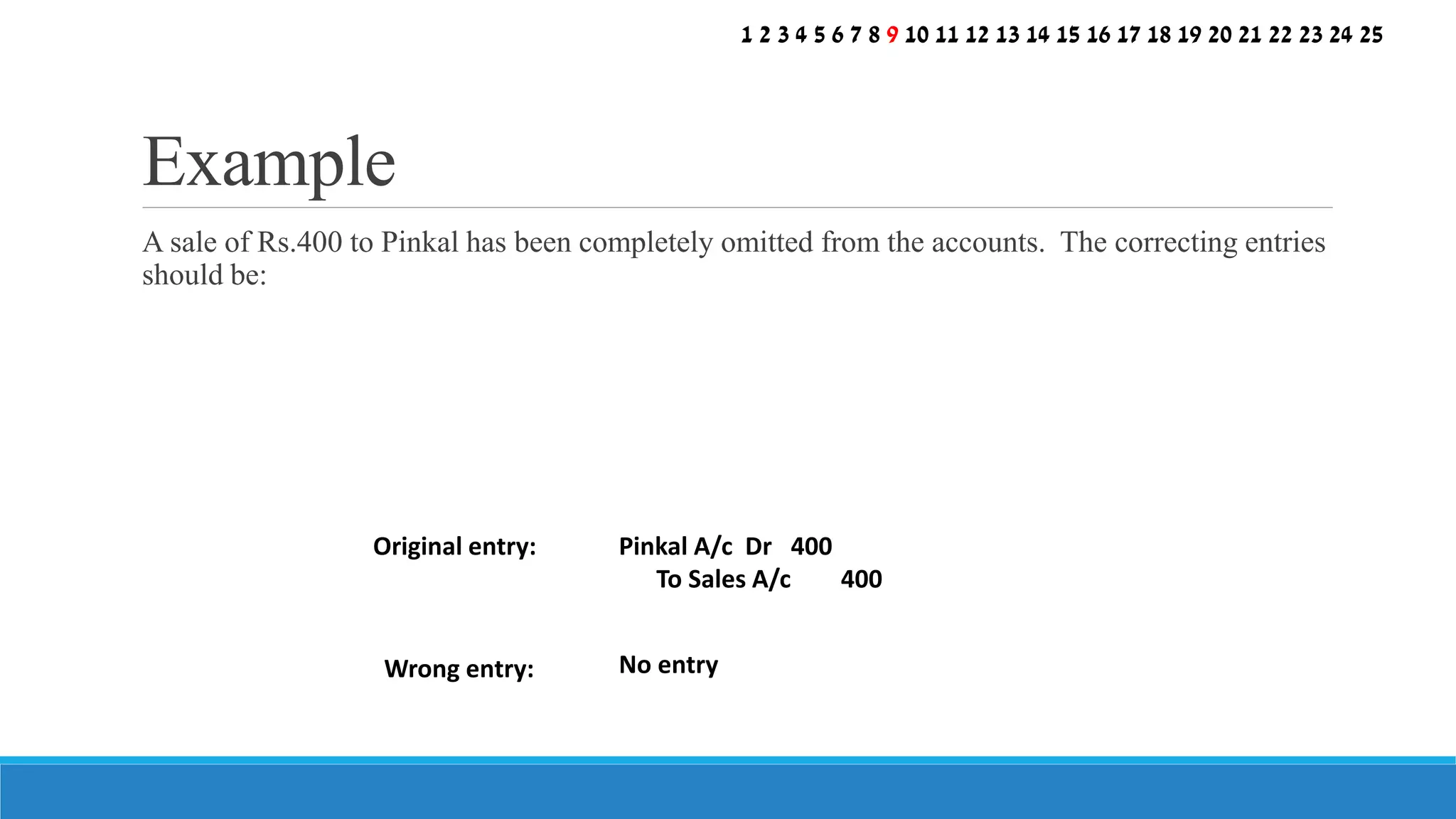

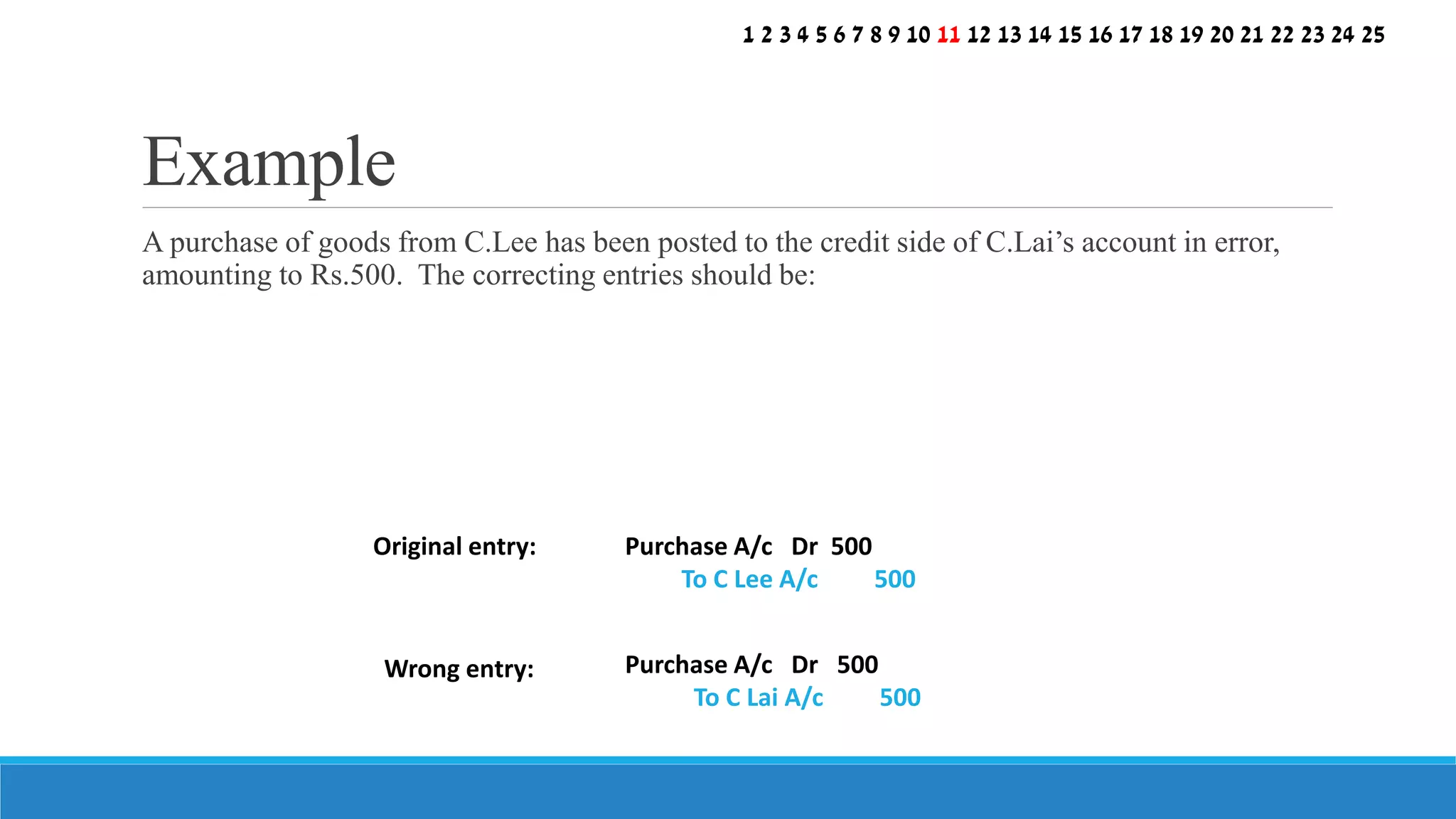

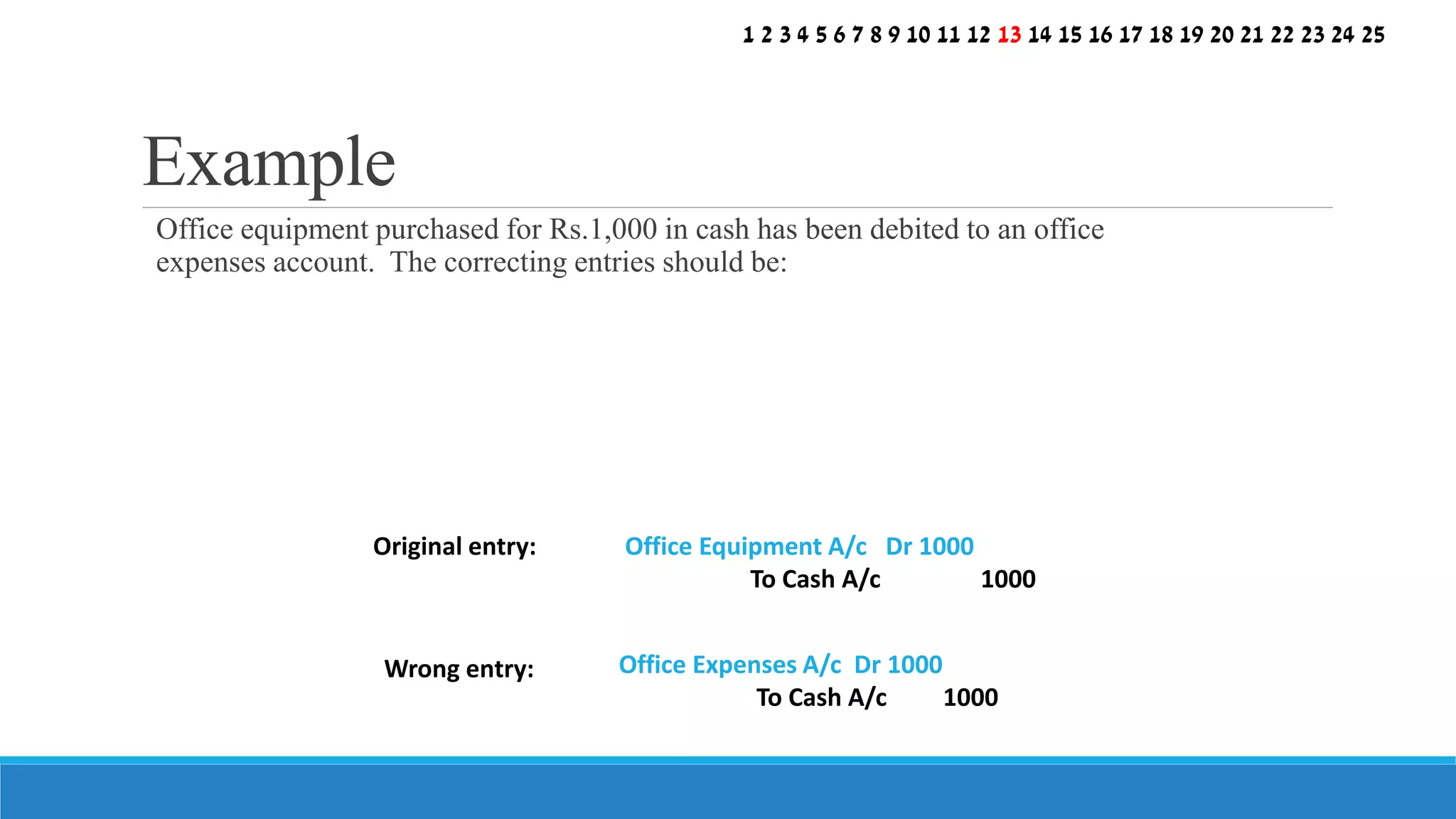

