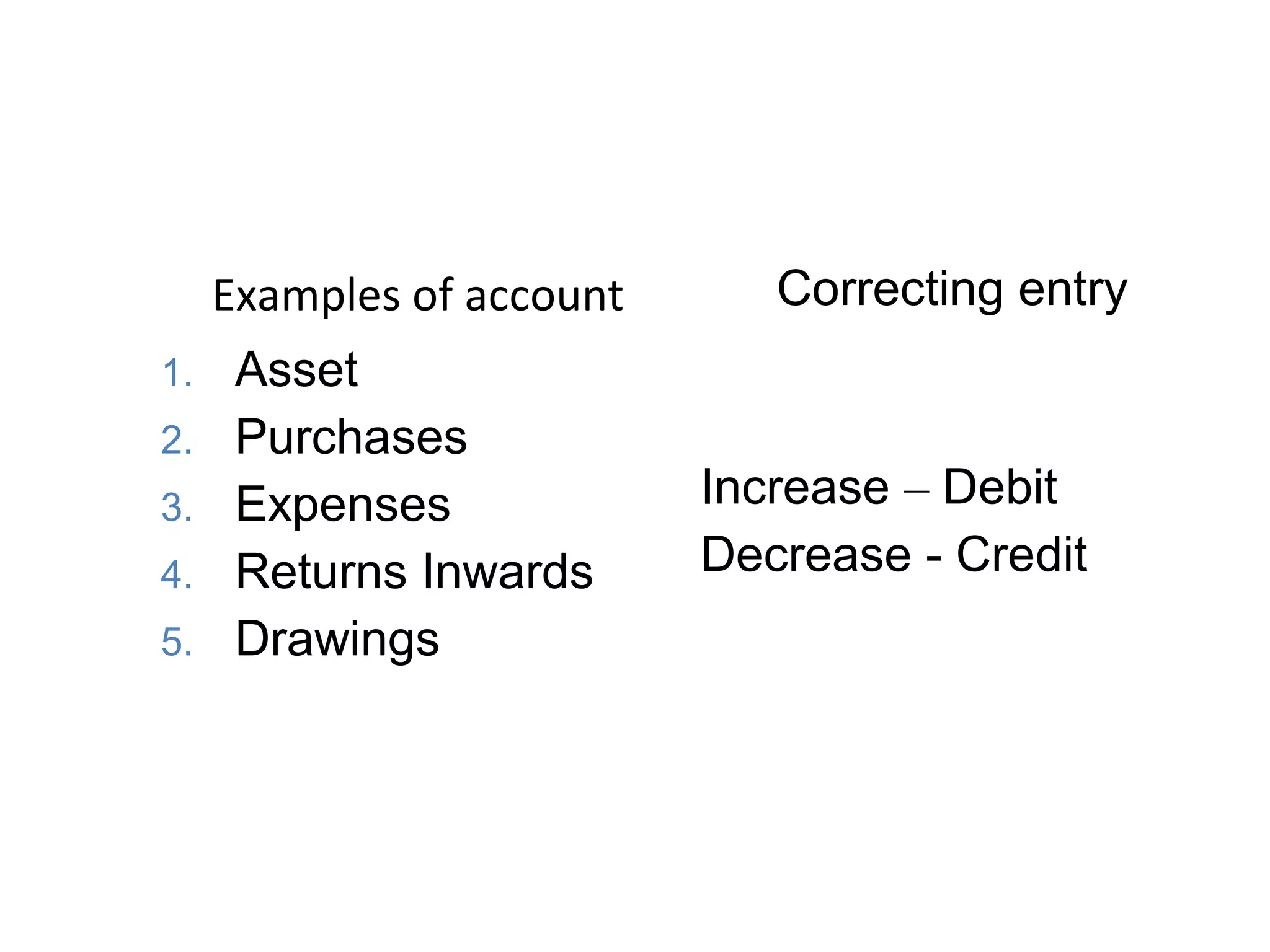

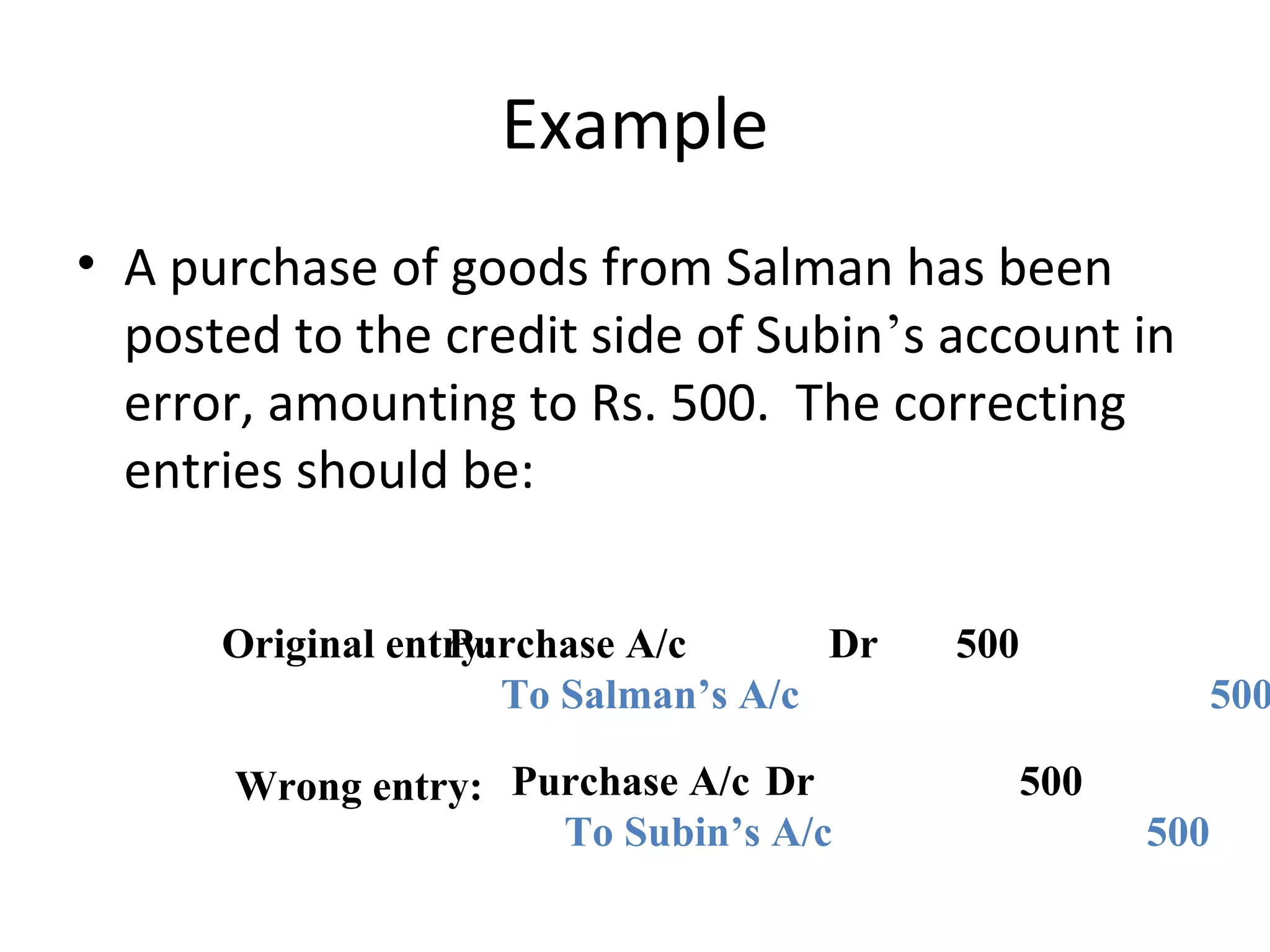

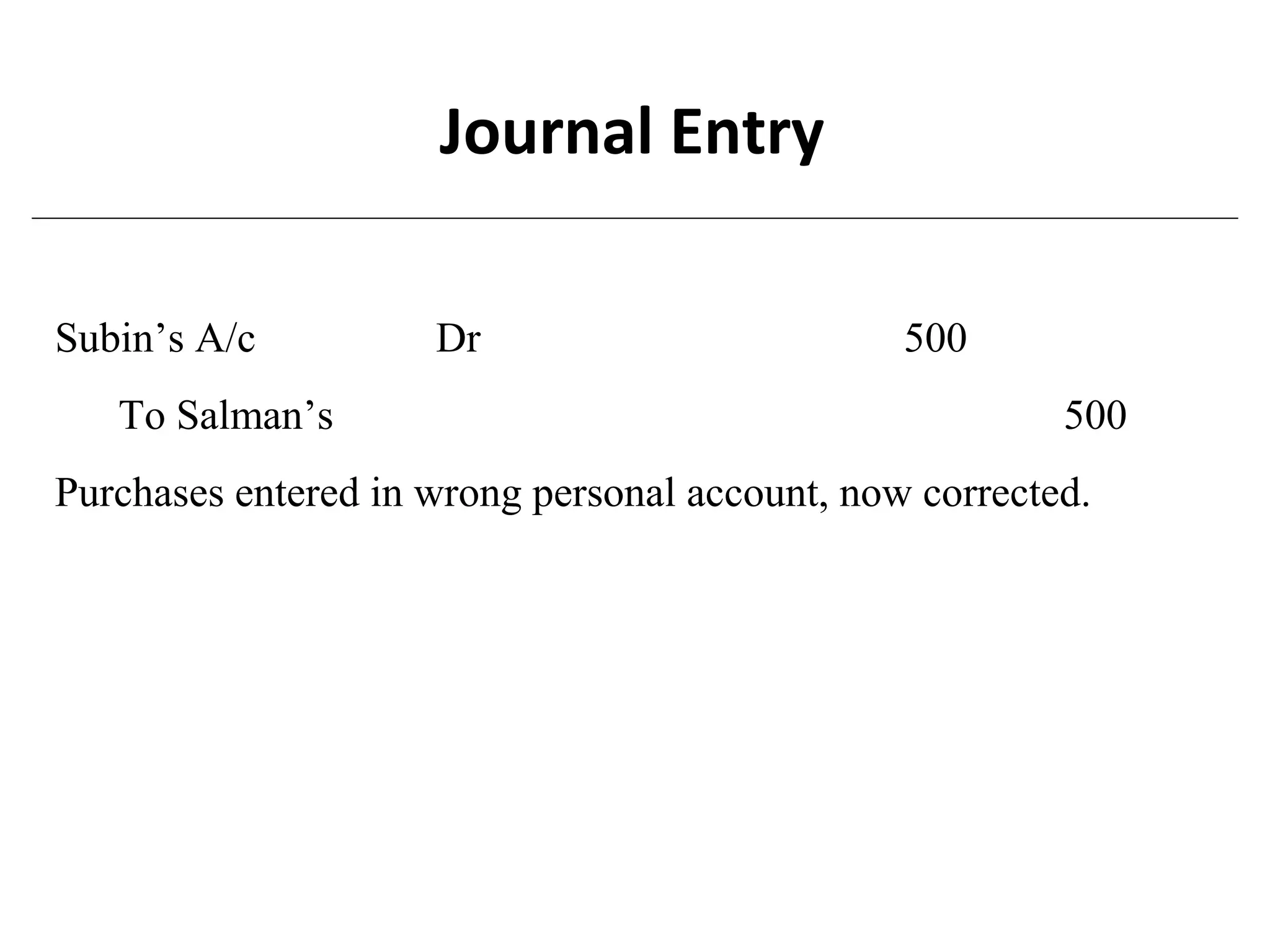

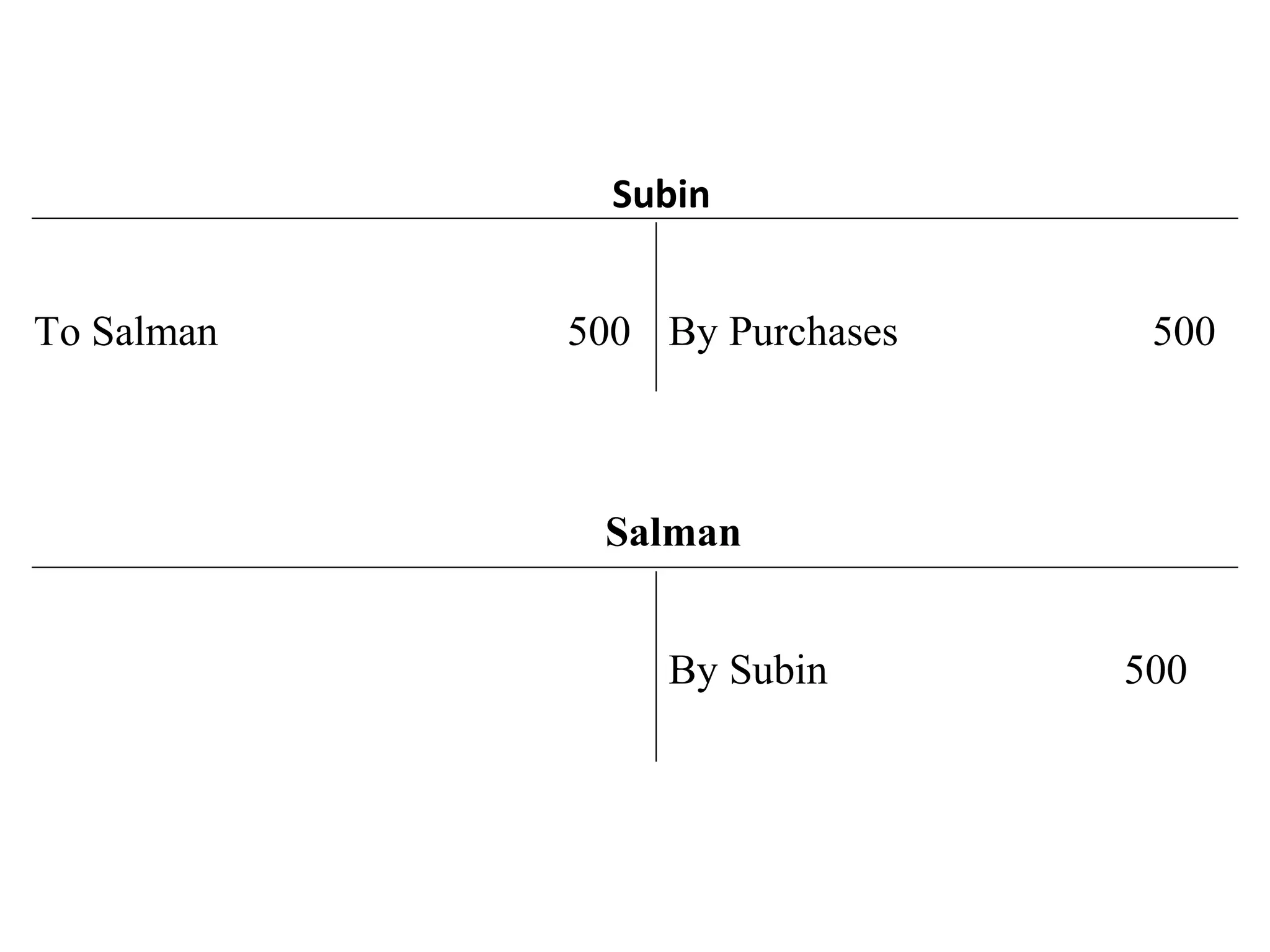

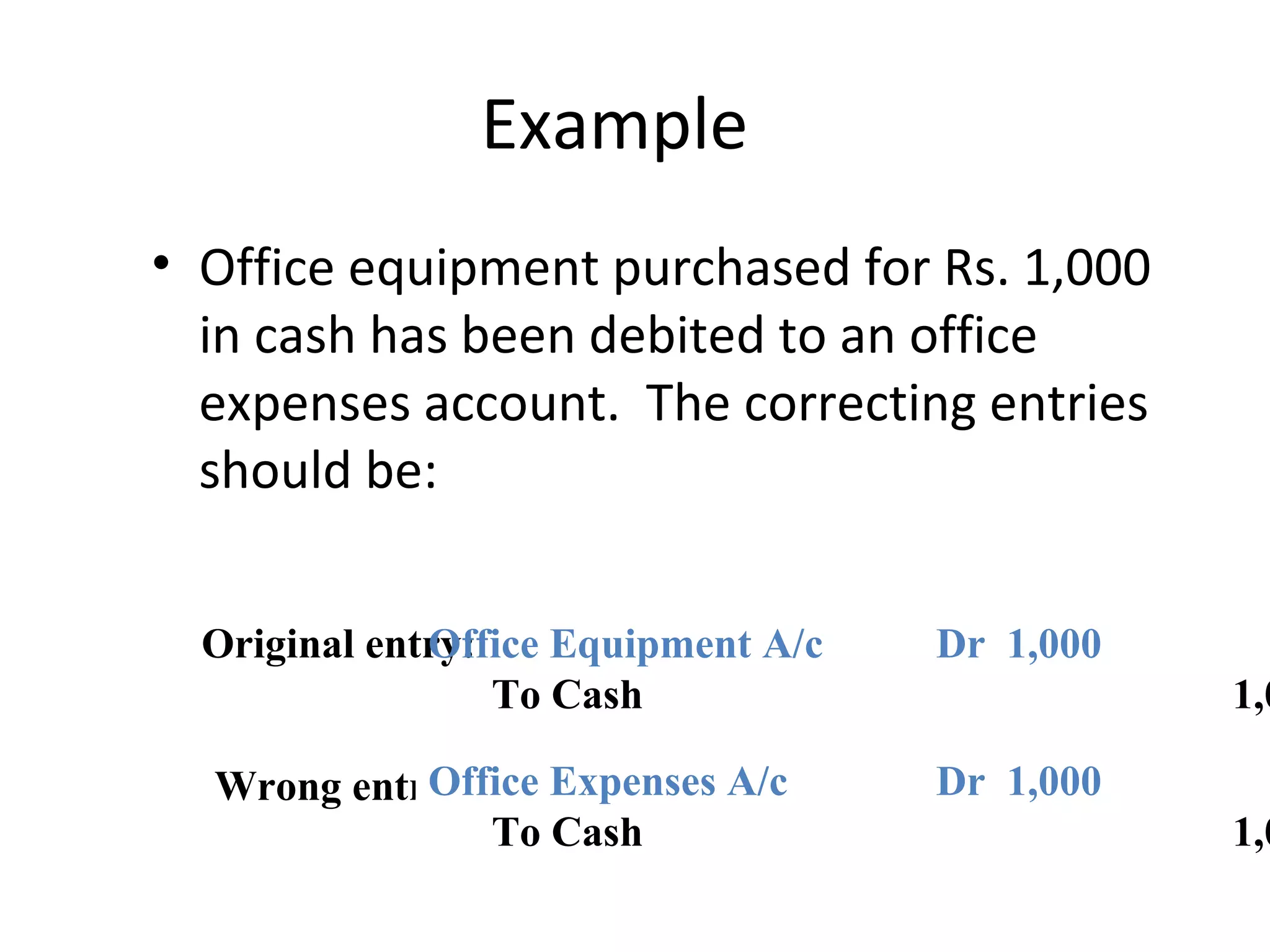

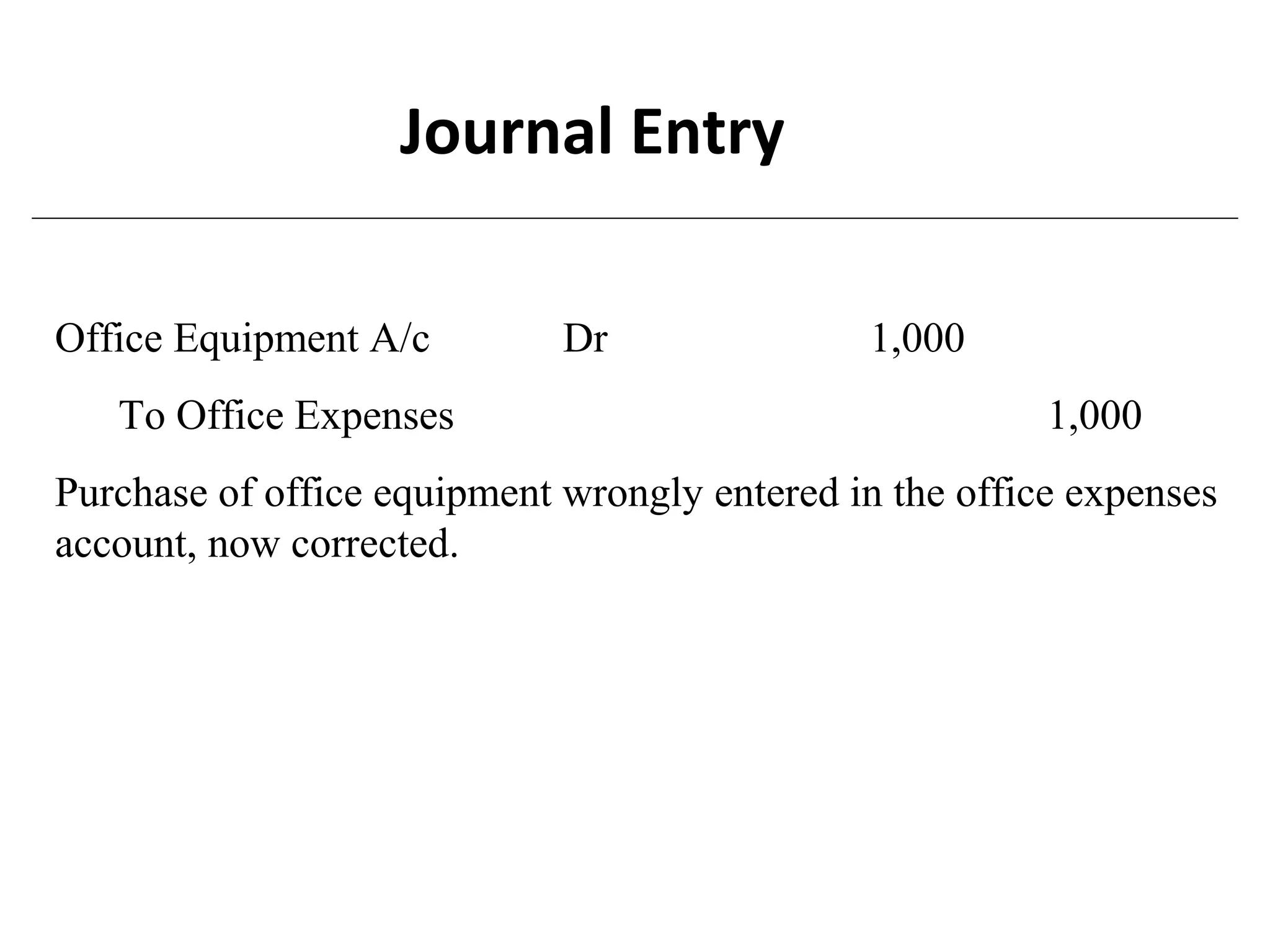

