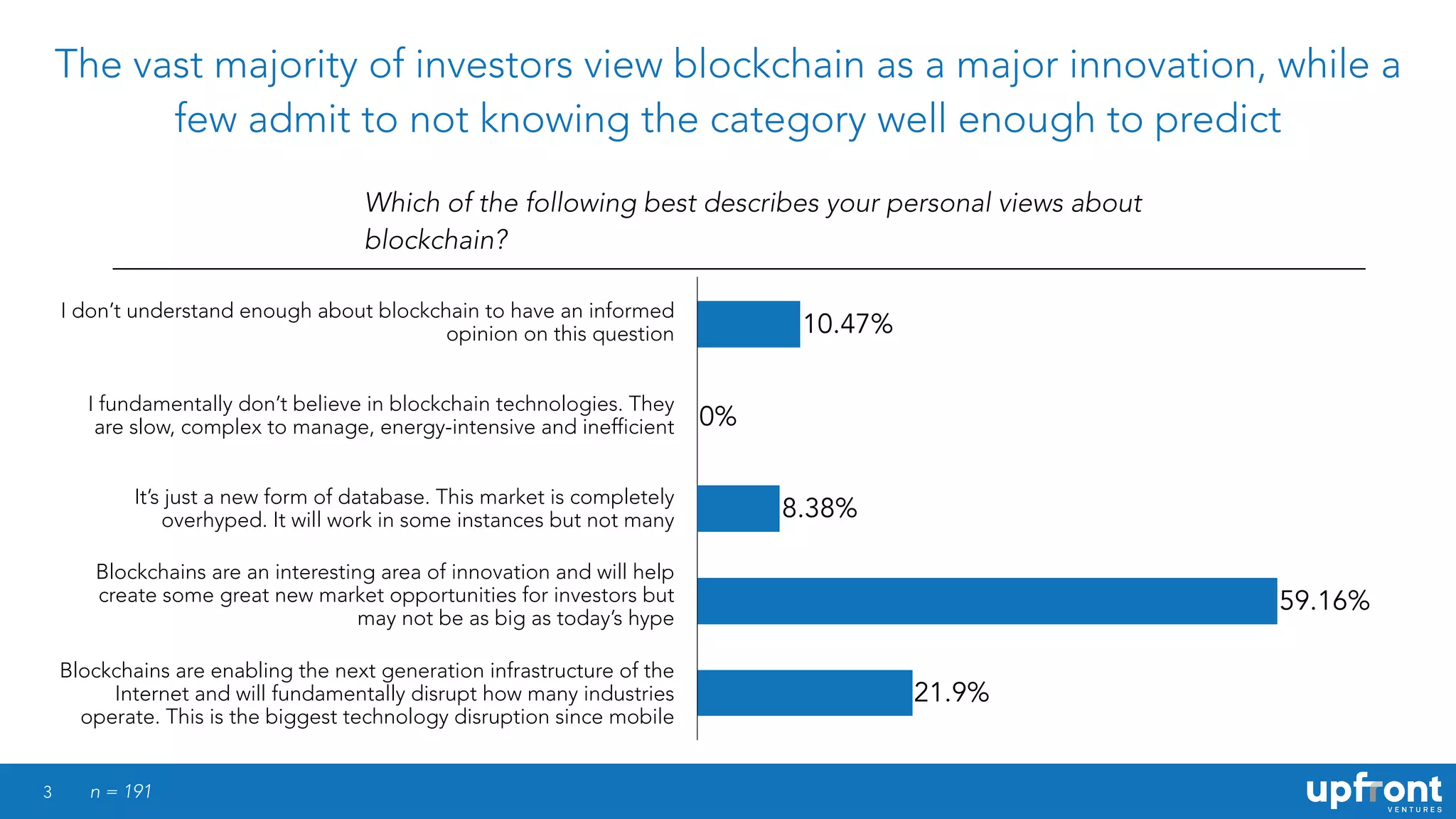

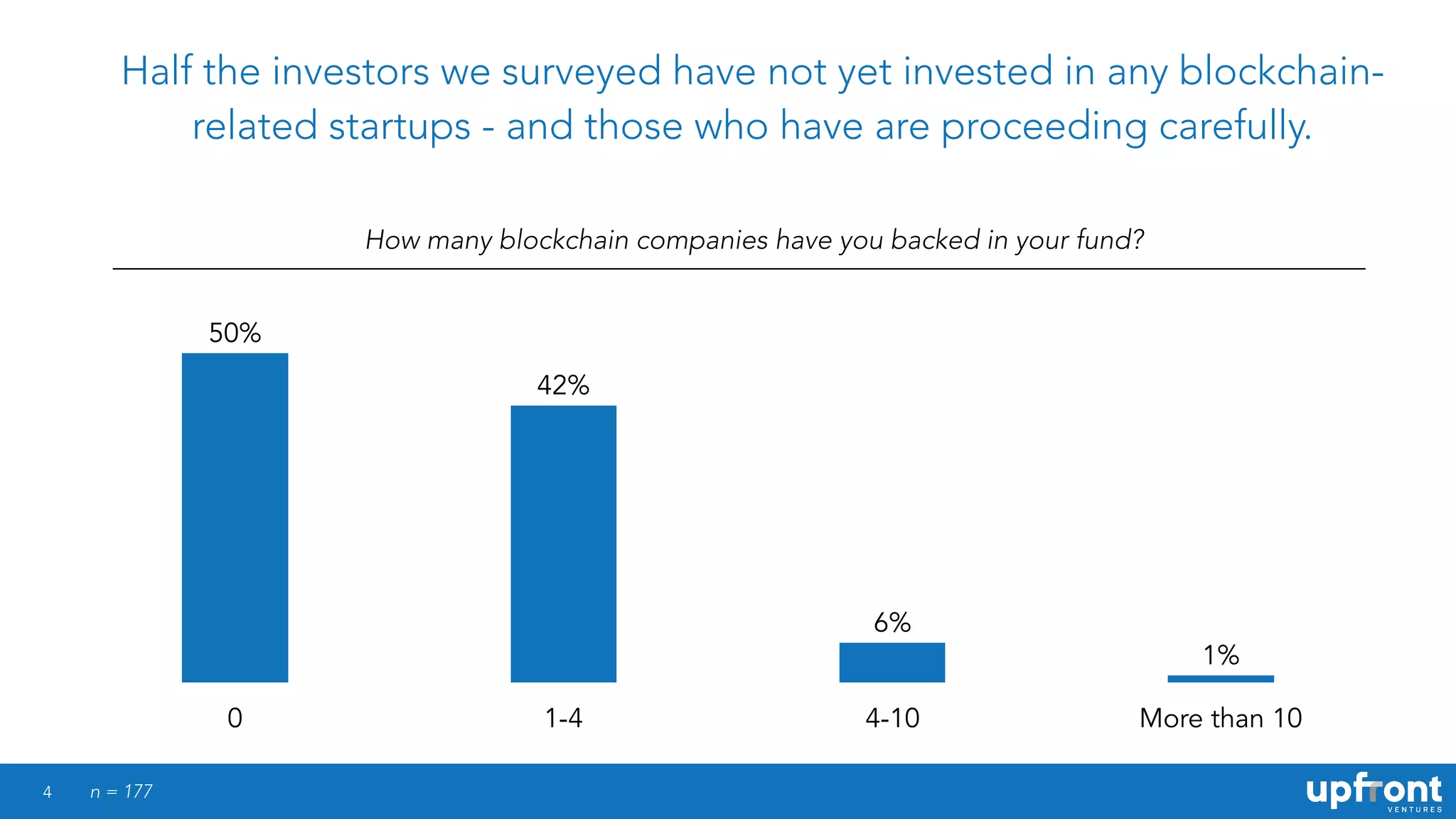

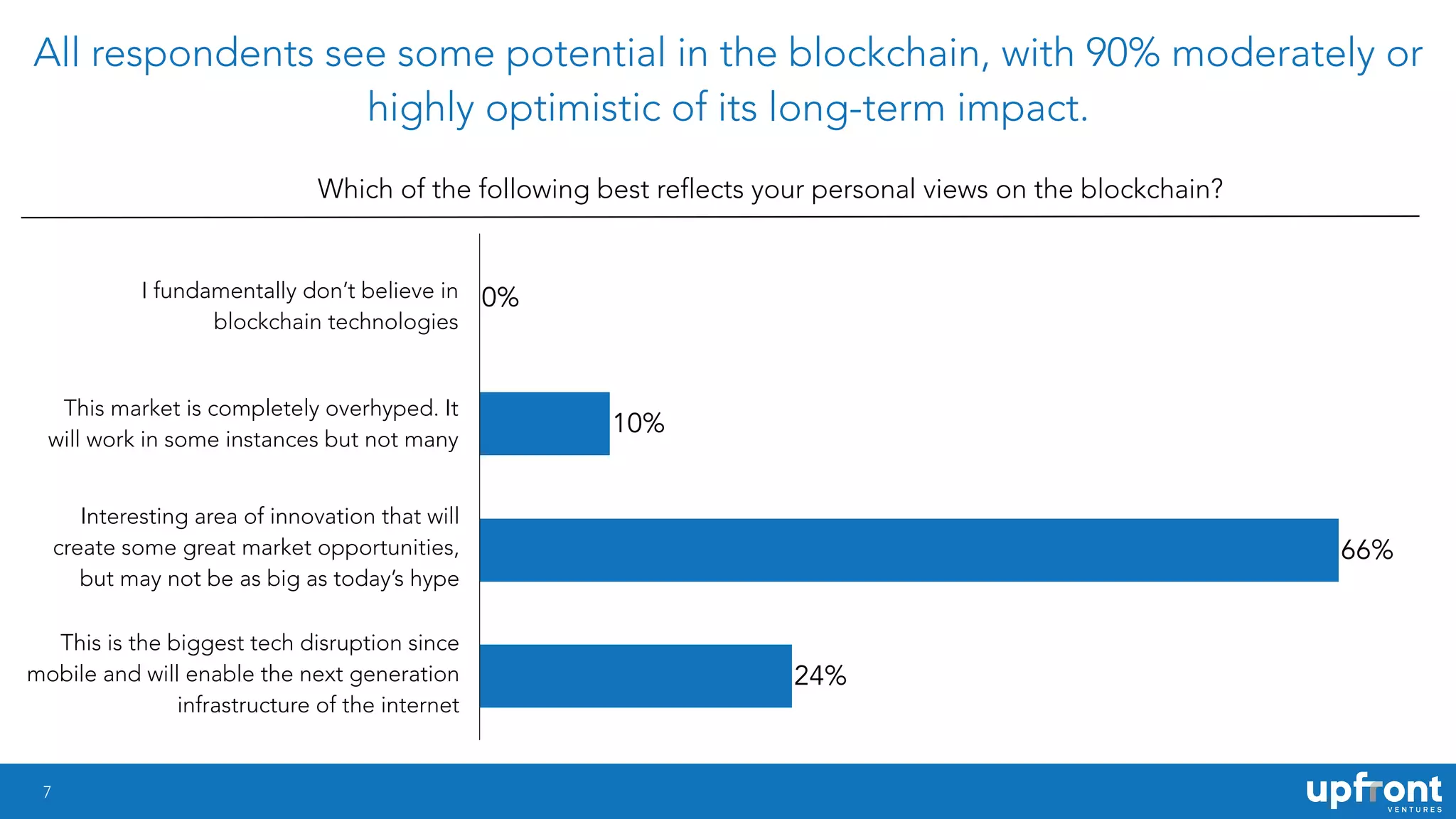

