BOARD WORK AND SEATWORK CHALLENGE 2018

STATEMENT OF FINANCIAL PERFORMANCE

(NARUTO SHIPPUDEN EDITION)

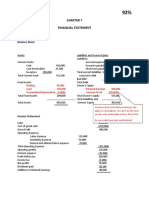

1. UZUMAKI NARUTO Company reported net income of P7,410,000 for the current year. The

auditor raised question about the following amounts that had been included in net income:

Unrealized loss on foreign currency translation (540,000)

Gain on early retirement of bonds payable 2,200,000

Adjustment of profit of prior year for error

in depreciation (net of tax effect) (750,000)

Loss from fire (1,400,000)

What amount should be reported as adjusted net income?

a. 6,500,000 c. 8,160,000

b. 6,610,000 d. 8,700,000

2. SASUKE UCHIHA Company reported income before tax of P5,000,000 for the current year. The

auditor questioned the following amounts that had been included in income before tax:

Equity in earnings of Cinn Company -40% interest 1,600,000

Dividend received from Cinn Company 320,000

Adjustment of profit year for arithmetical error in

depreciation (1,400,000)

What amount should be reported as income before tax?

a. 3,400,000 c. 4,800,000

b. 4,680,000 d. 6,080,000

3. SAKURA HARONO Company has a comprehensive insurance policy that allows assets to be

replaced at current value. The policy has a P250,000 deductible clause. One of the entity’s

waterfront warehouses was destroyed in winter storm. Such storms occur approximately every

four years. The entity incurred P100,000 of cost in dismantling the warehouse and plans to

replace it. The following data relate to the warehouse:

Current carrying amount 1,500,000

Replacement cost 5,500,000

What amount of gain should be reported as a component of income from continuing

operations?

a. 5,150,000 c. 3,650,000

b. 3,900,000 d. 0

4. KAKASHI HATAKE Company provided the following information for the current year:

Sales 50,000,000

Cost of goods sold 30,000,000

Distribution costs 5,000,000

General and administrative expenses 4,000,000

Interest expense 2,000,000

Gain in early extinguishment of long-term debt 500,000

Correction of inventory error, net of income tax-credit 1,000,000

Investment income – equity method 3,000,000

Gain on expropriation 2,000,000

Income tax expense 5,000,000

Dividends declared 2,500,000

What is the income from continuing operations?

a. 9,000,000 c. 9,500,000

b. 8,000,000 d. 7,000,000

5. TSUNADE SENJU Company provided the following information for the current year:

Sales 5,000,000

Cost of goods sold 2,800,000

Foreign translation adjustment – credit 400,000

Selling expenses 700,000

Unusual and infrequent gain 400,000

Correction of inventory error 200,000

General and administrative expenses 600,000

� Income tax expense 150,000

Gain on sale of investment 50,000

Proceeds from sale of land at cost 800,000

Dividends 300,000

What amount should be reported as income from continuing operations?

a. 1,200,000 c. 1,600,000

b. 1,350,000 d. 2,000,000

6. HASHIRAMA SENJU Company provided the following information for the current year:

Sales 7,000,000

Sales returns and allowances 100,000

Cost of goods sold 2,800,000

Utilities expense 1,000,000

Interest revenue 150,000

Income tax expense 800,000

Casualty loss due to earthquake 50,000

Finance cost 200,000

Salaries expense 600,000

Loss on sale of investments 50,000

What amount should be reported as income from continuing operations?

a. 1,550,000 c. 2,350,000

b. 1,600,000 d. 1,400,000

7. ITACHI UCHIHA Company provided the following information for the current year:

Uncollectible accounts expense 2,000,000

Freight out 3,500,000

Cost of sales 40,000,000

Loss on sale of equipment 1,500,000

Loss from typhoon 3,000,000

Sales 90,000,000

Interest income 4,000,000

Administrative expenses 10,000,000

Finished goods inventory, January 1 60,000,000

Sales commissions 7,000,000

Finished goods inventory, January 31 55,000,000

Income tax rate 30%

What amount should be reported as income from continuing operations?

a. 30,000,000 c. 27,000,000

b. 19,500,000 d. 18,900,000

8. AKATSUKI Company had the following events and transactions during 2014:

Depreciation for 2012 was understated by P300,000.