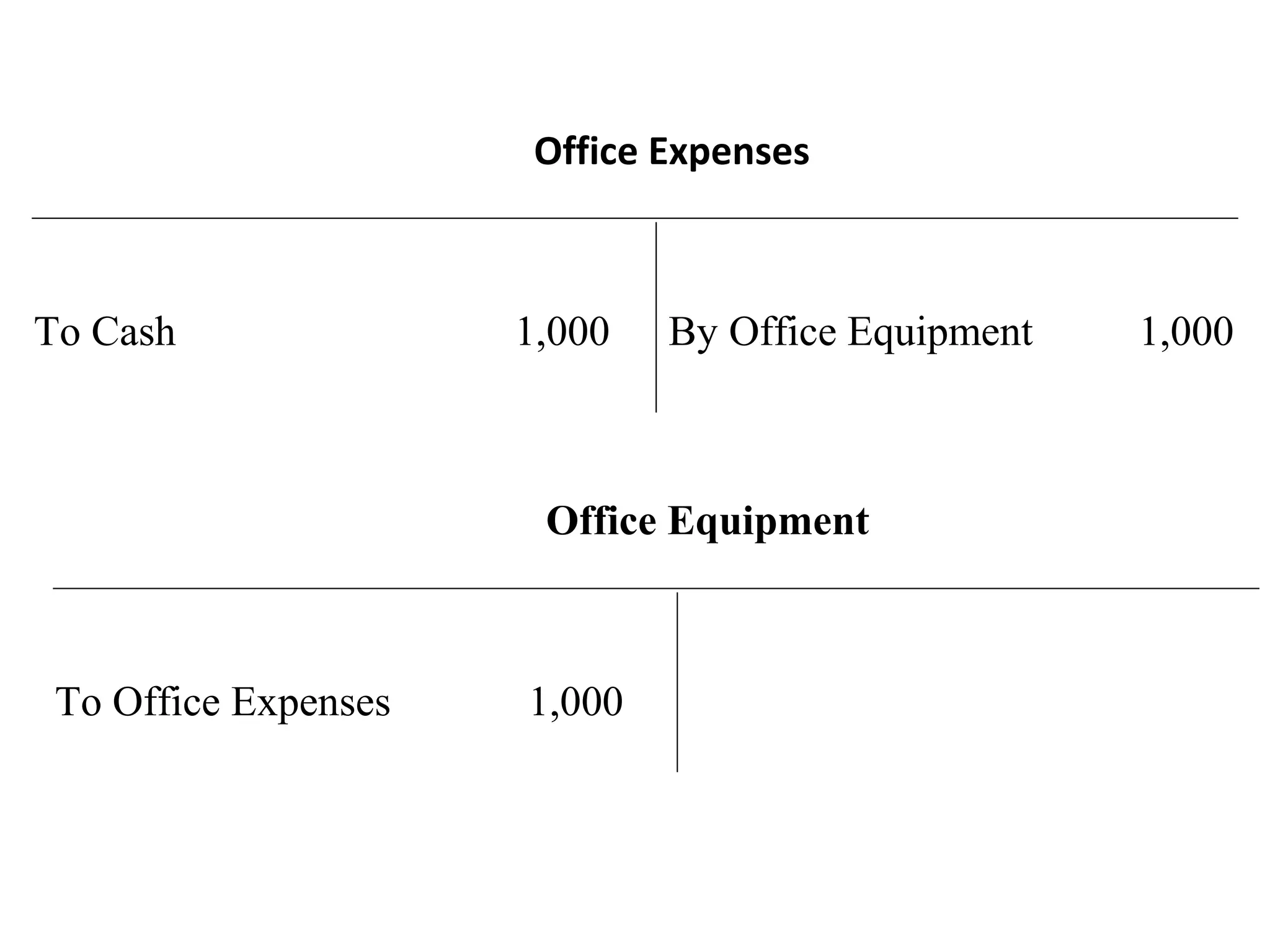

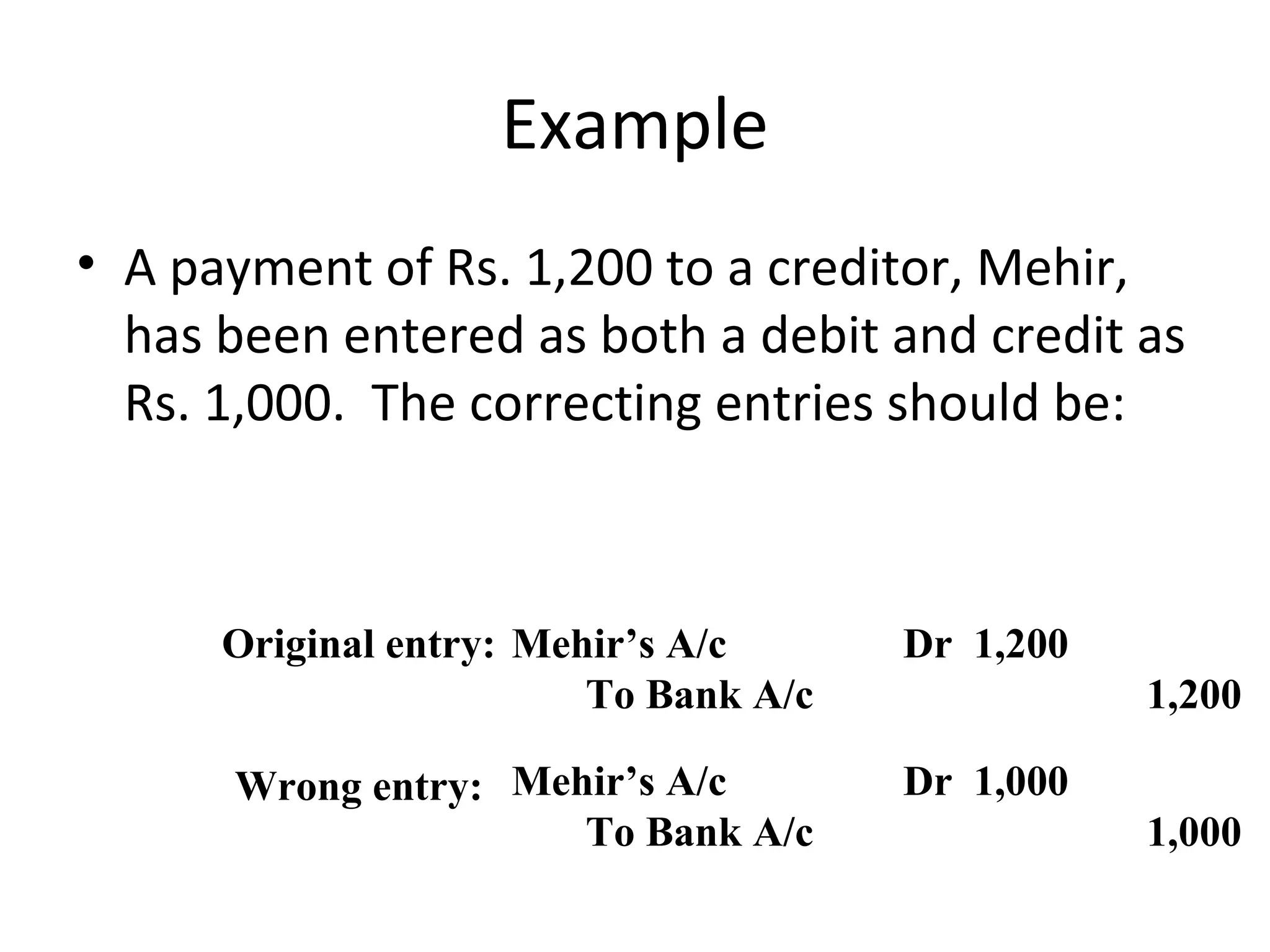

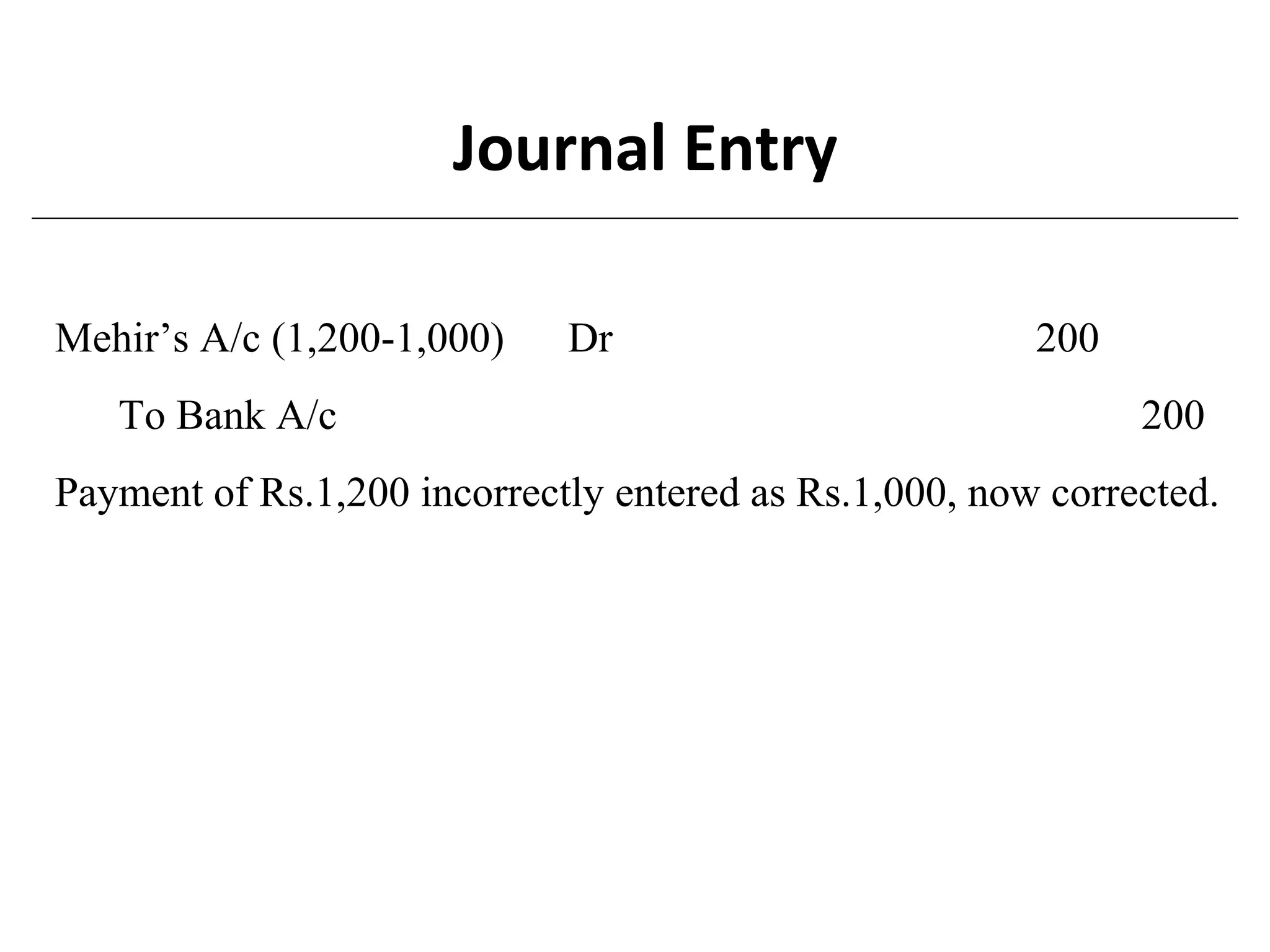

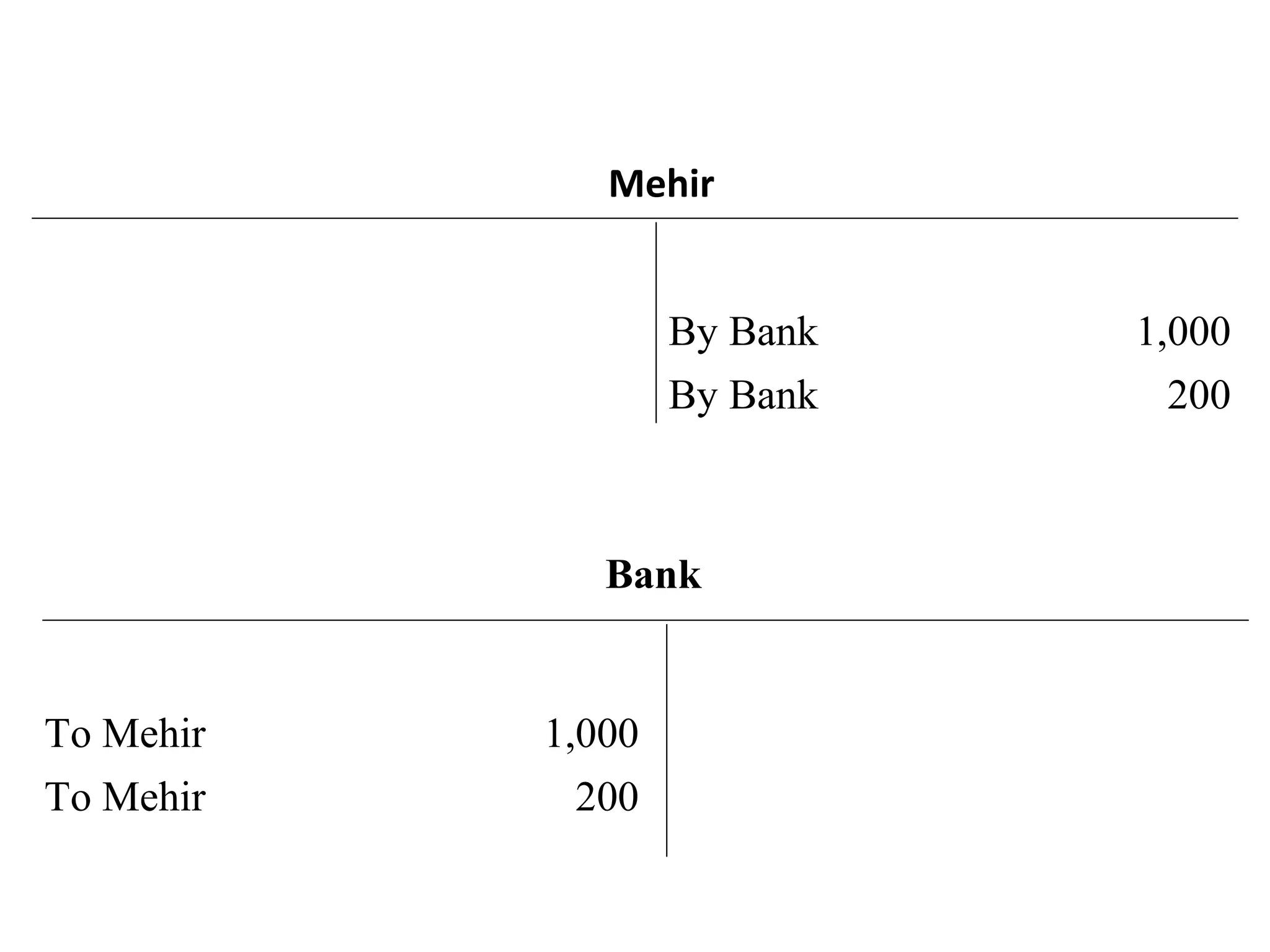

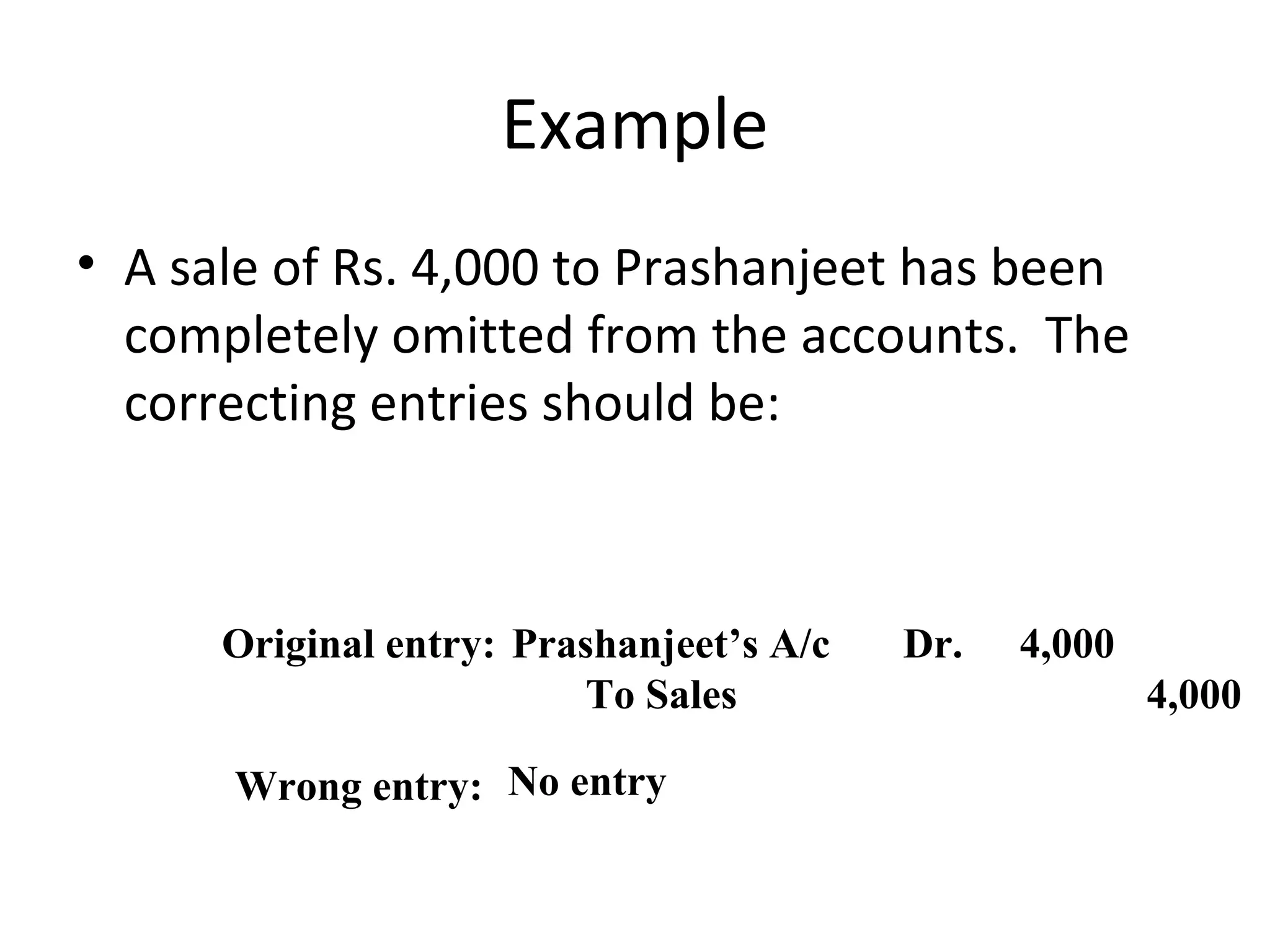

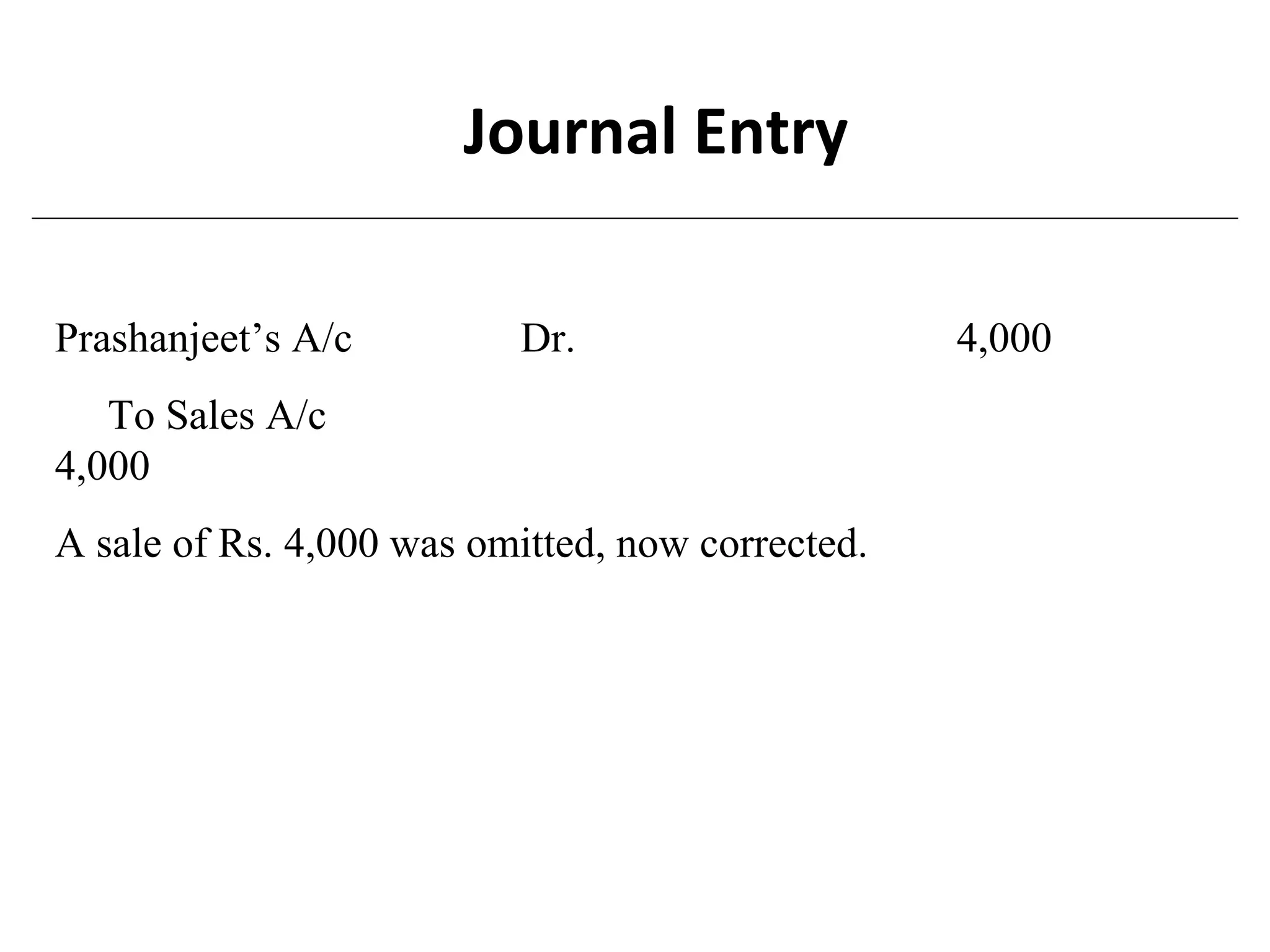

