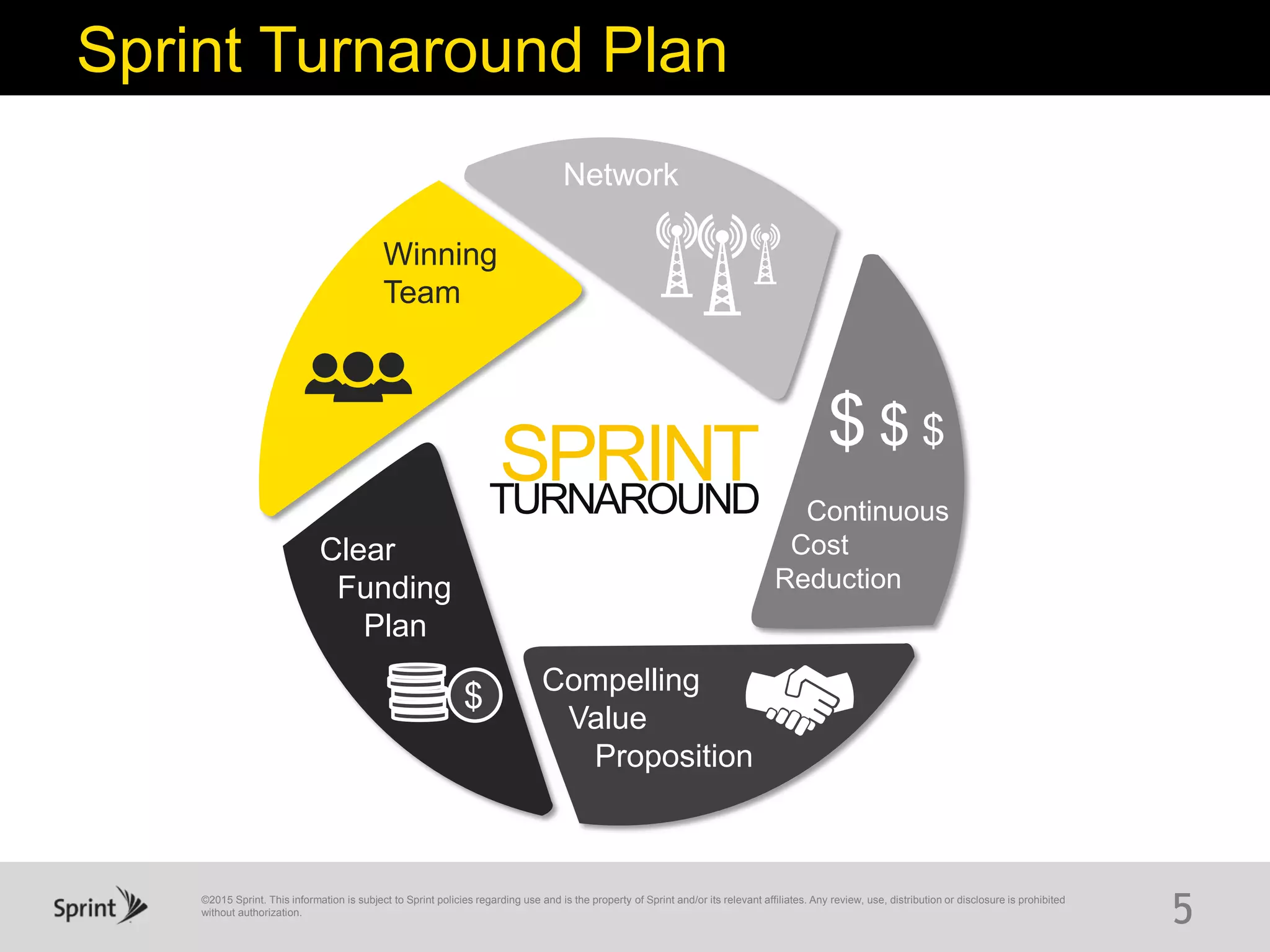

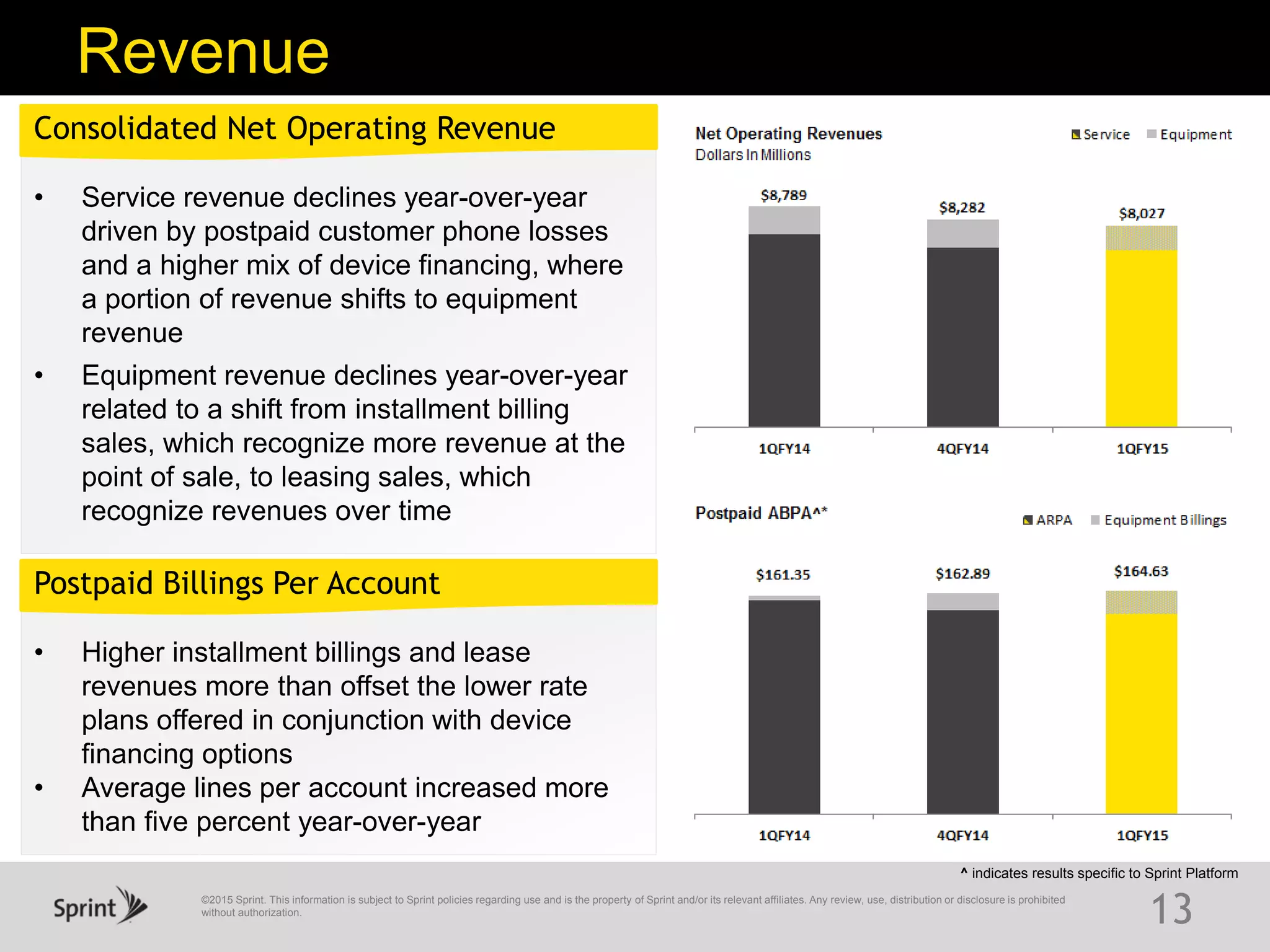

