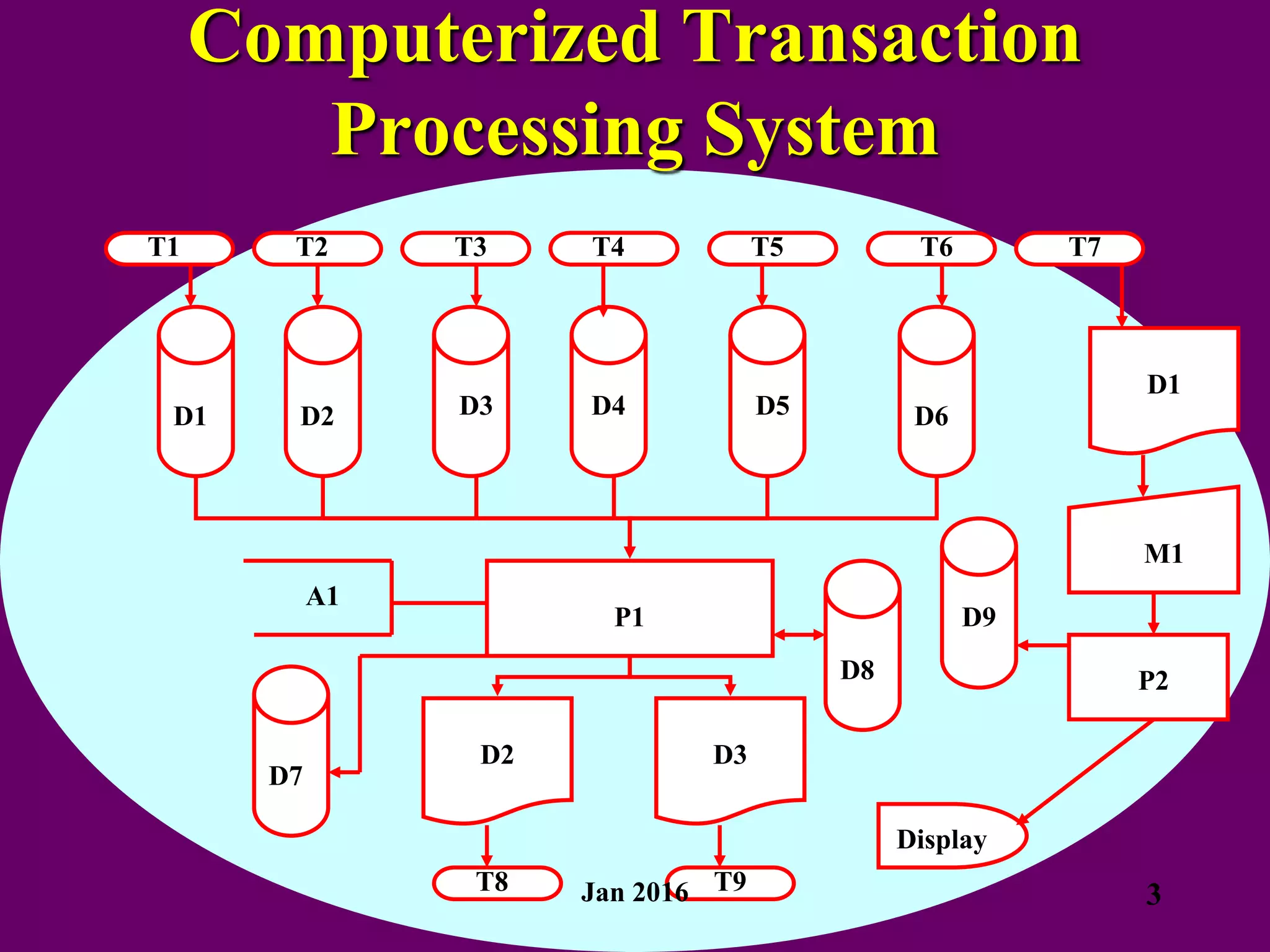

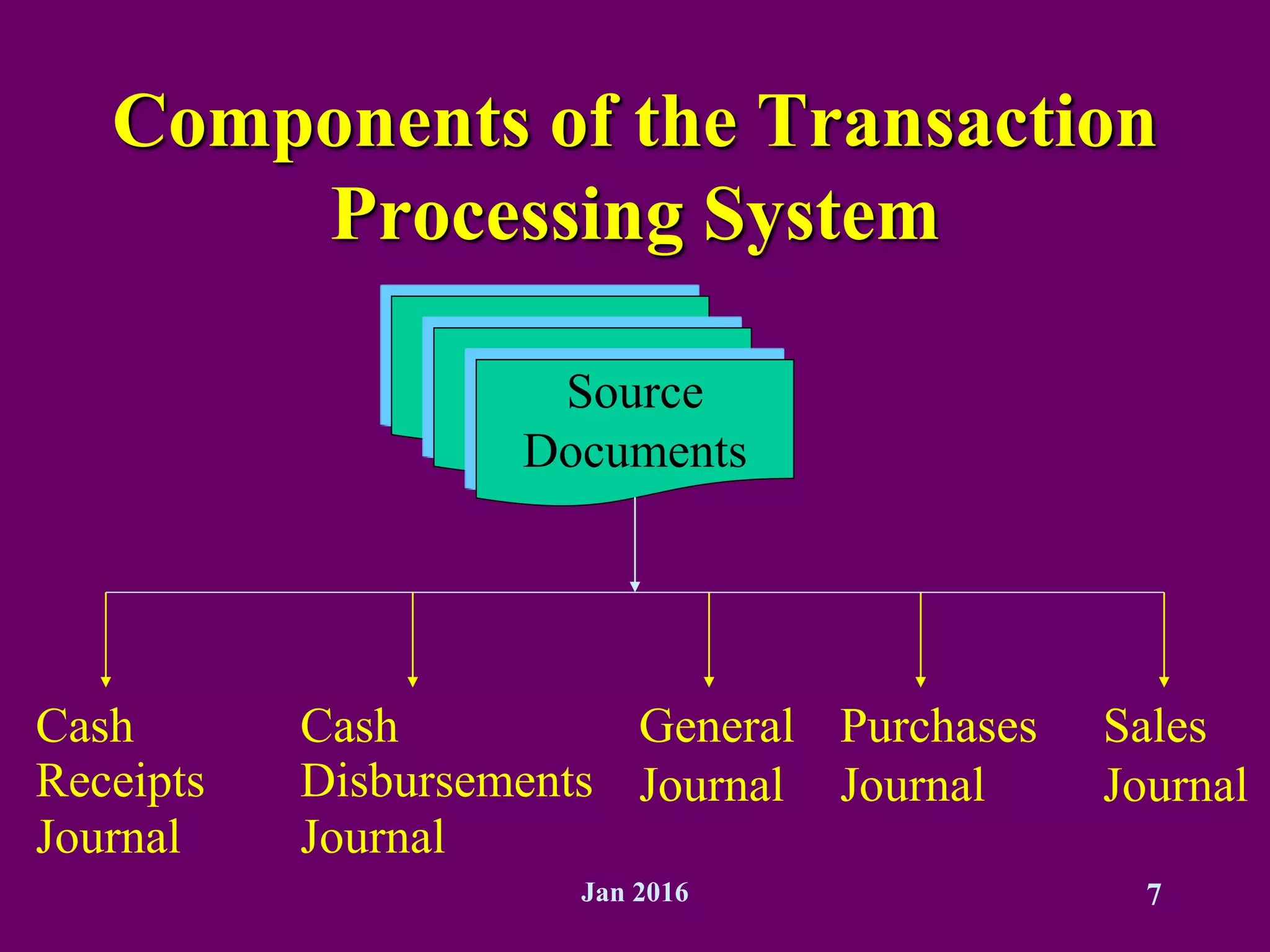

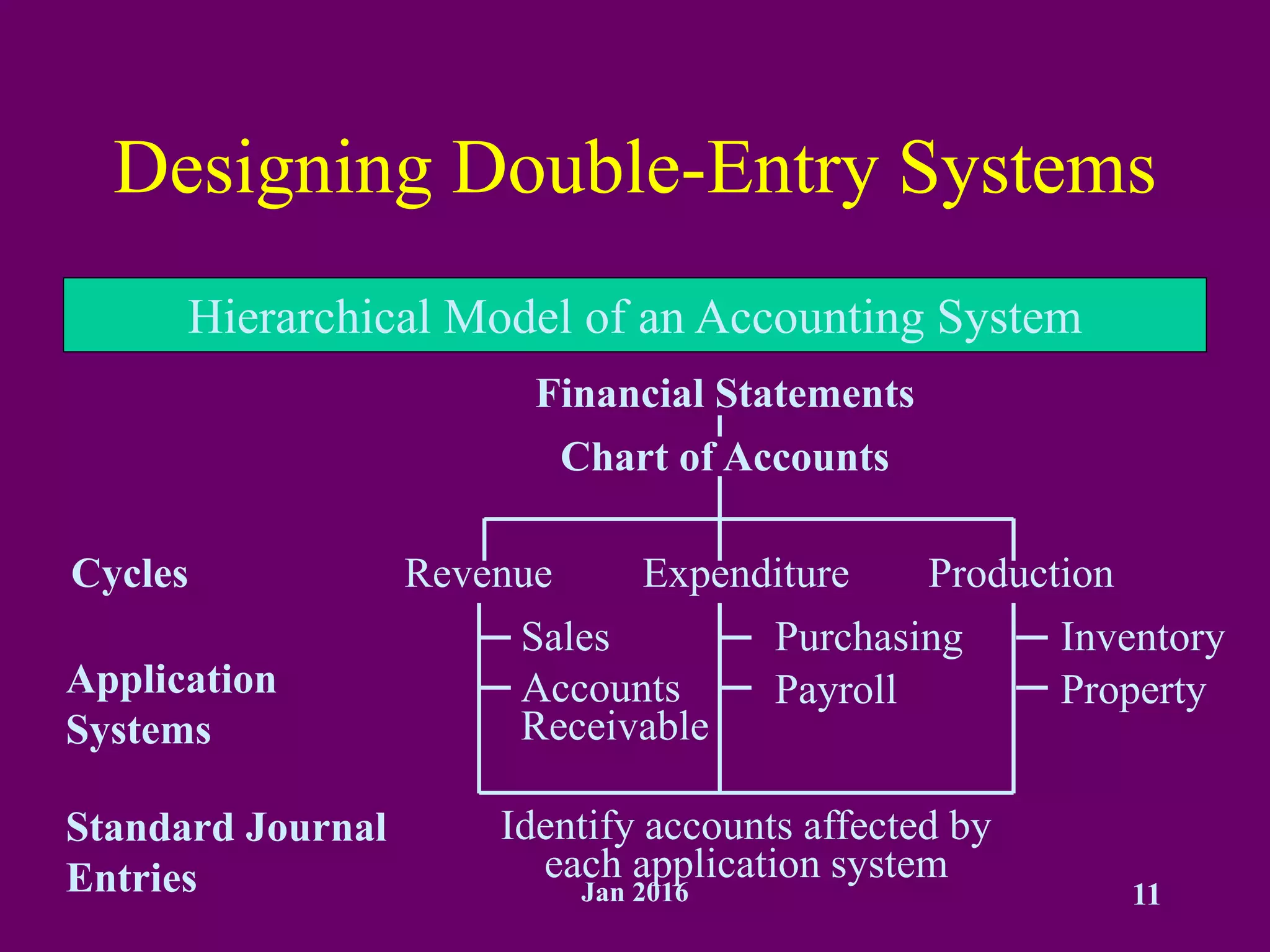

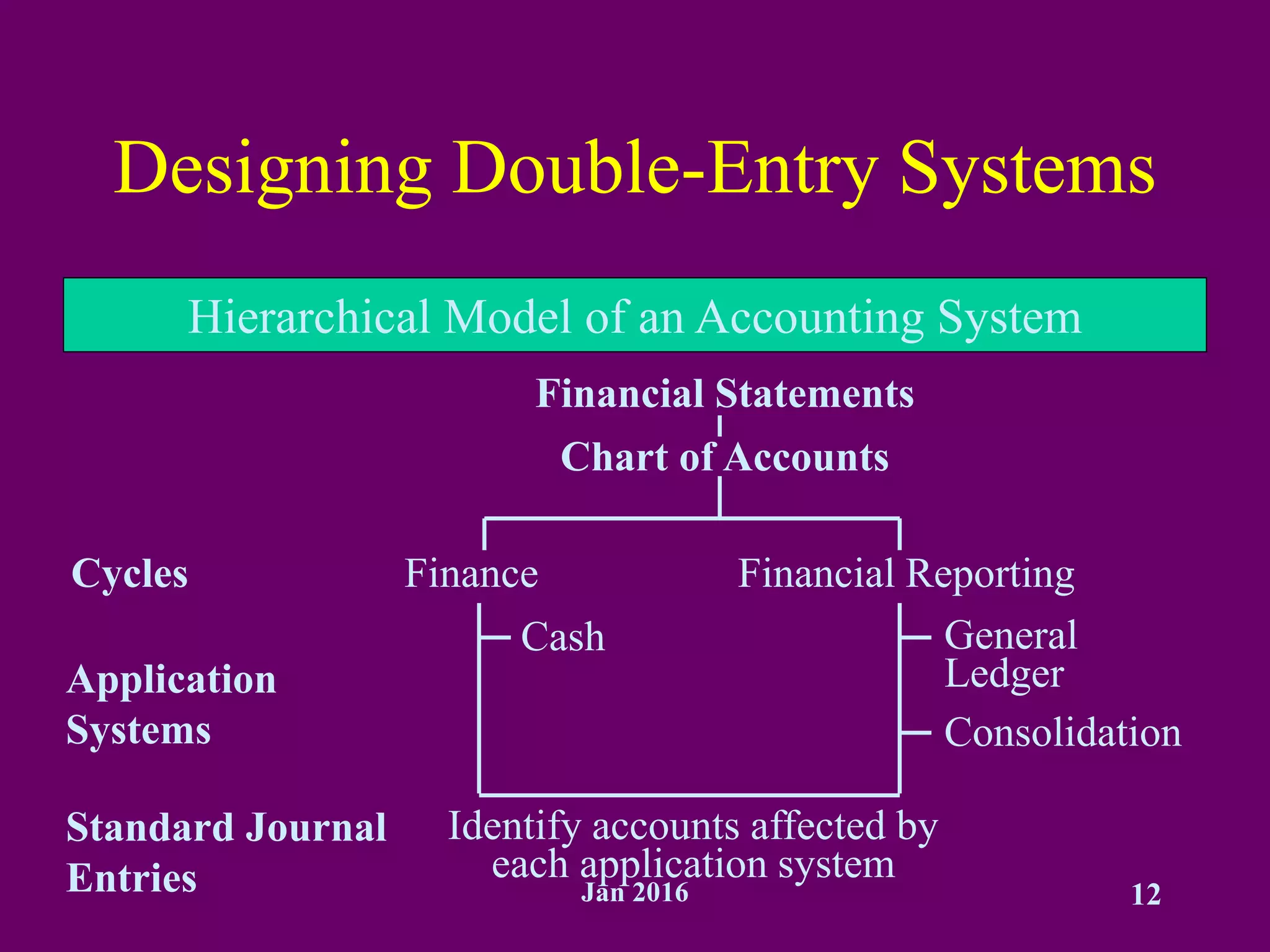

