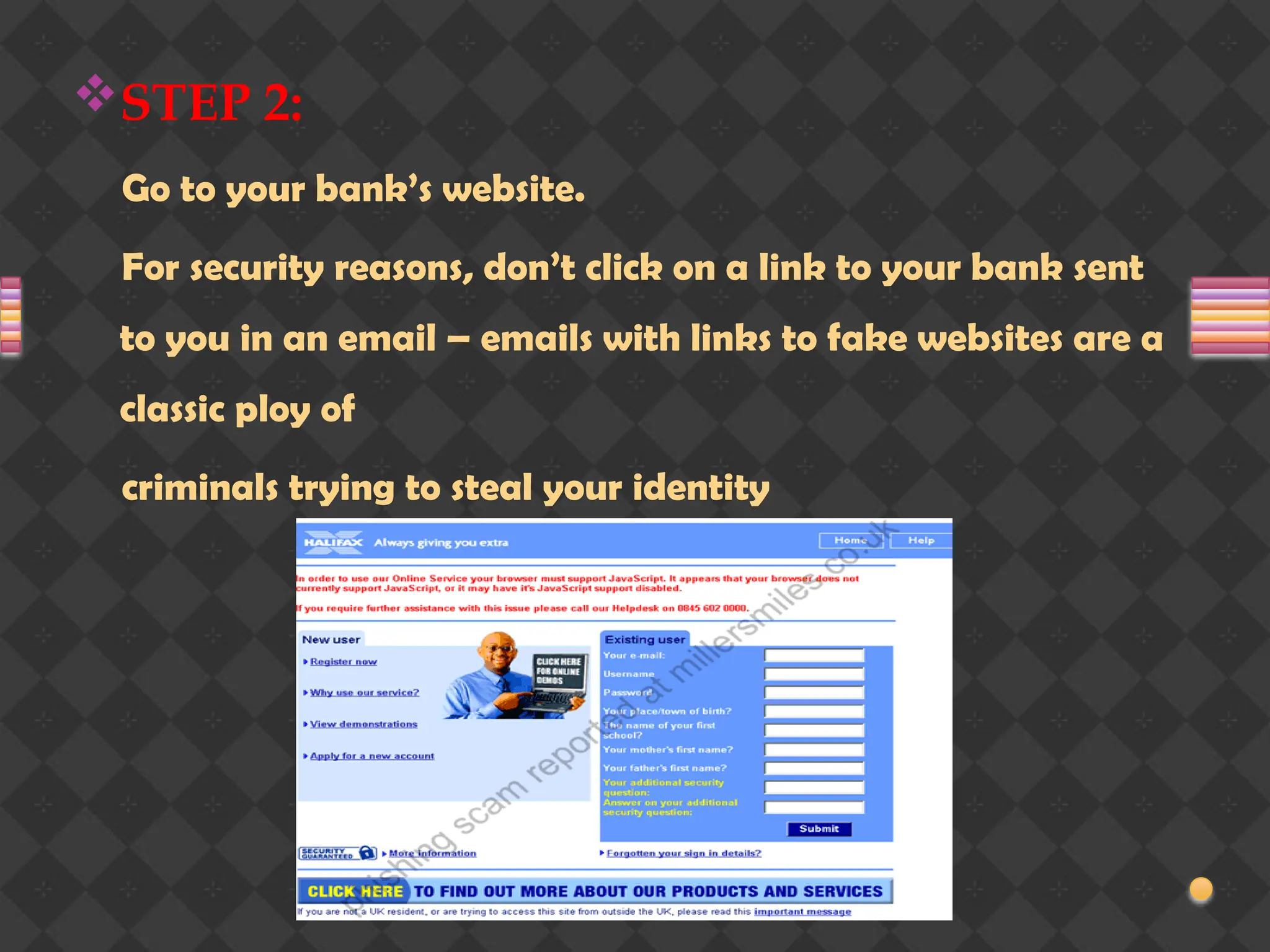

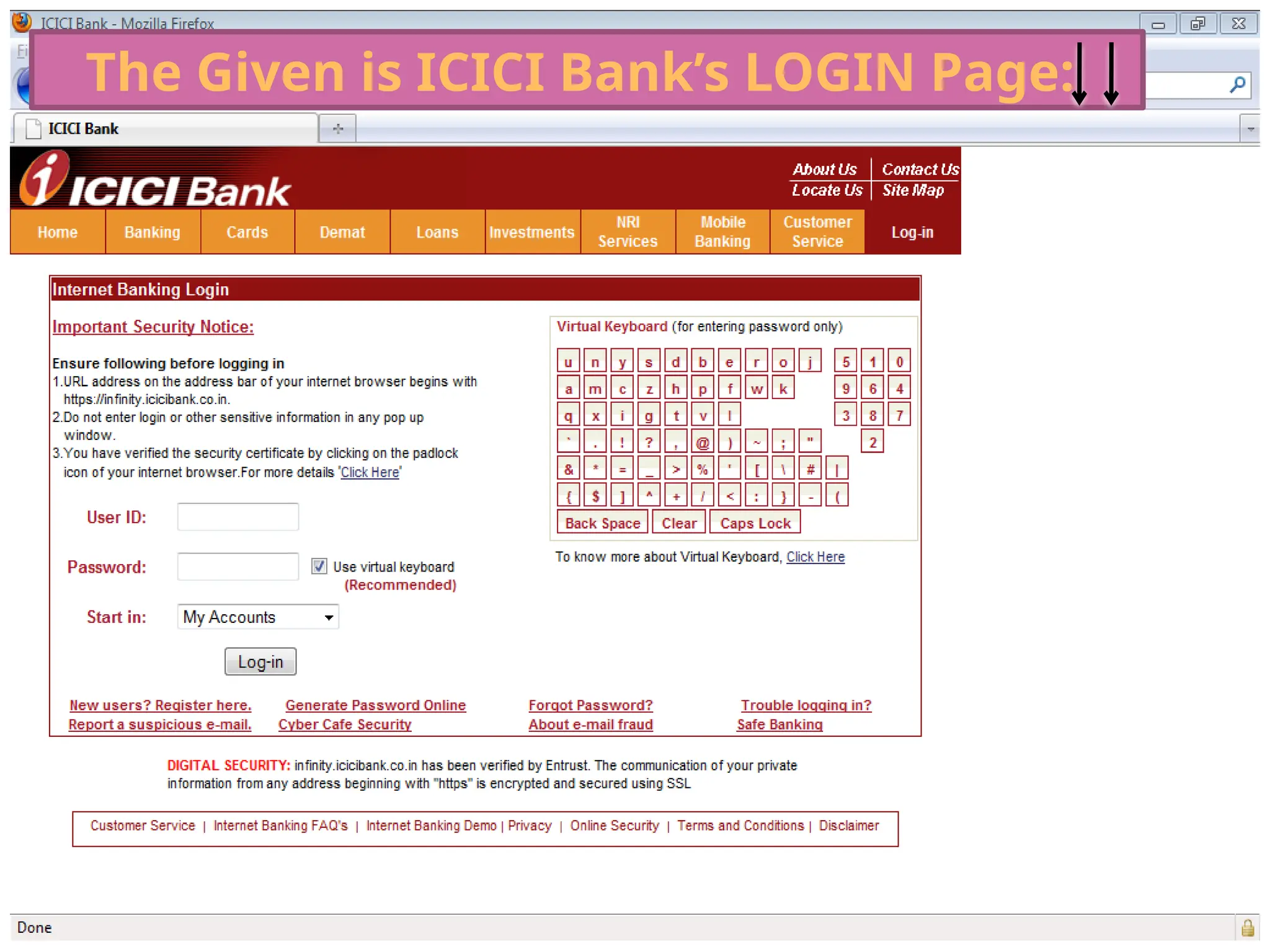

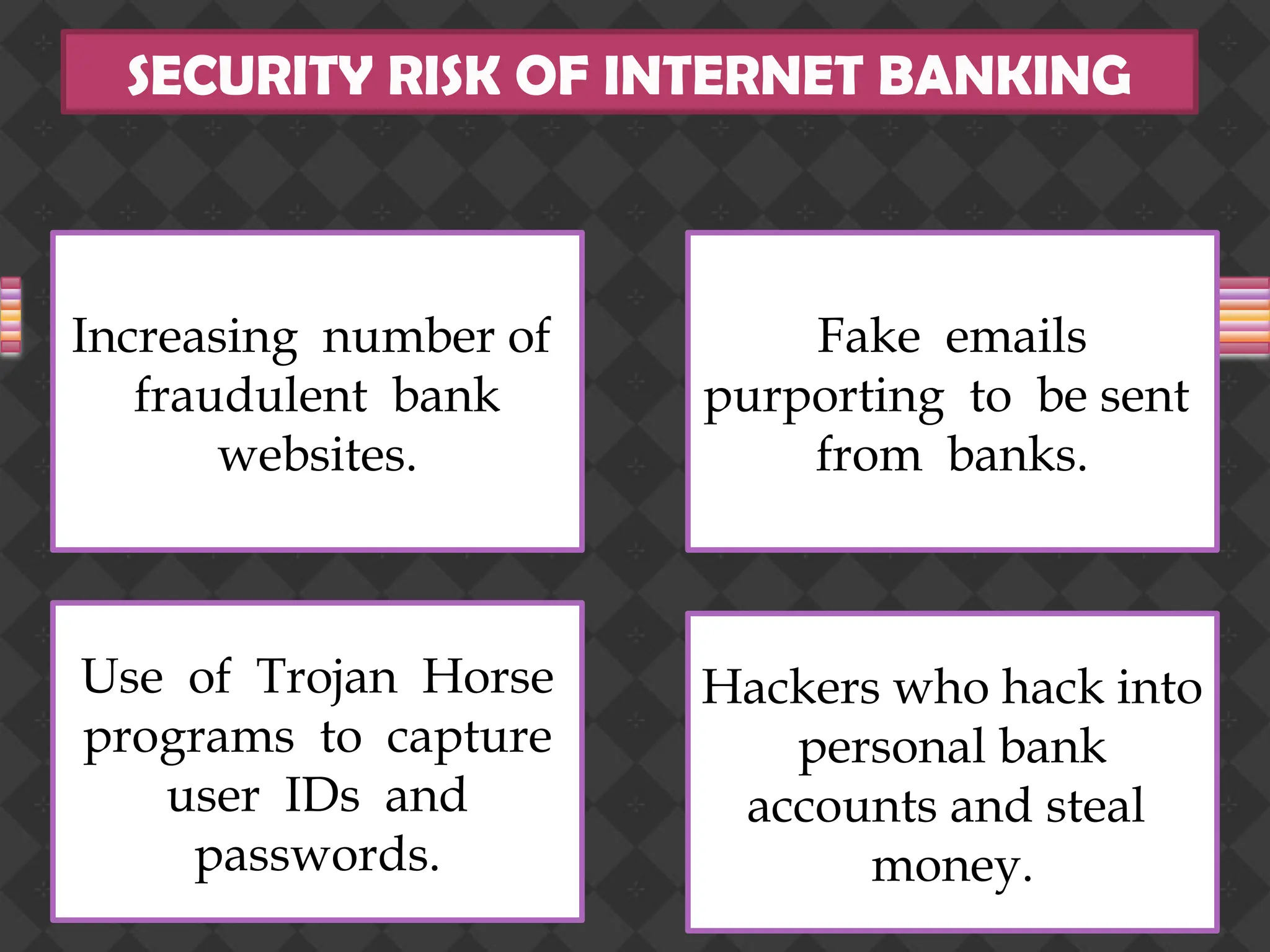