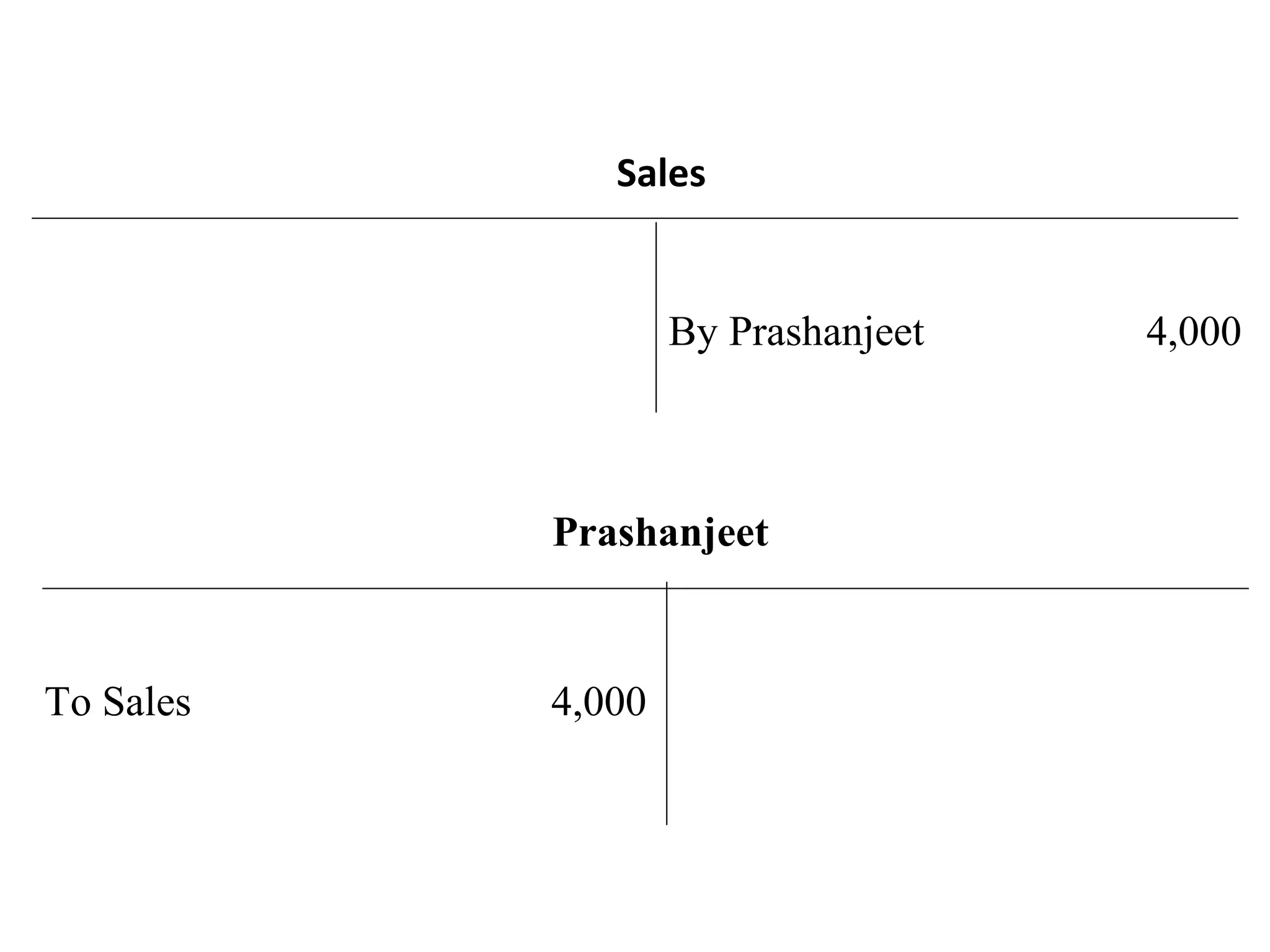

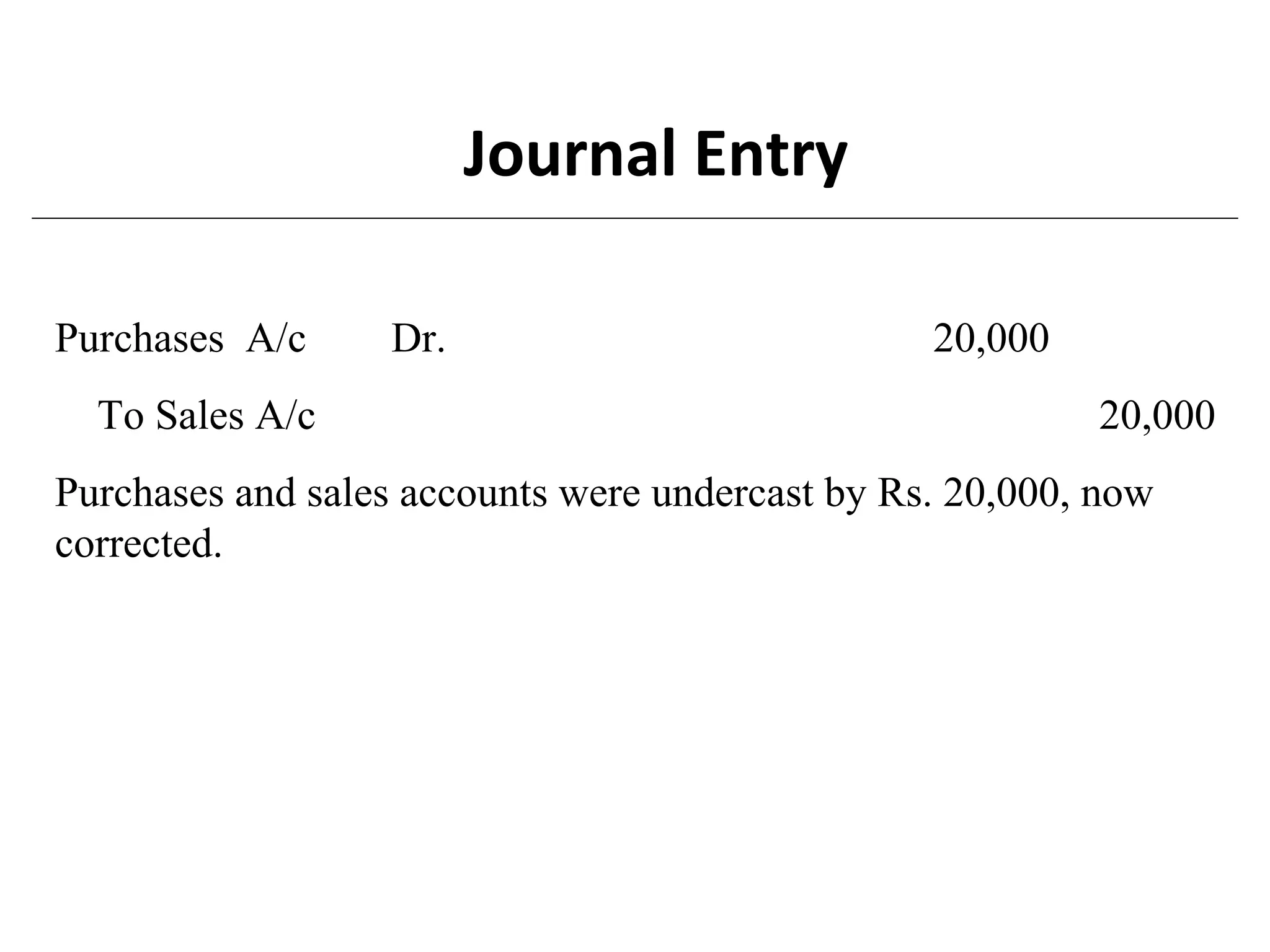

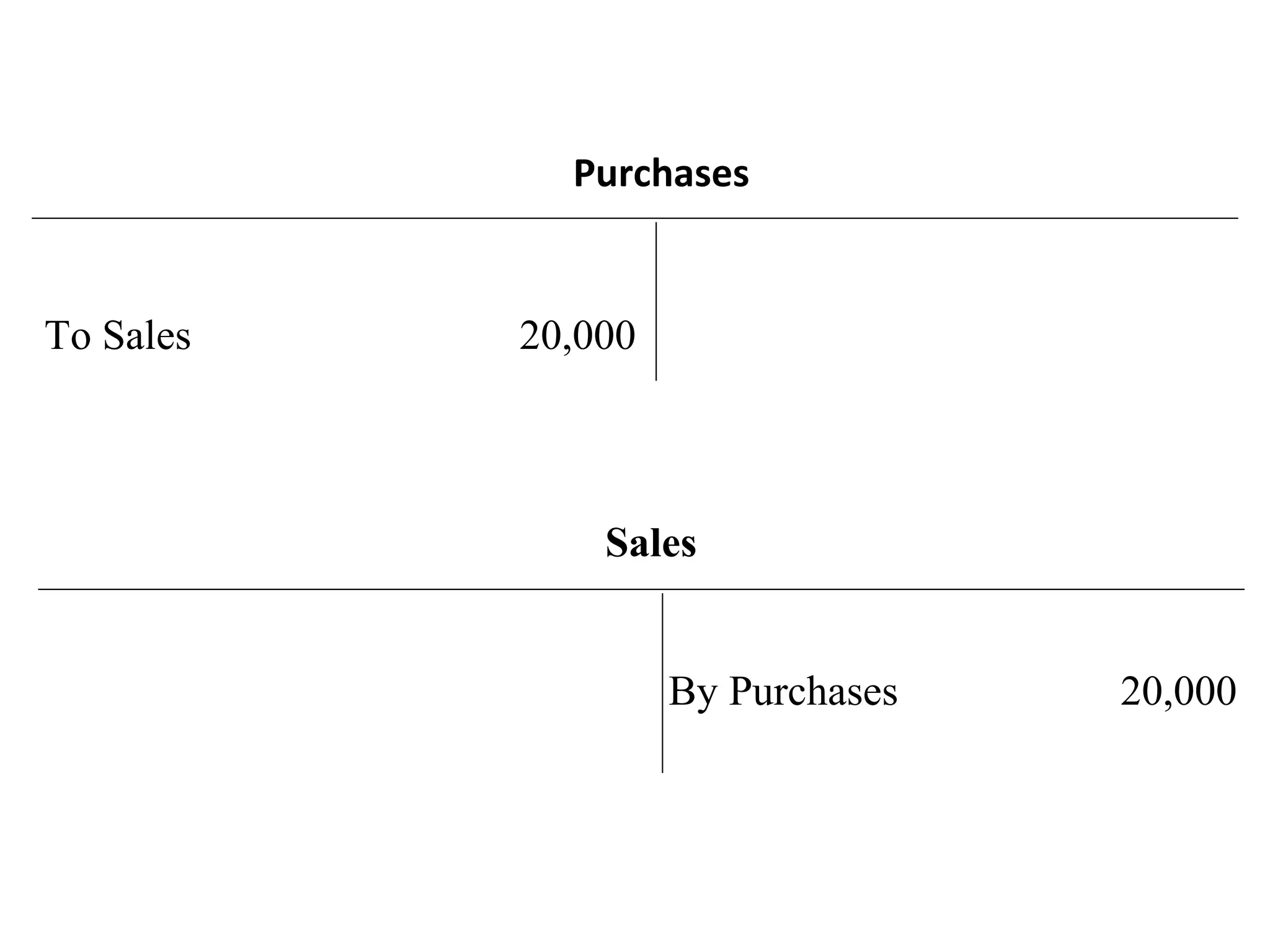

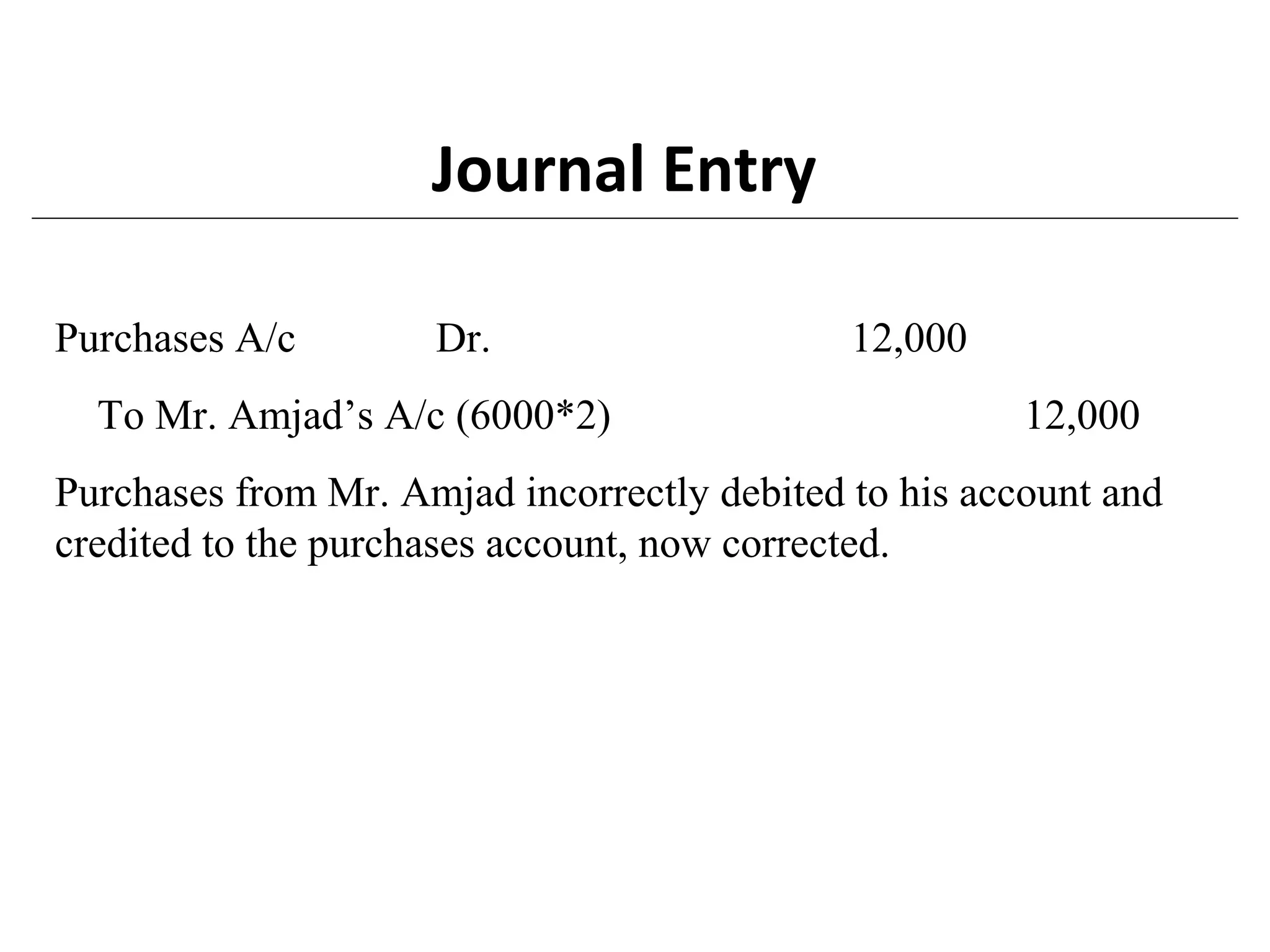

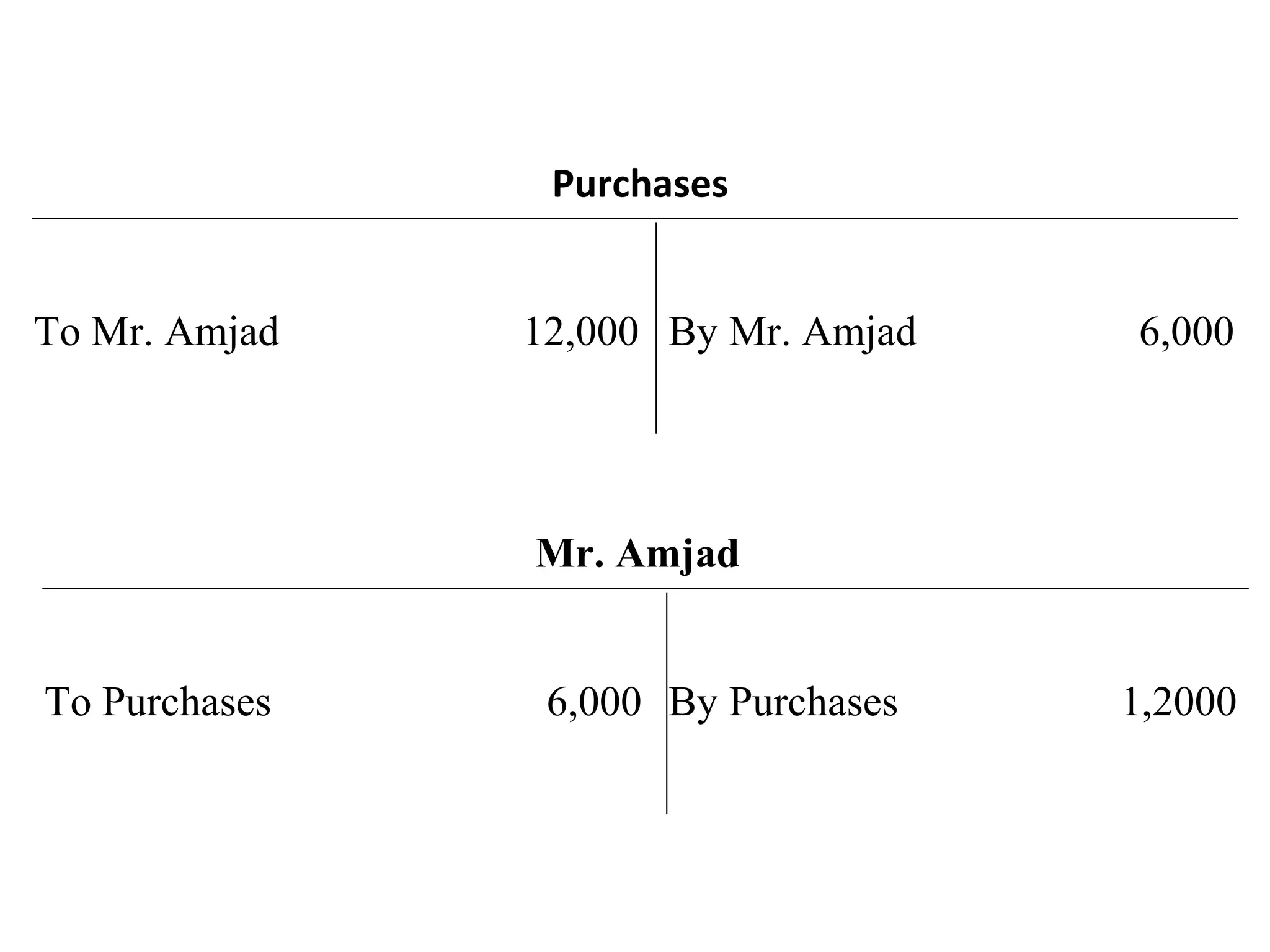

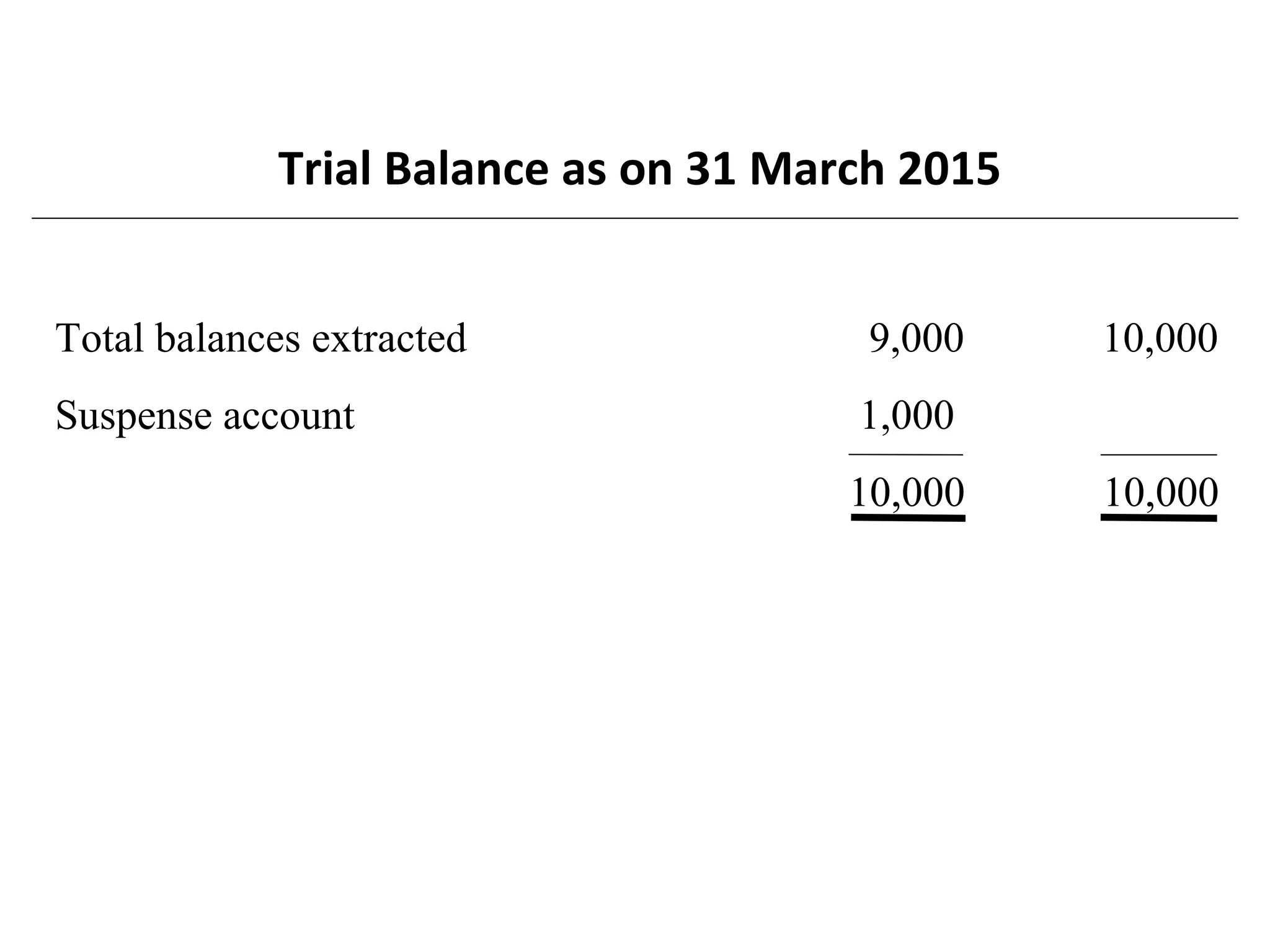

