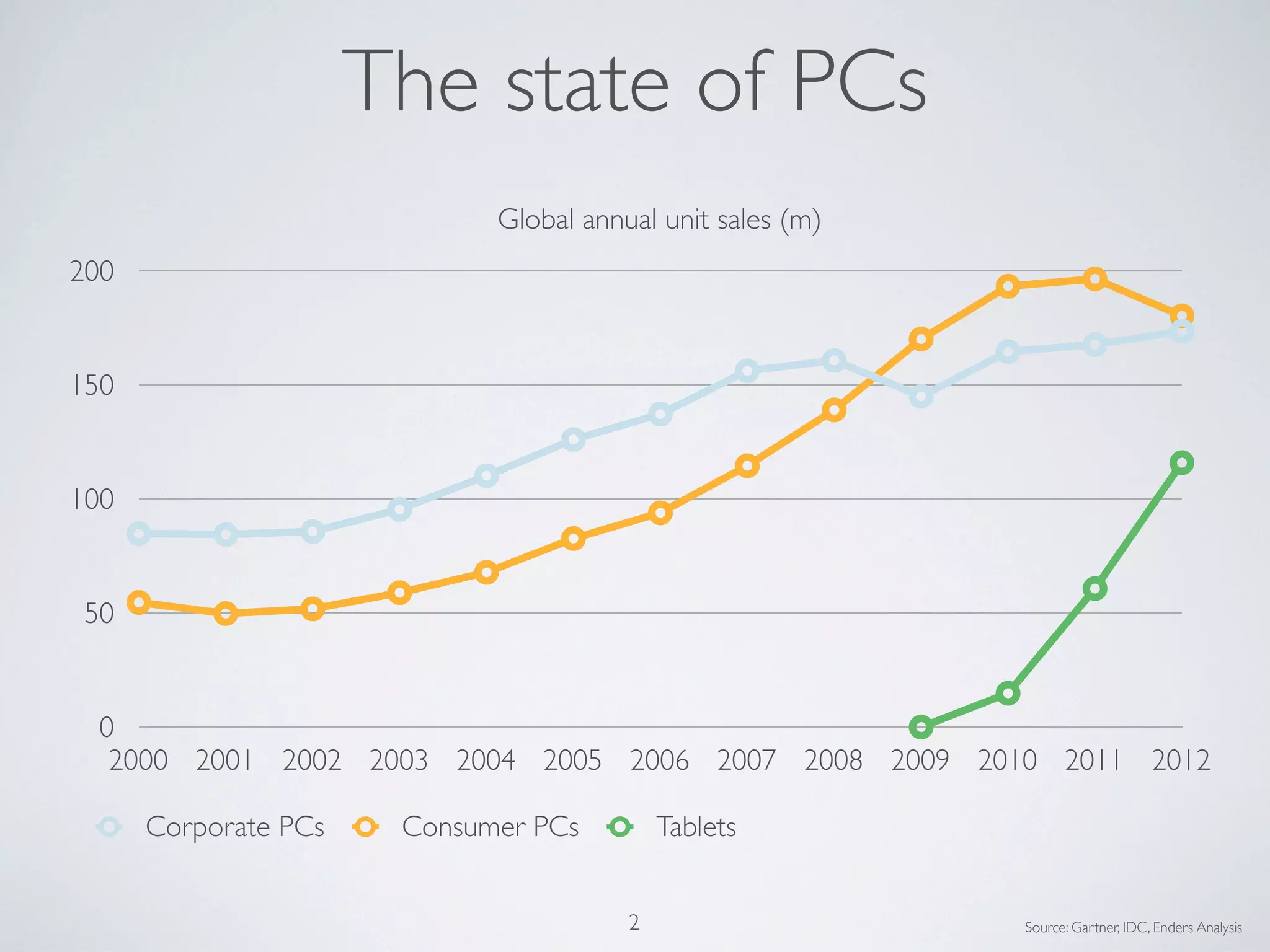

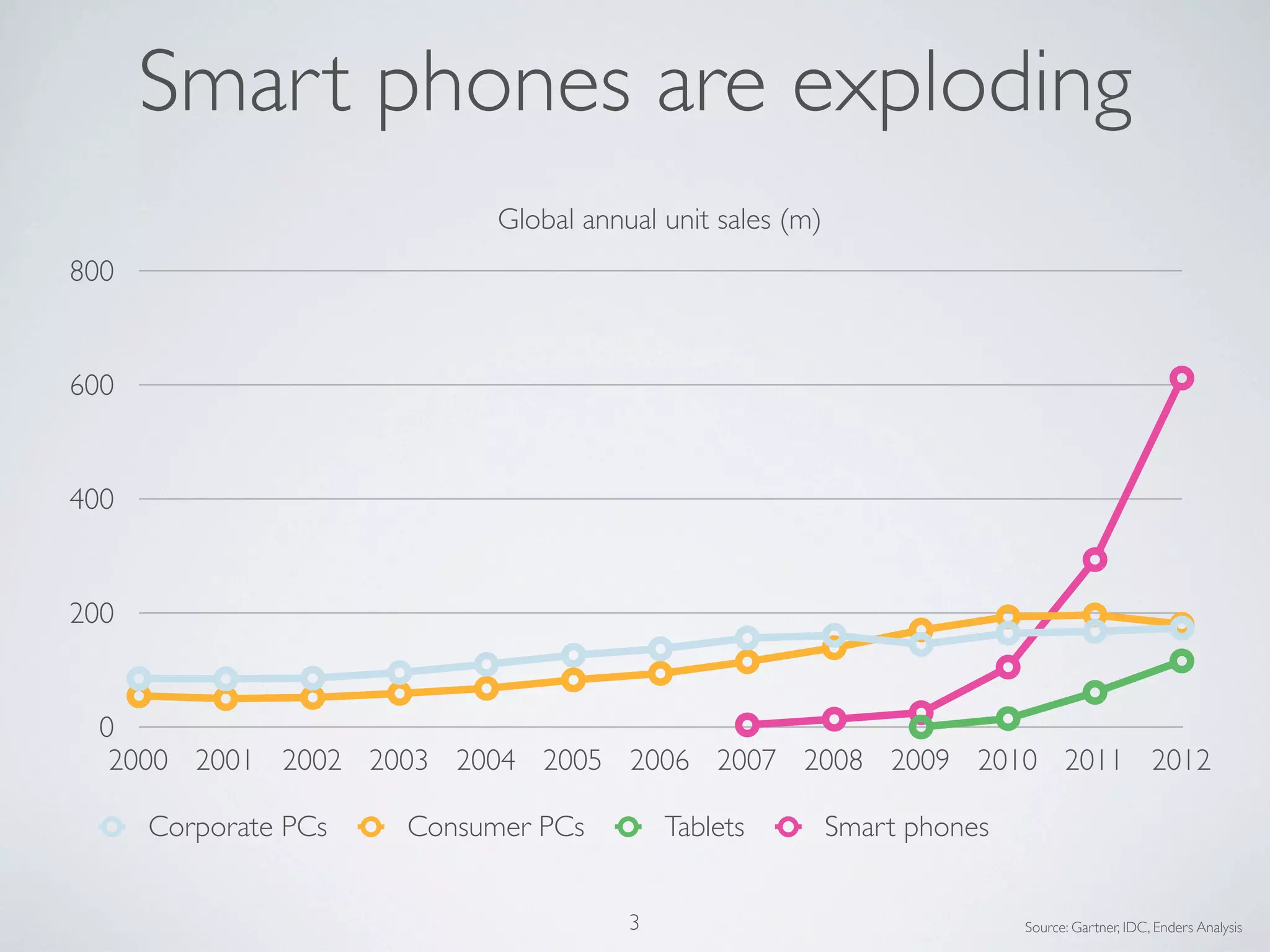

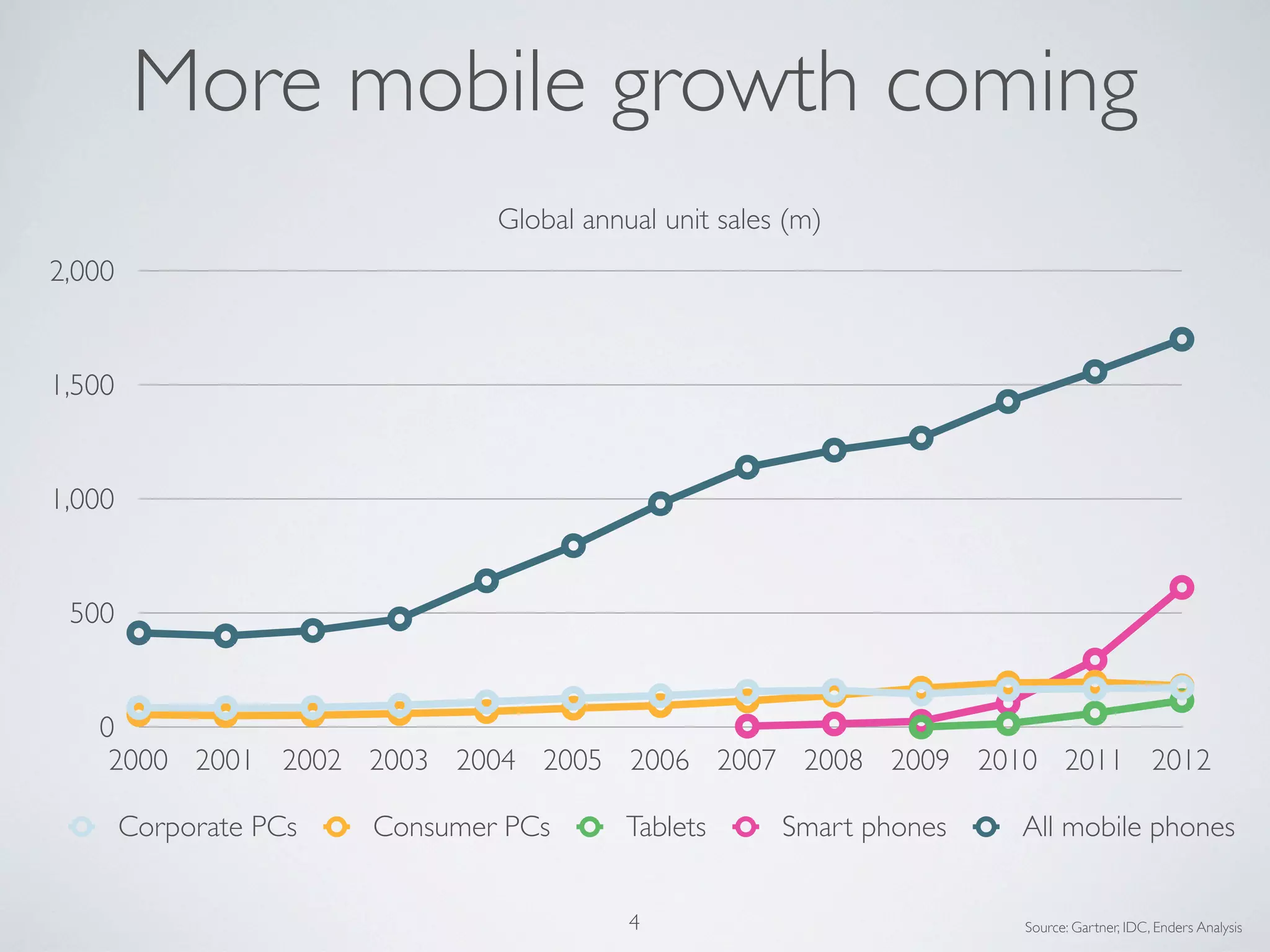