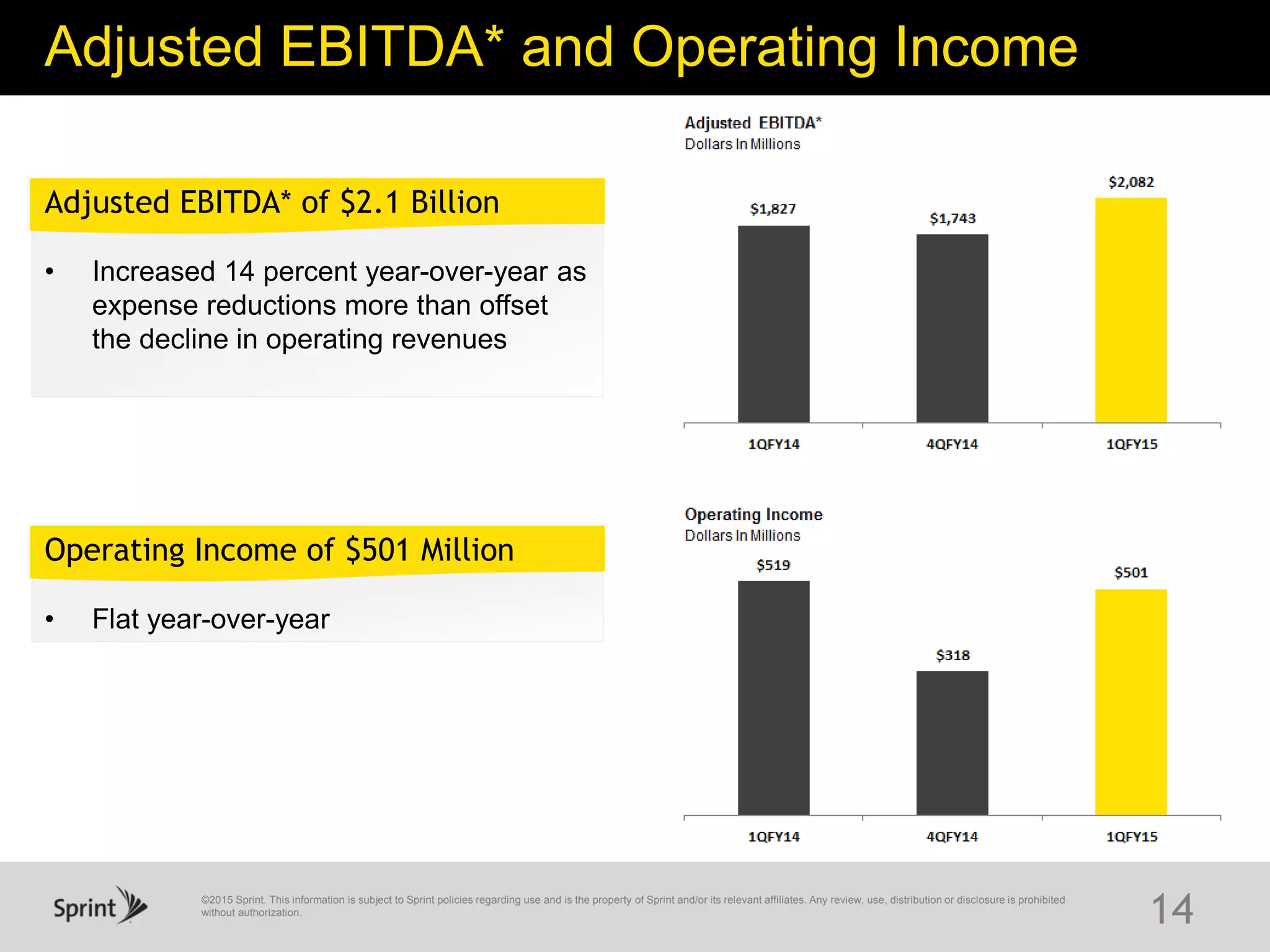

Sprint reported its fiscal 1Q15 results with the following highlights:

