This document provides a practical guide to predictive modeling and data science, focusing on implementation methods for analyzing a sizable banking dataset. It discusses data cleaning, visualization, exploration, model building, and performance estimation techniques using Python, specifically targeting the prediction of bank term deposit subscriptions. The guide aims to introduce new learners to the essential concepts and methodologies in predictive analytics, emphasized through the application of various machine learning techniques.

![Problem Statement and Data

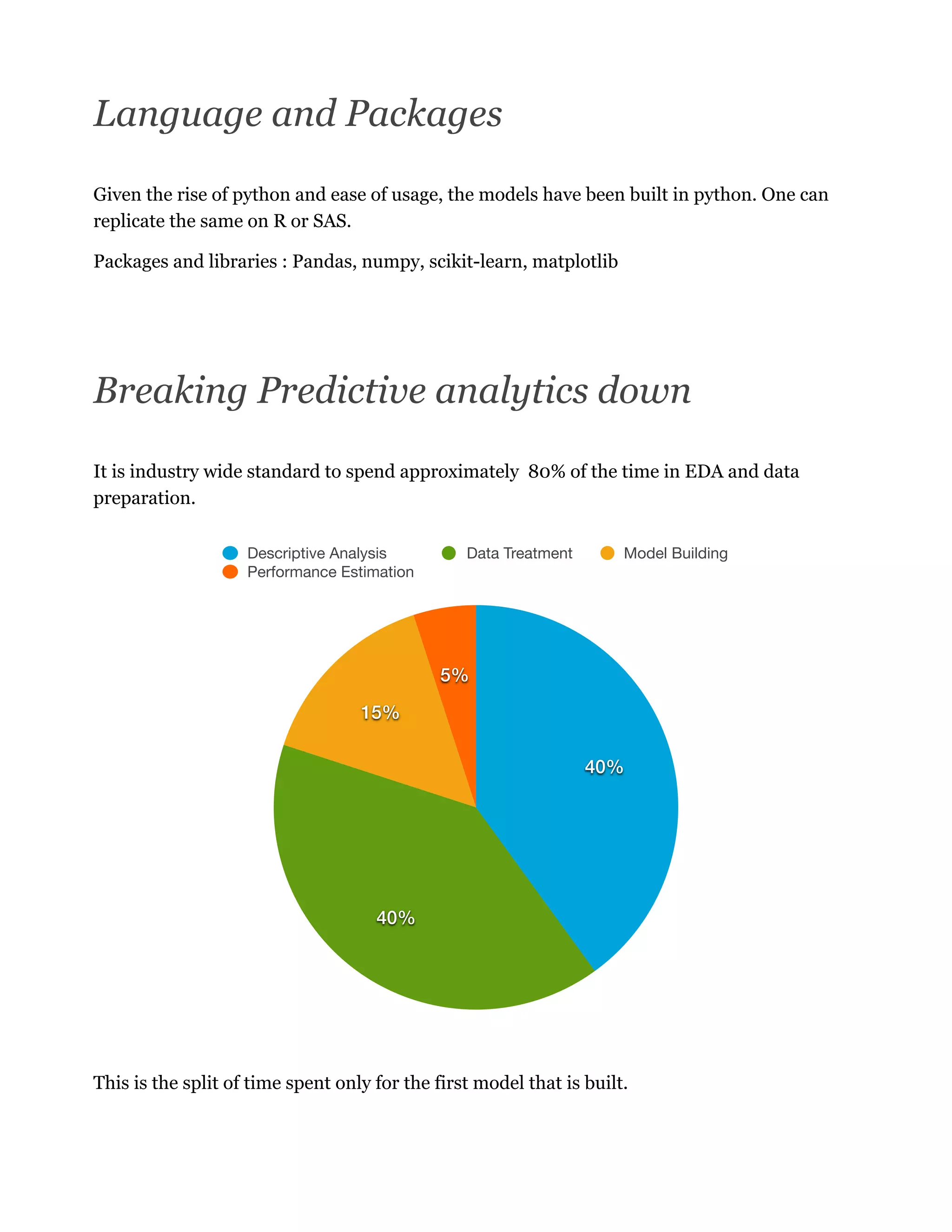

The name of the bank is Banco de Portugal

Website https://www.bportugal.pt/en-US/Pages/inicio.aspx

Problem statement : Predict using mathematical methods whether a customer a customer

subscribed to a term deposit loan.

Data has been taken from https://archive.ics.uci.edu/ml/datasets/Bank+Marketing

Citation : Moro et al., 2014] S. Moro, P. Cortez and P. Rita. A Data-Driven Approach to

Predict the Success of Bank Telemarketing. Decision Support Systems,

In press, http://dx.doi.org/10.1016/j.dss.2014.03.001

Available at: [pdf] http://dx.doi.org/10.1016/j.dss.2014.03.001

[bib] http://www3.dsi.uminho.pt/pcortez/bib/2014-dss.txt

1. Title: Bank Marketing (with social/economic context)

2. Sources : Sérgio Moro (ISCTE-IUL), Paulo Cortez (Univ. Minho) and Paulo Rita (ISCTE-

IUL) @ 2014

3. Past Usage: The full dataset (bank-additional-full.csv) was described and analyzed in: S.

Moro, P. Cortez and P. Rita. A Data-Driven Approach to Predict the Success of Bank

Telemarketing. Decision Support Systems (2014), doi:10.1016/j.dss.2014.03.001.

4. Relevant Information: This dataset is based on "Bank Marketing" UCI dataset. The data is

enriched by the addition of five new social and economic features/attributes (national wide

indicators from a ~10M population country), published by the Banco de Portugal and

publicly available at: https://www.bportugal.pt/estatisticasweb. The data is related with

direct marketing campaigns of a Portuguese banking institution. The marketing campaigns

were based on phone calls. Often, more than one contact to the same client was required, in

order to access if the product (bank term deposit) would be ('yes') or not ('no') subscribed.](https://image.slidesharecdn.com/predictivemodeling-160725033236/75/Predictive-modeling-3-2048.jpg)