Here are the answers to the practice questions:

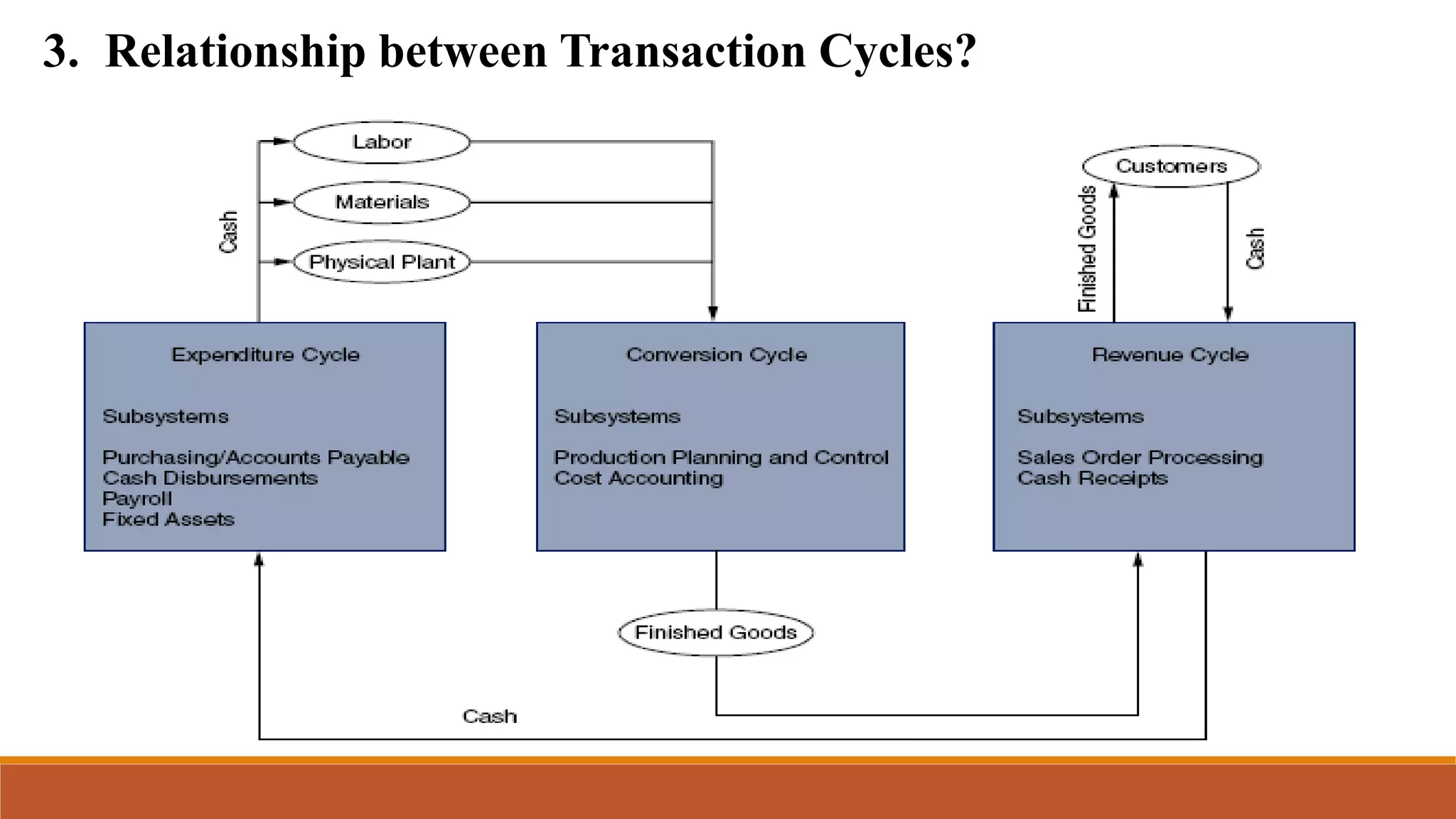

1. The three transaction cycles that exist in all businesses are:

- Expenditure cycle

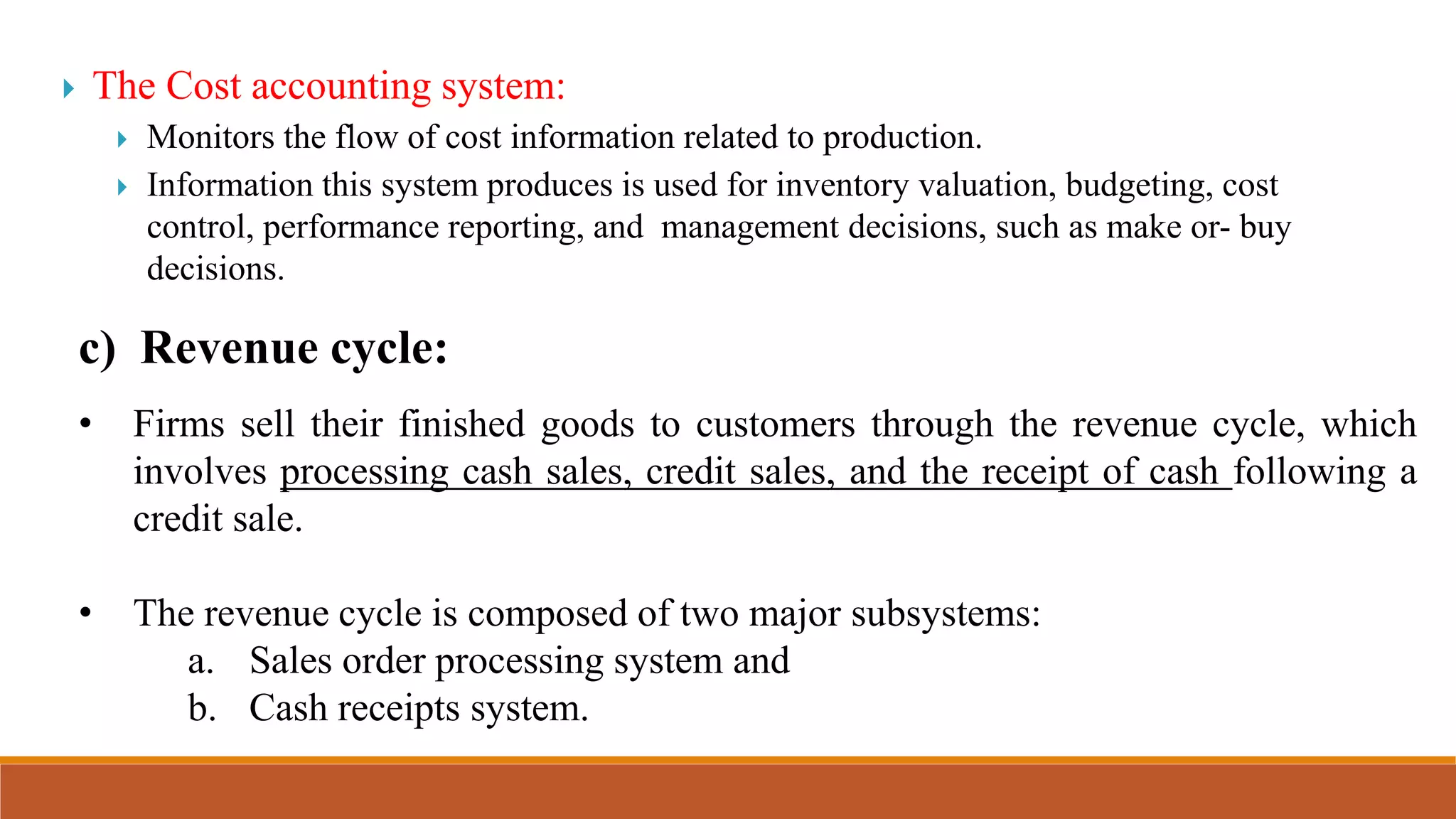

- Conversion cycle

- Revenue cycle

2. The major subsystems of the expenditure cycle are:

- Purchases/accounts payable system

- Cash disbursements system

- Payroll system

- Fixed asset system

3. The physical component of the expenditure cycle is the acquisition of goods or services. The financial component is the cash disbursement to the supplier, which occurs at a later point after the physical receipt of goods/services.

4. A general journal is used to record non-recurring or infrequent transactions. Journal vouchers