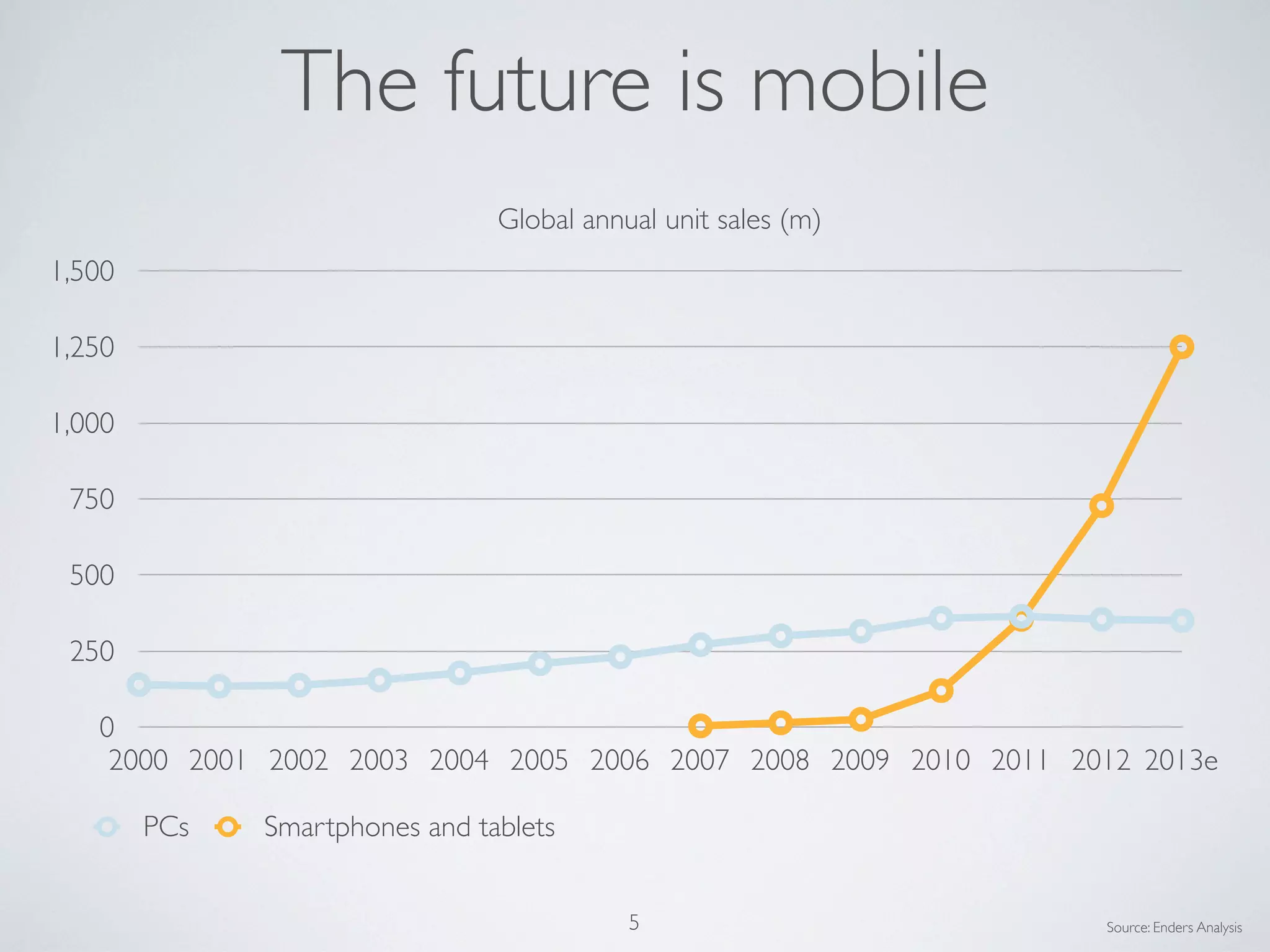

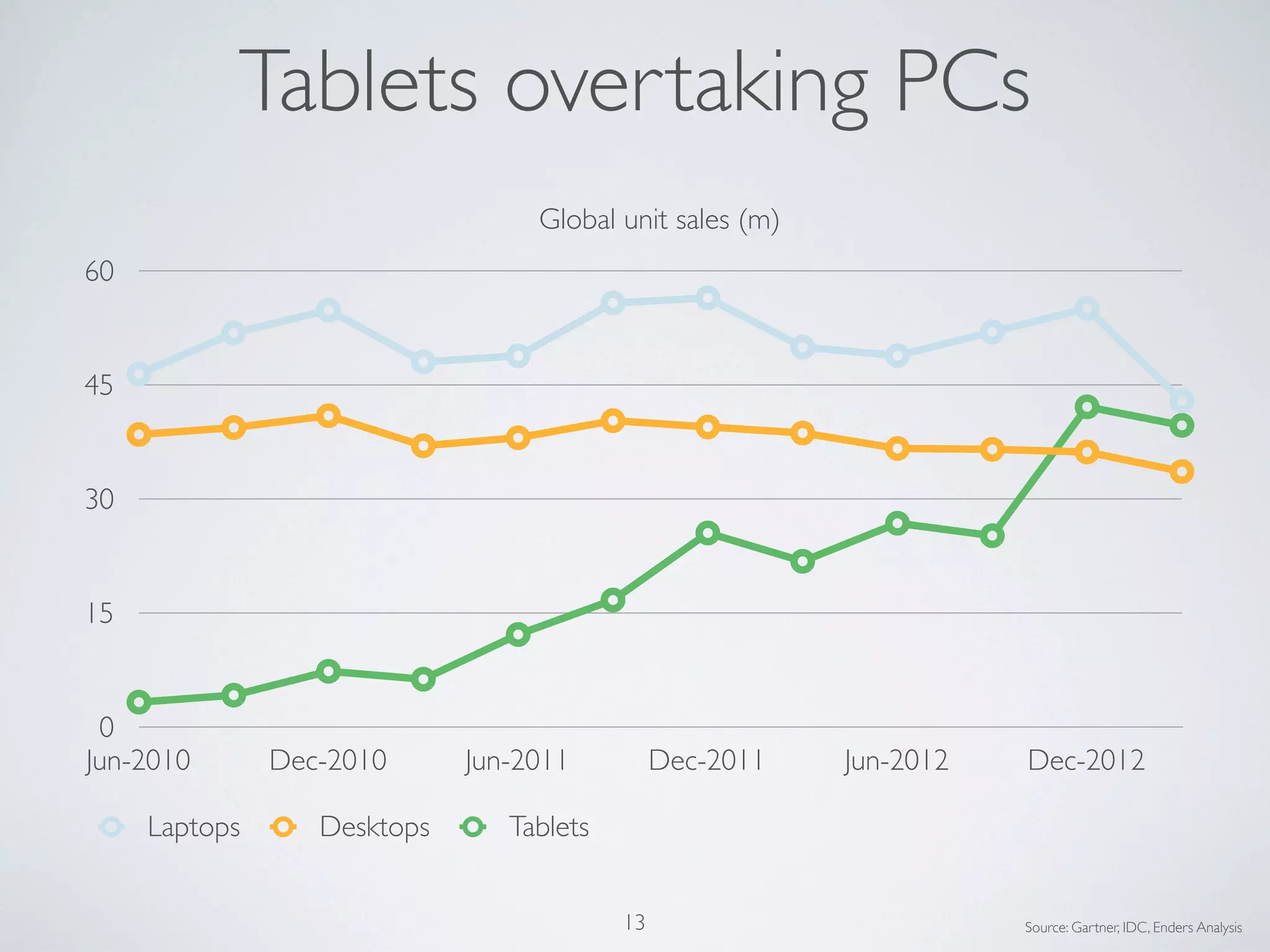

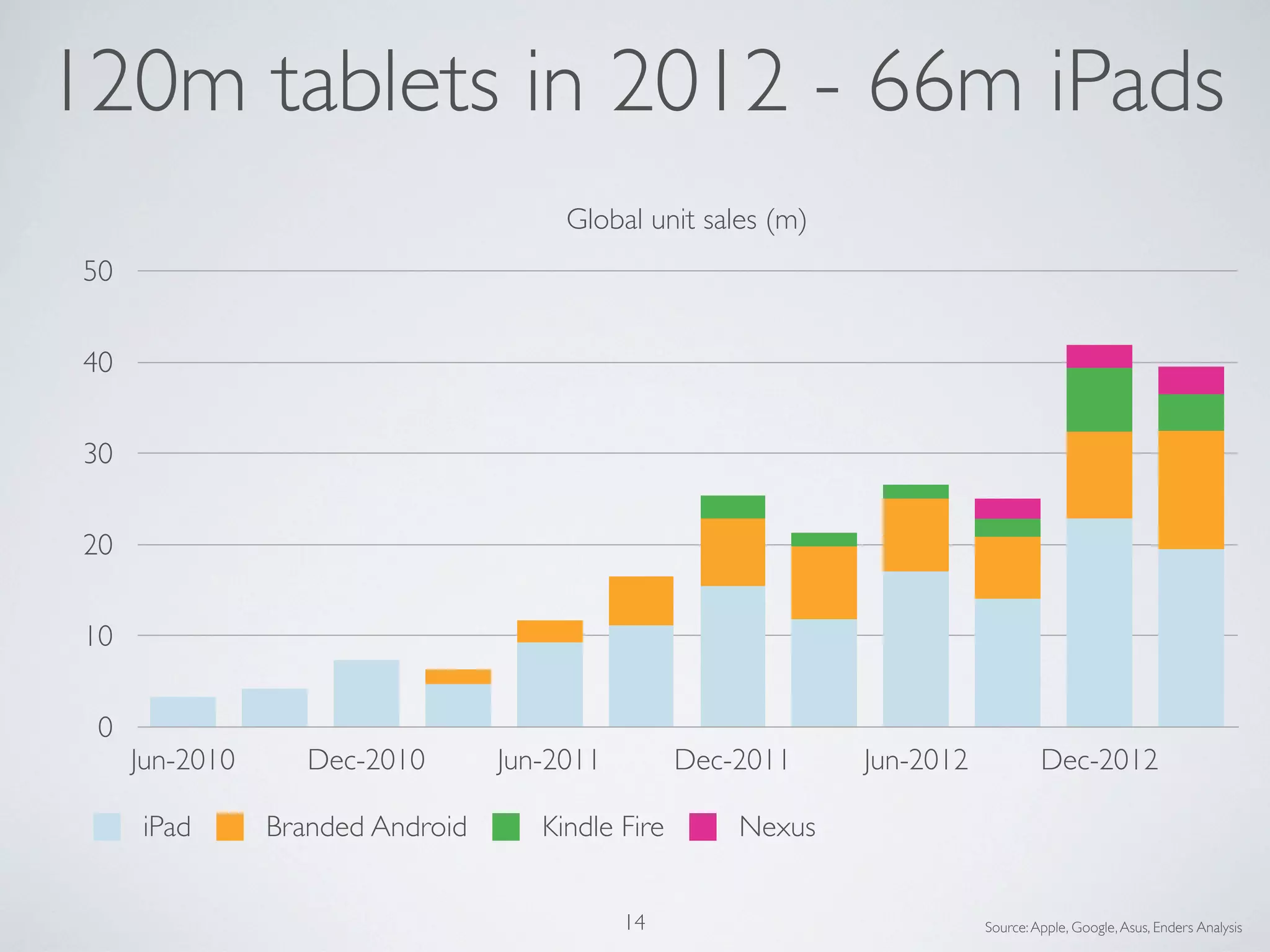