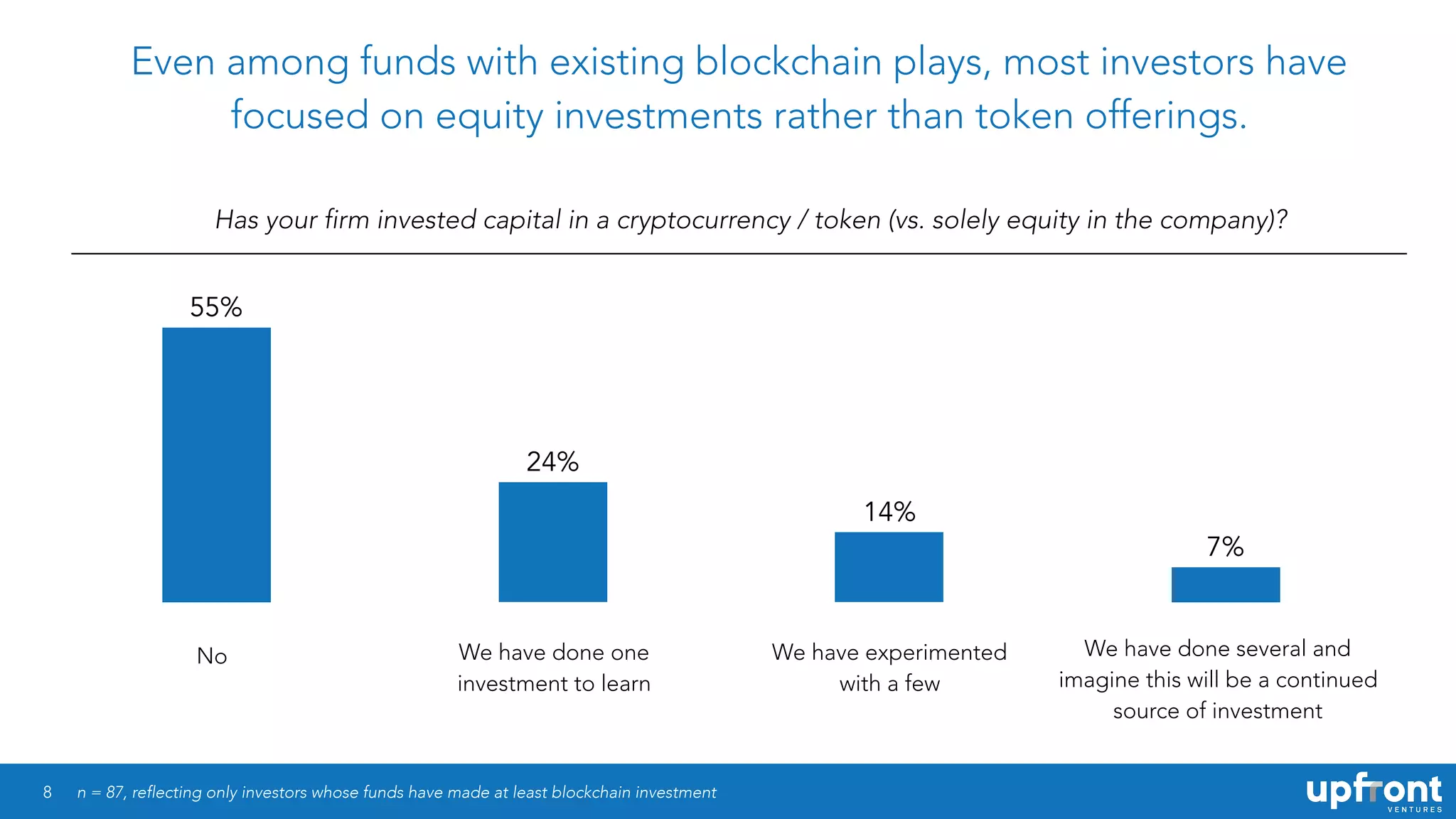

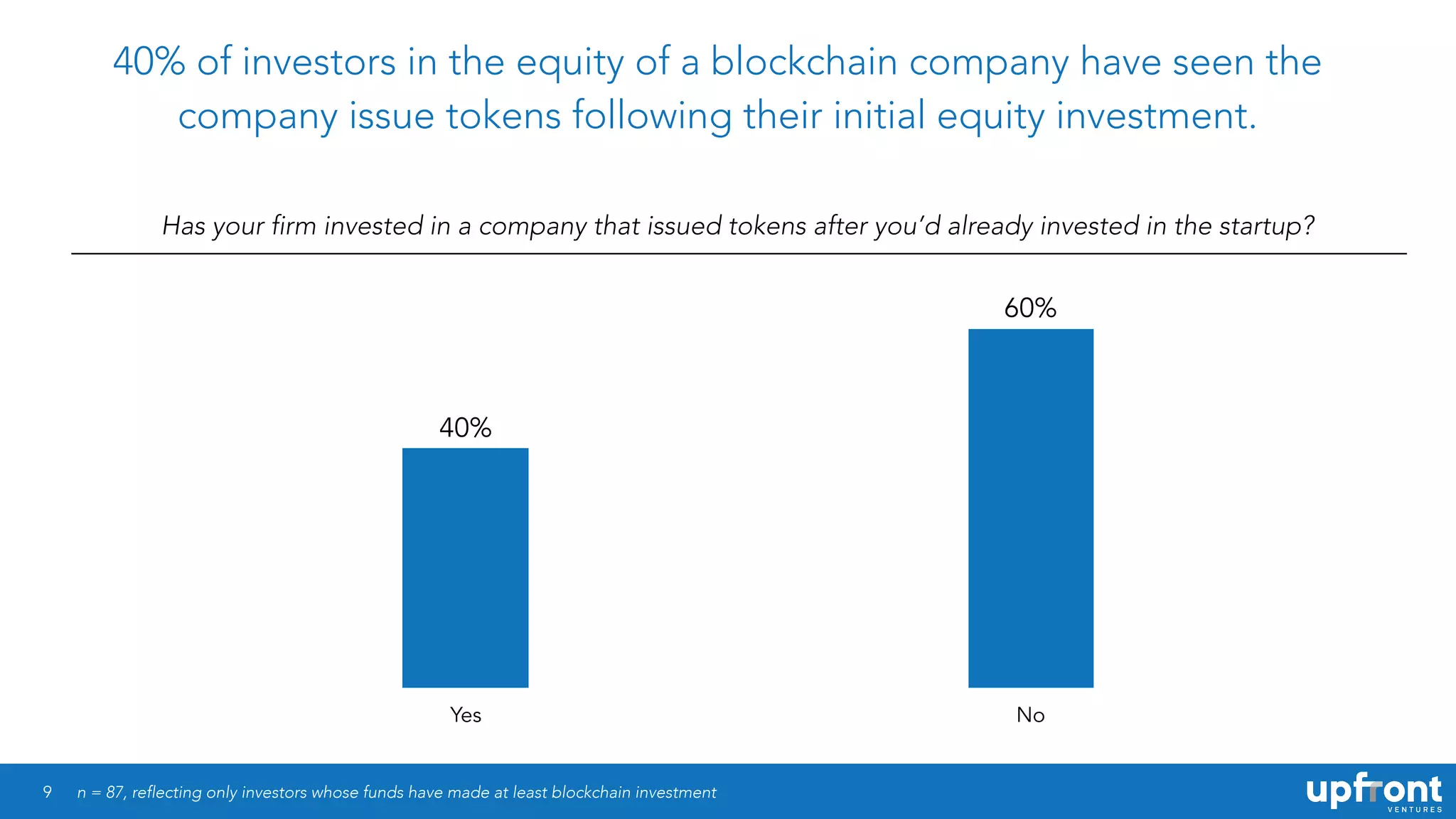

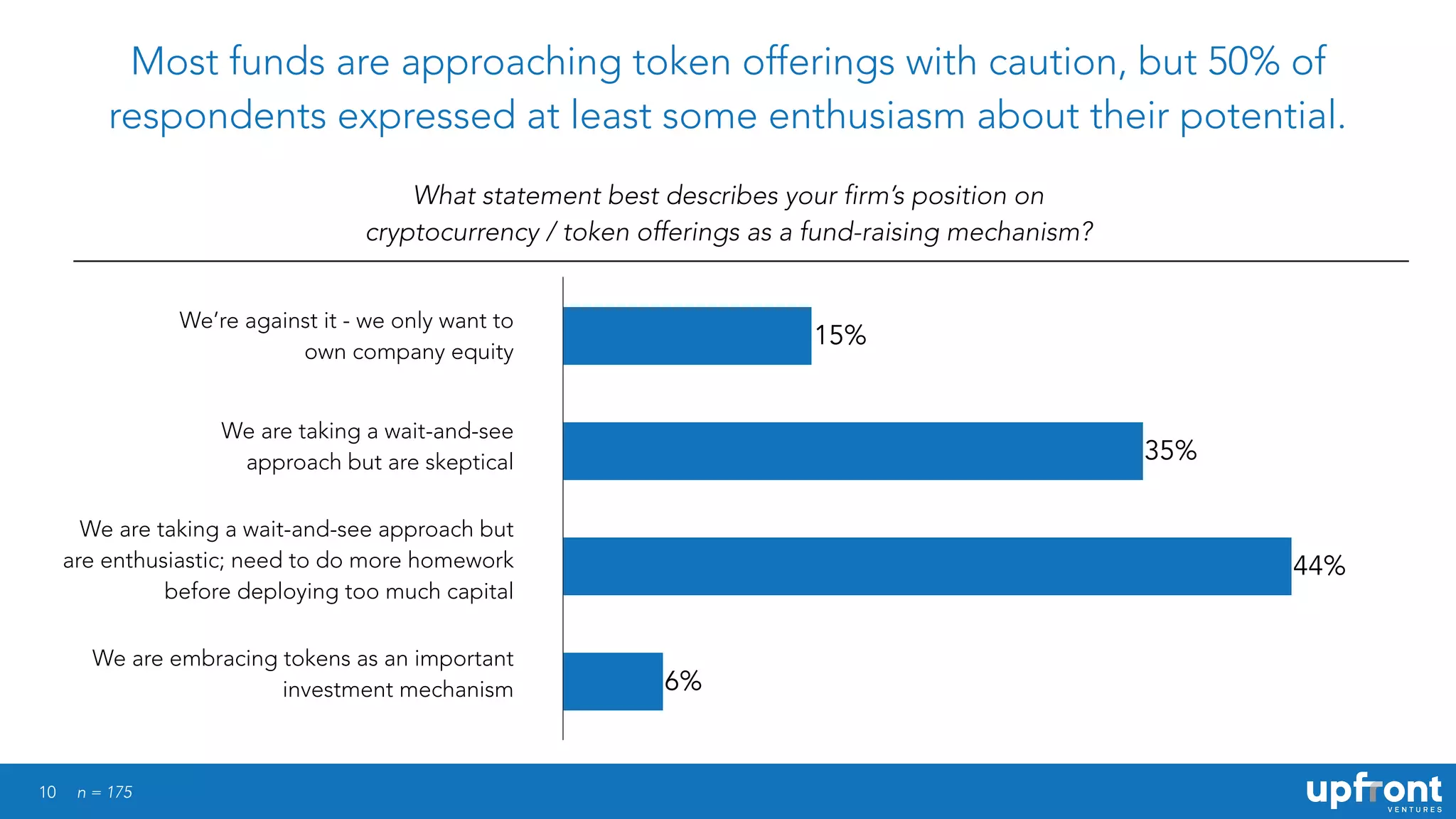