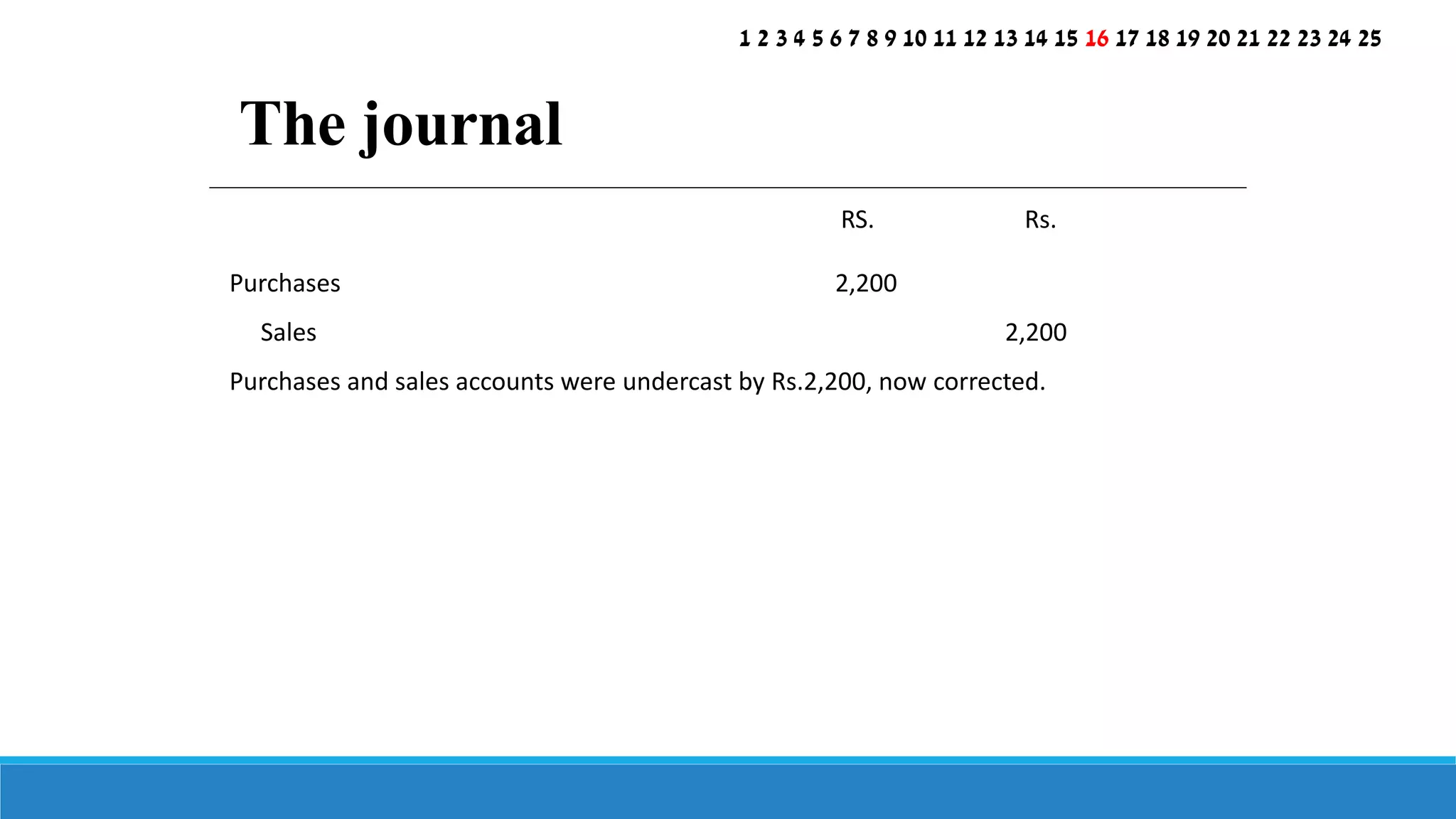

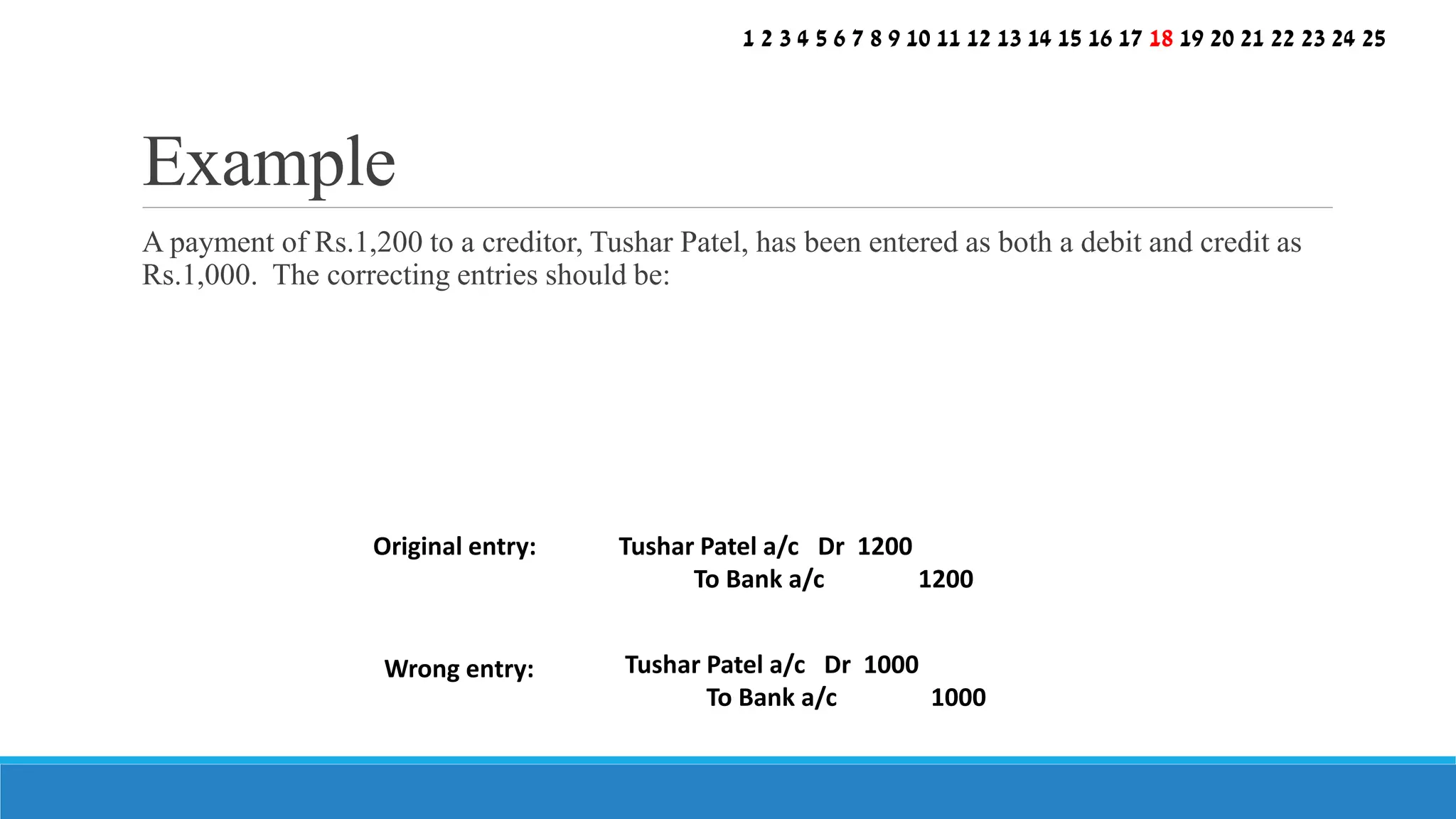

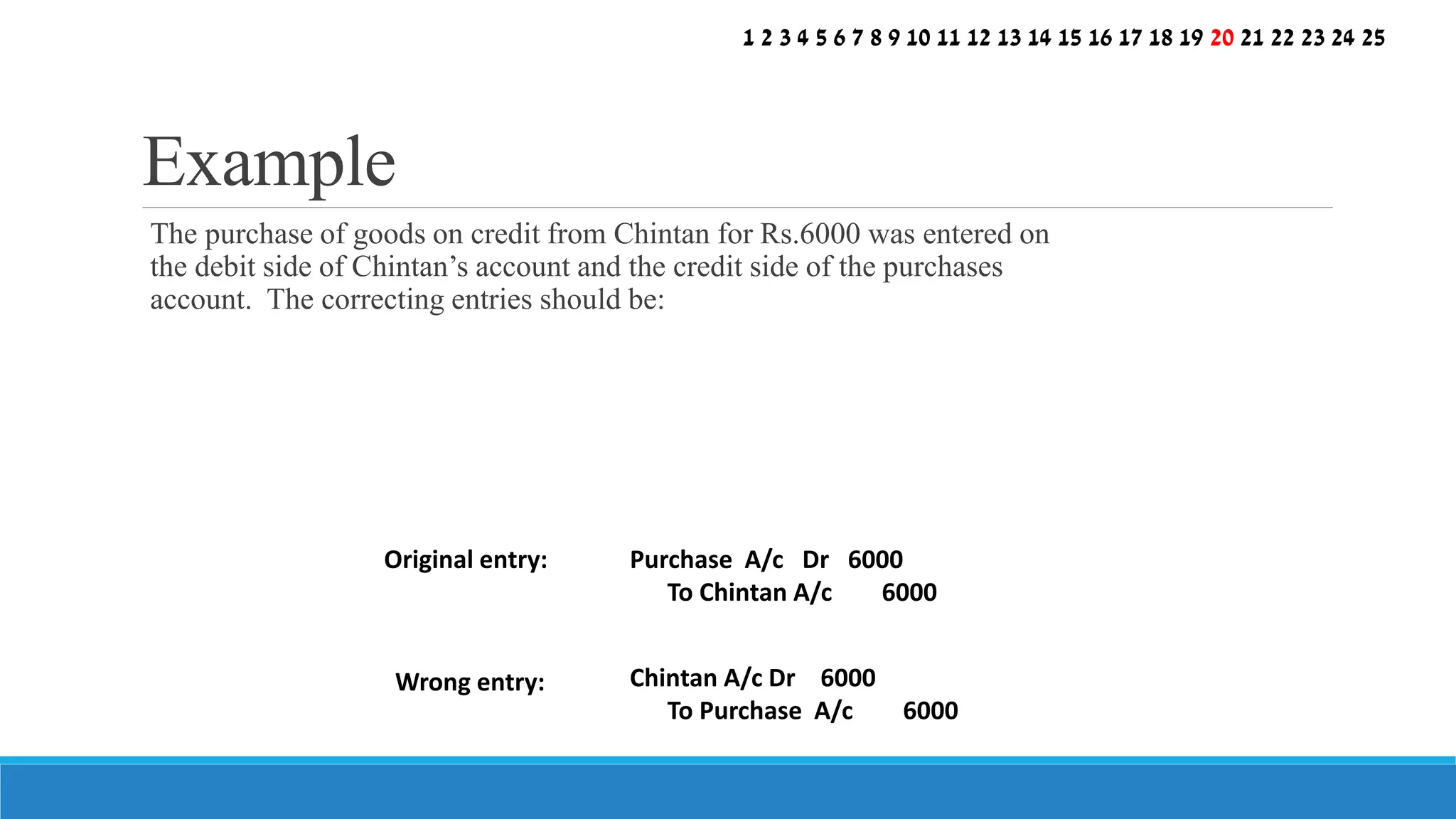