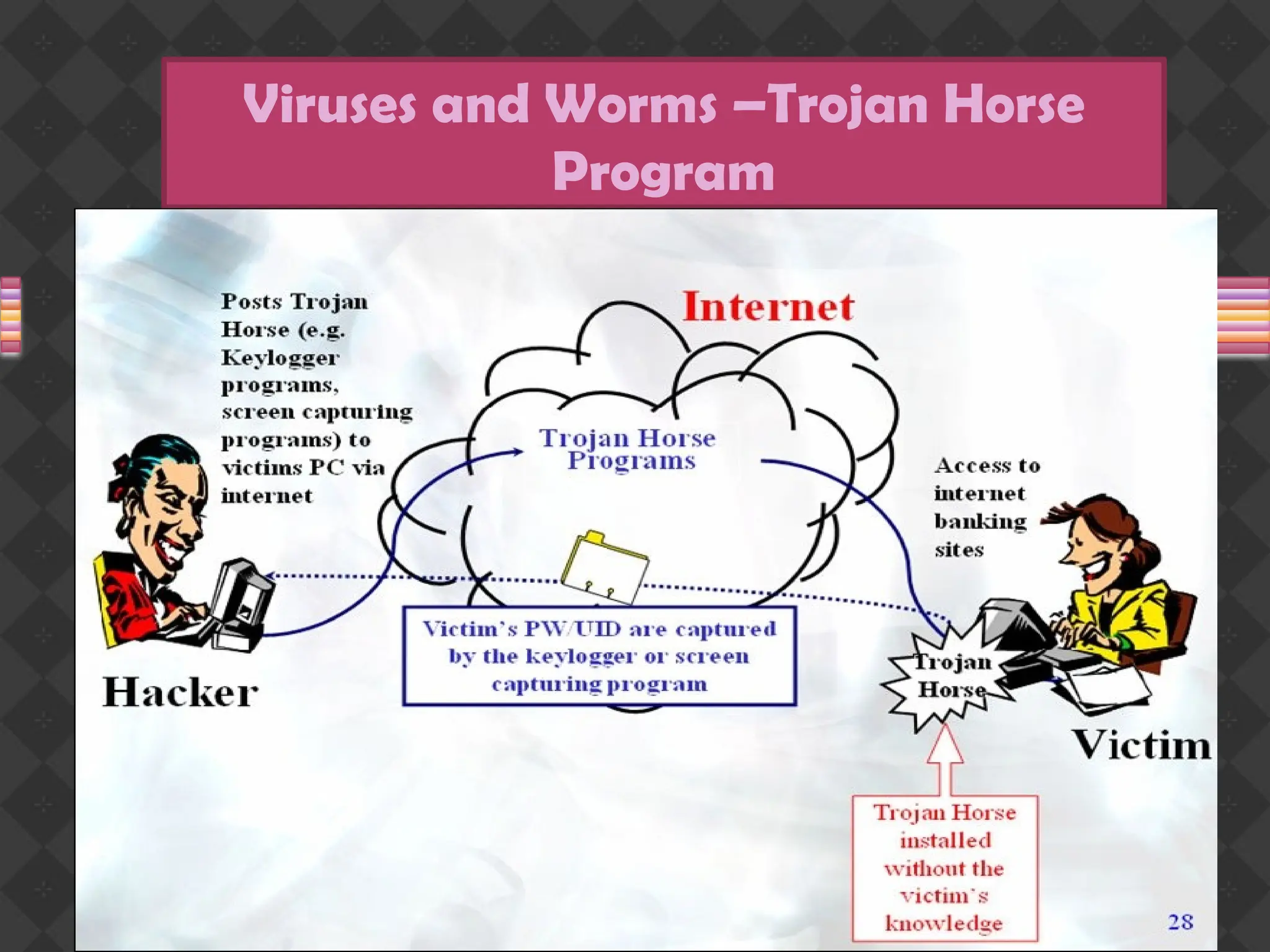

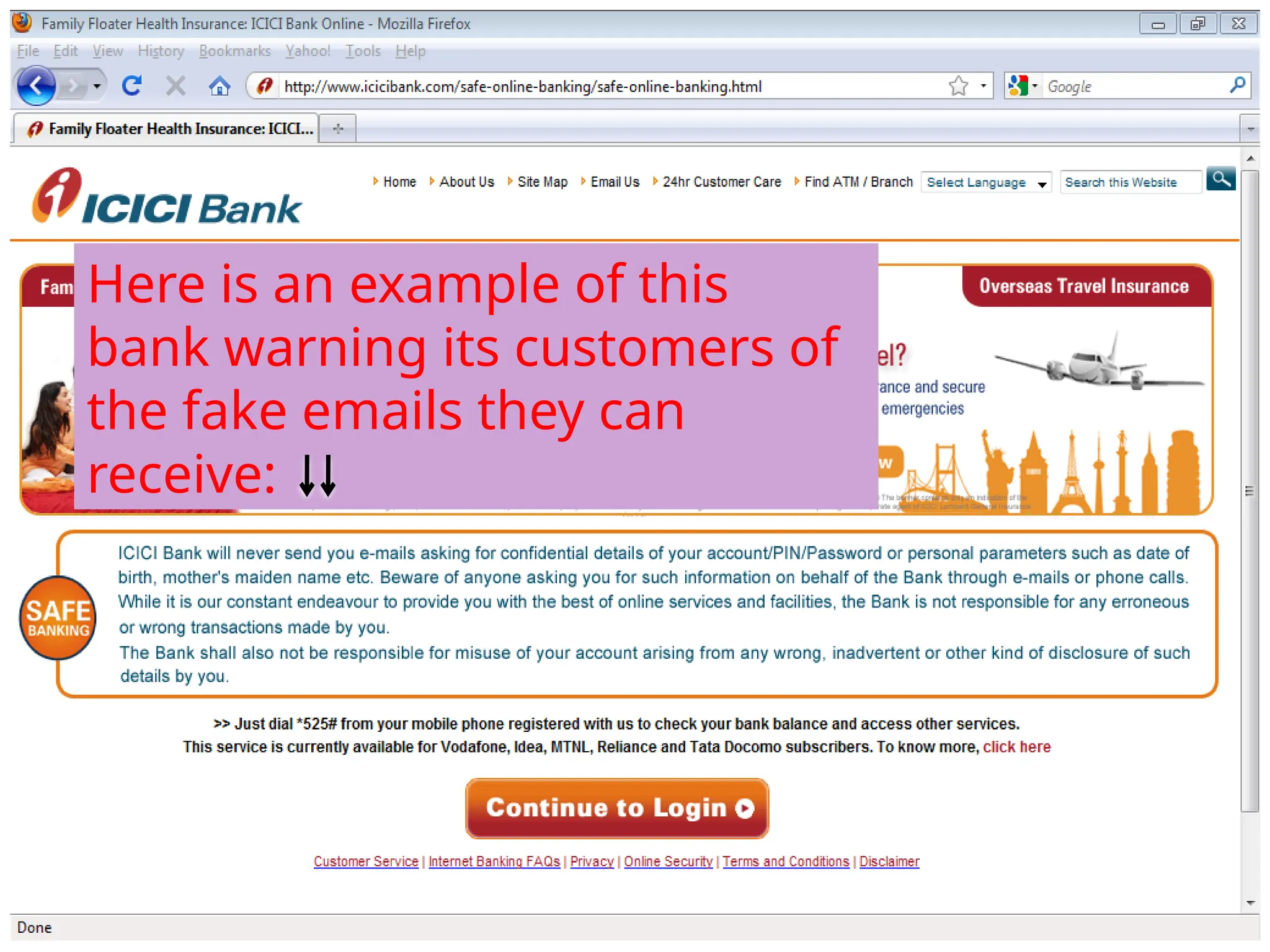