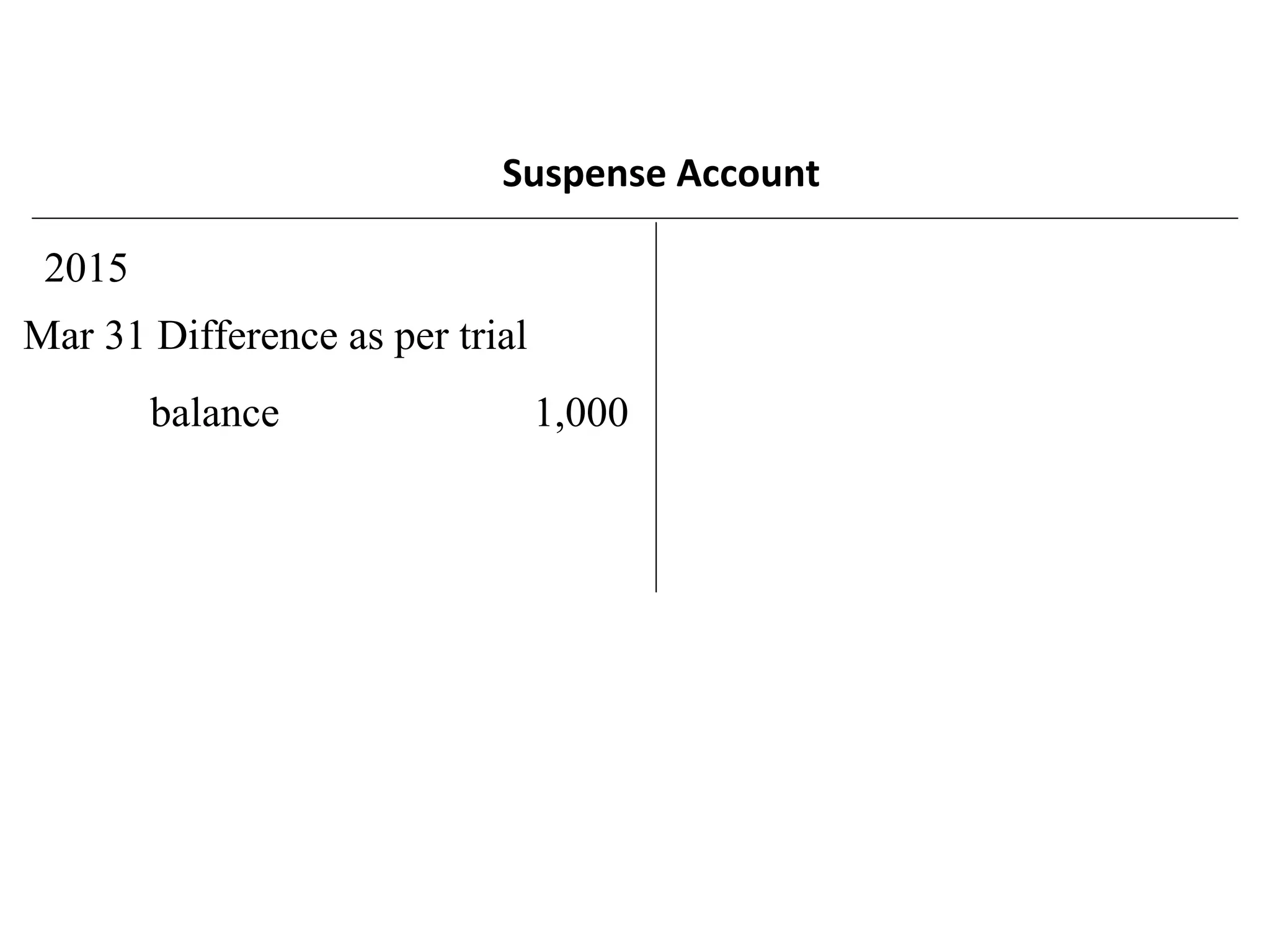

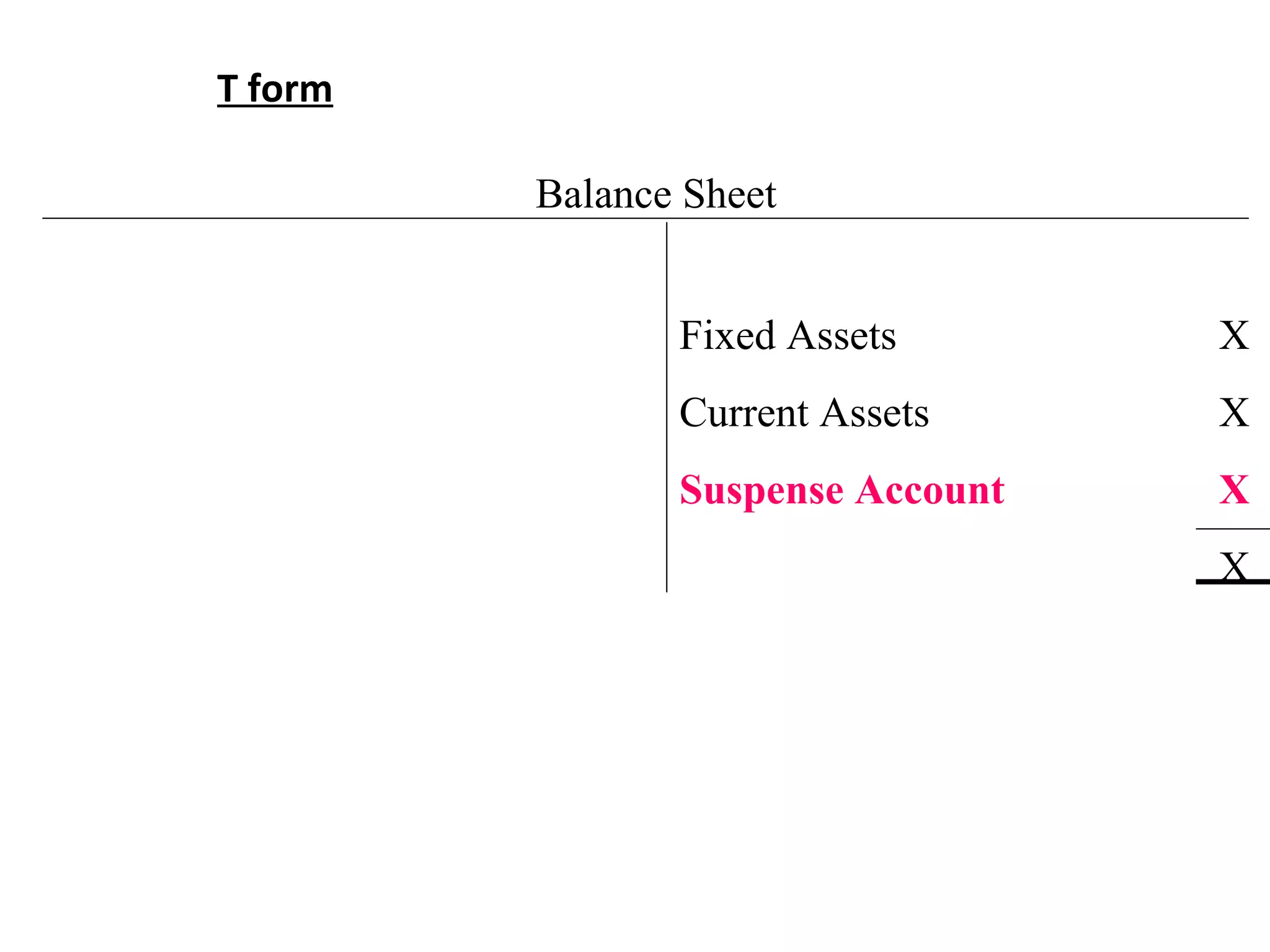

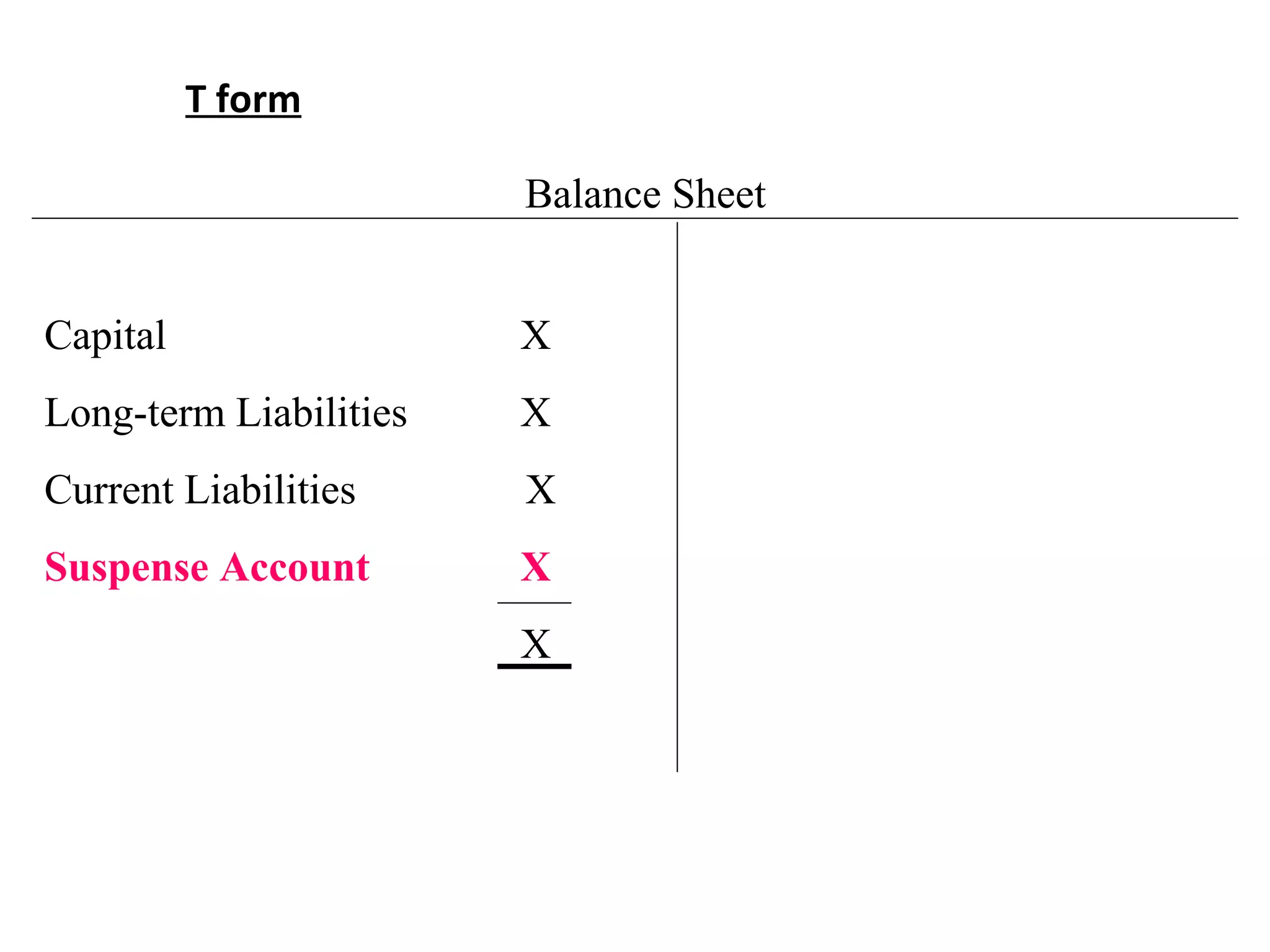

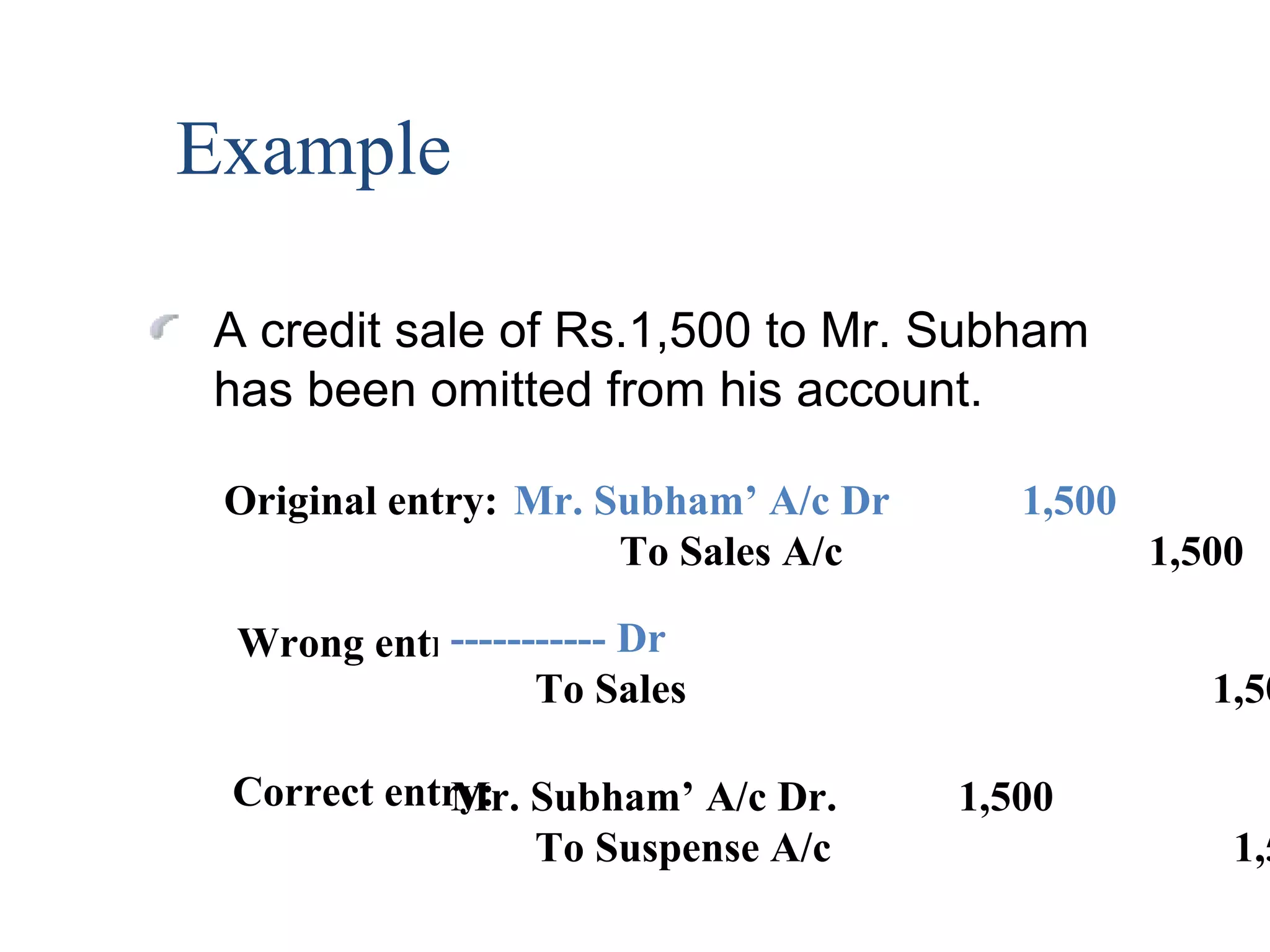

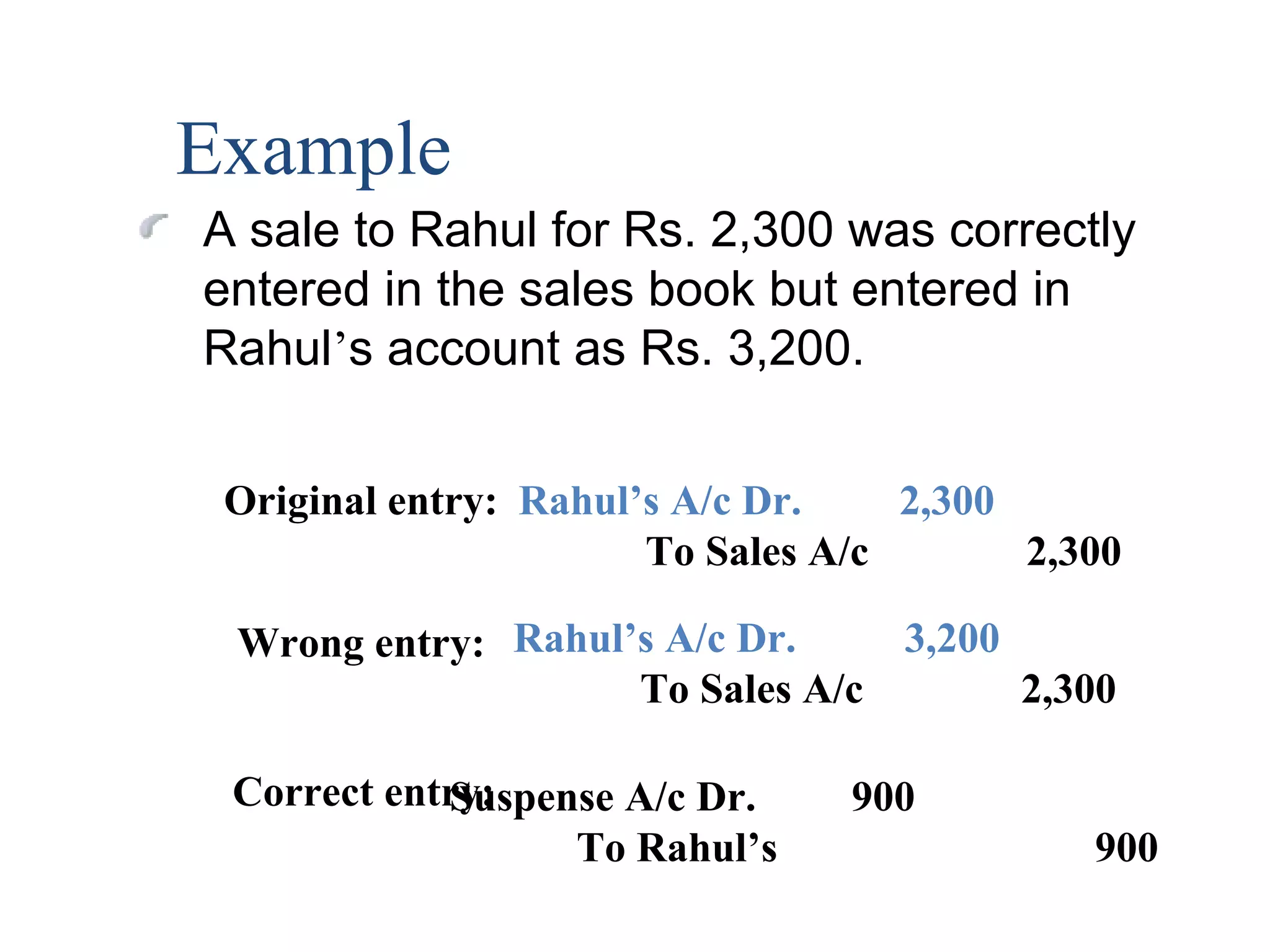

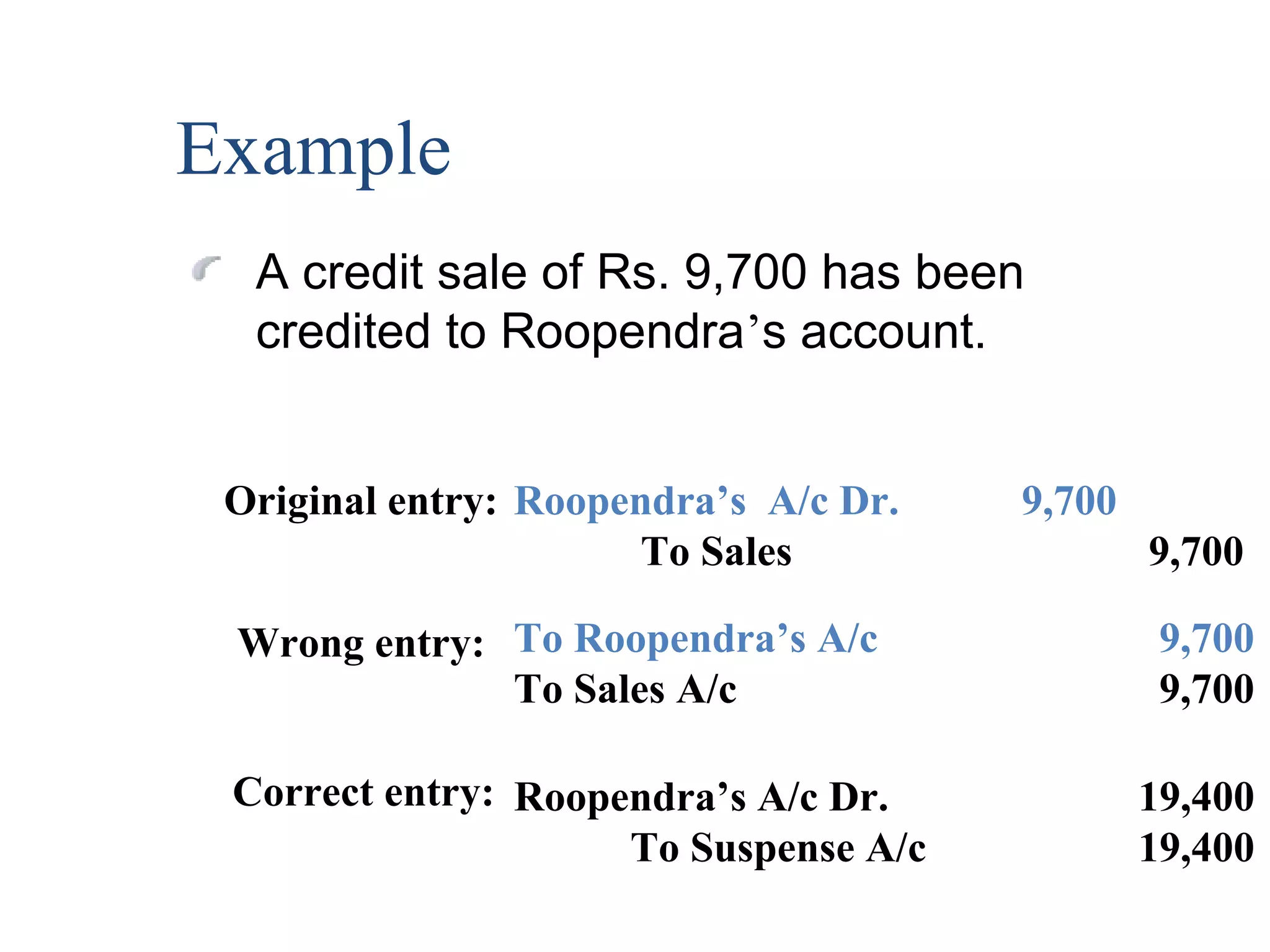

