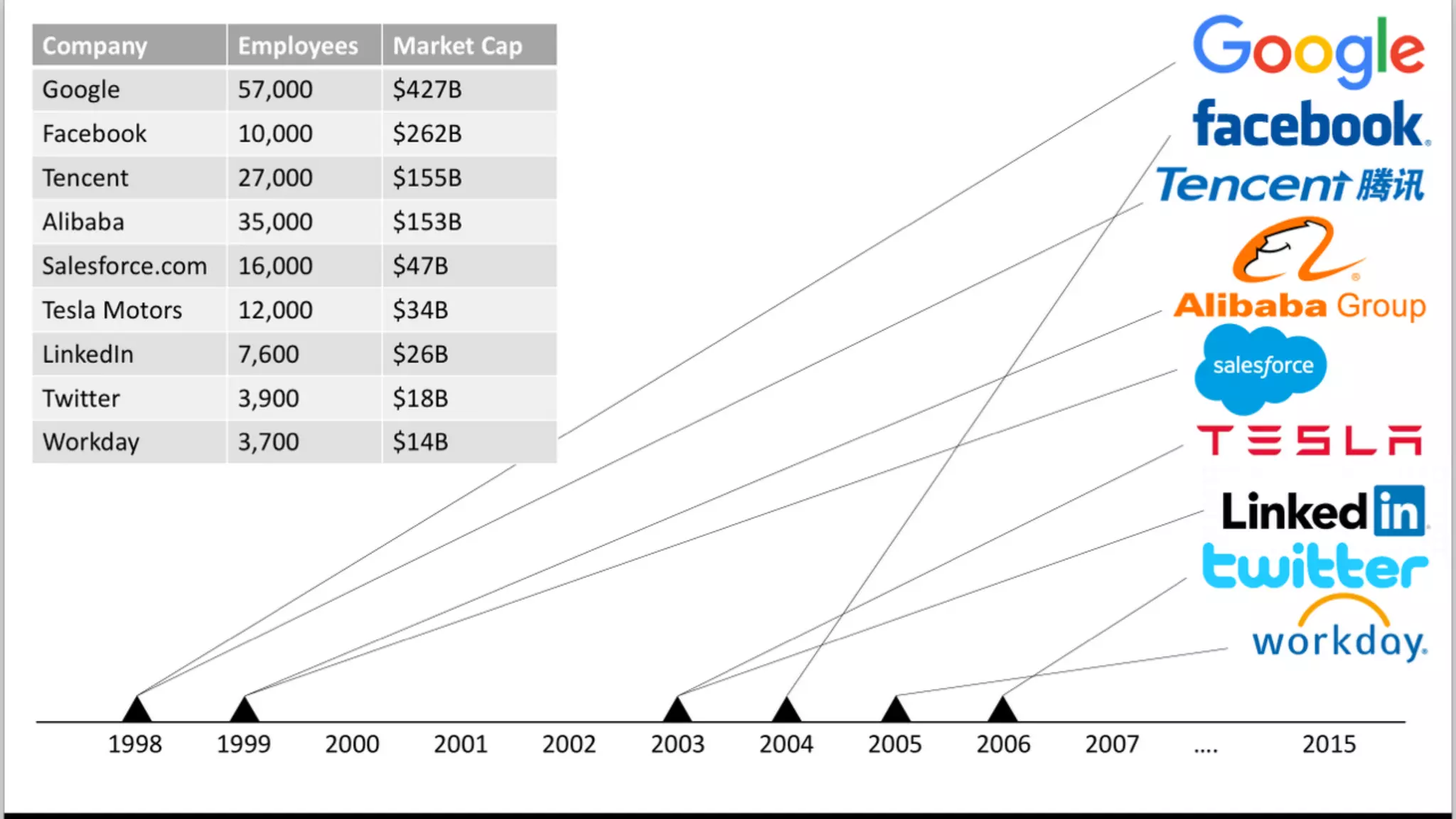

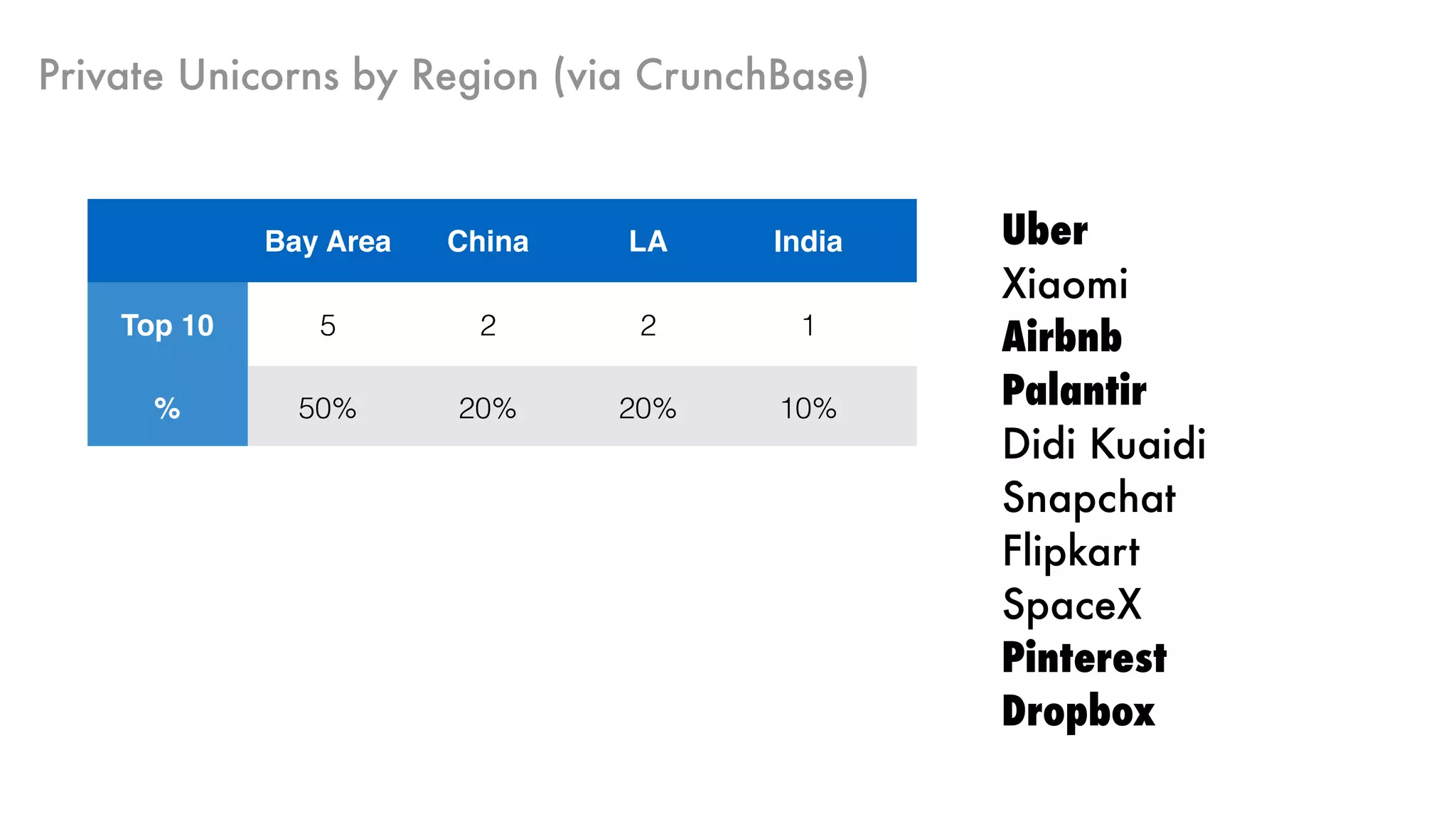

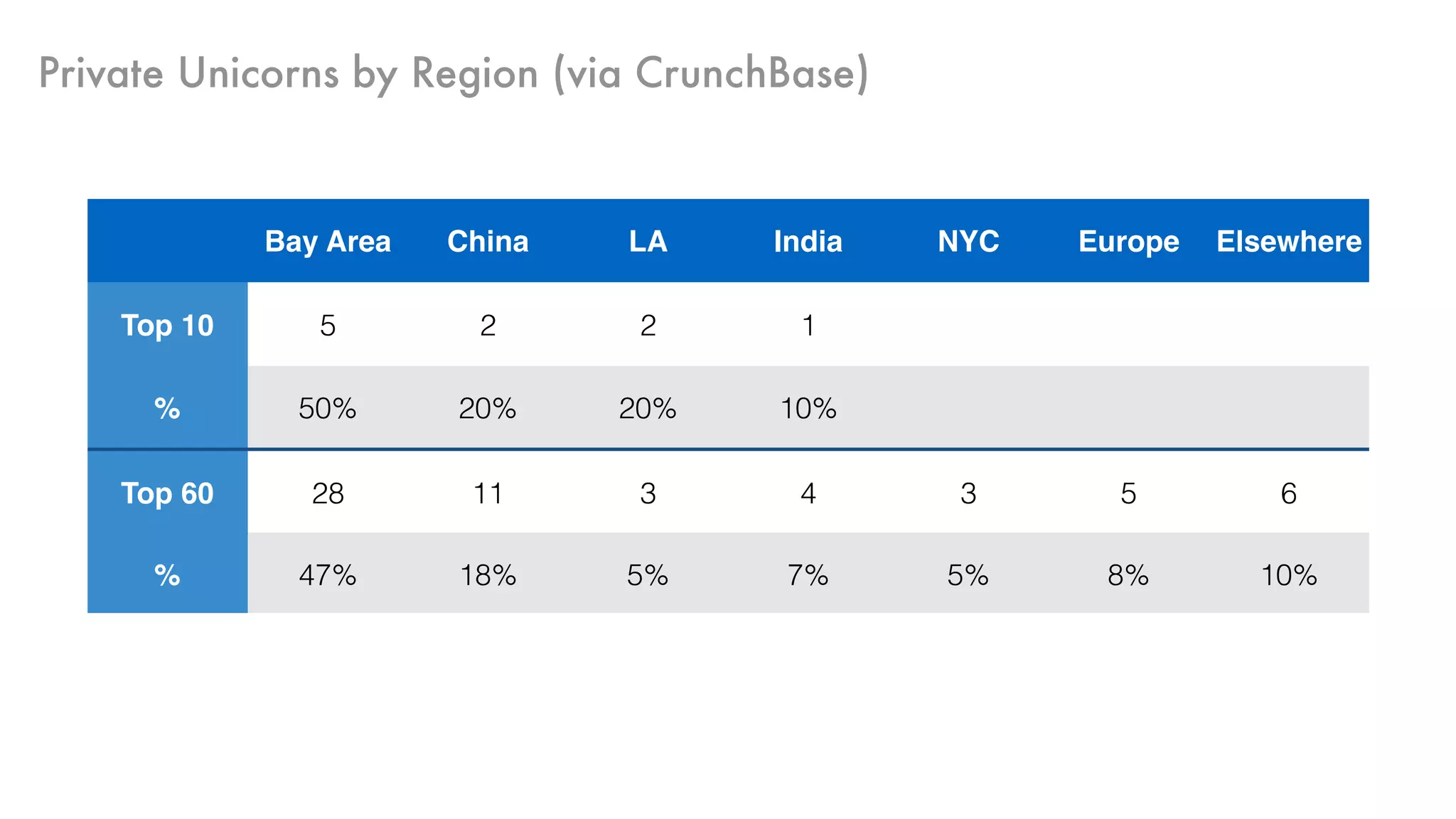

