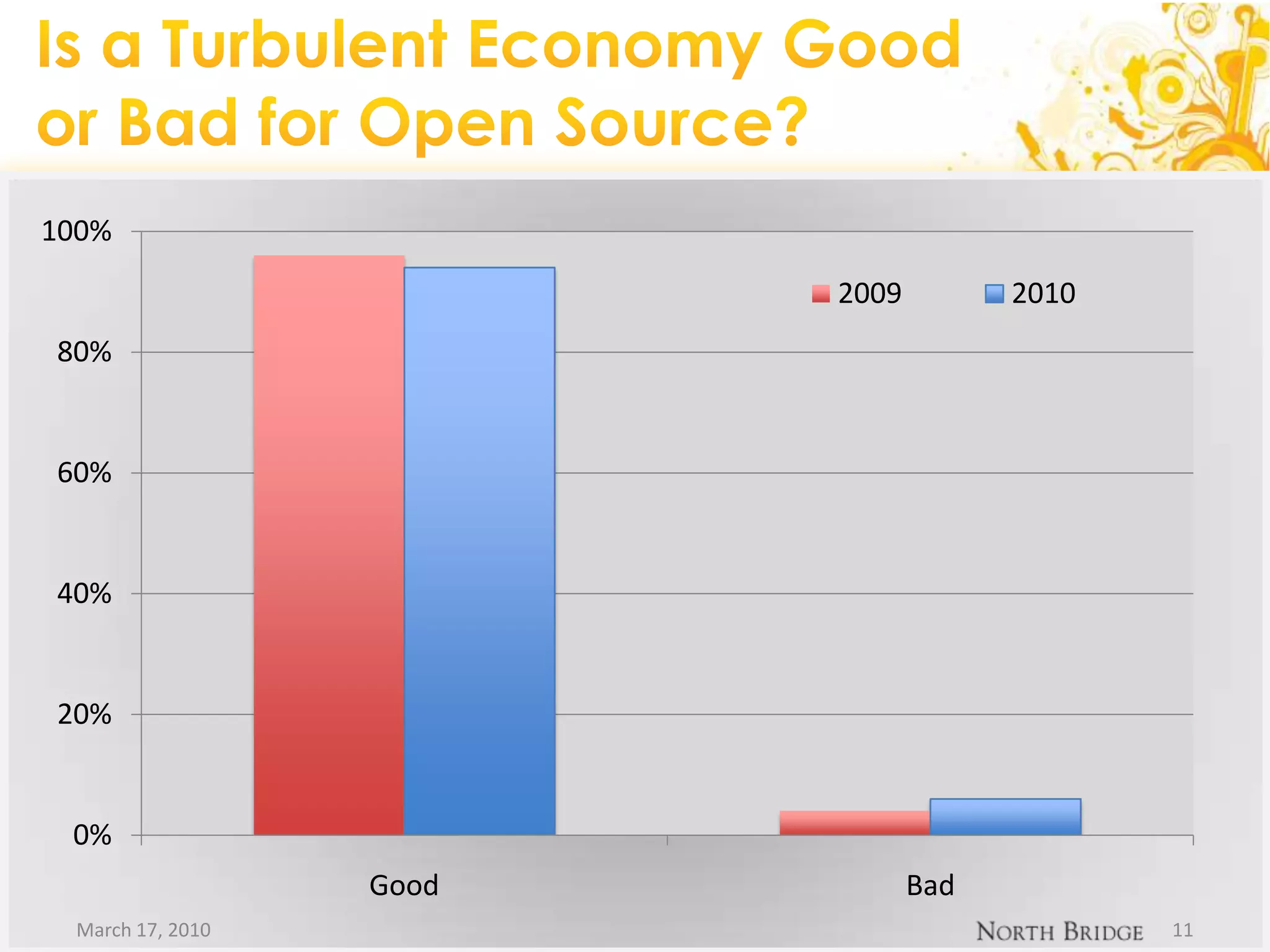

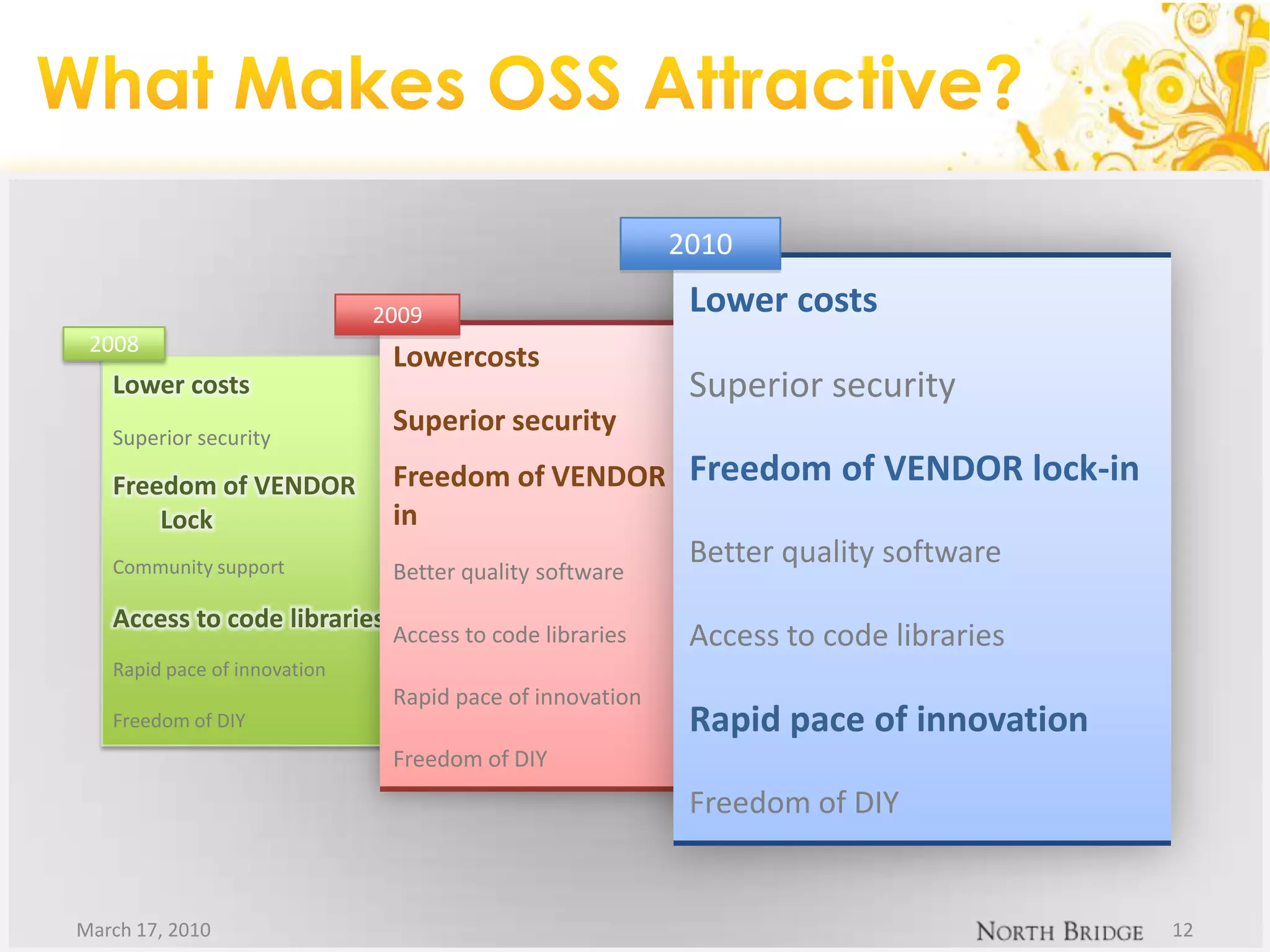

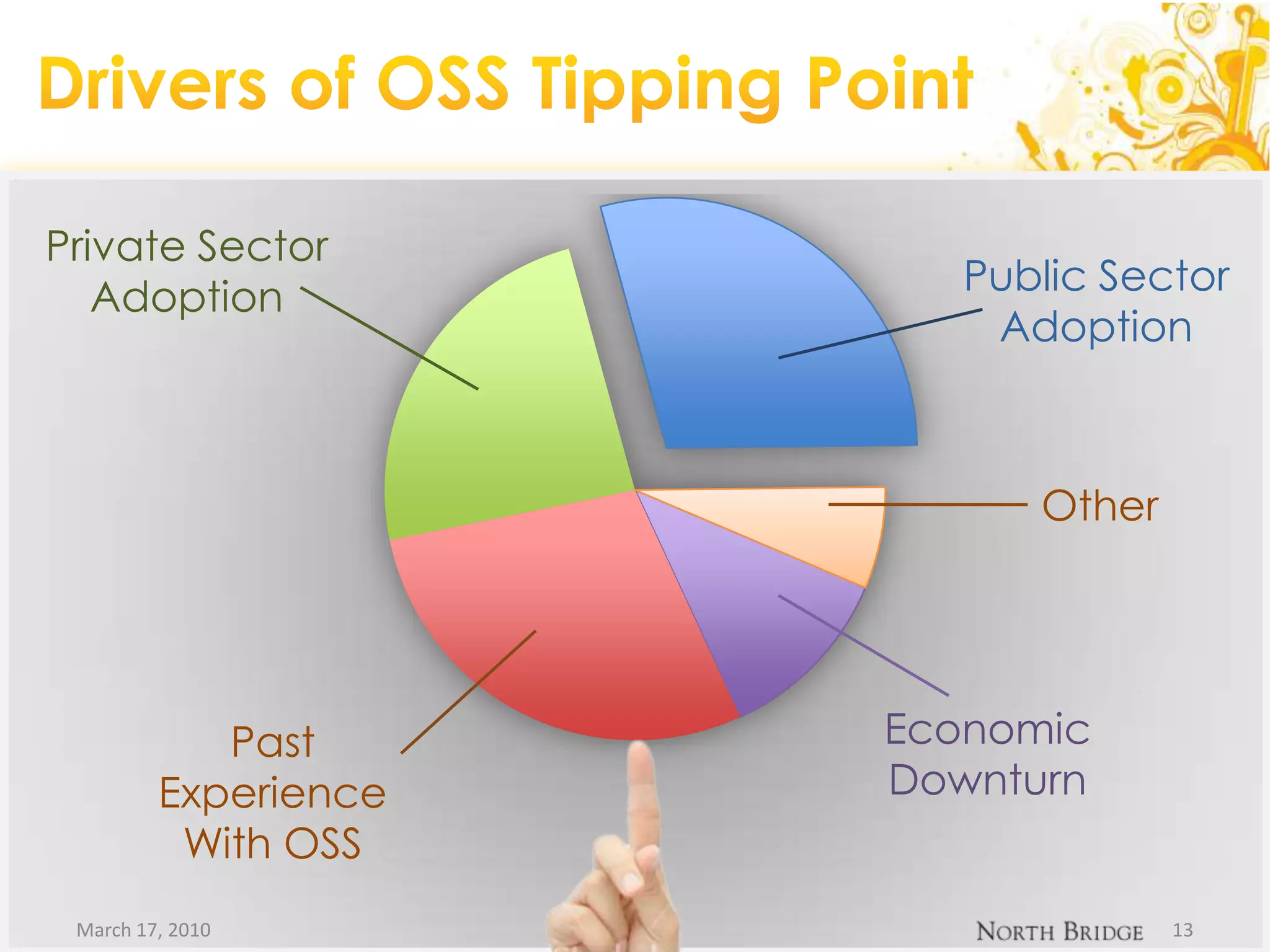

