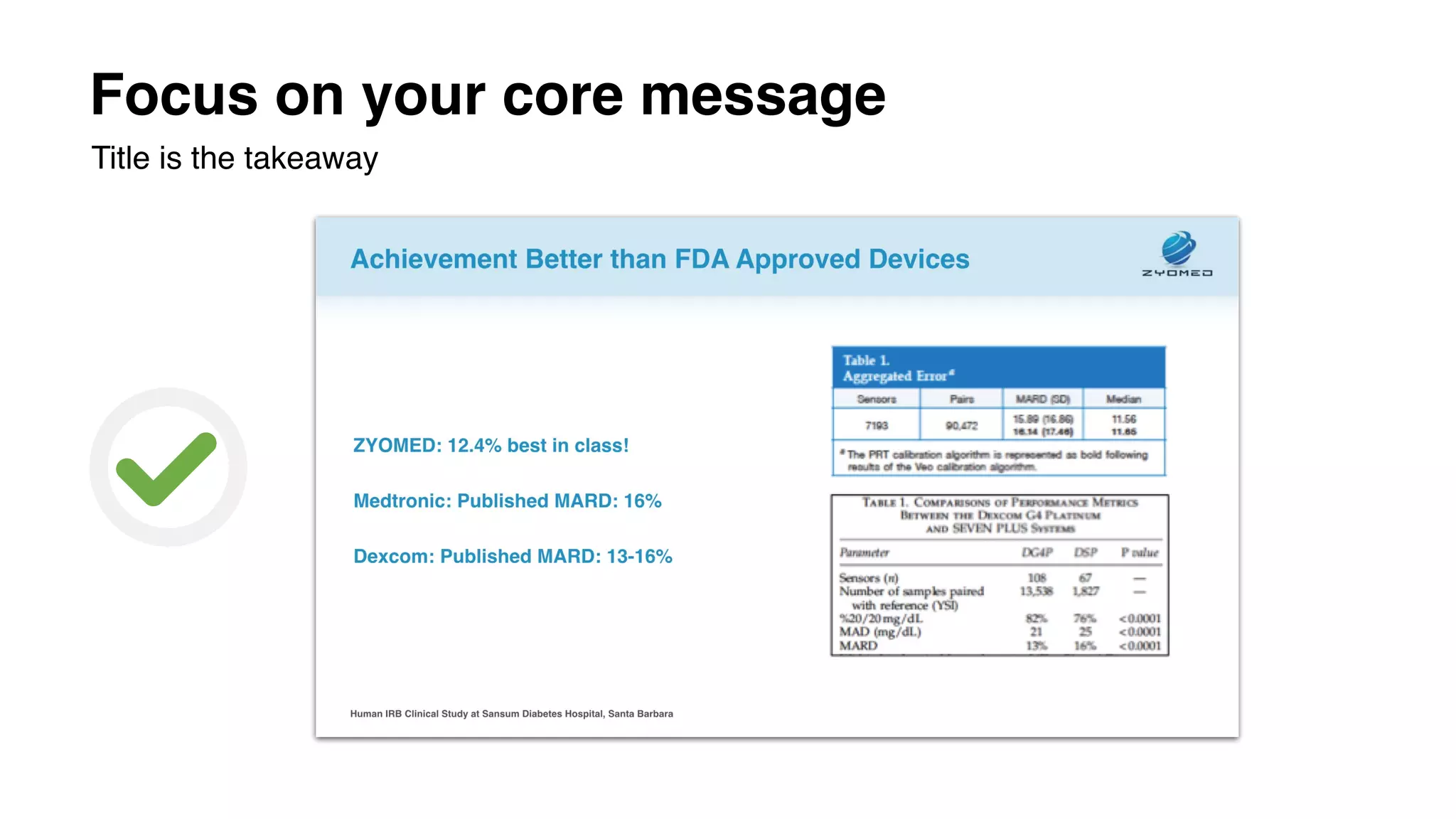

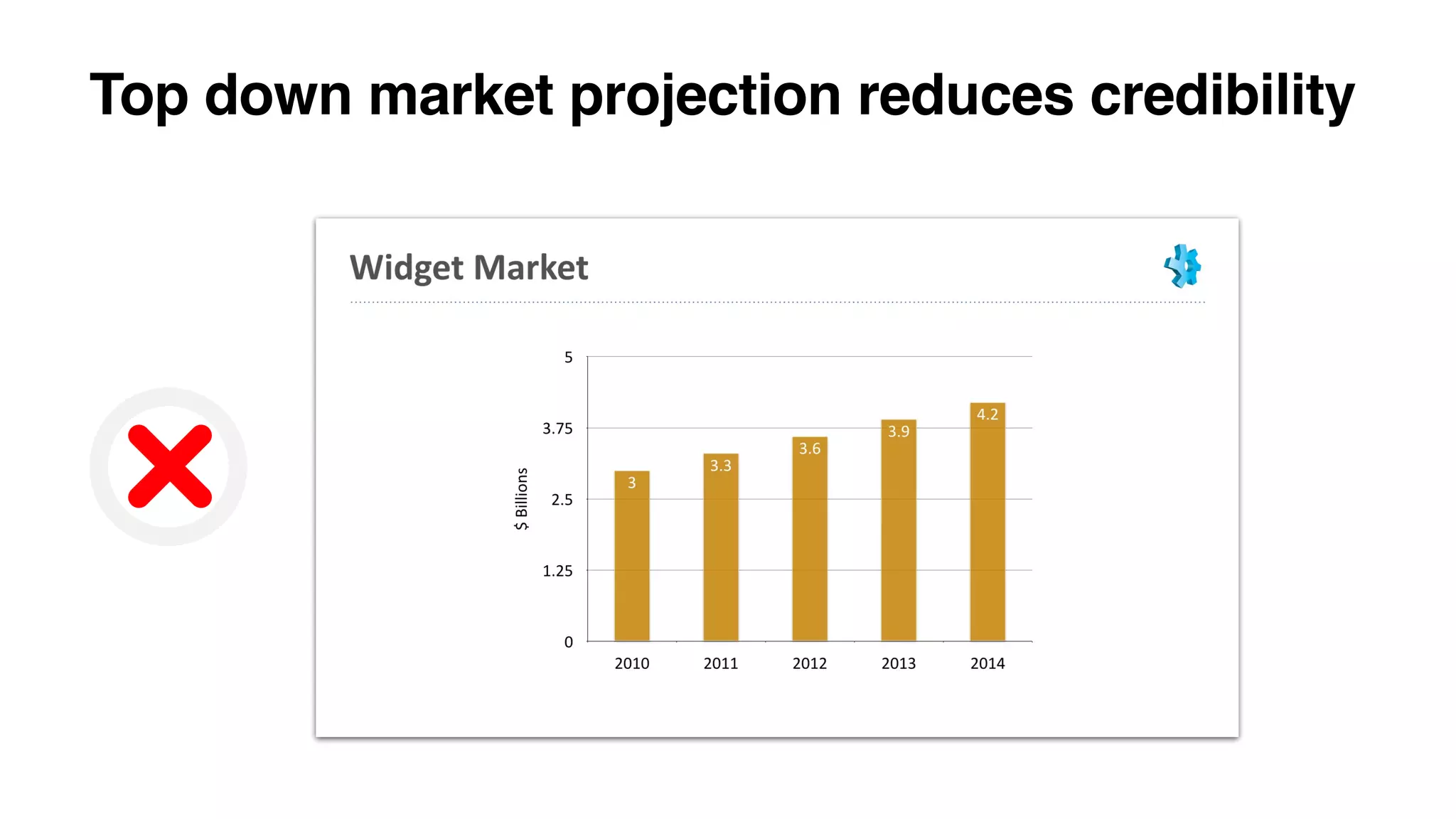

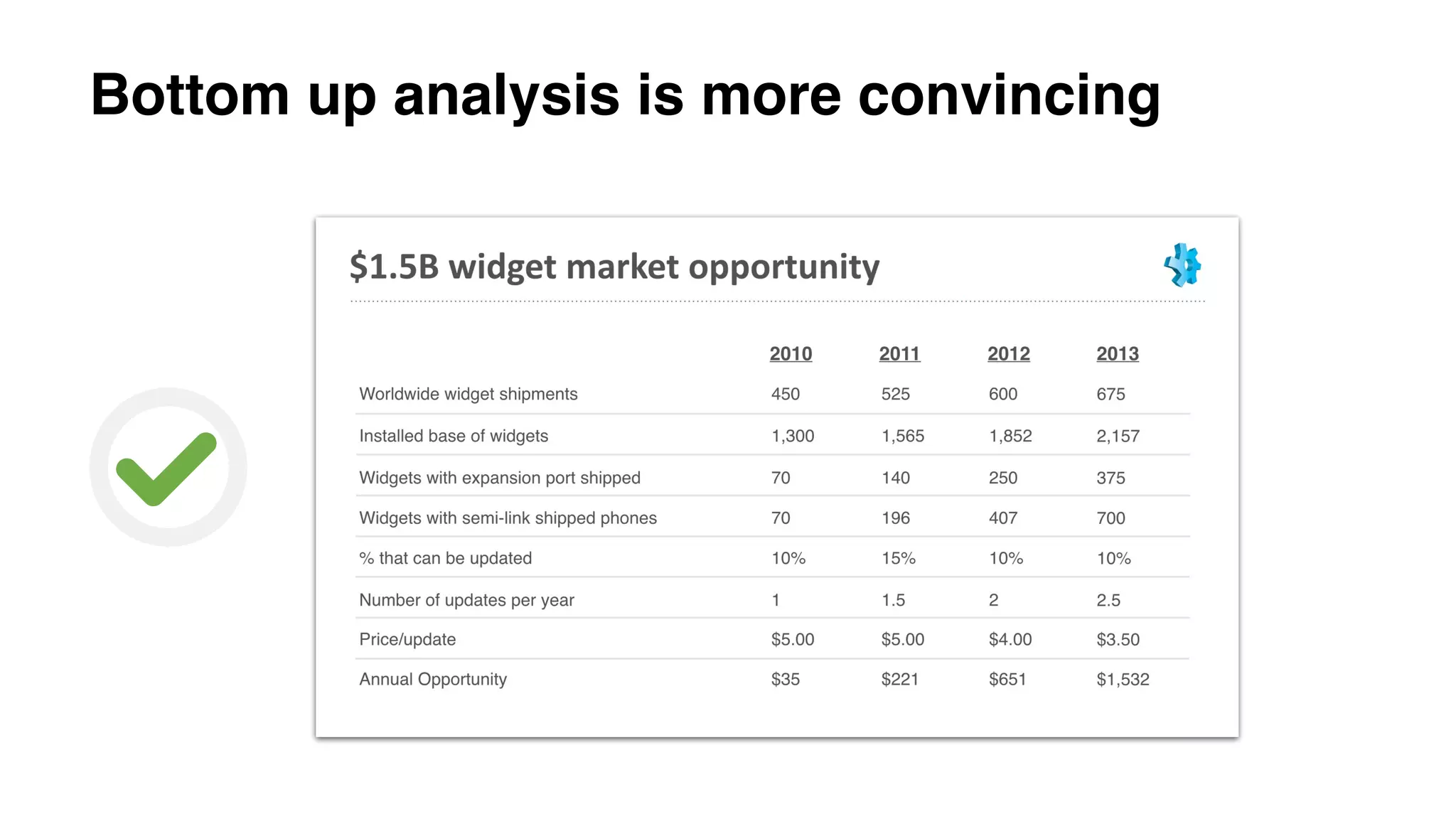