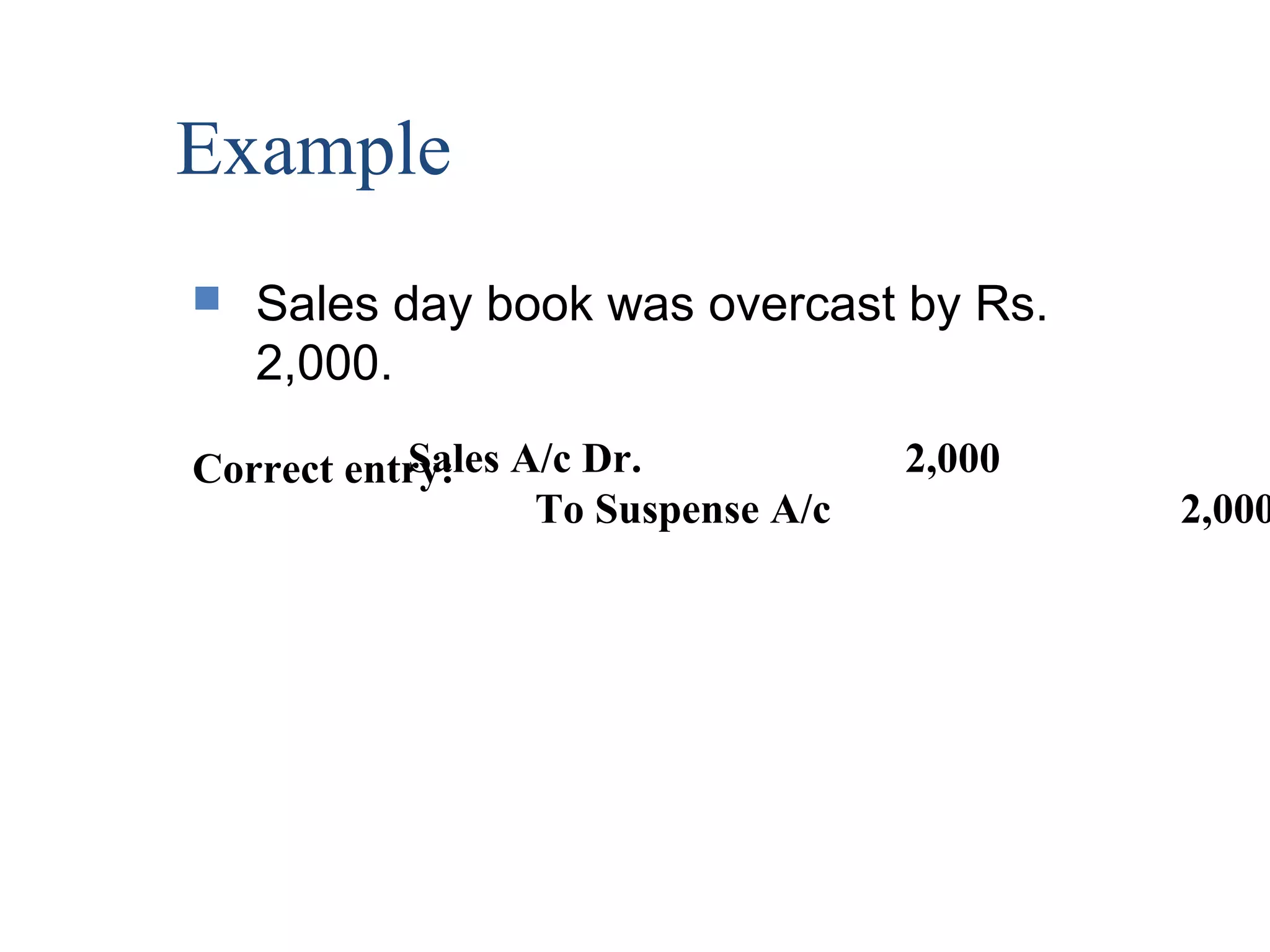

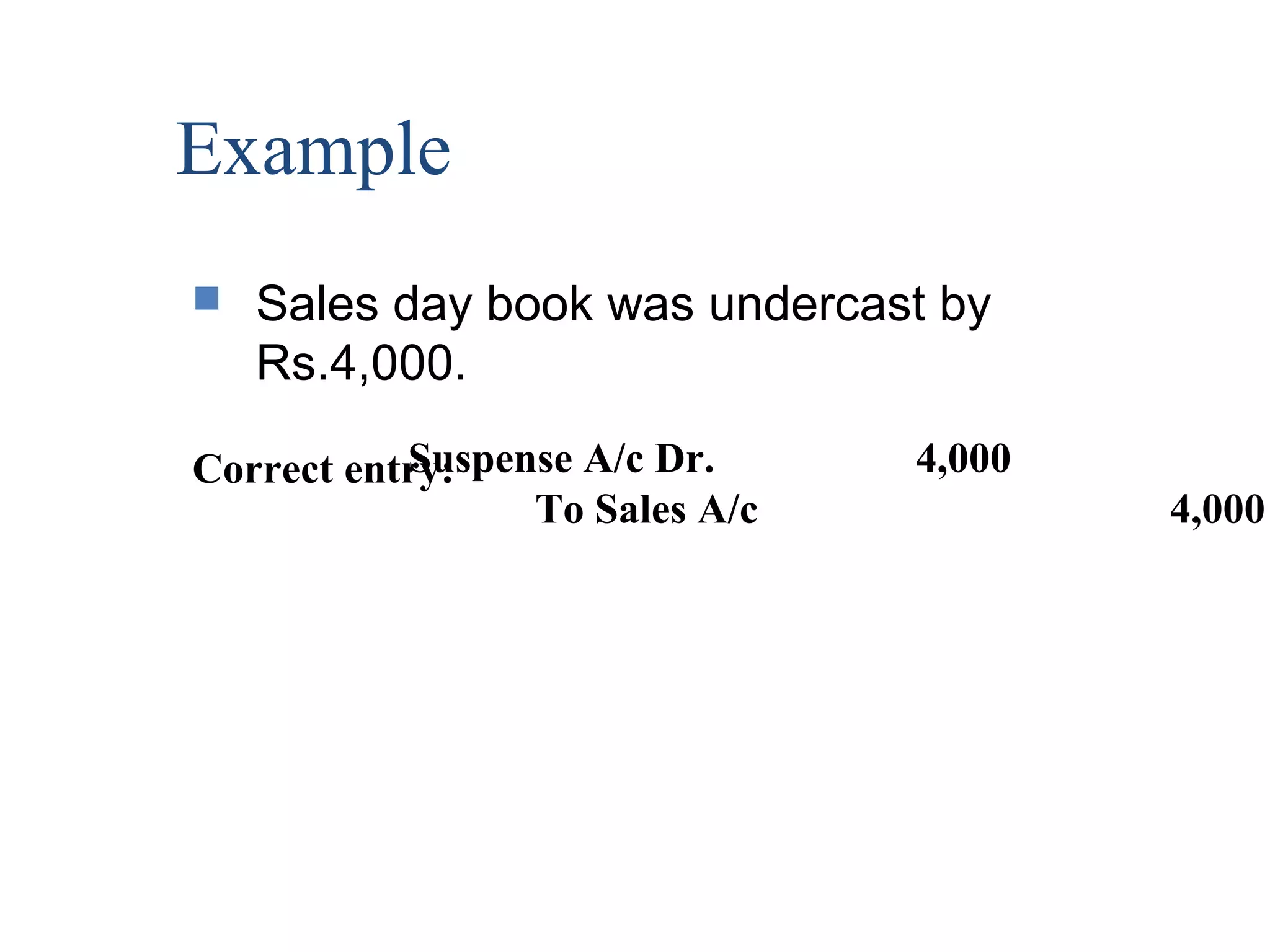

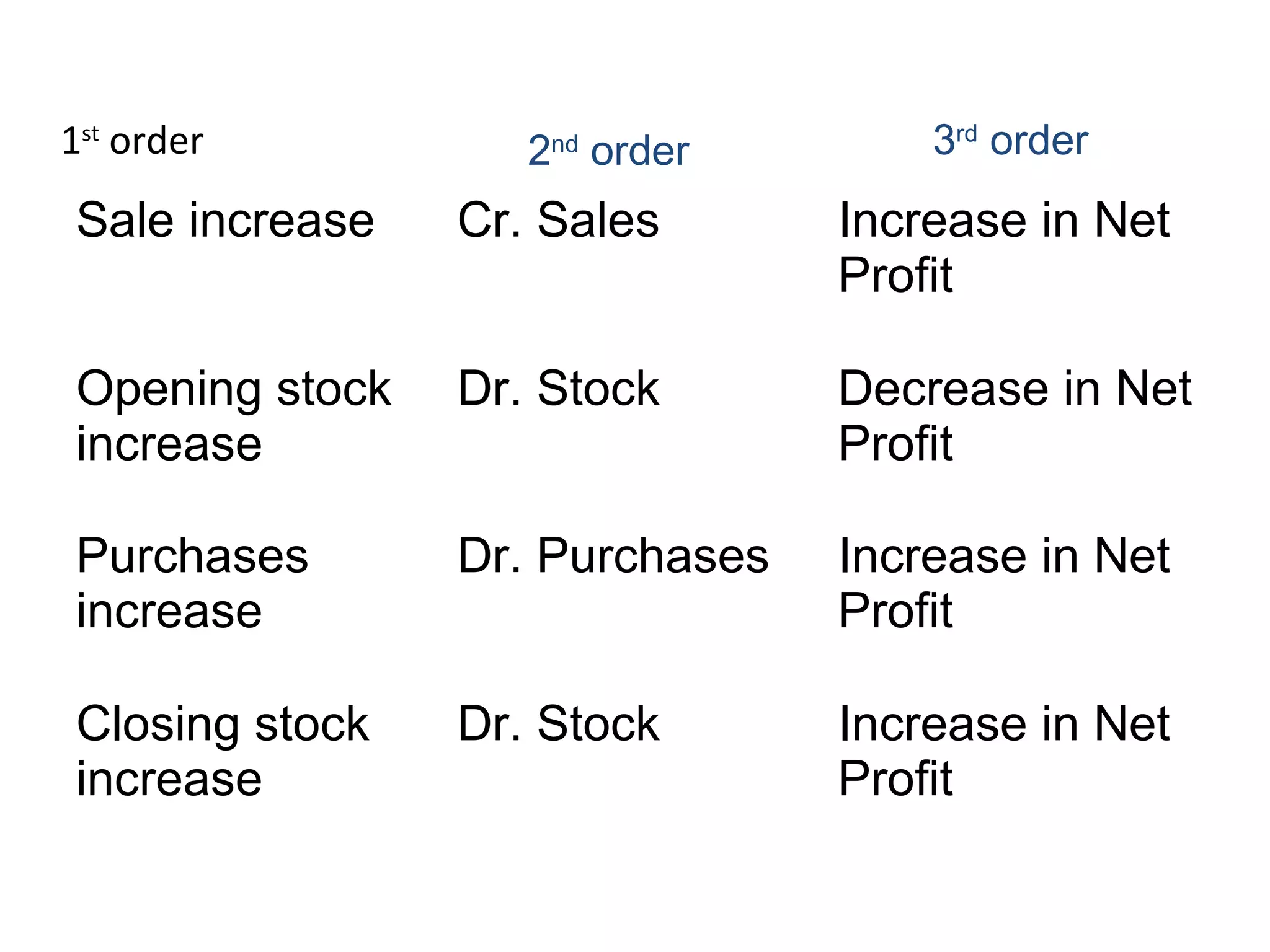

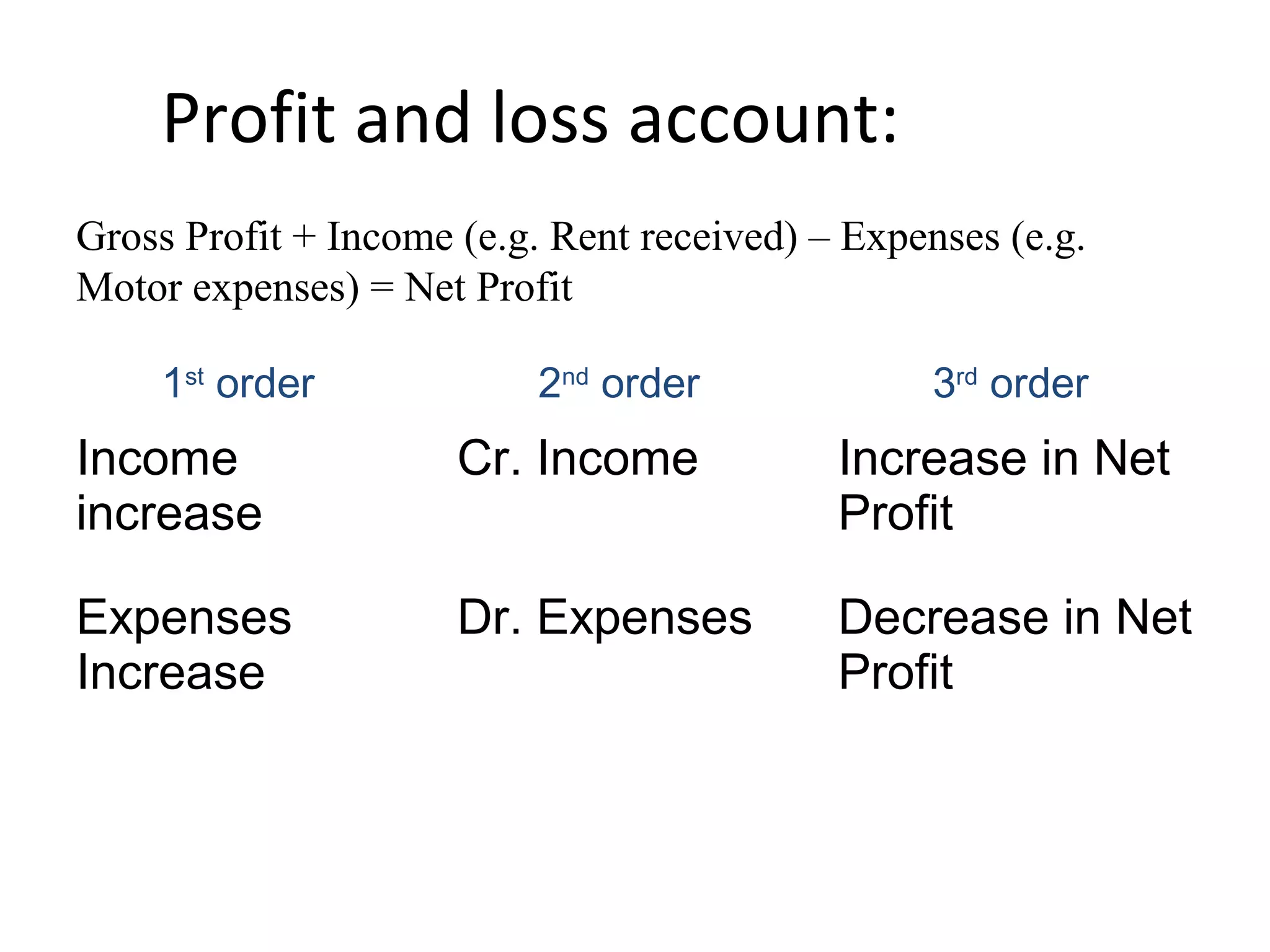

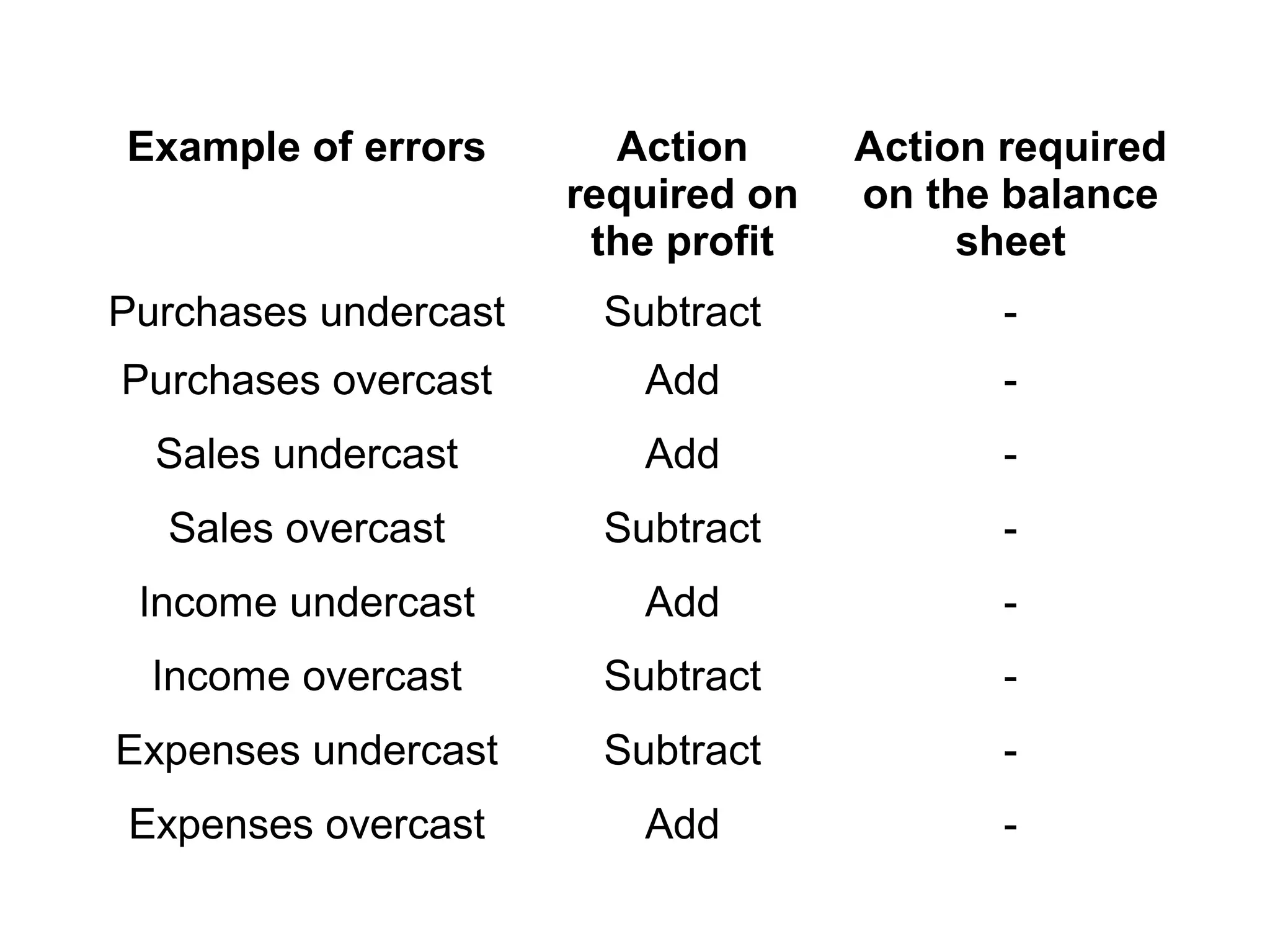

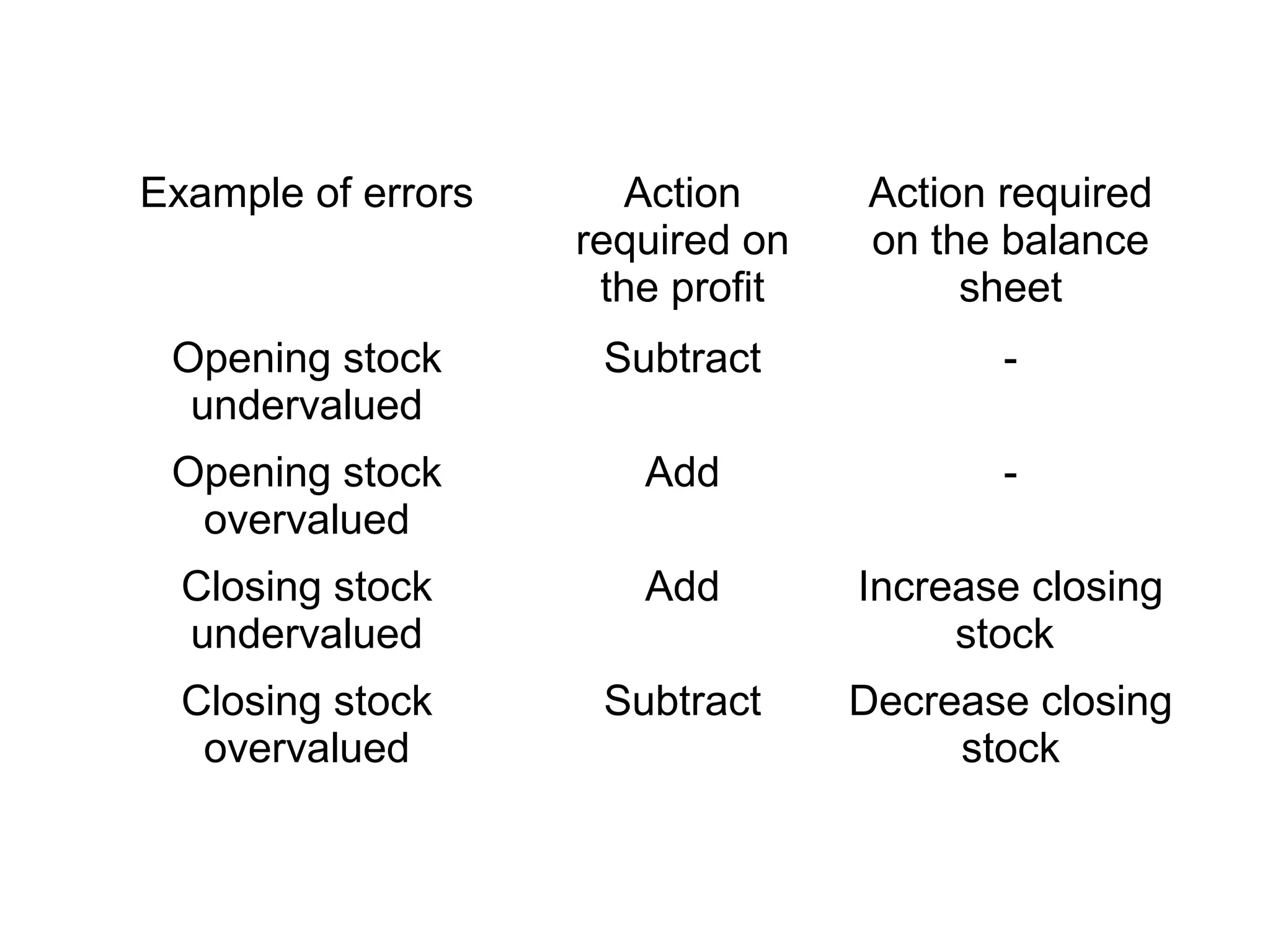