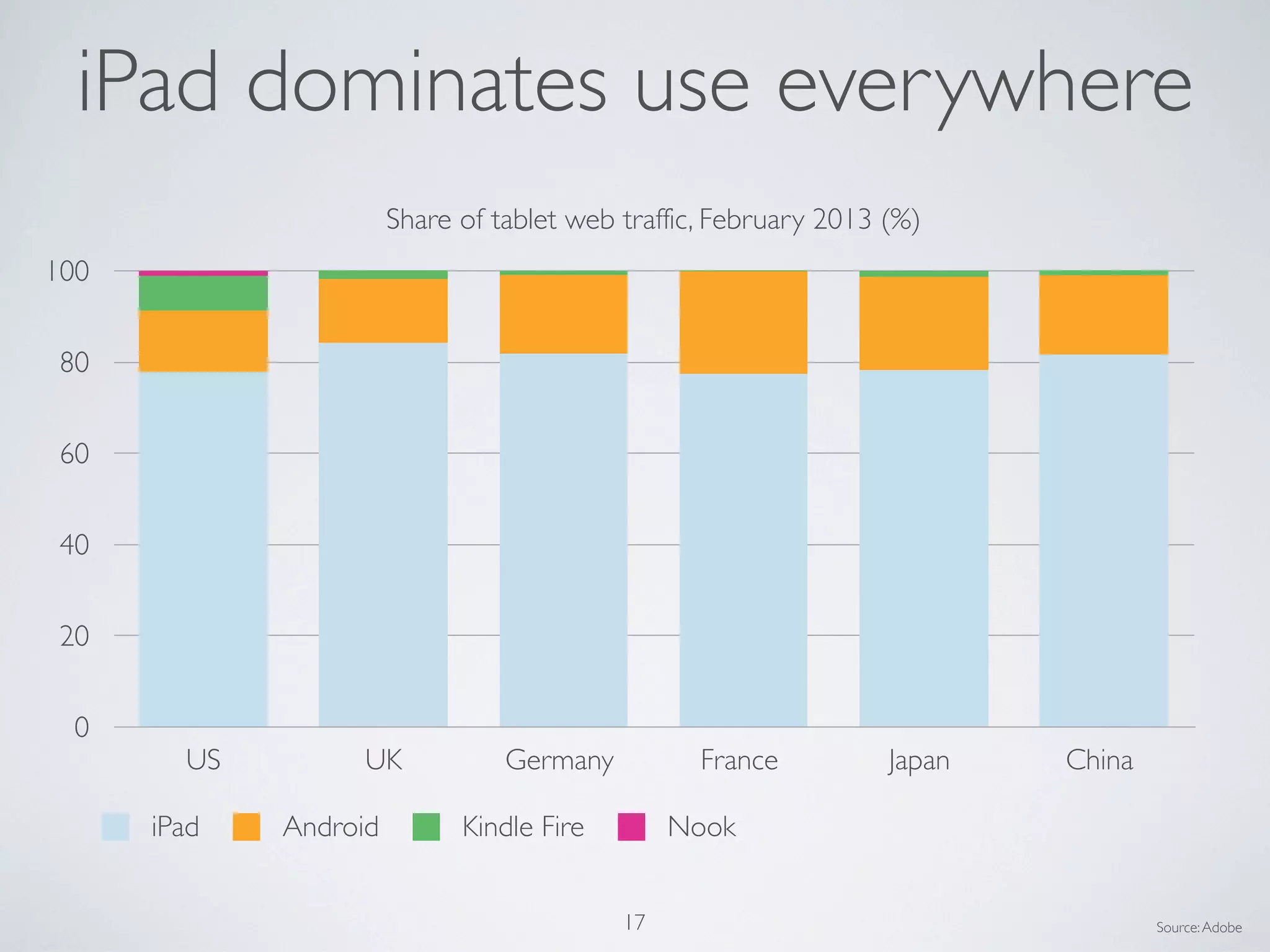

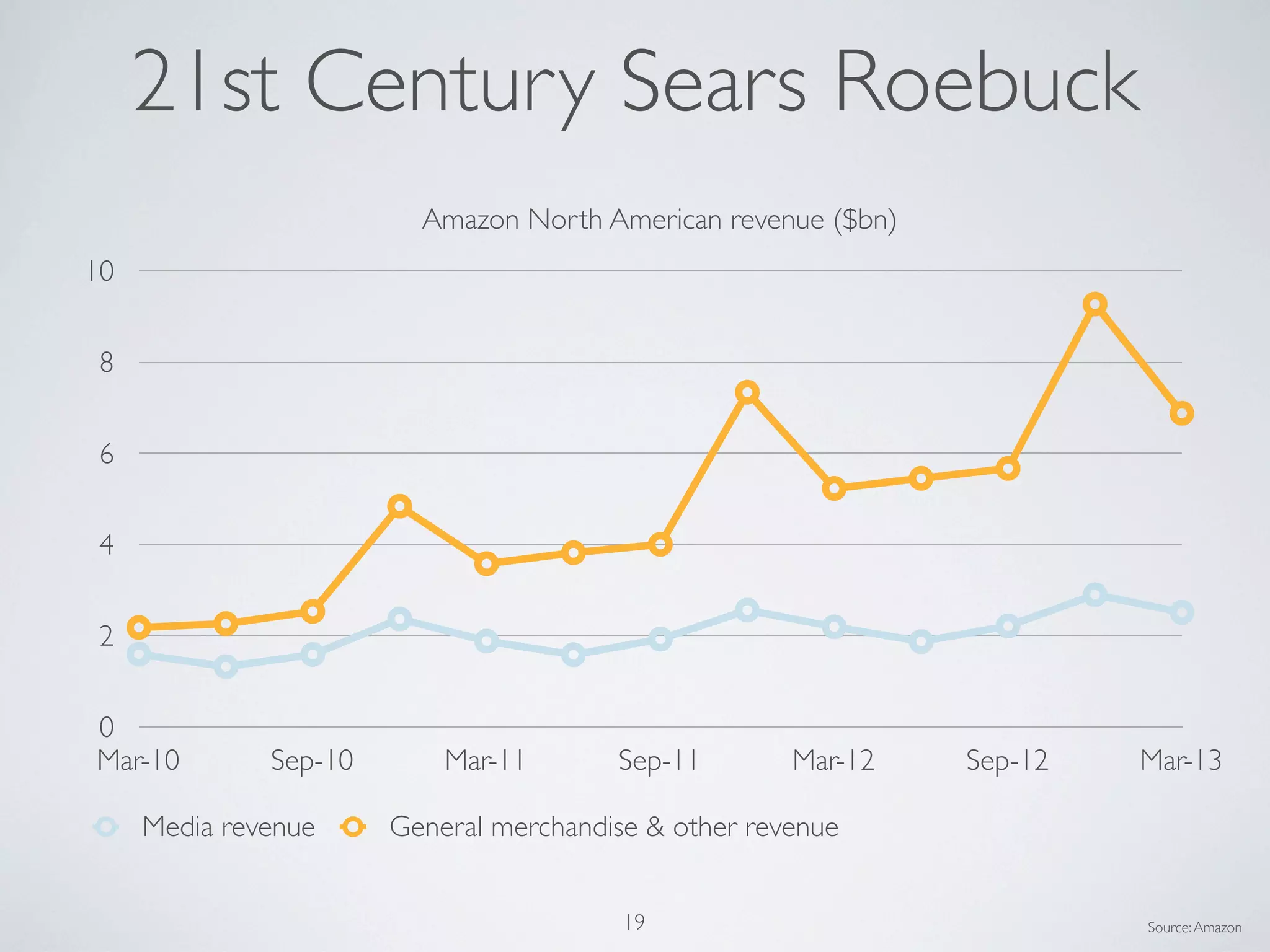