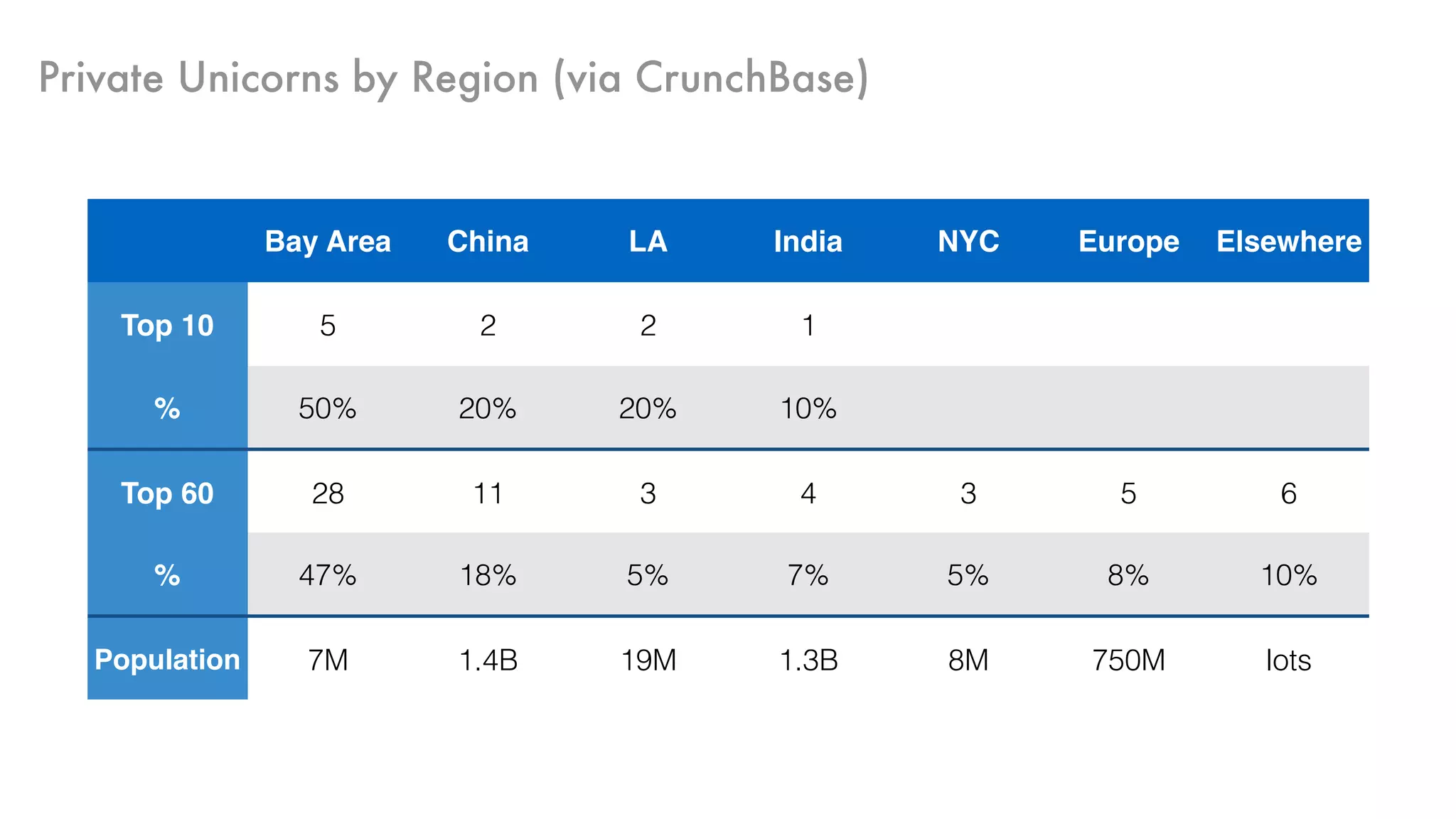

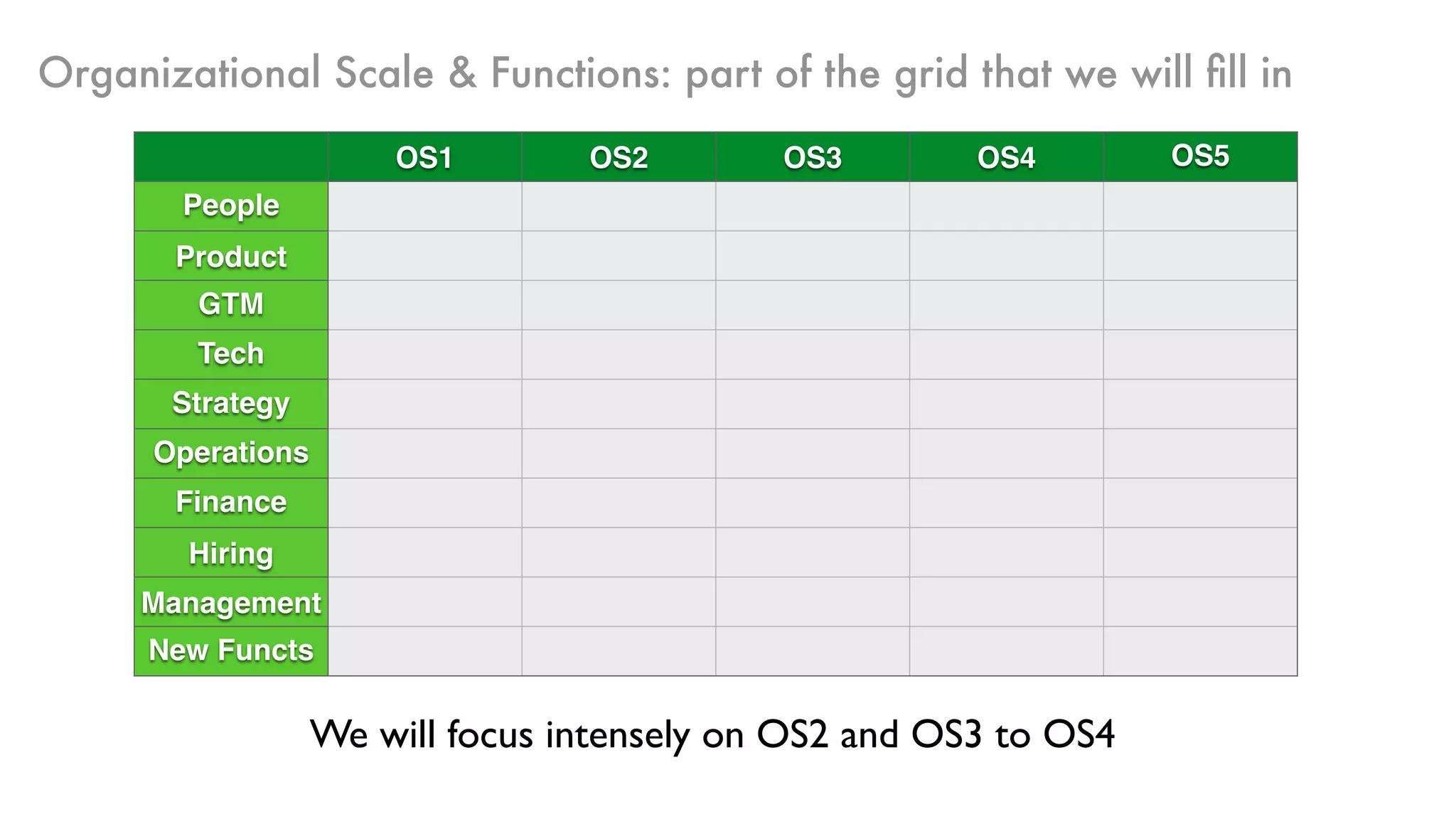