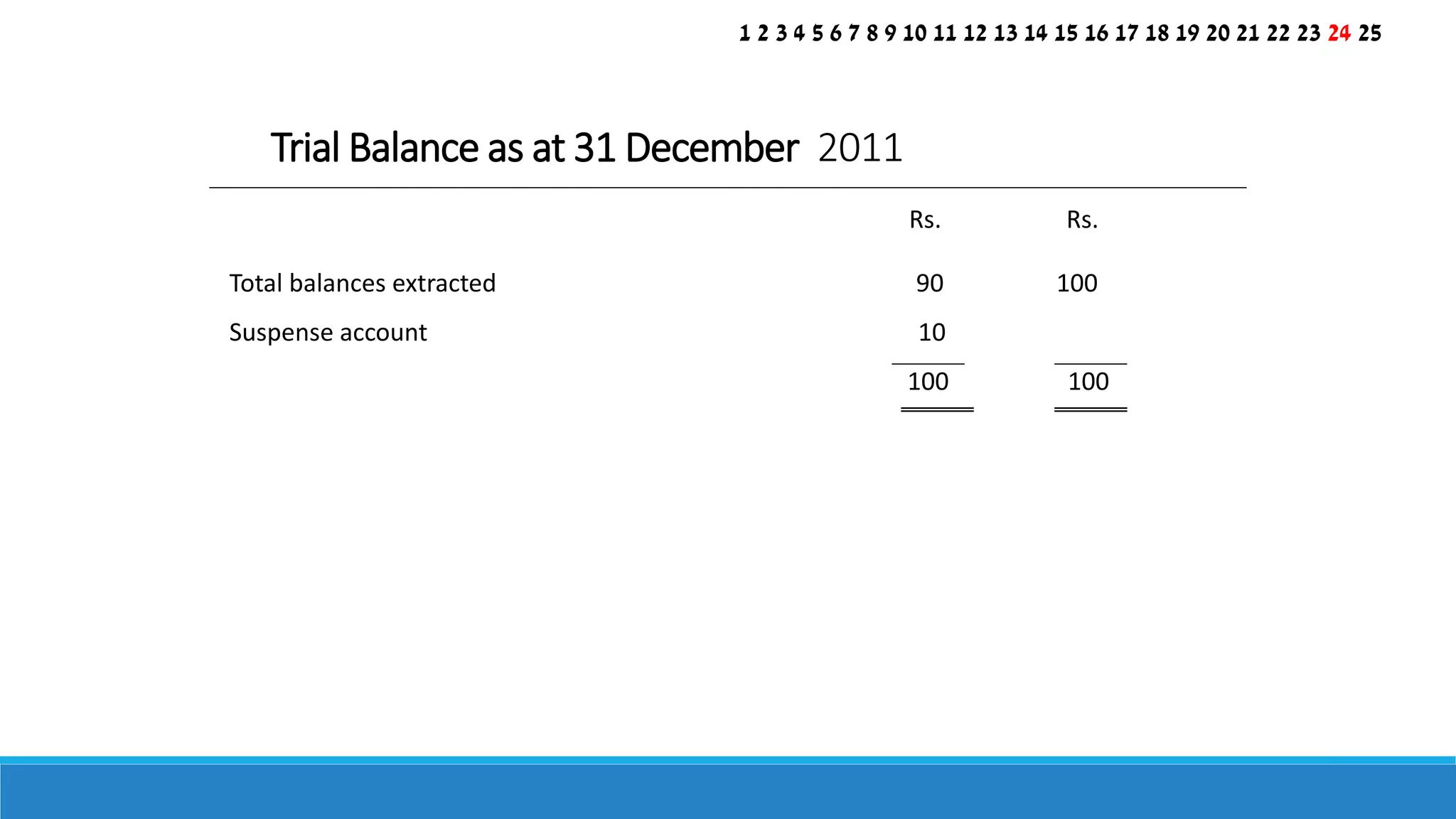

The document discusses the trial balance and types of errors that may occur in accounting. A trial balance is a list of ledger account balances that ensures total debits equal total credits. An unequal trial balance indicates errors exist. Errors may be those not revealed by the trial balance, such as omissions, or those revealed, like errors of calculation or wrong posting. Revealed errors require a suspense account to balance the trial balance. Key errors include omissions, commissions, principles, compensating, original entry, and complete reversals.