PIONEER ACADEMY, Mandsaur

Mandsaur

CLASS WORK SHEET

Class 12 - Accountancy

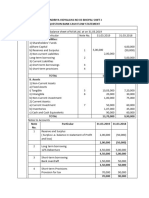

1. From the following Balance Sheets of X Ltd., you are required to prepare a Cash Flow Statement:

31.3.2018 31.3.2017

Particulars Note No.

₹ ₹

I. EQUITY AND LIABILITIES:

(1) Shareholder’s Funds:

(a) Share Capital 2,00,000 2,00,000

(,b) Reserve and Surplus 1,55,000 80,000

(2) Current Liabilities:

R

EE

(a) Trade Payables 1,28,000 1,45,000

(b) Short term Provision 1 45,000 35,000

ON

TOTAL 5,28,000 4,60,000

II. ASSETS:

(1) Non-Current Assets:

PI

(a) Fixed Assets:

(i) Tangible Assets 2 2,00,000 1,50,000

(ii) Intangible Assets 3 33,000 40,000

(2) Current Assets:

(a) Current Investments 4 15,000 12,000

(b) Inventory 2,15,000 1,80,000

(c) Trade Receivables 50,000 60,000

(d) Cash & Bank 10,000 8,000

(e) Other Current Assets 5 5,000 10,000

TOTAL 5,28,000 4,60,000

Notes:

31.3.2018 31.3.2017

(1) Short term Provision:

₹ ₹

1/5

All The Best

� Provision for Taxation 45,000 35,000

(2) Tangible Assets:

Machinery 2,00,000 1,50,000

(3) Intangible Assets:

Goodwill 33,000 40,000

(4) Current Investments:

Marketable Securities 15,000 12,000

(5) Other Current Assets:

Prepaid Expenses 5,000 10,000

Additional Information :

I. Machinery whose original cost was ₹ 50,000 was sold for ₹ 10,000 during the year. Accumulated depreciation on this

machinery was ₹ 26,000.

II. Depreciation on Machinery charged during the year ₹ 20,000.

III. An Interim Dividend was paid during the year @ 10% on Equity share Capital.

2. From the following Balance Sheets of X Y Ltd. as at 31.3.2018 and 31.3.2017 prepare a Cash-Flow Statement:

I. EQUITY AND LIABILITIES:

Particulars

R

Note No.

31.3.2018

31.3.2017

EE

(1) Shareholder’s Funds:

(a) Share Capital 1 8,50,000 4,60,000

ON

(b) Reserve & Surplus 2 1,70,000 2,40,000

(2) Non-Current Liabilities:

Long-term Borrowings 3 1,80,000 2,00,000

PI

TOTAL 12,00,000 9,00,000

II. ASSETS:

(1) Non-Current Assets:

Fixed Assets 7,00,000 5,00,000

(2) Current Assets:

(a) Inventory 2,50,000 2,10,000

(b) Trade Receivables 1,90,000 1,40,000

(c) Cash & Cash Equivalents 60,000 50,000

TOTAL 12,00,000 9,00,000

Notes :

(1) Share Capital: 31.3.2018 (₹) 31.3.2017 (₹)

Equity Share Capital 7,50,000 4,00,000

Preference Share Capital 1,00,000 60,000

2/5

All The Best

� 8,50,000 4,60,000

(2) Reserve & Surplus:

General Reserve 50,000 70,000

Profit & Loss Balance 1,20,000 1,70,000

1,70,000 2,40,000

(3) Long-term Borrowings:

10% Debentures 1,80,000 2,00,000

Additional Information :

i. During the year machine of the book value of ₹ 80,000 was sold for ₹ 50,000.

ii. Interim Dividend paid ₹ 80,000.