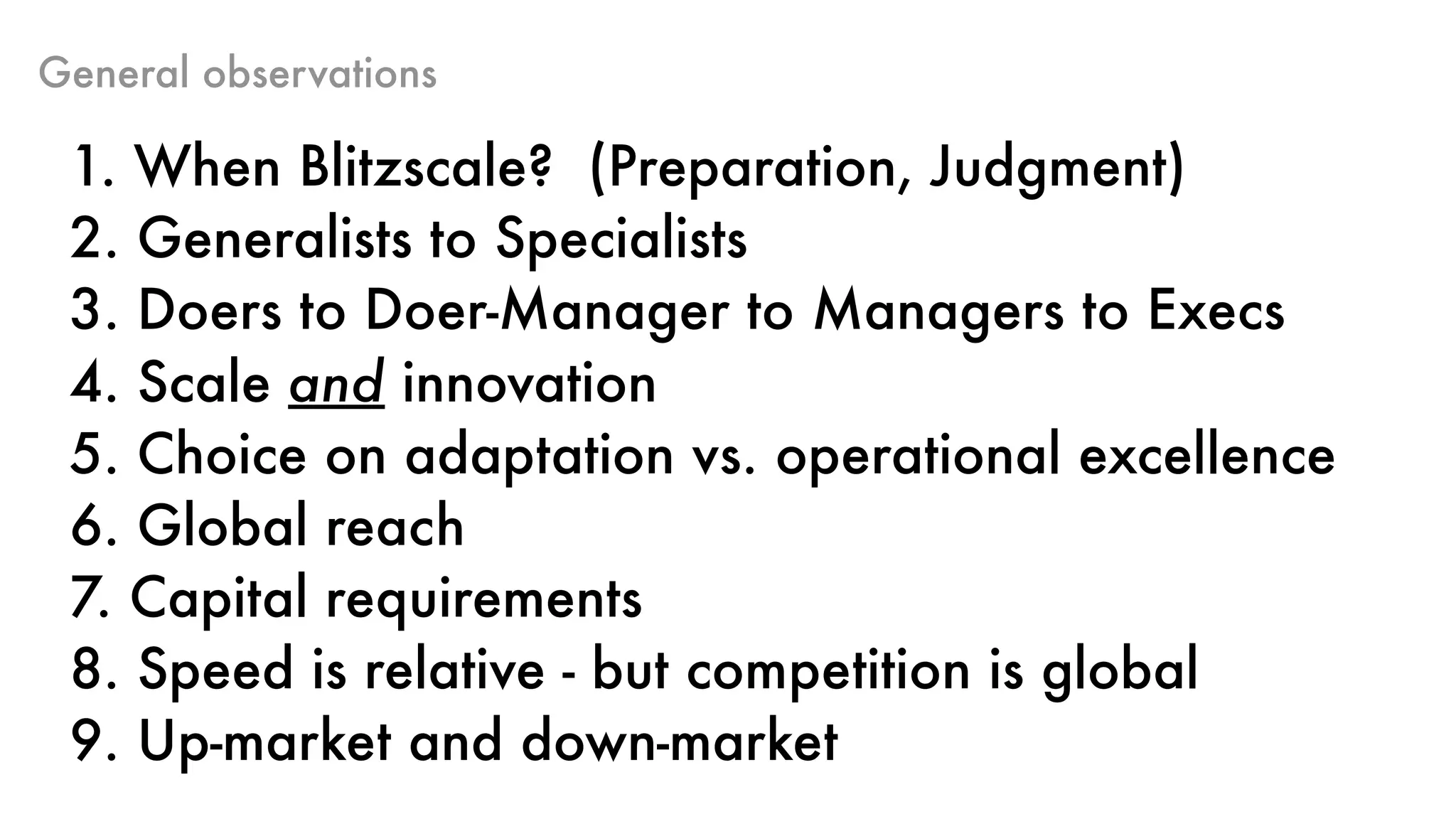

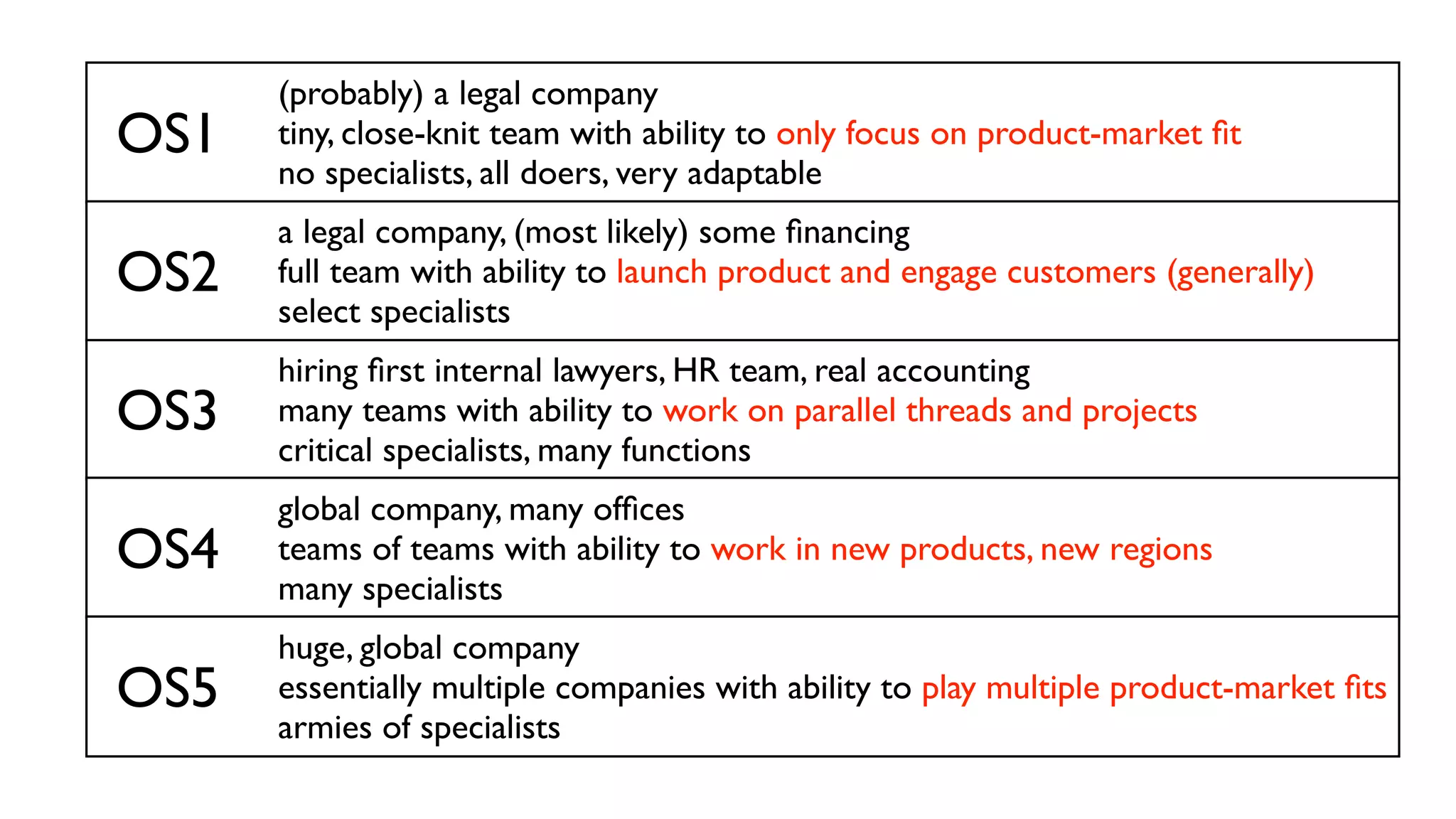

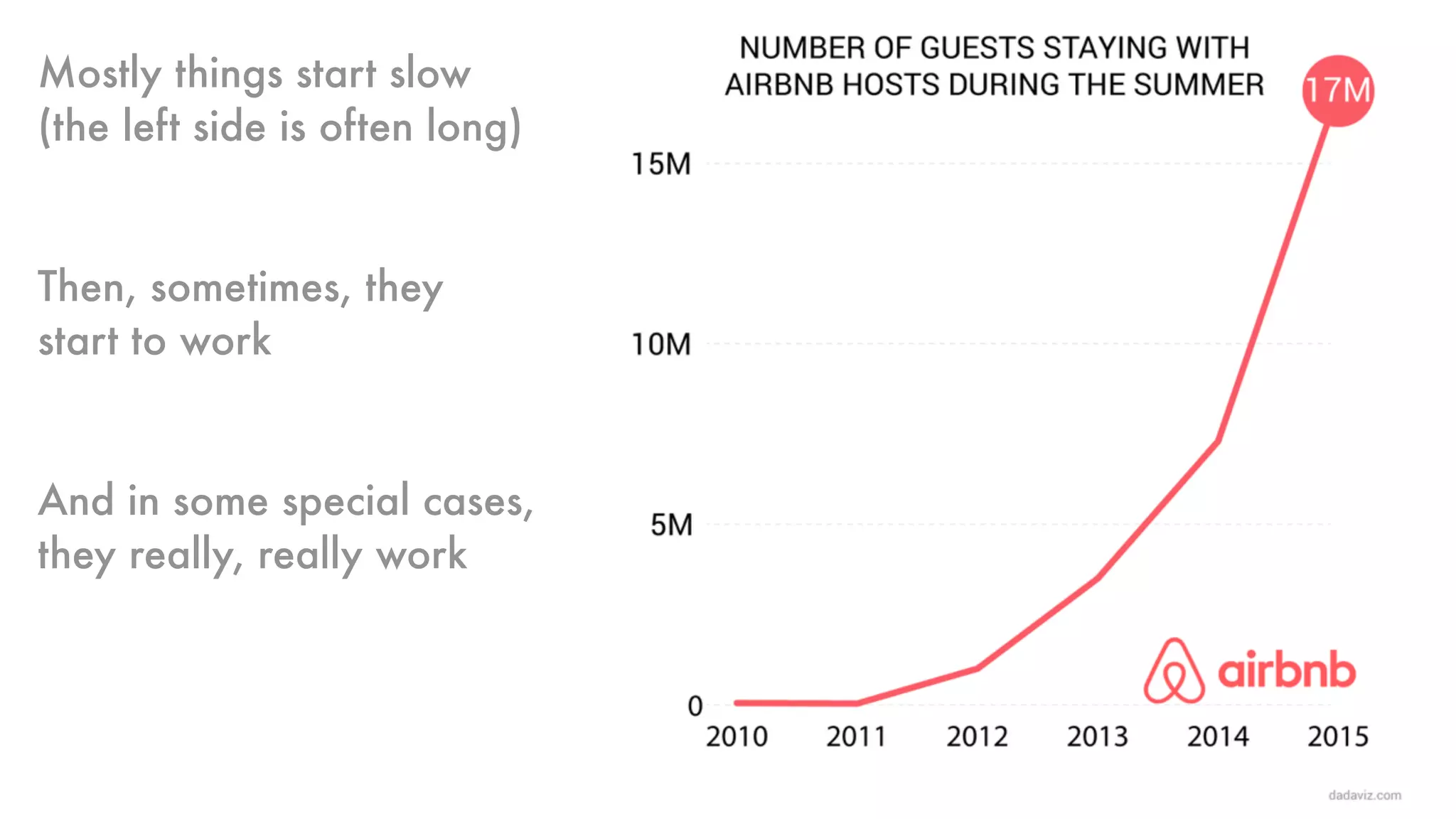

