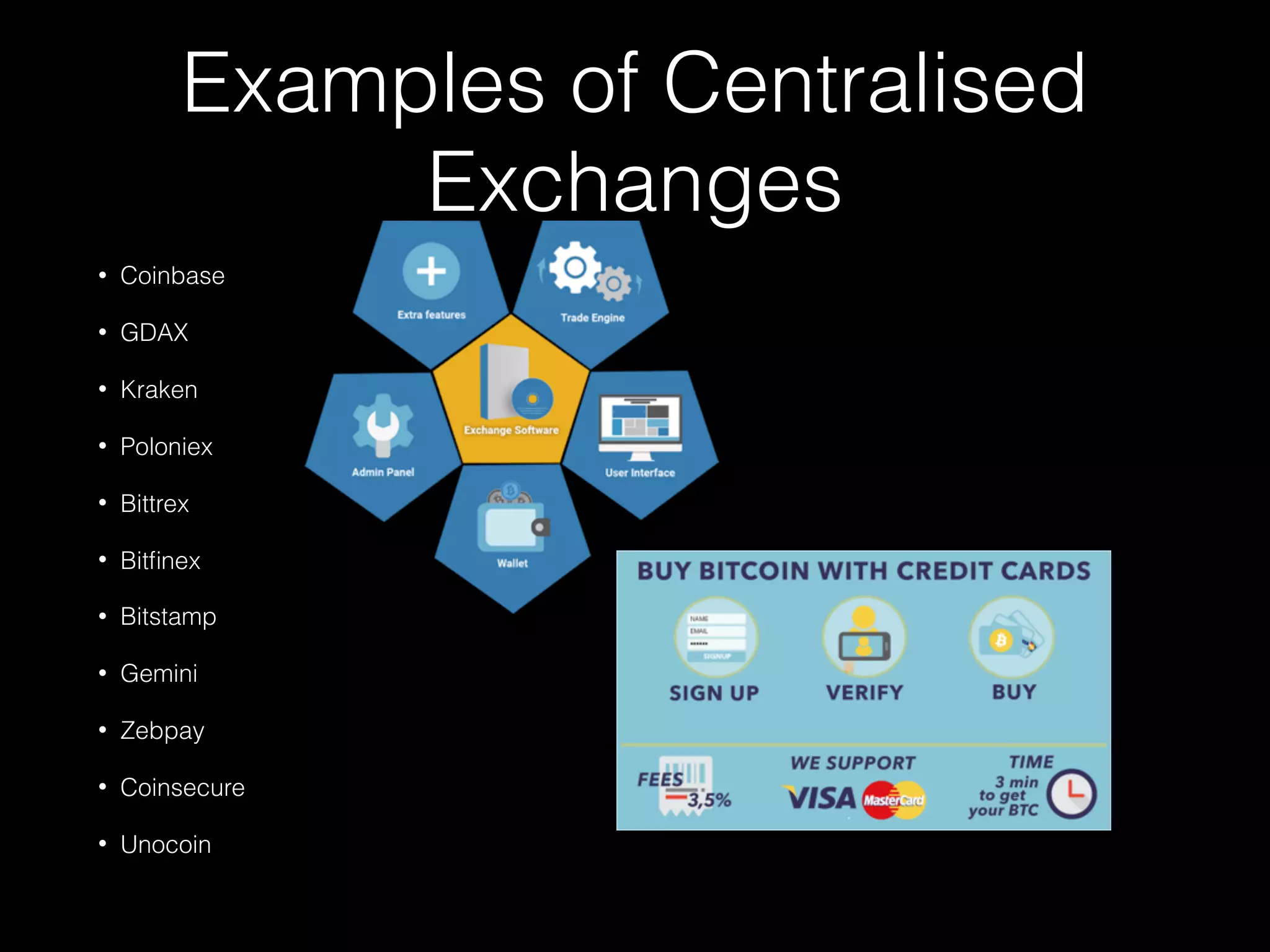

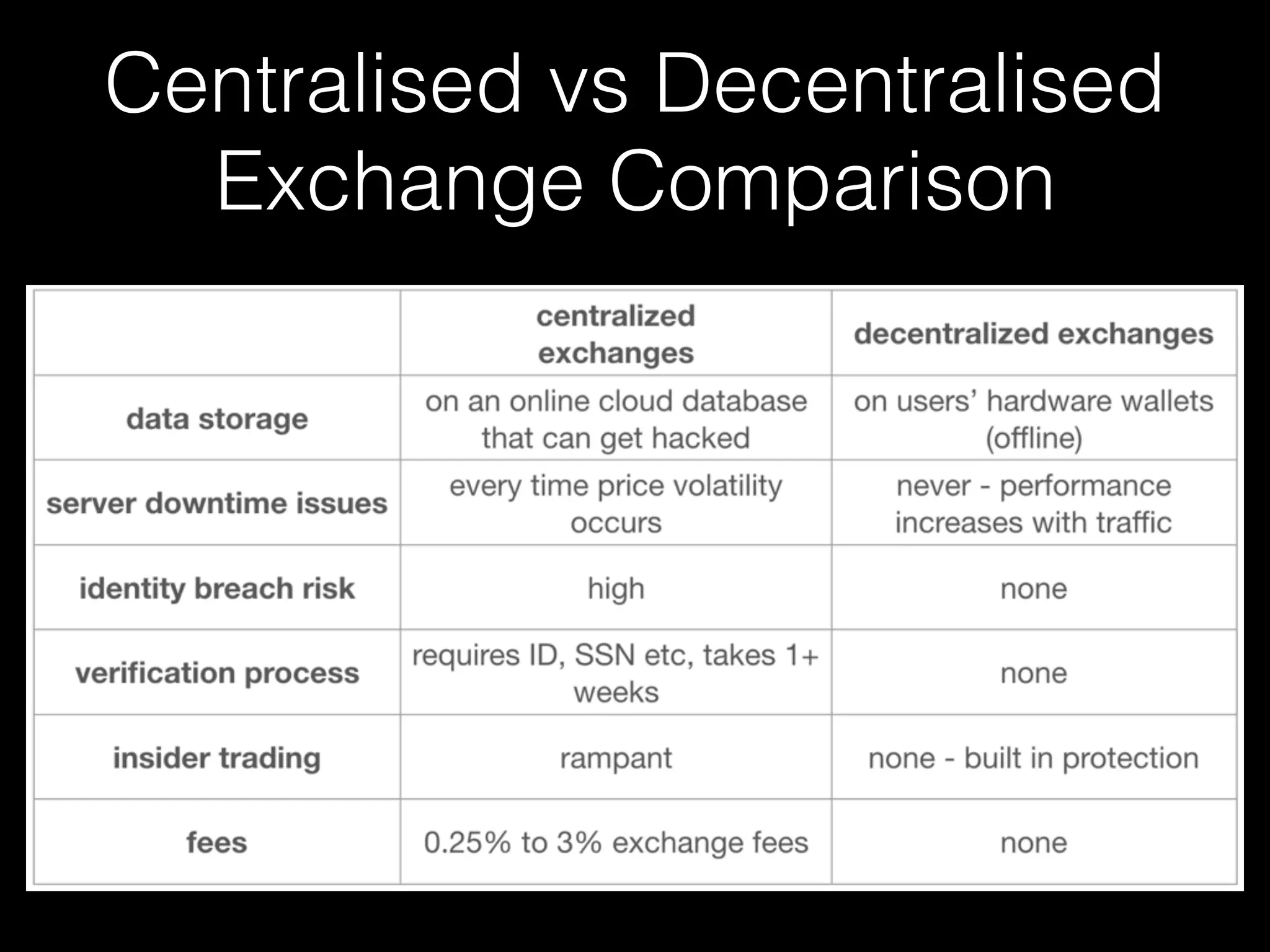

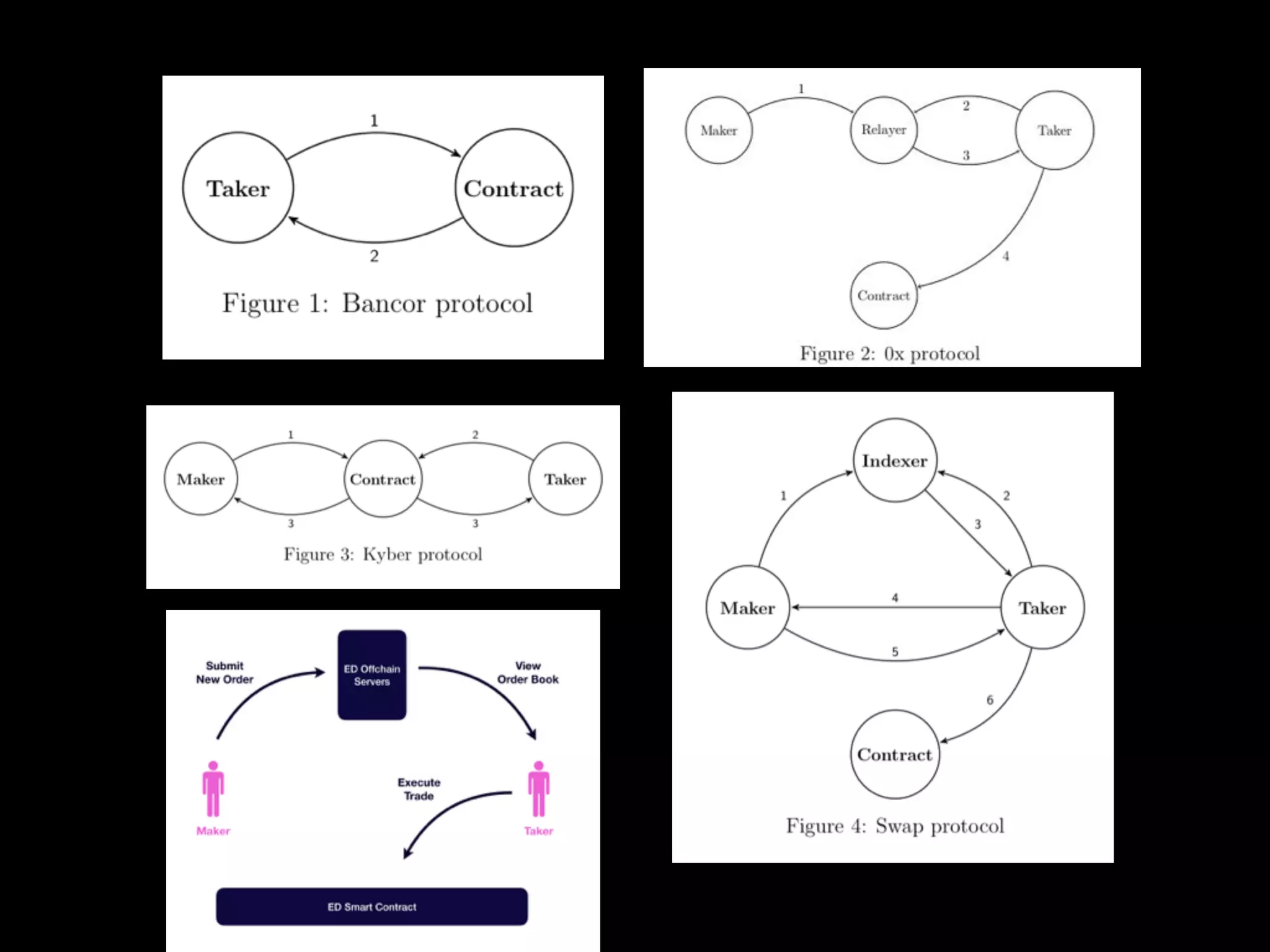

This document provides an introduction to decentralised exchanges (DEX). It begins by defining centralised exchanges and issues with them like security risks and high fees. It then defines DEX as peer-to-peer exchanges that occur directly between users without a third party, allowing users to control their own funds. Key benefits of DEX include lower fees and security, while issues include difficulty of use and low liquidity. Examples of DEX architectures and workflows are provided, as well as examples of specific DEX like 0x, Kyber, and AirSwap. The document concludes with a thank you and invitation for questions.