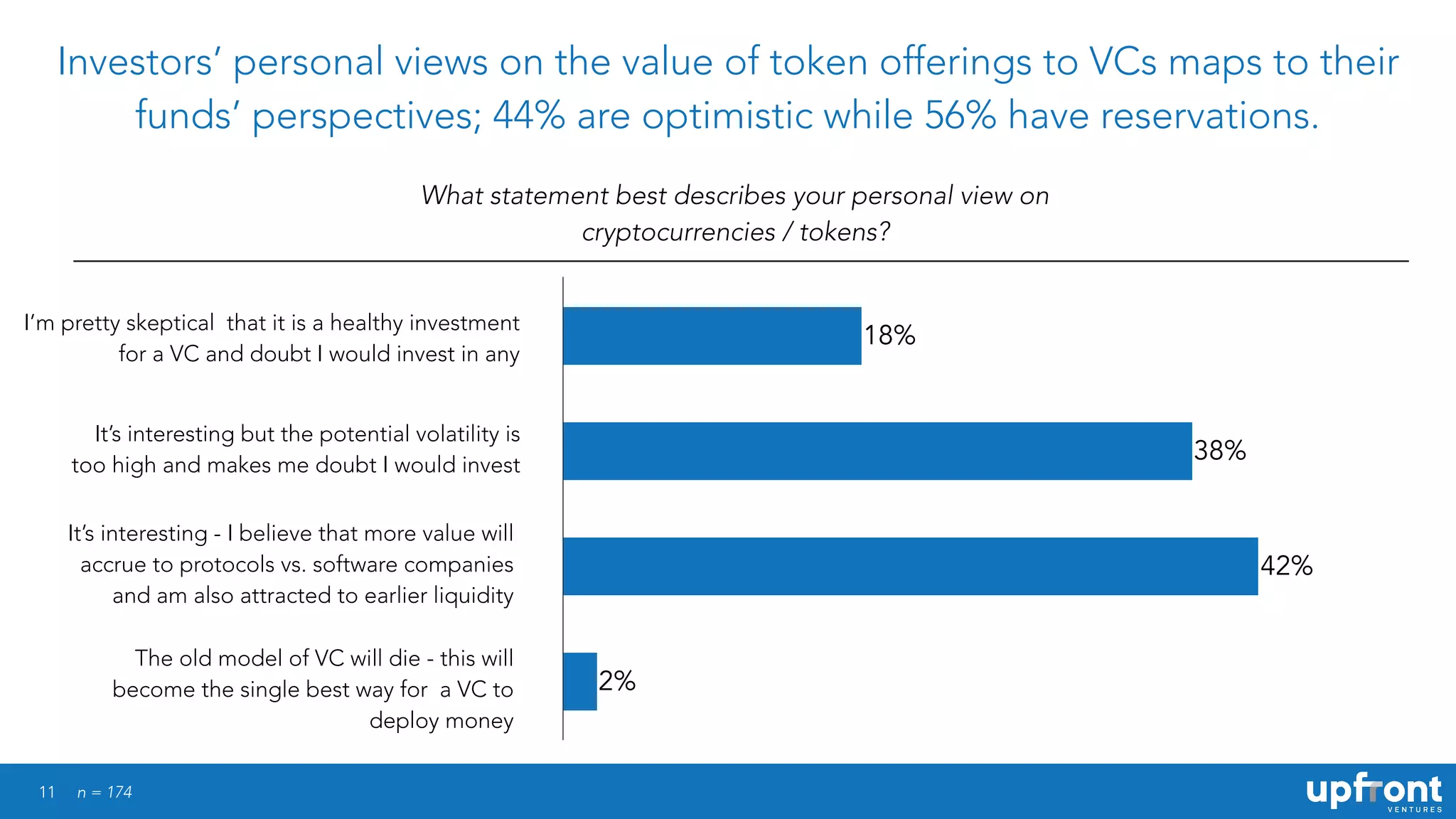

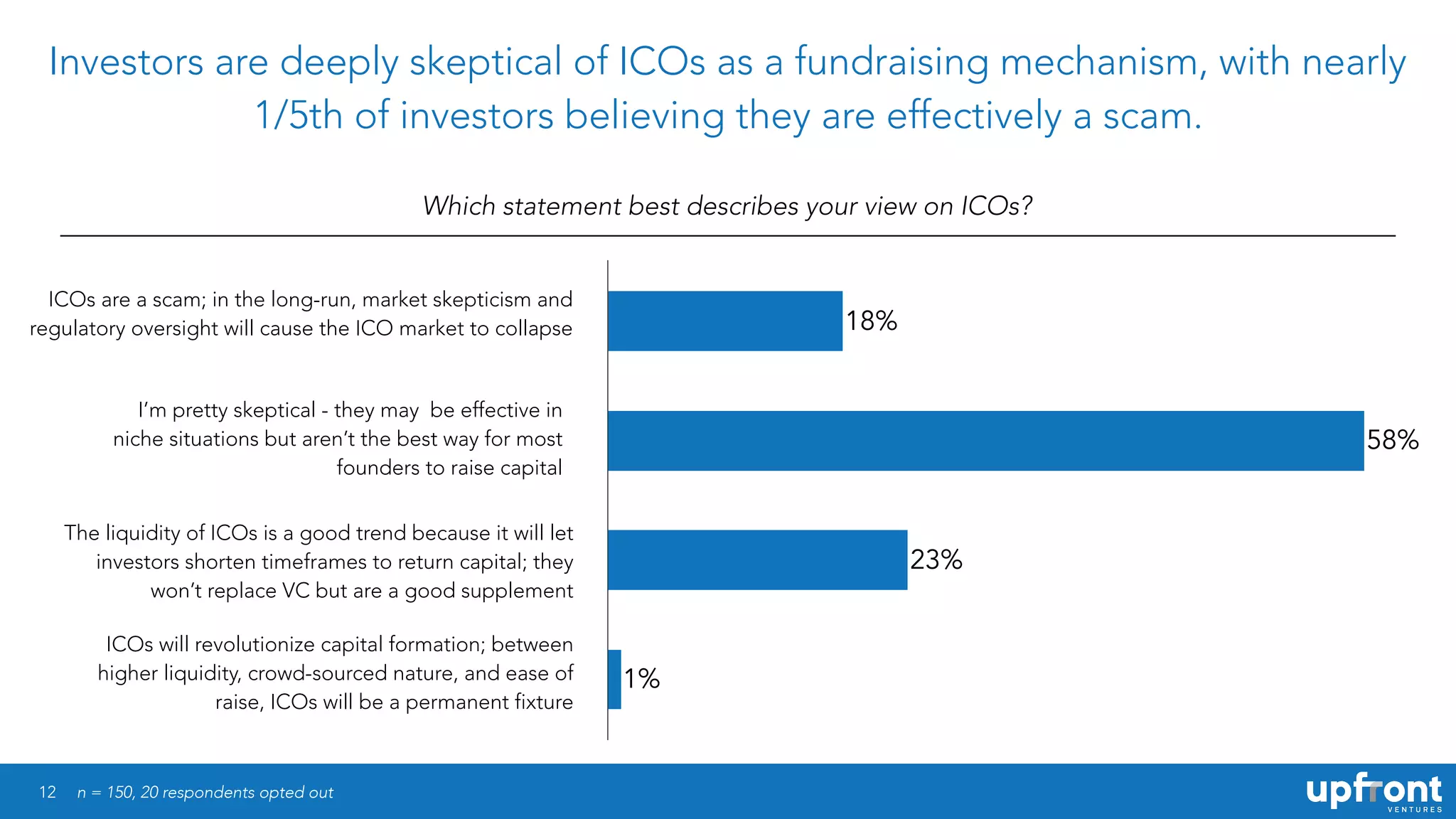

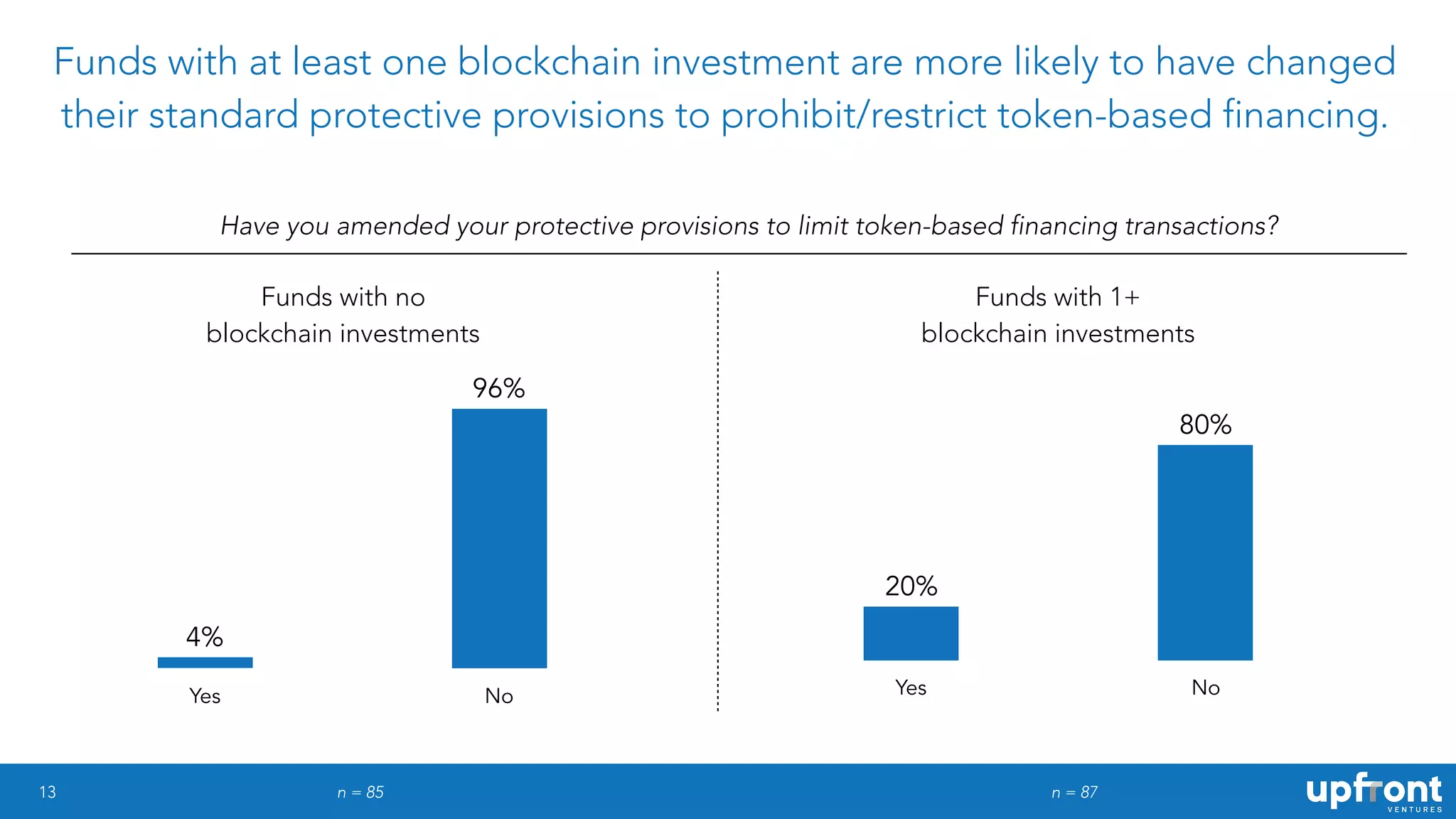

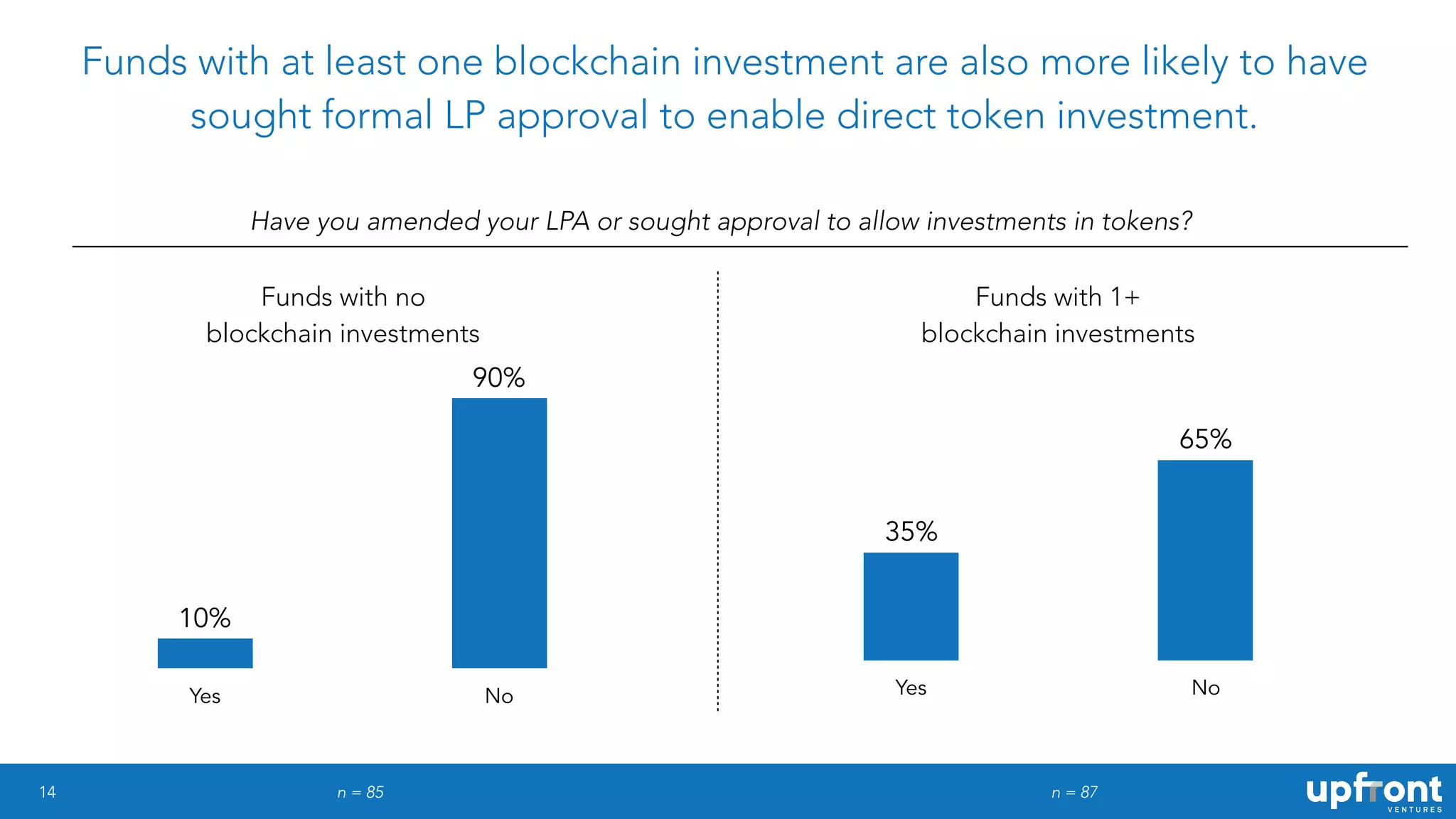