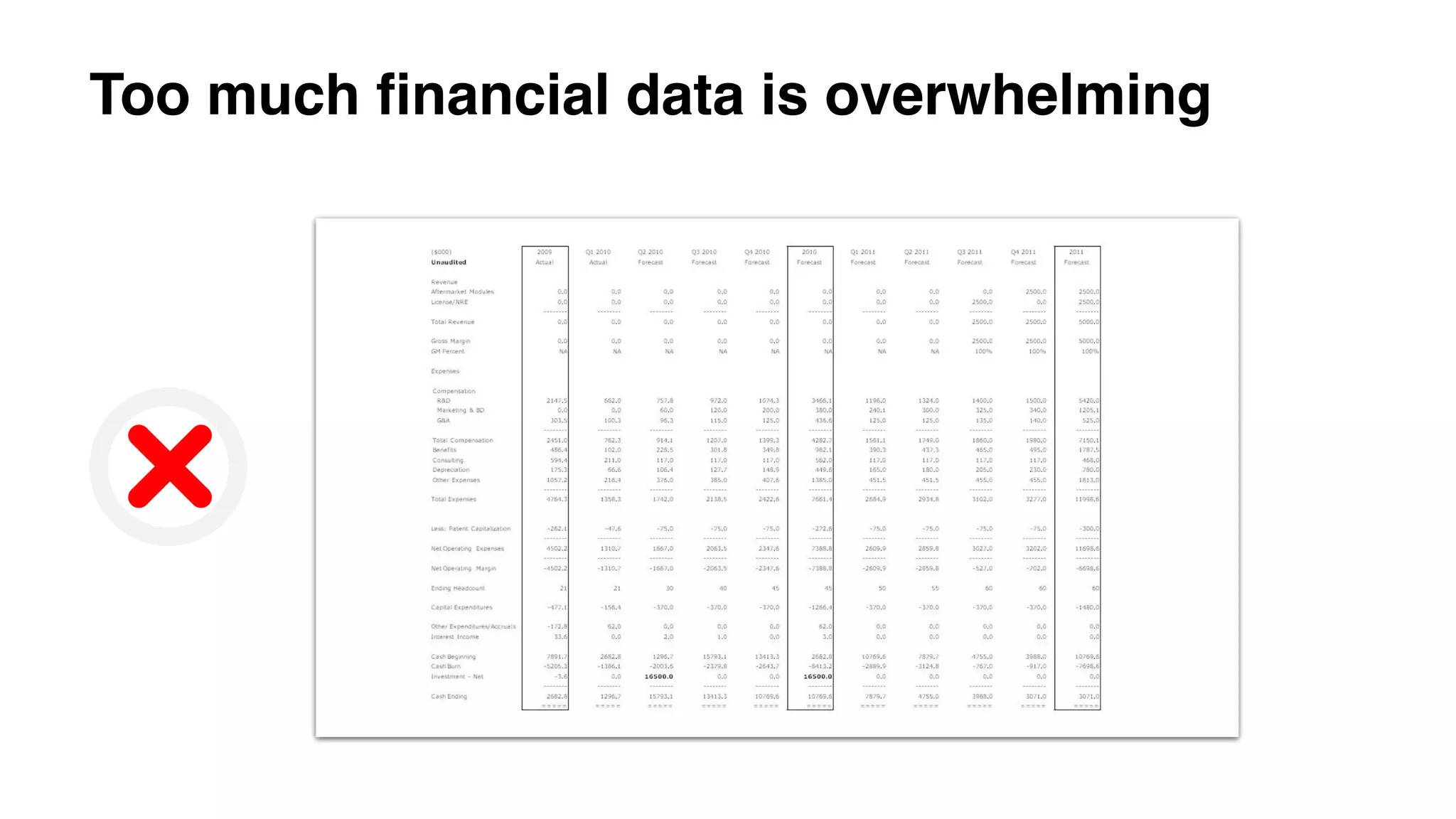

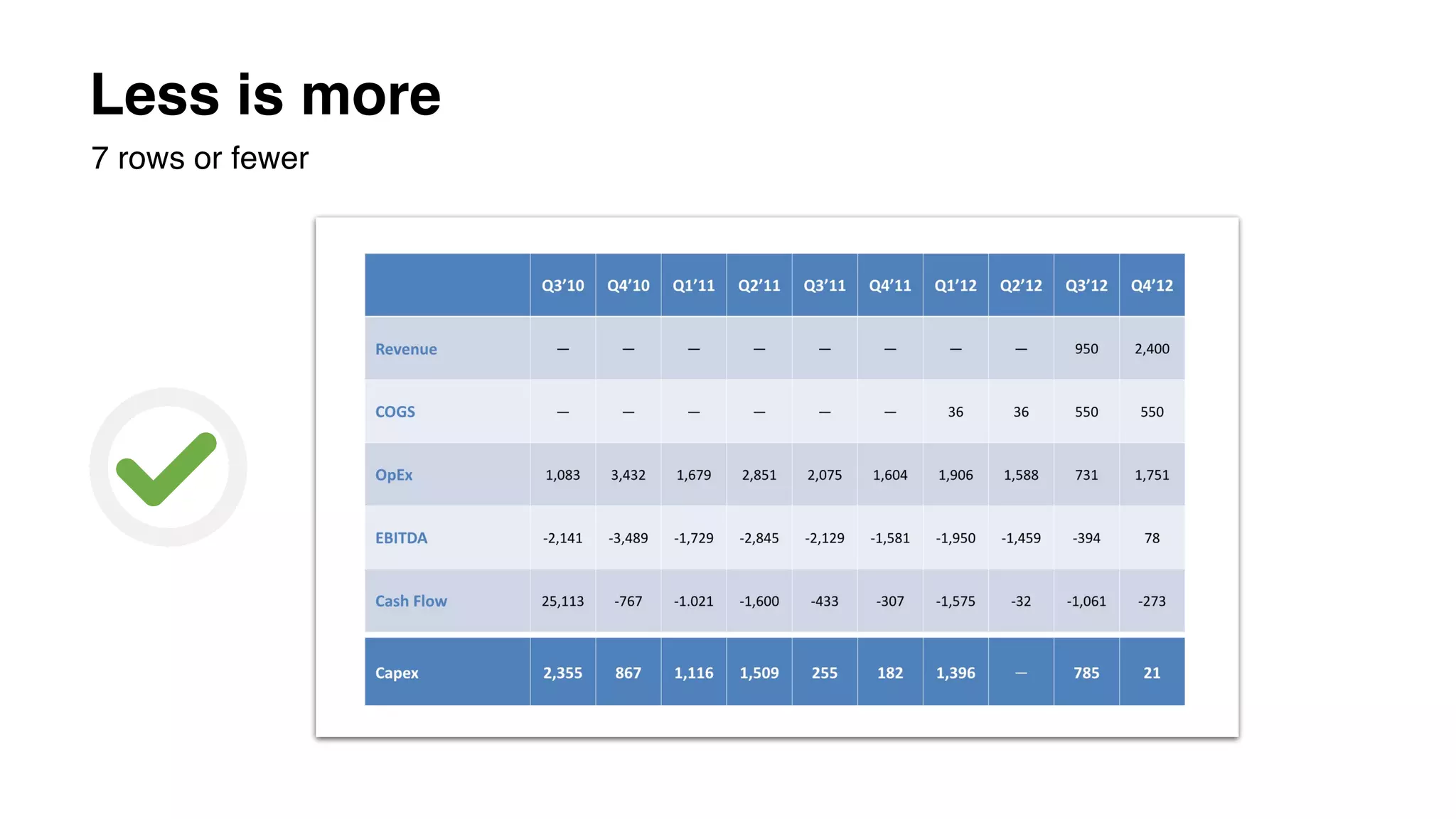

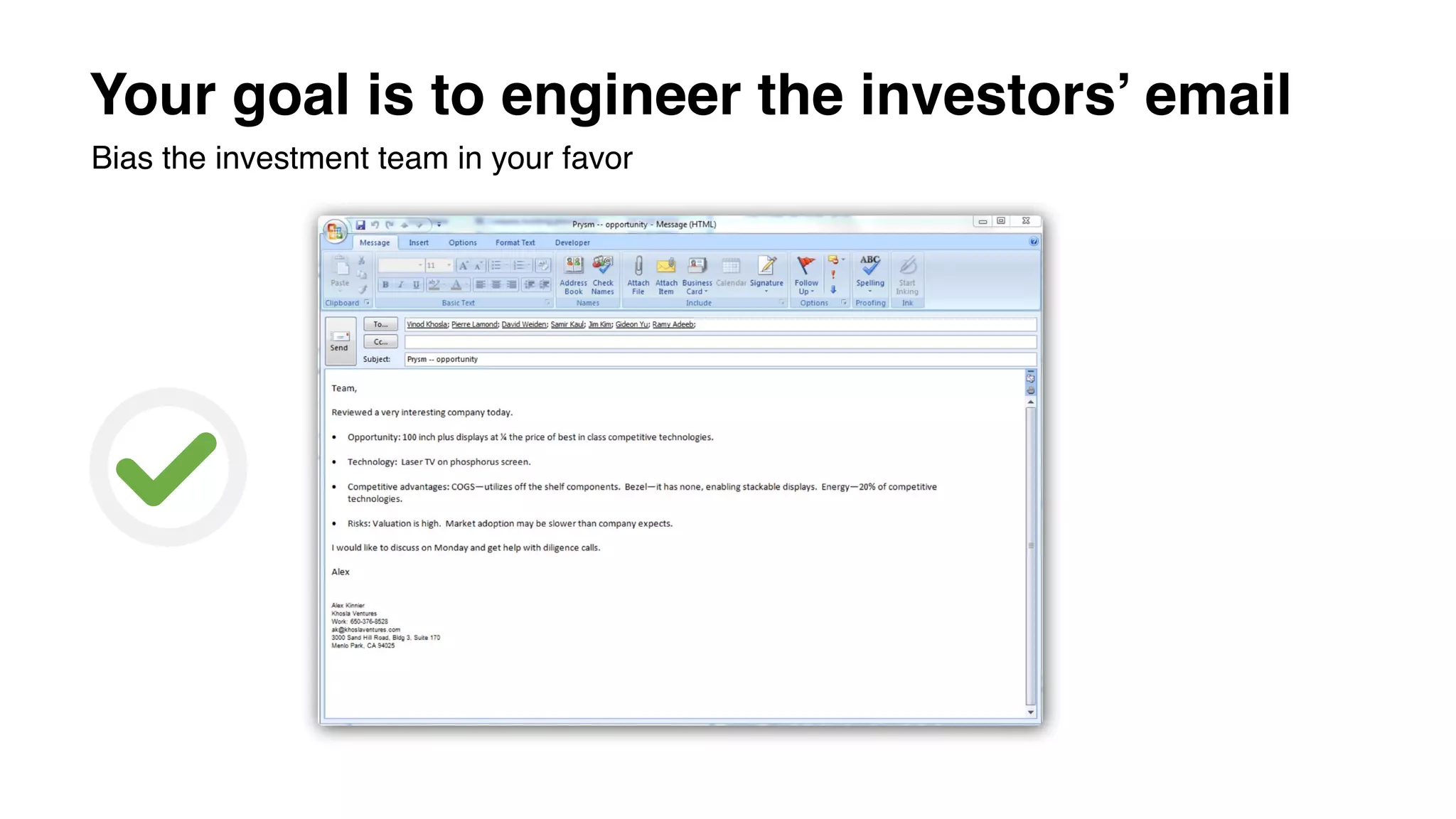

The document provides tips for developing an effective fundraising presentation deck for venture capitalists. It recommends starting with the key reasons to invest upfront, using clear and concise slide titles as the main takeaway message for each slide, and decluttering slides to remove unnecessary text, images or colors. Financial projections should use a bottom-up market analysis approach rather than top-down projections, and financial details on slides should be laid out clearly while keeping the number of rows to seven or fewer.