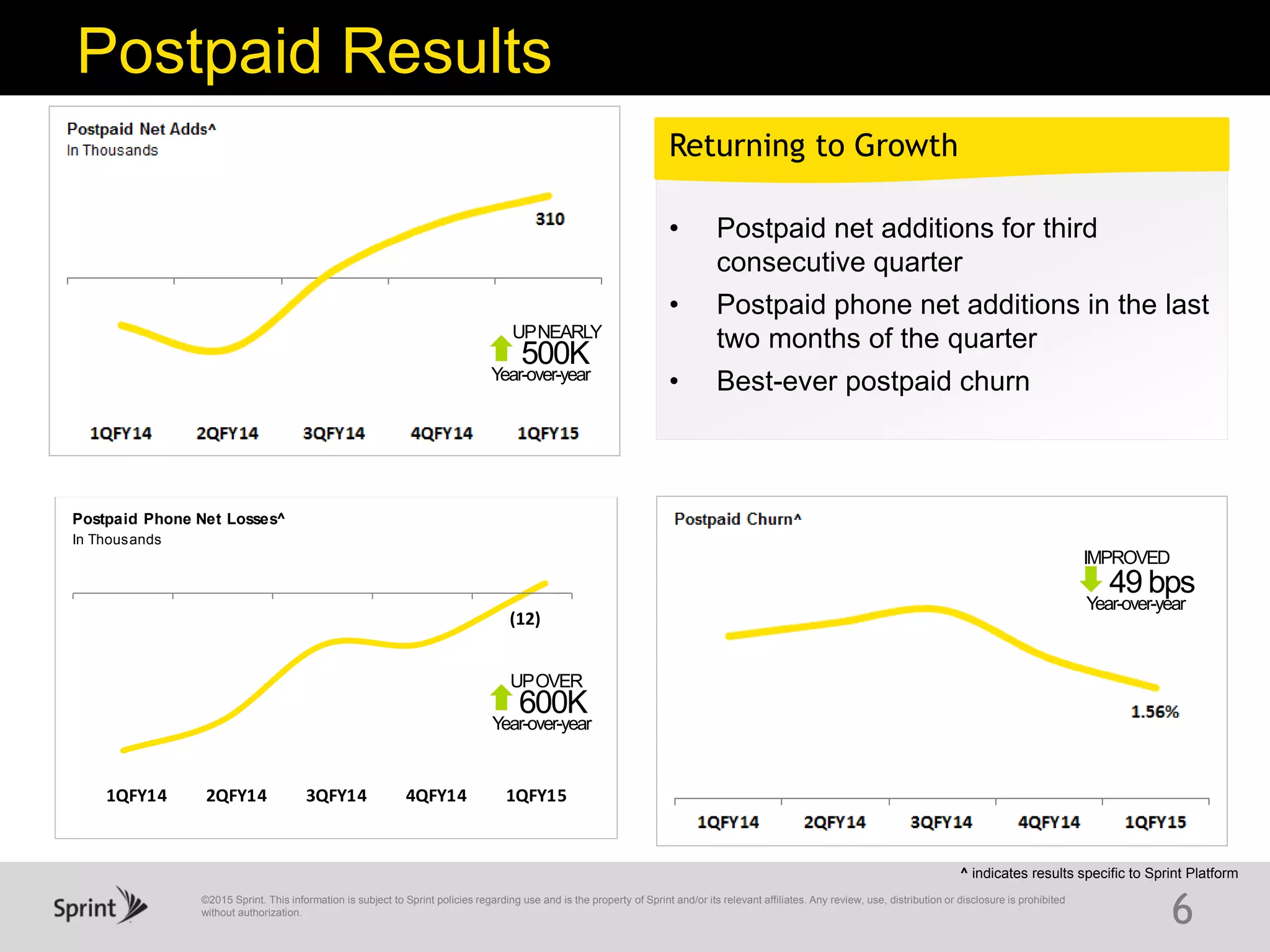

- Postpaid phone net losses improved for the third consecutive quarter and postpaid churn was the best ever.