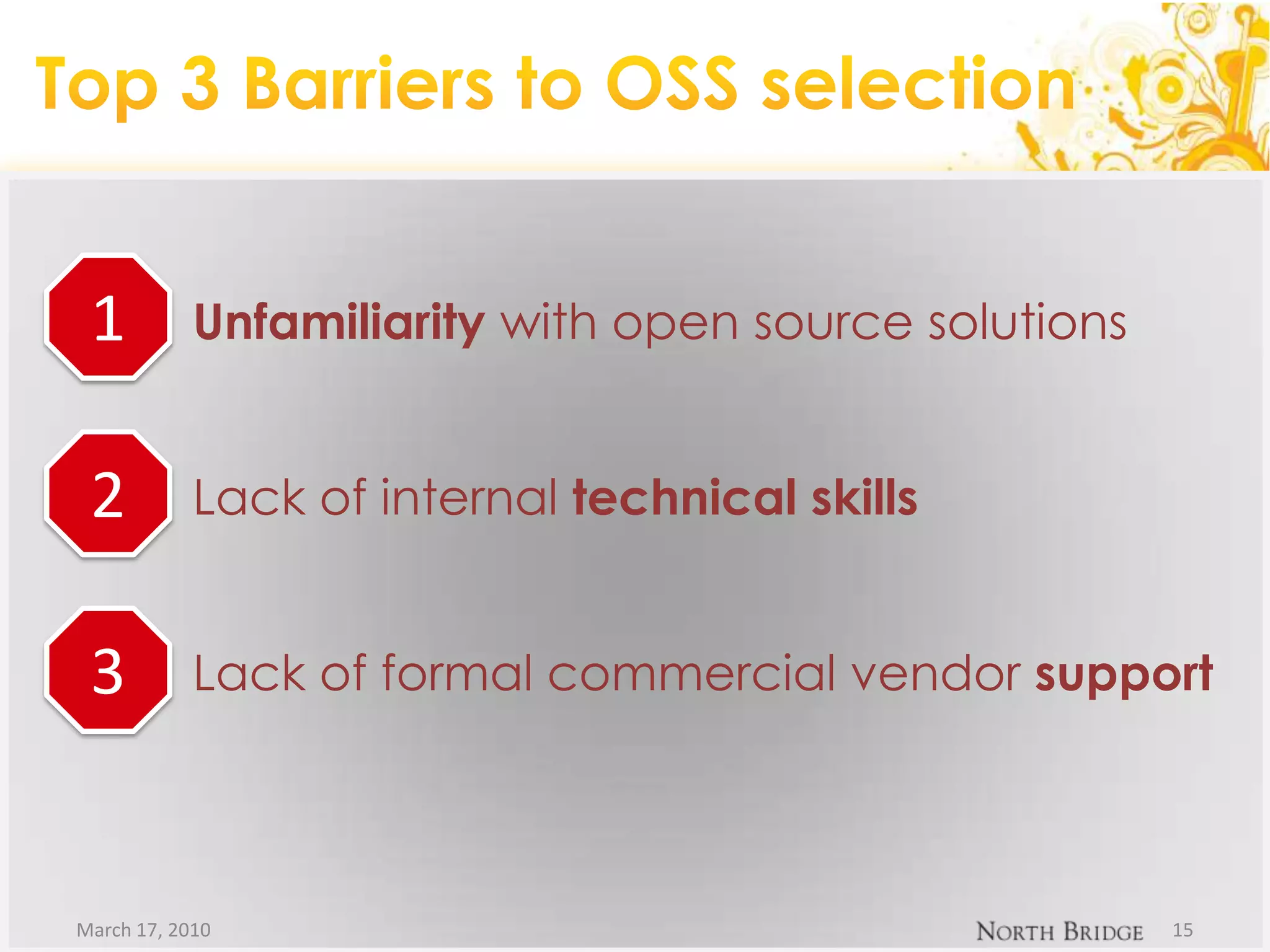

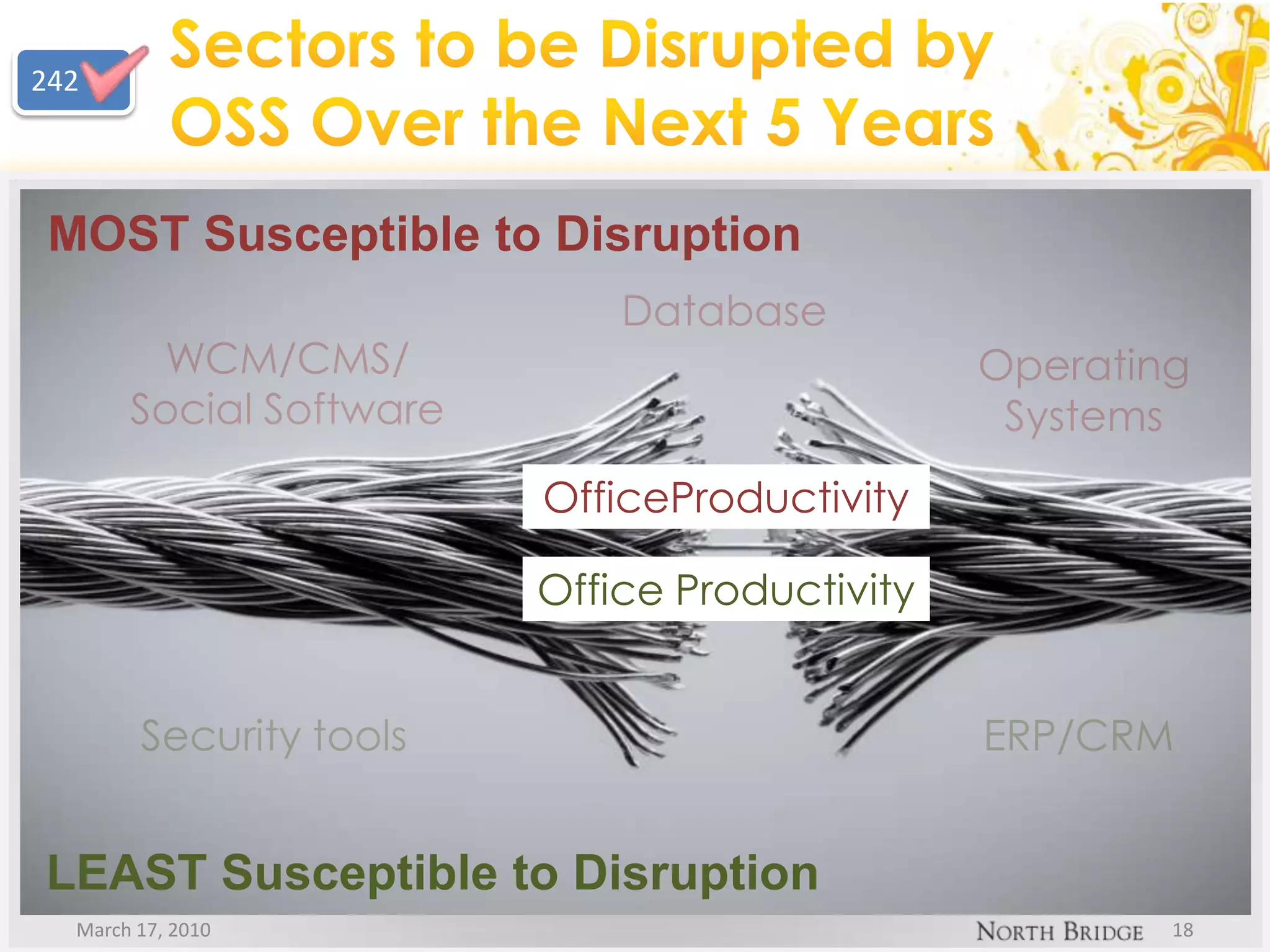

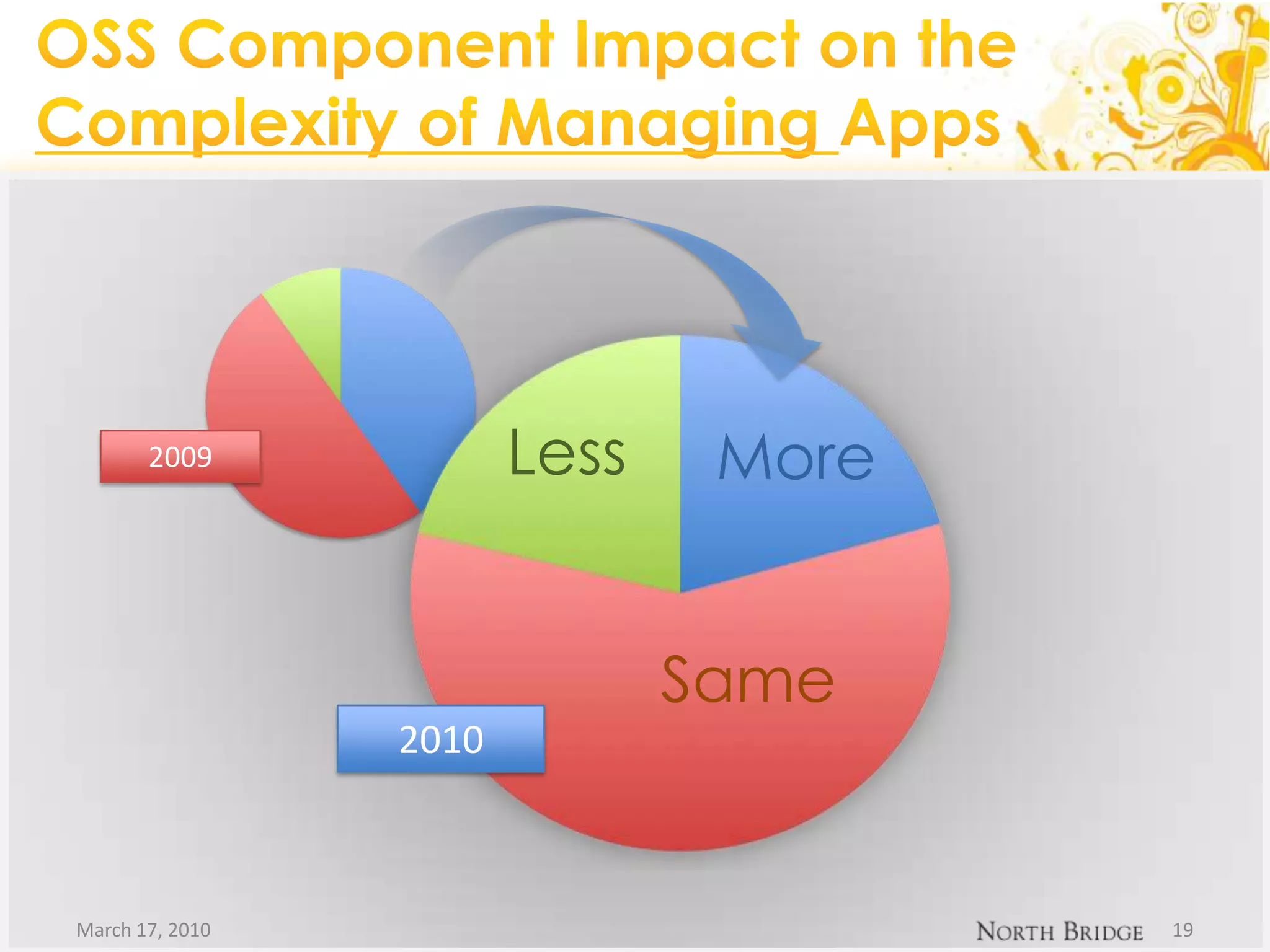