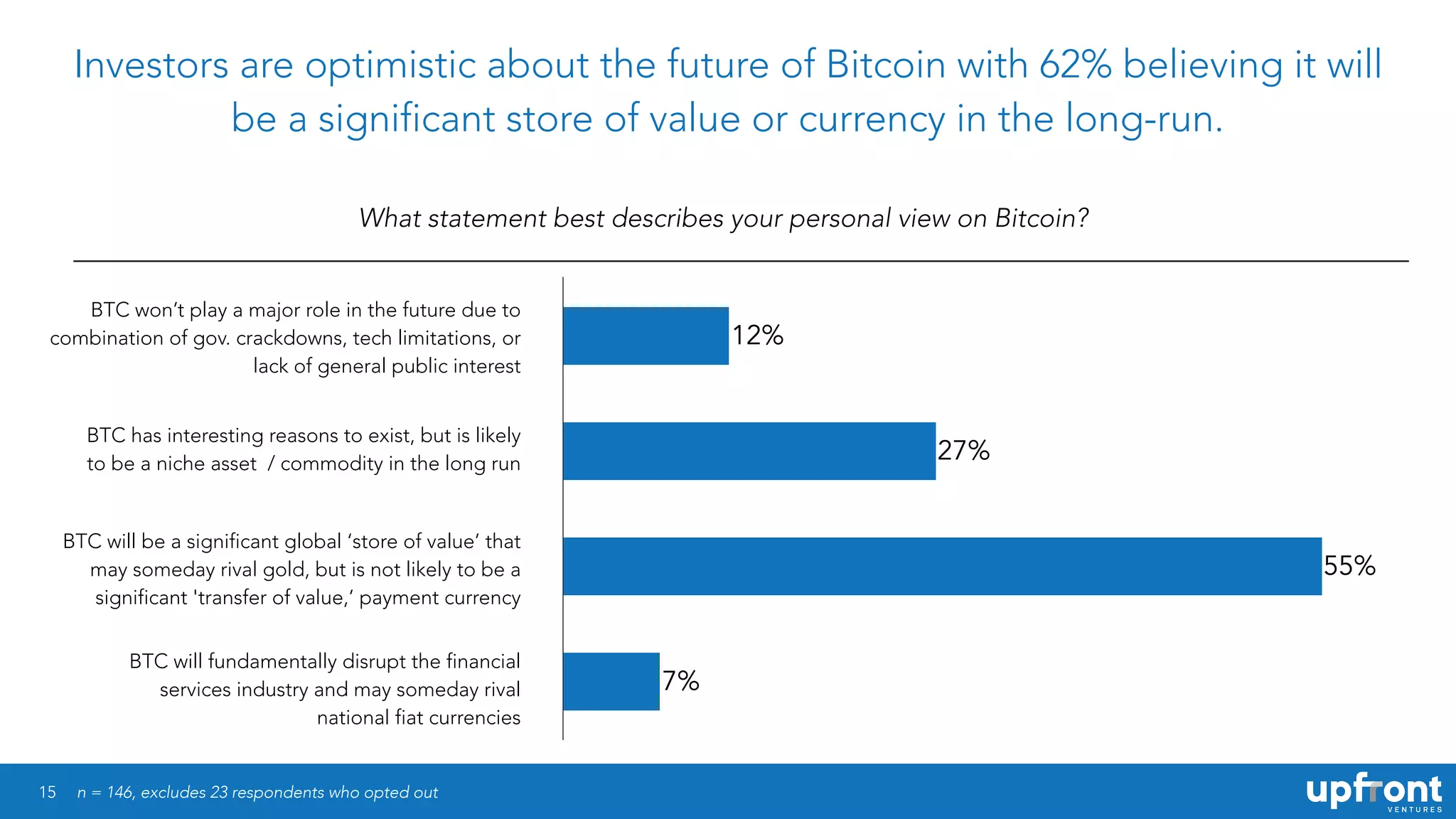

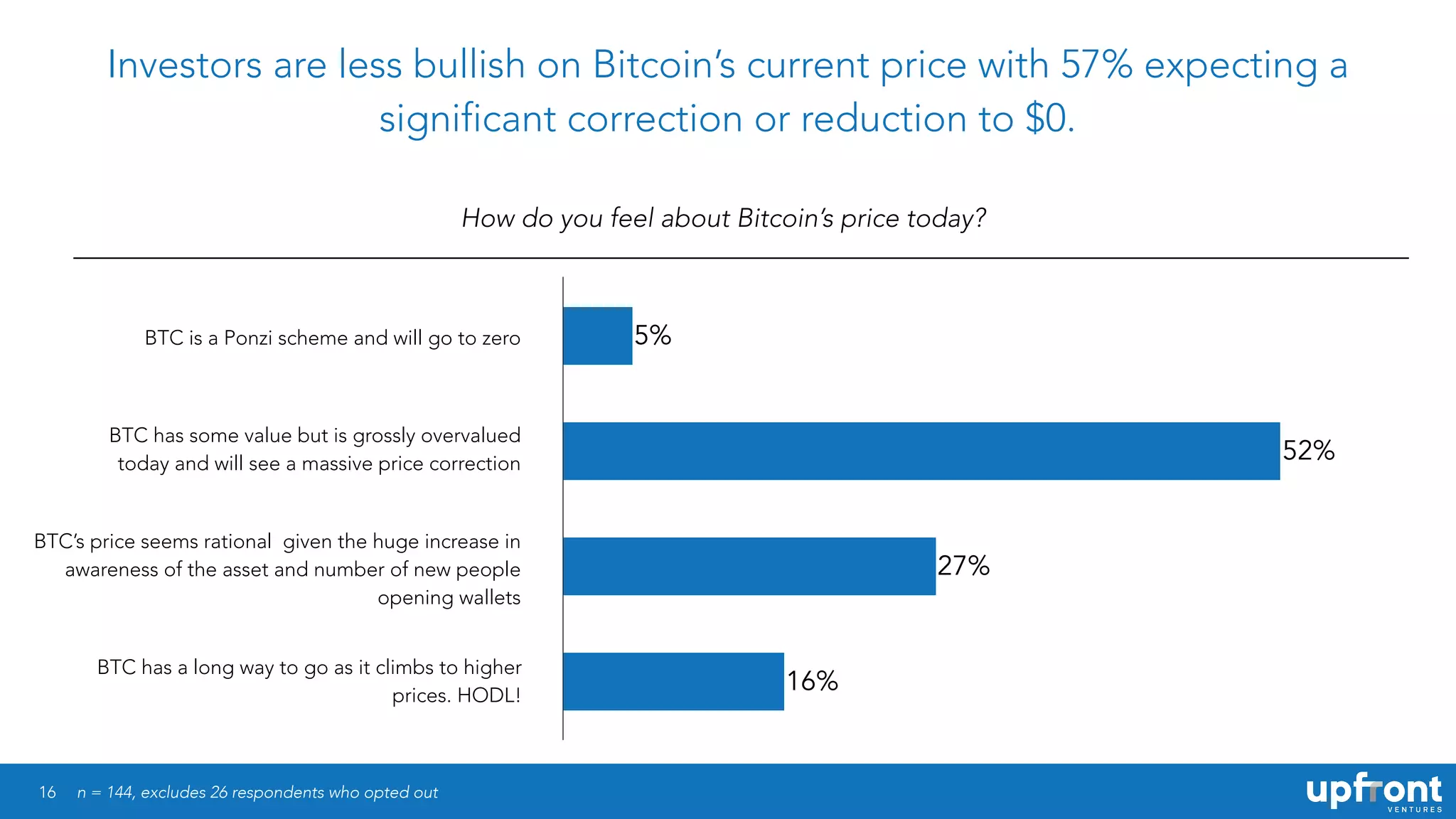

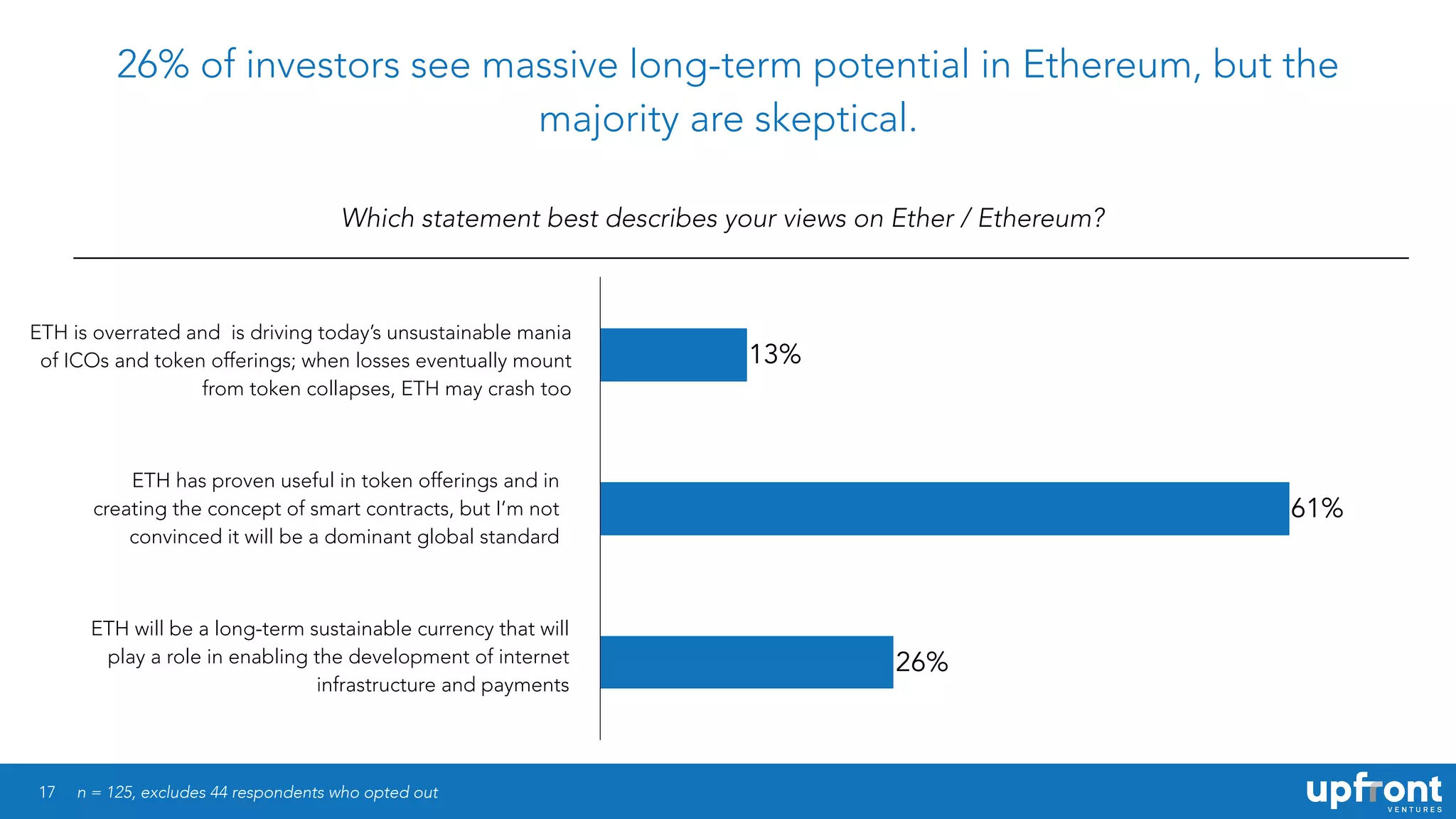