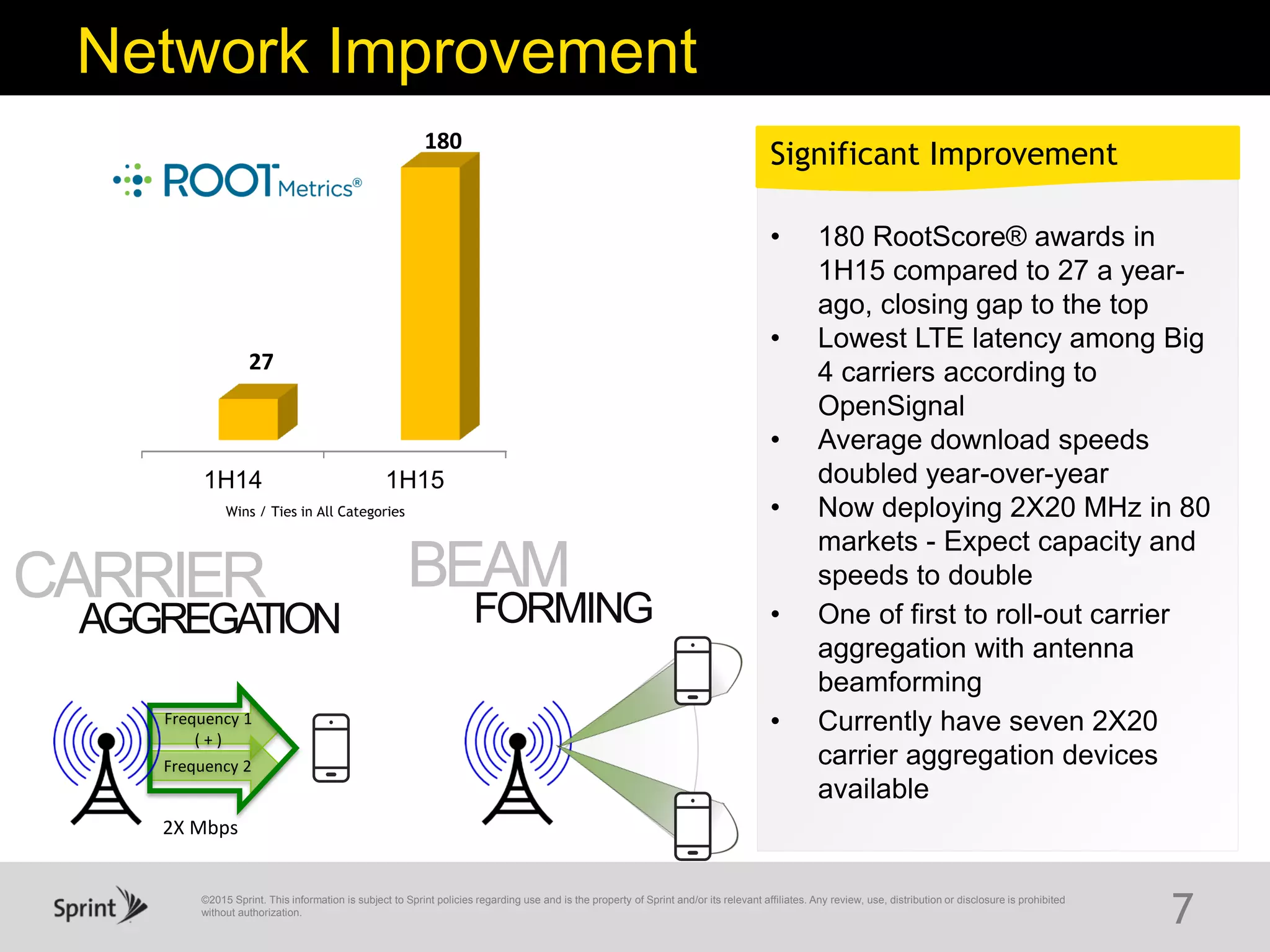

- Network performance improved significantly with 180 RootScore awards in the first half of 2015 compared to 27 in the same period last year.

- Cost reduction efforts and operational efficiencies increased adjusted EBITDA 14% year-over-year despite a decline in operating revenues.