A litigation settlement resulted in a loss of P250,000.

The inventory on December 31, 2012 was overstated by P200,000.

The entity disposed of a recreational division at a loss of P500,000.

Income tax rate is 30%.

What is the effect of these events on the income from continuing operations for

2014?

a. 175,000 c. 665,000

b. 385,000 d. 525,000

9. ALLIED SHINOBI Company provided the following for the current year:

Net income 3,500,000

Unrealized gain on derivative contract 250,000

Foreign currency translation adjustment – debit 50,000

Revaluation surplus 1,000,000

What is the comprehensive income for the current year?

a. 3,700,000 c. 4,800,000

b. 4,700,000 d. 4,500,000

� 10. TOBIRAMA Company an investment entity, provided the following income and expenses for the

current year:

Dividend income from investments 9,200,000

Distribution income from trusts 500,000

Interest income on deposits 700,000

Income from bank treasury bills 100,000

Unrealized gain on derivative contract 400,000

Income from dealing in securities and derivatives held

from trading 600,000

Write-down of securities and derivatives held for trading 150,000

Other income 250,000

Finance cost 300,000

Administrative staff costs 3,800,000

Sundry administrative costs 1,200,000

Income tax expense 1,700,000

What is the comprehensive income for the current year?

a. 4,200,000 c. 3,800,000

b. 4,600,000 d. 9,200,000

11. IRUKA-SENSEI Company provided the following information for the current year?

Sales 9,500,000

Interest revenue 250,000

Gain sale of equipment 100,000

Revaluation surplus during the year 1,200,000

Share of profit of associate 350,000

Cost of goods sold 6,000,000

Finance cost 150,000

Administrative expenses 300,000

Distribution costs 500,000

Translation loss on foreign operation 200,000

Income tax expense 950,000

What is the net income for the current year?

a. 2,300,000 c. 4,200,000

b. 3,300,000 d. 2,100,000

12. JIRAIYA Company provided the following data for the current year:

Sales 9,750,000

Share of profit of associate 450,000

Decrease in inventory of finished goods 250,000

Raw materials and consumables used 3,500,000

Employee benefit expense 1,500,000

Translation gain on foreign operation 300,000

Impairment loss 800,000

Finance cost 350,000

Other operating expenses 900,000

Income tax expense 900,000

Unrealized gain on interest rate swap designated

as a cash flow hedge 200,000

What is the net income for the current year?

a. 2,900,000 c. 2,000,000

b. 2,500,000 d. 1,850,000

13. NAGATO Company provided the following data for the current year:

Retaining earnings, January 1 3,000,000

Dividends 1,000,000

Sales 8,350,000

Dividend income 100,000

Inventory, January 1 1,040,000

Purchases 3,720,000

Salaries 1,540,000

� Contribution to employees’ pension fund 280,000

Delivery 205,000

Miscellaneous expense 125,000

Doubtful accounts expense 10,000

Depreciation expense 85,000

Loss on sale of securities 40,000

Loss on inventory write down 150,000

Income tax 735,000

Inventory on December 31 was valued at P700,000 (P850,000 less P150,000 write down of

absolute inventory).

1. What is the cost of goods sold?

a. 4,760,000 c. 3,910,000

b. 4,060,000 d. 4,210,000

2. What is the income from continuing operations?

a. 2,105,000 c. 1,520,000

b. 1,370,000 d. 1,410,000

3. What is the balance of retained earnings on December 31?

a. 4,370,000 c. 4,520,000

b. 3,370,000 d. 3,520,000

“Never give up! Just do it!”

-Naruto Uzumaki

E-07-17-2018-BSBAFM3A/3B