iii. Provision for tax Rs 10000

3. From the following Balance Sheet, prepare Cash Flow Statement:

Particulars Note No. 31st March, 2019 31st March, 2018

₹ ₹

I. EQUITY AND LIABILITIES

R

EE

1. Shareholders' Funds

(a) Share Capital 2,50,000 2,00,000

ON

(b) Reserves and Surplus 1 90,600 80,500

2. Current Liabilities

(a) Short-term Borrowing: Bank Loan - 70,000

PI

(b) Trade Payables 1,35,200 1,50,000

(c) Short-term Provisions: Provision for Tax 35,000 30,000

Total 5,10,800 5,30,500

II. ASSETS

1. Non-Current Assets

Fixed Assets:

(i) Tangible Assets 2 3,59,000 3,50,000

(ii) Intangible Assets: Goodwill 5,000 -

2. Current Assets

(a) Inventories 74,000 1,00,000

(b) Trade Receivables 64,200 80,000

(c) Cash and Cash Equivalents 8,600 500

Total 5,10,800 5,30,500

3/5

All The Best

� Note to Accounts

Particulars 31st March, 2019 31st March, 2018

₹ ₹

1. Reserves and Surplus

General Reserve 60,000 50,000

Surplus, i.e., Balance in Statement of Profit and Loss 30,600 30,500

90,600 80,500

2. Tangible Assets

Land and Building 1,90,000 2,00,000

Plant and Machinery 1,69,000 1,50,000

3,59,000 3,50,000

Additional Information:

i. Proposed Dividend for the year ended 31st March, 2019 was ₹ 25,000 and for the year ended 31 st March, 2018 was

₹ 14,000.

ii. Interim Dividend paid during the year was ₹ 9,000.

R

EE

iii. Income Tax paid during the year ₹ 28,000.

iv. Machinery was purchased during the year ₹ 33,000.

v. Depreciation to be charged on machinery ₹ 14,000 and on building ₹ 10,000.

ON

4. From the following Balance Sheet Himmat Ltd., prepare Cash Flow statement.

Particulars Note No. 31st March, 2020 31st March, 2019

₹ ₹

PI

1. EQUITY AND LIABILITIES

1. Shareholders' Funds

(a) Share Capital 15,00,000 10,00,000

(b) Reserves and Surplus

7,50,000 6,00,000

(Surplus, i.e., Balance in Statement of Profit and Loss)

2. Non-Current Liabilities

Long-term Borrowings 1 1,00,000 2,00,000

3. Current Liabilities

(a) Trade Payables 1,00,000 1,10,000

(b) Short-term Borrowings 2 95,000 80,000

Total 25,45,000 19,90,000

II.ASSETS

1. Non-Current Assets

4/5

All The Best

�(a) Fixed Assets

(i) Tangible Assets 3 10,10,000 12,00,000

(ii) Intangible Assets: Goodwill 1,80,000 2,00,000

(b) Non-Current Investments 6,00,000 -

2. Current Assets

(a) Inventories 1,80,000 1,00,000

(b) Trade Receivables 2,00,000 1,50,000

(c) Cash and Cash Equivalents 3,75,000 3,40,000

Total 25,45,000 19,90,000

Notes to Accounts

Particulars 31st March, 2020 31st March, 2019

₹ ₹

1. Long-term Borrowings

2,000, 10% Debentures of ₹ 100 each -

R 2,00,000

EE

Bank Loan 1,00,000

1,00,000 2,00,000

2. Short-term Provisions

ON

Provision for Tax 95,000 80,000

PI

3. Tangible Assets

Land and Building 6,50,000 8,00,000

Plant and Machinery 3,60,000 4,00,000

10,10,000 12,00,000

4. Cash and Cash Equivalents

Cash in Hand 70,000 50,000

Bank Balance 3,05,000 2,90,000

3,75,000 3,40,000

Additional Information

Income tax paid during the year includes ₹ 15,000

i. Land and Building of book value ₹ 1,50,000 was sold at a profit of 10%

ii. The rate of depreciation on Plant and Machinery is 10% on opening balance

5/5

All The Best