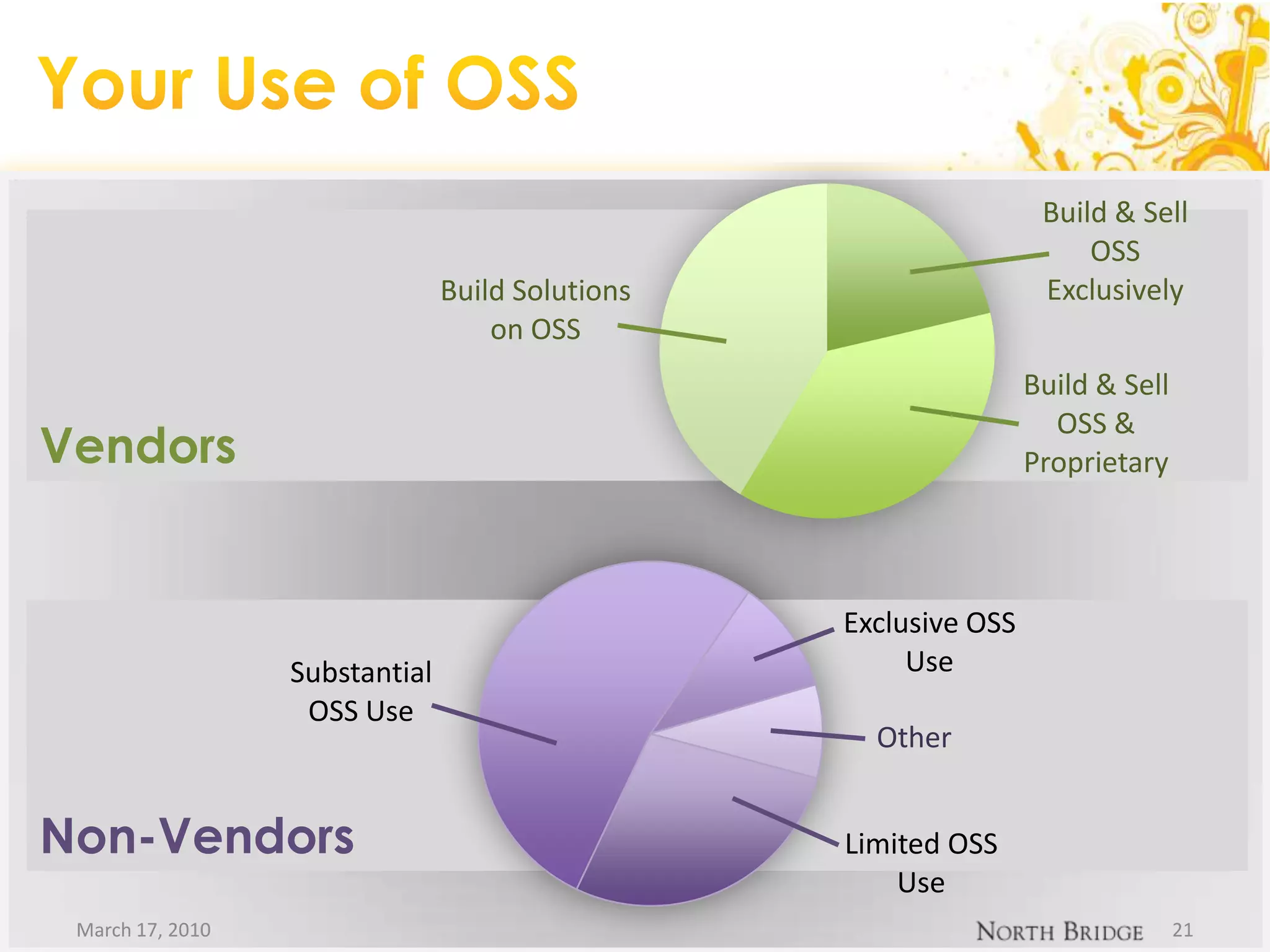

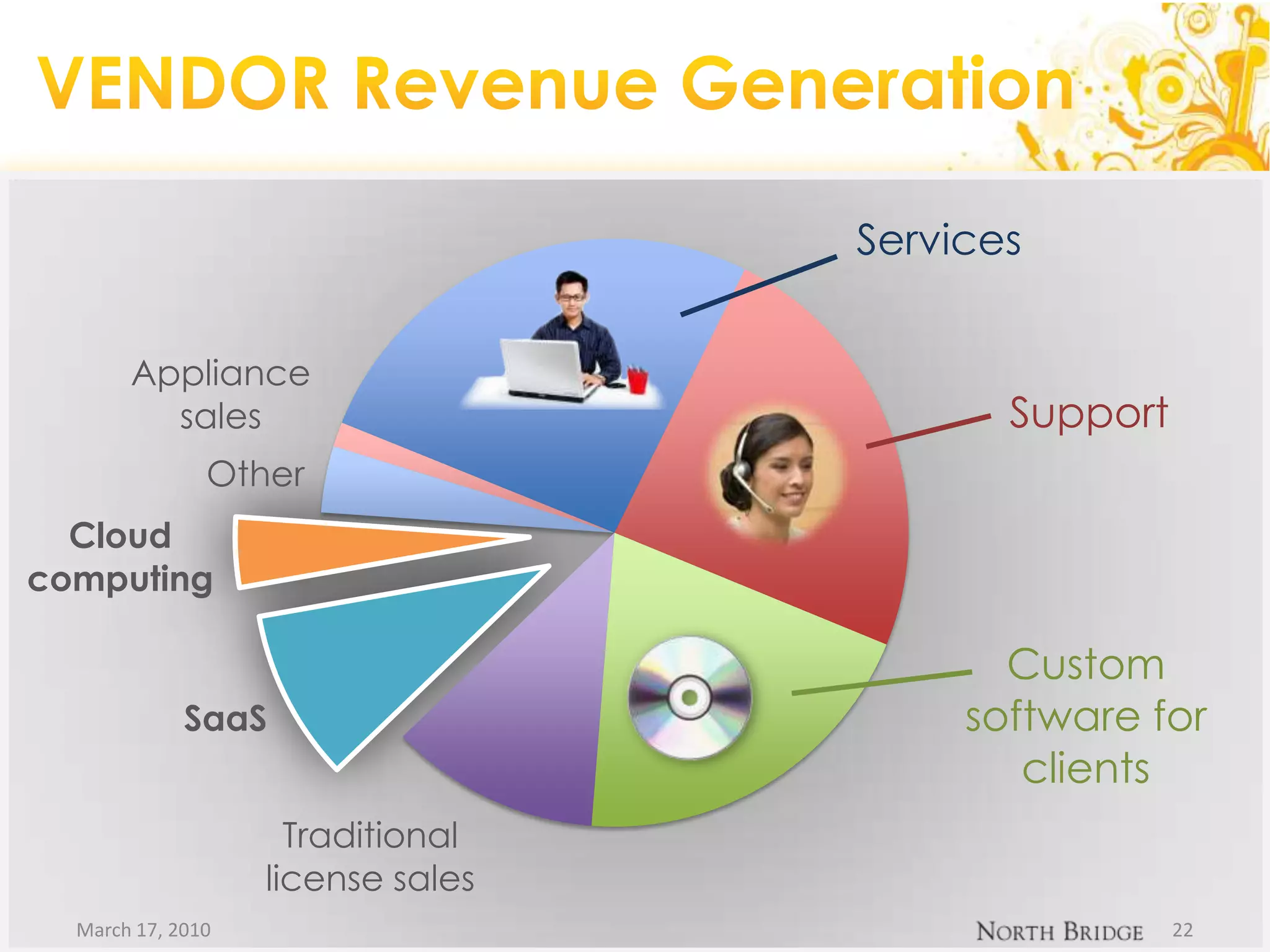

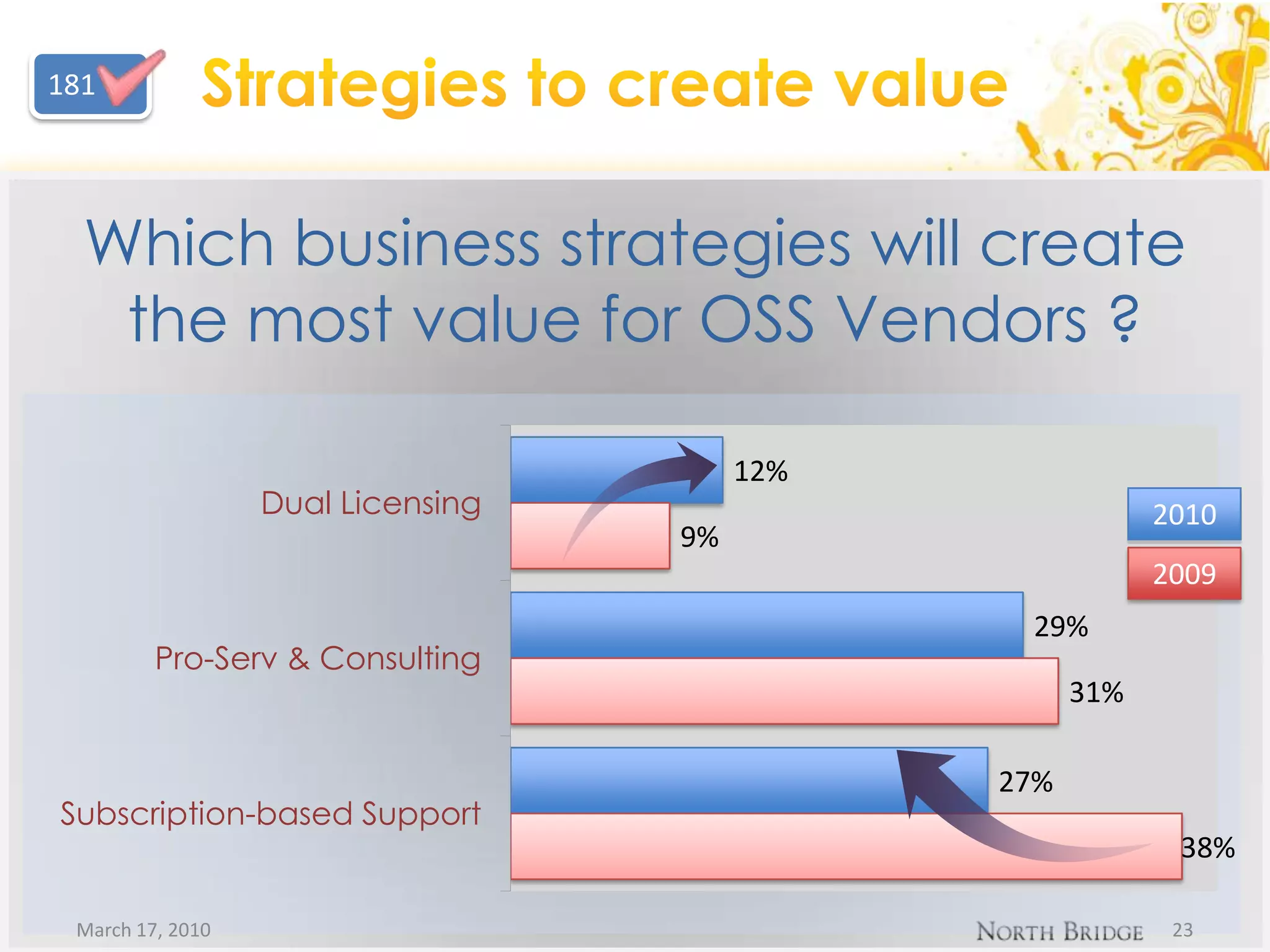