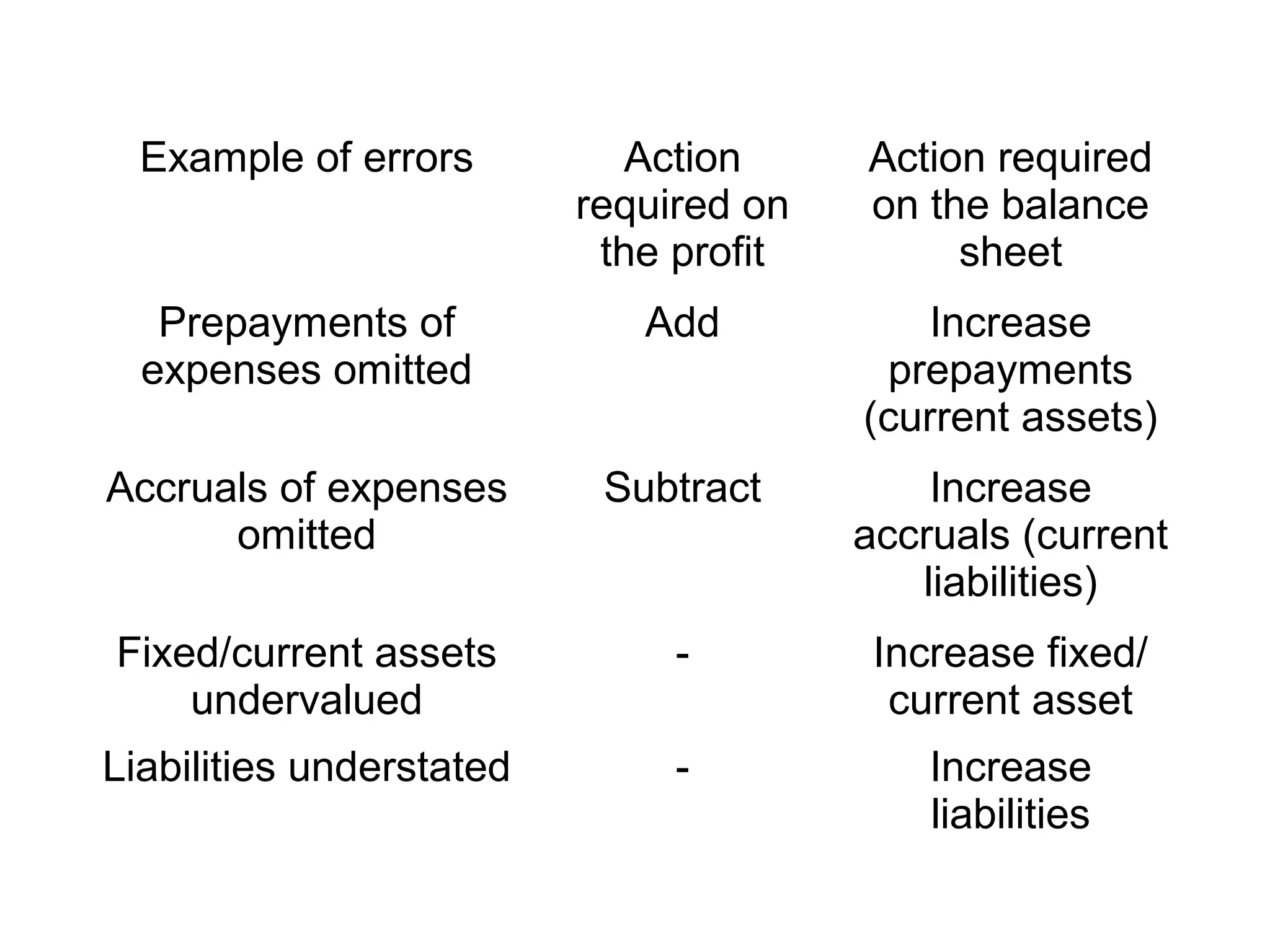

Accounting errors can occur unintentionally when recording transactions or preparing financial statements. There are two types of accounting errors: errors not affecting the trial balance, and errors affecting the trial balance. Errors not affecting the trial balance include errors of commission, principle, original entry, omission, and compensating errors. Errors affecting the trial balance result in an unbalanced trial balance, requiring the use of a suspense account to balance. Correcting entries must be made to clear the suspense account and properly reflect transactions in individual accounts. Corrections may also require adjustments to the income statement and balance sheet to accurately report profit and account balances.