0% found this document useful (0 votes)

112 views42 pagesSage Payroll Guide

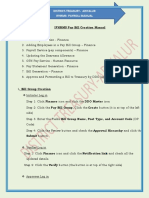

Chapter 3 provides a detailed guide on setting up payroll parameters, including bank and statutory accounts, allowance tables, and personnel file maintenance. It outlines the steps for configuring various accounts such as EPF, SOCSO, and tax, as well as the process for updating and processing payroll. Additionally, it covers reporting and government submissions related to payroll management.

Uploaded by

geniuskkCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

112 views42 pagesSage Payroll Guide

Chapter 3 provides a detailed guide on setting up payroll parameters, including bank and statutory accounts, allowance tables, and personnel file maintenance. It outlines the steps for configuring various accounts such as EPF, SOCSO, and tax, as well as the process for updating and processing payroll. Additionally, it covers reporting and government submissions related to payroll management.

Uploaded by

geniuskkCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 42