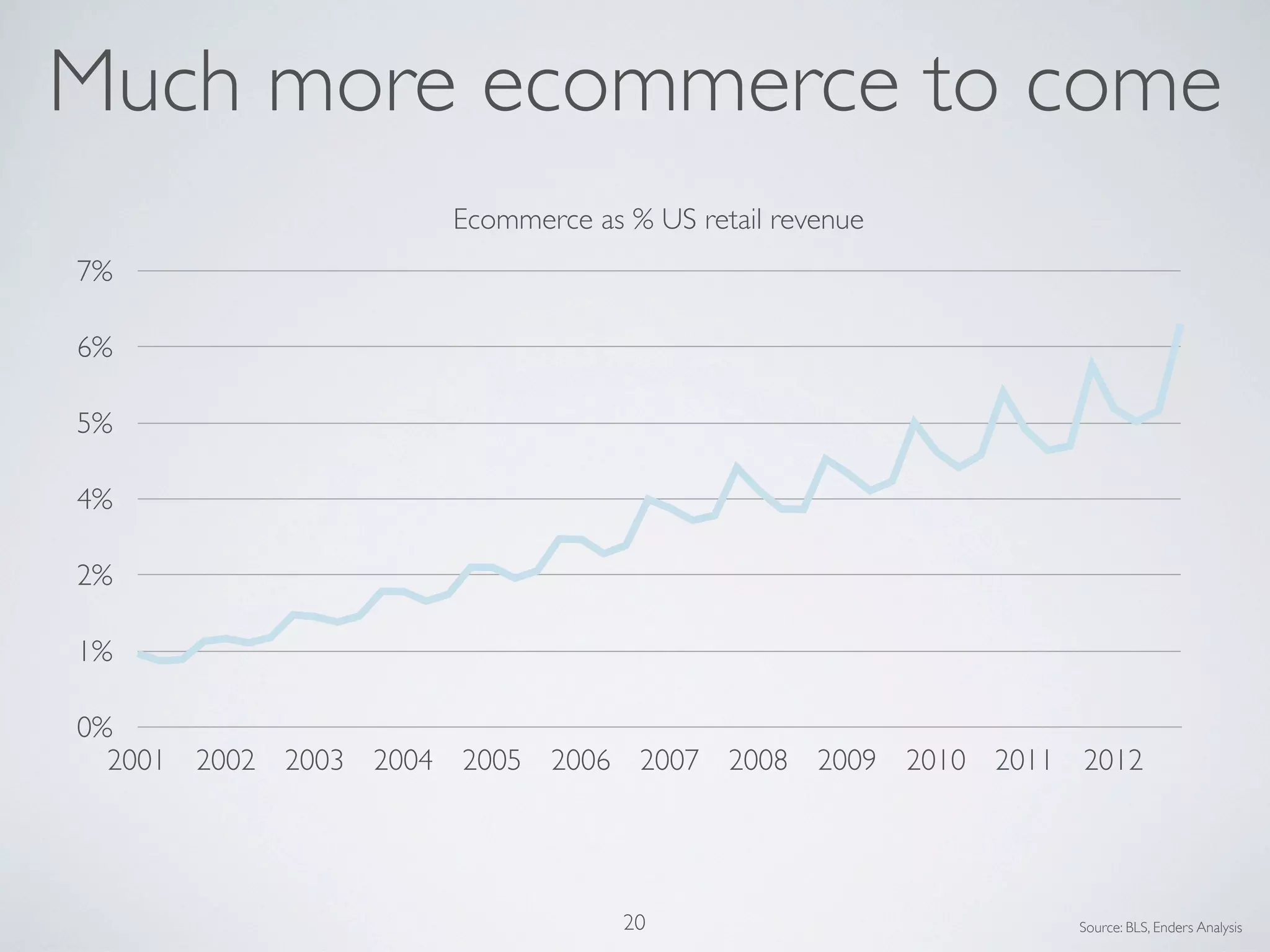

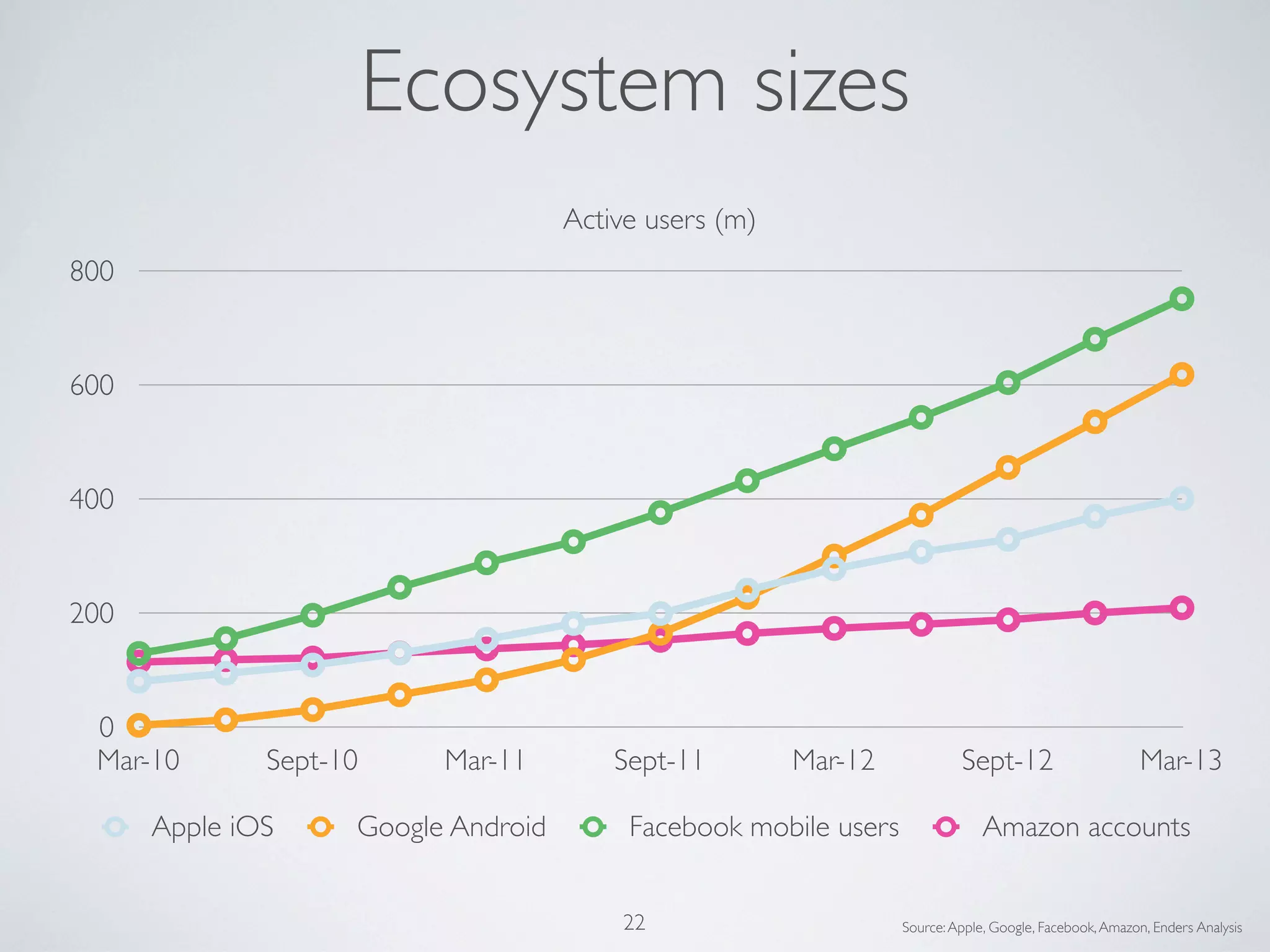

Mobile devices such as smartphones and tablets are dramatically increasing in sales and dominating the consumer technology market. Global PC sales peaked in 2011 and have declined since, being overtaken by surging tablet sales. By 2017 there will be over 7 billion mobile subscribers, compared to just over 1 billion PC users. This fundamental shift is changing industries like media, advertising, and retail as mobile internet usage grows and mobile platforms like Apple's iOS and Google's Android come to dominate the market.