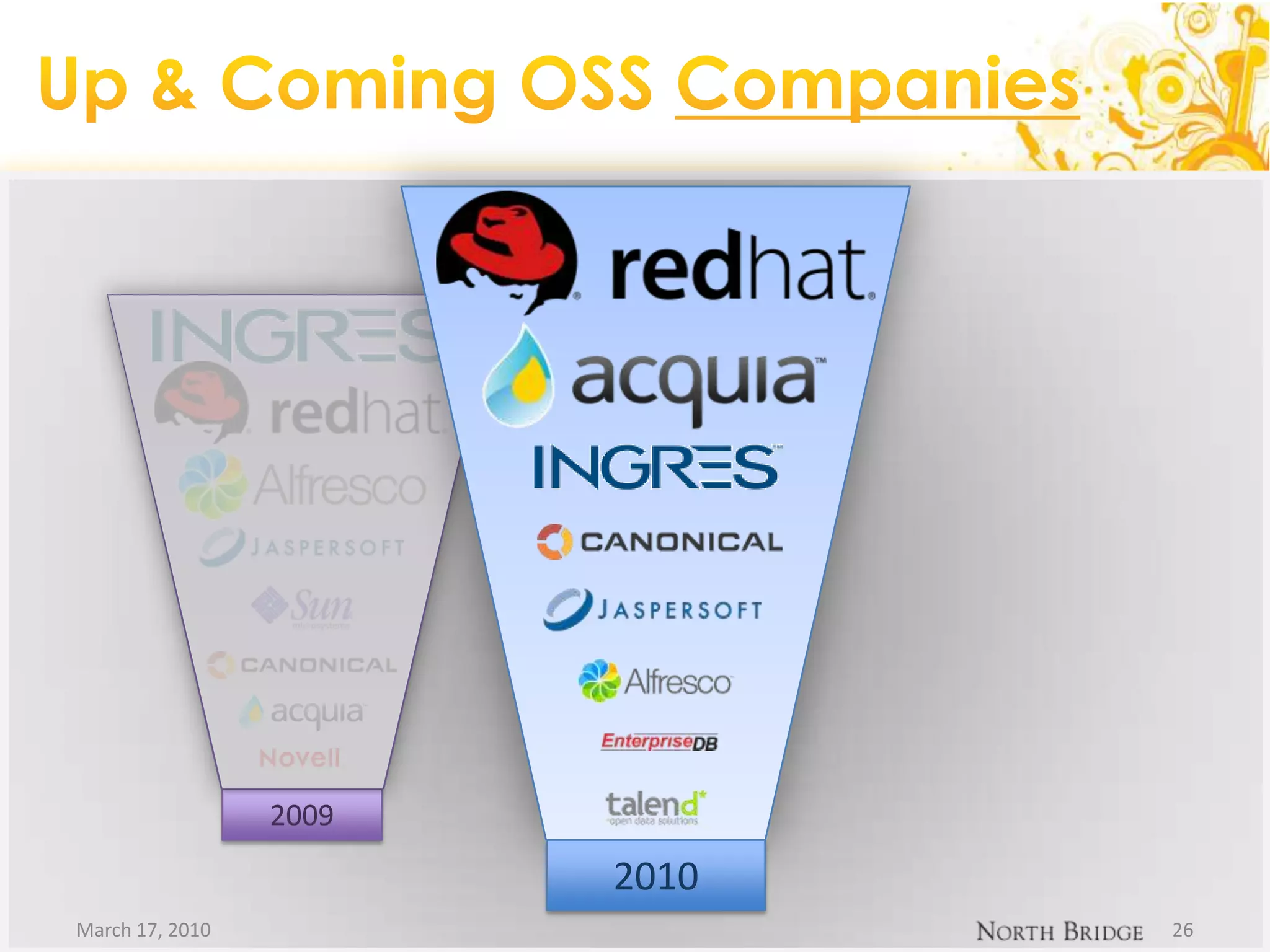

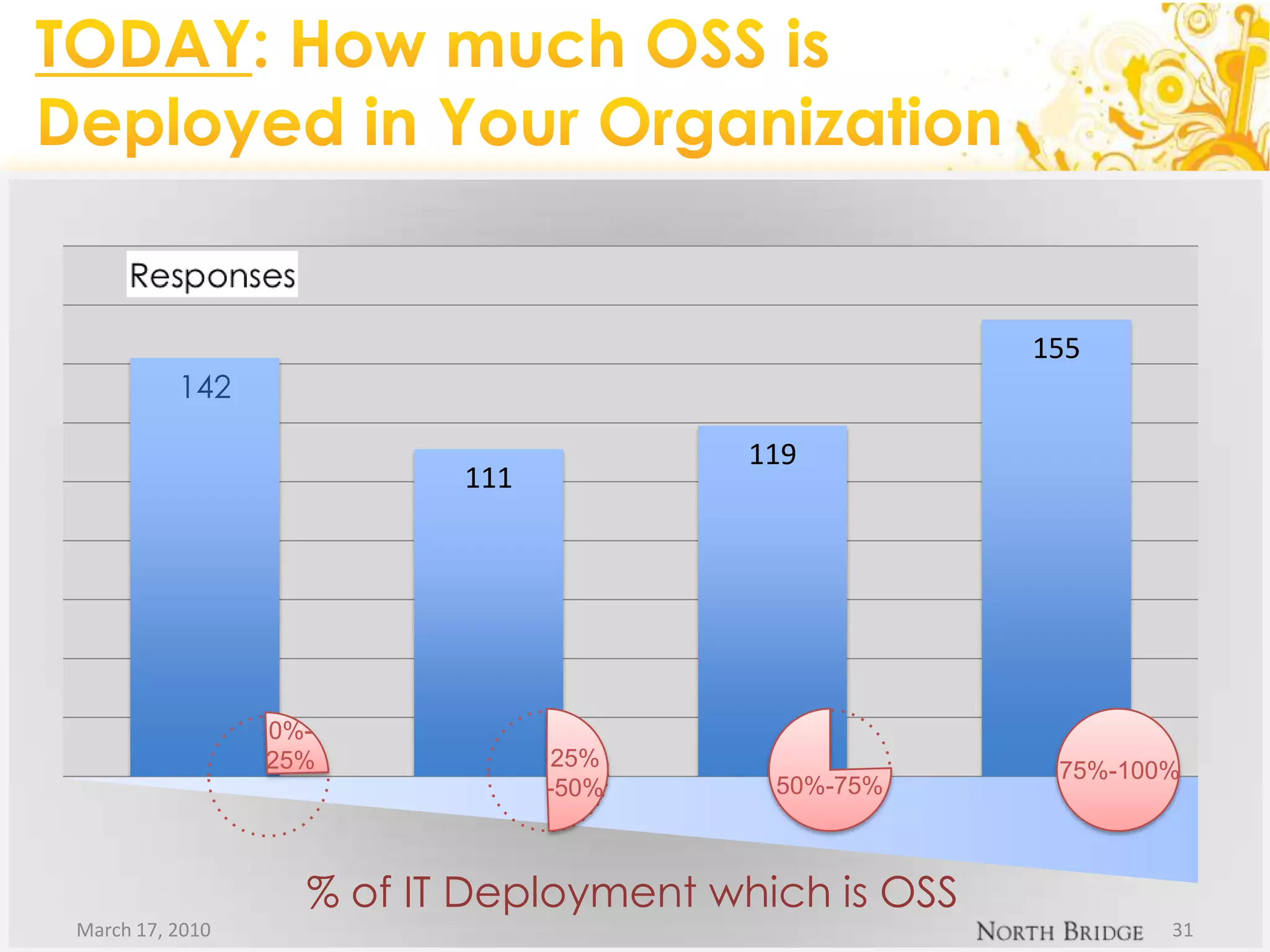

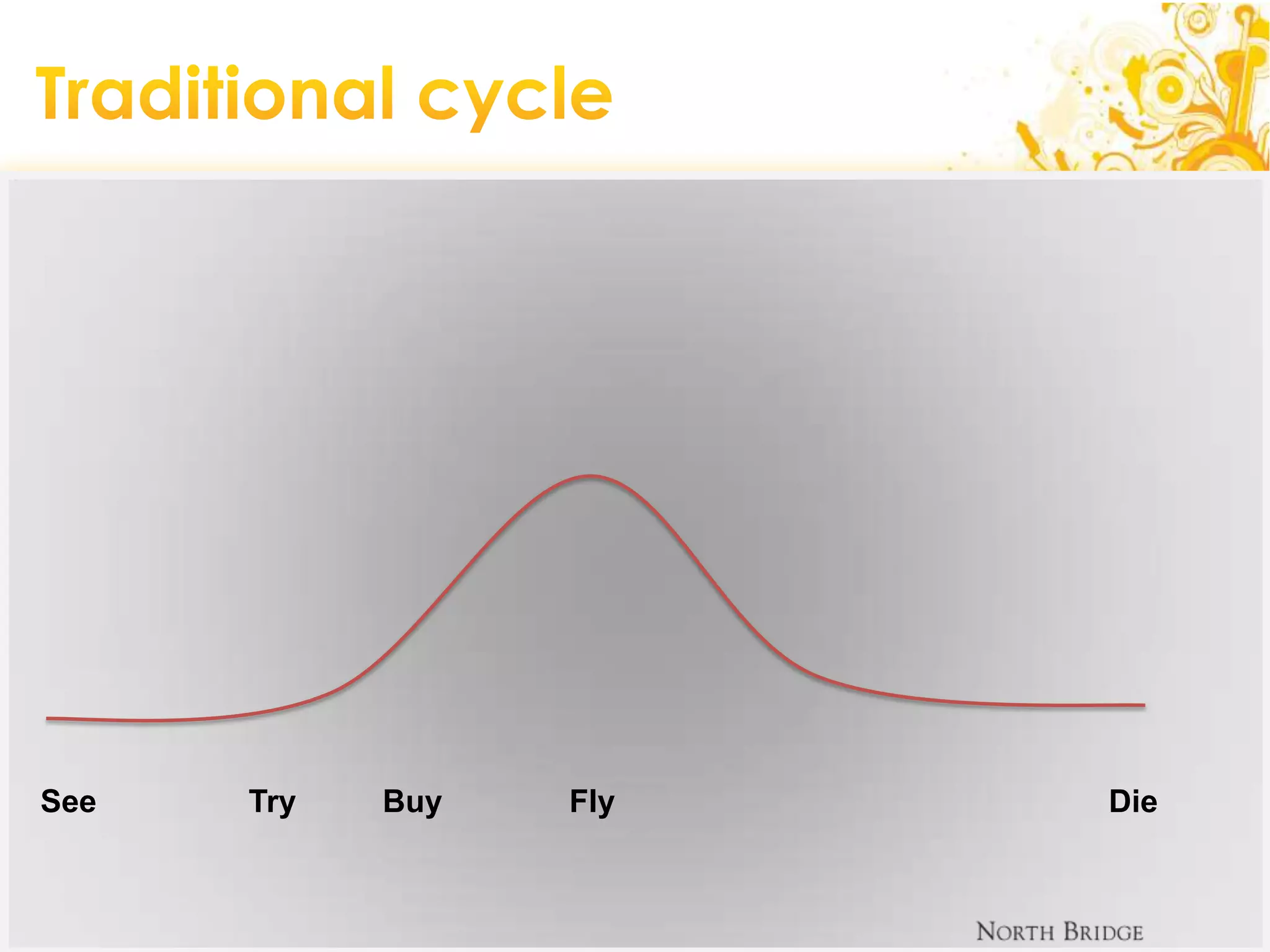