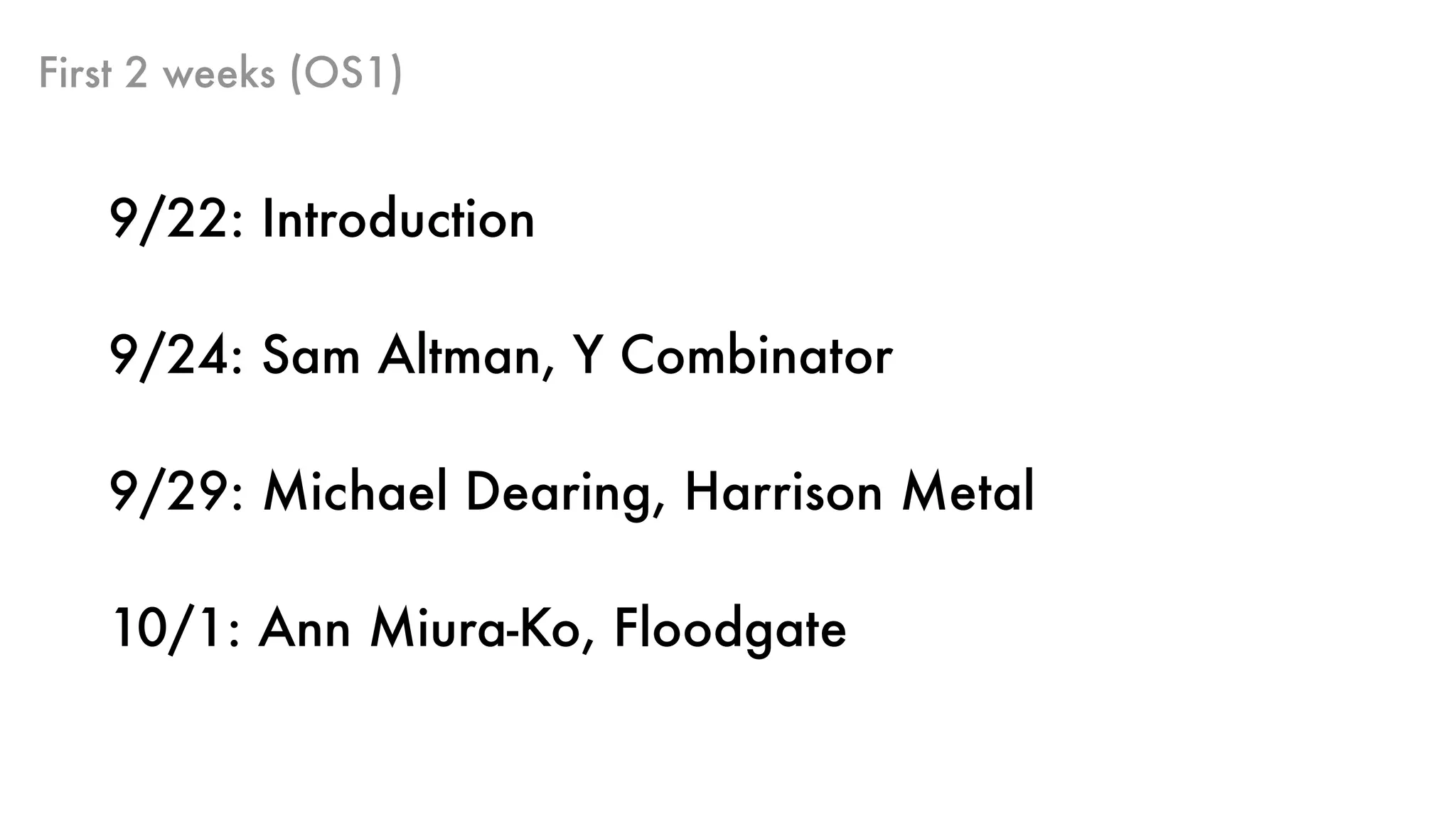

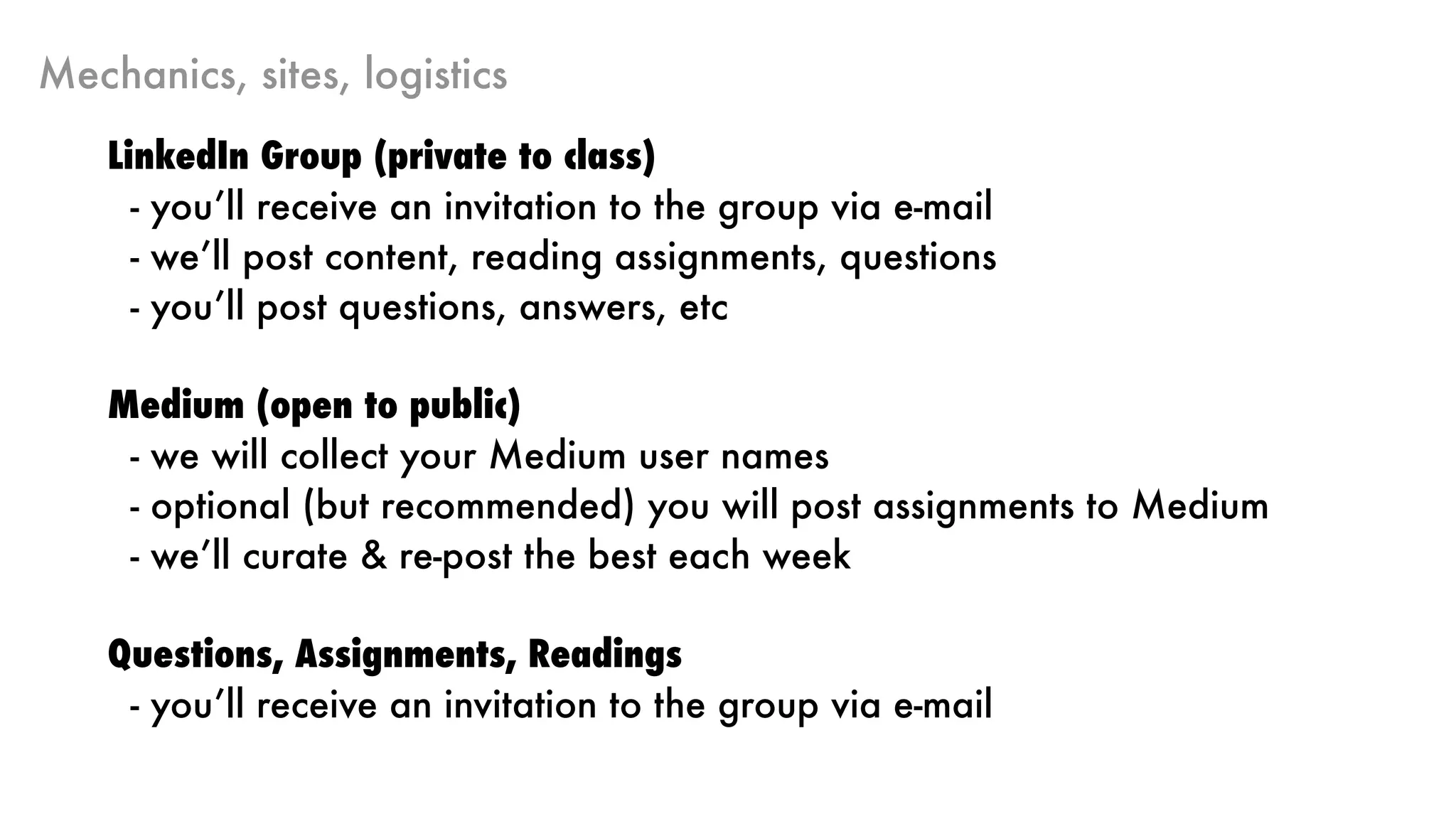

