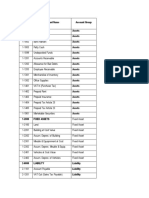

General Ledger Master Listing

RW Default

Account Cat Tax Mode Tax Code

Financial Category : B15 - Retained Income

5200/000 Retained Income / (Accumulated Loss) 45 No tax type Default 0

Financial Category : B25 - Long Term Borrowings

5500/000 Long Term Liabilities 55 No tax type Default 0

Financial Category : B30 - Other Long Term Liabilities

5600/000 Instalment Sale Creditors 58 No tax type Default 0

Financial Category : B35 - Fixed Assets

6100/000 Land & Buildings - Net Value 60 No tax type Default 0

6100/010 Land & Buildings - @ Cost 60 No tax type Default 0

6100/020 Land & Buildings - Accum Depre 60 No tax type Default 0

6200/000 Motor Vehicles - Net Value 62 No tax type Default 0

6200/010 Motor Vehicles - @ Cost 62 No tax type Default 0

6200/020 Motor Vehicles - Accum Depre 62 No tax type Default 0

6250/000 Computer Equipment - Net Value 63 No tax type Default 0

6250/010 Computer Equipment - @ Cost 63 No tax type Default 0

6250/020 Computer Equipment - Accum Depre 63 No tax type Default 0

6300/000 Office Equipment - Net Value 64 No tax type Default 0

6300/010 Office Equipment - @ Cost 64 No tax type Default 0

6300/020 Office Equipment - Accum Depre 64 No tax type Default 0

6350/000 Furniture & Fittings - Net value 65 No tax type Default 0

6350/010 Furniture & Fittings - @ Cost 65 No tax type Default 0

6350/020 Furniture & Fittings - Accum Depre 65 No tax type Default 0

6600/000 Other Fixed Assets - Net Value 66 No tax type Default 0

6600/010 Other Fixed Assets - @ Cost 66 No tax type Default 0

6600/020 Other Fixed Assets - Accum Depre 66 No tax type Default 0

Financial Category : B40 - Investments

7100/000 Investments 70 No tax type Default 0

Financial Category : B45 - Other Fixed Assets

7000/000 Goodwill / Intangible Assets 71 No tax type Default 0

Financial Category : B50 - Inventory

7700/000 Inventory Control Account 72 No tax type Default 0

Financial Category : B55 - Accounts Receivable

8000/000 Customer Control Account 74 No tax type Default 0

Financial Category : B60 - Bank

8400/000 Access Bank 76 No tax type Default 0

8410/000 Account Name 76 No tax type Default 0

Financial Category : B65 - Other Current Assets

8100/000 POS Cash Control 78 No tax type Default 0

8200/000 Sundry Customers 78 No tax type Default 0

Financial Category : B70 - Accounts Payable

9000/000 Supplier Control Account 80 No tax type Default 0

9100/000 GRN Accrual Account 80 No tax type Default 0

Financial Category : B80 - Other Current Liabilities

�9200/000 Sundry Suppliers 88 No tax type Default 0

9400/000 Provision for Future Expenses 90 No tax type Default 0

9400/010 Provision for Insurance 90 No tax type Default 0

9400/020 Provision for Salary Bonus 90 No tax type Default 0

9500/000 Vat / Tax Control Account 85 No tax type Default 0

9510/000 Vat / Tax Provision Account 85 No tax type Default 0

9990/000 Opening Balance / Suspense Account 88 No tax type Default 0

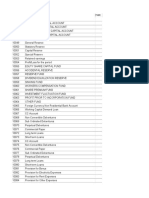

Financial Category : I10 - Sales

1000/000 Sales 10 No tax type Default 0

Financial Category : I15 - Cost of Sales

2000/000 Cost of Sales / Purchases 15 No tax type Default 0

2100/000 Inventory Adjustment 15 No tax type Default 0

2150/000 Inventory Count Variance 15 No tax type Default 0

2200/000 Purchase Variance 15 No tax type Default 0

2400/000 Recovery Account 18 No tax type Default 0

2400/010 Labour Cost Manufac Variance 18 No tax type Default 0

2400/020 Direct Cost Manufac Variance 18 No tax type Default 0

2400/030 Other Cost Manufac Variance 18 No tax type Default 0

Financial Category : I20 - Other Income

2700/000 Discount Received for Cash 20 No tax type Default 0

2750/000 Interest Received 20 No tax type Default 0

2800/000 Pft/Loss on Sale of Non Current Assets 20 No tax type Default 0

2850/000 Bad Debts Recovered 20 No tax type Default 0

2900/000 Sundry Income 20 No tax type Default 0

Financial Category : I25 - Expenses

3000/000 Accounting Fees 25 No tax type Default 0

3050/000 Advertising & Promotions 25 No tax type Default 0

3150/000 Bad Debts 25 No tax type Default 0

3200/000 Bank Charges 25 No tax type Default 0

3250/000 Cleaning 25 No tax type Default 0

3300/000 Computer Expenses 25 No tax type Default 0

3350/000 Consulting Fees 25 No tax type Default 0

3400/000 Courier & Postage 25 No tax type Default 0

3450/000 Depreciation 25 No tax type Default 0

3550/000 Discount Allowed for Cash 25 No tax type Default 0

3600/000 Donations 25 No tax type Default 0

3650/000 Electricity & Water 25 No tax type Default 0

3700/000 Entertainment Expenses 25 No tax type Default 0

3750/000 Finance Charges 25 No tax type Default 0

3800/000 General Expenses 25 No tax type Default 0

3850/000 Insurance 25 No tax type Default 0

3900/000 Interest Paid 25 No tax type Default 0

3950/000 Leasing Charges 25 No tax type Default 0

4000/000 Legal Fees 25 No tax type Default 0

4050/000 Levies 25 No tax type Default 0

4150/000 Motor Vehicle Expenses 25 No tax type Default 0

4200/000 Printing & Stationery 25 No tax type Default 0

�4210/000 Pft/Loss on foreign exchange 25 No tax type Default 0

4300/000 Rent Paid 25 No tax type Default 0

4350/000 Repairs & Maintenance 25 No tax type Default 0

4400/000 Salaries & Wages 25 No tax type Default 0

4450/000 Staff Training 25 No tax type Default 0

4500/000 Staff Welfare 25 No tax type Default 0

4550/000 Subscriptions 25 No tax type Default 0

4600/000 Telephone & Fax 25 No tax type Default 0

4650/000 Travel & Accommodation 25 No tax type Default 0

� External No. of

Blocked Reference Notes

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

�No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

�No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0

No 0