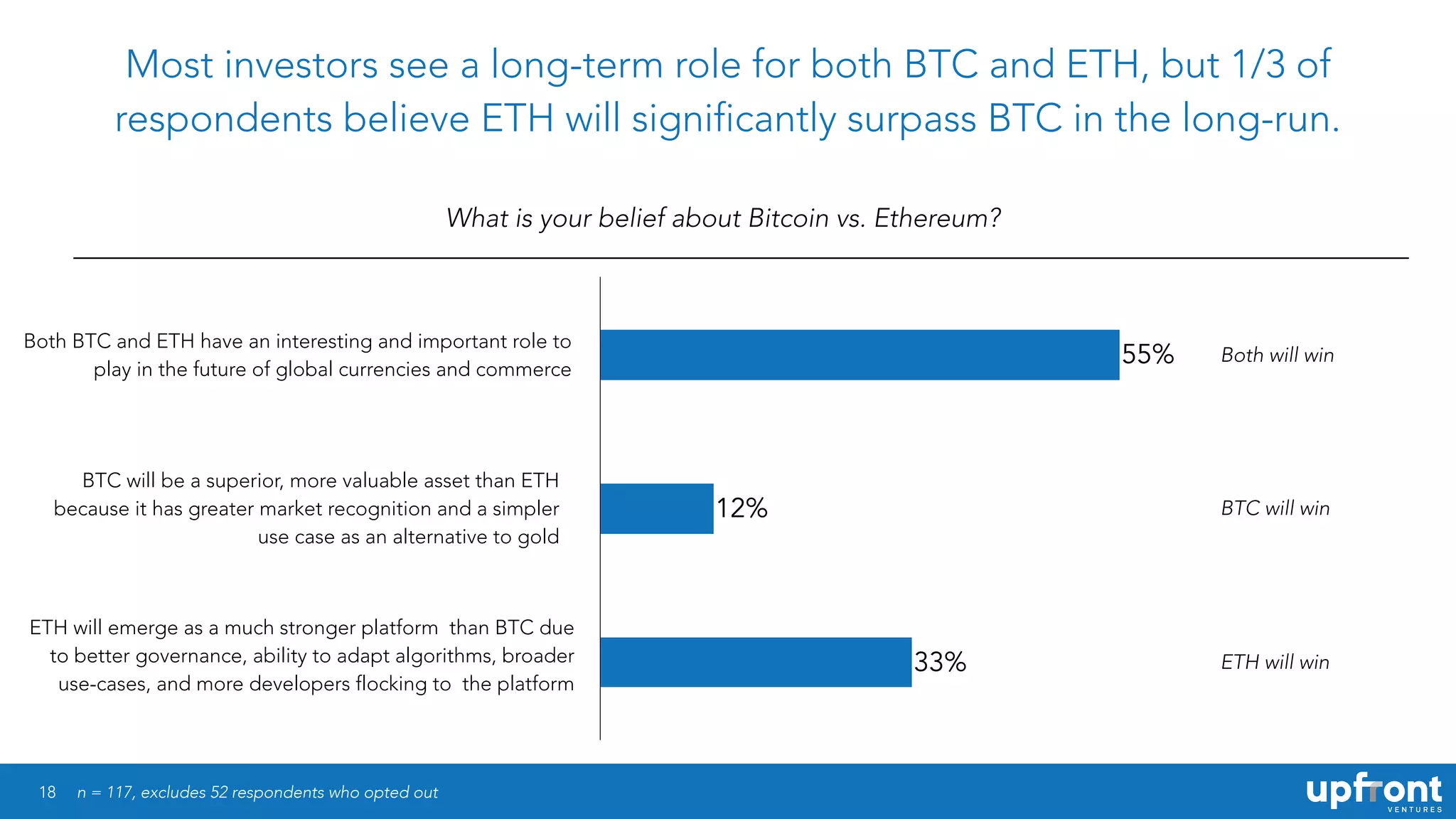

The 2018 investor survey reveals that the majority of respondents view blockchain as a significant innovation, with 90% expressing optimism about its long-term impact. A notable number of investors have not yet invested in blockchain startups, and those who have tend to approach the market cautiously, particularly regarding token offerings. While some see potential in Bitcoin and Ethereum, skepticism about ICOs and token-based financing remains prevalent among investors.