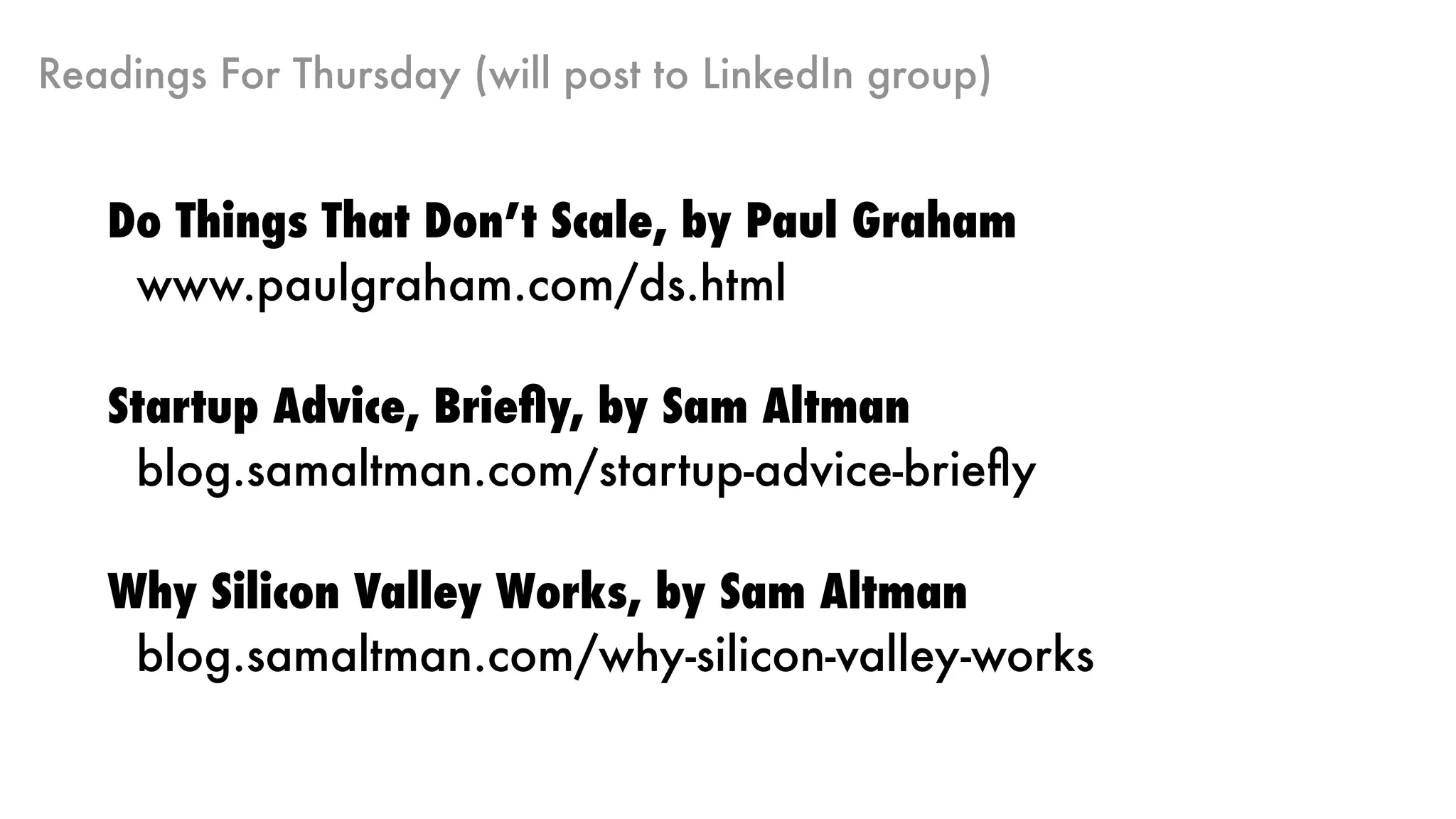

The document outlines a course on blitzscaling led by instructors including Allen Blue and Reid Hoffman, focusing on how Silicon Valley startups scale rapidly due to networks and organizational structure. Key themes include the role of founders, evolving business strategies, and the stages of organizational scale. The class will discuss scaling challenges, competition, and critical decisions during growth phases.