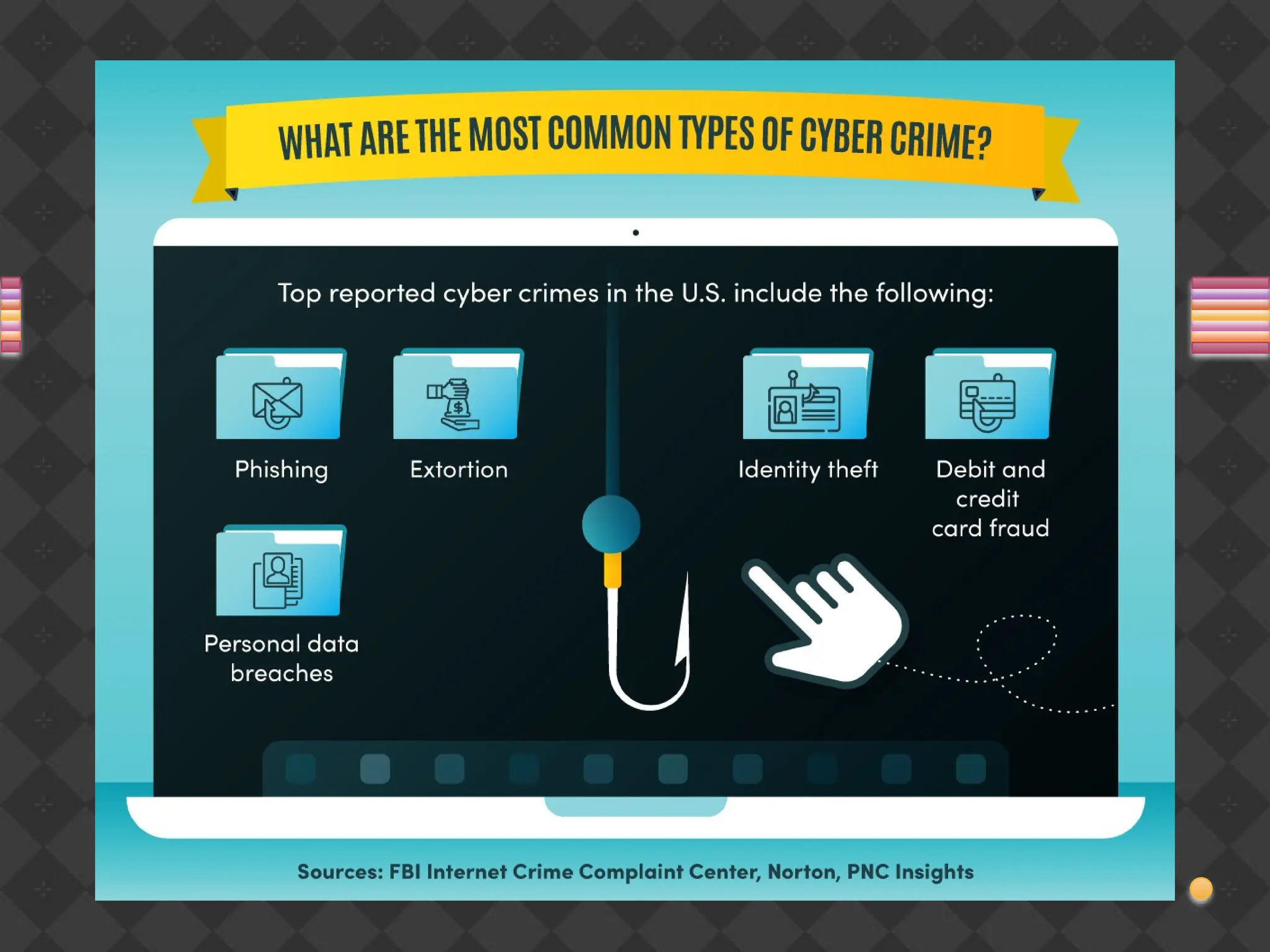

The document discusses the growing popularity of internet banking, highlighting its accessibility, historical development, and procedures for account access. It details the services offered, benefits like convenience and efficiency, as well as risks including phishing and pharming. Additionally, it outlines the security standards set by the Reserve Bank of India and relevant legal frameworks governing e-banking.