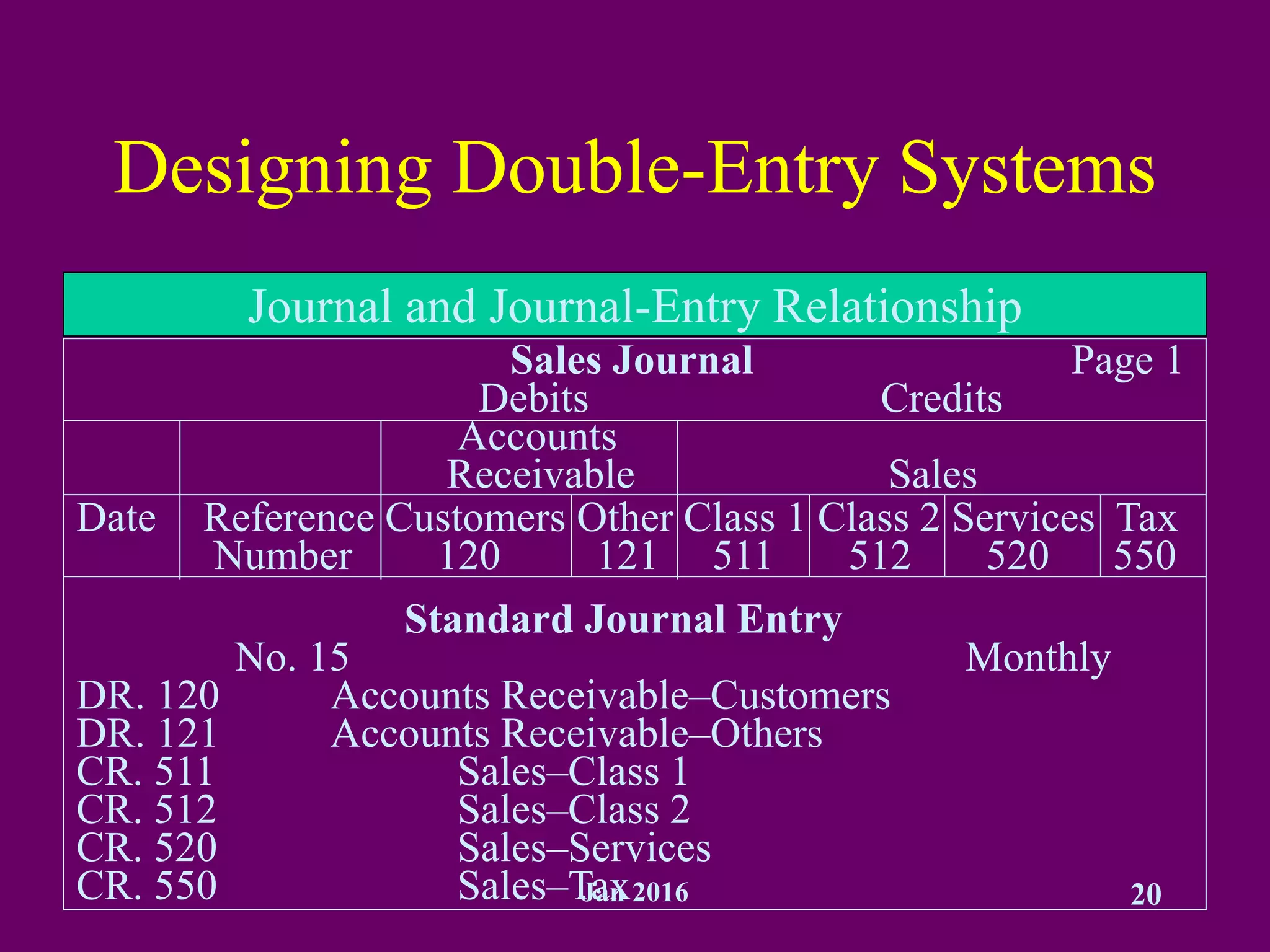

This document provides an overview of transaction processing systems and accounting information systems. It discusses the components of transaction processing systems including inputs, processing, journals, ledgers and outputs. It also covers designing double-entry accounting systems including identifying transaction cycles, developing standard journal entries, and considering batch versus direct processing. The document concludes with a discussion of form design and records retention considerations in accounting systems.