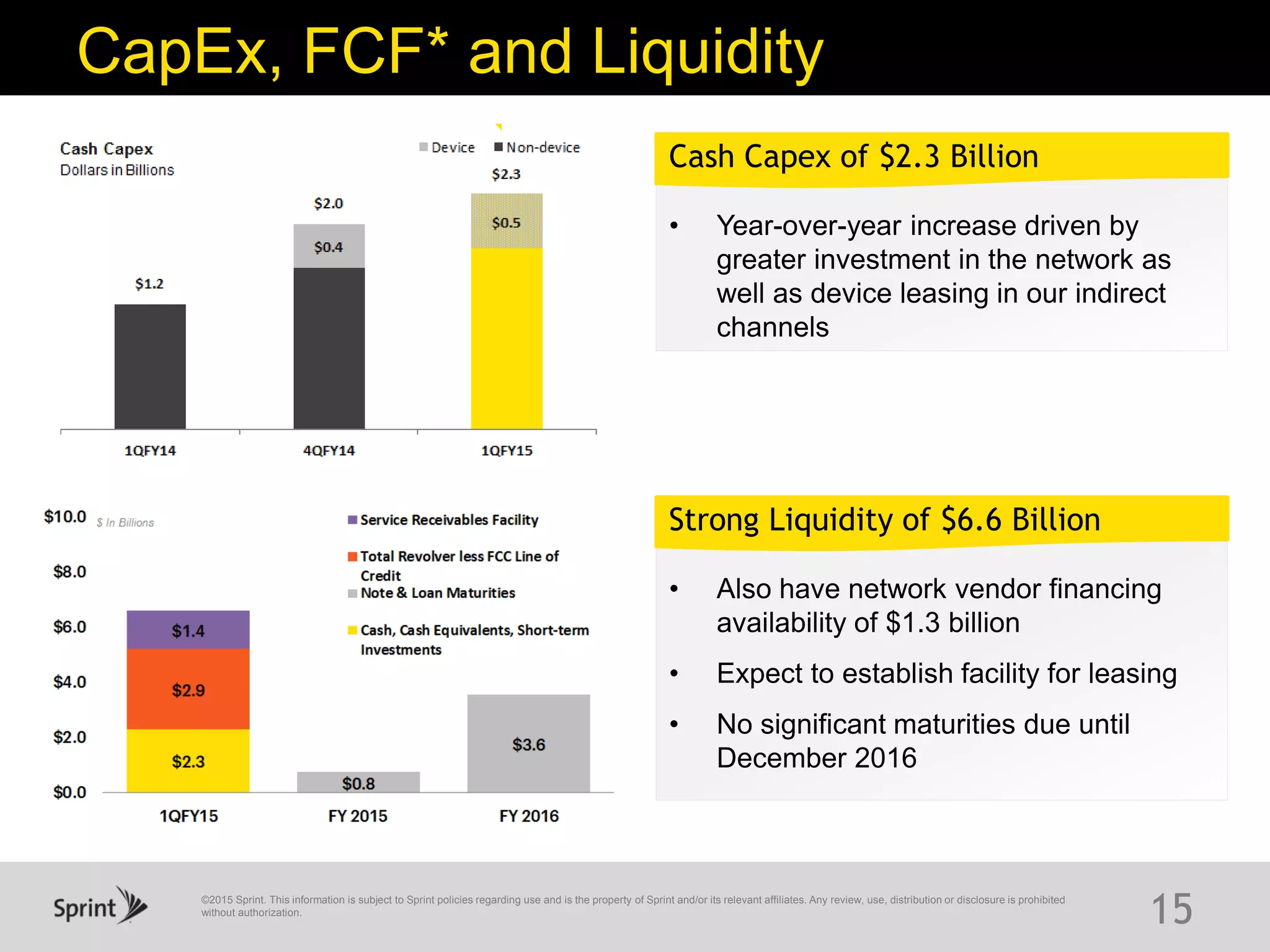

- Strong liquidity of $6.6 billion and no significant debt maturities until December 2016.

- Guidance for fiscal 2015 forecasts consolidated adjusted EBITDA between $7.2-7.6 billion and cash capex of approximately $5 billion