0% found this document useful (0 votes)

10 views1 page10 GAAP Principles

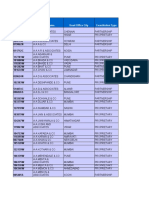

The document outlines the 10 GAAP principles essential for accounting practices, including the principles of regularity, consistency, sincerity, and full disclosure. Each principle emphasizes the importance of transparency, comparability, and integrity in financial reporting. Adhering to these principles ensures accurate financial representation and builds trust among stakeholders.

Uploaded by

rkingdom025Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

10 views1 page10 GAAP Principles

The document outlines the 10 GAAP principles essential for accounting practices, including the principles of regularity, consistency, sincerity, and full disclosure. Each principle emphasizes the importance of transparency, comparability, and integrity in financial reporting. Adhering to these principles ensures accurate financial representation and builds trust among stakeholders.

Uploaded by

rkingdom025Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1