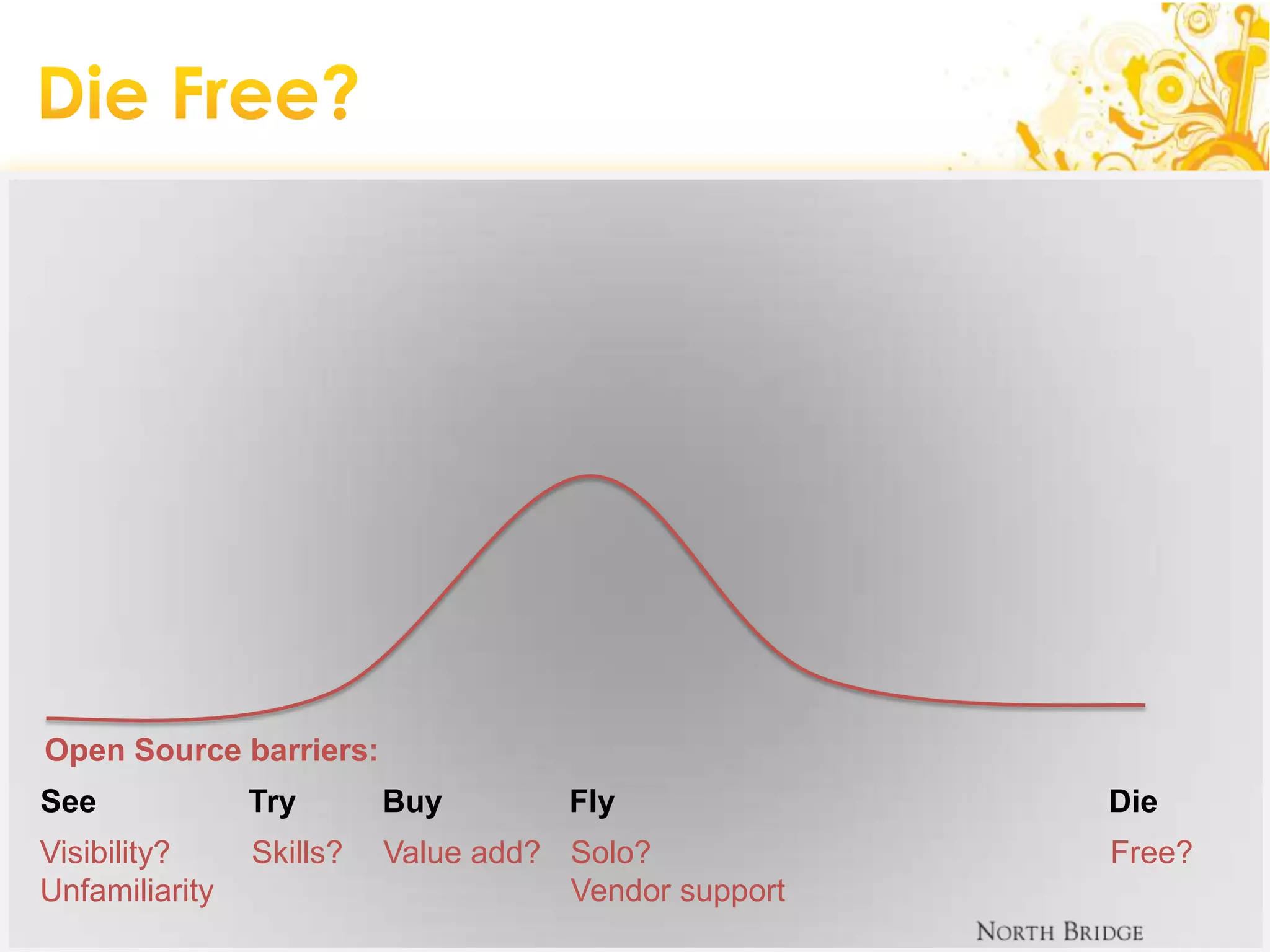

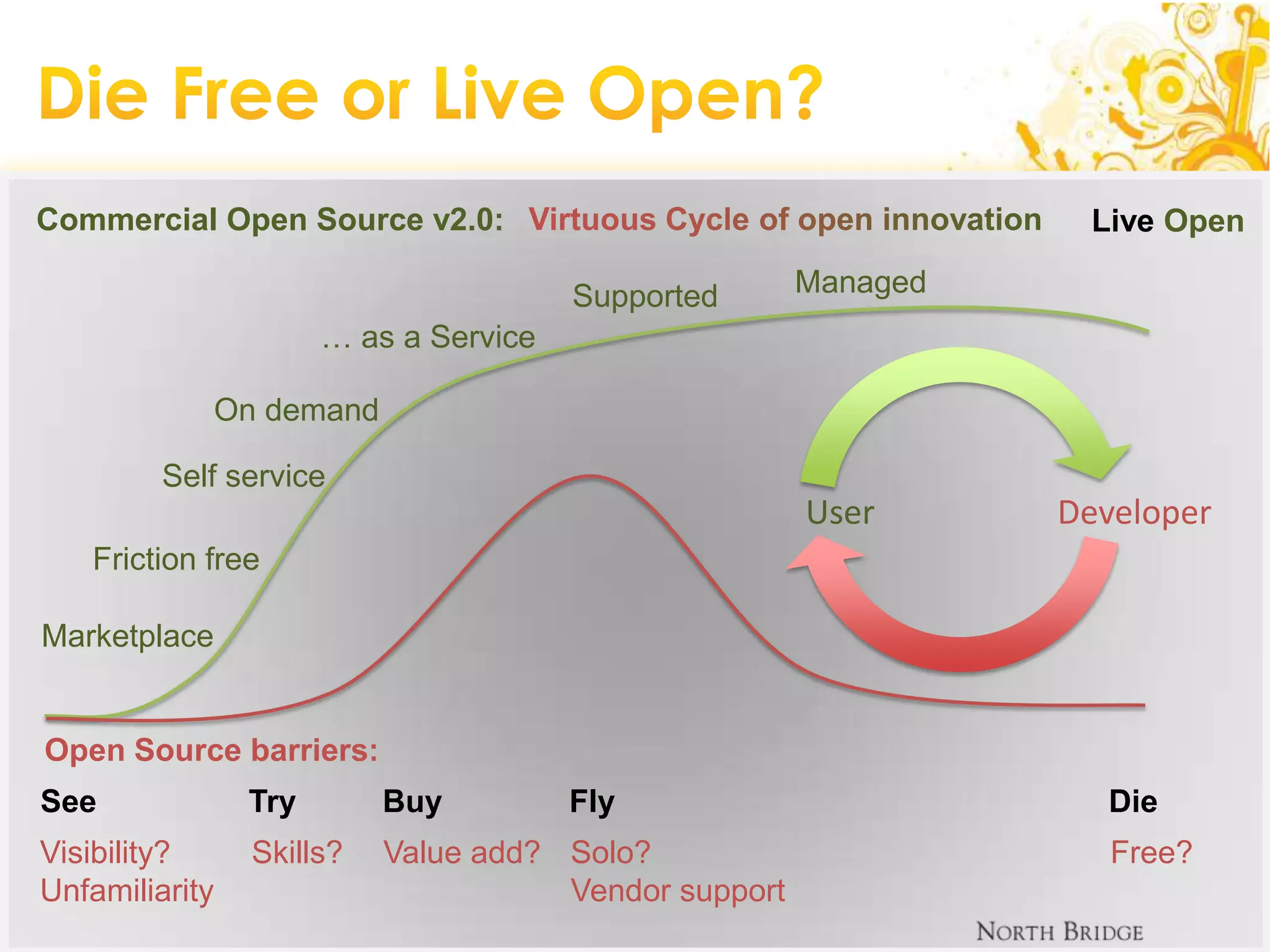

The document presents findings from the 4th annual leadership keynote on open source software (OSS), discussing industry survey results from 435 respondents. Key topics include barriers to OSS adoption, sectors susceptible to disruption, and strategies for OSS vendors. The summary highlights trends in OSS deployment and the economic factors influencing its adoption in both private and public sectors.